Interest Rates For Federal Student Loans

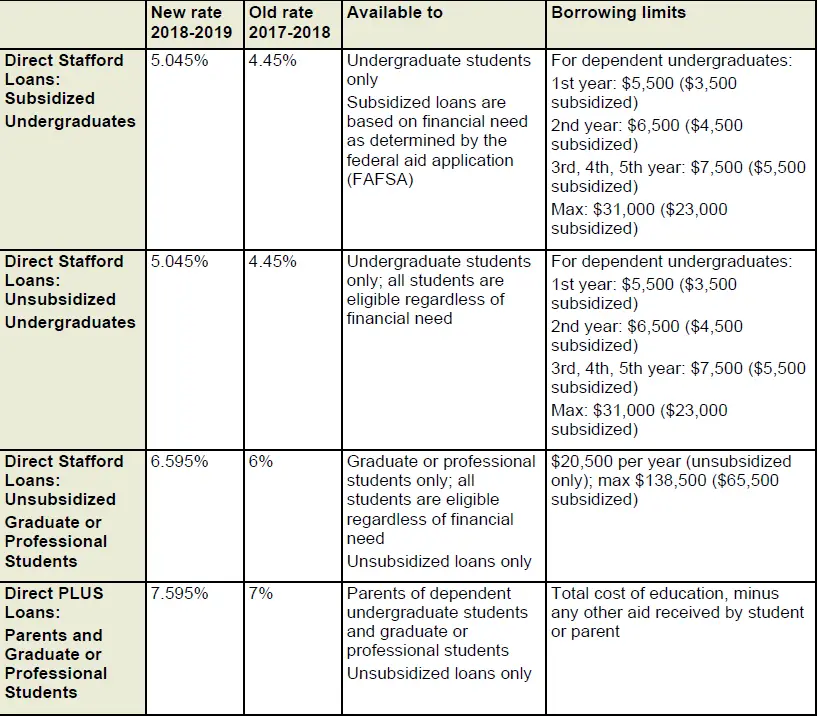

Federal student loans interest rates for the 2019-2020 school year range from 4.53% to 7.08%. As of July, 2006, all federal student loans have fixed interest for the life of the loan. Although rates are reevaluated by Congress every year, the interest rates on existing loans will not be affected.

Stafford loans for undergraduates in 2019-2020 came with interest rates of 4.53%. The Stafford loan rate for graduate students is 6.08%. Stafford Loans are the most common type of federal student loan. If your Stafford loan is subsidized rather than unsubsidized, it does not begin accruing interest until after you leave school.

Parents and graduate students may be eligible for PLUS loans, another type of federal student loan. At 7.08%, these have the highest interest rate of any federal student loan.

It should be noted that there is an aggregate limit to how much money students may borrow on federal loans. Undergraduates can only borrow $57,500 in total and no more than $23,000 of that can be a subsidized loan. Graduate students may borrow $138,500 and no more than $65,500 can be subsidized.

The graduate loan amounts include any money borrowed to obtain an undergraduate degree.

Student Loans And Your Credit Report

Your student loans will appear on your credit report as soon as they’re granted, so it’s extremely important that you keep them in good standing and monitor your reports and scores to make sure there are no errors. Your student loans will have a positive impact on your credit scores when you manage them well. You can guarantee that will happen by maintaining a perfect payment historyand as the balance recedes, your credit scores will likely rise!

Private Student Loan Interest Rates For The 2021

Here are the interest rates you can expect on private student loans from Credibles partner lenders:

- Fixed rates from : 2.91%+

- Variable rates from : 0.99%+

Interest rates for long-term private student loans have increased since last year while short-term rates have seen a slight drop. As of May 2021, the average student loan interest rates for borrowers who had credit scores of 720 or higher and who used Credible to take out a private loan were:

- 6.11% for a 10-year fixed-rate loan, up from 5.81% a year ago

- 4.21% for a five-year variable-rate loan, down from 4.42% last year

Tip:

If you decide to take out a private student loan, be sure to consider as many lenders as possible to find the right loan for you. Credible makes this easy you can compare your prequalified rates from our partner lenders in the table below in two minutes.

| Lender |

|---|

Learn More: When You Should Apply for a Student Loan

You May Like: Government Funded Internet Access For All

How Will Student Loan Rates Change In 2021

The low student loan interest rates brought on by the coronavirus are expected to stay, at least for a few years. “If the trajectory of the economy is as many expect over at least the next couple of years, we may eventually see some rates begin to rise off of these lows,” says Hamrick. “Even so, Federal Reserve officials have essentially pledged to leave their benchmark rates at record low levels in order to help the economy to heal after the pandemic and to boost employment.”

Federal student loan rates for the 2021-22 school year are higher than they were for the 2020-21 school year however, they are still low compared to pre-pandemic levels.

Student Loans In Canada: The Basics

The term student loan encompasses a broad array of financial products, from personal loans, bank issued student lines of credit, to government-backed installment loans. In Canada, the most common type of student loan is issued by the provincial or federal government , so thats where were going to focus the majority of our attention.

Recommended Reading: Government Jobs In Washington Dc Area

Interest Rates Rise For New Federal Student Loans

The interest rates on federal student loans will increase by nearly a full percentage point for new loans made from July 1, 2021 to June 30, 2022.

Thats a 20% to 38% increase in the interest charged on federal education loans over a 10-year repayment term.

Federal student loan interest rates will increase from 2.75% to 3.73% for new loans on or after July … 1, 2021.

getty

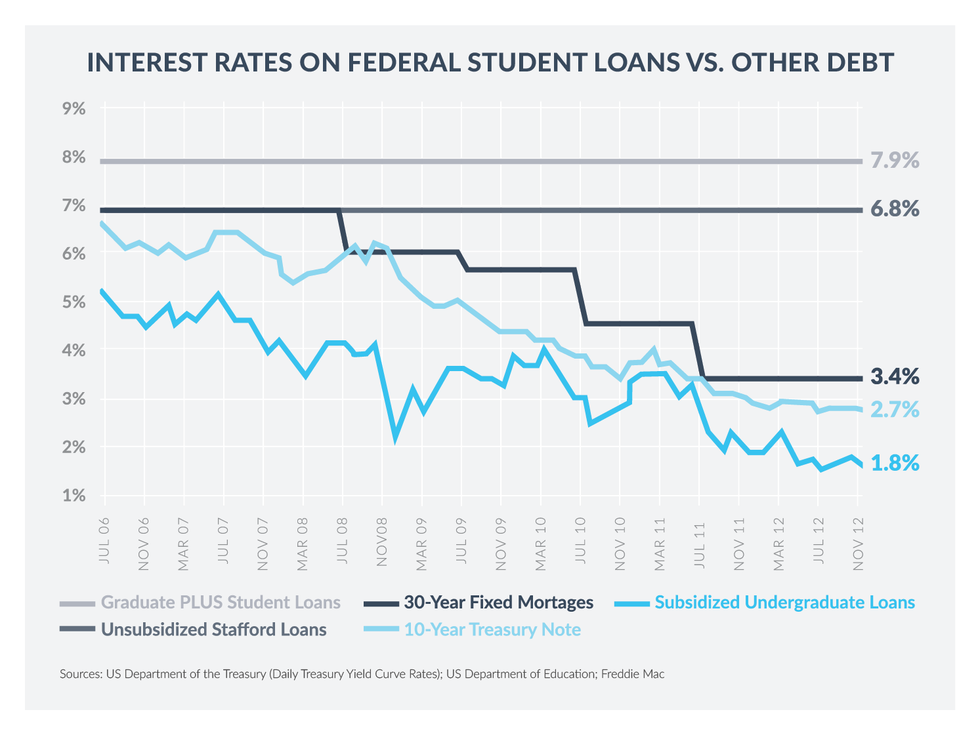

Interest rates on federal student loans reset each July 1, based on the last 10-year Treasury Note auction in May plus a margin of 2.05%, 3.6% or 4.6%. The high yield on the May 12, 2021 auction was 1.684%, up from 0.70% the year before.

This yields the following interest rates for new loans made during the 2021-22 academic year:

- The interest rate on Federal Direct Stafford loans for undergraduate students for 2021-22 will be 3.734%, up from the 2.75% rate for 2020-21, which was a record low.

- The interest rate on Federal Direct Stafford loans for graduate students for 2021-22 will be 5.284%, up from 4.3% in 2020-21.

- The interest rate on Federal Direct Grad PLUS loans and Federal Direct Parent PLUS loans for 2021-22 will be 6.284%, up from 5.3% in 2020-21.

The new interest rates will cost borrowers as much as an additional $590 per $10,000 borrowed on a 10-year repayment term.

Borrowers cannot borrow federal loans for next year now, before the interest rates increase, because the applicable interest rate is based on the loans disbursement date.

How To Get A Federal Loan

You can get the lowest interest student loans by applying for a federal loan. You must file a Free Application for Federal Student Aid , which is used by the federal government and most college and universities to determine the eligibility of a student applying for non-merit based financial aid.

Filing a FAFSA form is the first step in applying for more than 90% of aid money. Merit-based aid, which accounts for the other 10%, is awarded based on talent.

All applicants must:

- Have a valid Social Security number

- Have a high school diploma or GED

- Be registered with the U.S. Selective Service

- Be enrolled or accepted for enrollment at an eligible degree or certification program

- Not owe refunds on federal student grant

- Not be in default on student loans

- Not be guilty of the sale of illegal drugs while federal aid was being received

The FAFSA consists of approximately 130 questions related to the students and parents assets, investments, income, taxes paid, household size and number of dependent students in the family attending college or graduate school.

A student is considered a dependent and must include parental information on the FAFSA until he or she:

- Turns 24 years old

- Becomes an orphan or ward of the court

- Becomes a veteran of active military service

- Has one or more dependent children

Recommended Reading: Free Government Phone And Service

Student Debt Continues To Rise

Student debt continues to be an epidemic in our society. Since the 2008 recession, federal funding for public universities has decreased by 22%, while tuition costs have risen 27%. This has led to student loan debt thats surpassed $1.6 trillion. The debt may get worse if the education system is forced to undergo more budget cuts and if more unemployed Americans take advantage of low interest rates to go back to school.

Current & Historic Federal Student Loan Interest Rates

With the passing of the Coronavirus Aid, Relief, and Economic Security Act , no interest will accrue on federal student loans in repayment until January 31, 2022effectively setting the interest rate at 0%. Payments made during this time will first apply to unpaid interest accrued from before March 13, 2020, then directly towards the principal balance of the loan.

In the following table, you will find the current and historic interest rates for federal loans. These rates coincide with the academic year that the loans were taken out .

It should be noted that all of these are fixed rates, meaning that they do not change over time.

| Loan type | |

| 6.31% | 6.84% |

Federal student loans are issued by the Department of Education to eligible students who fill out the Free Application for Federal Student Aid, or FAFSA. The interest rates on these loans are set once a year and are based on the 10-year Treasury note.

Heres how interest works for different borrowers:

An added cost to federal loans worth mentioning comes in the form of an origination fee. Unlike most private lenders, the Department of Education deducts a fee from your loan amount prior to disbursement. This deduction means that your loan amount will be a bit higher than the funds disbursed to your school.

Here are the current and historical origination fees for federal student loans.

| Loan type | |

| 4.27% | 4.29% |

Recommended Reading: Federal Government Day Care Centers

Refinance Loan Interest Rates

Federal and private student loans can only be refinanced through private lenders.

- One study found that if every eligible borrower refinanced their loans, the national average interest rate would drop to 4.2%.

- 52.8% of borrowers are eligible for refinancing.

- 33.3% of borrowers consolidate or refinance their loans.

For more information, see our report on Student Loan Refinancing.

Subsidized Vs Unsubsidized Loans

The Department of Education offers subsidized and unsubsidized loans for undergraduate students. Subsidized student loans are available to students based on financial need.

With subsidized loans, the government pays any accumulated interest on your behalf while youre still completing your education. In other words, you wont owe any interest on your student loan until after you graduate.

When a loan is unsubsidized, you as the borrower may have to start repaying interest on your principal amount immediately. However, if your unsubsidized loan qualifies for an in-school deferment you can delay your interest payments .

Dont Miss: Free Government Flip Phones For Seniors

Recommended Reading: What Government Grants Are Available

Interest Rates And Repayment Plans

Your school loan interest rate may be constant, but the total amount of interest that you may end up paying will depend on the repayment plan you choose. For instance, if you have borrowed a Direct PLUS federal loan of $50,000 , you will pay the following amounts according to the repayment plan chosen by you:

Standard Repayment Plan

- Total Interest Payment: $64,780

Frequently Asked Questions

My search for current student loan interest rates mentioned fixed and variable options. What is the difference between these two?What are student loan consolidation interest rates?

Consolidating loans means combining multiple loans into one, which typically reduces multiple payments into one, and also lowers the interest rate. The interest rate on a federal consolidation loan is the average of the interest rate on all the loans. It is then rounded up to the nearest 1/8 of a percent.

What is a good interest rate on student loans?

The best private student loan interest rates lie somewhere between LIBOR + 2.0% or PRIME + 0.50% with no hidden charges. However, the problem with loans offering such amazing rates is that they are available only to borrowers with great credit history or someone with a credit-worthy cosigner.

How should I compare student loan interest?

How can I lower the interest on my student loans?

Are interest rates lower on federal student loans?

When does interest begin to accrue on my PLUS loan and when is interest capitalized?

Current Student Loan Refinancing Interest Rates

Refinancing student loans is a smart option if you can receive a lower interest rate than the rate on your existing loans. By receiving a lower rate, you reduce the total interest youll pay over the life of your loan.

Remember, refinancing is done by private lenders, not the federal government. This means that federal borrowers should only refinance their loans if they receive a lower interest rate and dont need the added benefits of federal loans, such as income-driven repayment plans or student loan forgiveness.

Here are the student loan refinance rates from several lenders.

| Lender |

To compare your options, check out our picks for the best student loan refinance companies.

Also Check: Government And Nonprofit Accounting Online Course

Ascent Student Loans Disclosures

Ascent Student Loans Disclosures

*Ascent Student Loans are funded by Bank of Lake Mills, Member FDIC. Loan products may not be available in certain jurisdictions. Certain restrictions, limitations and terms and conditions may apply. For Ascent Terms and Conditions please visit: AscentStudentLoans.com/Ts& Cs

Rates are effective as of 09/01/2021 and reflect an automatic payment discount of 0.25% on the lowest offered rate and a 2.00% discount on the highest offered rate. Automatic Payment Discount is available if the borrower is enrolled in automatic payments from their personal checking account and the amount is successfully withdrawn from the authorized bank account each month. For Ascent rates and repayment examples please visit: AscentStudentLoans.com/Rates

1% Cash Back Graduation Reward subject to terms and conditions. for details.

Effects Of Rising Rates For Students And Parents

A 1 percentage point rate increase translates to a few extra dollars per month in payments on a typical federal loan. The bigger impact will be felt on a loan’s overall accruing interest. In particular, parents and graduate students who borrow through the Plus loan could feel additional strain when taking out money for themselves or their kids’ education. This is because the Plus loan has a higher interest rate than other types of federal student loans.

For example, let’s say a parent borrows $10,000 with a Plus loan for a son’s 2021 sophomore year. Excluding origination fees, that’s about $5 more per month and $587 more in interest over 10 years compared with the same loan taken out in 2020. The Plus loan also allows parents and grad students to borrow for a variety of expenses, including the cost of attendance room and board tuition and fees and allowances for living expenses. Of course, paying off the loan early would result in lower overall interest.

You May Like: List Of Government Grants For Individuals In Usa

Choosing Federal Versus Private Student Loans

The interest rates we’ve discussed so far apply only to federal student loans. The other option is to take out a loan with a private lender. Unlike government-backed funding, private lenders use a risk-based approach to set student loan terms and interest rates, which may include your credit history and score, your income, existing debt and whether you have a co-signer.

Depending on those factors, you may find a private loan with a lower fixed interest rate. Keep in mind, however, that private loans don’t necessarily offer the same protections guaranteed with federal loans, including:

- Income-sensitive repayment: Your loan may qualify for up to eight repayment options depending on how much you owe and your income post-graduation. You can also extend the 10-year repayment period to up to 30 years if lower payments suit your budget.

- Debt forgiveness: There are a few paths to debt forgiveness for federal loans. If you have an income-driven repayment plan, the government may cancel the remaining balance on a loan you’ve paid for 20-25 years. Many federal loans are also forgivable if you work in teaching, nonprofit or public service fields. You can learn more about federal loan forgiveness on the Federal Student Aid website.

- Hardship options: Federal borrowers qualify for student loan forbearance or postponement in the event of job loss, illness, injury, returning to school or relief during a national emergency, like COVID-19.

The Difference Between Subsidized And Unsubsidized Student Loans

Federal student loans can be either subsidized or unsubsidized.The primary difference between the two options is the way you’ll pay the interest, your total debt after graduation and your repayment plan.

Direct Unsubsidized Loans:

- Who pays interest costs? The borrower.

- What’s the lifetime maximum limit? $31,000 for dependent undergraduate students, $57,500 for independent undergraduate students and $138,500 for graduate or professional students.

- Do you need to demonstrate financial need? No.

- Who can borrow? Undergraduate students, graduate students and professional degree students.

- Are there extra costs involved? 1.057 percent fee for loans disbursed on or after Oct. 1, 2020, and before Oct. 1, 2022.

Direct Subsidized Loans:

- Who pays interest costs? The U.S. Department of Education pays interest while the student is enrolled in school at least half time, during the six-month post-graduation grace period and during deferment. The borrower pays interest during regular repayment periods.

- What’s the lifetime maximum limit? $23,000.

- Do you need to demonstrate financial need? Yes.

- Who can borrow? Undergraduate students.

- Are there extra costs involved? 1.057 percent fee for loans disbursed on or after Oct. 1, 2020, and before Oct. 1, 2022.

Learn more:The difference between subsidized and unsubsidized student loans

Don’t Miss: Where To Cash A Government Check For Free

How To Reduce Student Loan Interest Rates

Whether your student loan is federal or private, there are a few ways to reduce the rate you have.

- Consolidate. If you have federal loans with interest rates that are higher than what is currently being offered, you may repackage them with a federal direct consolidation loan to get a lower overall rate. There is no extra fee to do this, but you can’t include private loans in the mix.

- Refinance. If you have an excellent credit history, you may also be able to refinance your existing private student loans with a new loan at a lower rate. There could be an origination fee involved, but it can still work out in your favor if the interest rate is significantly lower.

- Pay on Time. Want to be rewarded for being responsible? You will be if you pay your federal student loans on time. You could receive an interest rate reduction of 1% after 36 months of perfect payments, and 2% after 48 months.

- Enroll in Direct Debit. To ensure on-time payments, the vast majority of lenders, from federal student loan servicers to private lenders, will give you a break if you enroll in automatic payment systems. The payment is debited from your checking account on a certain day of the month, then delivered to the lender without you having to do anything but monitor your statements. As an incentive, the lender may reduce the interest rate by .25% or even .50%.