Keeping Compliant Records For Your Irs Mileage Reimbursement

IRS mileage reimbursement rules define what is considered an adequate record of your mileage. Employees and self-employed alike should log the following information:

- Total mileage of each trip

- The time and purpose of the trip

- Your destination

- The total mileage for the year

The records you keep must also be timely – recorded at or near the time of the trip.

Keep in mind if you use your vehicle for both business and personal driving, you should keep track of both, in order to figure out the percentage of business use you can claim mileage reimbursement for.

Learn more about keeping compliant mileage records.

More Mileage Tax Deduction In 2022

Many businesses have been suffering because of the increased gas prices and other goods. Deducting 4% more in 2022 Q1 & Q2 than in 2021 , and then further increasing that in 2022 Q3 & Q4 by 6,4% means that youll be able to deduct more when you file a Mileage Tax Deduction in 2022. The increase of the Standard Mileage Rate in 2022 can mean a bit of a relief to many and also a good reason to make sure that you create a 100% IRS-Proof Mileage Log, that meets every expectation. With MileageWise, you can get the most out of your business mileage tax deduction, track your business miles automatically with an app, and create your mileage log for taxes in just 7 minutes a month.

You May Like: Government Help For New Business

Federal Mileage Rate For Self

As a self-employed individual, you can claim mileage deductions on your annual tax return if you use your personal vehicle for business purposes. You must use the IRS mileage rate that corresponds to the year you are claiming mileage. on your tax return in 2023, you claim mileage using the mileage rate for 2022.

Also Check: Government Grants To Replace Roof

How To Calculate The Percentage Of Business Use

According to IRS mileage reimbursement rules, you can only claim mileage for the business use of your vehicle. Let’s go through a quick example of figuring out business use:

You’ve driven ten personal trips that total 200 personal miles. During that same period, you’ve also driven three business trips that amount to 100 business miles. The total number of miles youve driven is 300.

To figure out your business use, divide your business miles by the total mileage. In our example, your business mileage is 33% of the total miles youve driven.

The equation is simple, 100/300 = 0.33 = 33%.

Then, calculating your total mileage reimbursement based on the federal mileage reimbursement rate is simple: multiply the business mileage youve driven by the current IRS mileage rate.

100 business miles x 58.5 cents = $58.5

We hope you found our short overview of the rules of IRS mileage reimbursement helpful.

Use Automated Solutions To Track Mileage

Some software, like Motus mileage reimbursement application, can eliminate over-reporting of mileage by your drivers and make documenting your mileage reimbursement easy.

Employers often ask employees to manually track miles we found the number of miles tracked by auto-capture versus manual capture is 20% lower, Lackey said. She added that people are not necessarily lying or trying to cheat the system, but often just rounding up to the nearest mile.

Read Also: Us Government Tax Exempt Form

How Standard Mileage Rates Work

IRS optional standard mileage rates are prescribed by IRS Revenue Procedure 2019-46. This procedure lists the rules for deducting the costs of operating a vehicle for business, charitable, medical, or moving expenses.

Taxpayers are not required to use standard rates but may, instead, use the actual costs of driving the vehicle for an allowable reason. Normally, the IRS calculates standard mileage rates annually based on a determination of the average cost of maintaining a vehicle per mile.

For 2022, the extraordinarily high cost of fuel and petroleum products has resulted in a mid-year adjustment. As noted, this is unusual, having last occurred more than a decade ago in 2011, for the same reason. The rate adjustment in 2011 was 4.5 cents per mile from 51 to 55.5 cents per mile.

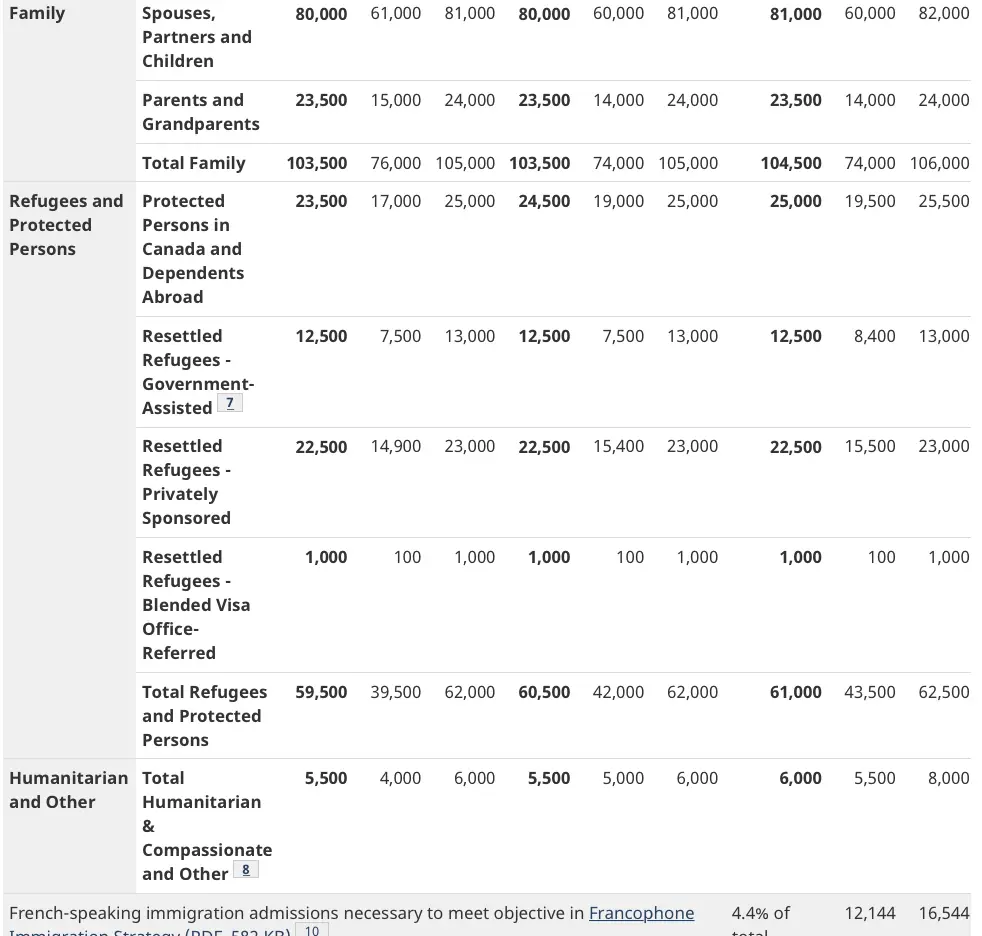

The table below shows the IRS optional standard mileage rate rates for the first and second half of calendar year 2022.

| Use |

|---|

You May Like: Government Funding Programs For Low Income Families

Federal Mileage Rate For Employees

Businesses often choose to reimburse employees by the standard mileage rate method, as it is the simplest in terms of administration work. If this is the case for you, then you use the current IRS mileage rate to calculate the reimbursement you should receive from your employer on a monthly basis. If you are located in California, check out deducated article on California mileage reimbursement.

Keep in mind that it’s up to your employer to set the rate and the rules for reimbursement, but the IRS’s standard mileage rate is the limit for what is tax-deductible. If you’re paid more per mile than the current IRS mileage rate, anything above it is considered taxable income.

If you want to learn more about other employee reimbursement methods, take a look at our mileage reimbursement for employees guide.

Also Check: What Is The Free Government Cell Phone

Irs Mileage Rate Deduction For Medical Situations

If you used your car for medical reasons, you may be able to deduct the mileage. “Medical reasons” include:

-

Driving to the doctor, hospital or other medical facility.

-

Driving a child or other person who needs medical care to receive medical care.

-

Driving to see a mentally ill dependent if the visits are recommended as part of treatment.

You can deduct parking fees and tolls as well.

If you dont want to deduct your mileage, you can deduct your unreimbursed out-of-pocket expenses, such as gas and oil. However, the expenses have to relate directly to the use of your car for medical purposes. Also, you can’t deduct repair and maintenance costs, depreciation or insurance.

Mileage isnt the only transportation cost you might be able to deduct as a medical expense. IRS Publication 502 has the details. Heres a big caveat: In general, you can deduct qualified, unreimbursed medical expenses that are more than 7.5% of your adjusted gross income.

» MORE:See what else you might be able to deduct as a medical expense

Mileage Reimbursement In 2022

Tax Cuts and Jobs Act of 2017 temporarily abolished various personal itemized deductions until December 31, 2025, prohibiting taxpayers from claiming deductions for unpaid employee travel expenses. Previously, various personal deductions of over 2% of Adjusted Gross Income had been deductible.

Many companies use the IRS mileage rate to reimburse employees for business trips by car. Mileage Reimbursement is a profitable solution for both the employer and the employee, depending on what method the parties use:

IR-2021-251, December 17, 2021

WASHINGTON The Internal Revenue Service today issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes.

Beginning on January 1, 2022, the standard mileage rates for the use of a car will be:

- 58.5 cents per mile driven for business use, up 2.5 cents from the rate for 2021,

- 18 cents per mile driven for medical, or moving purposes for qualified active-duty members of the Armed Forces, up 2 cents from the rate for 2021 and

- 14 cents per mile driven in service of charitable organizations the rate is set by statute and remains unchanged from 2021.

The standard mileage rate for business use is based on an annual study of the fixed and variable costs of operating an automobile. The rate for medical and moving purposes is based on the variable costs.

Recommended Reading: T Mobile Discounts For Government Employees

How To Claim Tax Deductions Using Irs Mileage Rates

If youre deducting mileage for moving, medical or charity purposes, youll need to itemize on your tax return in order to claim the tax deduction for mileage. Itemizing means youll need to set aside extra time when preparing your returns to fill out the big enchilada of tax forms: Form 1040 and Schedule A, as well as supporting schedules that feed into those forms.

If youre self-employed, youll claim your mileage deduction as a business expense on Schedule C.

If you file your taxes online, the software will ask about your mileage during the interview process and calculate the deduction.

Privately Owned Vehicle Mileage Reimbursement Rates

GSA has adjusted all POV mileage reimbursement rates effective January 1, 2023.

| Modes of Transportation | |

|---|---|

| If use of privately owned automobile is authorized or if no Government-furnished automobile is available | |

| If Government-furnished automobile is available |

| Standard mileage rates for moving purposes | $0.22 |

Airplane nautical miles should be converted into statute miles or regular miles when submitting a voucher using the formula .

For calculating the mileage difference between airports, please visit the U.S. Department of Transportation’s Inter-Airport Distance website.

QUESTIONS:For all travel policy questions, email

The shortcut to this page is gsa.gov/mileage.

Recommended Reading: Federal Government Health And Human Services

Setting Up A Mileage Policy

On the Manage Policies by Expense Category page,click the Create Policy choice list and select Mileage to open the Create Mileage Policy page.

On the Create Mileage Policy page, complete thefields as shown in the following table.

|

Field |

|

|---|---|

|

Lookup type that defines the applicable vehicle types. |

|

|

Fuel Type |

Lookup type that defines the applicable fuel types. |

|

Passenger Rate Type |

|

|

Lookup type that defines the additional rate types. |

Irs Mileage Rate Deduction For Volunteering And Charitable Activities

If you used your car to help a charity or to go somewhere to volunteer, the mileage can be deductible. You can deduct parking fees and tolls as well.

If you dont want to deduct your mileage, you can deduct your unreimbursed out-of-pocket expenses, such as gas and oil. However, the expenses have to relate directly to the use of your car in giving services to a charitable organization. Also, you can’t deduct repair and maintenance costs, depreciation, registration fees, tires or insurance.

» MORE:See what else counts as a charitable deduction

You May Like: Do I Qualify For Any Government Grants

How To Use The 2022 Federal Mileage Rate

The federal mileage rates for 2022 are the ones you need to use for calculating your reimbursement from January 2022 until the end of the year. Note that you should calculate the mileage youve accrued from January 1 June 30, 2022, with the intial rates set by the IRS. Any mileage you drive in the second part of the year from July 1st till December 31st, 2022, should be calculated using the newly announced IRS mileage rates for 2022.

It is highly likely that if you are an employer, your employees will expect to get reimbursed based on the new federal reimbursement rate for 2022. Keep in mind that when reimbursing your employees you are not obliged to use the standard rate. In any case, it is useful to know the mileage rate for 2022 because anything you reimburse above it will be taxed.

As self-employed, use the 2022 federal mileage rate to calculate the mileage deduction you can claim on your tax return in 2023 for the 2022 year.

Dont Miss: Chicago Police Academy Start Dates 2022

How Much Charity Can You Deduct In 2023

If youre wondering how much you can donate for taxes, weve got a mini-guide for you:

For the 2023 tax year, an individual is allowed to deduct up to $300 in cash donations without itemizing, which means a married couple filing jointly can deduct up to $600 in donations without itemizing. This is referred to as an above the line deduction.

In general, charitable gifts can be deducted up to 60% of your AGI , but you may be limited to 20%, 30%, or 50% depending on the type of contribution and the organization .

The specifics can be found in IRS Publication 526.

Recommended Reading: Us Government Excluded Parties List System

An Increase In Demand Versus Available Supply

An unprecedented increase in the price of gasoline, which raises the cost of automobile maintenance, is behind the mid-year bump in IRS mileage rates. The cost of gasoline has hovered around $5 per gallon for some time now as a direct result of a mismatch between supply and demand.

According to AARP, there are four main causes for that increased demand.

- Supply disruptions caused by the war in Ukraine

- Weather extremes due to annual hurricane and tornado damage

- A switch to more expensive summer gasoline blends

- Increased summer travel

While other regional and national factors come into play, these four are the primary drivers of increased fuel costs and, as a result, an increase in mileage rates.

Employees To Repay The Cost Of Fuel Used For Private Travel

There will be no fuel benefit charge if you correctly record all private travel mileage and use the correct rate , to work out how much your employees must repay you for fuel used for private travel.

You will not need to use the advisory rates where you can show that employees cover the full cost of private fuel by repaying at a lower mileage rate.

Also Check: Government Grants For Off The Grid Living

How Does Policygenius Make Money

Were an independent insurance broker, so we get paid a commission by insurance companies for each sale. Insurance commissions are already built into the price of an insurance policy, so youre not paying any extra for working with us to buy a policy. Our compensation on any particular purchase may vary depending on a number of factors, including the type and size of product, the insurer, and the volume of business we have with an insurer, but we dont push for or give preference to any one insurer over another because of the commission. Were here to fight for you, not for ourselves.

What Is The Standard Mileage Rate

The standard mileage rate is the default cost per mile to drive established by the Internal Revenue Service for taxpayers who claim a tax deduction on an IRS form for the cost of using a vehicle for business expenses, charitable or medical purposes, and even moving expenses. This federal mileage rate varies depending on the type of expense and is adjusted annually by the IRS.

You May Like: Government Contracts For Minority Businesses

When To Use The Current Mileage Reimbursement Rate

Usually, when people talk about the mileage rate, they mean the business ratefor example when you drive your personal vehicle for business purposes and are reimbursed the costs. Depending on whether youre an employee or self-employed the rate might even be different.

The IRS sets the standard mileage rate each year, and it represents the ceiling for tax-deductible mileage.

For employees

Businesses often choose to reimburse employees by the standard mileage rate method, as it is the simplest in terms of administration work. If this is the case for you, then you use the current mileage rate to calculate the reimbursement you should receive from your employer on a monthly basis. If you are located in California, check out deducated article on California mileage reimbursement.

Keep in mind that its up to your employer to set the rate and the rules for reimbursement, but the IRSs standard mileage rate is the limit for what is tax-deductible. If youre paid more per mile than the current IRS mileage rate, anything above it is considered taxable income.

If you want to learn more about other employee reimbursement methods, take a look at our mileage reimbursement for employees guide.

For self-employed

Completing The Mileage Rate Spreadsheet

On the Create Mileage Policy page, click the Create Rate button.

Note: In this example, you download a predefined spreadsheetto your local drive for completion because you selected mileage ratedeterminants and add-on rates on the Create Mileage Policy page. If,however, you create a mileage policy for a single currency with nomileage rate determinants or add-on rates, you create the mileagerate in a dialog box, rather than in a spreadsheet.

On the Create Mileage Rates spreadsheet in theMileage Rates region, complete the fields as shown in the followingtable.

|

Distance Threshold |

|---|

Don’t Miss: How To Make A Government Resume

Need A State Tax Exemption Form

Per OMB Circular A-123, federal travelers “…must provide a tax exemption certificate to lodging vendors, when applicable, to exclude state and local taxes from their hotel bills.” GSA’s SmartPay team maintains the most current state tax information, including any applicable forms.

Last Reviewed: 2022-11-14

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you’ve entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense.

Rates for foreign countries are set by the State Department.

Travel Mileage And Fuel Rates And Allowances

This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit nationalarchives.gov.uk/doc/open-government-licence/version/3 or write to the Information Policy Team, The National Archives, Kew, London TW9 4DU, or email: .

Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned.

This publication is available at https://www.gov.uk/government/publications/rates-and-allowances-travel-mileage-and-fuel-allowances/travel-mileage-and-fuel-rates-and-allowances

Don’t Miss: Budget Car Rental Government Rate Code

Fuel Not The Biggest Vehicle Expense For Employees

A CompanyMileage analysis of what it really costs to drive a car found that the impact of gas prices is less than those critics might imagine. That analysis was based on the estimated gas mileage and maintenance costs of three Chevrolet vehicles: an economy model, a mid-size sedan and a sport-utility vehicle. It found that fuel accounted for 30 percent of the overall cost. Insurance accounted for 12 percent licenses, registration and taxes for 7 percent and tires and maintenance 3 percent each.

The biggest factor in our vehicle cost analysis was the 45 percent of the overall cost represented by depreciation. Thats not surprising when you consider that an employee who drives a personal vehicle for work for three years might put another 30,000 or 40,000 miles on that vehicle.