Q What Improvements Qualify For The Residential Energy Property Credit For Homeowners

A. In 2018, 2019, 2020, and 2021, an individual may claim a credit for 10% of the cost of qualified energy efficiency improvements and the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year .Qualified energy efficiency improvements include the following qualifying products:

- Energy-efficient exterior windows, doors and skylights

- Roofs and roof products

What Are Some Of The Top Programs In The United States That Help People Go Solar

In addition to the federal solar tax credit program available to all Americans, many states have very good incentive programs available. Vermont, for example, has an Investment Tax Credit option that also offers up to 30% of eligible costs. In New Jersey, electricity consumers can enjoy up to $936 per year in cost savings as a result of the various programs, while in Arizona and Alabama you receive a $1,000 installation incentive and ongoing benefits for the next 10-20 years.

Looking For Free Solar Panels Try Financing Your System With A Solar Loan Instead

The revolutionary thing about solar leases was that they made it possible for virtually anyone with a roof to go solar, regardless of whether they had cash in the bank to purchase a system. Solar leases were crucial in removing barriers to entry back when solar system prices were prohibitively high.

But times have changed substantially since solar leases were introduced. Solar systems are now more affordable than ever, now that financing options other than solar leases have become viable. The most important of these is the solar loan, which combines the zero-down aspect of the solar lease with the benefits of system ownership .

The falling cost of solar

So before you sign up for the first free solar panel or no cost solar program deal that comes your way, make sure you understand what youre being offered and that youve considered all of your other options. In other words, be a smart solar shopper.

You May Like: Government Housing For Senior Citizens

Cant Wait For Laws To Pass

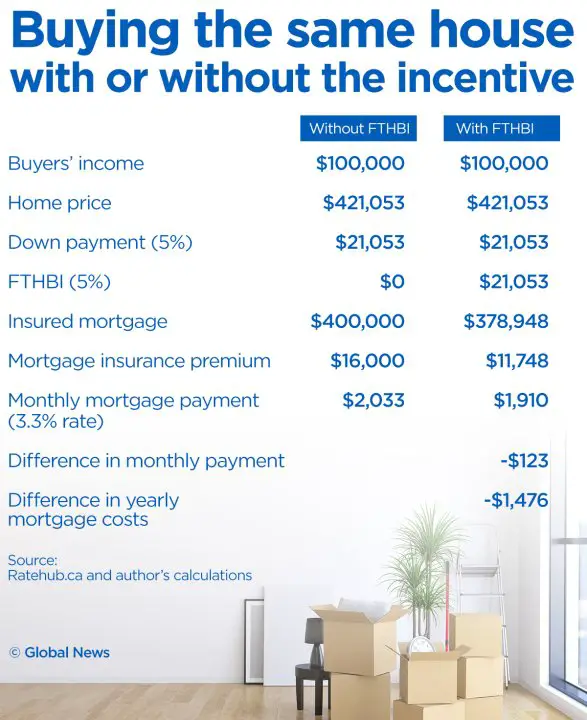

Dont let Congress make you wait. The FHFA First-Time Home Buyer Mortgage Rate Discount is available and will save you money.

Plus, buyers can use low- and no-money-down mortgages to purchase homes and combine them with local first-time home buyer programs and grants.

Get pre-approved for a mortgage today.

Dan Green

Dan Green is a former mortgage loan officer and an industry expert. He’s appeared on NPR and CNBC, and in The Wall Street Journal, Bloomberg, and dozens of local newspapers. Dan has helped millions of first-time home buyers get educated on mortgages, real estate, and personal finance. Have mortgage questions? Ask Dan in the chat.

Federal Income Tax Credits And Other Incentives For Energy Efficiency

**UPDATE 08/18/2022** As part of the Inflation Reduction Act of 2022 signed into law on August 16, 2022, residential energy efficiency tax credits have been extended through 2032. This information applies to the existing tax credits for 2022. Changes to residential energy efficiency tax credits under the Inflation Reduction Act will become effective starting in 2023. Please bookmark this page, as we will be updating the information here by the end of the year.

Tax credits for residential energy efficiency and those for builders of energy efficient homes were extended retroactively, through December 31, 2022. Tax deductions for energy efficient commercial buildings allowed under Section 179D of the Internal Revenue Code were made permanent under the Consolidated Appropriations Act of 2021.

The tax credits for residential renewable energy products are now available through December 31, 2023. Renewable energy tax credits for fuel cells, small wind turbines, and geothermal heat pumps now feature a gradual step down in the credit value, the same as those for solar energy systems. As of 2021, biomass fuel stoves are included in tax credits for residential renewable energy products.

ENERGY STAR certified products are independently certified to save energy, save money and protect the environment – and are available in more than 75 product categories.

Also Check: Government Jobs In Billings Montana

Utility Bill Rate Design

Good electricity rate design allows you to save money when you save energy. This might sound intuitive but not all provinces are same. Superior designs have low fixed monthly fees and tiered electricity rates. Inferior designs have high fixed fees and flat electricity rates.

Ontario scores near the front of the pack when it comes to these factors having time-of-use rates and fixed monthly fees of $26 .

For example, reducing your electricity bill from 1,500 to 750 kWh per month will save you 54% on your electricity bill in British Columbia, 48% in , but only 43% in Ontario!

Note that fixed monthly fees dont disappear even if you switch to solar youll pay them as long as you remain connected to the grid. But this isnt a bad thing $26/mo is a small price to pay for using the grid as your back-up energy source!

The only way to completely remove your fixed costs is to go off the grid, something most homeowners in Ontario dont do because of high battery costs.

Disconnecting from the grid also means that you wont be able to participate in your utilitys net metering program.

Solar Information & Programs

Learn about how solar energy works and available incentive programs in Massachusetts

Many people have the misconception that solar systems do not work in Massachusetts, due to New England’s diverse weather conditions. However, the experts agree that Massachusetts is an excellent location for solar systems. This section describes the different types of solar energy and how they are used in Massachusetts. In addition, find out what solar programs and incentives are currently available for your home, business, or institution.

Also Check: How To Get Free Housing From The Government

Solar Renewable Energy Credits

Some states have a particularly strong focus on renewable energy, and their local utilities are obliged to meet quotas regarding the amount of energy that they produce from solar and other renewable sources.

This requirement has given rise to the solar renewable energy credit or . Households with solar systems capable of producing more than 1 MWh of electricity can claim SRECs. You can sell in addition to selling them your electricity. Its a kind of extra reward for going with solar power.

Also Check: Government Jobs Las Vegas Nevada

How Do Other Incentives I Receive Affect The Federal Tax Credit

For current information on incentives, including incentive-specific contact information, visit the Database of State Incentives for Renewables and Efficiency website.

Rebate from My Electric Utility to Install Solar

Under most circumstances, subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law. When this is the case, the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit. For example, if your solar PV system was installed before December 31, 2022, cost $18,000, and your utility gave you a one-time rebate of $1,000 for installing the system, your tax credit would be calculated as follows:

0.26 * = $4,420

Payment for Renewable Energy Certificates

When your utility, or other buyer, gives you cash or an incentive in exchange for renewable energy certificates or other environmental attributes of the electricity generated , the payment likely will be considered taxable income. If that is the case, the payment will increase your gross income, but it will not reduce the federal solar tax credit.

Rebate from My State Government

0.26 * $18,000 = $4,680

State Tax Credit

For example, the net percentage reduction for a homeowner in New York who claims both the 25% state tax credit and the 26% federal tax credit for an $18,000 system is calculated as follows, assuming a federal income tax rate of 22%:

0.26 + * = 45.5%

Don’t Miss: Key West Hotels Government Rates

The Bottom Line: Your Property Must Be Located In Canada And Must Be Suitable And Available For Full

Other details you need to know

The Incentive may be associated with additional costs:

- Additional legal fees: Your lawyer is closing 2 mortgages so you may be charged higher fees.

- Appraisal fees: To repay your incentive, you may need to have an appraisal done to determine the fair market value of your home.

- Other fees: Additional fees may be incurred throughout the life cycle of the incentive, like switching your first mortgage to a new lender or refinancing your first mortgage.

- Property Insurance premiums: Additional costs may be incurred to account for an additional mortgage registered on the property. Talk to your insurance broker or insurance provider to find out more details.

Why Solar Panels Are Important

Solar panels are now the new invention and investment to make sure our next generation is going to get a greener and better future. Solar panels are electricity generation outfits and it is a source of clean energy. this source of energy can make sure someone is self-reliant and helps reduce the cost of energy. surely people are motivated to use solar panels because it is saving money and the environment as well.

Additionally, the government of the United States of America always put importance on green and clean energy and they have so many programs to let the program work vigorously. So here are some benefits to using solar panels.

Saving Energy Bills: when you are passing a bad situation due to counting much money to pay energy bills, solar panels can be one of the important paths to reduce or eliminate energy bills. Solar panels now are powerful to run all types of electronics or appliances such as fridges, AC, and other types of appliances. But it is important to balance with the natural energy and use of the solar panel.

Tax Credits and Rebates: Energy is limited and everyone should save energy for the betterment of the world and the next generation. Surely the source of energy comes from coal, gas, oil, and other fossil components. These are limited and people should reduce their dependency on energy and learn to use natural and clean energy.

Also Check: Dental Grants For Implants

Recommended Reading: Government Grant Money For Small Business

Gst/hst New Housing Rebate

You may qualify for this rebate allowing to recover part of the GST or HST that you paid on the purchase price or cost of building your new house, on the cost of substantially renovating or building a major addition onto your existing house, or on converting a non-residential property into a house.GST/HST New Housing provides all of the details on this rebate.

Q Are There Incentives For Making Your Home Energy Efficient By Installing Alternative Energy Equipment

A. Yes, the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property. Qualifying properties are solar electric property, solar water heaters, geothermal heat pumps, small wind turbines, fuel cell property, and, starting December 31, 2020, qualified biomass fuel property expenditures paid or incurred in taxable years beginning after that date. Only fuel cell property is subject to a limitation, which is $500 with respect to each half kilowatt of capacity of the qualified fuel cell property. Generally, this credit for alternative energy equipment terminates for property placed in service after December 31, 2023. The applicable percentages are:

Don’t Miss: Government Loans For Private Schools

Looking For More Homebuying Information

Take a moment to browse through our wealth ofhomebuying information. Youll find everything you need, from mortgage calculators, to home hunting worksheets.

- Homebuying Step by Step: Everything you need to buy a home in Canada.

- Condominium Buyer’s Guide: This Guide will give you the basic background information you need to figure out if condominium ownership is really for you.

- Financial Information and Calculators: Mortgage information, home buying calculators and government programs for buyers.

- Seniors Housing: Specific details on housing and financial information for people aged 55 and over.

- Newcomers: Everything newcomers to Canada need to know about homebuying.

- Mortgage Loan Insurance for Consumers: Details on costs, qualification requirements, product options, CMHC Green Home and more.

- Accessible and Adaptable Housing: Get more information about housing enabling people of all ages and abilities to stay in their community as long as possible.

CMHC providesmortgage loan insurance. This lets you buy a home with a minimum down payment starting at 5% with interest rates comparable to those with a 20% down payment. Ask your mortgage professional about CMHC.

The National Homebuyers Fund

The National Homebuyers Fund is a non-profit public benefit corporation that sponsors home buyers with up to 5 percent of a homes purchase price. In exchange for cash, home buyers agree to live in their home and make payments for five years, at minimum.

Renters cannot directly apply for the National Homebuyers Fund grant only your mortgage company can do it. Call 444-2615 to get a list of participating lenders.

Recommended Reading: How To Apply For Government Funding For Small Business

Challenges And Next Steps

The LMI solar policy landscape is evolving rapidly as all levels of government are experimenting with various policies and financing mechanisms to expand access to solar power. In spite of this increased attention, though, extending solar access to LMI communities remains challenging. Washington, DCs Affordable Solar Program, for example, is fully subscribed in the current round at 140 residences, but potential for expanding the program may be limited absent additional funding for the direct incentive. On the community solar front, New York and Colorado have tried different market support mechanisms and encountered challenges in addressing market needs, leading to program redesign and, in some cases, de-emphasizing the LMI market. Multifaceted approaches that simultaneously address the myriad challenges that LMI communities grapple with in pursuing solar power may offer a path forward.

Town Of Amherst Clean Energy Financing Program

If you live in the Town of Amherst, you could qualify for financing between $15,000-$25,000 to allow homeowners install efficiency and clean energy upgrades with a low lending rate and payments can be spread over a period of 10 years. To learn more or to apply, visit www.CleanEnergyFinancing.ca or call toll-free 1 727-7818.

Don’t Miss: Government Tax Programs That Pay You To Improve Your Home

What Kinds Of Incentives Are Available

The first point to note is perhaps an obvious one, but its worth saying. Nobody is just going to come to your house and install a solar system for free.

While there are lots of ways you can get financial help with the purchase of your solar system, it will take some careful planning, and you need to be aware of what is available to you before you get started with looking at designs. Lets go through all of the different options that might be available to you. You

What Solar Programs Help The Us Workforce

The shift to solar isnt only affecting residential and commercial installations, but its also opening up thousands of jobs. The National Solar Jobs Census shows 250,000 Americans were employed in solar in 2019. To support this growth, some solar programs exist to help train and deploy workers in the field. Some of these include:

- Solar Ready Vets, which is a program created by the Department of Energys SunShot Initiative. It enables service members on active duty a 5- to 6-week course teaching them about all aspects of the solar industry, ahead of their return to civilian life.

- The Solar Training Network coordinates and promotes a number of training programs aimed at helping Americans gear up for the industry and find work.

- A Women in Solar installation training program supported by Grid Alternatives gives women workers the chance to develop their leadership abilities and gain access to solar job opportunities.

There are also a number of other programs funded by the National Science Foundation, the Department of Labor and the Department of Energy, which offer workforce and training opportunities.

Also Check: How To Buy Used Government Vehicles

Am I Eligible To Claim The Federal Solar Tax Credit

You might be eligible for this tax credit if you meet the following criteria:

- Your solar PV system was installed between January 1, 2017, and December 31, 2034.

- The solar PV system is located at a residence of yours in the United States.

- You own the solar PV system .

- Or, you purchased an interest in an off-site community solar project, if the electricity generated is credited against, and does not exceed, your homes electricity consumption. Notes: the IRS issued a statement allowing a particular taxpayer to claim a tax credit for purchasing an interest in an off-site community solar project. However, this document, known as a private letter ruling or PLR, may not be relied on as precedent by other taxpayers. Also, you would not qualify if you only purchase the electricity from a community solar project.

What Is A Tax Credit

A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000. The federal tax credit is sometimes referred to as an Investment Tax Credit, or ITC, though is different from the ITC offered to businesses that own solar systems.

You May Like: What Is A Government Watch List Notice