What Is Down Payment Assistance

Down payment assistance helps first-time home buyers come up with a down payment to purchase a home and begin building wealth through homeownership. Down payment assistance takes multiple forms, including loans, grants, vouchers and more. Assistance amounts can range from a few thousand to tens of thousands of dollars, and can be used toward closing cost assistance, and/or principal or down payment reductions.

Down payment assistance programs are offered by local or state housing authorities and non-profit organizations. They work in conjunction with loan programs like those offered by the Federal Housing Administration , where you can put as little as 3.5% down. Theyre also compatible with VA, USDA, and conventional loan types. There are also lenders that specialize in down payment assistance programs who work with state or local housing agencies, or they may offer their own down payment assistance programs.

Rrsp Home Buyers Plan

As of March 19, 2019 , theHome Buyers Plan will allow first-time home buyers to withdraw up to $35,000 tax-free from their registered retirement savings plan to buy or build a home. The amount must be repaid over a period of 15 years.

This is a recent increase over the previous limit of $25,000.

Do I qualify for the Home Buyers Plan?

You must meet the following criteria to qualify for the Home Buyers Plan:

- You must be a resident of Canada at the time of withdrawal.

- You must be the owner of the RRSP from which the withdrawals are made.

- Your RRSP contributions must have stayed in the RRSP for at least 90 days before withdrawal.

- Neither you nor your spouse/common-law partner can have owned the relevant home for more than 30 days.

- Neither you nor your spouse/common-law partner can have owned another home in the last four years.

If you have a disability, the last requirement is waived. Additional requirements may apply in special cases.

Whats the benefit of the Home Buyers Plan?

The Home Buyers Plan allows you to withdraw before-tax contributions to your RRSP for your down payment. This can allow you to save significantly more for your down payment than you would be able to with after-tax income.

You can find out more on RRSPs and the March 2nd contribution deadline with ourGuide to RRSPs.

Is the withdrawal limit per person or per household?

How do I make a withdrawal?

You must submit aForm T1036to your financial institution for each withdrawal you wish to make.

Examples

What Is The First Home Owners Grant

As mentioned above, you can use the new HomeBuilder scheme in combination with some of the existing home buyer financial support programs, this includes the First Home Owner Grant scheme.

The FHOG was originally introduced in July 2000. Eligibility criteria and the size of the grant differs in each state and territory, but it is primarily available to first-time buyers purchasing a new residential property, or building their own new home.

As part of the FHOG, you may also be eligible for exemption or discounts on stamp duty or other related fees.

For example, the State Revenue Office Victoria outlines,

A $10,000 First Home Owner Grant is available when you buy or build your first new home.

The FHOG is $20,000 for new homes built in regional Victoria, for contracts signed from 1 July 2017 to 30 June 2021.

Your first home can be a house, townhouse, apartment, unit or similar but it must be valued at $750,000 or less, be the first sale of the property as residential premises and the home must be less than five years old.

As the FHOG varies greatly between each state and territory, we recommend finding out more about the specific details from the First Home Owner Grant website.

Recommended Reading: Mortgage Stimulus Program For Middle Class 2021

Don’t Miss: What Is Environmental Social Governance

How Do I Get A First

Start by exploring the housing finance agency in your state. You’ll likely come across a number of programs designed especially for first-time buyers such as yourself. Many programs offer grants to help turn your homeownership dream into reality.

Be aware that not all first-time homebuyer grants are the same. Fund amounts depend on various factors, including location, credit score, income, and family size. An experienced lender can also point you in the right direction as far as grants are concerned.

First Home Owner’s Grant

Buying or building your first home? You may be eligible for a $10,000 grant under the First Home Owner Grant scheme. The scheme is managed by Revenue NSW.

You can apply for the scheme when you arrange finance to buy your home. The bank or financial institution providing you with a loan will need to be an approved agent.

Also Check: Government Of Guam Job Openings

Using Money From Other Government Help For Example Your Council Or Benefits

Assistance through government key worker or other programmes cannot be combined with any other publicly funded home ownership scheme such as FTBI.

Because FTBI fees are not classified as rent, FTBI homeowners may not qualify for Housing Benefit. Buyersshould make sure they have made arrangements to ensure they can continue to make their FTBI payments iftheir income falls. Buyers should seek independent financial advice about this before purchasing an FTBI home.

First Home Owner Grant

A $10,000 First Home Owner Grant is available to those 18 years and over when you buy or build your first new home. Your first new home can be a house, townhouse, apartment, unit or similar that is newly built, purchased off the plan or substantially renovated.

For new properties the value must not exceed $600,000. For land that you plan to build on, the total must not exceed $750,000.

You also get the First Home Buyer Assistance Scheme benefits .

Also Check: Dental Implant Grants California

Read Also: Where Can You Get A Government Phone

Do I Qualify For This Program

Are you a first-time homebuyer?Youre considered a first-time homebuyer if you have not owned a home within the previous three years.

Are you planning to purchase a home in New Jersey?This program applies to homes to be used as a primary residence in any New Jersey county.

If you answered YES to the questions above, contact one of NJHMFAs participating lendersand ask for an NJHMFA Down Payment Assistance Program loan today!

You May Like: Columbia South Carolina Post Office

Single Family Housing Programs

Well built, affordable housing is essential to the vitality of communities in rural America. Rural Developments Single Family Housing Programs give families and individuals the opportunity to buy, build, or repair affordable homes located in rural America. Eligibility for these loans, loan guarantees, and grants is based on income and varies according to the average median income for each area.

Through the program options below, USDA Rural Development offers qualifying individuals and families the opportunity to purchase or build a new single family home with no money down, to repair their existing home, or to refinance their current mortgage under certain qualifying circumstances. There are also programs to assist non-profit entities in their efforts to provide new homes or home repair to qualifying individuals and families.

Also Check: Government Grants For Black Males

Finally Close The Deal

Once your offer has been accepted by the inspector, you must close the sale. Before closing, you should check your financial data to verify that your employment status hasnt changed and that the mortgage payment is possible. You will need to inspect the home within 24 hours of closing to ensure that there are no damages and that it is clean. The moment of truth is To accept the terms of the contract, and to transfer title to the property, you will need to sign many papers. You will be asked to bring a cashiers check made by an Escrow company, or to transfer funds to the company. You will receive the keys to your new house once you have signed all documents. Important: Remember to bring your ID.

First Time Home Buyers Program

Exclusive to British Columbia, the First Time Home Buyers Program is intended to exempt first-time buyers from one of the major costs associated with the purchase of your first home: the property transfer tax. The program reduces or eliminates the amount owing for tax, depending on certain qualifications.

Availability: British ColumbiaValue: Up to $8,000

Eligibility:

- Youre a citizen or permanent resident living in British Columbia for at least 12 consecutive months immediately before the date the property is registered, or you have filed a minimum of two income tax returns as a resident of B.C. in the previous six years.

- The property is located in British Columbia.

- Youll use the property as your primary residence.

- You must have never owned an interest in a principal residence anywhere in the world and have never received a tax exemption or refund as a first-time home buyer.

- For full exemption, the property must have a fair market value of $475,000 or less or have a fair market value of $500,000 or less . A partial exemption may apply if these maximums are exceeded.

- The total property size is 1.24 acres or less. A partial exemption may apply if this size is exceeded.

- Foreign entities and taxable trustees are not eligible.

Things to note:

How to apply: You can apply for this program by entering the exemption code FTH on your Property Transfer Tax Return.

Also Check: Free Government Phone Las Vegas

You May Like: How To Get Your Money Back From The Government

Can The Government Help Me Buy A House

For many, the biggest hurdle when trying to purchase their first home is coming up with the upfront costs of a down payment. While the amount needed to put down varies depending on the type of loan, it can still be a roadblock on the journey to homeownership.

The good news is that there are numerous government loan programs and down payment assistance options designed especially for those who need a little extra help with financing. These programs can be a solution in particular for those who can afford a monthly mortgage payment but may not have a large sum of money on hand for the down payment, Anderson explains.

Government-backed loans are a great option for anyone who wants to put less money down or has a lower credit score, explains Jeff Gravelle, chief production officer at Newrez, a national mortgage lending and servicing organization.

Since they are insured by the government, these loans are less risky to lenders and, therefore, allow lenders to offer lower interest rates. As a result, the monthly mortgage payments are often more affordable, he adds.

Good Neighbor Next Door Program

Supported by the Department of Housing and Urban Development ,Helpful personnel can benefit from the Good Neighbor program. From pre-kindergarten to 12th grade, as teachers, law enforcement officers, firefighters, EMTs and EMTs. degree to be able to find adequate housing. Participants may receive up to 50% discount on the cost of the house It is allowed, provided it is not in revitalization zones. The programs website portal allows you to search for available properties. You must also commit to living in your home for at least 36 month.

Good Neighbor Next Door Program HUD-sponsored program that allows 50% off the list price of homes located in revitalization areas, Good Neighbor began as the Teachers Next Door Program, but was expanded to include law enforcement, firefighters, and emergency medical technicians. Exactly who knows? Until the property is sold, you will need to live in it for 36 months. On the Good Neighbor Next Door website, these houses are listed for just seven days.

Recommended Reading: Applying For The Post Office

Also Check: Adobe Discount For Government Employees

Homeready And Home Possible

An FHA loan isnt the only low-down-payment loan option available. Fannie Mae and Freddie Mac two government-sponsored enterprises each offer a mortgage program with just 3% down. Fannie Maes low-down-payment option is called HomeReady and Freddie Macs is called Home Possible.

Though these arent technically government mortgage loans, they offer many similar benefits, such as flexible credit score and income guidelines. They also have reduced private mortgage insurance premiums, which leads to lower monthly mortgage payments.

I typically recommend investigating this route, says Jon Meyer, The Mortgage Reports loan expert and licensed MLO. Unlike FHA loans, these two first-time home buyer government programs do not require refinancing to remove mortgage insurance.

These programs are definitely worth exploring if youre considering an FHA mortgage.

How To Buy An Ftbi Home

The buying process has 5 stages.

Stage 1: Register your interest

- a reservation fee

- 5% exchange deposit .

- other fees on completion .

Stage 2: Eligibility approval

If eligible, the buyer will receive an Approval of Eligibility Letter from the Local HomeBuy Agent withineight working days of application. They will also receive details of the level of mortgage the buyer shouldbe seeking .

The Local HomeBuy Agent will also provide details of the applicable FTBI schemes in their area.

Stage 3: Pay reservation fee

If they have not already done so, the buyer makes appointments with sales teams at FTBI developmentschemes.

The buyer completes a Property Information Form, returns it to the Local HomeBuy Agent together withdetails of their solicitor/conveyancer and a copy of the housebuilders completed reservation form.The buyer will also pay a reservation fee, usually £500, to the housebuilder.

The buyer should instruct a solicitor to act for them and tell their Financial Advisor so that a full mortgageapplication can be submitted.

Also Check: Government Programs For First Time Homeowners

Is The $25000 Home Buyer Grant Available Yet

No, the $25,000 first-time home buyer grant program is still unavailable. Its currently a congressional bill which could pass in a few weeks, a few months, or maybe never. We expect that the bill will pass in some form before the end of the year. To be informed of the latest program news, Homebuyer publishes a special newsletter for this topic only.

Register for our program emails here.

First Time Home Buyer

The City’s First Time Homebuyer Program can help a family of four making less than $47,100 buy their first home.

To be eligible for participation in the City of El Pasos First Time Homebuyer Program, applicants must meet and/or comply with all the following Program criteria:

- HOMEBUYER EDUCATION: Applicant must complete a “Guide to Homeownership Course” offered by the YWCA Home Ownership Center, The El Paso Credit Union Affordable Housing, or Project Bravo prior to submitting an application.

- APPLICANT QUALIFICATION: The gross annual household income of the applicants family must be between 60% – 80% of the median income for the City of El Paso, as published by HUD on an annual basis.

Other applicants may be considered if another secondary financing is being utilized as long as the housing cost ratio does not exceed 35% of the applicant’s monthly gross income.

You May Like: Order A Free Government Phone Online

Hud Homes Program: Best For Buying A Foreclosed Home

The FHA is a sub-agency within the U.S. Department of Housing and Urban Development . In 1968, HUD established a program to sell homes it acquired through foreclosure. The program, known as HUD Homes, sells foreclosed residential properties to the public at steep discounts.

Down payment requirements vary for buyers of HUD-owned homes. Some require the standard 3.5 percent of an FHA loan. Others allow down payments as low as $100.

Browse HUD homes for sale at HUDHomeStore.com.

What Kind Of Help Can I Get To Buy A Home

The Department of Housing and Urban Development offers a variety of federal programs that may be able to help you purchase a home if you qualify for assistance: FHA Loans for First-Time Homebuyers. The Federal Housing Administration , part of HUD, insures mortgages, making it easier for potential homeowners to afford loans.

You May Like: Government Grants To Improve Your Home

Exemptions For Armed Forces And Their Families

Youre exempt from council conditions about being an essential worker or living in the area if youre:

- a member of the armed forces

- the divorced or separated spouse or civil partner of a member of the armed forces

- a widow or widower of a deceased member of the armed forces

- a veteran who left the armed forces in the last 5 years

You still need to meet other eligibility conditions.

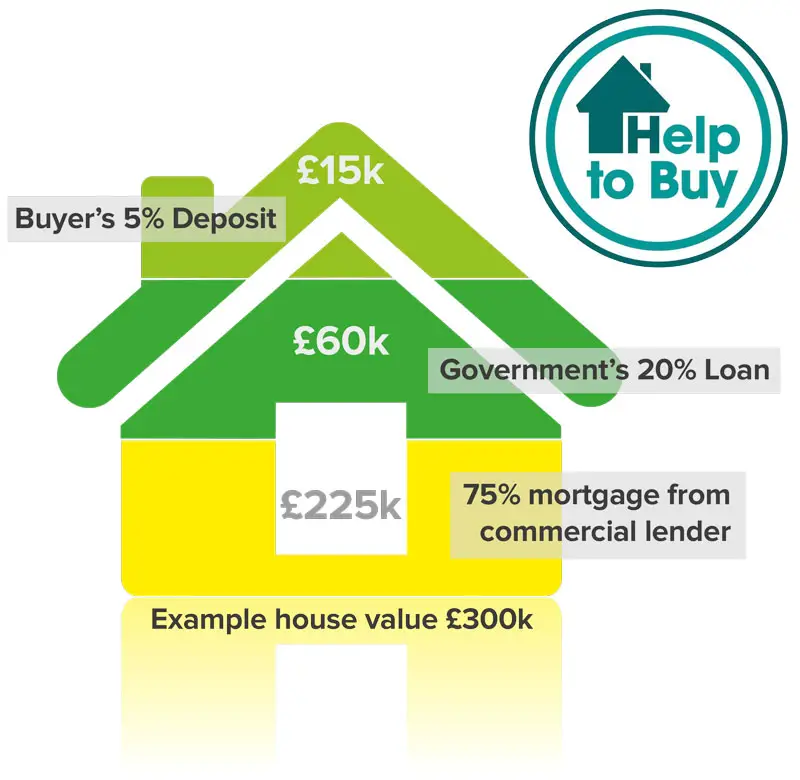

Help To Buy: Mortgage Guarantee Scheme

Announced in the 2021 Budget, the mortgage guarantee scheme offers lenders the option to purchase a guarantee on mortgages where a borrower has a deposit of only 5%.

The guarantee compensates mortgage lenders for a portion of net losses suffered in the event of repossession. The guarantee applies to 80% of the purchase value of the guaranteed property, covering 95% of these net losses. The lender therefore retains a 5% risk in the portion of losses covered by the guarantee. This ensures that the lender retains some risk in every loan they arrange.

Homebuy Wales supports households by providing an equity loan to help buy an existing property.

The scheme helps people who couldnt otherwise afford to buy a property.

Homebuy isnt available in all areas. And where it is available, the scheme will be subject to local residency and employment eligibility criteria.

Find out more about the Homebuy scheme at gov.walesOpens in a new window

You May Like: Missouri Government Vehicles For Sale