How Much Federal Taxes Are Taken Out Of Paychecks

Federal income taxes are an unavoidable bother. Uncle Sam will always get its cut of the action, using the IRS to collect whenever people happen to earn. While people who are self-employed may end up with a different situation, the average person with an employer will have taxes withheld from every paycheck. Federal income tax withholding is based on a rough guess from the IRS about what taxes you will owe at the end of the year. If you happen to pay more in taxes than you end up owing, then the money will be returned to you in the form of a tax refund. With this in mind, how much in federal taxes will be taken out of your paycheck? Heres how to figure it out.

Claiming exemptions to reduce tax withholdingWhen you start a new job, youll likely be required to fill out some financial forms. One of those forms will ask you the number of income tax exemptions you happen to have. Income tax withholding exemptions allow you to reduce the amount of tax an employer will take out of your paycheck. You are legally allowed to do this based upon things like dependents and head of household status. This can be dangerous, of course, because it can mean that you end up owing tax at the end of the year. Most people will not be able to claim enough exemptions to reach this level, however.

How Are Payroll Deductions Reported

When reporting employee tax withholdings and filing the required employer tax payments to the federal government, you typically use the following forms:

These documents can be submitted via paper or e-file. Individual states have their own guidelines for reporting payroll deductions, so its important to check with your local authorities.

Read Also: Home Loans For Federal Government Employees

How The Federal Government Generated Money In 2016

All told, the U.S. government collected $3.267 trillion in fiscal 2016. The vast majority of revenue came from the collection of taxes.

Image source: Department of the Treasury.

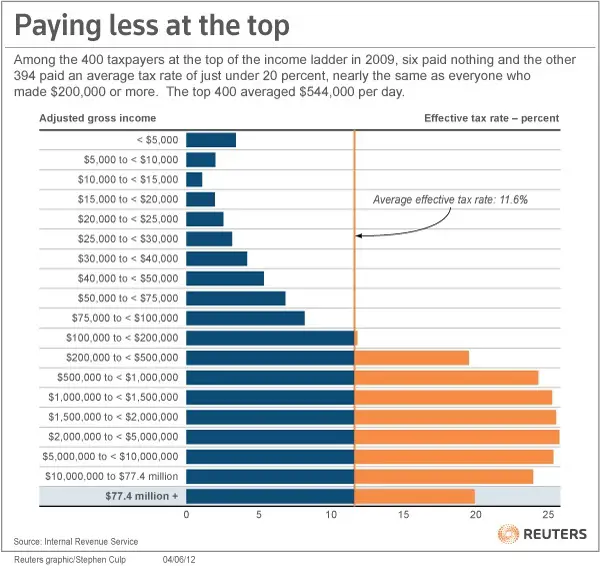

Individual income tax returns filed by an estimated 150 million-plus people in 2016 resulted in the collection of nearly $1.55 trillion. This figure is all the more impressive when you take into account the fact that 4 in 5 taxpayers receive refunds from the federal government in a given year. In a typical year, the top 1% of income earners in the U.S. pay more than 25% of all federal income tax revenue collected by the IRS.

Running a fairly close second in revenue collection with $1.12 trillion in fiscal 2016 were Social Security and other payroll taxes. Among social programs, Social Security is by far the largest. Not surprisingly, the 12.4% payroll tax that workers pay on earned income between $1 and $118,500 generates a lot of money for the federal government each year. This tax is typically split down the middle between you and your employer , while self-employed people pay the full amount.

Finally, $306 billion was collected from a plethora of additional taxes and duties according to the final monthly statement from the Treasury. This included the collection of more than $95 billion in excise taxes, $21 billion in estate and gift taxes, and $35 billion in custom duties.

The $3.267 trillion collected by the U.S. government in fiscal 2016 is an all-time high.

Recommended Reading: How To Get Free Government Money To Start A Business

Don’t Use This Tool If:

- You have a pension but not a job. Estimate your tax withholding with the new Form W-4P.

- You have nonresident alien status. Use Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens.

- Your tax situation is complex. This includes alternative minimum tax, long-term capital gains or qualified dividends. See Publication 505, Tax Withholding and Estimated Tax.

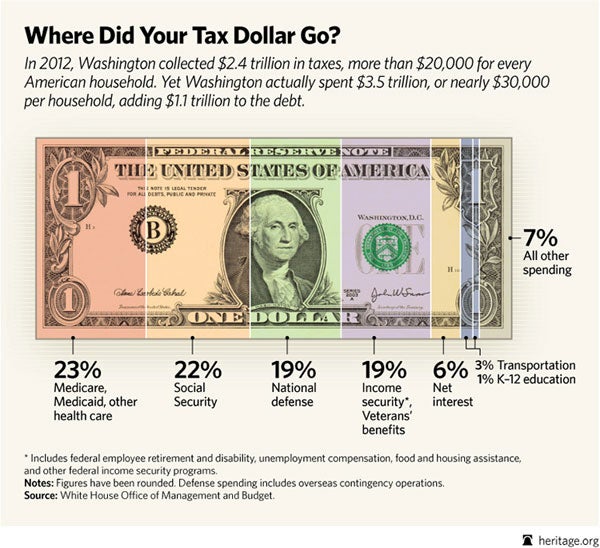

Where Does All That Money Go

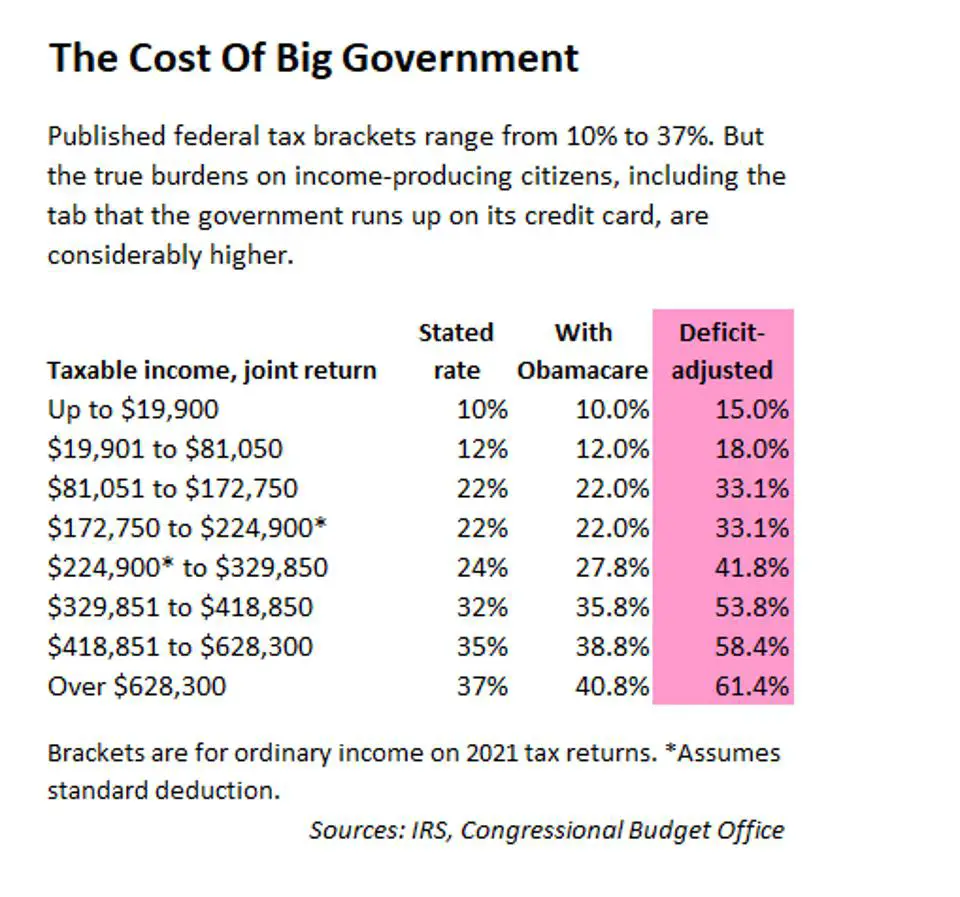

Federal income tax is the governments biggest source of revenue. It is used to pay the countrys ongoing expenses, such as national defense, infrastructure needs, social assistance programs, and paying interest on the national debt.

Many people are surprised to learn that all of the income you make is not taxed at one rate. Lets say you are the single filer in the example above, earning $41,600 per year. Your income falls into the 22% tax bracket. But, if you paid a flat 22% tax rate, you’d owe $9,152. Yikes. What gives?

Federal income taxes are paid in tiers. For a single filer, the first $9,875 you earn is taxed at 10%. The next $30,249 you earn–the amount from $9,876 to $40,125–is taxed at 15%. Only the very last $1,475 you earned would be taxed at the 22% rate. This IRS Tax Table can help you figure out how much federal income tax you owe.

Recommended Reading: Free Government Funding For Home Repairs

Federal Top Income Tax Rate

| Year | |

|---|---|

| 2011 | 35.00% |

When it comes to tax withholdings, employees face a trade-off between bigger paychecks and a smaller tax bill. It’s important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn’t. Additionally, it removes the option to claim personal and/or dependency exemptions. Instead, filers are required to enter annual dollar amounts for things such as total annual taxable wages, non-wage income and itemized and other deductions. The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information.

One way to manage your tax bill is by adjusting your withholdings. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven’t had enough withheld to cover your tax liability for the year. That would mean that instead of getting a tax refund, you would owe money.

If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding. Each of your paychecks may be smaller, but youre more likely to get a tax refund and less likely to have tax liability when you fill out your tax return.

Change In Withholding When You Start Social Security

Many retirees who have a pension are surprised by the increase in their taxes when they start Social Security. The amount of your Social Security benefits subject to taxation depends on your other sources of income. If your pension started a few years ago, and now you are starting Social Security benefits, you will likely need to increase your tax withholding.

Recommended Reading: How Much Does H& r Block Charge For Doing Taxes

Recommended Reading: Government In America Ap Edition

The Federal Taxes You Pay Throughout The Year

Your paychecks likely include a line item showing how much federal income tax was withheld from your pay. This money is sent to the federal government many times each year and represents a payment against the federal taxes you’ll owe when you prepare your tax return.

Typically, you’re required to pay federal income tax as you earn income throughout the year. If you’re self-employed and don’t receive a paycheck, you’ll generally make estimated tax payments on a quarterly basis.

Each year, you’ll file a federal income tax return to reconcile what you actually owe for the prior year with what you paid in.

- If you paid in more than you owe, you get a refund.

- If you paid too little, you will owe more tax.

Adjust Gross Pay For Social Security Wages

Now that you have gross wages, we can take a closer look. Before you calculate FICA withholding and income tax withholding, you must remove some types of payments to employees.

The types of payments not included from Social Security wages may be different from the types of pay excluded from federal income tax.

For example, if you hire your child to work in your business, you must take out the amount of their pay when you calculate Social Security withholding but don’t take it out when calculating federal income tax withholding.

Here’s another example: Your contributions to a tax-deferred retirement plan plan should not be included in calculations for both federal income tax or Social Security tax.

Recommended Reading: What Is The Government Interest Rate

An Example Of An Employee Pay Stub

In the case of the employee above, the weekly pay stub would look like this:

| Employee Pay Stub |

|---|

You must make deposits with the IRS of the taxes withheld from employees’ pay for federal income taxes, FICA taxes, and the amounts you owe as an employer. Specifically, after each payroll, you must:

- Pay the federal income tax withholding from all employees

- Pay the FICA tax withholding from all employees, and

- Pay your half of the FICA tax for all employees.

Depending on the size of your payroll, you must make deposits monthly or semi-weekly.

You must also file a quarterly report on Form 941 showing the amounts you owe and how much you have paid.

How Much Of Your Paycheck Goes To Taxes And Why

Its your first payday at a new job. You make $15 an hour, and you worked 80 hours over the past two weeks. Your paycheck hits your account, but you dont see $1,200 you see something closer to $950.

Thats because your employer deducted the taxes you owe the federal government. If you were a contractor or freelancer, you would have to calculate this amount and pay it yourself, but your companys payroll administrator does it for you as an employee.

Taxes are important. They fund essential public services and spaces like education, transportation, Medicare, Social Security, parks, and much more. Theyre not a bad thing it just sucks when people who make a lot of money dont have to pay nearly as much as you do in comparison. Instead of making $2,400 every four weeks, you earn about $1,900, so now you have to budget accordingly.

Several factors influence how much of your paycheck goes to taxes, though. Lets go over where your money goes and whether or not you could see it again.

You May Like: Government Dental Assistance For Seniors

What Are Federal Taxes

Federal taxes are the taxes withheld from employee paychecks. These taxes fall into two groups: Federal Income Tax and Federal Insurance Contributions Act . Federal Unemployment Tax Act is another type of tax withheld however, FUTA is paid solely by employers.

For employees, there isnt a one-size-fits-all answer to, How much federal tax is taken out of my paycheck? However, free online tax calculators and learning how payroll taxes work helps understand what take-home pay may look like.

Where Does The Us Government Get Its Money

The US Constitution can be vague at times, but when it comes to taxes, there is little question about the governments power. The Congress, James Madison writes, shall have Power to lay and collect Taxes, Duties, Imposts and Excises. In modern language, the government can tax its citizens, and it does. But just because the government has the power to do something doesnt mean it should. Despite the Constitutions clear mandate that the federal government may tax its citizens, taxes are a very complicated and often problematic part of American life. The US tax code is around 2,600 pages long. And there are additional tens of thousands of pages about the tax code: IRS regulations, revenue rulings, and case law covering court proceedings around the code. But a few fundamental questions can get to the root of how American taxes relate to the US debt.

Recommended Reading: Government Housing Assistance In Arkansas

How To Apply For The Cpp Death Benefit

Who Should Fill Out the FormIf there is an Estate, the Executor, Administrator or a legal representative for the estate should apply for the Death Benefit within 60 days after the date of death.

Otherwise, the person who paid for the funeral should apply.

Sometimes there is no funeral expense. For example, perhaps the body was donated to medical science and cremated by the hospital afterwards. Then the spouse or common-law partner should apply.

And, if no one else can apply, the next of kin can.

Where Can One Get the CPP Death Benefit Application FormThe application form is on the Government website at

If you can stand voice activated telephone systems, you can call and order a kit from the government at 1 800 277 9914 . Those are also the numbers to call for assistance.

What Do I Need to Fill Out the CPP Death Benefit FormThe person completing the form will need

What Is My Filing Status

The filing status you use largely depends on the answer to one question: Were you considered married on the last day of the year? If yes, you are considered married for tax filing that year. If not, you are considered not married.

Some particular circumstances under which married persons may be viewed as not married. For example, someone may qualify for Head of Household status even if they are not legally separated or divorced.

Types of filing statuses include:

Also Check: What Are Government Bonds Paying

Penalties For Missing Or Late On Employment Tax Payments

If employers fail to remit payroll tax payments or send them in late, it could have the following impact:

- Employers may face criminal and civil sanctions

- Employees may lose access to future Social Security or Medicare benefits

- Employees may lose access to future unemployment benefits

If youre late making deposits for FICA or federal taxes, youll be charged penalties as follows:

| Penalty | |

|---|---|

| 16 or more days but before 10 days from the date of the first IRS notice | |

| 10% | Amounts that should have been deposited, but instead were paid directly to the IRS or paid with your tax return |

| 15% | Amounts still unpaid more than 10 days after the date of the first IRS notice or the day you receive notice and demand for immediate payment |

Estimate Your Income Tax For The Current Year

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year .

This tells you your take-home pay if you do not have any other deductions, such as pension contributions or student loans.

If youre self-employed, the self-employed ready reckoner tool can help you budget for your tax bill.

You may be able to claim a refund if youve paid too much tax.

Recommended Reading: Headhunters For Federal Government Jobs

Withholding Taxes On Wages

If you’re an employer, you need to withhold Massachusetts income tax from your employees’ wages. This guide explains your responsibilities as an employer, including collecting your employee’s tax reporting information, calculating withholding, and filing and paying withholding taxes.This guide is not designed to address all questions that may arise nor does it address complex issues in detail. Nothing contained herein supersedes, alters or otherwise changes any provision of the Massachusetts General Laws, Massachusetts Department of Revenue Regulations, Department rulings, public written statements or any other sources of law or published guidance.Updated: September 15, 2022

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

Also Check: Mt Hood Brewing Government Camp

How Do I Create A Paycheck For An Employee

Employers typically have two basic options for creating paychecks:

Summary Of Payroll Taxes

Since your business and your employee are both taxpayers, there are two types of payroll taxes: ones that come out of your own pocket and ones that you collect from employee paychecks and remit to the federal government.

Payroll taxes that come out of your pocket:

-

FICA tax: contributions to Social Security and healthcare programs . This cost is shared by employer and employee. The employer portion is 6.2% for Social Security and 1.45% for Medicare, and youâll collect and remit the same amount from your employees.

-

FUTA tax: contributions to unemployment insurance. The total amount is 6.0%. However, most states have a 5.4% credit, meaning most employers only pay 0.6%.

Weâll cover both of these in more detail later on.

Payroll taxes that you collect and remit:

-

Federal income taxes

Weâll cover each of these in detail, beginning with federal income tax withholding.

Recommended Reading: American Government Online Course Free

Taxes On Pension Income

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs, 401s, 403s and similar retirement plans, and tax-deferred annuitiesin the year you take the money. The taxes that are due reduce the amount you have left to spend.

You will owe federal income tax at your regular rate as you receive the money from pension annuities and periodic pension payments. But if you take a direct lump-sum payout from your pension instead, you must pay the total tax due when you file your return for the year you receive the money. In either case, your employer will withhold taxes as the payments are made, so at least some of whats due will have been prepaid. If you transfer a lump sum directly to an IRA, taxes will be deferred until you start withdrawing funds.

Smart Tip: Taxes on Pension Income Vary by StateIts a good idea to check the different state tax rules on pension income. Some states do not tax pension payments while others doand that can influence people to consider moving when they retire. States cant tax pension money you earned within their borders if youve moved your legal residence to another state. For instance, if you worked in Minnesota, but now live in Florida, which has no state income tax, you dont owe any Minnesota income tax on the pension you receive from your former employer.

You May Like: Environmental Social And Governance Investing