Government Protection Against Debt And Debt Collectors

One of the biggest government debt relief programs is the legal protections that it offers. This includes the Fair Debt Collection Practices Act , which limits the actions of debt collectors. If you are behind in payments, then the last thing you want to face is harassment from a debt collector. The FDCPA prohibits debt collectors from very specific behavior including the use of abusive or threatening language, and threats of arrest.

Another area that the government offers debt relief is through collection laws and statute of limitations. These offer you protection in the case of a lawsuit and a potential judgment. These laws are both state specific and relate to the type of debt and assets.

One final area that the government offers debt relief is through a court approved bankruptcy, either a Chapter 7 liquidation, or a Chapter 13 court payment plan. Bankruptcy is generally considered a last-resort solution and not many people can qualify for a Chapter 7 bankruptcy or complete a Chapter 13 bankruptcy.

Learn About The Types Of Personal Bankruptcy

Federal courts have jurisdiction over all bankruptcy laws, so you must file a petition in a federal bankruptcy court. There are two main types of personal bankruptcy:

- Chapter 13 lets people with a steady income keep their property. This bankruptcy plan allows filers to keep a mortgaged house or car they might otherwise lose in the bankruptcy process.

- Chapter 7 is known as straight bankruptcy. It involves liquidating all assets that are not exempt under federal or state law.

Will You Waive My Late Fee

Whether you plan to skip a payment or just need a few more days to get the money together, missing a due date can trigger a late fee in addition to interest charges. If you cant avoid missing a payment or paying late, its worth asking for a one-time waiver.

There are acouple other questions worth asking about a late payment, too.

- Will I be charged a penalty APR? Some credit card issuers may raise your interest rate when you miss a payment. The higher interest rate is known as a penalty APR. But if you miss a payment because of the financial impact of COVID-19, you could ask your credit card issuer if it would be willing not to charge a penalty APR due to the situation.

- Will you report my late payment to the credit bureaus? Even if your credit card issuer agrees to waive the late fee and interest charges, it could still report a late payment to the credit bureaus, depending on how late your payment is. When you talk to your card issuer, you should make sure to ask if they intend to do so.

Also Check: Us Government Global Entry Renewal

Are There Grants To Pay Off Debt

Government and other relief programs offer grants money that doesnt have to be paid back to help with living expenses and more, for those who qualify. While there are no government debt relief grants, there is free money to pay off debt in that it will help you pay bills, giving you more income to pay on credit card and other debt.

The biggest grant the government offers may be housing vouchers for those who qualify. The local housing authority pays your landlord directly. Other government programs that provide long-term and temporary financial help for bills include the Low Income Home Energy Assistance Program , Temporary Assistance for Needy Families , the Special Supplemental Nutrition Program for Women, Infants and Children , help to pay student loans, and more. Well look at these in more depth below, including how to find them.

Be wary of offers to buy lists of government grant programs. They are usually frauds. There is no government program for credit card debt relief and legitimate debt settlement and relief programs operate by strict rules.

How Does It Work For Credit Card Debt

Step by Step Instructions on How Debt Settlement Works »

Don’t Miss: If You Owe The Government Money

Weigh Your Options For Debt Relief

The credit counselors job is to provide all the information you need to make an informed decision to get out of debt. The counselor can help you understand how a debt management plan through a credit counseling agency will work. They will also explain how this solution differs from others, like debt consolidation, debt settlement, and bankruptcy.

Once they answer all your questions, you may decide to explore other options before you choose a solution. As you research other options, these free resources can help you zero in on the best solution for your needs.

Who Should Use A Debt Settlement Company

Most debt relief companies arent for bill-paying consumers who just want a discount. On the contrary, you really need to assess the pros and cons before deciding whether debt settlement programs are right for you.

If you cant afford your current debt payments due to an event like job loss or illness and either cant or wont file for bankruptcy, then debt settlement should be your last resort for getting your finances straightened out.

When your credit report is teeming with missed payments, creditors know that they might not receive any repayment from you without a costly lawsuit, so they might be willing to settle for less than the full amount you owe them.

But because debt settlement can damage your credit score for years to come, you really should treat this service as a last-ditch effort. And if you do have success with debt settlement programs, make sure you develop healthy personal finance habits going forward to create lasting change.

Related Content:

Don’t Miss: Free Government Cell Phones For The Elderly

How Does Credit Card Debt Forgiveness Affect Your Credit

The impact of credit card debt forgiveness on your will depend on the form of forgiveness involved.

If you negotiate a settlement and pay less than the original amount of the debt, the debt will be noted on your credit report as settled for less than the original amount. That will harm your credit.

If you negotiate a payment plan or a reduced interest rate, your account will remain in good standing and your will not be damaged.

You can minimize credit damage by contacting your creditor and negotiating as soon as possible. Start before you miss a payment. If you wait until youve missed multiple payments you will hammer your credit and risk having your account charged-off or sent to collections.

Health And Human Service Funding

The plan provides a scheme that will allow as many as 3.64 million uninsured people apply for health care tax credits. As many as 1.77 million will qualify for $0 marketplace coverage. ARPA spends $120 billion on vaccines, supplies, and disaster recovery, and another $20 billion on community health centers, public health workers, and mental health and substance abuse programs.

Also Check: The Handbook Of Board Governance

How Does Credit Card Debt Forgiveness Compare With Debt Settlement

The two are identical in two ways their program is built around a client paying less than what is owed and taking a negative hit on your credit score but thats about it for similarities.

The Credit Card Debt Forgiveness program already has relationships with creditors who may accept 50%-60% of the balance owed. When the agreement is signed, each monthly payment reduces the balance until it is paid off in 36 months.

Debt settlement negotiates with each creditor, usually over a 2-3 year period, and can only hope that creditors agree to accept 50%-60% payment. Also, the balance continues to grow during the 2-3 year period because of late payment penalties and interest charges.

The forgiveness program has equal payments spread over 36 months. If the client wishes to pay the sum off early, they can without penalty.

Debt settlement asks its clients to stop paying the creditor and instead make monthly payments into an escrow account, which will be used to make a lump-sum offer to settle the debt. In the meantime, the account balance is growing because of late payment fees and interest charges.

When you join a forgiveness program, youll know upfront if your creditors accept the terms.

Relief from a possible lawsuit is a great reason to consider Credit Card Debt Forgiveness.

So is the relief of knowing you can afford to pay off your debts.

Federal Student Loan Interest Rates

Interest rates vary by type of federal loan. The following table shows applicable interest rates for each type of federal loan:

|

Lowest Interest Rates |

|

|---|---|

|

Direct Subsidized Loans |

|

|

Direct Unsubsidized Loans |

Fixed at 6.54% |

|

Fixed at 7.54% |

Some federal student loans also have origination fees, which are paid proportionately from each loan disbursement.

Also Check: Rectangular Government Survey System Map

Relief Through Debt Management Plans

A debt management plan allows you to pay your unsecured debts typically credit cards in full, but often at a reduced interest rate or with fees waived. You make a single payment each month to a credit counseling agency, which distributes it among your creditors. Credit counselors and credit card companies have longstanding agreements in place to help debt management clients.

Your credit card accounts will be closed and, in most cases, youll have to live without credit cards until you complete the plan.

Debt management plans themselves do not affect your credit scores, but closing accounts can hurt your scores. Once youve completed the plan, you can apply for credit again.

Missing payments can knock you out of the plan, though. And its important to pick an agency accredited by the National Foundation for Credit Counseling or the Financial Counseling Association of America. Even then, make sure you understand the fees and what alternatives you may have for dealing with debt.

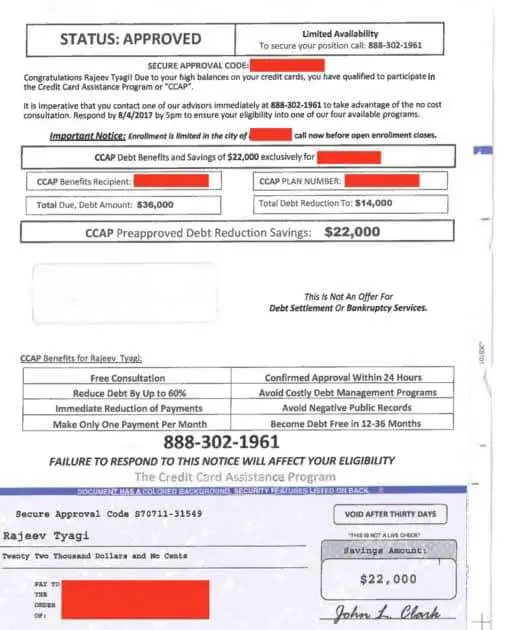

Beware Of Debt Settlement Scams

Some companies offering debt settlement programs may engage in deception and fail to deliver on the promises they make for example, promises or guarantees to settle all your credit card debts for, say, 30 to 60 percent of the amount you owe. Other companies may try to collect their own fees from you before they have settled any of your debts a practice prohibited under the FTCs Telemarketing Sales Rule for companies engaged in telemarketing these services. Some fail to explain the risks associated with their programs: for example, that many consumers drop out without settling their debts, that consumers credit reports may suffer, or that debt collectors may continue to call you.Avoid doing business with any company that promises to settle your debt if the company:

- charges any fees before it settles your debts

- touts a “new government program” to bail out personal credit card debt

- guarantees it can make your unsecured debt go away

- tells you to stop communicating with your creditors, but doesnt explain the serious consequences

- tells you it can stop all debt collection calls and lawsuits

- guarantees that your unsecured debts can be paid off for pennies on the dollar

Don’t Miss: Government Loans For Low Income Earners

How Can I Find Government Credit Card Debt Relief Programs

Youve probably seen ads on television telling you that you now have the right to settle your credit card debt, or touting a new government program to help with credit card debt. The fact is you have always had the right to negotiate debt with creditors . And while there are new government programs to help with pandemic-related financial hardships, they will not cancel your credit card debt.

There are, however, other ways to get credit card debt relief.

What Counts As A Government Employer For The Pslf Program

Any U.S. federal, state, local, or tribal government agency is considered a government employer for the PSLF Program. This includes employers such as the U.S. military, public elementary and secondary schools, public colleges and universities, public child and family service agencies, and special governmental districts .

A government contractor isnt considered a government employer.

You can visit our Public Service Loan Forgiveness Help Tool, which will help you determine if an employer is considered a qualifying employer under the PSLF Program.

You May Like: Free Government Watch List Search

Consult With An Attorney

If you’re dealing with liens on your property, wage garnishments, bank account freezes or even a lawsuit over your credit card debt, it’s a good idea to contact a debt attorney right away. Even if you choose not to hire an attorney, your initial consultation can help you determine the best course of action.

If you decide to hire an attorney, though, they can negotiate on your behalf, stopping the creditors from contacting you directly, and guide you through the legal process. They can also inform you of your rights and ensure that they remain protected.

Government Debt Relief For Medical And Hardship Situations

While there is no universal program to help with personal debt, some local programs help people in financial hardships. One of the main sources of financial hardship is due to illness and medical bills. Not only do people lose income, but medical debt can be costly. Left with no recourse, many people use up their savings and even run up credit card debt to pay their medical bills and get medical care.

The government has a website to help with medical and other bills. You can learn about state and federal health insurance programs that may help pay for bills or payment options. Here are some other areas that the government can offer relief: Paying for Telephone Service, Home Energy Bill, Medical Bills, Prescription Drug Costs, and Welfare or Temporary Assistance for Needy Families .

The government also provides information and programs about medical debt on their Medlinplus site. As the saying goes: “an ounce of prevention is worth a pound of cure.” While much of the information does not help with past debt, it may be possible to avoid some of the medical debt by arming yourself with knowledge.

Talk to Your Creditor

Anyone with secured debt should speak to their creditor as soon as they have a problem. Try to work out a plan that allows you to make your payments on time.

Read Also: Identity And Access Governance Solutions

Payday Loan Debt Relief

If youre in trouble with payday loans, then debt settlement is usually the best option. These debts carry rates of 300% or higher. Finance charges stack up quickly. You want to get out of debt for a percentage of what they say you owe.

That being said, if you have a few payday loans but most of your debt problems come from credit cards, you can include payday loans in a debt management program. This will consolidate the payday loans with your other unsecured debts. As a result, you can stop all those Direct Debit transfers that are draining your accounts and causing added fees.

On the other hand, if the bulk of your issues is with payday loans, use a debt settlement program.

Know Your Debt Collection Rights

If you have a debt in collection or a collector is attempting to contact you, it can make a tense time feel even more stressful.

Its important to first verify their identity to make sure its a legitimate collector, but you also have a number of rights and collectors can work with you on realistic repayment plans.

You May Like: Government Loans No Credit Check

Debt Settlement As An Alternative To Bankruptcy

Government Programs for Debt Relief

Filing for Chapter 7 or Chapter 13 Bankruptcy can plague you with a set of challenges, such as lawsuits, monetary judgments, or garnished wages which you may want to avoid, not to mention the long term impact on your credit score which it may incur. If you want to avoid bankruptcy, debt settlement is a viable and recommended alternative by the Federal Trade Commission. Under debt settlement, a debtor can receive a lump sum agreement or installment through which he or she will pay off debt at a reduced, fractional rate of the total account balance, perhaps at around half, or more or less depending on the debtors situation. Though debtors can hire a firm to help with creating a debt settlement plan, the FTC warns against for-profit firms as they are often out to scam debtors. Debtors can create their own self-managed debt settlement plan or look into free credit counseling agencies.

Read Also: What Is Of306

Tip No : Get A Good Feel From Your Initial Consultation

Most debt relief services offer free consultations. That way, they can evaluate your debt, credit, and finances to see if they can help you. But outside of finding out if youre eligible, use these consultations to get a read on companies you contact.

Make sure that you feel comfortable and confident after the consultation. If they leave you with more questions than answers, or you have a sinking feeling that something is wrong, dont move forward! Trust your gut and only work with someone that engenders trust.

And always keep in mind, that these consultations are free with no obligation. So, although the representative may push you to sign up immediately, theres no requirement to do so. You can thank them for their time, hang up and take time to consider what you want to do. You should never feel rushed or pressured into making a decision. Back to top

You May Like: Low Interest Government Home Loans