S To Register Under Pmay

To register under the PMAY scheme, follow the following steps

-

Step 1 Log onto the official PMAY website

-

Step 2 Select the Benefits Under Other 3 Components option by clicking on Citizen Assessment from the drop-box

-

Step 3 Enter your Aadhar number and click on Submit

-

Step 4 The site will verify your Aadhar details and if they are correct, you will be directed to the next page where you will have to furnish information such as your name, income, address, contact number, religion, caste, and the likes

-

Step 5 Once you have entered in all the information, type the Captcha Code in the box provided at the bottom of the page and click Submit

You can check and edit your details later on with the help of your Application and Aadhar number.

What Is The Pmay Scheme

The Ministry of Housing and Urban Poverty Alleviation has launched a Credit Linked Subsidy Scheme under the Pradhan Mantri Awas Yojana in June 2015.

The PMAY subsidy scheme is launched with an aim to provide housing to all eligible beneficiaries under Economical Weaker Sections , Lower Income Group , Middle Income Group I , and Middle Income Group II by 2022.

Is Pradhan Mantri Awas Yojana Applicable For Existing Home Loan

No, those looking to avail PMAY for existing home loan do not qualify for the scheme. This is because the basic PMAY eligibility for home loan is that the applicant or anyone from their household must not own a pucca house in their name anywhere across India.

The PMAY scheme is available for first-time homeowners.

Don’t Miss: Government Contract Jobs Work From Home

How To Apply For A Flisp

Find your home

- Find out what you can afford without FLISP using our affordability calculator.

- Get pre-qualified with our Home Loan Pre-qualification tool so that you can shop for your new home with confidence.

- Find the home you want to buy and put in an offer to purchase.

Apply for finance

- Apply online or call us on 0860 111 007.

- Once your finance is approved with an accredited financial institution, you will need to complete the home buyers education programme.

Apply for FLISP

- This is a separate application you need to complete in your personal capacity and submit to NHFC.

- Visit the NHFC website

Get paid out

- If your application is approved, the subsidy amount will be paid into your attorneys trust account or your home loan account once your bond is registered.

If you think you could qualify for a FLISP, it’s worth your while to enquire. It could help you along the way and you could be closer to owning your own home than you think!

Features Of The Home Loan Subsidy Under Pmay

The Pradhan Mantri Awas Yojana aims to provide home loan subsidies to eligible citizens in the country. This program entails the following features:

- Allotment of housing units that are fully equipped with water, electricity, and toilets.

- Provide adequate physical infrastructure for the inhabitants.

- Ensuring a better quality of life for the urban and rural poor.

- Provide housing security to the eligible availed of the scheme.

- The home loan subsidy to be allocated on the interest under the Credit Linked Subsidy Scheme

- The scheme also gives particular preference to the vulnerable sections of society such as senior citizens, differently-abled individuals, minorities, SCs, STs, and OBCs.

Read Also: How To Claim Free Money From Government

How The Subsidy Under Pmay Reaches You

Once your application for subsidy under the PMAY programme is approved, funds are transferred from the central nodal agency to the bank from where the beneficiary has borrowed his home loan. The bank will then credit this amount to the home loan account of the borrower. This money will then be deducted from your outstanding home loan principal. So if you have received Rs 2 lakhs as the PMAY subsidy and your outstanding loan amount is Rs 30 lakhs, it would reduce to Rs 28 lakhs after the subsidy.

See also: How does the PMAY interest subsidy scheme for EWS and LIG work?

How Do I Apply

You can apply through your financial institution or with the help of a home loan comparison service, such as ooba Home Loans.

Note You used to need your home loan approved before applying for FLISP, but now you can use other sources of finance, such as:

- the beneficiarys pension/provident fund loan

- a co-operative or community-based savings scheme, i.e. stokvel

- the Government Employees Housing Scheme

- any other Employer-Assisted Housing Scheme

- an unsecured loan

- an Instalment Sale Agreement or Rent-to-own Agreement

If you meet the qualification criteria, have a source of finance available, then the bank will likely approve your home loan on the basis that you have the resources available to pay it off in the form of FLISP.

Applying through ooba Home Loans:

The application process usually takes 7 days.

So consider utilising this government programme to make home ownershjp a reality. The government employs programmes such as FLISP to stimulate the economy and encourage home ownership among South Africans.

Are you interested in applying for FLISP? Get all your questions answered, such as whether you qualify, how to apply and how FLISP can be used to acquire your first home.

Apply for a housing subsidy

FLISP offering homebuyers a subsidy on their first home.

Don’t Miss: Highest Yielding Government Bonds In The World

Are You Eligible For A Government House Subsidy On Your Home Loan

Some South African citizens and permanent residents may qualify for a government subsidy to secure a home loan. The Department of Human Settlements has a programme called the Finance Linked Individual Subsidy Programme aimed at helping first-time home-buyers from low to medium income households to afford a home loan.

How FLISP works

Contributes towards your first property

Contributes towards buying your first residential property, vacant serviced residential land or building a house in a formal town.

Covers shortfall

It can be used as a deposit to cover any shortfall between the approved home loan amount and the purchase price.

Reduces monthly installments

If not for shortfall, it can be used to reduce your initial home loan amount making the monthly installments more affordable.

Cannot be used for fees and costs

It cannot be used to pay any charges or attorney fees such as transfer and/or bond registration costs.

Requirements for FLISP

In order to apply for a FLISP subsidy, you must meet the following requirements:

- Earn either a single or joint gross monthly household income of between R3 501 to R22 000

- Be a first time home buyer

- Be over the age of 18 years

- Have financial dependants

- Have never benefitted from any Government Housing Subsidy Scheme before

- Have an AIP for a home loan from an accredited South African financial institution.

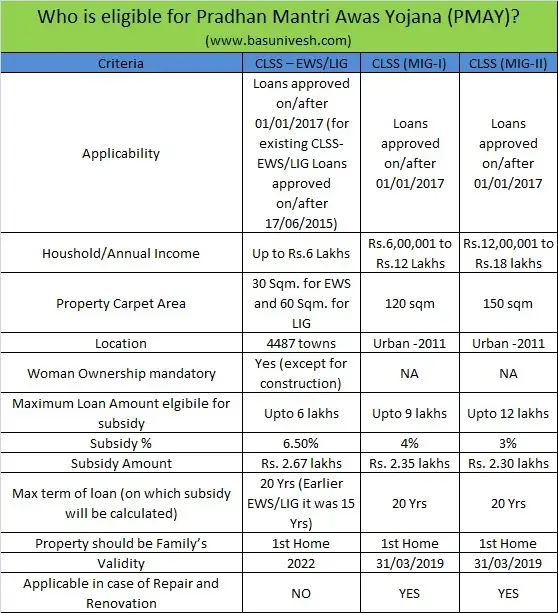

Eligibility Criteria For Pmay

- EWS or Economically Weaker Section -300,000 in a FY.

- LIG or Low-income Group- 300,001-600,000 in a FY.

- MIG or Middle Income Group

- MIG-I6,00,001-12,00,000 in a FY.

- MIG-II 12,00,001-18,00,000 in FY.

how to avail PMAY subsidy

- Must not own a pucca house under the name of any family member anywhere in the country

- Must not have received assistance under any other central scheme for housing.

- Any household that includes a married couple and unmarried children can apply for PMAY benefits.

- Any earning adult member of the family who is unmarried is considered as a separate household.

- Female ownership or co-ownership is mandatory for EWS and LIG categories.

| PMAY Features | |

| Maximum Loan Amount that Qualifies for Subsidy | Rs.6 lakhs |

| NPV Discount of Interest Subsidy | 9.00% |

- Visit and enter necessary details, including Aadhaar number and income details.

- Submit the downloaded form to authorised financial institutions along with necessary documents.

- Apply for a housing loan from your preferred financial institution listed under PMAY.

- The financial institution will forward your subsidy application to a Central Nodal Agency .

- The CNA disburses the subsidy amount to the lending institution upon verification of your application, thereby reducing the loan amount you need to repay.

Also Check: Government Jobs Fort Collins Co

Subsidy On Home Loans By The Government

The Indian Government has launched the Pradhan Mantri Awas Yojana Housing for All scheme in 2015 to provide affordable housing to all. Under the scheme, home loan interest subsidy can be availed by individuals if they meet the eligibility criteria. The interest subsidy is provided under the Credit Linked Subsidy Scheme .

What is Credit Linked Subsidy Scheme ?

EWS /LIG

Under this category, the interest subsidy is offered at a rate of 6.50%. The interest subsidy is offered during the tenure of the loan or for 15 years, whichever is lower. The interest subsidy is provided for loans up to Rs. 6 lakhs with the maximum subsidy amount being Rs. 2.20 lakhs.

Revised EWS /LIG

Under this scheme, the interest subsidy under revised EWS/LIG is offered at 6.50%. The subsidy is offered for the actual tenure of the home loan or a period of 20 years. The maximum subsidy amount is Rs. 2.67 lakhs. The subsidy can be availed only on those home loans that were approved on or after 1 January 2017.

MIG I

Applicants who fall under this category can avail subsidy at the rate of 4% with the maximum loan amount of Rs. 9 lakhs. The maximum loan term taken into consideration for the calculation of subsidy is 20 years. Under the scheme, the maximum subsidy amount is Rs. 2.35 lakhs.

MIG II

Eligibility to avail the benefits under PMAY

Pmay Home Loan Subsidy Form 2022

PMAY home loan Eligibility Criteria =

- Firstly, applicants who applied under the scheme, must not have their own pucca house before this scheme.

- Then, the family income of the applicant should be 18 lakh per annum can apply under the yojana.

- Although the income of the spouse should also mention at the time of application submission.

- Also, those beneficiaries who already have one built house, can not take benefit of this scheme.

- As a result of this scheme, no assistance has been given from any other department under the government.

- Secondly, all the statutory towns notified in the Census 2011 survey can get coverage of this project for housing for all.

- Applicants can get also a subsidy either single or married, in both ways they can apply.

- Do follow us for more details related to this scheme.

| PMAY Interest Subsidy Details : |

Don’t Miss: Colt 1911 Government Model Series 80

Pmay : Proposals For Over 60000 Houses Approved By The Government

A statement by the housing and urban affairs ministry said that proposals for over 60,000 houses in Chhattisgarh, Rajasthan, Andhra Pradesh, Karnataka, and Himachal Pradesh have been approved by the Central Government. A total of 114.04 lakh houses have been sanctioned under the Pradhan Mantri Awas Yojana . On 15 February, the Central Government gave the approvals at the 58th meeting of the Central Sanctioning and Monitoring Committee under the PMAY scheme. Out of the 114.04 lakh houses that were sanctioned, about 93.25 lakh have been commenced for construction and approximately 54.78 lakh are already constructed and delivered to the beneficiaries.The total amount invested under the mission is Rs.7.52 lakh crore. Central assistance of Rs.1.87 lakh has been earmarked for the mission of which, Rs.1.21 lakh crore has already been sanctioned.

16 Feb 2022

When Should You Apply For The Pmay Scheme

Given that the scheme has been around for 7 years, it has already seen two phases of implementation. The third and final phase began in April 2019. Accordingly, the Pradhan Mantri Awas Yojana last date for application is 15th March for the loan disbursed in February, and 25th March for the loans getting disbursed by 23rd March.

Must Read: Introduction to PMAY Pradhan Mantri Awas Yojana Credit linked subsidy scheme

Don’t Miss: How Can I Get Financial Assistance From The Government

Eligibility Criteria For Lig

-

The annual income of the household must be between Rs 3 lakhs and Rs 6 lakhs.

-

The maximum carpet area of the house can be up to 60 square metres.

-

A woman must be the owner of the house. If married, both the spouses can be in joint ownership. In case there is no adult woman in the family, a man can be the sole owner.

-

In the case of house extension/renovation/construction of existing kutcha houses, women’s ownership is not compulsory.

Introduction: Loan With Government Subsidy For A Business

The small-scale company sector, also known as the Small and Medium Enterprises sector, is responsible for around 40% of India’s overall Gross Domestic Product . This industry is important for employment in India, although it confronts tough competition from privately funded firms. Recognizing this, the Government of India has proposed a number of credit packages to help finance the small-scale company sector. SMEs can use these loans to support their day-to-day operations, develop their firm, acquire new equipment, and so on.

Also Check: Aluguel De Carros Governador Valadares

S To Take Before You Hire A Lawyer

A reputable lawyer doesnt guarantee results, no matter what your circumstances.

Before you hire someone who claims to be a lawyer , or someone who claims to work with lawyers, ask relatives, friends, and others you trust for the name of a lawyer with a proven record of helping homeowners facing foreclosure.

Get the name of each lawyer wholl be helping you, the state or states where each lawyer is licensed, and their license number in each state. Your state has a licensing organization or bar that monitors lawyers conduct. Call your state bar or check its website to see if a lawyer youre thinking of hiring has gotten into trouble. The American Bar Association has links to your state bar or search online for the name of your state and the words state bar to find the site for your states bar association. Get in writing specific information about the work the lawyer or firm will do for you, including the cost, and the payment schedule

If you decide to hire a lawyer, stay in touch with them and keep a file with a record of your conversations, letters, emails, texts, and paperwork.

Read Also: Government Programs To Help The Elderly

Eligibility Criteria For Ews

-

The annual income of the household must be up to Rs 3 lakhs.

-

The maximum carpet area of the house can be up to 30 square metres.

-

A woman must be the owner of the house. If married, both the spouses can be in joint ownership. In case no adult woman is in the family, a man can be the sole owner.

-

In the case of extension/renovation/construction of existing kutcha houses, women’s ownership is not compulsory.

Don’t Miss: Colt 45 Automatic Government Model

What Is Pmay Subsidy

The PMAY scheme offers its beneficiaries with subsidy, where the Pradhan Mantri Awas Yojana interest rate is charged at a subsidised or reduced rate than regular housing loans. This is done to make it possible for everyone to afford a home.

Let us understand this with the help of an example For a maximum loan amount of Rs. 6 lakhs given at an original interest rate of 9% for a period of 20 years, a beneficiary belonging to the LIG category will get the loan at a subsidised rate of 6.5%. Here, the Net Reduction in EMI is Rs. 2405

Additional Read: Read all about

What Are The Benefits Of The Clss Scheme

Here are the benefits you get under the housing loan subsidy scheme:

- Subsidised interest rate up to a certain amount on your home loans.

- The subsidised amount under the scheme is directly transferred into your account. Thus, your outstanding principal gets reduced, and so does your EMI.

- You can extend your loan tenure up to 20 years.

- There is no maximum limit to the loan amount. If the amount crosses the specified limits, the interest will be at the standard rate provided by the lender.

- You can enjoy tax benefits under the subsidy on home loan by the Government as stated in the Income Tax Act of 1961.

The key benefit of the CLSS is the subsidized interest rate. The subsidy is decided based on the income groups. For a better understanding, here is a complete table of the subsidy rates of the income groups along with the maximum loan limit.

| Annual Household Income |

|---|

| 3.00% |

Illustration:

Lets assume, you have applied for a home loan of 12 Lakh at an interest rate of 8.5% and with a tenure of 20 years. In such a scenario, you pay an EMI of 10,414, and the total payable interest will be 12,99,331. Now suppose, you have availed a 3% subsidy on a home loan by Government under the MIG-ll group. Your EMI will be reduced to 8,418. The total payable interest will be 10,50,292. Under the subsidy scheme, you will save 1,996 on each EMI and total interest of 2,49,039.

Read Also: Invesco Government Money Market Fund

Loan / Subsidy Amount In Assam Aponar Apon Ghar Scheme

The loan amount and the subsidy on it which can be availed under Assam Aponar Apon Ghar Scheme is given in the table below:-

Loan Amount Subsidy Amount

Rs. 5 lakh to Rs 10 lakhs Rs 1 lakh

Rs. 10 lakhs to Rs. 20 lakhs Rs. 1.5 lakh

Rs. 20 lakhs to Rs. 30 lakhs Rs. 2 lakh

Rs. 30 lakhs to Rs. 40 lakhs Rs. 2.5 lakhs

The mode of disbursement of the Subsidy amount is through DBT directly into the loan account of the loanee.

Is The Pradhan Mantri Awas Yojana Active Or Not

The central government has extended the validity of both the verticals of the PMAY programme. The PMAY-Gramin programme is valid till March 31, 2024. The PMAY-Urban scheme is valid till December 2024. However, the benefits of the credit-linked subsidy scheme under the scheme were available to home buyers only till September 30, 2022. Due to lack of clarity, most banks in India have currently stopped offering CLSS to borrowers.

While some deadlines have been extended, benefits offered under Section 80EEA to promote affordable housing came to an end on March 31, 2022, since the government made no announcement to continue with the section in Union Budget 2022-23.

Read Also: Us Government Hud Homes For Sale