How Environmental Social And Governance Criteria Work

Investors have, in recent years, shown interest in putting their money where their values are.

As a result, brokerage firms and mutual fund companies have started offering exchange-traded funds and other financial products that follow ESG criteria. Robo-advisors including Betterment and Wealthfront have promoted these ESG-themed offerings to younger investors.

ESG criteria are also increasingly informing the investment choices of large institutional investors such as public pension funds. According to the most recent report from US SIF Foundation, investors held $17.1 trillion in assets chosen according to ESG criteria at the end of 2019, up from $12 trillion just two years earlier.

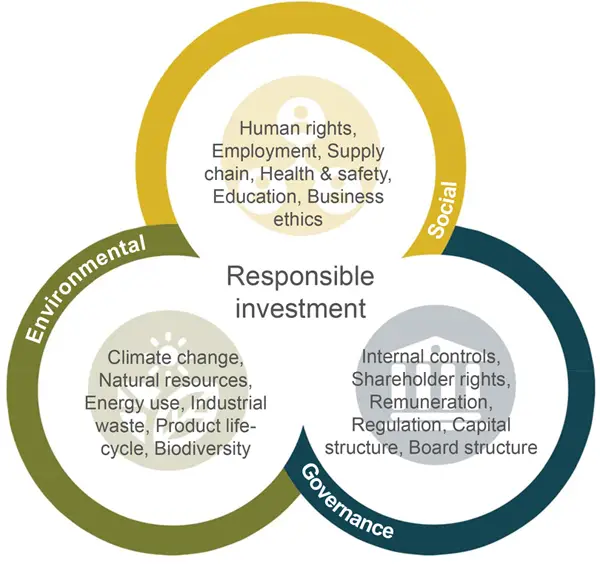

ESG investing is sometimes referred to as sustainable investing, responsible investing, impact investing, or socially responsible investing . To assess a company based on ESG criteria, investors look at a broad range of behaviors and policies.

Why Is Esg Good For Business

A 2019 survey of over 1,000 CEOs from around the world by the UN Global Compact found that 87% believe the SDGs provide an opportunity to rethink approaches to sustainable value creation. 70% of those CEOs see the SDGs providing a clear framework to structure sustainability efforts.

ESG can be both an investment philosophy and a series of core values. Companies that are sustainable tend to be builders of both profit and society, as ESG is an investment in responsible growth.

What Is Environmental Social And Corporate Governance

Short for environmental, social and governance, ESG represents a more stakeholder-centric approach to doing business. As ESG increasingly becomes top of mind for directors, its essential to consider the global nuances that drive focus region by region.

Companies that adhere to ESG standards agree to conduct themselves ethically in those three areas, and can draw on a range of ESG strategies, tactics and ESG solutions to do so.

But with such a wide range of possible approaches and solutions, and a panoply of issues that fall under the ESG umbrella, where should organizations focus? How should they make a start?

A good first step is to identify the issues fit into the umbrella categories of environmental, social and governance. Those can include:

- People from demographics or ethnic groups that have previously not engaged with your brand

Cost reductions could include:

- Reduced employee attrition and associated reduced recruitment and retention costs

- A lowered risk of financial penalties resulting from regulatory compliance breaches

- The cost benefits of more sustainable, less volatile supply chains

“ESG, as I refer to integrated risk management in corporates, is one thing that I see carrying on in 2021.”

Ezekiel Ward, founder of North Star Compliance Ltd.

Don’t Miss: Do Nonprofits Receive Government Funding

Do Your Own Esg Research

For investors looking for individual stocks, various outlets publish best of lists of the top ESG-rated stocks each year. You can start with these lists to identify potential investments that might align with your goals and then build a diversified portfolio with an asset allocation strategy that fits your investment horizon.

You dont have to hunt for just individual ESG stocks, though. You can also opt for funds, just as you can with non-ESG investing. This saves you the hassle of picking individual companies by letting a fund manager or index make the choices for you. Research for ESG ETFs and mutual funds may also be a bit easier online.

You can find highly rated ESG funds and ETFs from a variety of brokerages and fund families using screening tools like Morningstars and ESG as a keyword.

For more granular info, As You Sow is a great resource that breaks out exposure to companies involved in things like fossil fuels and deforestation in both ESG and non-ESG funds, says Walters of USA Financial.

Walters says investors should take note of expense ratios for ESG funds. ESG characteristics are important, but so are more traditional metrics like cost, he says. Expense ratios for ESG funds have decreased over the years, but they are still higher than other funds on average.

What Does A Bad Esg Score Mean For Business

Companies that have poor sustainability or high carbon footprints typically fall on the lower end of the ESG rating scale. These companies struggle with their overall environmental impact and have a history of energy-intensive practices and procedures. There is often a lack of automation, poor or bare-minimum compliance, and sometimes even unsafe or dangerous working conditions. These companies will have high turnover, poor retention rates, and employees reporting low levels of satisfaction.

At companies with low ESG ratings, theres also often a lack of transparency with employees and investors, sometimes even going as far as to hide important or relevant information. These companies often do just enough on the side of governance to remain compliant but arent making the effort to do any more than the minimum. Companies with a low ESG score simply arent appealing to socially responsible investors, and they will struggle to be viewed as a solid long-term investment by this growing base of investors.

Recommended Reading: Data Governance In Health Information Management

Environmental Social And Governance Investing And How To Get Started

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Socially responsible investing has taken the world by storm, and providers and investors alike are scrambling to jump aboard the sustainable bandwagon.

Unfortunately, the arena of “sustainable” has a lot of gray areas. ESG, or environmental, social and governance investing, is looking to change that. ESG investing uses particular criteria to grade investments in an attempt to clarify exactly what sustainable should look like.

Sustainable And Resilient Finance: 2020 Oecd Business And Finance Outlook

29/09/2020 – The 2020 edition of the OECD Business and Finance outlook focuses on sustainable and resilient finance, in particular the environmental, social and governance factors that are rapidly becoming a part of mainstream finance. It evaluates current ESG practices, and identifies priorities and actions to better align investments with sustainable, long-term value especially the need for more consistent, comparable and available data on ESG performance.

Read Also: An Effective Information Governance System Should Include All Except

Are Stakeholders And Shareholders The Same

Although shareholders are an important type of stakeholder, they are not the only stakeholders. Examples of other stakeholders include employees, customers, suppliers, governments, and the public at large. In recent years, there has been a trend toward thinking more broadly about who constitutes the stakeholders of a business.

Financial Markets And Climate Transition: Opportunities Challenges And Policy Implications

04/10/2021 – The accelerating threat of climate change raises the urgency of commitment to climate transition, including the important role of global financial markets to align investment with net zero. Financial markets and climate transition focuses on the critical contribution financial markets must play towards achieving an orderly transition to low-carbon economies, and the policies needed to support this. It explores the key elements that could factor into market pricing of climate transition risks and opportunities, offers frameworks and case studies, reviews the growing range of market products and practices and puts forward policy options that can support this transition.

This report was launched at an OECD Ministerial Meeting side event on 4 October 2021 which hosted a high-level panel discussion on Strengthening ESG approaches and market alignment to foster climate transition.

Read Also: Government Grants For Small Businesses Owned By Minorities

Peoples Attitudes Are Changing

Google and Impax carried out a survey of over 300 investors with £500,000 or more of long-term savings and investments. The aim was to determine what their attitudes to climate change were following the COP21 Conference in Paris.

Below are some of the surveys findings:

- 70% of respondents said they were concerned about climate change.

- 15.3% said they had taken steps of both investing in sustainable/clean energy stocks plus not investing in fossil fuels.

- 33.5% claimed to currently have investments that are focused on clean energy, energy efficiency or sustainability.

Writing in the Financial Times, Nyree Stewart quotes Hamish Chamberlayne, an SRI manager at Henderson Global Investors, who said:

The big picture is that in the next few decades the global economy is going to transform to a low-carbon economy and it will be one of the biggest investment events of our lifetime.

We have a global economy that is roughly $80trn and extremely dependent on carbon, so transitioning to an economy where we are much less dependent on carbon will result in enormous disruption to established industries and geopolitical relationships and how the global economy works. In the next 10-20 years there will be huge risks and opportunities.

How Esg Investing Is Growing And Changing

ESG investment began in the 1960s. While certain ethical concerns have changed, the principle of sustainable investing remains the same. More and more investors are adopting ESG criteria as a tool to evaluate potential investments alongside traditional financial analysis.According to a report by PWC, the practice of ESG investing has grown over the last few years. The report states that the ESG asset pool will continue to grow rapidly and become essential in the investment process in the coming years.The growth of ESG investing can be boiled down to three reasons, according to financial firm MSCI:

- The world as we know it is changing.

- The next generation of investors is changing the way investment works.

- Data and analytics have evolved to provide more information than ever.

Also Check: 9000 Dollar Government Grant Phone Call

What Is The Difference Between Esg And Csr

If you want to know how ESG is different from CSR? ESG is the integration of environmental, social, and governance factors into investment decisions.

CSR stands for corporate social responsibility, which focuses on a companys voluntary initiatives to improve its impact on society.

The difference is that ESG integrates both voluntary and involuntary impacts while CSR only considers voluntary initiatives.

ESG also considers long-term and short-term impacts, while CSR only focuses on immediate actions.ESG can be a supplementary tool to help investors meet their goals without being forced to invest in companies with values they disagree with.

In other words, CSR is a subset of ESG. It is a companys responsibility to ensure that they are not harming the environment or violating international labor standards.

The two terms are often used interchangeably because companies want to ensure they are taking care of their entire corporate citizenship.

Moving Towards A Sustainable Future

The Morgan Stanley Institute for Sustainable Investing recognizes the drastic increase in sustainable investing versus traditional investing in the last two decades. Global warming, social justice, and eradicating plastic are some of the most focused on causes. Receiving recommended solutions from firms that specialize in ESG investing will be a great guide in moving further with a sustainable business.

Since climate change is such a considerable share of environmental problems, the necessity for benchmarking and strategizing carbon reduction strategies is increasing. It is only through technology that companies will be able to properly calculate, measure, track, analyze, offset, and report on their emissions accurately. This is the only way for companies to prove their transitions to net zero and be able to lower their emissions every year. There is no way to track if they are really being lowered without verifiable GHGP-compliant reports to provide for a fair ESG criteria assessment. In fact, carbon-intensive stocks are so highly priced, that they are actually now high-risk because decarbonization is increasing by the minute whether it be due to government regulations or staying competitive amongst green consumers. Moving towards a sustainable future requires decarbonization amongst other criteria and requires the technology to be able to transition to net zero.

Also Check: Lawyers To Sue The Federal Government

Are Regulators Aware Of This Change

On the one hand, 2020 was also a year for progress in legislative matters. In the European Union, one of the biggest milestones was the creation of a taxonomy that classifies environmental economic activities based on six objectives: climate change mitigation and adaptation the protection of water and marine resources the transition to a circular economy the prevention and control of pollution the protection and restoration of biodiversity and ecosystems. The European Green Deal was also presented in 2020, marking a milestone because all policies and legislative bills must consider sustainability in a cross-cutting manner. This year, the publication of the Renewed Sustainable Finance Strategy is expected.

In the banking sector, the European Banking Authority launched its Sustainable Finance Action Plan in December 2019 with a mandate from the Commission to sequentially integrate them in prudential regulation. Among other things it included: the voluntary exercise of sensitivity to transition risks in 2020 the dissemination of ESG risks according to Pillar 3 of Basel and a report on the classification and prudential treatment of assets with a sustainability perspective .

Keep reading about

Is Buying A Clean Etf Considered Esg Investing

Certain holdings of “clean” ETFs may not align with the goals and values of an ESG investor. For example, sometimes a holding such as a large-cap oil-and-gas company will be added to a “clean” ETF due to its investments or intentions in the alternative energy space. It is always a good idea to conduct your own research to ensure that investments align with your values and investment goals.

Don’t Miss: Government Grants To Help Pay Mortgage

Why Is Cfa Institute Focused On Esg

CFA Institute consistently monitors key debates and evolving issues in the investment industry. ESG investing and analysis has become of increasing interest to investment professionals globally as governments, asset owners, and high-net worth investors consider the impact of ESG factors on their investments and local markets. We believe more thorough consideration of ESG factors by financial professionals can improve the fundamental analysis they undertake and ultimately the investment choices they make. CFA Institute is specifically focused on the quality and comparability of the ESG information provided by corporate issuers and how to integrate various ESG factors into the investment selection process.

Esg Investing And Analysis

Because ESG has become a large part of the investment process for businesses, having an ESG analysis performed for your company can go a long way to showing investors that your company is worth their time and money. Investors have started looking at the overall values of the companies theyre investing in, and brokerage firms and mutual fund companies have responded by offering exchange-traded funds that track ESG ratings.

ESG investing is often called impact investing, sustainable investing, responsible investing, or socially responsible investing . ESG investors want to invest in companies that have a commitment to accountability, sustainability, and that are overall good places for employees to work. Companies negatively contributing to the environment, social responsibility, or governance, arent viewed favorably by these investors as a solid long-term investment.

Recommended Reading: Rsa Identity Governance And Lifecycle

Example Of An Internal Stakeholder

Investors are internal stakeholders who are significantly impacted by the associated concern and its performance. If, for example, a venture capital firm decides to invest $5 million in a technology startup in return for 10% equity and significant influence, the firm becomes an internal stakeholder of the startup.

The return on the venture capitalist firm’s investment hinges on the startup’s success or failure, meaning that the firm has a vested interest.

What Is An Example Of A Stakeholder

In the event that a business fails and goes bankrupt, there is a pecking order among various stakeholders in who gets repaid on their capital investment. Secured creditors are first in line, followed by unsecured creditors, preferred shareholders, and finally owners of common stock . This example illustrates that not all stakeholders have the same status or privileges. For instance, workers in the bankrupt company may be laid off without any severance.

Recommended Reading: Where Can I Cash A Government Check For Free

Actions Speaks Louder Than Words

In a globalised and social-media-oriented world, people have become more aware of whats happening, and they decide to support a cause about the environment or business across the globe easily than ever before.

As a result, ESG has become a consumer demand rather than a respected business practice. It defines how a company is accountable to its stakeholders, its people, society, and itself.

This practice is about being transparent so others can see your operational practices and motives and measure your impact when you make choices. Therefore, it is about being proactive in prioritising sustainable behaviours in all that you do for the benefit of the environment, your people, and society.

Increasing Risk In Not Embracing Esg

The world around us is changing fast and so to is investors tolerance towards businesses with poor governance practices, and/or unsustainable environmental or social impacts. Today, corporate ESG leaders are enjoying access to, and the inclusion in, an ever-increasing pool of ESG funds. Conversely, ESG laggards with poor ESG performance are being excluded from this growing volume of ESG funds, and some in the case of companies associated with deforestation in Brazil now face divestment from the portfolios of reputable asset management firms.

According to Reuters, in June 2020, seven major European asset management firms with over $5 billion linked to Brazil indicated they would divest from beef producers, grains traders and even government bonds in Brazil if they do not see progress in resolving the surging destruction of the Amazon rainforest.

Businesses that ignore ESG do so at their peril as there are clear indications of significant and increasing financial risks in being an ESG laggard.

You May Like: Am I On A Government Watchlist