What Is An Adequate Accounting System 10 Questions To Determine If Your Accounting System Is Adequate For Government Contracts

In many cases, having an adequate accounting system is an integral part of successfully winning and performing on Federal contracts. Many companies find it challenging to determine when accounting system requirements are triggered and how to navigate obtaining a determination of adequacy.

Our clients and prospects unanimously have the same questions. Since these questions are so prevalent, we thought wed answer them here for you.

If you have additional questions about adequate accounting systems or need to know if your system is approved, contact us asap and well be happy to help.

What Are The 12 Key Elements Of A Dcaa Audit

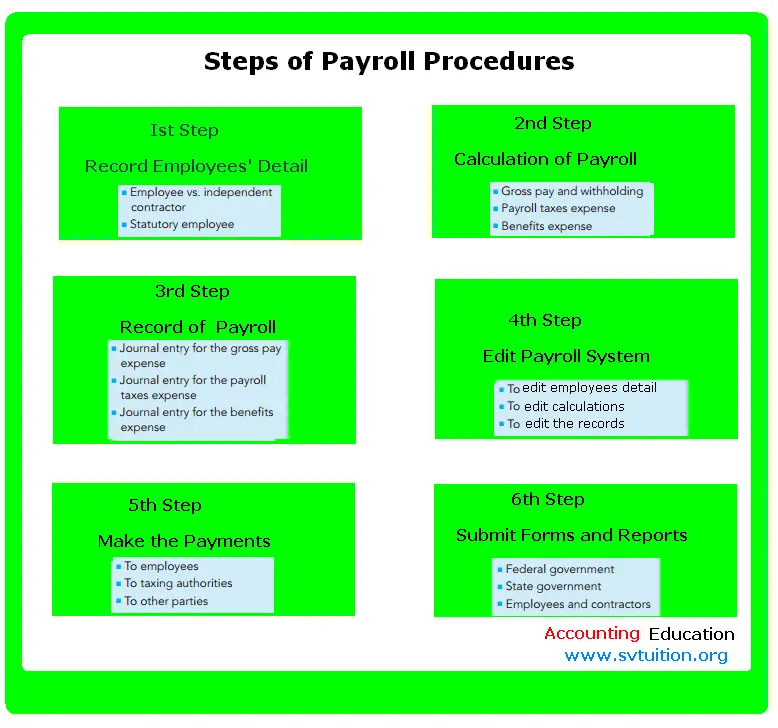

An accounting system is much more than something you download or install from packaged computer software. It encompasses all the technology, people, and processes you use to record and report information. The funds the government provides from the contract will go through this process, and a DCAA audit is their way of making sure these elements are able to meet their requirements. DCAA audits serve a number of purposes depending on the system that needs to be audited, including contractor purchasing system review , benefits and compensation, pre-award audits, and special event planning and execution.

Here is what a DCAA compliant accounting system needs to be able to do:

This means the contractor must have a policy defining the characteristics of a direct cost and an indirect cost. The accounting system must have separate accounts for each cost element in significant detail for audit. Finally, the direct costs must be separated from indirect costs in the accounting system.

Job costing systems For every direct cost transaction, a job or project number must be assigned, and a separate ledger must be maintained.Employee timekeeping An adequate timekeeping system is one that separates hours not only by day but also by the project.

Accounts payable systems All expenses and payables reports must be compared or reconciled each accounting period.

Government Approved Accounting Systems

When your organization is considered for a government contract, it is issued a series of pre award surveys such as Standard Form 1408. SF 1408 is an assessment that evaluates the design of your accounting system to determine if it is acceptable for a prospective contract. While there are no accounting systems that are universally accepted by the federal government, there are various measures that can be implemented to confirm compliance as a government approved accounting system. For government contractors, preparation is an important step in demonstrating that your accounting system satisfies the criteria listed on the SF 1408. Our certified public accountants assist in the selection of a DCAA compliant accounting system for your organization, as well as verify the required standards are met for any systems built in-house. You can find the SF 1408 checklist for a government approved accounting system by following the link using the button below.

Also Check: Get Free Laptop From Government

What Is The Purchase Order Cost

Purchase order cost is the cost of sending the purchase order out to the supplier. This includes the cost of all the resources required to send the purchase order to the supplier. What do we mean by resources?

That includes everyone included in the process and the time spend by them. Lets understand what these resources are

Time spent to create a requisition-This could vary from minutes to a couple of minutes depending upon the length of the requisition.

Time spent to get it approved This includes the time spent to get the requisition approved. That also includes the time spent by executives to approve the order.

In case if the requisition is not routed to the correct person, then it needs to re-routed to the correct person.

Time spent on creating the purchase order:Once the requisition is approved, someone needs to create the purchase order in the system and then send the purchase order to the supplier.

So every step mentioned above adds to the cost of the purchase order process.

Also Check: Free Government Grants For New Businesses

Achieving Dcaa Compliance For Your Accounting System

An adequate accounting system for government contracts is a critical factor for being awarded lucrative contracts with federal agencies. It is a prerequisite for many Requests for Proposals and specific contracts, particularly cost-reimbursable contracts.

Being able to satisfy a DCAA audit is a crucial step in becoming a government contractor. To ensure that your accounting system complies with all guidelines and regulations, it is important to meet each of the 12 critical elements discussed above.

If you need help in managing your cost accounting system, contact the experts at Warren Averett to find out how their experience can ensure you peace of mind.

You May Like: How Do I Get A Government Business Loan

What Does It Mean To Be Dcaa Compliant

Any organization that seeks success from the defense contracting industry must strongly adhere to the highest levels of organization, security, accountability, and financial management. The government ensures defense contractors adhere to these high standards by complying with Defense Contract Audit Agency audits.

To be DCAA compliant means that the organization has the systems and procedures in place to pass a DCAA audit. There is no certification they issue or any formal statement of compliance. Instead, DCAA checks to make sure your organization meets government rules and exhibits financial management behavior that meets rigorous government standards. These standards exist because when the government uses money for any purpose, they are responsible for explaining how that money is used, and through DCAA accounting system requirements, they transfer part of the responsibility to the entities that receive government contracts. For example, when your business is awarded a government contract, your management processes need to be able to fully document how contract money is used and the results these funds achieve. This means the accounting system you use must be flexible, secure, and comprehensive.

DCAA audits are a critical requirement for many of our clients. This blog will examine what an audit means and how a business can use it to improve other processes.

Identifying And Segregating Unallowable Costs

Both new and experienced government contractors often struggle with identifying unallowable costs. These costs don’t meet the authorized criteria under the contract terms in FAR 31. So they are excluded from any bills and proposals related to the contract.

If you include these costs into bills, claims, or proposals by mistakes, you could face penalties. DCAA-compliant accounting systems allow you to identify and segregate unallowable costs to avoid penalties and maintain a good reputation.

Recommended Reading: Grant Writing For Government Agencies

Bronze Medal = Adequate Accounting System

In most cases, an adequate contractor accounting system is considered in the context of a DCAA pre-award accounting system review. The purpose is to satisfy FAR 16.301-3 Limitations on cost-reimbursement contracts for which the contractors accounting system is deemed adequate for determining costs applicable to the contract or order . Assuming the contractor passes a DCAA pre-award accounting system review, that contractor now has an adequate system and should be able to use that reference in bidding on subsequent cost-type contracts. In rare cases, a DCAA pre-award results in a contracting officer letter approving the accounting system. This is unintended, but if it happens, take it and run with it.

Dod Contracts And Whistleblowers

When you do business with the federal government, youre dealing with a trillion-dollar business. There are hotlines for wronged employees to call and file a whistleblower complaint.

Know that whistleblower provisions state that anywhere from 15% to 30% of the damages recovered go to the whistleblower.

You have to so careful in the way that you document things and the way that you communicate with your employees.

Northwestern University had a purchasing coordinator, Melissa Theis, who noticed some irregularities. The University had to pay a $3 million fine and Melissa wound up with a $498,100 settlement.

Read Also: Free Government Phone New Hampshire

How To Identify An Adequate Accounting System For Government Contracts

Written by Hobie Frady on October 8, 2020

A critical factor in securing government contracts is having a DCAA compliant accounting system. In fact, many Requests for Proposals and negotiated contracts require an adequate cost accounting system in place prior to any consideration.

In particular, cost-reimbursable contracts require contractors to comply with the Federal Acquisition Regulation Subpart 16.3.

These guidelines establish estimates of the total cost of contracts for obligating necessary funds, and they set the ceiling for contractors that they may not exceed without the prior approval from the contracting officer.

Another important requirement of FAR Subpart 16.3 is that all cost-reimbursable contracts must feature a contractor employing an accounting system approved by the government.

Gaining this approval represents a major accomplishment for government contractors as it can be a difficult process to prove an adequate accounting system for government contracts.

Calculate Contract Cost By Task Project Objective And Contracts

Your cost system must be aligned and fully integrated with your accounting system. Calculate the cost of all elements including labor and direct material. For each project, calculate these costs separately to keep transparency.

This requires a cost ledger in which you can assign direct costs to projects. DCAA requires a formal report that includes all direct costs according to cost elements.

You May Like: Federal Government Disability Retirement Lawyers

The Documentation You Need For Your Direct Costs

Lets talk a little bit about the documentation that you have to have for some of your direct costs.

- Consultants For consultants, youre required to have a consulting agreement with an hourly rate and a detail of the scope of the work to be done. The consultant has to provide you with an invoice detailing the number of hours they worked and the work performed.

- Subcontractors When it comes to subcontractors, its really the same thing, but taken to an institutional level. Obviously youre required to have a signed subcontract agreement, but the key here is that you need to flow down all the regulations in your prime award to all your subcontractors making them subject to the same provisions. The Government sees them as co-investigators.

- Travel I spoke a little bit earlier about travel and the government. They have published per diem rates. Depending on where in the country youre traveling, the rates are different. Theyre higher in San Francisco than they are in Ames, Iowa.

- Materials When it comes to materials, you have to create a paper trail when you vouch expenses. An expense comes in. It should be clearly marked as a direct, an indirect or an unallowable expense. If its a direct expense, which project did it go to? All of the supporting documentation needs to be lined up with that voucher document.

The Dcaa Approved Accounting System Myth

Myth: I can buy a DCAA approved accounting system in a box.

Many government contractors are probably searching for the elusive DCAA approved accounting system. They want to know which brands are approved and how much they costs. Some are more interested in a specific software package because they have been told the DCAA auditors are more lenient if you have it. However, the problem is that a DCAA approved accounting system does not exist right out of the box. Two companies can purchase the same exact accounting package and one will pass an audit and the other maynot.

Truth: DCAA does not endorse any accounting software package.

Truth: An accounting system is more than accounting software.

Truth: QuickBooks or most commercial job cost accounting software can pass a DCAA audit.

The Federal Acquisition Regulations only require that the system be able to track job cost in accordance with its rules. In fact, most job costs accounting systems can become compliant. Many probably are already in operation but the systems terminology is just not in terms government contractors expect. QuickBooks is the easiest because it is user-friendly and is basically a desktop system that doesnt have to be run on a server. However, industry-specific software can be tweaked to segregate direct and indirect costs and to track labor costs by job or project.

Truth: DCAA will not audit you until a government agency asks them to.

Read Also: Us Government Loans And Grants

Provide Historical Accounting Data

DCAA can require access to the historical accounting data of the contractor. This data will also demonstrate whether or not the contractor is capable of managing large-scale contracts.

If you can ensure DCAA compliance, you may be considered reliable for your cost data reliability requirement for follow-on procurements.

The above are just a few DCAA compliance processes of many, but as a contractor, your company must align according to all of them.

How To Get A Dcaa Approved Accounting System

Federal Acquisition Regulation Defense Contract Audit Agency Defense Contract Audit Manual

Many small businesses are confused when first entering the government contracting world, and often ask, “does the DCAA approve my accounting system?” The answer is simply: no, they do not, and there are no official “government approved accounting systems.” Perhaps one of the most important concepts to understand is that the term “DCAA approved accounting system” is a misnomer . There are merely accounting systems, like QuickBooks, that can be made compliant with the FAR & DCAA requirements , and DCAA compliant accounting software that is designed to pass a DCAA audit. Furthermore, you cannot simply request a DCAA audit to certify your system. Rather, DCAA will audit your accounting and timekeeping systems at specific times or due to specific events, at the request of another federal entity .

Also Check: How To Steal Money From The Government

Sbir Pre Award Audits

When youre going from a Phase I SBIR award to a Phase II award, typically Phase I is fixed price, and Phase II is a cost-reimbursable award. Before you get that $1.0 $1.5 million Phase II award, the Defense Contract Audit Agency is going to come out and do a pre-award audit

DCAAs goal in a pre-award survey is to review the prospective contractors accounting system and related internal controls to provide reasonable assurance that accounting system and cost data are reliable, risk of misallocations and mischarges are minimized, contract allocations and charges are billed the same way they are accounted for. More specifically, DCAA will focus on your ability to allocate costs among contracts in a logical manner, exclude unallowable costs, record employee labor hours and dollars by contract, segregate direct and indirect costs, provide timely, accurate cost accounting data to support billings, and provide accurate data to support incurred costs claimed by contract.

Interim Accumulation Of Costs

The accounting system needs to be updated or post transactions at least monthly. In addition, the accounting system must be able to present the costs on a current, year to date and cumulative basis at least monthly inclusive of indirect costs to provide a full absorption costing of a project or contract.

This can be demonstrated with job cost reports on a current period, year to date and inception to date basis. The balances need to be traceable to the job cost subsidiary ledger. Most project accounting systems can handle the accumulation of direct costs by project as described above. Indirect cost allocation tools may be necessary to present indirect cost allocations. The indirect cost allocation can be handled manually as well. Indirect cost allocations be made consistent with the contractors disclosed practices.

Don’t Miss: Temp Agency For Government Jobs

Key Element No : Homogenous Indirect Cost Pools And Allocation Bases

Contractors are required to maintain homogenous indirect cost pools. This means the indirect costs must be accumulated into separate indirect cost pools combining functions that are not disparate. This means the functions must be similar and have a similar relationship to the cost objectives being managed. A violation would be combining manufacturing functions with engineering or services functions. These are disparate functions and are not homogenous. The most common indirect cost pool structure includes fringe, overhead and G& A.

The allocation bases used must be equitable. This means the allocation base selected must allocate indirect costs in an equitable manner avoiding skewing the allocation to one or a group of contracts. Allocation bases should be selected that best represent the activity being managed. This is normally an input base, an output base or some surrogate of both. The most commonly accepted allocation bases are:

Fringe Total employee labor

Overhead Direct labor, B& P/IR& D labor and allocable fringe

G& A Total cost input or a value added base when the total cost input base proves to be inequitable.

Under cost reimbursable contracts, indirect cost rates should be calculated periodically on a year to date basis and compared to the budget or provisional indirect cost billing rates.

What Exactly Is Far Compliant Accounting Software

We often hear about DCAA compliant accounting software as if there is such a thing. The DCAA evaluates a prospective contractors accounting system not based on rules related to compliance that were created within the agency, but rather by regulations primarily contained in the Federal Acquisition Regulations . The exception is found within the DCAA Manual 7641.90 with respect to Timesheet Preparation which is not rooted in the FAR or the DFARS that pertain to Department of Defense contractors.

The FAR is comprised of 53 Parts, including three reserved parts that are without content. So then, what exactly within the myriad of regulations contained in the other 50 parts and subparts relate to a compliant cost accounting system? The long answer is references to the Cost Accounting Standards and phrases that contain words such as adequacy of the contractors accounting system and cost accounting records do appear throughout the FAR, including but not limited to FAR Parts 4 , 7 , 9 , and 15 . However, the short answer is that when it comes to the specific feature set of your accounting software, it boils down to six parts of the FAR in particular:

Part 16 Types of Contracts

Part 30 Cost Accounting Standards Administration

Part 31 Contract Cost Principals and Procedures

Part 32 Contract Financing

Part 42 Contract Administration and Audit Services

Part 52 Solicitation Provisions and Contract Clauses

Don’t Miss: Subsidy On Home Loan By Government