Which Is Better Ee Bonds Or I Bonds

EE Bond and I Bond Differences The interest rate on EE bonds is fixed for the life of the bond, while I offer bond rates that are adjusted to protect against inflation. EE bonds offer a guaranteed return that will double your investment if held for 20 years. There is no guaranteed return with I bonds.

Which type of savings bond is best?

Series I savings bonds are the best overall because their incomes match inflation, come in paper and electronic forms, and can avoid federal taxation when used to pay for education.

Can you lose money in I bonds?

No, I bonds can not lose value. The interest rate can not go below zero and the redemption value of your I bonds can not go down.

Two Credit Risk Yield Curves

The spot, forward and par yield curves, and their corresponding time series, are calculated using two different datasets reflecting different credit default risks.

- One sample contains “AAA-rated” euro area central government bonds, i.e. debt securities with the most favourable credit risk assessment.

- The second dataset contains all euro area central government bonds.

Disclaimer And Limitation Of Liability

The content of this website section, including yields, prices and all other data or information, is made available by the ECB for public information purposes only. It is not intended to be used for any other purpose including, without limitation, calculating price/yield quotations, identifying trading opportunities or as the basis for any other form of advice regarding the pricing of financial assets or identifying investment opportunities.

The ECB aims to keep the content of this website section current and accurate, taking reasonable measures to update this site every TARGET business day at noon . An update may however be delayed on the same TARGET business day or postponed to the following TARGET business day, for example when a TARGET business day falls on a public holiday observed by the ECB. No data or other information can be provided regarding any day which is not a business day for the relevant trading venue from which the euro area yield curve data are sourced.

The ECB does not endorse or take responsibility for the content of any other website that this website section may direct users to or for any replication of the content of this website section on other websites or in any other form of redistribution.

This disclaimer is without prejudice to the general disclaimer and copyright of the ECB.

Recommended Reading: Government Jobs In Las Vegas Area

Is There A Downside To I Bonds

Another disadvantage is that I bonds cannot be bought and held in a traditional or Roth IRA. I bonds must be held in a taxable account. Another disadvantage of I bonds is that there is an interest penalty if the bonds are redeemed within the first five years.

Can an I Bond lose money?

You can cash your Series I bonds at any time after 12 months. You will receive the original purchase price plus interest income. I bonds are meant to be longer-term investments If you repay an I bond within the first 5 years, you will lose your last 3 months interest.

What is the catch with I bonds?

I bonds earn interest for 30 years, as long as you do not cash them in advance. You must keep them for at least one year, and if you redeem them after less than five years, you will lose the last three months of interest.

Types Of Government Bonds In India

The multiple variants of Government bonds are discussed below

- Fixed-rate bonds

Government bonds of this nature come with a fixed rate of interest which remains constant throughout the tenure of investment irrespective of fluctuating market rates.

The coupon on a Government Bond is mentioned in nomenclature. For instance, 7% GOI 2021 means the following

Read Also: Dump Truck Bidding Contracts

United States 10y Bond Yield Spread

The United States 10Y Government Bond has a 1.752% yield. Click on Spread value for the historical serie.

A positive spread, marked by a red circle, means that the 10Y Bond Yield is higher than the corresponding foreign bond. Instead, a negative spread is marked by a green circle.

| United States 10Y vs |

|---|

Inflation Is Another Consideration

Typically movements in interest rates tend to follow long-term inflation trends. If inflation is moving higher, interest rates tend to follow suit. If inflation stays low, there is usually less pressure on interest rates. Yet as government reports of inflation levels topping the 5 percent mark, the highest since 2008, occurred in mid-summer, interest rates barely moved.

Why has the bond market seemed less concerned about inflation? While many anticipated inflation would tick higher, we dont expect a dramatic, sustained change, says Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management. Second, if interest rates are rising too fast, the Federal Reserve may step in and add liquidity to the bond market to help temper that trend. If the Fed uses its assets to buy bonds, it helps bring more balance to the supply-demand equation, keeping interest rates lower. The Fed has been a buyer of Treasury bonds for more than a year, but has indicated it plans to reduce its purchases begin late in 2021 and perhaps curtail its purchasing activity completely by mid-2022.

Read Also: Local Government Employee Credit Union

Who Should Invest In Government Bonds

Government Bonds are one of the most secure forms of investment in India attributed to its Sovereign guarantee. Risk-averse investors who prefer superlative security of their investments devoid of uncertainty created present in market-linked instruments can look to invest in this type of securities. It is also a suitable long term investment option for entities that do not have experience in investing in stock market tools.

Individuals seeking to dilute the risk factor in their overall investment portfolio while also ascertaining higher than average returns on their investments can allocate a stipulated portion of their corpus for investment in Government Bonds as well.

The Indian government has undertaken several measures to ensure that G-Secs gain understanding and popularity among retail investors at the same time simplifying methods of subscription for retail investors.

For instance, it has introduced the system of Non-Competitive Bidding for certain G-Secs, including Government Bonds. Through the facility of NCB or Non-Competitive Bidding, investors can conveniently bid and invest through select websites and mobile applications provided they have a functional Demat account.

Hence, entities seeking to dilute or diversify their investment portfolio or starting their venture as investors can consider investing in government bonds, the excess corpus they have.

Government Bonds With High Interest Rates

Before we get started, let me clarify that this article is not intended to provide any kind of investment advice. Any investment is potentially risky, and investing in government debt typically based in random foreign currencies can be especially risky even for experienced investors.

Basically, any decision you make with this information is yours alone and youre responsible for the consequences of your own investments.

With that said, here are the worlds highest yielding government bonds as of September 2018.

Argentinas peso appears to once again be headed for financial ruin

Also Check: 8774182573

What Are Treasury Bonds

Treasury bonds are government debt securities that are issued by the U.S. Federal government and sold by the U.S. Treasury Department. T-bonds pay a fixed rate of interest to investors every six months until their maturity date, which is in 20-30 years.

However, the interest rate earned from newly-issued Treasuries tends to fluctuate with market interest rates and the overall economic conditions of the country. During times of recession or negative economic growth, the Federal Reserve typically cuts interest rates to stimulate loan growth and spending. As a result, newly-issued bonds would pay a lower rate of return in a low-rate environment. Conversely, when the economy is performing well, interest rates tend to rise as demand for credit products grows, leading to newly-issued Treasuries being auctioned at a higher rate.

What Is Interest Rate For Government Bonds

When a government of India issues the bonds it will generally make regular interest payments during the life of the Gov Bond and repay the initial investment, or principal amount, when the bonds expire on their maturity date.Generally, short-term bonds are known as Treasury Bills in India with a maturity of less than one year.T-bills are available with different maturity periods ranging from 91 days to 365 days.On the other side, bonds with a maturity of more than a year, ranging from 5 to 40 years are long-term securities knows as Government Bonds .Both the central and state governments can issue government bonds. Though, the bonds issued by state governments are also known as State Development Loans .In this article, we will discuss in detail about the Interest Rate for Government Bonds India in 2021.

Also Check: State Of Nevada Unclassified Jobs

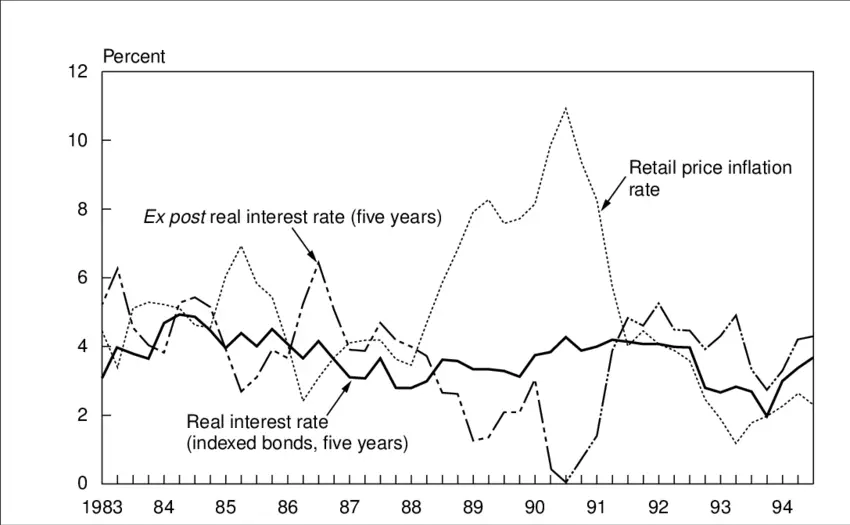

Inflation Expectations Determine The Investor’s Yield Requirements

Inflation is a bond’s worst enemy. Inflation erodes the purchasing power of a bond’s future cash flows. Typically, bonds are fixed-rate investments. If inflation is increasing , the return on a bond is reduced in real terms, meaning adjusted for inflation. For example, if a bond pays a 4% yield and inflation is 3%, the bond’s real rate of return is 1%.

In other words, the higher the current rate of inflation and the higher the future rates of inflation, the higher the yields will rise across the yield curve, as investors will demand a higher yield to compensate for inflation risk.

Note that Treasury inflation-protected securities can be an effective way to offset inflation risk while providing a real rate of return guaranteed by the U.S. government. As a result, TIPS can be used to help battle inflation within an investment portfolio.

What Are I Bonds

I bonds are savings bonds issued by the federal government. They are designed to protect the value of your money from inflation. The I stands for inflation. The interest rate on I bonds is directly correlated with inflation. If inflation is high, the interest rate is high. If inflation is low, the rate is low. Inflation is quite high right now. It hit 6.22% in October which is well above the 1% or 2% inflation that weve been used to.

The Treasury created 30 year I Bonds in 1998 so that investors had a tool they could use to hedge against inflation. They are backed by the federal government, so unless the government shuts down and defaults on its debt , the interest rate on I bonds is almost guaranteed. In essence, think of I savings bonds as like a high-yield CD.

Don’t Miss: Cio Sp3 Fbo

How To Buy Government Bonds

You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:

The government auctions the bonds where financial institutions largely participate. Auctions are also open to the general public. The financial institutionsFinancial InstitutionsFinancial institutions refer to those organizations which provide business services and products related to financial or monetary transactions to their clients. Some of these are banks, NBFCs, investment companies, brokerage firms, insurance companies and trust corporations. read more then sell these bonds to banks, pension funds, and individuals. Individuals can acquire bonds from the financial institutions with the help of brokers.

Investors can also buy them directly from the government. For example, using the TreasuryDirect account, individuals, trusts, corporations, estates, etc., can directly purchase Treasury securities from the US government. It is an account where one can purchase and hold the security. The picture above describes how an individual can acquire these bonds in the US.

Government bonds are valuable for the government, investors, and economy in the following ways.

For investors

For the Government:

For the Economy:

Daily Treasury Par Yield Curve Rates

This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative quotations obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. For information on how the Treasurys yield curve is derived, visit our Treasury Yield Curve Methodology page.

Recommended Reading: Government Jobs Vegas

Mutual Funds For All Your Goals

-

Instant investment

| 2021 |

- Floating Rate Bonds

As the name suggests, FRBs are subject to periodic changes in rate of returns. The change in rates is undertaken at intervals which are declared beforehand during the issuance of such bonds. For instance, an FRB could have a pre-announced interval of 6 months which means interest rates on it would be re-set every six months throughout the tenure.

There is another variant to FRBs, wherein the rate of interest rate is bifurcated into two components: a base rate and a fixed spread. This spread is decided through auction and remains constant throughout the maturity tenure.

- Sovereign Gold Bonds

The Central Government issues sovereign Gold Bonds, wherein entities can invest in gold for an extended period through such bonds, without the burden of investing in physical gold. The interest earned on such bonds is exempted from tax.

Prices of such bonds are linked with golds prices. The nominal value of SGBs is reached by calculating the simple average of closing prices of 99.99% purity gold, three days preceding such bonds issuance. SGBs are also denominated in terms of one gram of gold.

Investors seeking liquidity from such bonds shall need to wait for the first five years to redeem it. However, redemption shall only take effect on the date of subsequent interest disbursal.

- Inflation-Indexed Bonds

- 7.75% GOI Savings Bond

- Bonds with Call or Put Option

- Put option only

- Both

- Zero-Coupon Bonds

How Can You Buy I Bonds

There are two ways to buy I Bonds.1) You can purchase I Bonds electronically via TreasuryDirect.gov.2) You can also purchase up to $5,000 of paper I Bonds from your tax return.

You cannot resell them and you must cash them out directly with the US government. Electronic I Bonds can be redeemed directly on the Treasury Direct website and the paper I Bonds can be cashed in at a local bank.

To purchase electronic I bonds from the Treasury Direct website, follow the instructions below.

Step 1: Choose the type of account you are opening. You will choose the first option for individual/personal. You will also use this option if you are purchasing for a business or a trust.

Step 2: Provide personal information. This includes information such as your SSN, email address, bank account, and routing number. Since the application is linked to a bank account, make sure that you choose one that you are going to use forever. Changing a bank account once you have established an account on Treasury Direct can be a complicated process.

Step 3: Choose your password, personalized image, security questions etc. After you have completed this step, you will receive your account number by email. Make sure you save your account number because this is what you will use to log in to your account.

Read Also: Federal Grants For Dental Implants

Risk Of Selling Before Maturity

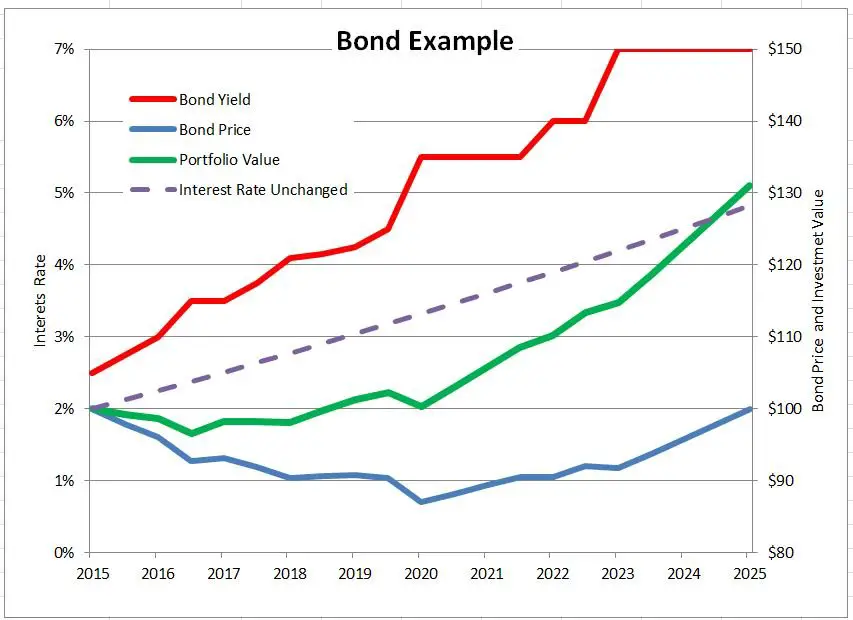

If you buy a bond and hold it to maturity, you’ll get back the face value. But if you sell a bond before maturity, you’ll get market value. This can be more or less than the face value.

The market value of a bond depends on supply and demand. Market interest rates have the biggest impact on the price of bonds. The credit risk of the issuer and how long the bond is issued for can also have a big impact on the price of a bond.

The price of fixed rate bonds and indexed bonds moves in the opposite direction to market interest rates:

- If market interest rates rise, the price of these bonds falls.

- If market interest rates fall, the price of these bonds rises.

The price of floating rate bonds doesn’t move very much when interest rates change because their coupon payment rate adjusts.

Some bonds can be hard to sell. If you’re planning to sell before maturity, look for bonds with high liquidity, for example, AGBs.

The Fed Stays On The Sidelines

An additional factor that may contribute to what remains a modestly favorable environment for bonds is that the Fed is holding fast to its stance of maintaining a 0 percent target rate for the Fed Funds rate it manages through next year. This is the benchmark overnight lending rate banks charge each other. While that policy guidance remains in tact, some members of the Federal Open Market Committee anticipate that the Fed may begin raising short-term rates by the latter part of 2022.

An important consideration for the Fed is the fact that more than eight million Americans remained unemployed as of the end of August, a significant concern for the long-term health of the economy. Higher unemployment could allow the Fed to justify sticking to its current interest rate plan.

Freedman also notes that the European Central Bank seems committed to maintaining its own interventionist stance, designed to maintain liquidity in the fixed income markets. Theres no sign that central banks are flinching from their current stance, notes Freedman. In short, there is little likelihood that Fed policies will have an appreciable impact on domestic bond markets.

Also Check: City Of Las Vegas Job Openings