Ask The Experts: The Best Credit Reports In Life Are Free

Fortunately, its pretty easy to get a free credit report these days. But we could all stand to make some improvements in terms of how often we check and what we do with the information. So WalletHub convened a panel of personal finance experts for some tips and insights. Below, you can see who they are, what we asked them and how they recommend getting more from your free credit reports.

Is Annualcreditreportcom Safe

To understand the precautions AnnualCreditReport.com takes, its important to have an overview of how the site works. First, you must provide your Social Security number. Youll also need to give AnnualCreditReport.com your first and last name, your current address, and, if youve lived there for less than two years, your previous address.

Once you enter that information, the site asks you which credit report youd like to request. You can select one, two, or all three. Perhaps you may want to space out your requests so you are checking on one report every few months.

After making your selection, AnnualCreditReport.com takes additional steps to verify your identity. Youll be asked to review your details to make sure theyre correct. Then youll be asked to answer three security questions, which will vary, depending on your situation. For instance, you may be asked what year you took out a car loan, the balance on your mortgagea dollar rangeor to choose a city youve previously lived in from a list. If you answer those questions successfully, youll be able to view your credit report.

Your credit reports wont include your credit scores. Experian, TransUnion, and Equifax can provide those separately, but there are sometimes fees. You can get scores for free from sites such as CreditKarma.com or CreditSesame.com. Many major credit card companies also include free scores monthly as a perk.

Get Your Credit Score

Your credit score comes from the information in your credit report. It shows how risky it would be for a lender to lend you money.

Learn more about how your credit score is calculated.

You can access your credit score online from Canadas 2 main credit bureaus.

Your credit score from Equifax is accessible online for free and is updated monthly. If you live in Quebec, you can also access your credit score from TransUnion online for free.

Other companies may also offer to provide your credit score for free. Some may ask you to sign up for a paid service to get your score.

Read Also: Dollar Rental Car Government Discount Code

Consumer Rights Under The Fair Credit Reporting Act

Consumers also have a right to see their own credit reports. By law, they are entitled to one free credit report every 12 months from each of the three major bureaus. They can request their reports at the official, government-authorized website for that purpose, AnnualCreditReport.com. Under FCRA, consumers also have a right to:

- Verify the accuracy of their report when its required for employment purposes.

- Receive notification if information in their file has been used against them in applying for credit or other transactions.

- Disputeand have the bureau correctinformation in their report that is incomplete or inaccurate, in an effort to repair their credit.

- Remove outdated, negative information .

If the credit bureau fails to respond to their request in a satisfactory manner, a consumer can file a complaint with the Federal Consumer Financial Protection Bureau .

Get Your Credit Score And Report For Free

If you’ve ever applied for credit or a loan, there will be a credit report about you.

You have a right to get a copy of your credit report for free every 3 months. It’s worth getting a copy at least once a year.

Your credit report also includes a credit rating. This is the ‘band’ your credit score sits in .

Recommended Reading: Apply For Free Government Money Online

Check Your Credit Reports Regularly For Free

Accounts listed on your credit report that you do not recognize may indicate that you have become a victim of identity theft. The next section contains specific information related to credit reports, credit scores and identity theft.

What is a Credit Report and How is it Used?A credit report contains detailed information about a persons credit history, including credit accounts and loans, bankruptcies and late payments and recent inquiries. Credit reports are compiled by three major companies known as credit reporting agencies.

Typically, when a consumer applies for credit, the prospective lender obtains the applicants credit report to help determine creditworthiness. The information in a credit report is one of several factors that help lenders determine whether to offer credit, and on what terms, such as interest rate, annual percentage rate, grace period and other contractual obligations of the credit card or loan. This information is also used to generate a credit score, which is explained in greater detail below.

Requesting FREE Credit ReportsConsumers are entitled to one free credit report every twelve months from each of the three major credit reporting agencies. The official website from which consumers can request their free annual credit report is www.annualcreditreport.com.

What Goes Into A Credit Score

Each company has its own way to calculate your credit score. They look at:

- how many loans and credit cards you have

- how much money you owe

- how long you have had credit

- how much new credit you have

They look at the information in your credit report and give it a number. That is your credit score.

It is very important to know what is in your credit report. If your report is good, your score will be good. You can decide if it is worth paying money to see what number someone gives your credit history.

Your credit history is important. It tells businesses how you pay your bills. Those businesses then decide if they want to give you a credit card, a job, an apartment, a loan, or insurance.

Find out what is in your report. Be sure the information is correct. Fix anything that is not correct.

Recommended Reading: Government Grants For Down Syndrome

How To View Your Free Credit Reports Every Year

Reviewing your credit reports is a crucial part of avoiding errors and preventing identity theft. Those reports contain the raw information that goes into your credit scores, and bad information can lead to lower .

Fortunately, its free to see whats in your credit reports. The federal Fair Credit Reporting Act requires that U.S. consumers be entitled to a free credit report each year.

In the past, it was harder to get that information for free. You had to purchase reports or qualify based on certain activities based on the credit report . Some statesrequired that residents periodically be entitled to a free report, but federal law makes it official nationwide.

What Is A Credit History

Sometimes, people talk about your credit. What they mean is your credit history. Your credit history describes how you use money:

- How many credit cards do you have?

- How many loans do you have?

- Do you pay your bills on time?

If you have a credit card or a loan from a bank, you have a credit history. Companies collect information about your loans and credit cards.

Companies also collect information about how you pay your bills. They put this information in one place: your credit report.

Don’t Miss: Government Contractor Jobs In Houston Tx

Talk To A Qualified Credit Counselor

Before taking out a home equity loan, be careful and consider the pros and cons. You should explore alternatives with a credit counselor that do not put your home at risk of a forced sale. If you are unable to make payments on time, you could end up losing your home.

Contact a qualified credit counselor through the National Foundation for Credit Counseling .

How To Obtain Your Free Credit Reports

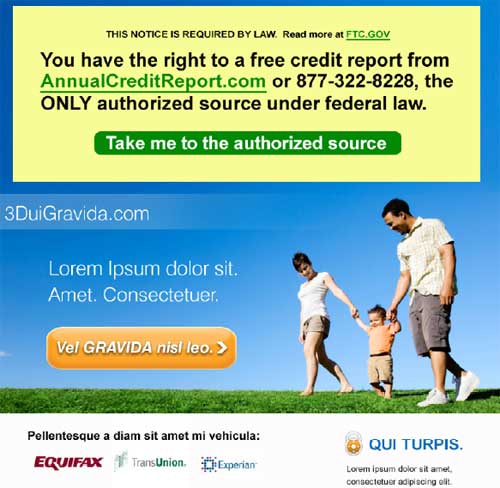

The three major credit reporting agencies in the U.S. teamed up to provide where you can order your free credit reports: www.annualcreditreport.com.

Once there, answer a series of questions to verify your identity, and select which reports to view. You can also call 877-322-8228 to request a copy of your credit reports by phone.

Also Check: 8774182573

You May Like: Ok Google Free Government Phones

How The Fair Credit Reporting Act Works

The Fair Credit Reporting Act is the primary federal law that governs the collection and reporting of credit information about consumers. Its rules cover how a consumers credit information is obtained, how long it is kept, and how it is shared with othersincluding consumers themselves.

The Federal Trade Commission and the Consumer Financial Protection Bureau are the two federal agencies charged with overseeing and enforcing the provisions of the act. Many states also have their own laws relating to credit reporting. The act in its entirety can be found in United States Code Title 15, Section 1681.

The three major credit reporting bureausEquifax, Experian, and TransUnionas well as other, more specialized companies, collect and sell information on individual consumers financial history. The information in their reports is also used to compute consumers credit scores, which can affect, for example, the interest rate theyll have to pay to borrow money.

Dont Miss: Rtc Las Vegas Jobs

Report Scams To Third Parties

You may want to report the scam to organizations outside of the government. Third parties may be able to get your money back or remove fraudulent charges.

Report a scam that happened with an online seller or a payment transfer system to the companys fraud department.

If you used your credit card or bank account to pay a scammer, report it to the card issuer or bank. Also report scams to the major credit reporting agencies. Place a fraud alert on your credit report to prevent someone from opening credit accounts in your name.

Recommended Reading: Government Programs To Help Small Businesses

Determine How You Want To Request Your Report

You are entitled to a free credit report every 12 months from each of the three major consumer credit reporting companies: Equifax, Experian, and TransUnion. You can request and review your credit report in one of the following ways:

- Online: Complete the online application process on AnnualCreditReport.com, the official government website for requesting a credit report.

- Phone: Call 322-8228

- Mail: Download and complete the Annual Credit Report Request form. The completed form should then be mailed to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281

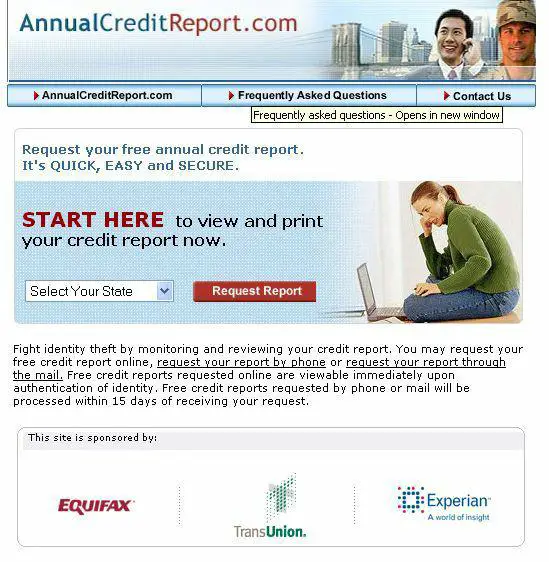

Image courtesy AnnualCreditReport.com.

Be on the lookout for suspicious websites that offer free credit reports, especially those mimicking the name and design of AnnualCreditReport.com. Some websites will only give you a free report if you buy their products or services, while others will give you a free report and then bill you for services you have to cancel. To ensure you’re going to the correct site, you can type www.AnnualCreditReport.com into your web browser address line or visit the Consumer Financial Protection Bureau ‘s website. If you find a link to AnnualCreditReport.com on a site you don’t trust or in an email, play it safe and don’t click on it.

You are also eligible for additional free credit reports if any of the following applies to you:

Viewing And Saving Your Credit Reports

The credit report itself is presented in an easy to use format, with links to each section of the credit report, including open accounts, potentially negative information and recent credit inquiries. This electronic format is far easier than the old method of requesting a copy of the credit report by mail, reading through the paper and painstakingly documenting errors by hand. You can easily spot any attempts at identity theft or other potential problems.

The online credit report also provides a dispute link so you can dispute any erroneous information found on the report. You can use this or you can submit disputes through regular mail and send them via certified mail. We have found both methods work equally well.

The web site has a FAQs section for asking how to questions about getting your credit report and using this free service more effectively. The FAQ link is located right at the top of the home page, making it visible to consumers wanting answers to their questions.

The site also includes a customer comment form consumers can use to contact the AnnualCreditReport.com organization. You may ask questions about the use of the site or your credit report using this form that are not already covered in the frequently asked questions section of the web site.

Don’t Miss: Government Of Canada Eta Application

Have Your Personal Information Ready

In order to request a credit report, you will have to provide several pieces of personal information, specifically your full name, date of birth, mailing address, Social Security number , and your previous mailing address. Additional information may be required to process your request, in which case the consumer credit reporting company you requested your credit report from will contact you by mail. As this information is used to identify you for the request process, omission of any information when filing by mail may delay your request.

Although most of this information should be known to you, some details may be harder to recall. While you can simply pause when filling out a mailing request form or an online application, failing to have all of this information on hand while making a request by phone could result in a slower application process or having to start over at a later time.

When requesting your credit report online, you will be asked several security questions about your finances that only you should be capable of answering . As these questions will vary from person to person, it can be difficult to adequately prepare for them. Note that, should you request your credit report by mail or phone, you may not be required to answer any security questions.

Why Should I Get My Credit Report

An important reason to get your credit report is to find problems or mistakes and fix them:

- You might find somebodys information in your report by mistake.

- You might find information about you from a long time ago.

- You might find accounts that are not yours. That might mean someone stole your identity.

You want to know what is in your report. The information in your report will help decide whether you get a loan, a credit card, a job or insurance.

If the information is wrong, you can try to fix it. If the information is right but not so good you can try to improve your credit history.

Don’t Miss: Buy Gold From Us Government

The 6 Best Free Credit Reports Of 2022

- Best for Credit Monitoring:

- Best for Single Bureau Access:

- Best for Improving Credit:

- Best for Daily Updates: WalletHub

AnnualCreditReport.com makes it simple to review your Equifax, Experian, and TransUnion credit reports all in one place.

-

Reports from three major bureaus available

-

No account requirement

-

Only accessible once a year

-

No credit score access

In 2003, a Federal law passed granting every consumer the right to a free report from all credit reporting agencies each year. AnnualCreditReport.com is the centralized site that allows every consumer to access their free credit report granted by Federal law.

The Consumer Financial Protection Bureau confirms that AnnualCreditReport.com is the official website that allows you to access each of your credit reports from all three of the major credit bureaus Equifax, Experian, and TransUnion at no cost. You can obtain one free credit report every 12 months through AnnualCreditReport.com, without signing up, creating an account, or entering your credit card information. Alternatively, you can call 1-877-322-8228 to order your legally free credit report.

Downsides Of Late Payment

A late payment not only lowers your credit score, but also costs you in the form of late fees and higher interest rates. For instance, you could be charged a late fee even if you pay your credit card bill just one day late. Your lender will certainly raise your interest rate if you fall into the habit of regularly missing your credit card payments, which would mean you would have to pay more money to carry a balance.

Donât Miss: Dental Implant Grants

Recommended Reading: Free Android Phones From Government

What Is Credit Score & Credit Report

The credit report is created using a borrowers credit history with detailed information of his/her prior borrowings and how loans/credit cards have been handled in the past. Apart from credit history, credit report also contains a list of banks/NBFCs that have made an enquiry for the consumers credit report.

The formula used for generating credit score is proprietary and it varies from one credit bureau to another, so the credit score of the same individual also varies from one CIC to another. Credit score is one of the key factors considered by lenders when approving a loan or credit card application. The closer an applicants score is to 900, greater are the chances of being approved for new credit cards and/or loans.

You May Like: Congress Mortgage Stimulus Program 2019

Pick The Reports You Want

There are three major US credit bureaus: Equifax, Experian and TransUnion. Each maintains a separate account of your credit record. Therefore, certain credit information might appear on one report but not on another.Choose the reports youd like to receive. The Fair Credit Reporting Act permits you to receive one of each credit report every 12 months in other words, you could request an Equifax report today, an Experian report tomorrow, and a TransUnion report the next day.I like to receive all three reports at once, so Im going to check all three boxes.

You May Like: Safelink Free Phone Replacement

You May Like: What Is The Government’s Phone Number