Protect Your Personal Information

Take the following precautionary measures to avoid becoming a victim of ID theft:

- Don’t give out your personal information online, by phone or by mail unless you’re the one who initiated the contact or transaction and you’re confident that the company or individual is trustworthy and will keep your personal information secure.

- For a complete list of the type of information ID thieves seek out, visit the Identity Theft and Identity Fraud web page.

How Will I Know If My Identity Was Stolen

Here are ways you can tell that someone is using your information:

- You see withdrawals from your bank account that you cannot explain.

- You find credit card charges that you didnt make.

- The Internal Revenue Service says someone used your Social Security number to get a tax refund or a job.

- You do not get your bills or other mail.

- You get bills for utilities or medical services you did not use.

- Debt collectors call you about debts that are not yours.

- You find strange accounts or charges on your credit report.

Social Security Combats Fraud

Social Security has zero tolerance for fraud. We aggressively investigate and prosecute those who commit fraud against our programs. Social Security is diligently working at national, regional, and local levels to combat the fraud that undermines our mission to serve the American public. OIG conducts investigations of allegations of SSA fraud. They refer cases to U.S. attorneys within the Department of Justice, among other state and local prosecuting authorities, for prosecution as a Federal Crime.

Read our Legal Enforcement and Financial Penalties publication to learn more about our efforts. Visit our OIGs Investigations page to view a list of recent fraud investigations.

Don’t Miss: Agencies That Hire For Government Jobs

What Do I Do When Someone Steals My Identity

It is very important to act fast.

First, call the companies where you know fraud happened.

- Explain that someone stole your identity.

- Ask them to close or freeze your accounts.

- Then change your password or personal identification number .

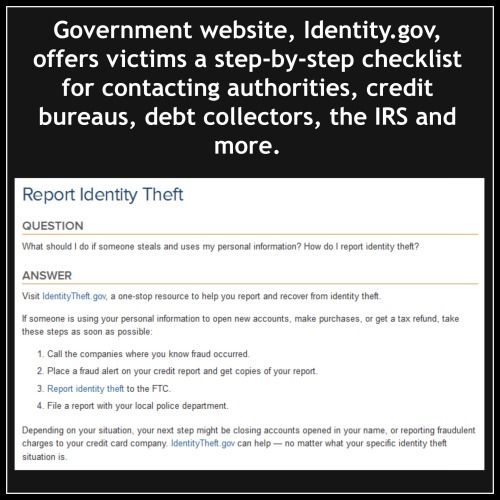

Then visit IdentityTheft.gov or call 1-877-438-4338.

- Report the crime and get a recovery plan thats just for you.

- You can create an account. The account helps you with the recovery steps and tracks your progress.

How To Place A Fraud Alert And Get Your Credit Report Fraud Alert

To place a fraud alert on your credit file, you simply need to request it from any one of the three nationwide credit reporting agencies. They are free, and once you place a fraud alert with one nationwide credit-reporting agency, federal law requires that it be forwarded to the other nationwide credit-reporting agencies. Automatic reporting is helpful to you, because you dont know which credit-reporting agency a creditor is using.

Its the same with fraud: you never know where the perpetrator is applying for credit and which credit reporting agency is being used.

There are three types of fraud alerts:

1. Initial fraud alerts:

If you are concerned about or you suspect identity theft, an initial fraud alert can make it harder for an identity thief to open accounts in your name. These alerts last for one year and may be renewed. Anyone requesting your credit file during this year-long window is alerted that you suspect you are a victim of fraud. When you or someone else attempts to open a credit account in your name, increase the credit limit on an existing account, or get a new card on an existing account, the creditor is required to take additional steps to verify that you have authorized the request. If the creditor cannot verify your authorization, then the request is supposed to be denied.

2. Extended fraud alerts:

3. Active duty military alerts:

Also Check: How To Become A Government Spy

Consider A Credit Freeze

The strongest protection against new accounts being opened in your name is a credit freeze, also called a security freeze. A freeze means that your file cannot be shared with potential creditors, insurers, employers, or residential landlords without your permission. For more information, see our CIS 10: How to Freeze Your Credit Files.

Place A Fraud Alert With Credit Bureaus

If you suspect your personal information has been exposed, place an initial fraud alert on your credit files so that applications in your name get extra scrutiny.

This alert is available to anyone who suspects identity theft. Contact any bureau, and it will take care of notifying the others:

-

TransUnion: 800-680-7289

The alert entitles you to another round of free credit reports, beyond the ones you get every 12 months by using AnnualCreditReport.com. These can help you discover fraudulent credit accounts.

Also Check: Why Data Governance Is Needed

Reporting To Government Agencies

If your identity is stolen, you may need to request new or updated documentation with different government agencies.

-

If you believe someone has applied for unemployment benefits using your personal information, use our secure fraud reporting form to alert us or call the DUA customer service department at .

- Registry of Motor Vehicles Request a new license if yours was lost or stolen

- Social Security Administration: Request a replacement card if your Social Security card was lost or stolen. Under certain circumstances you might need to request a new Social Security number.

- United States Postal Inspection Service: Notify the U.S. Postal Inspection Service if you think an identity thief has filed a change of address with the post office. Contact your local postmaster to make sure that all mail in your name comes to your address.

- The State Departments Bureau of Consular Affairs: If your passport was stolen, complete this online form to report the loss or theft and replace your passport.

Report The Crime To The Police

Under California law, you can report identity theft to your local police department.1 Ask the police to issue a police report of identity theft. Give the police as much information on the theft as possible. One way to do this is to provide copies of your credit reports showing the items related to identity theft. Black out other items not related to identity theft. Give the police any new evidence you collect to add to your report. Be sure to get a copy of your police report. You will need to give copies to creditors and the credit bureaus. For more information, see Organizing Your Identity Theft Case” by the Identity Theft Resource Center, available at

Read Also: Government Accounting Problems And Solutions

Report Identity Theft To Other Organizations

You can also report the theft to other organizations, such as:

-

Credit Reporting Agencies – Contact one of the three major credit reporting agencies to place fraud alerts or freezes on your accounts. Also get copies of your credit reports, to be sure that no one has already tried to get unauthorized credit accounts with your personal information. Confirm that the credit reporting agency will alert the other two credit reporting agencies.

-

National Long-Term Care Ombudsman Resource Center – Report cases of identity theft due to a stay in a nursing home or long-term care facility.

-

Financial Institutions – Contact the fraud department at your bank, credit card issuers and any other places where you have accounts.

-

Retailers and Other Companies – Report the crime to companies where the identity thief opened credit accounts or even applied for jobs.

-

State Attorney General Offices – Your state’s attorney general might offer tips, checklists, or an advocate to help you recover from identity theft. These resources don’t replace filing an ID theft report with the FTC.

You may need to get new personal records or identification cards if you’re the victim of ID theft. Learn how to replace your vital identification documents after identity theft.

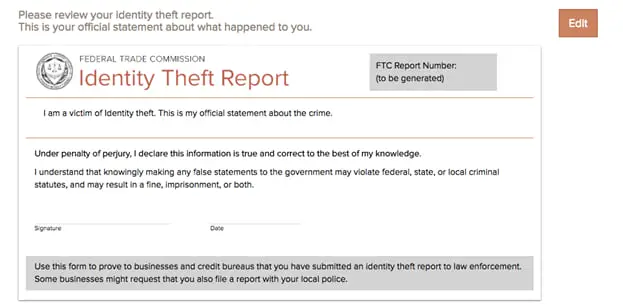

Uses For An Ftc Identity Theft Report

For victims of identity theft, getting an Identity Theft Report makes it easier to fix problems that an identity thief has caused. In many cases, you’ll be able to use an Identity Theft Report instead of a police report to clear up credit issues related to identity theft.

You can use the report to:

- permanently block fraudulent information that results from identity theft, including accounts or addresses, from appearing on your

- ensure that these debts do not reappear on your credit reports

- prevent a company from continuing to collect debts that result from identity theft , and

- place an extended fraud alert on your credit report.

Also Check: Colt 45 Automatic Government Model

Your Social Insurance Number Is Confidential

If your SIN falls into the wrong hands, it could be used to obtain personal information and invade your privacy. When the SIN is not linked to you as its rightful owner, another person could receive your government benefits, tax refunds or bank credits. Your personal information could also be revealed to unauthorized people, which could lead to identity theft and other types of fraud.

If someone uses your SIN to work illegally or to obtain credit, you may suffer hardship. You could be requested to pay additional taxes for income you did not receive or you could have difficulty obtaining credit because someone may have ruined your credit rating.

There are a number of things you can do to protect your SIN:

- provide your SIN only when you know that it is legally required

- store any document containing your SIN and personal information in a safe placedo not keep it with you

- contact Service Canada if you change your name, if your temporary citizenship status changes to a permanent resident status or if information on your SIN record is incorrect or incomplete

- take immediate measures to protect your SIN when you suspect someone else is using your SIN fraudulently

What Can You Do To Protect Yourself From Identity Theft

- Be extremely careful when you provide personal information such as your SIN, or date of birth over the phone.

- Never provide personal information by Internet or email. The CRA does not ask you to provide personal information by email.

- Be suspicious if you are ever asked to pay taxes or fees to the CRA on lottery or sweepstakes winnings. You do not have to pay taxes or fees on these types of winnings. These requests are scams.

- Keep your access codes, user ID, passwords, and PINs secret.

- Keep your address current with all government departments and agencies.

- Register for My Account on the CRA Web site at canada.ca/my-cra-account and check your personal information regularly to ensure it is current and valid.

- Choose your tax preparer carefully! Make sure you choose someone you trust and check their references. You may also consider authorizing your representative to use the CRAs secure Represent a client online service. Always review your return, agree with the content before filing, and follow up to ensure you receive your notice of assessment as it contains important financial and personal information that belongs to you.

- Before supporting any charity, use the CRA Web site at canada.ca/charities-giving to find out if the charity is registered and get more information on the way it does business.

- Be careful before you click on links in any email you receive. Some criminals may be using a technique known as phishing to steal personal information.

You May Like: How Much Does The Federal Government Spend

Pandemic Has Increased Risk To Canadians Of Identity Theft And Financial Fraud

Since March, when Canada closed its borders and much of the country went into lockdown because of COVID-19, more Canadians are using the internet to bank, shop, socialize, and work remotely. In the process, more of their personal data is ending up online for bad actors to prey on.

They threaten the privacy of Canadians through the theft of personal information, which facilitates additional criminal behaviour, including identity theft and financial fraud, according to a report released Wednesday by the Communications Security Establishment and its Canadian Centre for Cyber Security .

The report titled National Cyber Threat Assessment 2020 states that cybercriminals who are motivated by financial gain almost certainly represent the most pervasive cyber threat to Canadians.

Using statistics from the Canadian Anti-Fraud Centre, the report goes on to say that Canadians lost over $43 million to cybercrime fraud in 2019, and it is almost certain that actual amounts are higher.

China, Russia, Iran and North Korea, meanwhile, pose the greatest state-sponsored cyber threat to Canadian individuals and organizations, according to the report.

As more Canadians work from home using multiple devices connected to the internet, they make themselves vulnerable to cybercrime, especially if their internet connections arent secure.

Use The Id Theft Affidavit

Creditors may ask you to fill out fraud affidavits. The Federal Trade Commissions ID Theft Affidavit is accepted by the credit bureaus and by most major creditors. Send copies of the completed form to creditors where the thief opened accounts in your name. Also send copies to creditors where the thief made charges on your account, to the credit bureaus, and to the police. The form is available on the FTC Web site at ww.ftc.gov/bcp/edu/resources/forms/affidavit.pdf. File a complaint of identity theft with the FTC. See their Web site at www.consumer.gov/idtheft The FTC keeps a database of identity theft cases that is used by many law enforcement agencies.

You May Like: Government Programs For Mental Illness

If Your Mail Was Stolen Or Your Address Changed By An Identity Thief

Notify the Postal Inspector if you think an identity thief has stolen your mail or filed a change of address request in your name. To find the nearest Postal Inspector, look in the white pages of the telephone book for the Post Office listing under United States Government. Or go to the Postal Inspection Services Web site at www.usps.gov/websites/depart/inspect.

Consider A Credit Freeze Or Extended Fraud Alert

Watch for and dispute errors on your credit reports to make sure everything was taken care of. You can access free credit report information from TransUnion via NerdWallet.

Then, think about protecting yourself in the future. A is considered the surest way to ensure your credit isnt used without your consent. Credit freezes with the major credit bureaus are free.

If you dont want to place freezes, you can get an extended fraud alert that lasts for seven years. Like the initial one, you need contact only one of the bureaus. But this time youll need to provide documentation, including an identity theft report:

-

Equifax: Mail this form to Equifax Information Services LLC, P.O. Box 105069, Atlanta, GA 30348-5069, or fax to 888-826-0597.

Don’t Miss: Data Strategy Vs Data Governance

What To Do Right Away

If someone steals and uses your personal information, take these three steps as soon as possible:

For a list of additional steps you can take, including placing a freeze on your credit file and signing up for credit monitoring, review the Consumer Alerts listed at the end of this Alert.

If You Become A Victim

- Report the incident to local police if the matter involved a theft/crime

- Report the incident to the Canadian Anti-Fraud Centre if the matter involved a scam or fraud

- Advise your bank and credit card companies. Request new bank or credit cards with new numerical identifiers on them

- Report any missing identity documents or cards, such as a drivers licence, a health card or immigration documents to the appropriate organization

Recommended Reading: Is There Government Funding For Solar Panels

If You Suspect Someone Is Using Your Sin

If you suspect that someone is using your SIN fraudulently, act quickly to prevent personal loss and minimize the negative impact.