Michigan Schools And Government Credit Union $200 Bonus

Gain a $200 bonus in total when you open a Regular or Fresh Start Checking account online or in-branch.

- What youll get: $200 Bonus

- Eligible account: Regular or Fresh Start Checking Account

- Where its available: MI

- How to earn it:

- Earn $100 when you set up your direct deposit of $100+ to your new checking account within 60 days.

- Gain $100 when you complete 10 debit card transactions.

| Additionally, you can take advantage of some of the best offers available for entry level checking accounts such as Chase Total Checking , Wells Fargo Checking , Citi Priority Account , Discover Cash Back Debit , Chase Secure Banking , Aspiration Spend & Save Account , as well as TD Bank Convenience Checking . |

Michigan Schools And Government Credit Union Jobs In

Hotwww.glassdoor.com

Michigan SchoolsGovernment Credit UnionWarrenMichigan SchoolsGovernment Credit UnionWarrenMichigan SchoolsGovernment Credit Union WarrenGlassdoor

362 People Used

The Right Scholarship Essay Format And Structure

How To Create Your College List From Home During Covid-19

Important Things To Know About Merit Aid Scholarships

Scholarships Focusing On Low-Income Students And Families

Does The Small Amount Of Interest Gained On A Time Deposit Make Sense Given The Fact That I Am Losing Access To My Capital

This is a decision that depends on your own specific circumstances, your needs for cash, and other investments that you may wish to pursue over the next 12 months . The premium in a one-year CD is very small, however, a small difference in compounding interest can make a large difference over long period of time. You may wish to familiarize yourself with our Savings Booster Calculator in order to understand the importance of compounding interest at higher rates on your money over time.

Don’t Miss: Missouri State Jobs In Kansas City

Michigan Schools And Government Credit Union Review

Michigan Schools and Government Credit Union was founded in 1954 and is based in Clinton Township, MI.

Learn more about Michigan Schools and Government Credit Union and its products by browsing the services it offers. You can also read our community reviews and hear what others have to say about their experience with Michigan Schools and Government Credit Union.

SuperMoney DisclosureEditorial Disclaimer

Security Service Federal Credit Union: 055% Apy $25000 Minimum Deposit

Security Service Federal Credit Union was founded in 1956 to serve the needs of members and families of the U.S. Air Force Security Service Command.

Based in San Antonio, it offers a full slate of consumer banking products, such as checking and savings accounts, mortgages, auto loans and credit cards.

- What a one-year CD pays: 0.55 percent APY.

- Membership restrictions: People who live, work, worship, attend school, volunteer or have a business in Colorado, Texas or Utah are eligible to join, as are members of select military branches or units and Department of Defense employees at specific military bases within the credit unions service area. Members families and household members also can join.

- Minimum deposit for the APY: $25,000.

- Early withdrawal penalty: forfeit all dividends earned, not to exceed 90 days of dividends, with minimum of 30 days of dividends.

Read Also: Dental Grants For Low Income

Rasaq In Georgia Member Of Robins Federal Credit Union

When you talk of intelligence and good training, the staff of Robins Federal Credit Union are intelligent and well trained. I came to this conclusion because of what happened one afternoon when I walked in. When it got to be my turn at the teller station, I was called in the usual greeting of “May I help you?” I walked straight to the called, but I was surprised when she called me by my name to greet me. I paused for a moment and asked if she called my name, she said yes. I was surprised because I am very new to the credit union. I am very happy that they are able to recognize and identify me by name out of all of the customers coming in every day.

Holly In Texas Member Of Greater Texas Federal Credit Union

I am an employee and a member of an “over the top” credit union, Greater Texas Federal Credit Union. We are dedicated to going out of our way to assist our members and potential members with new and more convenient services. At our branch in Cedar Park, Texas we have free cookies and coffee every morning just to show our appreciation to our members. We feel as if we owe our members more than they know. All of GTFUC’s employees love coming to work knowing that we are extending a hand to someone in need. We do not treat our members as a number. They are all called by name. We all have big hearts and much love and appreciation to spread around. They say everything is bigger in Texas and that’s the truth. Although we are a small, growing financial institution, we are huge at heart and in mind. We are always surveying new areas for the most beneficial towns to open a branch that is convenient for our members to visit and take care of their financial needs.

Don’t Miss: Entry Level Government Jobs Sacramento

Curso Completo De Photoshop

FAQs

Can I add online courses to my resume?

Listing online classes on your resume is a definite do. Just make sure you do it thoughtfully so you’re sending the right message about your continuing education. After all, you worked hard to complete all these courses in your free time, you owe it to yourself to make sure they count.

Is financial aid available?

Just as financial aid is available for students who attend traditional schools, online students are eligible for the same provided that the school they attend is accredited. Federal financial aid, aid on the state level, scholarships and grants are all available for those who seek them out. Heres what students need to know about financial aid for online schools.

Are online courses worth it?

Yes. Online courses are can equip you with the necessary knowledge and skills that is sought by the employers.

What are the benefits of online courses?

1. Career advancement and hobbies2. Flexible schedule and environment3. Lower costs and debts4. Self-discipline and responsibility

utica college student portal log in

About michigan and schools credit union

- Search Courses By

Lee In New York Member Of Sefcu

While raising my family in remote Plattsburgh, NY, Dannemora FCU was our lifeline. I’m sure we had at least 4 car loans for them in over 27 years, and each year they helped us keep Holiday debt under control with their Holiday club, which accepted payroll deductions to that account and gave us a check in October to start our holiday shopping. No I live in Albany, where I use SEFCU, primarily serving state employees. SEFCU treats me like family! They’ve provided financial council and guidance for me as I start a new life alone. You won’t find them tooting their horns. You’ll just find them building communities, providing financial education to every age group and providing a safe, secure place for average Americans to keep their hard-earned dollars. Credit unions are the best keep financial secret. EVERYONE can find a credit union to belong to and be a working part of.

Read Also: Jobs History Majors

How The Cd Compares

When compared to the 270 similar length-of-term CDs tracked by DepositAccounts.com that require a similar minimum deposit and are available within the FOM, Michigan Schools and Government Credit Union’s 18-month CD currently ranks first.

The above rates are accurate as of 11/24/2017.

To look for the best CD rates, both nationwide and state specific, please refer to our CD rates table, or our new Rates Map page.

Genisys Credit Union Traditional Cds

Here are Genisys Credit Unions standard CD rates and Jumbo CD rates. Currently, the jumbo CDs provide a higher yield to the tune of 0.05% per term.

To put these yields in perspective, the current national average on a 12 month CD and a 60 month CD sit at just 0.15% and 0.32% APY, respectively, according to recent FED data.

Genisys Credit Unions CD Rates:

| CD Term |

Read Also: Hotels Government Camp Oregon

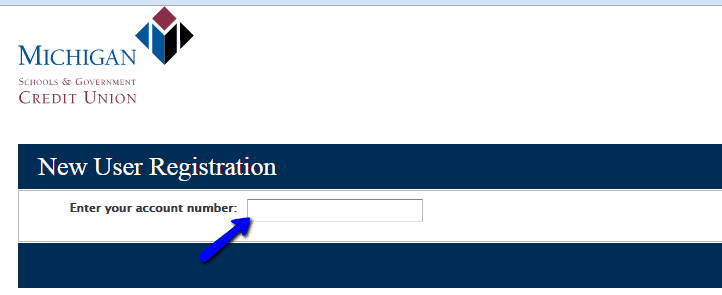

How To Reset Your Password

Resetting your password for your online account is another simple step that you may have to take when you have forgotten your password. You will be required to provide your account number during this process. Here are the steps to follow:

Step 1-Just below the login part, you will see forgot your password. Click the link

Step 2-Enter your account number and click submit

You may have to provide more information to complete the process

Warren Frequently Asked Questions

Where is the Michigan Schools And Government online account access for Warren customers?

Warren customers can access their accounts online at http://www.msgcu.org.

Are auto loans available for customers at the Warren of Michigan Schools And Government?

Yes, Warren customers can visit the branch to see auto loan rates offered by Michigan Schools And Government. You can also find the full auto loan rates and terms online at http://www.msgcu.org.

Where can I apply for a Michigan Schools And Government credit card?

The Michigan Schools And Government does offer credit cards. You can find out more about credit cards by going to the Warren at 13612 E 14 Mile Rd.You can also find out more about credit cards offered at http://www.msgcu.org.

Can I get a mortgage from the Warren of Michigan Schools And Government?

Mortgage loans are available at Warren. You can get current mortgage rates and get approved for a loan by visiting customer service at the Warren. Alternatively, you can compare mortgage rates at http://www.msgcu.org.

Are online bill payments available?

Customers of the Warren can pay bills online by setting up online access at http://www.msgcu.org.

Also Check: Dental Grants For Individuals

Michigan Schools & Government Credit Union Bill Payment

It offers online bill payment facility to all its users and provides several different methods to pay bills. You can pay your bill online at Michigan Schools & Government Credit Unionâs website, mail your payment to the processing center, or pay your bill in person at any authorized location. It also provides you with the option to set up automatic bill payments online and make alternative payment arrangements. You can also cancel account and contact customer support online.

Hereâs the info you need to make your payment in any way you choose:

Online: Log in to your account and pay online at .

You can mail your check to 40400 Garfield Rd Clinton Township, Mi 48038. Before sending the payment you should call the customer service number 586-263-8800 for reconfirmation.

Use the automated system to make a payment. The phone number is 586-263-8800.

In Person: Pay at any of the nationwide customer service centers.

| Online Login |

|---|

Leona In Michigan Member Of Michigan Schools And Government Credit Union

I have been with my credit union most of my married life. We built our home in 1968 in Shelby Township and I started driving a school bus for Utica in 1978. It was then Macomb Schools and Government C. U. and I joined. They got to know me and I always took my check in and cashed them and got to be friends with the girls behind the counter and never, ever, had a bad experience with them. I just love the 23 Mile branch. They are all warm and welcoming. Over the years there have been many new faces behind the counter and I love them all. I have never had a bad experience. I trust them with my money and don’t deal with any banks. They are always there for me and all my needs.

Don’t Miss: Governmentjobs.com Las Vegas

Megan In Michigan Member Of Christian Financial Credit Union

Credit unions, especially mine really streamline the process. I drive up to the window, say what I want to do, verbally provide my account number and hand over my license and I’m done. No forms or extra work. In addition, I find that credit unions, especially mine are customer focused. Several years ago I wrote a check for a large purchase and then forgot to transfer the money into my checking account. The credit union seeing that I was in good standing and had the money picked up the telephone, called me and told me the check was coming through providing me an opportunity to quickly transfer funds over the phone. I never got that type of service from a traditional bank. In addition, my credit union gave me a chance to restore my credit after my divorce by not just looking at my credit scores, but at my history of payment on previous loans, such as auto. It’s because of that second chance they gave me that I have such good credit today. I love my credit union, I recommend them to everyone and would never switch.

Brenda In Pennsylvania Member Of Navy Federal Credit Union

I have been an extremely satisfied customer of the Navy Federal Credit Union headquartered in Vienna, VA. I joined in 1987 when I married a Lieutenant in the Marine Corps. When he was killed in Iraq, I was treated with great respect and dignity by the staff at the credit union, to include receiving a hand written letter from the NFCU president. I have always banked through the mail and via telephone and have had a uniquely positive experience with everything and everyone related to the credit union. This is a standard every financial institution should try to achieve.

Recommended Reading: Free Government Flip Phones

Michigan Schools And Government Credit Union

Industry: Financial services company

The Michigan Schools and Government Credit Union is headquartered in Clinton Township, Michigan, and has a membership size of more than 125,000 and assets of over $2 billion as of January 2019. MSGCU was founded in 1954 and is a not-for-profit financial institution, which is owned and operated by its members.Headquarters: Clinton Charter Township, MIFounded: 1954

Michigan Schools and Government Credit Union List of Employees Thereâs an exhaustive list of past and present employees! Get comprehensive information on the number of employees at Michigan Schools and Government Credit Union. You can filter them based on skills, years of employment, job, education, department, and prior employment.

Michigan Schools and Government Credit Union Salaries. You can even request information on how much does Michigan Schools and Government Credit Union pay if you want to. Learn about salaries, pros and cons of working for Michigan Schools and Government Credit Union directly from the past employees.

Find People by Employers You can rekindle an old relationship, reconnect with a long-lost friend, former boss, business acquaintance who might be useful in your new line of work. With our employee database, the possibilities are endless. All you have to do is type in a couple of keywords and weâll bring you the exact information you wanted!

Pros And Cons Of Credit Union Cds

Brick-and-mortar banks can be pretty stingy when it comes to paying interest on savings accounts. In many cases, their CD rates arent impressive either.

But finding a credit union offering competitive rates on CDs is fairly easy. As member-owned institutions, credit unions operate for the benefit of their customers.

The drawback? You may not have access to a credit union share certificate if you cannot qualify for membership. Many credit unions are easy to join, but there are still institutions that have restrictions based on where you live or work or the group youre affiliated with.

Like certificates of deposit at banks, credit union share certificates may also automatically renew after the term expires. For that reason, its important to keep track of your investments, should the need arise to use the funds before the certificate has matured, which would likely result in an early withdrawal penalty.

Here are some credit unions offering todays best widely available 1-year CD rates:

Read Also: Congress Mortgage Stimulus Program 2019

Alliant Credit Union: 055% Apy $1000 Minimum Deposit

In 1935, whats now Alliant Credit Union was founded as the United Airlines Employees Credit Union. Alliant currently has approximately 600,000 members nationwide.

Alliant offers competitive APYs with low minimum balance requirements for CDs. Alliant also has traditional individual retirement account CDs, Roth IRA CDs and SEP IRA CDs.

- What a one-year CD pays: 0.55 percent APY.

- Membership restrictions: Current employees or those who are retired from a business that partners with Alliant Credit Union may be eligible to join the credit union. You may also be able to join by belonging to an organization that Alliant Credit Union partners with. You can also qualify to join Alliant Credit Union if you live or are employed in a community near its Chicago headquarters. If those circumstances dont apply to you, you can make a one-time $5 payment and Alliant Credit Union will donate that money to Foster Care to Success so you can become an Alliant Credit Union member.

- Minimum deposit: $1,000.

- Early withdrawal penalty: Dividends on the number of days the CD is open, up to 90 days.

State Employees Credit Union: 035% Apy $250 Minimum Deposit

State Employees Credit Union serves about 2.6 million members and has 270 branch offices. It was established in 1937 and has its main office in Raleigh, North Carolina.

- What a one-year CD pays: 0.35 percent APY.

- Membership restrictions: Youll need to meet one of the State Employees Credit Union eligibility requirements to become a member. Some ways to become a member are by being an employee of the state of North Carolina, being a federal employee assigned to North Carolina state agencies, being an employee of public boards of education or by being a county employee of social services, health, mental health or civil defenses. Immediate family, which includes a spouse, children, parents or siblings, of a current member also may be eligible for membership.

- Minimum deposit: $250.

- Early withdrawal penalty: Youll lose at least 30 days of dividends, but no more than 90 days of dividends.

Also Check: Loudoun Government Jobs