Variable Vs Fixed Loan Interest Rates

A variable interest rate can fluctuate over the life span of a loan. A fixed interest rate is just as it sounds fixed and unchanging for the life of a loan.

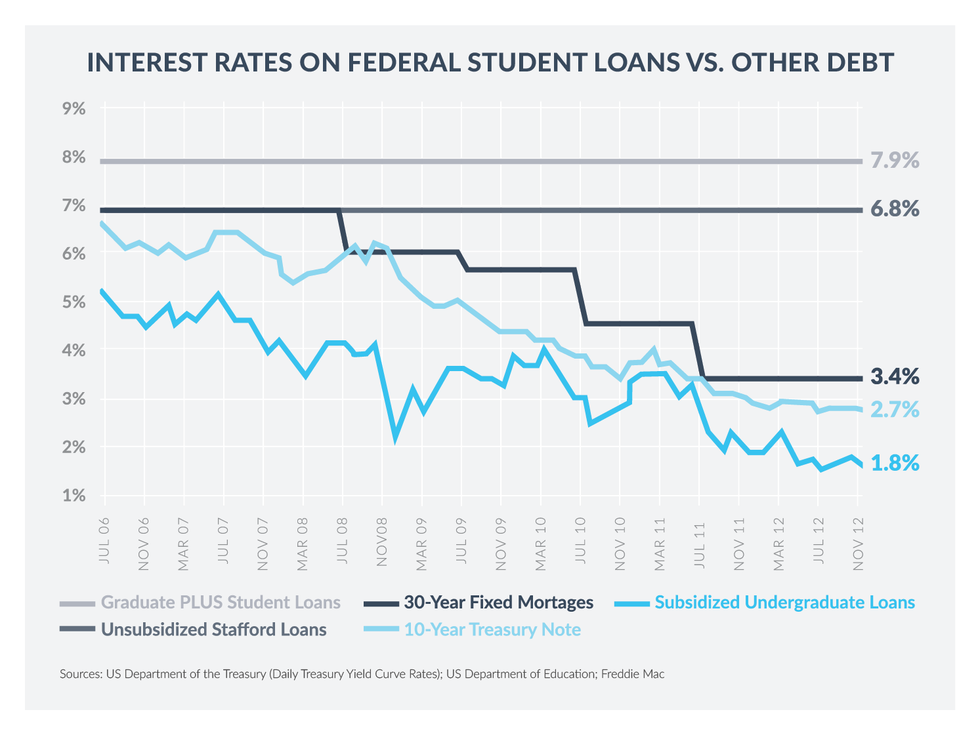

While all federal student loans come with a fixed interest rate, offer students the flexibility of a variable interest rate in addition to a fixed interest rate option. At the time of your loan disbursement, you might discover that variable interest rates are lower than the federal student loan fixed rate, but there are advantages to having a stabilized rate.

To learn more, see our resource page.

University Of Toronto Advanced Planning For Students

University of Toronto Advance Planning for Students is a financial aid program for full-time students who are Canadian citizens, permanent residents, or protected persons and are eligible for need-based government student assistance or funding from a First Nations band.

U of T will ensure that unmet need is met for students who are assessed by OSAP as requiring maximum assistance and whose assessed need is not fully covered by government aid.

Students receiving funding from another province/territory or a First Nations band are also eligible for consideration and may submit an online UTAPS application.

Provincial And Territorial Grants

The Northwest Territories, Nunavut and Quebec do not participate in the Canada Student Grants programme .

This doesnt mean that students from these provinces and territories cant apply for a grant to study a Masters in Canada. Instead, each offers their own student grant programme.

Grant amounts, eligibility criteria and applications procedures will be broadly similar to those for the Canada Student Grants programme, but may still vary slightly between the three provinces and territories.

For more information, consult the website of the student finance authority in your province or territory bg-white shadow-sm border rounded p-3 w-100:

- Students from the Northwest Territories should apply for Masters grants via the Department of Education, Culture and Employments Student Financial Assistance website.

- Students from Nunavut should apply for Masters grants via the Department of Family Services website.

- Students from Quebec should apply for Masters grants via the Aide financière aux études website.

Also Check: Fulton County Government Human Resources

Financial Aid For Graduate School

Financial aid is available for grad students, in addition to any savings you may have, or employer tuition assistance. It is important to note that as a grad student, you are considered an independent student. This means federal loan limits are higher and you are not required to leverage your parents information to qualify for aid.

But dont fall into the trap of thinking that grants and scholarships are not available at the graduate level. You may just need to search differently for available resources, and understand the new resources available to you as a potential grad student, which we cover below.

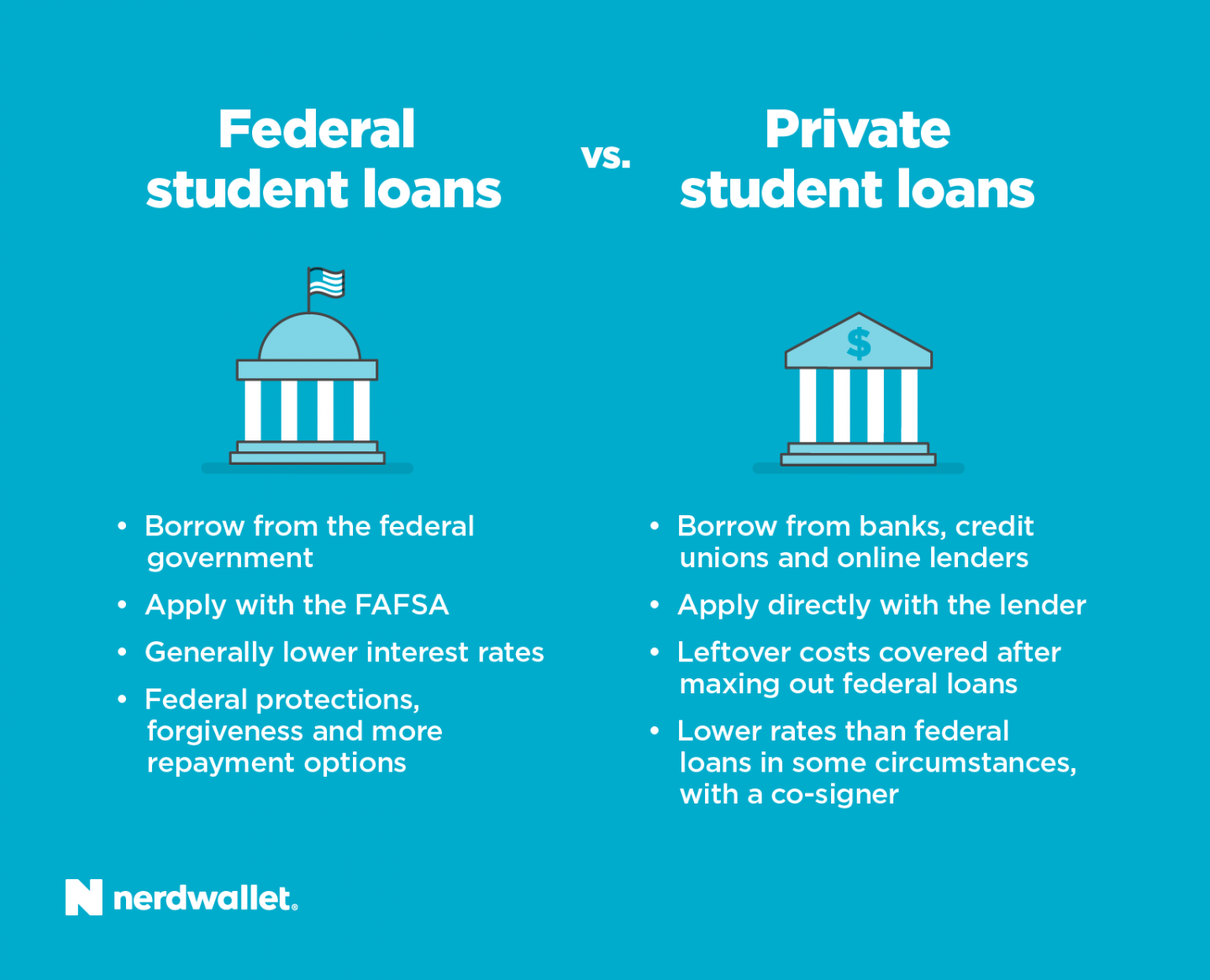

Cons Of Federal Student Loans

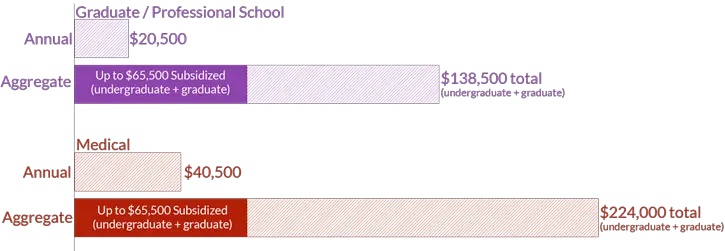

- Loan limits: Direct Unsubsidized Loans have a $138,500 total limit. If you reach this student loan limit, youll have to consider PLUS Loans or private student loans to fill any financial gaps.

- Application deadlines: Unlike private student loans, federal student loans have strict application deadlines. If you miss the deadline, you wont be able to borrow until the following academic year. Keep in mind that on top of federal deadlines, some states have their own deadlines, too be sure to check in with your schools financial aid office to make sure you apply on time.

- Higher interest rates: Federal student loans sometimes have higher interest rates compared to what borrowers can get on a private student loan if they have excellent credit.

No matter which type of student loan you choose, its important to consider how much that loan will cost you in the future. This way, you can prepare for any added expenses.

You can find out how much youll owe over the life of your federal or private student loans using our student loan calculator below.

Enter your loan information to calculate how much you could pay

Checking rates wont affect your credit score.

You May Like: Government Loans For Working Parents

Which Graduate Student Loan Is Right For You

The average student loan debt for graduate school alone is $71,000, according to the latest data from the National Center for Education Statistics. But some students take on much more for advanced degrees dentists average $292,169 in debt, for example.

Federal loans are usually the best choice when paying for grad school because programs like income-driven plans can help keep payments manageable. However, if you have good credit and are entering a profession with strong earning potential, private loans may cost less in the long run.

Many lenders offer student loans for graduate school. Some also have loan programs for specific professional degrees. Evaluate all your options to get the best deal possible.

Masters Fees For Canadian Students

As a Canadian citizen youll benefit from substantial government investment in higher education. This keeps Masters fees relatively low for domestic students, at around half the rate paid by international applicants.

In the 2021-22 academic year, the average cost of a Masters in Canada was between CAD $9,705 and CAD $27,296 . Your university will usually calculate this total based on the price of a set number of instalments plus any supplementary costs .

Note that individual Canadian universities set their own fees and these may vary. Certain degree programmes may also be more expensive particularly those in professional subject areas such as Medicine. The average cost of an executive MBA, for example, is CAD $63,667 .

If youd like to look up the cost of a specific Masters in Canada, you can either look at the details of courses listed on FindAMasters.com or check the information provided by individual universities.

Don’t Miss: How Much Does The Government Pay For Assisted Living

What Are The Drawbacks Of Private Student Loans

Compared with federal student loans, private student loans have some disadvantages:

Private student loans are harder to get. Almost all private student loans are credit-based. This means you must show a positive credit history and adequate income to qualify or have a co-signer who can assume the risk. Federal student loans for undergraduates do not require a co-signer. PLUS loans for parents and graduate students don’t require excellent credit but may require a co-signer if the borrower’s credit history shows an adverse event, such as bankruptcy, foreclosure or loan charge-offs.

Interest rates for private student loans are higher than interest rates for federal student loans. The interest rate for federal student loans issued after July 1 is 3.73%, fixed . Interest rates on private student loans for most borrowers will be significantly higher. In addition, students with financial need can qualify for subsidized student loans from the federal government. Interest does not accrue on subsidized loans while the student is in school, during the grace period or when the loan is in deferment. Interest on private student loans begins to accrue immediately and does not stop until paid in full.

Ascent Graduate And Health Professions Student Loan

Min. Credit Score

Fixed APR

Variable APR

View details

Best for graduate students who want flexible payment options.

Pros

-

Forbearance of 24 months is longer than many lenders offer.

-

Grace period of 9 months is longer than many lenders offer.

-

You can see if youll qualify and what rate youll get without a hard credit check.

Cons

-

You must be enrolled at least half-time to qualify.

Qualifications

-

Typical credit score of approved borrowers or co-signers: Not available.

-

Minimum income: Not available.

-

Loan amounts: up to $200,000.

Available Term Lengths

7, 10, 12 or 15 years

Disclaimer

Also Check: Government Policies To Reduce Greenhouse Gas Emissions

Best Private Graduate Student Loans

Unlike federal student loans, private student loans dont just come from one source, and they dont have one fixed interest rate.

There are multiple lenders offering private student loans to grad students, including banks, credit unions, and online lenders. There is a lot of variation in interest rates and terms, so you should shop around carefully to make sure youve found the best lender for your needs.

Here are our picks for the best graduate student loans from our partners.

How Much Can I Borrow Under The Us Direct Loan Program

U.S. Direct Loans are need-based and non-need based and are subject to annual limits. The maximum amount you can borrow each year depends on your grade level and on whether you are a dependent student or an independent student.

Annual Loan Limits for Dependent Undergraduates

| Grade Level |

|---|

The graduate aggregate limit includes all federal loans received for undergraduate study.

Don’t Miss: Single Mom Money From Government

Forbearance And Deferment Options

Forbearance and deferment are terms that refer to a period during which your federal student loan monthly payments are postponed or reduced due to financial hardship or other circumstances.

The type of federal loan youve been issued determines whether interest will accrue during this time. Deferment often refers to postponements or reduction periods for federal loans issued to students who have demonstrated financial need , during which interest will not accrue.

Interest will accrue during postponement or reduction periods for all other types of federal student loans.

Provincial Student Loan Programs

Students who are Canadian citizens or permanent residents may be eligible for financial assistance from their provincial governments. Applications for the Fall session are usually available in late May or early June. It is recommended that you apply for student loans at least 10 weeks prior to the start of the new academic year. Please note that you may only ever hold student loans from one province.

Once you have submitted your online Ontario Student Assistance Program application please be sure to upload the OSAP consent and declaration signature pages and supporting documentation to your OSAP Application.

Getting Your Money

Complete either your Full-Time or Part-Time Master Student Financial Assistance Agreement if required. The Master Student Financial Assistance Agreement is a lifetime student loan agreement, so only needs to be completed once for full-time studies or part-time studies.

Reporting Changes & Updates to Information

If your circumstances or those of your spouse change while you are in school, you must promptly inform Enrolment Services of these changes.

Maintaining the Interest-Free Status on Your Previous Loans

If you decide to take a loan, your OSAP loans will not accrue interest in some situations.

If youre a full-time student receiving OSAP, your loan will automatically be interest-free for your study period once the university confirms your enrolment.

If youre a:

Getting Help

Don’t Miss: Government Grants Anyone Can Get

Direct Plus Loans For Parents

Parents may choose to offset the cost of higher education by obtaining loans to help pay for those expenses.

Benefits: PLUS loans can help cover the educational expenses not met by federal student aid. Additionally, parents can defer payment on loans until after the student’s graduation. As these loans are not need-based, parents don’t need to demonstrate financial need to apply.

Eligibility: Eligibility depends on a modest credit check. An endorser may be required if the borrower has adverse credit. Some schools require that a FAFSA be completed before a PLUS loan can be awarded, but some do not.

Pros Of Private Graduate Student Loans

- Higher loan limits: You might be able to borrow up to your schools cost of attendance with private loans.

- Can apply at any time: Unlike federal student loans, private student loans dont have application deadlines. This could make them a good option if youve exhausted scholarship, grant, and federal student loan options, or if you run out of funds during the semester.

- Lower interest rates: If you have excellent credit, you might qualify for a lower interest rate on a private loan compared to a federal loan.

Read Also: Is The Government Shutdown Again

How To Apply For Private Loans

As for how to specifically apply for a private loan, it varies. There are just too many types of loans and lenders to allow for any single, “average” process. Start by searching generally for private loans, then narrow your search by focusing on the type of degree youre pursuing. When you’re ready to apply, prepare to provide financial information to the lender, including bank statements, pay stubs, and school documents.

Cons Of Private Graduate Student Loans

- Must have good credit: Youll typically need good to excellent credit to get approved for a private student loan. If you have poor or fair credit, youll likely need to apply with a cosigner to potentially qualify.

- Dont come with federal protections: Private student loans generally dont offer the benefits that come with federal student loans, such as access to federal forbearance options and student loan forgiveness programs. Any protections that do come with private loans are provided at the discretion of the lender.

- Lack of repayment plans: Unlike federal loans, private loans dont provide a variety of repayment plans to choose from. For example, most lenders dont offer extended or income-driven repayment plans.

You May Like: Colt 45 Automatic Government Model

Masters Funding For International Students In Canada

As an international student in Canada you wont be eligible for the same public funding as domestic postgraduates. This means you wont normally be able to apply for loans or grants .

Dont worry though theres plenty of other funding available for international Masters students in Canada. In fact, several scholarship programmes exist purely to attract and support postgraduates studying overseas at Canadian universities.

You Wont Get Student Loan Cancellation For All Your Student Loans

This may comes as a surprise to many student loan borrowers, but theres no discussion of cancelling all student loan debt. . Its important to clarify this point so that borrowers can level set their expectations. Sen. Bernie Sanders proposed cancelling all $1.7 trillion of student loan debt. However, Congress is not considering his proposal and theres no expectation that Schumer, Warren or Biden endorse that position. Both the Warren-Schumer and Biden proposals also focus on federal student loans only. That said, Congress could adopt this other student loan forgiveness proposal from Sanders.

Also Check: Ventura County Government Center Traffic Tickets

Taking On Rejecting Or Varying Your Funding Volumes

Northwood University uses passive financing confirmation for approval of Subsidized and Unsubsidized mortgage prizes. This implies should you be a returning pupil that has used money at Northwood in previous decades, the loan amounts shall be set-to an acknowledged status within 14 days of awarding if you dont tell usa that you do not would like them.

- When you need to acknowledge the Subsidized/Unsubsidized money amounts shown on executive Award page and have done the grasp Promissory observe and access guidance in the government beginner help website you DO NOT need to take action. Cash advance loans will instantly become acknowledged within 14 days of awarding. You will see any absent and essential products by visiting your own My personal scholarships or grants Self-Service through My.Northwood WebAdvisor.

- If you would like decline their loan or change up the amount borrowed, you are doing must take actions. Initial, visit the WebAdvisor tab at My.Northwood subsequently understand to People > Simple Money For College.

If you establish you may like to sign up for the cancelled financing at a later time with the award 12 months and are usually still make an effort to enrolled at least part-time please look at school funding company.

Ascent Student Loans Disclosures

Ascent loans are funded by Bank of Lake Mills, Member FDIC. Loan products may not be available in certain jurisdictions. Certain restrictions, limitations and terms and conditions may apply. For Ascent Terms and Conditions please visit: AscentFunding.com/Ts& Cs.

Rates are effective as of 10/01/2021 and reflect an automatic payment discount of either 0.25% OR 1.00% . Automatic Payment Discount is available if the borrower is enrolled in automatic payments from their personal checking account and the amount is successfully withdrawn from the authorized bank account each month. For Ascent rates and repayment examples please visit: AscentFunding.com/Rates.

1% Cash Back Graduation Reward subject to terms and conditions, please visit AscentFunding.com/Cashback. Cosigned Credit-Based Loan student borrowers must meet certain minimum credit criteria. The minimum score required is subject to change and may depend on the credit score of your cosigner. Lowest APRs are available for the most creditworthy applicants and may require a cosigner.

You May Like: How To Get Free Grant Money From The Government

Private Undergraduate Student Loans

Private student loans for undergraduate students function similarly to other types of private loans in that a credit and income review will be required to determine your ability to repay the loan. This review can also affect the interest rate on your loan. Since most undergraduate students have not yet established a credit history or have a steady income, it is often necessary to apply with a cosigner.

Learn more about .

Who Can Get Federal Student Loans

Anyone attending a four-year college or university, community college, or career school can apply for federal student aid, including:

- Grants, which dont need to be paid back

- Work-study, which is part-time work that allows students to earn money while in school and

- Federal student loans

Most federal aid is decided based on financial need. Students must submit the FAFSA® and meet several other basic eligibility requirements to qualify.

Parents may also apply for federal student loans, called Federal PLUS Loans. These loans can also be applied toward the students educational costs.

Types of Federal Student Loans| for Loans Disbursed Between July 1, 2021 and June 30, 2022 | |||

| Direct Loan for Dependent Undergraduates | Direct Loan for Independent Undergraduates | Direct Loan for Graduates | |

|---|---|---|---|

| No |

1Limit of combined subsidized and unsubsidized funds. back2Additional unsubsidized eligibility available for student whose parent is unable to obtain a PLUS loan. back

Recommended Reading: Government Jobs Bachelor’s Degree