Migrating From Legacy Models

Subscription and consumption billing models are becoming increasingly popular. But many companies must also maintain legacy complex milestone and renewal billing models when migrating. The need to bill for multiple models on a single invoice adds complexity that most companies are not equipped to handle.

Manual Processes And Revenue Management

The revenue recognition process is complex and requires source data from an increasing number of systems. Many companies are finding manual processes ineffective for aggregating and grouping the disparate data in a way that allows for the robust analysis and reporting required for modern revenue recognition.

Best Property Tax Software Solutions In 2021

Managing the complexities of commercial property taxes can be overwhelmingeven if youre only dealing with a few parcels. Thats why many companies turn to technology to keep their process running smoothly. To help in your research, weve compiled a list of the most popular property tax software solutions available.

Note: PTX Tech does not offer property tax software, but our TaxFeed and TaxSets property tax data can be used with any of these leading software solutions.

Also Check: Low Income Housing Government Programs

Check Your Property Assessment

Residential taxpayers will pay $12.98 for every thousand dollars of assessed value. That’s a decrease from last year’s $13.98, but your bill may be higher if the market value of your property has gone up enough. The tax rate for commercial property also fell to $26.02 from $28.18. The median commercial tax bill will fall by a nominal $3.

Residents may check the assessed value of their property in this list. If you believe the city has assessed your property’s value too high, you may apply for an abatement starting in January, in a brief window that lasts to Feb. 1. There are also some tax breaks available to seniors and veterans. The city will in the coming weeks begin examining loosening the guidelines for those exemptions for the first time since Bill Carpenter was mayor, O’Donnell said.

Youll Be Treated Like Family

We are focused on delivering unparalleled service. Youll see this in our literature, but its not a marketing strategy its a mindset deeply embedded in our DNA. Our goal is to provide such remarkable customer service that our customers feel compelled to remark upon it.

We are extremely proud of the many long-term customer relationships we have built. We strongly believe that our success is a direct result of putting the customer first and consistently listening to them. Delivering unparalleled customer service is the foundation of our company.

Also Check: Government Jobs In Williamsburg Va

Personal Property Tax Bills

Personal Property tax statements are normally mailed to owners in July of each year. If you do not receive your statement by September 1, please contact our office to request a duplicate. Property taxes not paid in full by January 5 following billing are assessed an interest charge of 2% for the month of January and an additional ¾ of 1% each month thereafter.

Rda Systems Constituent Portal: Property Tax Software For Government

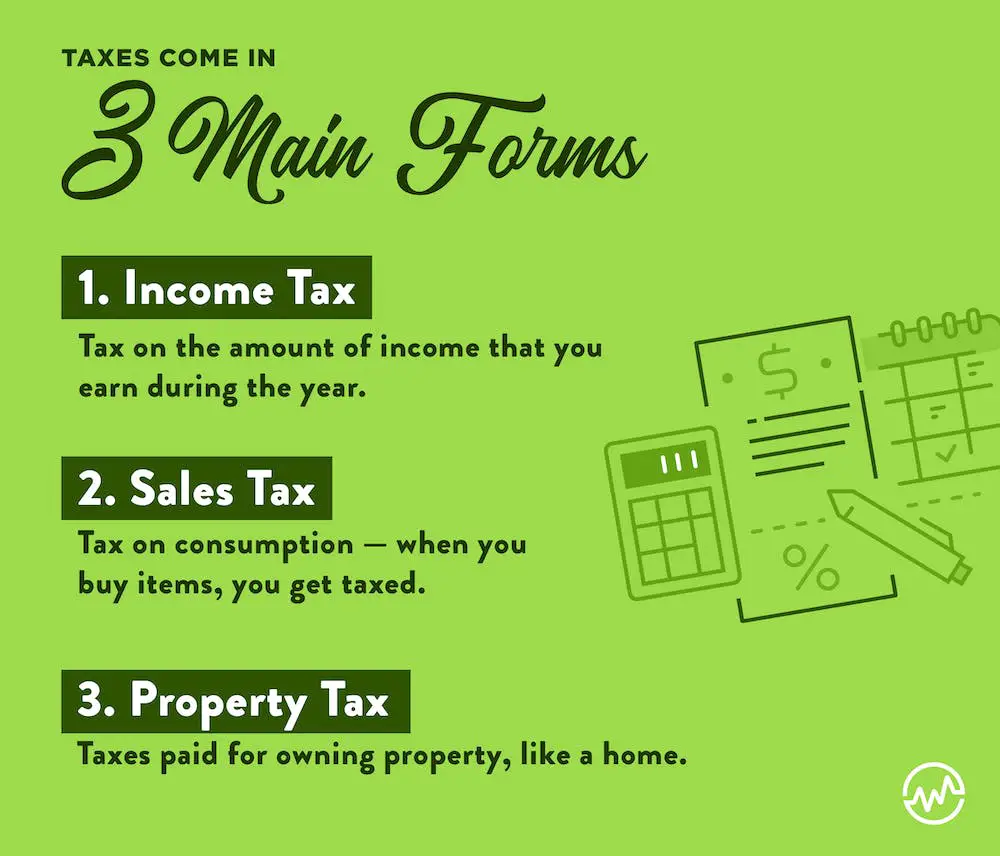

Local governments rely heavily on property taxes as a source of revenue. Treasury departments spend much of their time generating tax bills, processing payments, and following up on delinquent taxes.

The right government tax software can help treasurers increase revenue, decrease overhead and administrative burden, and help treasury staff manage entire billing, collection, and distribution processes.

To achieve this, local municipalities need property tax software for the government that is easy to use. Tools like RDA Systems Constituent Portal help automate key administrative functions, especially property tax collection.

Here are some of the benefits your agency will get from using the RDA Constituent Portal.

Easy and Secure Access

With RDA Systems Constituent Portal, taxpayers have easy and secure access to their personal property and real estate bills. They also have the convenience of making online payments.

This ability to collect tax payments online also benefits the local government, reducing the time needed to process taxes and other payments as well as manage receivables.

Real Estate Tax History

Tax collectors and treasurers can access the information and tools they need to keep detailed records throughout the tax process that are essential for accuracy and accountability.

Constant Updates

Harness Technology

Let the system do the work.

Also Check: Government Benefits For Small Business Owners

What Does Property Tax Fraud Software Reveal

Property tax fraud software reveals important connections, such as if someone is related to a value assessor in the area, that could point to property tax fraud. It can also help you skip trace individuals after property tax fraud moves to collections as well as uncover information, such as property records and address history, about the individual.

Make Property Tax Payment Easier For Everyone

Nobody likes paying taxes. Its one of the things that taxpayers dread, and the government can have a difficult time processing. However, when you have property records and past addresses available at the drop of a hat, it can be much easier to guide taxpayers through property tax payment.

Ideally, you want to use tools that make government processing easier for people. That includes public servants, government organizers, and taxpayers alike. The best way to make it easier for you to identify and fix property tax fraud, as well as make it easier for taxpayers to pay their property taxes, is to use Tracers.

You May Like: How To Get A Government Travel Card

Drive The Adoption Of Online Payments With Payits Government Revenue Collection Software

Agencies can deploy PayIt to digitize not only taxes but also utility bills, DMV transactions, court payments, licensing applications, tolling and more. PayIts software for government integrates with backend systems and is scalable to support increasing demands and new features.

Book a demo to learn more about our award-winning government revenue management solutions.

Bringing government and people closer through our award-winning digital platform.

Onesource From Thomson Reuters

ONESOURCE is a unique software that offers a property tax workflow center in addition to tracking assessments and bills. ONESOURCE enables administrators to assign tasks and responsibilities to specific team members, track their progress, and plan for the property tax team itself. ONESOURCE also offers:

- Complete audit trail that can be used for Sarbanes-Oxley compliance

- Payment tracking with automatic notifications in the event of increases

Don’t Miss: Government Jobs Fort Worth Tx

The Benefits Of Property Tax Collection

Important Documents

Keep land value changes organized

Delinquent Accounts

Manage delinquent accounts at the touch of a button

Quick Statements

Quickly process billing & owner statements

Statewide Vehicle Tax Transformation

North Carolina Department of Revenue

Vehicle registration fees and vehicle property taxes were being billed and paid separately, under a complex system in which each county was responsible for managing vehicle tax collections, while the state DMV collected registration fees. This led to data inconsistencies, duplicate costs and a steep erosion in voluntary compliancewith as many as 40% of vehicle owners not renewing or paying county taxes on time.

Rising to the challengeUsing the Arist platform, Farragut worked with the North Carolina Departments of Revenue and Transportation to launch North Carolinas Tag & Tax Together system. This created a consistent, convenient way to pay annual vehicle tag renewals and vehicle property taxes at the same timeleading to an annual revenue increase of $220 million.

Also Check: What Is Gsa Government Contracts

Bs& a Cloud Has Partnered With Microsoft Azure Data Centers

Nearly two-thirds of Fortune 500 companies use Microsoft Azure for their cloud computing solution, and an average of 1,000 customers are signing up every day. Azure provides high availability and redundancy because of Microsofts vast global footprint. Microsoft provides some of the most advanced security technology in the industry, so you can be confident your data is safely protected.

Avoid Property Tax Fraud With The Tools At Tracers

There are many ways in which property tax fraud can occur. Someone may underestimate the value of a property, thereby drastically decreasing the amount of tax they pay, or just lie on their tax forms. However, no matter how an individual commits property tax fraud, it still has a definite impact on the community and the local government, which means the government often prosecutes it. With the public records search engine at Tracers, its easier to root out and avoid property tax fraud.

You May Like: Easy Government Contracts To Win

We Have The Tools You Need

GUTS considers itself a solutions provider and not a software vendor. In other words, solutions designed by end users for end users. Every product and solution developed and implemented in our local government client sites was designed by subject matter experts from our client base. Since the development of our first product, GUTS has brought together a professional team of individuals to make our product and customer support more efficient and effective. We take pride in the software solutions we provide including CAMA and our Tax & Billing software.

Igov Services Property Tax Billing And Collection Cloud Based Software Includes All The Features Needed To Be Successful And Deliver Results

- Dashboards to analyze Billing, Collections and Delinquents for easy audits of starting, collections and ending values.

- Assessment Import Wizard for annual and supplemental assessment data.

- Integrated Mortgage features for tagging, bill files and combined payment file / single check import.

- Taxpayer public and private portal for history, bills and receipts.

- Email / text / web access to payoff statements and history saving 100s of phone hours and postage.

- Complete Collection automation

- Delinquent processing including automated penalty / interest and custom calculation rates.

- Sheriff Tax Sale processing plus audit / case controls

- Payment plans fully automated

We encourage you to participate in a real demonstration with our team.

Don’t Miss: Free Government Assistance For Home Repairs

Citizens Want To Pay Property Tax Online

One of Forresters predictions for 2022 is that 80% of consumers will see the world as all digital, with no divide. New citizen demands highlight the importance of a digital-first strategy for agencies of all sizes.

Equally important is the push toward digital equity. The U.S. infrastructure bill package, for example, included a $65 billion investment in bringing affordable high-speed internet to more Americans. The 2021 State of Cities report indicates that 24% of the communities saw improvements in the availability of broadband and digital connectivity, with this percentage reaching 34% in the case of core urban communities.

These digital trends reinforce the importance of deploying an efficient electronic government payment system, giving more convenience to residents and streamlining service delivery. As Gartner points out, more governments look at citizen experience as a key performance indicator . Offering consumer-grade services can help boost customer satisfaction and civic engagement.

Online property tax payments bring convenience to your residents. With a government payment platform, citizens can interact with agencies anytime and anywhere. Service delivery becomes quicker when there is no need to wait for mailed bills or receipts, or visits to government buildings or banks.

Benefits Of An Intuitive Tax Software

The need to modernize IT infrastructure and service delivery to keep up with the times is the main driver for digital government transformation, according to a Deloitte study.

Improving the tax collection system is a great starting point for a scalable government platform because taxes are a leading source of revenue for municipalities. Consider, for example, MyToronto Pay. Launched in 2022, the platform currently enables the citizens of TorontoCanadas largest cityto pay property taxes, parking violations and utility bills online, with more services coming in the next phase of the projects implementation.

With a modern government tax solution, agencies can:

- Increase compliance. By making it easier for citizens to pay taxes online, agencies boost their revenue collection and disburse funds faster.

- Improve employee productivity. Higher adoption of online payments and tax office workflow automation reduces manual tasks, such as payment processing and reconciliation efforts. Employees can redirect their attention to other essential projects.

- Minimize issues with legacy payment systems. Deficient legacy solutions often expose organizations to security risks and are a maintenance burden for the IT personnel.

Read Also: How To Get A Government Apartment

Obtain Information In The Best Way For You

There are plenty of ways that you can obtain information about someone you might think is committing property tax fraud. Whether you have a significant amount of evidence or youre only just starting your investigation, you should consider one of the three methods of gathering evidence that Tracers offers:

As you might imagine, each of these are most useful for a specific situation. Batch processing, for example, is great when you want to get small amounts of information about a number of people at once. Individual searches, on the other hand, works better when you want to delve into one person more deeply.

The Benefits Of The Right Revenue Recognition Solution

SOFTRAX Revenue Manager is an automated, cloud-based solution that eliminates spreadsheets and workarounds, reduces human errors, and increases the agility of your back office.

SOFTRAX Revenue Manager automates your most complex revenue management processes so your finance team can focus their skills on strategic analytical tasks condent that day-to-day tactical functions are being executed efciently, accurately, and compliantly.

SOFTRAX Revenue Manager introduces enterprise-level automated functionality to streamline the revenue recognition process, automate the complex requirements of ASC 606, and advance your path toward continuous accounting.

Don’t Miss: Government Grants For Cleaning Business

Your Property Tax Challenges Solved

Enterprise-grade property tax software built for real estate buyers and operators.

Forecast property taxes in real time.

Put your property tax bills on autopilot.

Maximize your savings with tax appeals.

Automatically review and analyze assessment data to identify savings opportunities.View your self-serve, vendor-served, and TaxProper-managed appeals in one place.Manage appeals throughout the property tax appeal lifecycle.

Streamline how you get assessment data.

Assessment and tax data automatically pulled in from local government offices.

How TaxProper Works

1. Search Your Address

2. File your appeal

Work With A Company That Knows How To Handle All Industries

Its important that you trust the company you utilize for your searching needs. After all, why would you work with a company that you dont trust? The good news is that Tracers is a longstanding master in the field of searches, no matter what industry. Tracers has options for all these industries:

Plus, this isnt an exhaustive list. Tracers software works with companies from all industries, including government agencies, and that makes it uniquely qualified to provide services if youre looking to uncover property tax fraud. This is a great option for anyone whos looking for a new way to rejuvenate their government department.

You May Like: Papa John’s Government Street

How Can I Get Started With Using Property Tax Fraud Software On My Own

To help your own agency get started rooting out property tax fraud, you should use a software like Tracers. Tracers works with companies from all industries, including government agencies, and that makes it uniquely qualified to provide services if youre looking to uncover property tax fraud.

Explore More Solutions

Improve Your Tax Collection System With An Integrated And Automated Platform

Paying property taxes shouldnt be time-consuming, so we made it fast and easy with our software for government. Whether you need a county revenue collection system or a municipal property tax software, we can help. Our GovWallet allows property owners to securely store their preferred payment methods and access digital versions of their documents and transaction history with just a few clicks.

Also Check: How Much Does The Government Take Out Of Your Check

Property Tax & Collections Software

The Harris Govern Property Tax & Collections Software provides a streamlined system and user-friendly interface that reduces the time and energy needed for processing and managing Property Tax & Collections.

Meet The Harris Govern Property Tax & Collections Software

Does Your Tax Collection Software Help You Increase Efficiencies in Your Office?

Property taxes are a vital source of revenue for local governments, so you need a comprehensive software that is easy to configure and use. Tax Collectors and Treasurers often spend lots of time and resources generating tax bills, processing payments, and managing delinquent taxes. This can result in missed revenue and increased government overhead.

The Harris Govern Property Tax & Collections software is perfect for tax accounting and tracking needs because it is comprised of four easy-to-use applications that simplify the entire process. Our software speeds up traditional local government billing and collections for real property, personal property, business occupancy, tax delinquency, excise, and individual assessment.

Imagine Being Able To:

Shape the future. Forget ill-fitting, off-the-shelf software and take-it-or-leave-it installations. Well create a solution formed around your specific needs and infrastructure.

Build from strength. Take advantage of our robust software foundationone thats already proven its mettle across multiple large, innovative implementations.

Work with experts. Were as conversant in tax code as we are in computer code. This combination of experience ensures we can keep up with all of your new ideas.

Control your destiny. Instead of vendor lock-in, you get full ownership, investment protection, and maintenance flexibility through source-code licensing.

With the right partnerone whos accountable, who does what they say and says what they mean, who youd trust with your professional lifethis isnt just possible its practical.

Don’t Miss: Florida Government Grants Small Business

Igov Services Cloud Based Tax Collection Software Focus Points

- Entire platform is integrated with real time data sharing so easily visualize a customer or location and all its tax revenue types history.

- Live Dashboards display collection, billing, delinquent and tax type specific data such as business filings, returns, extensions and more.

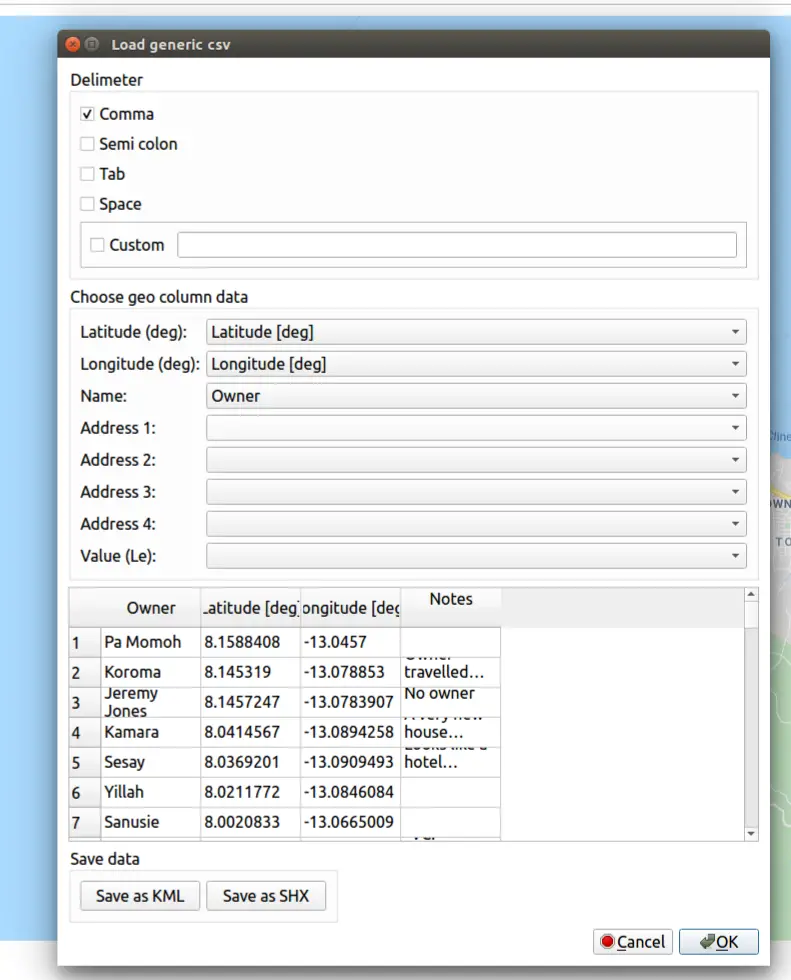

- Ready to Use Interfaces to import property assessments, lock box payments, mortgage files, GIS location data for our Google maps, Mutliple Credit Cared / eCheck/ ACH Formats and POS equipment.

- Easy Excel Template Data Conversion Tools to import your existing data and get started clean and accurate.

- Creative taxpayer delivery methods such as email / text / and mobile app eliminating over 100 phone call hours per tax season and reducing postage budget.