Federal Loans Private Loans And How To Tell The Difference

With the high cost of attending college, many students and their families have had to take out one or more student loans. When students graduate, decent-paying jobs are not always available. As a result, many borrowers report difficulty repaying their student loans, and loan servicers and debt collectors are not always easy to work with. The following information is for anyone seeking to repay student loans.

Stafford Loan Aggregate Limits

Students who borrow money for education through Stafford loans cannot exceed certain aggregate limits for subsidized and unsubsidized loans. For undergraduate dependent students, the maximum aggregate limit of subsidized and unsubsidized loans combined is $57,500, with subsidized loans limited to a maximum of $23,000 of the total loans. Students who have borrowed the maximum amount in subsidized loans may take out a loan of less than or equal to the amount they would have been eligible for in subsidized loans. Once both the subsidized and unsubsidized aggregate limits have been met for both subsidized and unsubsidized loans, the student is unable to borrow additional Stafford loans until they pay back a portion of the borrowed funds. A student who has paid back some of these amounts regains eligibility up to the aggregate limits as before.

Graduate students have a lifetime aggregate loan limit of $138,500.

Student Loans In Bankruptcy Proceedings

United States federal student loans and some private student loans can be discharged in bankruptcy by demonstrating that the loan does not meet the requirements of section 523 of the bankruptcy code or by showing that repayment of the loan would constitute “undue hardship.” In contrast to credit card debt, which often can be discharged through bankruptcy proceedings, this option is not generally available for educational loan debt. Unless able to prove the loan was not an educational benefit, those seeking to discharge their student loan debt must initiate an adversary proceeding, a separate lawsuit within the bankruptcy case where they illustrate the required undue hardship. Many borrowers cannot afford the up front costs to retain an attorney or the additional litigation costs associated with an adversary proceeding, let alone a bankruptcy case. Further complicating matters, the undue hardship standard varies from jurisdiction to jurisdiction, but is generally difficult to meet. In most circuits discharge depends on meeting three prongs in the Brunner test:

In July 2021, The U.S. Court of Appeals Second Circuit ruled that private student loans are dischargeable in bankruptcy. This case was the third known case opening the possibility of bankruptcy protection for student debtors.

Don’t Miss: Government Grants For New Windows

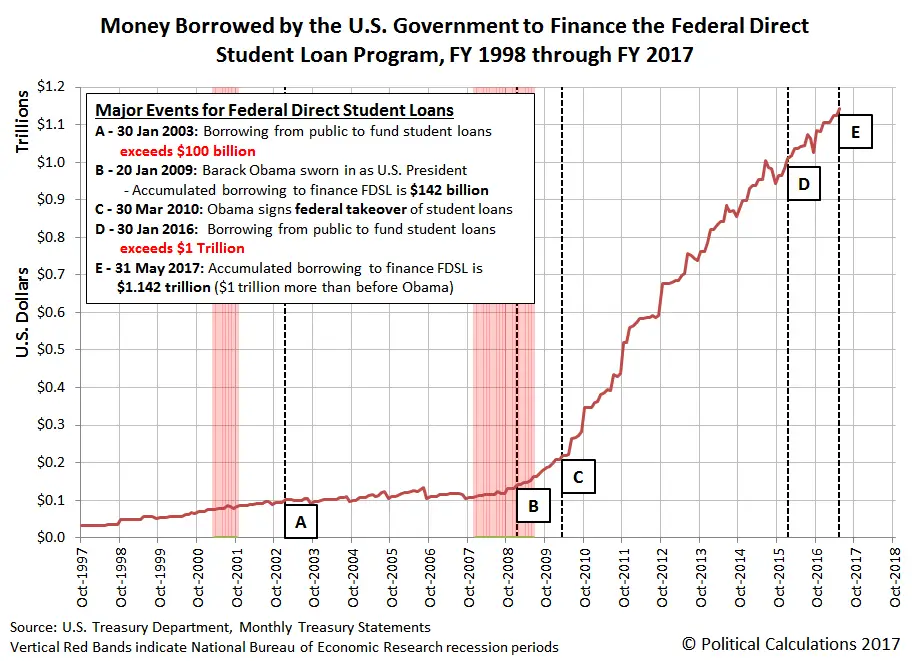

The Direct Student Loan Program

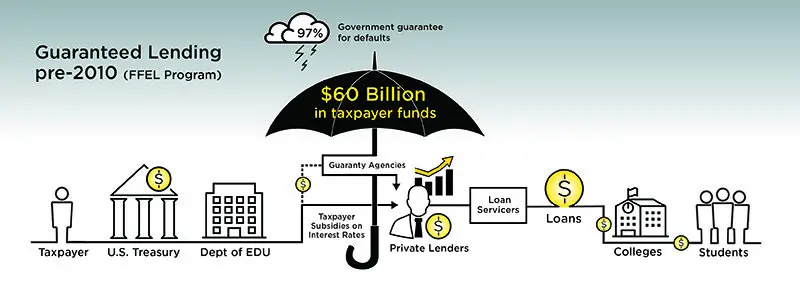

Prior to June 30, 2010, lenders issued federal student loans either as guaranteed student loans or as “direct” student loans. Direct loans are issued directly by the federal government. Whether you received guaranteed or direct loans depended on which loan program your school signed up for.

After June 30, 2010, you can only get a federal student loan under the direct student loan program. A direct loan is made directly from the federal government to students. The federal government contracts with loan servicers to handle day-to-day loan management.

Elizabeth Warrens View On The Events

Senator Elizabeth Warren has been a supporter of the idea of refunding. Warren criticized the Education Department as it relied on other companies, like Navient, to operate. Even when Betsy DeVos was still in charge, she urged her to make Navient refund the money.

As a response to Mitchell Zaiss order, she noted that it is a good beginning making the loan company pay the money. She added that instead of solving the issue, Navient delayed the payment for more than six years. However, she also wanted the Education Department to stop working with Navient as a contractor. She mentioned that it is time to eliminate Navient as it is scamming students and taxpayers.

When making claims, Warren relied on the Office of the Inspector Generals audit, dated 2009. In that audit report, the inspector noted Navient got allowances for students who did not qualify for loans. Therefore, the Education Department overcharged Navient by around $22.3 million.

In short, Navients billing practices were claimed to be faulty, and the inspector suggested the Federal Student Aid get money back from the loan company. As mentioned before, Navient spokesman noted the company practices were compliant with the Education Departments guidance. So, Navient has never accepted wrongdoing.

Also Check: Federal Government Job Training Programs

What Is A Government

The term government mortgage loan can mean a couple of different things. In most cases, however, the general concept is the same.

Definition: A government-backed or insured mortgage program is when a private-sector lender issues the loan to the borrower, and the government insures or guarantees it. The insurance / guarantee means that the mortgage lender is protected against losses, if the homeowner fails to repay later on.

The term government-insured mortgage loan is used to distinguish these programs from conventional home loans that do not receive any kind of government backing.

Do You Have A Private Loan

The good news about federal government loans is that there are many different programs available to help you if you are having trouble repaying these loans. There are even ways to cancel these loans in limited circumstances. The bad news is that the federal government has extraordinary powers to collect student loans if you default. These powers, such as tax refund and federal benefits offsets, have no time limit.

Also Check: Single Mom Money From Government

State Supported Student Loans And Loan Forgiveness Programs

With the cancellation of the Federal Family education Loan Program, states were forced to assume responsibility for their own student loan programs. Every state in the country has its own Department of Higher Education, which offers a wide selection of grants and scholarships for its resident students. Many states also sponsor loans, and loan forgiveness programs, through their Department of Higher Education.

State sponsored student loans are often provided by private lenders who have been certified by the state as preferred lending organizations for students and their families. These are not, strictly speaking, guaranteed loans. State preferred lending organizations may offer more attractive loan agreements, including lower interest rates, loan deferments and student friendly repayment schedules, but they are not guaranteed or underwritten by the state. As with any private lender loan, students should research all state sponsored loans carefully, and should fully understand all of their responsibilities as a borrower before agreeing to any loan.

For more information on state sponsored loans, and loan forgiveness programs, please refer to our section on State Sponsored Student Loans .

Background Information

What Happens After You Submit The Fafsa

After you submit the FAFSA, the government will send you a , which gives you basic information about your eligibility for federal student aid.

The colleges you included on your FAFSA will have access to this information, and theyll use it to determine the amount of federal grants, work-study, and loans you may qualify for.

The colleges youre accepted to will send you a detailing the financial aid you are eligible to receiveincluding federal student loans, grants, and work-study.

The amount of federal aid you receive from each school can vary, just as the cost of attending each school varies.

You May Like: Government Jobs In Mcdonough Ga

Direct Loan And Ffel Programs

There are two types of Federal student loans available to college bound students:the Federal Direct Loan program and the Federal Family Education Loan program. Both are key components of a successful financial aid strategy.

Federal student loans should be the very first step you take in the financial aid process:

- The Direct Federal Loan program is administered through the U.S. Department of Education who also acts as lender for the program.

- The Federal Family Education Loan Program, or FFEL, includes the Stafford Loan , the PLUS Loan and Federal Direct Consolidation Loan. FFEL makes Federal loans possible through private lenders, such as Sallie Mae and Nelnet. When private lenders work with Federal college loan programs more students have access to post secondary education.

Federal student loans are guaranteed by the government, which means if you default on the repayment of your student loan the government will back the lender financially for the loss. Federal loans also offer some of the lowest interest rates available making them more affordable for students struggling to find the money to attend college or university. So, what sets Federal student loan programs apart from private lenders and other types of loans?

How To Fix The Problem

There are two key steps to addressing the student loan crisis. First, there needs to be a major cultural shift away from the belief that college is a one-size-fits-all requirement for success. We are beginning to see this as many young Americans start to realize they can attend a trade school for a fraction of what it would cost for a four-year college and that they can get in-demand jobs with high salaries.

Second, parents and school systems should stress economic literacy so that young people better understand the concepts of resources, scarcity, and prices. We also need to teach our youth about personal finances, interest, and budgeting so they understand that borrowing a large amount of money that only generates a small level of income is not a sound investment.

Finally, the current system of student loan financing needs to be reformed. Schools should not be given a blank check, and the government-guaranteed loans should only cover a partial amount of tuition. Schools should also be responsible for directly lending a portion of student loans so that its in their financial interest to make sure graduates enter the job market with the skills and requirements needed to get a well-paying job. If a student fails to pay back their loan, then the college or university should also share in the taxpayers loss. Only when the demand for higher education decreases will we witness a decrease in its cost.

Don’t Miss: How Can I Get Government Assistance For Housing

Finding Your Loan Information

If you are unsure which agency is servicing your defaulted student loan, you may retrieve your loan information from the National Student Loan Data System . This system contains financial aid information collected from schools, agencies, and other educational institutions. You will need your Federal Student Aid ID information to access your account. Or, you may contact the Federal Student Aid Information Center .

Federal Student Loan Benefits

- You have flexibility. Though any student loanfederal or privateis a legal agreement and must be paid back with interest, federal student loans generally offer more flexible options than private student loans. For example, with federal student loans, the borrower can change their repayment options even after the loan has been disbursed .

- You can make payments based on your salary. Some federal student loans allow for income-driven repayment plans, which cap payments based on the borrowers income and family size.

- You dont need a strong credit history to get federal student loans. Unlike with private student loans, most federal student loans dont require the borrower to have a strong credit history. This can be especially helpful for recent high school graduates who plan on attending college but havent had enough time to build up credit of their own.

- You dont need a cosigner. With most federal student loans, other than Direct PLUS Loans, the borrowers credit is not considered, so its not necessary to apply with a cosigner.

Also Check: Government To Forgive Student Loan Debt

How To Apply For Federal Loans

The key to securing a federal loan for your college career begins with the FAFSA. You will need to fill out and submit the Free Application for Federal Student Aid before the yearly deadline. When you file a FAFSA you are automatically considered for all Federal loans, grants and scholarships depending upon the financial information you provide. Almost every student qualifies for Stafford Loan aid in either a subsidized or unsubsidized loan.

What happens once you’ve filed the FAFSA?

The follow-up to the FAFSA is your Student Aid Report or SAR. This report is generated by the government from the information you provide in your FAFSA. A copy goes to all colleges to which you’ve applied and this information will help determine the nature of any loans, grants or scholarships you may be offered.

When you have an award letter or aid package in hand from the college you’ve chosen the next step is to choose a financial aid lender. In the past colleges and universities provided students with Preferred Lender Listsâthese are out. You are free to choose your own lender for your Federal loans.

Differences In Repayment Options For Guaranteed And Direct Loans

The most important difference between guaranteed and direct loans is the availability of repayment programs. The federal government offers several repayment plans for low-income borrowers like the:

- Income Based Repayment Plan

- Income Sensitive Repayment Plan

- Pay As You Earn , and

- Pay As You Earn Repayment Plan .

Some of these plans are available to certain FFEL borrowers. Generally, the repayment plan options are more generous for direct loans than for FFELs.

To determine whether you have FFEL guaranteed or direct loans, access the National Student Loan Data System.

You May Like: Government Contracts For Disabled Veteran Owned Business

Who Actually Owns Student Loan Debt

As of early 2020, American students were on the hook for approximately $1.6 trillion in student loans. The average borrower owed between $25,000 and $35,000, up significantly from past decades. With that much money on the line, it’s reasonable to be curious about who might ultimately receive all those principal and interest payments. While $1.6 trillion may be a significant liability for the borrowers, it can be an even bigger asset for creditors.

What Is The Difference Between A Federal Loan And A Federally Held Loan

The vast majority of federal student loans are federally held loans.

Some older student loans are federal, but not federally held. These loans include some Graduate PLUS loans, Parent PLUS loans, and Perkins loans.

With some PLUS loans, a commercial lender issued the loan, and the federal government guaranteed the loan. This practice ended in 2010, but many borrowers still have PLUS loans held by commercial lenders.

Thus, within the category of federal student loans, we have federally held loans and federally guaranteed loans held by commercial lenders or schools.

The major downside with the federally guaranteed loans is that they dont qualify for Public Service Loan Forgiveness or benefit from the current Coronavirus relief. However, borrowers can fix this issue.

Recommended Reading: Government Says Aliens Are Real

Types Of Federal Student Loans

There are three types of federal student loans:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans, of which there are two types: Grad PLUS Loans for graduate and professional students, as well as loans that can be issued to a student’s parents, also known as .

These loans are available through the Federal Direct Loan Program. Since federal loans offer different benefits than private student loans, you should always explore them first.

Learn more about the three types of federal student loans:

Leaving The Country To Evade Repayment

Debt evasion is the intentional act of trying to avoid attempts by creditors to collect or pursue one’s debt. Some news accounts report that individuals are fleeing the US in order to stop repaying their student loans. While leaving the country does not discharge the loan or stop interest and penalties from accruing, it is generally more difficult to collect debts against debtors who reside in foreign nations.

International addresses make it more difficult to find people, and collection companies would usually need to hire an international counsel or a third party collector to recoup the debt, cutting into their profits and reducing their incentive to go after a debtor. ‘It increases our expenses to go overseas,’ says Justin Berg of American Profit Recovery, a debt collection agency in Massachusetts. ‘Our revenues are cut by more than half,’ he says.”

Some nations may enter into agreements with the US to facilitate the collection of student loans.

After default, co-signers of student loans remain liable for repayment of the loan. Cosigners are often the parents of the borrowers.

Read Also: Government Help For Single Pregnant Mothers

Policy Goals For Helping Current Borrowers

Overall, the purpose of any policy proposal for current student loan borrowers has to be about reducing the negative effects of these debts. That said, each policy idea may attempt to address a different negative effect. For example, policies focused on interest rates target negative effects related to the size of monthly payments, which can help with faster repayment over time. Meanwhile, policies focused on immediate forgiveness are about reduction in the amount owed right away, while those with longer-term forgiveness may be about creating a safety net for those with perpetual struggles.

Regardless of which problem a given policy tries to solve, it is important that it consider four factors: equity, simplicity, striving for broad impact, and providing a sense of meaningful relief. Understanding how a given policy idea lines up against each of these goals can help policymakers ensure they optimize their solutions for the problems they want to address and in a manner that would be effective. More on each of these goals follows below.

Address equity

While the various challenges student loans present may be clear for certain individuals who are in different situations and financial circumstances, meaningful variations exist even for borrowers who otherwise have the same levels of educational attainment and/or income. This can be due to other factors such as the presence or absence of familial wealth or discrimination in housing or employment.

Ensure simplicity