Free Money From The Government

Free money from the government took on a new meaning in 2020 and 2021, with the issuance of significant COVID relief. While much of the pandemic-related relief has ended for now, there are other day-to-day government programs available to those in need. But unlike the stimulus checks that were issued automatically during COVID, you’ll have to seek out and apply for these financial boosts.

Most of these programs are funded by taxes, so technically you pay something, but it’s as close as youll get to finding free money from the government.

Who Does The Government Borrow From

Rather than borrowing from banks, the government typically borrows from the market primarily pension funds and insurance companies. These companies lend money to the government by buying the bonds that the government issues for this purpose. Many companies favour investing money in government bonds due to the lack of risk involved: the UK government has never defaulted on its debt obligations and is unlikely to in the future, primarily because it is able to collect money from the public via taxation. The market in government debt also tends to be stable and liquid, and offers an interest rate in excess of that which is available on other riskless investments .

What To Do If You Are Dealing With Creditors

If youre in a situation where you have more financial commitments than you have money to pay them, it can be tempting to ignore the problem. After all, you cant afford the debt. Putting the issue out of mind may feel like a temporary solution.

But ignoring your debt is usually a mistake. Defaulted debts might snowball into a bigger issue, even if your Social Security benefits arent at risk. Instead of pretending that your debt problem doesnt exist, here are some better alternatives to consider.

You May Like: Tax Benefits For 1099 Employee

You May Like: The Best Free Government Cell Phone

Get Paid For Parenting

You can overcome insomnia or those sleepless nights of being a parent through governmental intervention. Using the Canada Child Benefit allows you to receive a large monthly payment, free of tax. What you get is determined by the number of children in your household, their age, and your familys earnings. However, the amount is limited to $563.75 per child .

Subsidized And Unsubsidized Loans

Subsidized loans are loans for which a third party, or someone other than the borrower, pays the interest on a loan for a set period of time. With a subsidized federal student loan, for example, the bank or the government , pays the interest while the borrower is in school, during a grace period following graduation, and if the borrower needs a loan deferment.

Unsubsidized loans, on the other hand, require the borrower to pay all interest costs, right from day one. In the case of federal student loans, borrowers do not need to demonstrate financial need for an unsubsidized loan, and in many cases may be able to borrow more.

Also Check: Can You Refinance Government Student Loans

Is It Possible To Reduce The National Debt

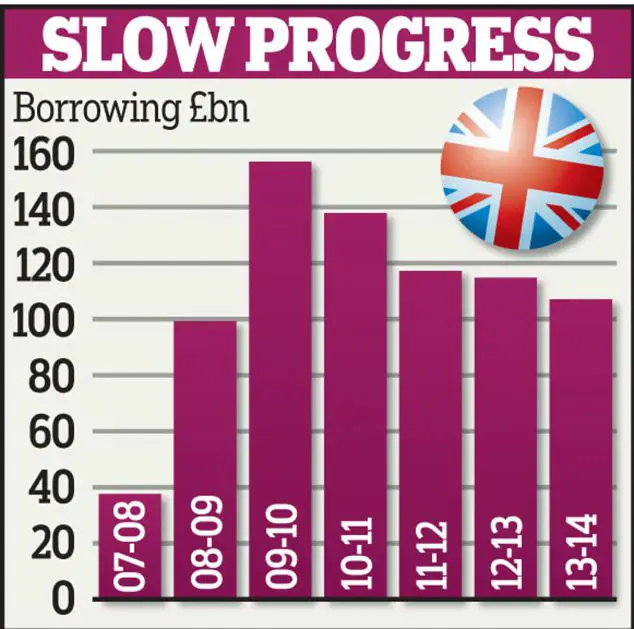

The debt is currently higher than its ever been before. While the government talks about reducing the deficit, the reality is that the total national debt will keep growing. Even if it stops the debt growing, taxpayers will continue paying around £120 million a day in interest on the national debt.

It is very unlikely that the government will be able to reduce debt in the current system. To understand why, consider what would need to happen for the debt to be paid down. First, the government would need to start paying the annual interest on the national debt each year out of tax revenue, rather than simply borrowing the money to pay it. Interest payments totalled £43bn for 2012, so if the government wanted to reduce the debt it would have to find an additional £43bn in taxes, which would require, for example, raising VAT to roughly 30% .

In addition, in the five years before the banking crisis the government spent an average of 10.6% more than it received in taxes every year. So even after the £43bn interest on the national debt is paid, to run a balanced budget right now, it would need to raise an extra £22bn in taxes , or cut public services by £22bn equivalent to shutting down a fifth of the National Health Service.

Safe Cash Advance For Social Security Recipients

If youve ever found yourself asking, Can I get an advance on my SSI check? the answer may surprise you. Although many lenders only work with people who have traditional paychecks, some do offer cash advances for Social Security recipients. If you rely on your Social Security payments to get by, these advances might help you get through an emergency or just a tight week.

Recommended Reading: Apply For Personal Government Grants

Agriculture Rural And Farm Service Loans

These loans provide funding to encourage farming, which can lead to food security and rural development. Several loan programs are available for agriculture and farm service. Capital allows the purchase of livestock, feed, farm machinery, equipment, and even farmland within the eligibility criteria.

Loans are also available for constructing on-farm storage, cold storage, and processing and handling facilities for selected commodities. Other available loans cover fisheries, financing for aquaculture, mariculture, and commercial fishing industries. The dedicated Rural Housing Farm Labor Housing Loans and Grants program offers capital for the development and maintenance of housing for domestic farm laborers.

Keep Your Home Safe And Get Money From The Government

Maybe you have older parents who have some mobility difficulties or you have mobility issues yourself. If so, the governments Home Accessibility Tax Credit is used for renovations, such as wheelchair ramps and in-home stairlifts. You get rewarded for reducing the likelihood of injuries and can claim as much as $10,000 for the home improvements. That can translate to a tax rebate of 15% when tax time rolls around.

Read Also: Mt Hood Brewing Government Camp

How Much In Student Loans Can I Get Per Semester

Loan limits are determined on a per-year basis, even though they might be disbursed each semester. In most cases, your college processes your federal loan money at the start of each school term. Schools that dont follow traditional terms must disburse loan money at least twice during the school year.

For example, if you qualify for $3,500 in subsidized loans as a first-year undergraduate student, youll get half of that each semester.

Is This What The Government Does In A Financial Crisis

What Ive described until now is what happens very often. A crash is a particularly extreme case where the governments need to sell a lot of gilts all at once . They also urgently need people and companies to spend money to keep the economy flowing as much as possible. The problem is that in crisis times, people dont exactly have excess money they will want to be tying up in investments. So to help, the central Bank will often step in and buy up most of the gilts. They have the power to invent the money they spend buying the gilts.

In October 2020, the government had sold gilts worth £262bn to pay for their economic packages to help people through the pandemic and of that amount, £246bn had been bought by the bank of England..

How/Why exactly are the Bank of England involved?

The government does not want to be seen inventing new money for free. . This is traditionally seen as something that weak economies do not strong/well established ones like the UK. In times of crisis, selling a voucher is a way they can sneakily get themselves cash while still technically selling it to the private sector .

Dont they eventually have to pay it all back?

This is all very well as a quick fix but dont the government eventually have to give back the money theyve borrowed when the vouchers end? After all people arent giving the government money, theyre swapping money now for money+interest in the future!

Dont the interest payments push the government into more and more debt?

Read Also: Is Medicare Funded By The Federal Government

Get Money For Learning

Are you a student struggling to pay for your studies? If so, you can reduce educational costs by applying for the Canada Student Grant. The grant money has been doubled for the 2020 to 2021 academic calendar year. If you are from a low- or middle-income family and enrolled in undergrad studies, you can get $6,000 annually as a full-time student. Part-time students receive up to $3,600 in grant money.

Is There A Way To Borrow Money From The Government

Yes, there are ways to borrow money from the government. The government offers a vast array of loans to individuals, communities, and businesses. These loans are usually a direct loan, where you borrow money from the government directly, or a guaranteed loan, where you borrow money from a lender that has been approved by the government.

Read Also: Democratic Republic Of Congo Government

How Does The Government Borrow

One of the main tasks of the Swedish National Debt Office is to manage central government debt. We do this at as low cost as possible in the long term and without taking too great risks.

The Swedish National Debt Office borrows money on behalf of the Swedish government by selling government securities, primarily bonds, by auction. Those who buy bonds lend money to the government. The bonds can then be sold on a secondary market. When a bond matures, the Swedish National Debt Office pays back the money to the owner of the bond. Then we borrow again by selling new bonds.

How Much In Student Loans Can I Get Per Year

The amount you can borrow in federal student loans depends on your year, dependency status and the type of loans you receive. For instance, first-year undergraduate dependent students can receive as much as $5,500 . Third-year students can receive up to $7,500 total, only $5,500 of which can be subsidized.

Don’t Miss: Government Grants For Small Businesses Start Up

Home Improvement And Repair

If you own a home that is in need of repair , the government is willing to help make your house and neighborhood a clean, safe place. FHA 203 loans provide funding for the purchase or rehabilitation of a home. After a disaster, the U.S. Small Business Administration provides funding for repairs to your primary residence and to replace certain belongings.

In addition to backing loans, the government offers programs that can help you reduce the amount you borrow. Public servants, such as law enforcement officers, teachers, firefighters, and paramedics, can also benefit from the Good Neighbor Next Door program.

What Is The Federal Deficit

The budget deficit is the difference between government spending and government revenue. Taxes make up most of the revenue.

For October, the government revenue hit $237.7 billion, which is a 3.2 percent decline from the same time last year, due in large part to a reduction in personal income taxes . The month’s spending hit $521.8 billion, which is a 37.3 percent increase from October 2019. Issues related to the COVID-19 pandemic increased the government’s spending.

You May Like: Bank Of America Cashpay Government Card

Home Equity Loans And Helocs

Home equity loans and home equity lines of credit are two types of secured loans that are based on borrowing against the equity in a home. To qualify for them, a borrower must have at least 15% to 20% equity in their homea loan-to-value ratio of 80% to 85%and generally a of at least 620, though some lenders put that at 700 to get a HELOC.

Both are secured by the homeowners home. A home equity loan gives the borrower an up-front lump sum that is paid back over a set period of time with a fixed interest rate and payment amount. A HELOC, on the other hand, is a credit line that can be used as needed. HELOCs usually have variable interest rates, and the payments generally are not fixed.

Notably, the Tax Cuts and Jobs Act no longer allows the deduction of interest on these two loans unless the money is used for home renovations.

Also Check: Check Social Security Retirement Benefits

Does Government Borrowing Create New Money

In most cases the process of government borrowing does not create any new money. While most individuals and businesses accept bank deposits in payment, the UK government does not they require that the purchasers of new bonds settle the transaction by transferring central bank reserves into a government-owned account at the Bank of England. This means that new money is not created in the process of government borrowing.

For example, lets say a pension fund holds an account at MegaBank, and wishes to buy £1 million in government bonds. The fund asks MegaBank, which is one of the Gilt-Edged Market Makers , to buy £1 million of new government bonds. MegaBank decreases the pension funds account by £1 million and then purchases the bonds on behalf of the pension fund. To settle its transaction with the government, it transfers £1 million of reserves to the governments account at the Bank of England. The balance of MegaBanks account at the Bank of England will drop by £1 million. The government now has £1 million of central bank reserves in its account at the Bank of England, which can be used to make payments. It has borrowed the money without any additional deposits being created.

To spend the money it could now transfer the reserves to Regal Bank where an NHS hospital holds an account. Regal bank would then receive £1 million of central bank reserves, and could increase the account balance of the hospital by £1 million.

Read Also: Best Government Phones In California

What Happens If You Hit Federal Loan Limits

If your cost of attendance exceeds what you can borrow in federal student loans, you may not have enough cash on hand to cover the extra costs. If youre worried about not having enough money to pay for school, you have a few options, including:

Working part-time. Find a job that lets you work non-traditional hours so you can pay for school. You can look on- or off-campus, depending on your living situation and transportation options. Consider a side-hustlelike delivering groceries, tutoring or freelancingto cover your extra schooling costs.

Requesting payment assistance. Many schools require payment in full, whether that comes from your lender or you. If you cant pay your outstanding bill, talk to your schools financial aid office about a payment plan, like making monthly payments instead of one lump-sum payment. Also inquire about emergency grants or interest-free loans, which vary by school but might be available based on your need.

Switching schools. Cost of attendance varies by each school. Since every institution has different service fees, you might pay more at a private or big-name school compared to community colleges, which tend to have fewer fees. If you can, consider attending local colleges for the first couple years and then transferring to your school of choice to complete your bachelors degree.

Options For Students Homeowners And Businesses

When you need to borrow money, the U.S. government can be an appealing source of funding. Government loans typically have borrower-friendly featurestheyre relatively easy to qualify for and might have lower rates than you can find with private lenders. However, it can be a challenge to find out about the many different government loan programs in order to take advantage of them.

You May Like: Qualifications For Free Government Phone

Sources To Get The Money You Need

Borrowing money can fund a new home, pay for college tuition or help start a new business.

Financing options range from traditional financial institutions, like banks, credit unions, and financing companies to peer-to-peer lending or a loan from a 401 plan.

Has The Federal Government Borrowed From Social Security

Social Security is a separate, self-funded program. The federal government does, however, borrow from Social Security. Heres how: Social Securitys tax revenue is, by law, invested in special U.S. Treasury securities. Social Security redeems the securities to pay benefits.

Who started taking money from Social Security?

President ReaganThe taxation of Social Security began in 1984 following passage of a set of Amendments in 1983, which were signed into law by President Reagan in April 1983. These amendments passed the Congress in 1983 on an overwhelmingly bi-partisan vote.

Don’t Miss: Entry Level Government Jobs Charlotte Nc

How Much In Student Loans Can I Get For Part Time

You can get student loans and financial aid as a part-time student. How much you receive in federal loans is based on your cost of attendance, how many credits youre taking and the type of student you are. Youll need to be enrolled at least half-timewhich varies by schoolto qualify for federal aid. Some private lenders may offer loans to students enrolled less than half-time.

Does The State Borrow Money

Yes. The state borrows money for a variety of construction, repair, and renovation projects involving state highways, higher education facilities, state park improvements and state government buildings. State borrowing also provides financing to local school districts for school buildings and renovations. The state also has issued Clean Michigan Initiative bonds to finance environmental cleanup, pollution prevention, and redevelopment projects.

Recommended Reading: Government Programs To Pay Off Student Loans

File And Suspend For Married Couples

Another way of getting extra money from the SSAthis one involving married coupleswas permitted for a few more years.

Known as file and suspend, this practice involved the higher-earning spouse applying for Social Security as soon as they reached their full retirement age . This also allowed their spouse to begin collecting spousal benefits, worth half of the filers benefits.

| Full Retirement Age | |

|---|---|

| 1960 and later | 67 |

The filer would then suspend their application, but the spouse could still collect spousal benefits. At the age of 70, the original filer would begin collecting their benefits at a higher rate.

File and suspend enabled a couple to come out many thousands of dollars ahead. This was partly because spousal benefits reach their maximum value at the spouses FRA. An individuals own benefits, on the other hand, reach their maximum value at age 70.

The Bipartisan Budget Act of 2015 prevented retirees from filing and suspending by making it so a spouses benefits were automatically suspended at the same time as the person making the request.