Solar Itc Avail It While You Still Can

Solar prices keep dropping. It has plunged by an eye-popping 70% since 2010, and experts foresee further reductions in costs. So why not hold off a few months, even a couple of years more, before installing solar panels? Who knows, the price might dip some more, right?

Wait no longer would be the wiser choice. The best time to go solar is now while the solar ITC is around to give you a hand with the cost of installing a PV system. Sure, the price of solar panels and other equipment might go down further, but will it be enough to offset the tax credits you will otherwise get if you move forward now? Add to that the amount you will save on your electricity bills if you go solar sooner than later.

The window of opportunity is closing fast. If you want to benefit from the ITC, the time to act is now.

What Is The Solar Investment Tax Credit

- The federal solar investment tax credit is a tax credit that can be claimed on federal income taxes for 26% of the cost of a solar photovoltaic system.

- The system must be placed in service during the tax year and generate electricity for a home located in the U.S.

- A solar energy PV system must be placed into service before December 31, 2021, to claim the credit in 2022 or December 31, 2022 to be claimed in 2023.

- There is no maximum amount that can be claimed.

Solar Tax Credit Requirements

The solar tax credit is a federal program, so you need to meet certain requirements to qualify:

- The property must be used as your main residence or business location

- You must own the solar energy system outright or have a solar lease or power purchase agreement in place

- The solar energy system must have been installed by December 2022

Do you need help understanding taxes? If youre curious about rebates and income tax, we also wrote a guide to income tax calculators.

Recommended Reading: Federal Grants For Dentures

What Is The Difference Between A Tax Credit And A Tax Rebate

Its important to understand that this is a tax credit and not a rebate.

A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000. Tax credits offset the balance of tax due to the government .

Tax rebates are payable to the taxpayer even if they owe no tax. While most people qualify for the solar panel tax credit, there are some who do not. Anyone who does not owe federal income taxes will not be able to benefit from the solar tax credit. And, if youre on a fixed income, retired, or only worked part of the year, you may not owe enough energy taxes to take full advantage of this solar tax credit.

Note: If you do owe sufficient federal taxes the year that you finance or purchase your system, then the credit can be applied to pay off the taxes owed. If you already paid that taxes by withholding it from your paycheck, the federal government will apply the tax credit to a tax refund. This refund can be used to pay down the balance on a loan. Its important to note that the tax credit be carried forward one year, which means that you can use any remainder from this year as a credit towards next years taxes.

Solar Sales Tax Exemption

Many states apply a tax for consumer purchases ranging from 2.9% to 9.5%. However, there are currently 25 states that offer a solar energy sales tax exemption for going solar, including Arizona, Florida, Iowa, Maryland, Massachusetts, New Mexico, and New York. This sales tax exemption applies to the cost of the solar panels, inverter, battery bank, and installation.

Before installing solar panels, its helpful to understand all the solar incentives available, so you can take advantage of them. There may be local solar policies that can reduce the upfront cost of installing a solar system or create greater utility bill savings.

You May Like: Grants To Start A Trucking Company

Solar Tax Credit Calculator:

It is easy to give you the rate of the solar tax credit. But it is much harder to give you the dollar value for your specific home. Luckily SolarReviews.com has developed one of the most accurate solar calculators. Using data from local solar installs in your area we can give you a very accurate cost guide for your specific home.

It will show you the dollar value of the federal solar tax credit and include any state tax credits if eligible. This gives homeowners who use our calculator the opportunity to figure out if solar is worth it for their home, before talking to solar companies.

Calculate the dollar value of the tax credit

How Do I Apply For The Federal Solar Tax Credit

Homeowners should complete IRS Form 5695 when they file their federal tax returns. First, you complete Part 1 of the form to determine your renewable energy tax credit. Make sure to keep all of your receipts for your solar system project and enter the information accurately. Next, you enter the amount of your tax deduction on your 1040 form. The Internal Revenue Service provides detailed instructions on completing the tax form.

Remember that the ITC is a tax credit, not a tax refund. The difference is that a tax refund is paid out to the taxpayer, but a tax credit reduces the amount of taxes owed. So, if your tax liability for the year is less than the ITC, the Internal Revenue Service will not refund you for the tax deduction. Instead, the deduction would roll over to the next tax year to be applied to your next years tax liability .

We are not a professional tax service provider or preparer. All information provided is for educational purposes only. Please consult a tax professional for tax advice about your federal income tax preparation. You can also contact the Internal Revenue Service directly for any additional information.

Don’t Miss: Congress Mortgage Stimulus Middle Class

New York Solar Incentives

Residents of New York have a number of ways to offset their solar panel installation costs, above and beyond whats offered by the federal tax incentive:

- NY-Sun Megawatt Block incentive: Under this program, solar consumers can claim a dollars-per-watt cash rebate for their systems. Both residential and commercial systems can qualify for this program.

- Solar Energy System Equipment Credit: This solar incentive allows residents to deduct up to $5,000 or 25% of total solar energy expenses from their taxes . The credit is available to homeowners who purchase a new system or who choose to lease a system.

- Sales tax exemption: Buyers do not pay the states 4% sales tax on solar equipment.

- Net metering: New York residents may also take advantage of the current statewide net metering program, which allows any excess solar power generated by a system to be fed back into the solar grid in exchange for credits on utility bills.

Does The Residential Solar Tax Credit Apply To New Home Purchases

If you buy a new home that already has solar installed, you can still claim the Solar Investment Tax Credit in the year that you move in, regardless of when the house was originally built or sold. For example, if your home was built in 2019, and then you bought it in 2020, but didnt move in until 2021, then you would claim the ITC on your 2021 taxes.

Keep in mind, the ITC can only be claimed once, so youll want to check and make sure that your builder hasnt already claimed the credit. If your builder has claimed it, then you may be able to ask for a reasonable allocation for those costs, and factor that into the final purchase price.

Also Check: Rtc Las Vegas Jobs

Residential And Commercial Itc Factsheets

The 26% federal investment tax credit is among the most important incentives currently available for solar PV. These two guidesone for homeowners and one on the commercial ITCprovide a concise, yet thorough, overview of the ITC, demystifying the tax code with intuitive explanations and examples, answering frequently asked questions, and explaining the process of claiming the ITC. Designed for readers unacquainted with the ITC, these guides clearly outline the most important aspects of the ITC, while still providing the specificity and comprehensiveness to be a useful reference for more seasoned professionals in the solar industry.

Federal Incentives And Programs

-

Capital Cost Allowance Renewable Energy

The CCA provides business tax incentive to those in industry who are utilizing systems that produce energy by using renewable sources or fuels from waste, or conserve energy by using fuel more efficiently. Such equipment is eligible for accelerated capital cost allowance according to the Schedule II of the Income Tax Regulations under classes 43.1 and 43.2. This means that eligible equipment under class 43.1 may be written-off at 30 percent per year on a declining balance basis. Equipment that is eligible under class 43.1 that was acquired after February 22, 2005 and before year 2020 may be written-off at 50 percent per year on a declining balance basis under Class 43.2.

Natural Resources Canada provides a technical guide to Classes 43.1 and 43.2:

-

Canadian Renewable and Conservation Expenses

The CRCE provides income tax incentives for certain start-up expenses associated with clean energy generation and energy conservation projects. Income Tax Regulations allows such expenses to be fully deducted in the year they are incurred, carried forward indefinitely and deducted in future years, or transferred to investors through a flow-through share agreement.

-

Natural Resources Canada provides a technical guide to CRCE:

Don’t Miss: Federal Government Jobs Las Vegas

How Much Can You Save With Solar Incentives

In this article, well discuss the solar incentives and rebates available to homeowners in many areas of the U.S. When youre ready to speak with a qualified professional, follow the links below. Each of these companies can help you identify and apply for incentives available in your area.

- Most efficient panels on the market

- National coverage

- Cradle to Cradle sustainability certification

- Great warranty coverage

- Customer service varies by local dealer

Services Offered

- Doesn’t offer solar batteries

Services Offered

Contact The Kc Green Energy Team About Installing Or Updating Your Solar Panels

The KC Green Energy team specializes in the design and installation of solar electric energy systems. We custom-design each system to suit your needs and maximize your ROI. As a family-owned operation, who also specializes in roofs, you can trust us to focus on quality craftsmanship. Contact us for a free site analysis or to learn more about our services today!

Don’t Miss: Free Grants For Dental Implants

Do I Qualify For The Federal Solar Tax Credit

The Office of Energy Efficiency & Renewable Energy states the following criteria determines whether you can qualify to claim the federal solar tax credit:

- Date of installation: You installed your solar system between Jan. 1, 2006, and Dec. 31, 2023.

- Original installation: The solar PV system is new. The credit can be claimed only on the original installation of solar equipment and not the repurposing or reuse of an existing system.

- Location: The solar system is located at your primary residence or secondary home in the United States. It may also be used for an off-site community project if the electricity generated is credited against your homes electricity consumption and does not exceed it.

- Ownership: You own the solar PV system. You cannot claim the credit if you are leasing or in an agreement to purchase electricity generated by the system, including a solar power purchase agreement .

Is The Last Year To Claim 30%

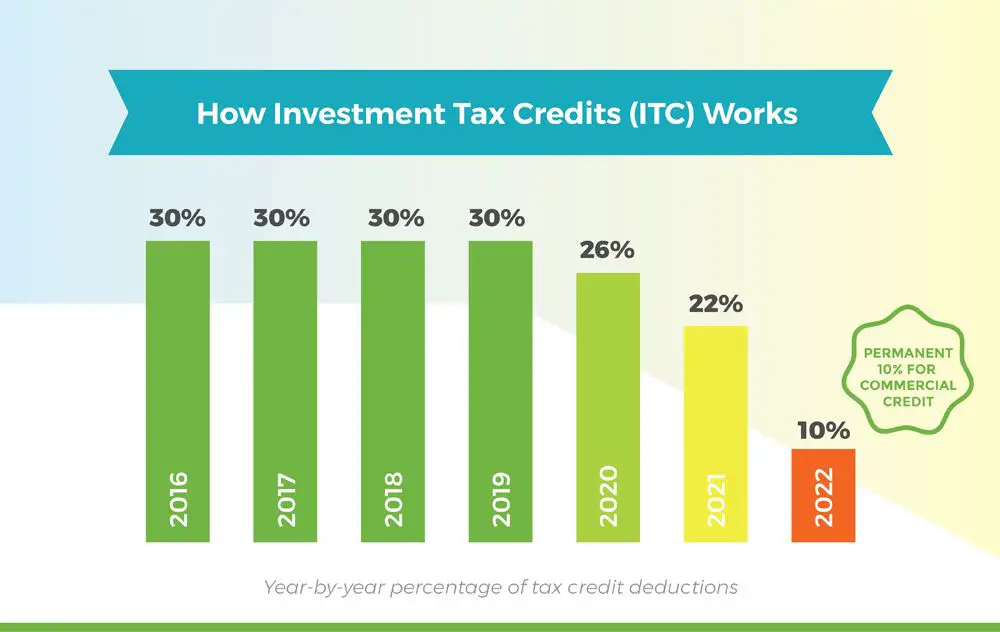

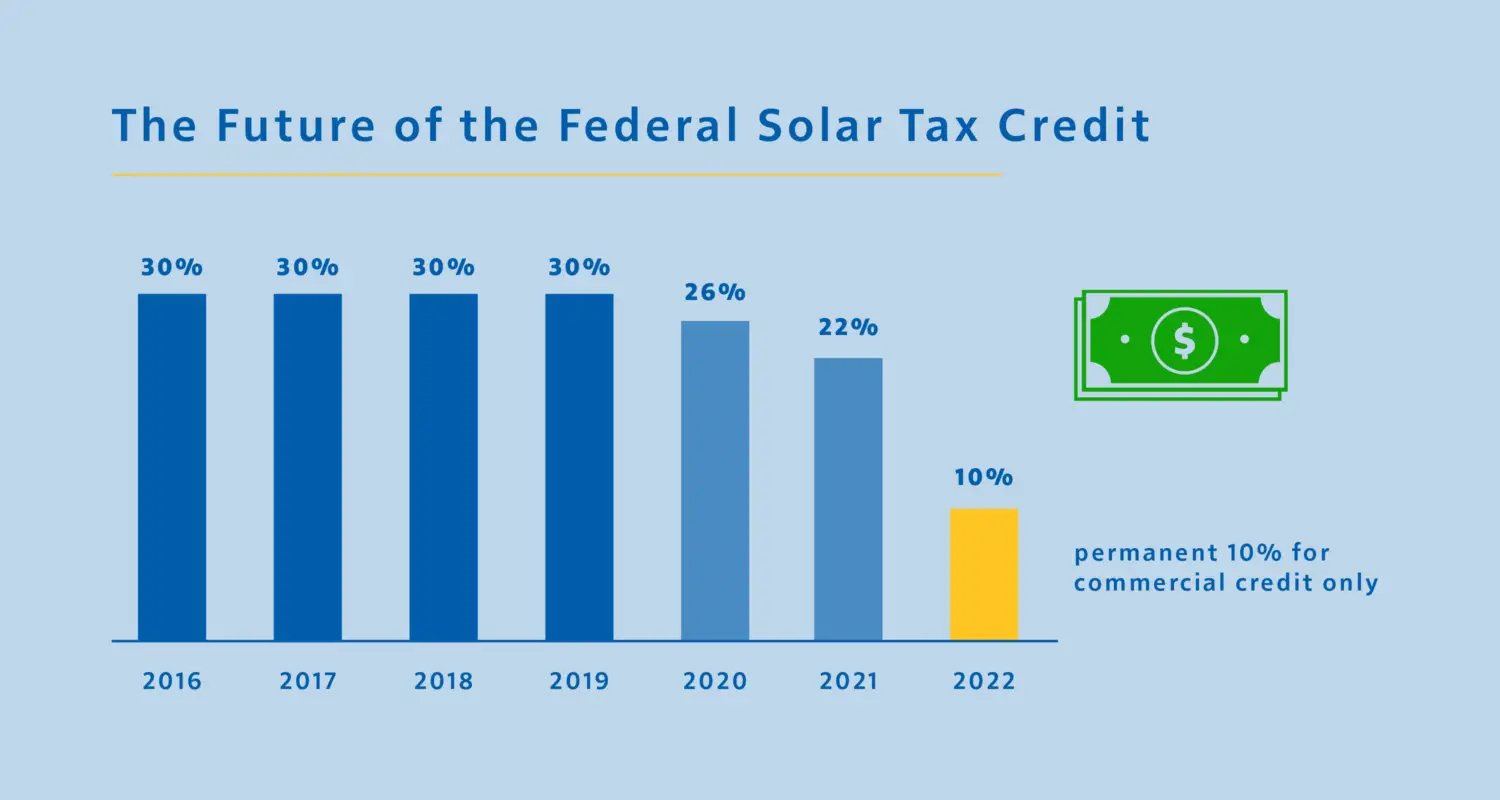

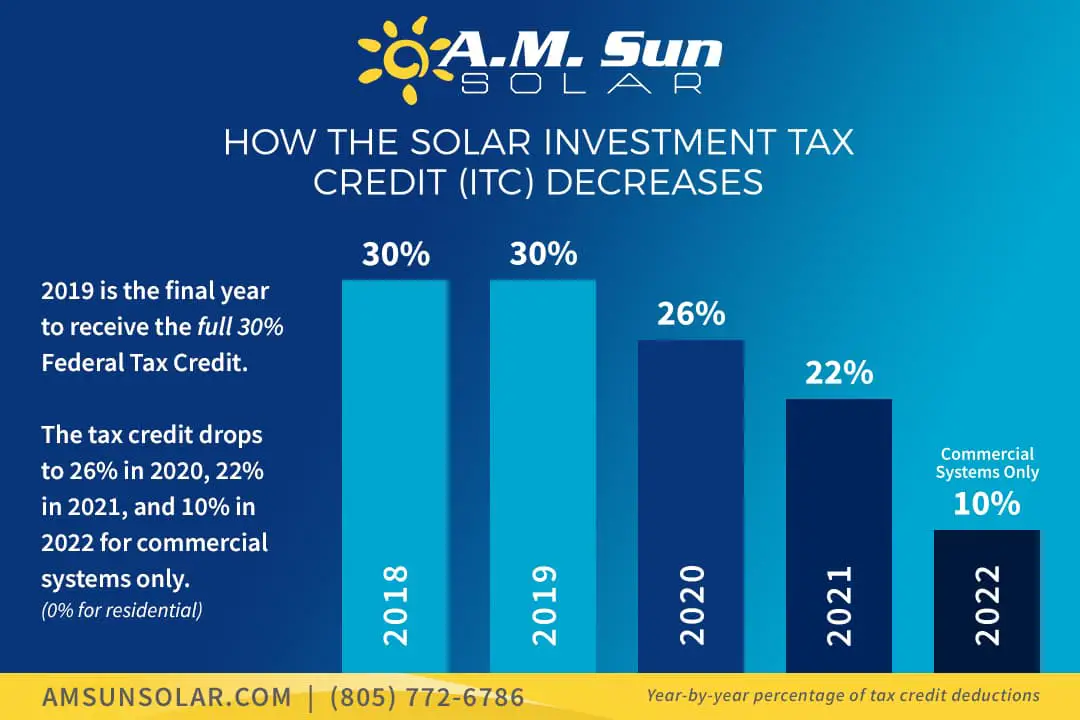

Unfortunately, 2019 is the last year the ITC allows for a 30% tax credit the deduction drops to 26% for projects that begin construction in 2020 and 22% for projects that begin in 2021. After that, the residential credit will drop to 0, and the commercial and utility credit will drop to a permanent 10%8. This means that now is the time to get the most benefit from this attractive federal incentive to install solar.

Also Check: Best Entry Level Government Jobs

Are There Any Government Grants For Solar Panels

The solar investment tax credit, or federal ITC, is a tax credit worth 26% of installed solar electric costs. A number of states will offer their own incentives for solar panels as well, coming in the forms of additional tax credits, rebates, grants or low-interest loans. Local utilities may also offer their own special incentives for solar depending on your area.

The Best State Tax Credits For Solar

When it comes to solar tax credits, some states are better than others.

The best state tax credits for solar can be found in California, Colorado, Connecticut, Delaware, Maryland, Massachusetts, Minnesota, New Jersey, and Pennsylvania.

If youre looking to go solar and want the biggest bang for your buck in terms of solar tax credits and solar incentives, these are the states you should consider moving to.

Read Also: Dump Truck Bidding Contracts

Tax Credits And Deductions

Tax credits are under-appreciated because they are misunderstood. A tax credit is a dollar-for-dollar reduction in your business tax bill because the credit is applied against your gross income. So if you spend $100 on an energy-efficiency project, your business tax is reduced by $100.

Tax deductions are almost as good, but they come into play after your gross income is determined. In either case, making the most of all the tax deductions and tax credits you are eligible for is a great way to reduce your business taxes.

You can only get a tax credit for property or equipment that you buy and put into service for a specific year. In other words, you cant just buy something and let it sit and hope to claim the tax credit.

How Many Years Can I Claim The Solar Tax Credit

The federal tax credit is worth 26% of the total cost of your installation and can be applied to your federal income tax liability. If you plan to claim the ITC but you dont owe any taxes during the calendar year, the tax credit does roll over, but only for up to five years.

So, if you dont anticipate paying a few thousand dollars in income tax over the next five years, you wont be able to take full advantage of the ITC.

Read Also: Free Government Flip Phones

Srecs: Solar Renewable Energy Certificates

As of 2020, 38 states and the District of Columbia have a renewable portfolio standard requiring that a specified percentage of the electricity utilities sell comes from renewable resources. This incentivizes governments to reward residents who help the state reach its goal.

If you live in one of these 38 states, your solar panels may earn solar renewable energy certificates for each megawatt-hour of clean energy generated. To meet the requirements of a states RPS, public utilities will purchase these certificates from you in cash. The certificates then allow public utilities to count the clean energy you generate toward their own goals.

Though complex to understand, SRECs offer tremendous upside in the form of additional income to both residential and community solar customers. Eligibility will vary depending on your location, but any reputable solar company will be able to walk you through the process of earning and selling your renewable energy certificates.

We Hope You Enjoyed Our Solar Tax Credit 2022 Guide

Solar tax credits are still available to taxpayers in 2022. However, they will reduce from 26% of the total cost of installing solar panels to 22% by 2023. Then, in 2024 they will no longer be available to residential taxpayers.

Are you considering going solar-powered this year? If so, you must do so before the end of December 2022. This will ensure that you receive solar tax credit 2022 for the full 26%.

Dig a little deeper into your state solar tax credit offerings. You may find that solar rebates or other solar incentives are available to you, which will further reduce the cost of your solar energy system!

We hope you enjoyed reading this solar tax credit 2022 guide. Read more helpful guides from Tax Savers Online!

Read Also: Data Governance Implementation Plan

Availability Of Solar Rebates

Solar rebates are available in most US states. However, they are not available in every state. You can check with your local solar company to see if solar rebates are available in your area.

If solar rebates are not currently offered in your state, dont worry! There are other solar incentives that may be available.

Additionally, solar rebates are changing rapidly. You can check with your solar company for the most up-to-date information about solar rebate programs in your area or visit EnergySages Rebate Database to see what solar rebate opportunities exist near you!

Improve A Qualified Home

If youre looking at the benefits of the ITC for your own property, Section 25D of the Internal Revenue Code defines eligibility regarding the solar tax credit.

The property you improve needs to be one you own, not one you rent. It must be a property that you live in for at least part of the year, so vacation homes are eligiblebut a commercial property is not pertinent here, as it is covered by Section 48. In any case, this residence can include a house, houseboat, condominium, cooperative, mobile home, and prefabricated home. Keep in mind that if you are attaching solar panels to a condominium, you will likely need to consult on this move with the association and obtain their approval. A similar concern might apply to a residential property set in a suburb managed by an HOA.

Don’t Miss: Can I Get A Replacement Safelink Phone