Why Apply For A Government

Government-backed loans are advantageous in that the risk to the lender is reduced, therefore they can approve more applications. Depending on the loan scheme, it may also come with features or benefits that you dont normally see with other loan products.

The UK Government has offered several different types of business loan over recent years, including:

- Low interest loans

- Government-guaranteed loans

Finance under the Recovery Loan Scheme is currently available in the form of term loans, overdrafts, invoice financing and asset financing.

Some government-backed funding programs run indefinitely while others, such as the recent coronavirus loan schemes, are open for a fixed period.

Check your eligibility for a Funding Circle business loan in 30 seconds without affecting your credit score.

Loans For Federal Employees With Bad Credit No Credit Check Listed

If your credit is less than perfect and youre a federal employee, there are many different loan options available to you. As weve reported in previous articles, allotment loans are an option for federal employees with bad credit. The same is true for installment loans. Both allotment and installment loans take money for repayment directly from your paycheck, guaranteeing that the lender gets repaid for the loan.

However, if these types of loans arent exactly what youre looking for, you can also consider a personal loan, home equity line of credit, and/or last-ditch lending with a payday loan. For more information on what financing option is best for you, as well as the list of companies that specialize in each type of loan, see below.

Get Loans For Postal Workers

U.S. Postal Service Federal Credit service is one of the options that you can consider if looking for a lender. Also, there is a wide range o

f other lenders that you can find on the Internet.

They are willing to give USPS loans with no credit check, which is particularly great for people with a low credit score.

When looking for a premier loan provider, you should pay attention to the following factors:

- Check the rates of several lenders and compare them

- Repayment terms. You want to be provided with loan terms convenient for you

- Addition fees. Find out if you have to pay any processing fee or similar charges. Also, you should check what fines will be applicable to you in case you delay your scheduled payment or pay off your loan earlier

- You want to know what other borrowers think of a certain lending service provider. If a company has been operating on the market for at least several months, you should be able to find customer reviews of it.

Recommended Reading: Federal Government Health And Human Services

What Credit Score Do You Need For An Sba Loan

The Small Business Association does not specify a minimum credit score required to secure an SBA loan. However, SBA loans are provided by lenders who may have minimum score requirements. Typically, this minimum is 620 to 640. However, the higher your score, the more likely you are to receive approval.

Donât Miss: Grants For Dental Implants For Seniors

Loans From Federal Credit Unions

There were 5,099 federally insured credit unions in the United States as of December 2020. These non-profit organizations frequently offer both secured and unsecured federal employees installment loans. However, only credit union members are eligible to apply for a loan.

So before you can borrow money from them, you must first sign up for membership. If you meet the requirements for membership, you will most likely only have to pay a one-time charge.

The terms of credit union loans may differ from whats obtainable with other installment loans for federal employees only.

Also Check: Where Do You Buy Government Bonds

How Government Loans Work

Rarely does government lend money. However, when it does, it benefits both the borrower and the US government. The government makes money available to borrowers and once repaid, it recoups its capital plus interest.

Government loads might be secured or not secured, but they are guaranteed by the US government.

Allotment Loans For Federal Government Employees

Installment loans are widely available for federal government workers, and they definitely have a lot of advantages. Unlike payday loans, they usually have bigger loan amounts and their interest rates are much lower too.

When it comes to installment loans up to $5,000, it is one of the most common options for those who work in the public sector.

Moreover, several types of installment loans are specifically designed for federal government employees.

Federal allotment loans offer an opportunity for government employees to lend money on good terms. It is relatively easy to meet the requirements for federal employee allotment loans even if you have a bad credit rating. The secret is simple: the repayment is guaranteed by the fact that the borrower works for the state.

To make the repayment process smoother, allotment payments are evenly distributed between the debtors paychecks. Payroll allotment loans involve that a particular amount of money is automatically deducted from your remuneration.

Another great benefit is the approval process. If you need money today, for example, for a medical emergency, you dont have time to spend hours in banks. Allotment loans for employees have a fast approval procedure, which means you can get money in several hours or even minutes.

Also Check: Us Government Patent Office Search

Complete The Online Application

Once the system has generated a possible installment for you, you may want to take the next step and actually apply for one of the installment loans for federal employees that are available. Simply click on Apply, which is found on the top right-hand side of your screen. Then, get to work providing all your information. This will range from your full name and surname all the way to what your monthly expenses are. Be as thorough and accurate as possible, as the information you provide will affect the outcome of your loan application.

Put The Union Plus Personal Loan To Work For You

With the Union Plus Personal Loan program, brought to you by AFGE, youll get just the options you need for a more secure financial future. The Union Plus Personal Loan allows AFGE members to consolidate credit card and other revolving debts into one simple monthly payment. Save money with no annual fees, pre-payment fees or origination fees. Plus, enjoy the peace of mind when you sign up with a 45-day guarantee. Simply return the entire amount and the loan will be canceled with no penalty.

Toll-free Benefits Line:

Recommended Reading: Government First Time Small Business Loans

Government Bad Credit Home Loans

FedHome Loan Centers is your connection for affordable government programs to help you buy, sell or refinance residential real estate.

FedHome Loan Centers is comprised of a tight network of experienced Realtors®, seasoned loan specialists, government approved lenders and other mortgage professionals who work together on your behalf to enhance your home-buying, home-selling or home-refinance experience.

You can contact a Government Loan Specialist at FedHome Loan Centers now by calling: 877-432-LOAN

Benefits Of A Personal Loan For Government Employees In India

We at Poonawalla Fincorp make borrowing a seamless and hassle-free process. Our Personal Loan for central government employees comes with numerous advantages that make it a great option to meet any of your borrowing requirements. Our loan is easy to avail, requires no collateral, has minimum documentation needs, and the entire process can be completed online. You have to submit your application and documents to get an instant approval. This special Personal Loan for government employees is also applicable as Personal Loan for govt teachers.

Noteworthy Features of Poonawalla Fincorp Personal Loan for Central Government Employees:

- No restriction on usage of the loan amount

- Maximum loan amount of up to 30 lakh

- No collateral needed

Please note that checking your credit score is important since it shows your credibility. Having a low credit score may not necessarily mean rejection, but the Personal Loan interest rate for government employees with a low credit score may differ.

Don’t Miss: Fundamentals Of Governance Risk And Compliance

Kashable Loans For Federal Employees

Kashable offers Installment loans for federal employees only and Payroll loans for federal employees up to $200,000 with a 6% APR. Repayments through payroll allotments.

- Amount: Loan amounts range from $500 to $20,000.

- Terms: A six- to 24-month loan is available.

- The annual percentage rate begins at 6%. Requirements: You must be a federal government employee.

- Is a credit check necessary? Yes

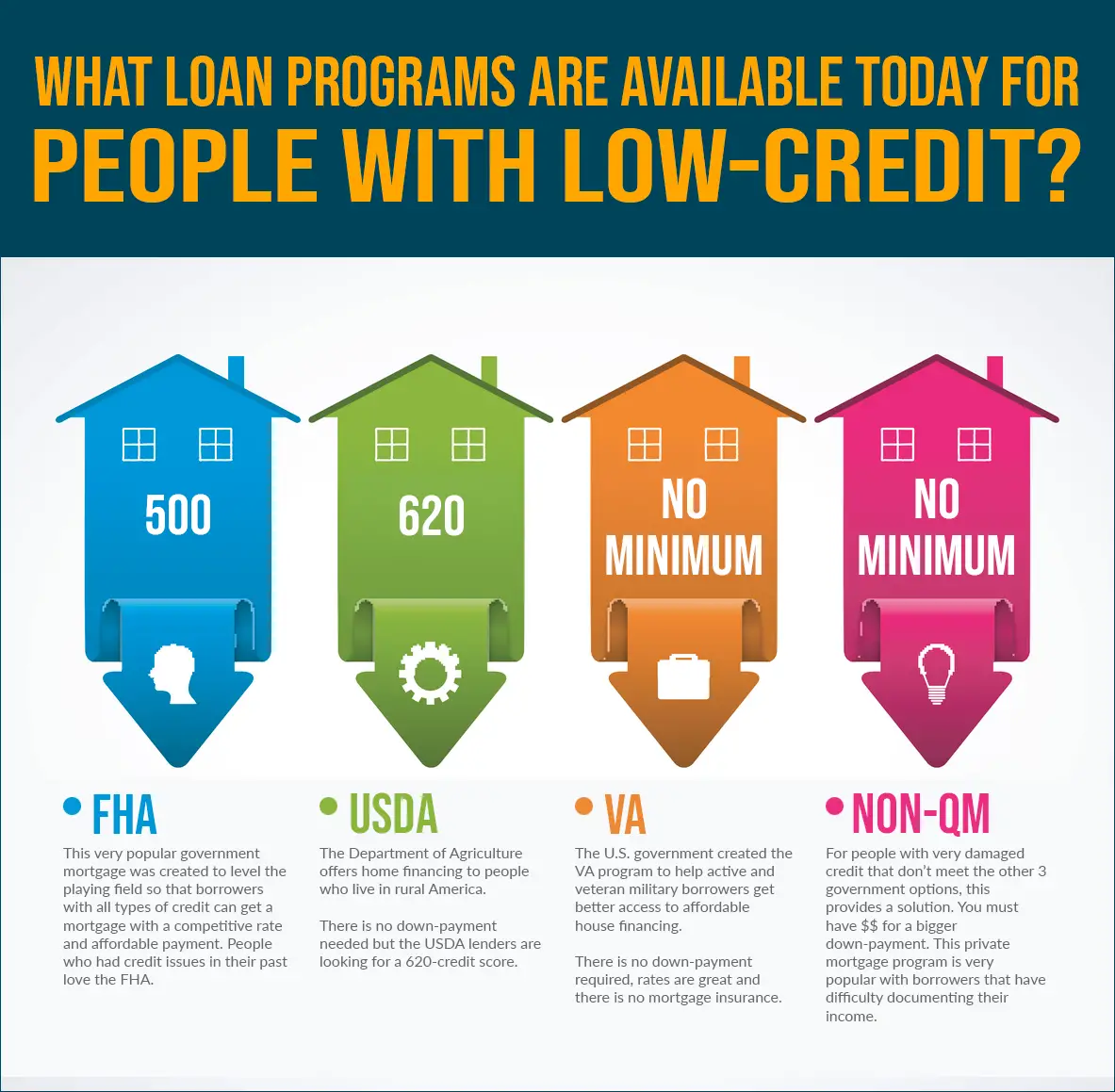

Home Loans For Government Employees With Bad Credit

The good news for government employees with bad credit is that a home loan is not out of your reach. Programs are available to government workers and those who have served in the military that are not available to private citizens.

Qualifying for one of these loans can save you money on application fees, insurance costs, even the down payment and interest rates. So, even if your credit is less than perfect, the home of your dreams may still be attainable.

Recommended Reading: Federal Government Money Support Program

What Credit Score Do I Need To Get Installment Loans For Federal Employees

Most lenders require an individual to have a credit score of at least 580. That said, you will need a higher credit score if you wish to get a personal installment loan without an origination fee attached and with a very low APR. There are some lenders that loan money to borrowers with lower credit scores, though.

Is A 401k Hardship Withdrawal The Same As A Hardship Loan

With a hardship loan, you borrow money from a lender. A 401 hardship withdrawal is where you borrow money from the 401 account you have with your employer.

You may be eligible for this option if you need cash to cover certain medical expenses, burial or funeral expenses, expenses to prevent foreclosure and eviction, and other essential expenses.

Consider a 401k hardship withdrawal as a last-resort option.

Hardship loans from traditional lenders may be a smarter choice because you wont have to pay regular income taxes on the amount you borrow or the 10% penalty tax you will be hit with for removing funds from your 401k before you turn age 59.5.

Personal loans are typically faster, more affordable options that wont hinder your retirement goals. You should view a 401k hardship withdrawal as a last resort.

Read Also: Government Assistance For Maternity Leave

How Do I Get A Hardship Loan

Each lender has its own application process for hardship loans. In most cases, however, the process is fast and easy.

Youll likely be able to fill out an application online from the comfort of your own home. The lender may ask you to provide your personal details, including your name, address, and your monthly rent or mortgage payment.

You can apply for a hardship loan online from the comfort of your own home.

You may also need to explain the financial hardship youre experiencing and what youd like to use the funds for. Since lenders know borrowers need the funds as soon as possible, theres a good chance youll get approved the same day you apply or within 24 hours.

As with a traditional installment loan, you can receive the money via direct deposit, check, or prepaid card, depending on the lender. Youll then make a loan payment every month until youve repaid your loan in full.

Advantages Of Best Allotment Loans For Federal Employees

Allotment loans for low-credit federal employees have several advantages. These include:

Small Loan

Allotment loans can cover small amounts that employees need. This ranges from hundreds to thousands of dollars.

Easy To Qualify

More than 43 million Americans have a credit score below 599, which is low credit. Poor credit can make it difficult to get a traditional loan. The disbursed loans provide access to much-needed resources for low-rated government officials.

Fast Approval

When a government employee needs money urgently, such as for car repairs or emergency medical care, there is no time to wait for a lender’s approval. The approval process for civil servant loans is quick. Employees are typically eligible for loans within minutes.

Simple Requirements

Allotment loan do not require many papers and documents to be submitted to employees. If the employee has reached the age of 18, is a US citizen, and has a valid bank account, she is ready.

Short Payment Plan

Civil servants who take out installment loans do not have to worry about taking years to pay off their loans. Installment loans usually have short-term payment plans that allow the borrower to see the payment term when they first sign up, so the end is always in sight.

Use Freely

When government officials apply for installment loans, they do not have to say what the money is for. This means you don’t have to spend your credits on specific things. Also, the borrower can know that the loan is completely confidential.

Also Check: Can The Government Help You Get A Car

Want To Avail A Small

1. WeLoans â Best for bad credit loans online with same day approval ET Spotlight Pros

- Connects bad credit borrowers instantly with verified lenders across the nation

- Both short-term and long-term lending options are offered

- Multiple repayment options are offered

Cons2. US Bad Credit Loans â Best for personal loans for bad credit ET Spotlight Pros3. CocoLoan- Best for overall loans for bad credit ET Spotlight Pros

- Bad credit loan of different amounts is offered

- Funds processing is quick and safe

- Keep every userâs data protected

Cons

- No expert assistance is offered

4. iPaydayLoans â Best for cash advance loans for bad credit online ET Spotlight Pros

- Few lenders might ask for a soft credit check if the loan amount exceeds $5,000

5. US Installment Loans â Best for installment loans for bad credit ET Spotlight Pros

- Loan facilities offered without any discrimination

- Any credit score is considered

- Advanced AI is used to match borrowers with lenders

Cons

- Customer support isnt that dependable

6. UK Bad Credit Loans â Get loans for bad credit in UKPros

- Only for the people in the UK

- At times, your offers might contain redundant information

7. Payday Loans UK â Best for payday loans for bad credit in UKPros

- Some lenders will ask for bank account details

ProsConsProsConsProsFAQsQ1: Ar

Same Day Installment Loans For Federal Employees

Waiting around for cash is tough. In fact, it can be downright frustrating. You may miss out on a deal, find yourself in a tricky situation, or be unable to get yourself or a loved one the care needed because youre waiting for loan funds to pay out! When you apply for installment loans for federal employees via the Heart Paydays website, you can rest assured that the lenders on the panel have a reputation for quick turnarounds on loans. This means that they disburse funds reasonably quickly. Some lenders have a reputation for organizing 60-minute payouts, whereas others ensure the funds hit their clients bank accounts by the next business day.

Also Check: How To Buy Short Term Government Bonds

Can You Get A Loan Online Without A Credit Check

You may struggle to find an online loan that doesnt require a credit check. Since most online lenders are not local to you, they rely on a credit check or background check to verify your ability to repay your debt.

The online lending networks listed above will run a soft credit check when you submit your initial loan request. This initial credit pull gives the lender access to a modified version of your credit report and doesnt place a hard inquiry or cause any damage to your credit score.

Lenders use this information to prequalify you for a loan. If you accept a loan offer, the online lender may require a hard credit check for final approval.

If you need to bypass a credit check altogether, your only option may be a local payday loan lender or a title loan agency in your town. Just keep in mind that the convenience of skipping a credit check comes with a cost and that price will include a very high interest rate and other fees.

An in-person or online payday loan or cash advance is the most expensive option you may have. These lenders will want to see proof of income to verify that you can repay your debt within 15 to 30 days. As long as you can pass that test, you will likely qualify for a short term online payday loan.

But with an interest rate that will likely start around 400%, these are not loans that you should jump into without considering your other options.

Read Also: What Is A Government Home Loan

How Do I Apply For A Postal Employee Loan

You wont likely have trouble finding a suitable lender even with terrible credit if you need quick cash and are already a member of a credit union.

Even online, there are many lenders prepared to provide USPS loans to postal workers without giving credit ratings much thought.

To qualify :

- Make a minimum monthly income.

- A citizen or resident of the US.

- Being a retired employee, family relative, or USPS worker.

You May Like: Federal Government Dental And Vision Insurance

Allotment Loans With Bad Credit

Have you ever heard about installment loans? These loans should be paid in several regular but smaller payments, which make them extra convenient.

Among their advantages are a bigger loan amount and lower interest rates. For instance, if you are planning to take around $5000, it can be a perfect choice.

Moreover, there are some installment loans that are specifically created for state workers.

They are called allotment loans for federal government employees.

Federal allotment loans allow federal workers to borrow money on favorable terms. Here are their main advantages.

Overall, these loans are the ideal option if you are going to make a big purchase, or need money, for example, to pay for college.