You Currently Have Direct Loans And Have Not Yet Applied For Pslf

You will need to submit a PSLF form so we can review your loans under the simplified rules and determine whether your current or past employers qualify for PSLF. You can submit this form through the PSLF Help Tool at StudentAid.gov/PSLF. Because we expect an influx of applicants due to this announcement, you may see some delays in having your application processed, but we will work as quickly as possible to assist you. You will need to submit your application by October 31, 2022.

Can You Get Forgiveness On A Defaulted Loan

Generally, being delinquent or in default on a student loan harms, if not negates, your chances of receiving forgiveness. With that said, check the qualifying criteria of your preferred forgiveness program. For federal loan forgiveness programs, for example, you would have to rehabilitate or consolidate a defaulted loan to become eligible for relief.

When Can I Apply For A Debt Reduction Grant

Debt Reduction Grants are awarded four times per year: spring, summer, fall, and winter.

Upon graduating from a post-secondary program, an applicant must meet the PEI residency requirement.

- If a graduate is living on PEI prior to their graduation date, then they are required to complete the 6-month residency requirement after their graduation date before they apply

- If a graduate does not live on PEI prior to their graduation date but moves to PEI in the future, then they are required to fulfill the 6-month residency requirement before they apply.

All graduates must apply within the 3-year period following their graduation date.

Recommended Reading: What Government Agencies Regulate The Restaurant And Foodservice Industry

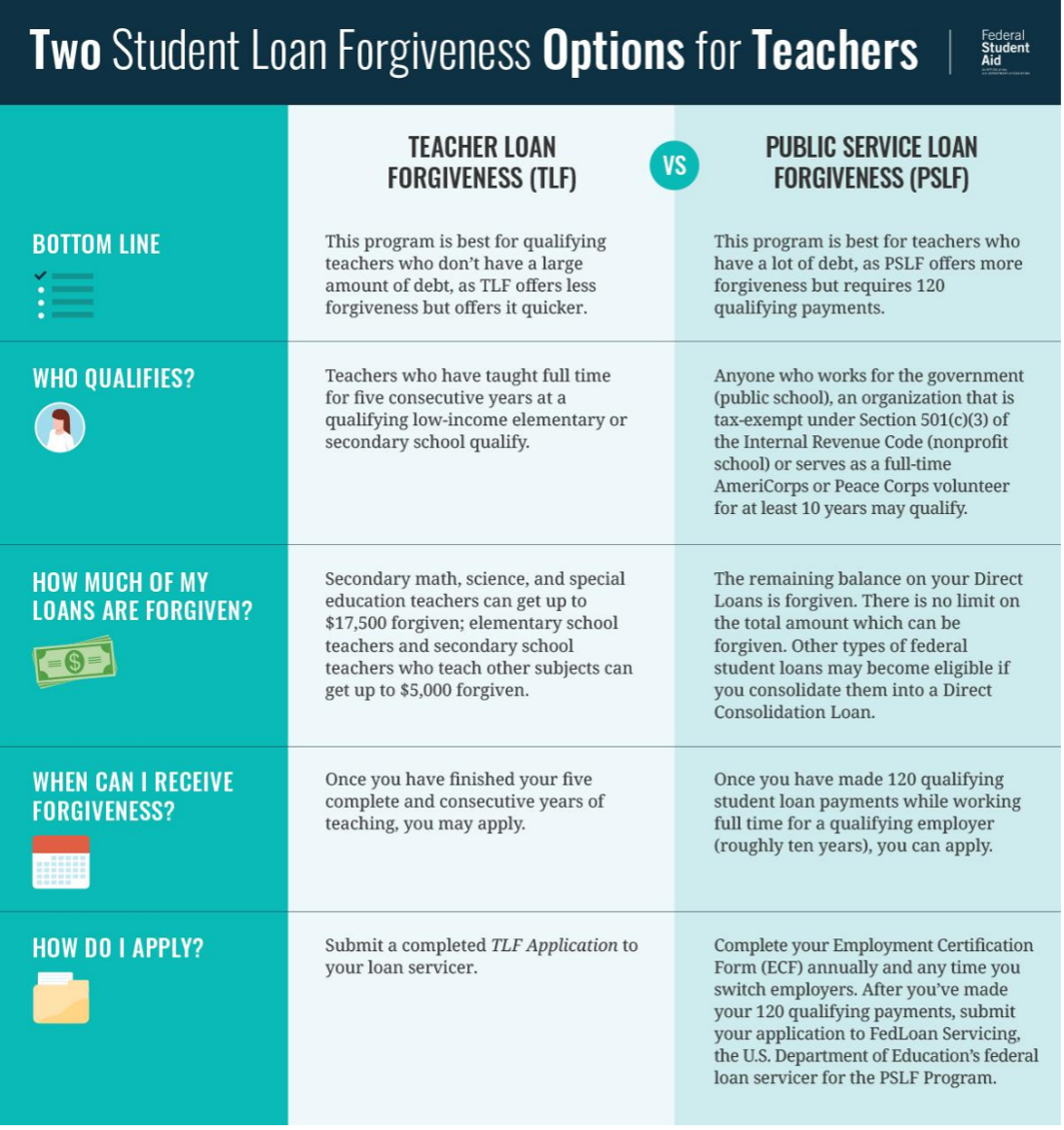

Public Service Loan Forgiveness Program

Forgives the remaining balance on your Federal Direct Loans after 120 qualifying payments .

View complete program details at StudentAid.gov/publicservice.

Here are some highlights:

- This program has the broadest employment qualification requirements of the federal programs listedit doesnt require that you teach at a low-income a public school, or even be a teacher. Most full-time public and private elementary and secondary school teachers will meet the employment requirements.

- You must have Direct Loans. If you have other types of federal loans, like FFEL or Perkins Loans, you must consolidate in order for those loans to qualify. To check which types of loans you have, log in to StudentAid.gov.

- You should repay your loans on an income-driven repayment plan if you want to get the most value out of the program. You can apply for an income-driven repayment plan on StudentLoans.gov.

- In order for payments to count toward the 120 needed to get forgiveness, they need to be full payments, made no more than 15 days late, and made after October 1, 2007.

- Loan amounts forgiven under PSLF are NOT considered taxable by the IRS.

To confirm whether you qualify for the program, submit this form ASAP.

Gross Monthly Family Income Threshold For Zero Affordable Payment

-

Gross monthly family income threshold for zero affordable payment

Number of Family Members

5 or more

$5,652

Above the income threshold for zero payments , the monthly affordable payment gradually increases with family income but will never exceed a maximum of 20 per cent of family income.

Note: If your spouse also has government student loans in repayment, your Monthly Affordable Payment will be adjusted by your share of the government student loans held by both of you. For example, if the Monthly Affordable Payment based on your family income is $150, and you have two-thirds of the government student loans in repayment, your Monthly Affordable Payment will be $100 .

Also Check: What Is The Interest Rate Of Government Bonds

Alternatives To Government Aid

Government-backed student loans are the lowest cost way to finance your education, but sometimes you wont qualify or receive enough to cover all your education costs. For example, if your spouse or parents earn too much money, you may not qualify, or if you have RRSP savings, you may be assessed to have a $0 need for government student loans.

Ideally, only those Canadians who do not need student loans would be denied, but this isnt always the case. If you need loans to finance your education and dont qualify for government student loans, here are your options:

How Will The Government Know What My Income Was

The Department of Education says it already had income information for nearly 8 million borrowers, likely because of financial aid forms or previously submittedincome-driven repayment plan applications. Those borrowers will automatically receive the debt relief if they meet the income requirement.

Other borrowers will need to apply for the student loan forgiveness if the Department of Education doesnt have their income information on file.

You May Like: Cybersecurity Governance Risk And Compliance

Student Loan Forgiveness Is Temporarily Blocked But Not For Pslf

Borrowers should know that the Limited PSLF Waiver is entirely distinct from Bidens one-time student loan forgiveness program that can provide $10,000 or up to $20,000 in student loan forgiveness for borrowers with eligible loans who have earned within certain income guidelines.

Last week, a federal appeals court temporarily blocked implementation of Bidens one-time student loan forgiveness program in response to a lawsuit brought by Republican-led states. However, that administrative stay only applies to the one-time cancellation program. It does not apply to PSLF.

In addition, while FFELP loans are excluded from relief under the one-time cancellation initiative following a policy reversal by the Biden administration several weeks ago, FFELP loans can still potentially benefit from the Limited PSLF Waiver and ultimately qualify for student loan forgiveness if borrowers follow the required steps.

How Repayment Assistance Works

If youre eligible, your monthly payments will be reduced to something more affordable based on your family size and income. In some cases, you will not have to make any monthly payments.

There are two stages to the Repayment Assistance Plan:

RAP Stage 1

- Lasts for up to 60 months within the first 10 years after you leave school

- Intended to help with temporary repayment difficulties

- Monthly payments reduced

Read Also: Jp Morgan Us Government Money Market Fund

Am I Eligible For Forgiveness If My Loans Are In Default

Yes, defaulted federal student loans are eligible for debt relief.

For borrowers who have a remaining balance on their defaulted student loans after the cancellation is applied, there will be an opportunity to get out of default once payments resume in January 2023 as part of what the Department of Education is calling its Fresh Start initiative.

Can You Get Loan Forgiveness For Private Student Loans

Forgiveness for private student loans is more rare than for federal loans, but its possible to qualify for sometimes significant repayment assistance via state- and employer-based programs. Many banks, credit unions and other private lenders also discharge outstanding private loan balances in the case of the primary borrowers total and permanent disability or death.

Also Check: Free Government Funding For Home Repairs

How Much Is A Debt Reduction Grant

The Debt Reduction Grant is calculated based on the money an individual borrows each year from the PEI Student Loan Program. Generally, PEI student loans have two funding sources, the Canada Student Loan , which is federal funding administered by the National Student Loan Centre and the Provincial Student Loan , which is provincial funding administered by Edulinx. The Debt Reduction Grant is only applied to an applicants PSL, the provincially funded part of your PEI Student loan.

Prior to Aug. 1, 2018 – $2,000 per year

As of Aug. 1, 2018 – $3,500 per year

The Debt Reduction Grant Worksheet provides helpful examples of how the grant is calculated and the worksheet may be used to estimate an applicants debt reduction grant.

Forgiveness With Revised Pay As You Earn

Revised Pay As You Earn works much the same way as Pay As You Earn. Under this plan, your payments will be capped at 10% of your discretionary income. Undergraduate loans are forgiven after 20 years, while graduate school loans are forgiven after 25 years.

Unlike IBR and PAYE, which require you to end up with a lower payment than on the standard plan, theres no such requirement for REPAYE anyone with eligible loans can apply, even if they end up paying more with an income-based payment. As a result, you could end up with high monthly payments on REPAYE if you suddenly start making a lot more money.

Whos eligible?

Anyone with qualifying federal student loans is eligible for REPAYE.

Which loans qualify?

While REPAYE is broadly open to everyone, your loans might not qualify. Eligible loans include:

- Direct subsidized and unsubsidized loans

- Direct grad PLUS loans

- FFEL Stafford loans, if consolidated

- FFEL PLUS loans made to grad students, if consolidated

- Federal Perkins loans, if consolidated

- Direct consolidation loans, unless they repaid parent PLUS loans or FFEL loans made to parents

What are the requirements?

Borrowers with undergraduate loans must make consistent payments for 20 years. Those with loans for graduate school or professional study must make payments for 25 years.

How do you apply?

Read Also: What Is Government Mortgage Relief Program

You Dont Know What Kind Of Federal Loans You Have

Its very common for borrowers to not know what kind of federal loans they have. You can see what loans you have by logging into your account on StudentAid.gov, going to the My Aid page , and scrolling down to the Loan Breakdown section.

There, youll see a list of each loan you have borrowed, even if you have paid the loan off or consolidated it into a new loan. Direct Loans begin with the word Direct. Federal Family Education Loans start with FFEL, and Perkins Loans include the word Perkins in the name.

Private Institutions And Other Student Loan Providers

If you dont qualify for government student loans or receive a loan large enough to cover all your post-secondary education costs, you may have to look at other options. If this is the case, here are some alternatives for you to consider:

- Student Line of Credit: Offered by most banks and credit unions, a student line of credit is similar to a regular line of credit, where you are approved for a maximum limit, but you only pay interest on the amounts you actually withdraw. Student lines of credit usually only require you to pay interest on the loan while you are in school, and some convert to installment loans once you graduate.

- Personal Loans or Bank Student Loans: Personal loans are offered by many lenders including traditional banks and online lenders like Loans Canada and Loan Connect. Personal loans are usually paid back monthly over a period of time, so you should only borrow as much as you need in order to minimize the payments youll need to make while you are in school.

Don’t Miss: Government Funding For Small Business Owners

State Lrap Programs For Doctors And Other Health Care Professionals

While many programs are available nationally, you might also find loan assistance from your state. There are a variety of state LRAPs across the country.

The Massachusetts Loan Repayment Program, for instance, awards up to $50,000 to health professionals working in shortage areas. You might find other repayment assistance options in your state.

What Happens Now For Borrowers

Borrowers will have to wait for the government’s appeal to the 5th Circuit Court to play out. While it can be tough to follow all the various legal challenges, borrowers can subscribe for updates from the Department of Education and check the Federal Student Aid website for further information.

It could take months for the court to issue a final ruling. If it overturns the Texas lower court’s ruling, then the Biden administration could begin canceling student debt.

But the Department of Justice could also ask for an emergency stay of the Texas judge’s order. If granted — and if a different appeals court ends its temporary stay on the program in a separate, pending case — then the administration would be allowed to cancel debt before a final ruling is made by the 5th Circuit.

Initially, the Biden administration said that it would start granting student loan forgiveness before payments are set to resume in January after a years-long pandemic pause.

But Thursday’s ruling in Texas puts that timeline in jeopardy.

“For the 26 million borrowers who have already given the Department of Education the necessary information to be considered for debt relief — 16 million of whom have already been approved for relief — the Department will hold onto their information so it can quickly process their relief once we prevail in court,” said White House press secretary Karine Jean-Pierre in a statement Thursday.

Also Check: How Do I Apply For A Free Government Grant

What Does Bidens Plan Include

Bidens plan will provide up to $10,000 in federal student loan forgiveness for eligible borrowers, plus an additional $10,000 for recipients of Pell Grants. To qualify for this relief, borrowers must have an individual income of less than $125,000 . Additionally, the pause on federal student loan repayment that originally began during the COVID-19 pandemic has been extended through Dec. 31, 2022.

When payments do restart, borrowers may also have access to a new avenue for reducing their monthly payments. According to the White House, the U.S. Department of Education is proposing a new income-driven repayment plan that will protect more low-income borrowers from having to make any payments, in addition to capping monthly payments for undergraduate loans at 5% of a borrowers discretionary income.

What If I Cant Repay My Student Loans

If youve had difficulty finding employment after graduation and you cant make your monthly student loan payment, you dont need to resort to a debt consolidation loan or a credit counsellor like Consolidated Credit just yet. You can apply for the repayment assistance plan . RAP is available in every province and, although some vary in detail, most of them are similar to the federal RAP. Here are the details:

When you apply for RAP, youll need to prove that your financial situation cant support your monthly payments. Youll need to provide details about your income, and, depending on those details, you may be assessed to make a payment that does not exceed 20% of your income.

You can apply for RAP when your student loans go into repayment or if your financial circumstances change. RAP requires you to re-apply every six months, but there is no limit on how long you can use RAP. If youve been eligible for 60 months, the federal government will begin to cover both the interest and principal amounts that exceed your monthly payments.

Don’t Miss: Government Help With Your Mortgage

Pei Debt Reduction Program

If youre a PEI resident and you have to borrow at least $6,000 in federal or provincial student loans each year, you could be eligible for a special grant to reduce the debt from your provincial student loan.

Eligible Academic Periods

If you started your schooling prior to August 1st, 2018, you could qualify for a debt reduction grant of up to $2,000 per year of your studies, which you can apply directly to your unpaid provincial student loan balance. To qualify, you must graduate from your program within one year of filing your application.

If you commenced your education after July 31st, 2018, you may be eligible for a debt reduction grant of up to $3,500 per year of study. Once again, you may use your grant funds to pay any provincial student loan balances. However, you must graduate within 3 years of sending your application .

Check out what happens to your student bank account when you graduate.

Eligibility Requirements For The PEI Debt Reduction Program

If you graduated during an academic year prior to, you must submit your application within one year of your graduation date. You also have to submit:

- A completed Debt Reduction Grant application

- A copy of your certificate, degree or diploma

- Your loan statement balances from National Student Loans Service Centre and Edulinx-PEI

How Student Loan Forgiveness Works

The recent highly publicized collapse of several for-profit colleges and the pandemic-induced 2020 economic crisis have intensified longstanding concern about the mounting burden of student debt. Broad loan forgiveness for all borrowers, not just those who work in public service, participate in a repayment plan, or have been defrauded by their college, has become a widely debated political issue.

Loan forgiveness means a debt is eliminated or forgiven in finance parlancerelieving the borrower of the obligation to repay it. Although any student loan can theoretically be forgiven, student loan forgiveness generally applies to U.S. government-issued or government-backed loans. These loans account for 92% of all student loans in the country.

In other words, the widely publicized forgiveness programs do not apply to any privately issued loans, like those from a commercial bank or lenders like Sallie Maeeven if those loans are earmarked for students.

In some cases, borrowers may be able to get their loans forgiven or canceled. Individuals who want their loans forgiven must apply and may have to continue making payments until their application is approved.

Read Also: How To Find And Bid On Government Contracts

Perkins Loan Cancellation For Teachers

Forgives up to 100% of your Federal Perkins Loan Program if you teach full-time at a low-income school, or if you teach certain subjects.StudentAid.gov/teach-forgive

Here are some highlights:

- This program can only forgive your Federal Perkins Loans. Check to see if you have Perkins loans at StudentAid.gov.

- If you are eligible for this program, up to 100 percent of the loan may be canceled for teaching service, in the following increments:

- 15 percent canceled per year for the first and second years of service

- 20 percent canceled for the third and fourth years

- 30 percent canceled for the fifth year

- Each amount canceled per year includes the interest that accrued during the year.

- To find out if a school is classified as a low-income school, check our online database for the year you have been employed as a teacher.

- Even if you dont teach at a low-income school, you may qualify if you teach mathematics, science, foreign languages, bilingual or special education, or different subject determined by your state education agency to have a shortage of qualified teachers in your state.

- Private school teachers can qualify if the school has established its nonprofit status with the Internal Revenue Service , and if the school is providing elementary and/or secondary education according to state law.

To apply for Perkins Cancellation, contact the school where you obtained the Perkins Loan. Each school has its own process.