Humana Medicare Supplement Insurance Plans

In most states*, policies are standardized into plans labeled A through N. All policies cover basic benefits, but each has additional benefits that vary by plan.

Medicare Supplement insurance plans A through G generally provide benefits at higher premiums with limited out-of-pocket costs compared to plans K through N. Plans K through N are cost-sharing plans offering similar benefits at lower premiums with greater out-of-pocket costs. Some companies may offer additional innovative benefits.

Effective Jan. 1, 2020, plan options C, F and High Deductible Plan F are only available for purchase by applicants first eligible for Medicare prior to 2020.

The purpose of this communication is the solicitation of insurance. Contact will be made by an insurance agent/producer or insurance company.

Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and in some states to those under age 65 eligible for Medicare due to disability or End Stage Renal disease.

Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program.

GNHL7EUEN

How Much Do Medicare Supplement Plans Cost

Each insurance company prices its plans differently. It may be a good idea to compare premiums from several insurers before you buy, since the benefits will be essentially the same.

Medicare Supplement insurance companies can use one of three ways to rate, or price, their policies:

- Community-rated, which means everyone pays the same premium regardless of age

- Issue-age rated, which means your premium is based on your age at the time you buy the policy

- Attained-age rated, which means your premiums go up as you get older and hit certain preset milestones.

Although the premium for a community-rated plan may be higher at first, it may be least expensive over time. Attained-age Medicare Supplement plans usually start with a low premium, but the increases at different age milestones can be steep. Be sure you know how your plan is rated before you buy so you arent hit with unexpected premium hikes later on. Also note that plans canand dochange their premiums from time to time.

Guide To Medicare Supplement

To purchase Medicare Supplement Insurance you must be enrolled in Medicare Part A and Part B. Medicare Supplement Insurance provides coverage for gaps in medical costs not covered by Medicare. Medicare Supplement plans are standardized and offer various benefits to help offset your healthcare cost.

The California Department of Insurance regulates Medicare Supplement policies underwritten by licensed insurance companies. The CDI assists consumers in resolving complaints and disputes concerning premium rates, claims handling, and many other problems with agents or companies. The Consumer Hotline 800-927-4357 is serviced by experienced professionals who will answer your questions, or assist you in filing a complaint.

To find information on Medicare Supplement Insurance, the names of companies authorized to sell it and compare premiums, please visit our Guide to Medicare Supplement page.

You May Like: Government Student Loans For Graduate School

What Is Medicare Part C

A Medicare Advantage Plan is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called Part C or MA Plans, are offered by private companies approved by Medicare.

If you join a Medicare Advantage Plan, the plan will provide all of your Part A and Part B coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs. Most include Medicare prescription drug coverage .

Medicare pays a fixed amount for your care every month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare. However, each Medicare Advantage Plan can charge different out-of-pocket costs and have different rules for how you get services . These rules can change each year.

Using Medicare In Other States

If you have Original Medicare, then you will be covered anywhere in the U.S.

Since Original Medicare is a federal program, it provides blanket coverage across the country. But, even in another state, you still have to receive treatment from a doctor who is enrolled in Medicare.

If you have Medicare Advantage, then it will depend on your specific plan. Some plans require you to stay within a network or use certain doctors, limiting you if you travel outside of your network.

You May Like: Government Funding For Religious Organizations

Comparison With Private Insurance

Medicare differs from private insurance available to working Americans in that it is a social insurance program. Social insurance programs provide statutorily guaranteed benefits to the entire population . These benefits are financed in significant part through universal taxes. In effect, Medicare is a mechanism by which the state takes a portion of its citizens’ resources to provide health and financial security to its citizens in old age or in case of disability, helping them cope with the enormous, unpredictable cost of health care. In its universality, Medicare differs substantially from private insurers, which must decide whom to cover and what benefits to offer to manage their risk pools and ensure that their costs do not exceed premiums.

Medicare also has an important role in driving changes in the entire health care system. Because Medicare pays for a huge share of health care in every region of the country, it has a great deal of power to set delivery and payment policies. For example, Medicare promoted the adaptation of prospective payments based on DRG’s, which prevents unscrupulous providers from setting their own exorbitant prices. Meanwhile, the Patient Protection and Affordable Care Act has given Medicare the mandate to promote cost-containment throughout the health care system, for example, by promoting the creation of accountable care organizations or by replacing fee-for-service payments with bundled payments.

When Can I Buy Medigap

After you are signed up for Medicare Part A and Part B, you can look into getting Medigap. The open enrollment period for Medigap automatically starts the first month you have Medicare Part B, as long as you’re at least 65 years old. It is important to purchase Medigap during the open enrollment period, or it might become unavailable to you or overly expensive.

Recommended Reading: Yoga Certification Course By Government Of India

Services Medicare Doesnt Cover

- Most long-term care. Medicare only pays for medically necessary care provided in a nursing home.

- Custodial care, if its the only kind of care you need. Custodial care can include help with walking, getting in and out of bed, dressing, bathing, toileting, shopping, eating, and taking medicine.

- More than 100 days of skilled nursing home care during a benefit period following a hospital stay. The Medicare Part A benefit period begins the first day you receive a Medicare-covered service and ends when you have been out of the hospital or a skilled nursing home for 60 days in a row.

- Homemaker services.

- Most dental care and dentures.

- Health care while traveling outside the United States, except under limited circumstances.

- Cosmetic surgery and routine foot care.

- Routine eye care, eyeglasses , and hearing aids.

General Features Of Medicare Supplement Insurance Plans

Medicare Supplement insurance plans work with Original Medicare to help with out-of-pocket costs not covered by Parts A and B. The following are also true about Medicare Supplement insurance plans:

- Predictable costs help you stay ahead of unexpected out-of-pocket expenses.

- No network restrictions mean you can see any doctor who accepts Medicare patients.

- You don’t need a referral to see a specialist.

- Coverage goes with you anywhere you travel in the U.S.

- There is a range of plans available to fit your health needs and budget goals.

- Purchasing a Medigap plan and a Medicare Part D prescription drug plan could give you more complete coverage.

- Guaranteed coverage for life means your plan can’t be canceled.

As long as you pay your premiums when due and you do not make any material misrepresentation when you apply for this plan.

For PA residents only: As long as you pay your premiums when due. You do not misstate one or more material facts when you apply for this plan. UnitedHealthcare has 2 years to act on misstatements. The 2 year limit does not apply to fraud.

Rates are subject to change. Any change will apply to all members of the same class insured under your plan who reside in your state. can provide peace of mind by helping with some of these costs.

Also Check: Hospital Administration Jobs In Government

Which Supplement Plan Should You Enroll In

If you have Original Medicare, then you could probably benefit from a Medicare Supplement plan to help you with some of the costs. The Supplement plans directly work with the Original Medicare plan to give you greater coverage and to help keep your costs low.

They will vary in their total coverage, so you can get low coverage plans that are much cheaper than what we have talked about here. You dont have to pay a lot for your Medicare Supplement plan. You just have to decide how much coverage you would benefit from and what kind of insurance plan you can afford.

We can help you by answering questions and pointing you toward a plan that would be a good fit for you.

Feel free to call us for help now at 1-888-891-0229

We can help you to assess your coverage needs and show you health insurance plans and providers that would be able to meet those needs for you. Your needs could change on a regular basis.

You should reassess your health insurance coverage every year to see if you might need a different kind of plan than what you had previously. As your budget changes or as your health changes, it could be in your best interests to enroll in a different kind of health coverage plan than what you have had before.

Transferring Medicare To Another State

If you move to another state or region, you will need to find a new Medicare Advantage plan available in that area. According to CNBC, you will have two months to change and update your plan after youve arrived in your new state of residence.

If you have Original Medicare, all you need to do if you move is give Medicare your new address and location info.

You May Like: How To Sue The Us Government

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

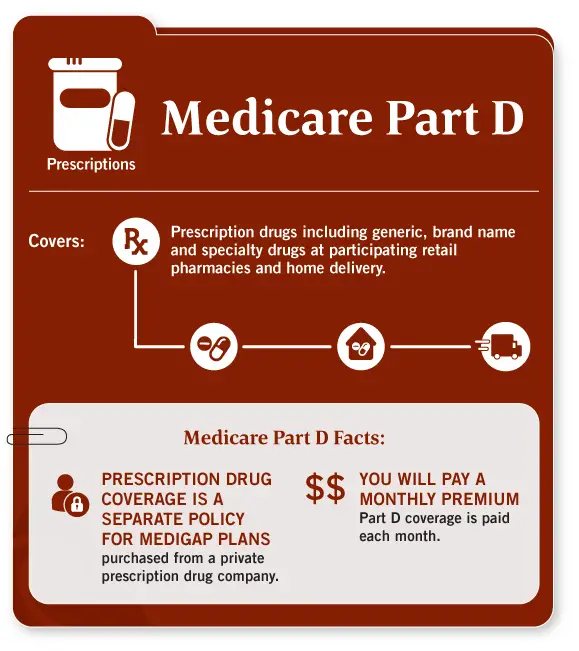

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medicare hospital insurance if they have worked and paid Medicare taxes long enough. You can sign up for Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Medicare Plan G Vs Plan N In Missouri For 2023

Medicare Plan G One low deductible, then 100% coverage. Higher premiums than Plan N

Medicare Plan N Lower monthly premiums, small out-of-pocket costs such as co-pays, and possibly Medicare Part B excess charges

The difference in monthly premiums between Medicare Plan N and G in Missouri can often be up to $30 per month!

If you are healthy and do not visit your doctor very often, but still want great coverage, Medicare Plan N is a great option.

Read Also: How To Get Government Id

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

When Is The Best Time To Buy A Plan

The Medicare Supplement Open Enrollment period starts on the 1st day of the 1st month in which youre age 65 or older and enrolled in Medicare Part B. In some states, you can buy a plan on the 1st day youre enrolled in Medicare Part B, even if youre not yet 65.

If you meet certain criteria, such as applying during your Medicare Supplement Open Enrollment Period, or if you qualify for guaranteed issue, a company cant use your medical history to determine your eligibility. Rules in some states may vary.

Don’t Miss: How Ngo Get Fund From Government

Medicare Plan F Vs Plan G

Using our free online quote engine you can check the different premiums between Medicare plan F and plan G. Just enter your zip code anywhere on this page that you see a quote box and you can begin shopping the rates in minutes.

We are one of the few companies online that actually show you the real rates from the top companies.

The only difference between Medicare plan F and plan G is who pays the Medicare part B deductible each year. With plan F, this deductible is paid for you however you are paying higher premiums for the plan.

On plan G you pay the deductible yourself, however, the premiums are much lower than Plan F, and in almost every case plan G will save you money.

Save Money on Medicare Plan G in Missouri

The extra premiums for Medicare Plan F are often far higher than the deductible itself, so in almost all cases you can save money with Medicare Plan G in Missouri.

Medicare Supplement Plan G pays for 100% of the gaps in Medicare except for the Medicare Part B annual deductible. In 2022 this deductible was $2022 and should be close to this in 2023.

Effects Of The Patient Protection And Affordable Care Act

The Patient Protection and Affordable Care Act of 2010 made a number of changes to the Medicare program. Several provisions of the law were designed to reduce the cost of Medicare. The most substantial provisions slowed the growth rate of payments to hospitals and skilled nursing facilities under Parts A of Medicare, through a variety of methods .

PPACA also slightly reduced annual increases in payments to physicians and to hospitals that serve a disproportionate share of low-income patients. Along with other minor adjustments, these changes reduced Medicare’s projected cost over the next decade by $455 billion.

Additionally, the PPACA created the Independent Payment Advisory Board , which was empowered to submit legislative proposals to reduce the cost of Medicare if the program’s per-capita spending grows faster than per-capita GDP plus one percent. The IPAB was never formed and was formally repealed by the Balanced Budget Act of 2018.

Meanwhile, Medicare Part B and D premiums were restructured in ways that reduced costs for most people while raising contributions from the wealthiest people with Medicare. The law also expanded coverage of or eliminated co-pays for some preventive services.

Read Also: What Is Data Governance In Information Technology

How Medicare Supplement Insurance Works

Medicare Supplement Insurance covers common gaps in Medicares standard insurance plans. People who apply for Medigap coverage must take part in Medicare Parts A and B. Medigap plans supplement, but do not replace, primary Medicare coverage.

The Medigap Open Enrollment Period is six months from the first day of an individual’s 65th birthday month. These plans may also have open enrollment for six months after signing up for Part B coverage.

There are 10 Medigap plans, from Plan A to Plan N.

Insured individuals pay monthly premiums for private Medigap policies directly to the insurance provider. These premiums exist above and beyond the premiums paid for Medicare Parts A, B, and D. That means someone with Medigap will pay one premium for Part B and another for the plan offered by the private company. Although private insurance companies offer Medigap plans, the federal government requires companies to standardize policy coverage. This standardization means that Medigap Plan C from provider Z provides the same coverage as Plan C from provider Y.

All Medigap plans must cover preexisting conditions after a six-month waiting period. However, those who have continuous medical coverage for six months before enrolling may be able to avoid this and get immediate coverage.

Dropping Your Entire Medigap Policy

You may want a completely different Medigap policy . Or, you might decide to switch to a Medicare Advantage Plan that offers prescription drug coverage.

If you decide to drop your entire Medigap policy, you need to be careful about the timing. When you join a new Medicare drug plan, you pay a late enrollment penalty if one of these applies:

- You drop your entire Medigap policy and the drug coverage wasn’t creditable prescription drug coverage

- You go 63 days or more in a row before your new Medicare drug coverage begins

Recommended Reading: Centre For International Governance Innovation

The 10 Standard Medicare Supplement Insurance Plans

There are 10 Medicare supplement insurance plans. Each plan is labeled with a letter of the alphabet and has a different combination of benefits. Plan F has a high-deductible option. Plans K, L, M, and N have a different cost-sharing component.

Every company must offer Plan A. If they offer other plans, they must offer Plan C or Plan F.

Medicare Supplement Insurance Or Medigap Plans

Medicare Supplement insurance plans or Medigap policies are sold by private insurance companies. There are 10 modernized plans labeled A through N that pay for part, or all, of Medicares co-payments and deductibles, with Plan F being the most comprehensive. Some may also cover other health care costs that Medicare does not pay for, such as foreign travel emergency medical care.

Don’t Miss: Laws Governing Data Mining Practices