Where To Apply For A Sba Paycheck Protection Program Loan

Apply for this loan through any existing SBA 7 lender or through any participating federally insured depository institution, federally insured credit union, and Farm Credit System institution. Start by consulting with your local lender to see if it is participating.

The SBA and the Treasury Department announced that the PPP would reopen the week of Jan. 11, 2021, for new borrowers and existing PPP loan recipients.

Initially, only community financial institutions, including community development financial institutions , minority depository institutions , certified development companies, and microloan intermediaries were able to make first-draw PPP loans beginning Jan. 11, 2021. Second-draw PPP loans through the same lenders started Jan. 13, 2021. First- and second-draw loans were available from small lenders with less than $1 billion in assets as of Jan. 15, 2021, and all participating PPP lenders were approved to make loans beginning Jan. 19, 2021.

Do not use any other road to apply for a PPP loan scammers will offer shortcuts to PPP loans, just as they did with the original program. The Federal Trade Commission filed a case against one such company on April 17, 2020. Only apply by first going to the SBA website. And know that the SBA will never ask for Social Security numbersor bank account or credit card numbersup front, the FTC cautioned.

Sba 7 Loan Debt Relief

The SBA Debt Relief program will pay principal, interest, and fees for six months on new 7, 504, and microloans made from March 27, 2020, to Sept. 27, 2020. The program also will pay principal, interest, and fees for six months on existing 7, 504, and microloans beginning with the first payment due after March 27, 2020.

Fedex Small Business Grant

Each year, FedEx awards ten business owners grants and other prizes to help them manage the costs associated with growth and development.

Grant totals vary from year to year, but in 2019, FedEx awarded one $50,000 prize, one $30,000 prize, and eight $15,000 prizes. Each recipient also received between $1,000 and $7,500 in FedEx print and business services.

Only United States-based, for-profit businesses who have been in business for at least six months and have fewer than 99 employees are eligible for this grant.

The 2019 award season has already come to a close however, FedEx will be opening the application up for the 2020 award season in early 2020 typically February.

Also Check: City Of Las Vegas Government Jobs

Key Benefits Of Small Business Loans

Fueling Growth: Many small business owners want to grow their company, but that can require significant cash investment. A small business loan allows you to invest in your business without tying up your cash. It can allow you to finance expansion to a new location, invest in marketing campaigns, hire additional staff, and more.

Buying Equipment: When equipment necessary to the operation of your business fails, a short-term small business loan can help get operations moving again without a four-year or longer loan obligation.

Investing in renovations and other projects: There are times when ramping up a new project requires upfront costs that might exceed a business ability to cover with cash flow, but will be recouped in 60 or 90 days as their customer pay their invoices. In that case, the ability to get in and out of the financing quickly at a lower total dollar cost could make more sense than making payments on a longer-term loan for several years.

Bridging seasonal cash flow gaps: Many seasonal businesses sometimes borrow to meet short-lived cash flow demands during lulls that exist between their busy seasons. Doing so requires the business to ensure that it has sufficient cash flow during that slow period to make the larger periodic payments often associated with a short-term loan.

How To Apply For A Loan

Financial institutions deliver the program and are solely responsible for approving the loan.

Discuss your business needs with a financial officer at any bank, caisse populaire, or credit union in Canada. The financial officer will review your business proposal and make a decision on your loan application. Once the decision is made to offer financing under the program, the financial institution will disburse the funds and register the loan with Innovation, Science and Economic Development Canada.

Read Also: Government Grants For Dental Implants

Shuttered Venue Operator Grant Program

The Shuttered Venue Operators Grant program, authorized by the CAA on Dec. 27, 2020, includes $15 billion in grants to shuttered venues. Funds are administered by the SBAs Office of Disaster Assistance.

Eligible applicants can qualify for SVO Grants equal to 45% of their gross earned revenue, with a maximum of $10 million. There is $2 billion reserved for eligible applicants with up to 50 full-time employees.

Eligible entities include:

- Live venue operators or promoters

- Theatrical producers

- Live performing arts organization operators

- Relevant museum operators, zoos, and aquariums that meet specific criteria

- Motion picture theater operators

- Any business entity owned by an eligible entity that also meets eligibility requirements

SVO Grants are only available to venues that:

- Have been in operation as of Feb. 29, 2020

- Have not received a PPP loan on or after Dec. 27, 2020

SVO Grand funds may be used for: payroll, rent, utility, mortgage payments, debt, worker protection, payments to independent contractors, maintenance, administrative costs, state and local taxes, operating leases , insurance, advertising, and other costs of production.

Grantees may not use funds to purchase real estate, make loan payments on loans originated after Feb. 15, 2020, make investments, or make political contributions or payments.

Bank Credit Facilitation Scheme

Features:

- The loans under this scheme are facilitated by the National Small Industries Corporation which has signed a Memorandum of Understanding with banks to offer loans to meet the credit requirements of SME units.

- The facilitation is carried out by offering MSME units the option to pick between private and public sector banks.

- The loans are available in the form of working capital and term loans.

- Through this scheme, the NSIC will also help SME units to get loans at affordable rates, help with the documentation process, and other necessary services related to the loan.

Also Check: Government Jobs In Las Vegas Nevada

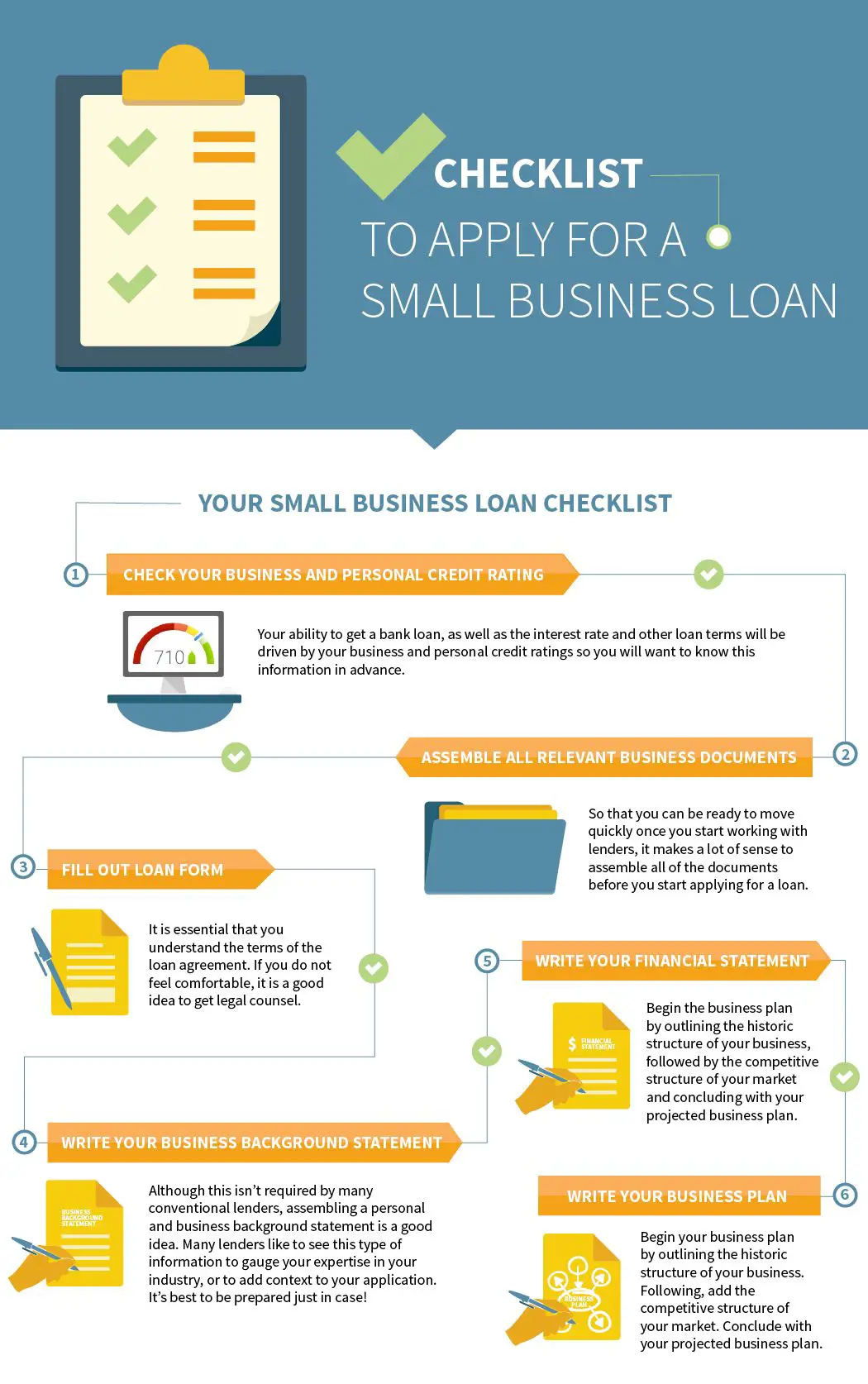

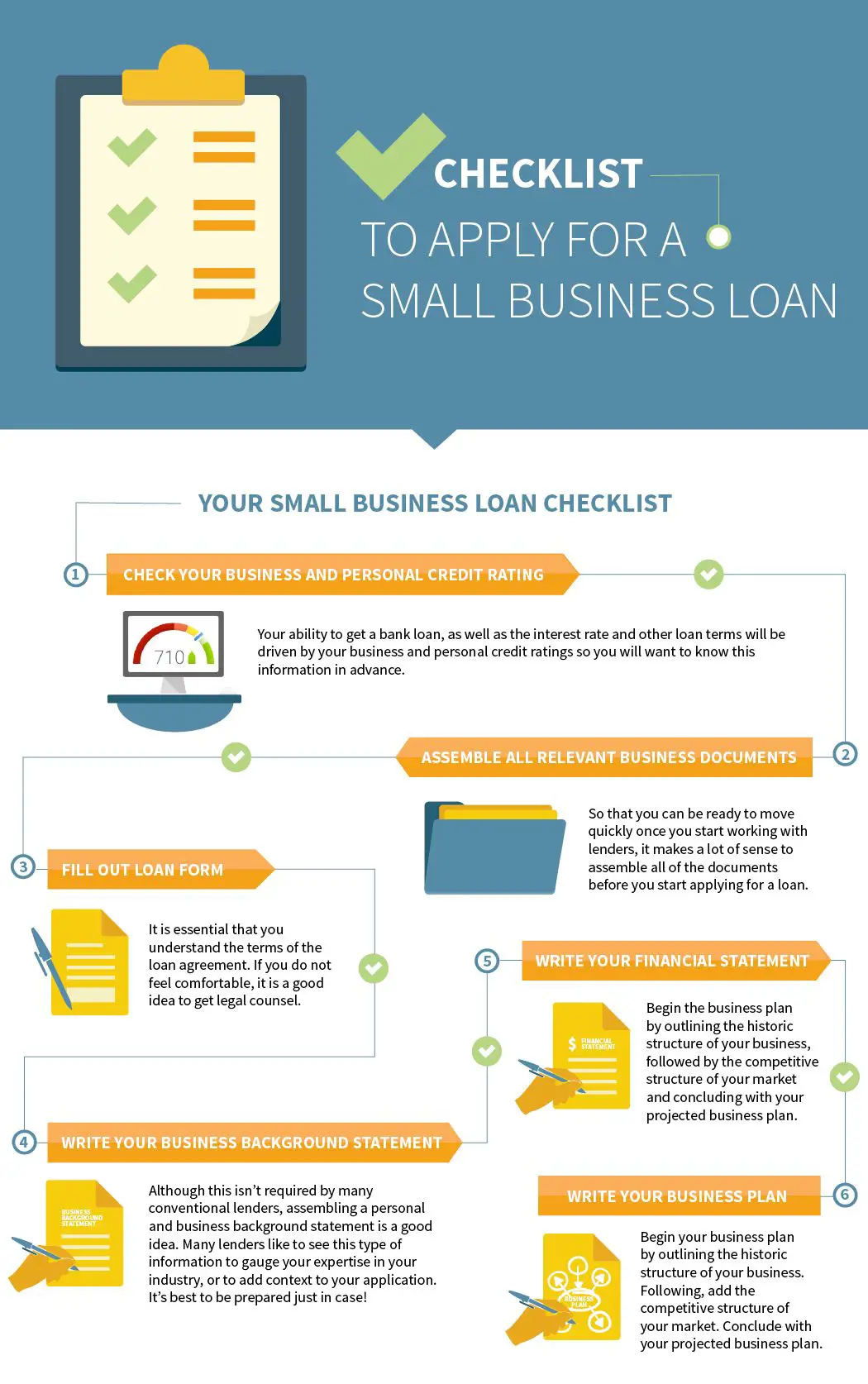

What Documents Are Needed To Apply For A Small Business Loan

When applying for a small business loan, expect to provide business bank statements, personal and/or business tax returns, business licenses and permits, proof of business registration and your businessâ Employer Identification Number or Federal Tax Identification Number .

To obtain financing for your business, you may also have to provide a business plan and copies of financial statements, including a profit and loss statement, balance sheet and cash flow statement. Likewise, expect to furnish information regarding current accounts receivable and accounts payable as well as the specifics of existing debt. Depending on your creditworthiness and the type of loan, you may also need to provide proof of collateral.

Government Loan Schemes For Small Scale Businesses

| Name of the Scheme | |||

|---|---|---|---|

| At the discretion of SIDBI | Rs.10 lakh onwards | Up to 10 years including 3 years moratorium | |

| Pradhan Mantri Mudra Yojana | Varies from bank to bank | Up to Rs.10 lakh | Varies from bank to bank |

| Varies from bank to bank | Varies from bank to bank | 5 years to 7 years | |

| Stand-Up India Scheme | Up to base rate + 3% + tenor premium | Rs.10 lakh to Rs.1 crore | 7 years |

| MSME Loans in 59 minutes | 8.5% onwards | Rs.1 lakh to Rs.5 crore | As per the bank |

Read Also: Government Grants To Start Trucking Business

Turn To The Sba For Everything From Covid

Information in this article reflects congressional funding as well as guidance from the Small Business Administration following passage of the Consolidated Appropriations Act , 2021, on Dec. 27, 2020, and the American Rescue Plan Act of 2021, signed into law on March 11, 2021.

Whether youre seeking financial help for your small business in response to the coronavirus pandemic or simply wondering how to obtain financing to expand, a loan from the Small Business Administration may be just the solution that you need.

Low-interest, long-term SBA loans are a viable option for business owners suffering substantial disaster-related physical or economic damage or who want to grow their business and cant obtain other nongovernment financing.

Where To Find Government Grants For New Businesses

Government grants are available for UK businesses, as well as via the Welsh and Northern Ireland Assemblies, and from the Scottish Parliament. If youre starting a UK business, begin with the useful Business Finance Support Finder. The Welsh government has access to a similar list of grants at its Business Grants website. Enterprise Ireland has access to funding for small businesses up to larger enterprises, while the Scottish governments Funding Opportunities website provides access to over 600 grants and funding options.

Don’t Miss: Rtc Jobs Las Vegas

How Do I Apply For A Small

The most recent application form is posted on the Treasury Departments Cares Act resource page. Once you gather the information described in the form, you should contact an SBA-approved lender. You can find one by plugging your Zip code into an online tool on the SBAs website.

Borrowers are advised to apply online or by phone rather than in person. If you dont already have an established banking relationship, your application will be handled on a first-come, first-served basis, SBA and Treasury Department officials have said.

Congress approved an additional $310 billion after the initial $349 tranche of PPP funding ran out just two weeks after its launch in early April. Banks are cleared to start processing those loans as of 10:30 a.m. on Monday, April 27.

Changes To The Ppp Loan Program That Target Very Small Businesses

On Feb. 22, 2021, the Biden administration announced several changes to the PPP program designed to make PPP funds available to the smallest businesses, including some excluded from previous relief efforts.

- Beginning Feb. 24, 2021, businesses with fewer than 20 employees will have an exclusive two-week window to apply for PPP funding. During this period, larger businesses will not be allowed to apply.

- The formula used to calculate PPP loans has been revised to allow sole proprietors, independent contractors, and self-employed individuals to receive more financial support.

- Eligibility rules have been changed to let small business owners with non-fraud-related felonies receive PPP loans as long as the applicant is not incarcerated at the time of the application.

- Also newly eligible are those who are delinquent on federal student loans.

- Non-citizen small business owners who are lawful U.S. residents, including Green Card holders and those here on a visa, also will be eligible and allowed to use their Individual Taxpayer Identification Numbers to apply for PPP relief.

Recommended Reading: Federal Government Jobs Las Vegas Nv

Support For Businesses Impacted By Covid

Launched on April 9, 2020, the Canada Emergency Business Account is one of the Government of Canadaâs financial relief measures to support Canadian businesses that have been adversely affected by COVID-19. Eligible businesses that are approved by the Government of Canada get access to a loan to help pay for non-deferrable operating expenses such as rent, payroll and insurance which are critical to sustain business continuity

For more information on other business relief programs, please or call us at 1-888-648-3511.

IMPORTANT INFORMATION

The date that your existing CEBA loan converts into a non-revolving term loan has been extended.

is now the last date that you will be able to withdraw or transfer funds from your CEBA loan

- Your CEBA loan will be available to you through the RBC CreditLine for Small Business as a revolving line of credit until and

- On the outstanding balance on your CEBA loan converts into a non-revolving term loan.

As a reminder, no interest applies on your CEBA loan before January 1, 2023. Beginning January 1, 2023, interest accrues on the balance of the term loan at the rate of 5% per annum, payable monthly on the last day of each month.

South African Micro Finance Apex Fund

Samaf gives financial services to small-scale entrepreneurs living in rural and outer urban areas. Samaf does not lend money directly to the public. It uses existing institutions within communities to handle the funds and lend to qualifying entrepreneurs. Samaf has three products: the Micro-Credit Fund , the Capacity Building Fund and the Savings Mobilisation Fund .

Contact Samaf: 012 394-1805Websites: www.samaf.org.za www.thedti.gov.za

Also Check: Government Jobs In Las Vegas

But First: What Is An Sba 7 Loan

The SBA 7 loan is a government-backed loan provided by financial institutions like banks and credit unions. The SBA doesn’t lend directly, but they insure these loans in case a borrower defaults. This makes the SBA 7 loan an attractive option for lenders, since it reduces some of the risk involved. You can use the SBA 7 loan for a variety of things, including the purchase of real estate or land, equipment, working capital, refinancing debt, and of course buying a business!

Because your lender will need to get approval from the SBA to back your loan, the application process and paperwork for an SBA 7 loan can be lengthy. However, these loans typically boast better terms than traditional small business loans, and sometimes even come with counseling to ensure your business runs efficiently.

Minority Business Development Agency

The MBDA provides a wealth of information, resource, and tools to help minority business owners overcome the challenges they often face. Though they dont fund specific grants, they often post information about available grants that may benefit minority business owners.

One example of this is the Virtual Business Center Grant competition, which is currently featured on their site. Through this grant, minority business owners can receive approximately $5,200 to assist in the purchase and use of workplace technology.

Recommended Reading: Goverment Jobs In Las Vegas

My Bank Never Responded To The Application I Filed Before The Initial $349 Billion Was Exhausted Should I Apply Again

Nearly 80 percent of the small businesses that applied for a loan were still waiting for an answer as of April 17, the day after the program ran out of money, and many didnt know where they stood in the process, according to the National Federation of Independent Business.

Banks have said they process loans on a first-come, first-served basis, and many continued accepting applications after the programs initial funds were exhausted. Small-business owners should check with their banks to determine where they stand in the process.

The Sbas Rules And Regulations Have Changed Since I Submitted My Application Do I Need To Apply Again

No. The SBA and Treasury Department have continually issued new regulations since the Paycheck Protection Programs April 3 start date.

The Treasury Department stated in a recent fact-sheet that borrowers and lenders may rely on the laws, rules, and guidance available at the time of the relevant application.

If a borrowers application has not yet been processed, however, it can make modifications to account for new rules, the Treasury Department stated.

You May Like: Grants For Homeschooling Parents

What Is A Grant From The Government

A grant is one of the ways the government funds ideas and projects to provide public services and stimulate the economy. Grants support critical recovery initiatives, innovative research, and many other programs. You can find a list of projects supported by grants in the Catalog of Federal Domestic Assistance . You can also learn about the federal grant process and search for government grants at Grants.gov.

A Canada Small Business Financing Loan Is Commonly Used For:

- New businesses looking for financial support to start or grow a company

- Established businesses experiencing issues with cash flow as a result of a large investment

Not sure if this product is right for your business?

85% of the loan is guaranteed by the Federal government.

Previous Purchases Are Eligible

Purchases made within the past six months are eligible for financing.

Repayment Options That Work for You

- Floating rate principal plus interest

- Floating rate principal including interest

- Fixed rate principal plus interest rate

- Fixed rate principal including interest

Terms That Meet Your Needs

- Equipment loans up to a 10-year amortization

- Leasehold improvements up to a 7-year amortization

- Real property loans/ immovable up to 15-year amortization

Read Also: Possible Careers For History Majors

National And Regional Funds

There are a number of government-backed funds in the UK, designed to support smaller businesses in accessing finance.

The national funds or programmes are available to smaller businesses across the country. The regional funds, as youd expect, are available to smaller businesses within the relevant regions.

Cartier Womens Initiative Grant

At the culmination of this competition-style award program, 21 finalists will receive one-to-one personalized business coaching, access to valuable workshops and networking sessions, media visibility, and a scholarship to the INSEAD Social Entrepreneurship Executive Education Programme. Seven of the top finalists will receive $100,000 in prize money, and 14 finalists will receive $30,000.

To be eligible for this award, you must be an impact-driven business that aims to have a positive and measurable environmental and/or social impact. In addition, your business must be in its first to fifth year of operation and aligned with one of the Sustainable Development Goals as set by the United Nations.

Cartier Womens Initiative is accepting applications for the 2020 Edition award from now until August 14, 2019, at 2 p.m. . If youre interested in this grant, you can apply online at the Cartier Womens Initiative website.

Don’t Miss: City Jobs Las Vegas Nevada