Food Stamps And Meal Programs During The Covid

Because of the COVID-19 pandemic, it may be easier for you and your family to get food stamps and take part in meal programs. Contact your state’s social services agency to see if you’re eligible.

During the pandemic:

-

Food stamp recipients may receive additional funding. More people may be eligible to receive SNAP during the pandemic than normally.

-

Parents whose kids’ schools are closed can pick up school meals for their kids to eat at home.

-

People can enroll in food programs remotely rather than in person. This applies to programs for pregnant women, families, seniors, and people with disabilities.

What Your Loan Servicer Must Do If You Request Forbearance

If you’re having trouble making payments on your federally backed mortgage because of the COVID-19 pandemic, contact your loan servicer. They must:

-

Defer or reduce your payments for six months if you contact them to make arrangements.

-

You can request an extension if you need it. For most loans, your forbearance can be extended up to 12 months.

Offer options for how you can make up the deferred or reduced payments. They will discuss these options with you at the end of your forbearance period.

Types Of Federal Student Loans

There are several types of federal student loans, including:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans, of which there are two types: Grad PLUS Loans for graduate and professional students, as well as loans that can be issued to a student’s parents, also known as .

These federal student loans are available through the Federal Direct Loan Program. Since federal loans offer different benefits than private student loans, you should always explore them first.

Learn more about the three types of federal student loans:

Read Also: What Kind Of Government Grants Are Available

My Government Loan Application Was Denied What Can I Do Next

There are a few things that you can try:

- Apply for reconsideration. Some loans allow applicants to apply for reconsideration if an unmet requirement has now been met. For example, under the Bayanihan CARES 2 program, part of the requirements is Must not have any unresolved negative credit dealings. If you were previously denied but can now show proof that all negative credit dealings have been resolved, then you can reapply.

- Consider other government loans available. If there are other government loans available that fit you and your requirements, then you can apply to them next.

- Check out your business loan options from banks and private lenders. For example, Radiowealth Finance Co. has flexible loan options due to their low loan limit of PHP 10,000.

Everything You Need To Know About The Student Loan Forgiveness Plan

Following more than a year of debate within the administration, President Biden said in late August he would cancel $10,000 in federal student loan debt for borrowers making under $125,000 a year or couples making less than $250,000 a year.

Evan Vucci/AP

People who received federal Pell Grants in college, which are awarded to those from low-income households, also will be eligible for up to $20,000 in forgiveness. Around six in 10 borrowers with any federal loans also received a Pell Grant, according to the White House.

Seth Wenig/AP

The plan will forgive debt for tens of millions of Americans, providing unprecedented relief for borrowers but is certain to draw legal challenges and political pushback.

Shawn Thew/EPA/Shutterstock

Who Qualifies for Bidens Plan, and What It Means for Borrowers

The plan is expected to benefit the majority of the more than 43 million people in the U.S. who hold a total of $1.6 trillion in student loan debt. Only federal debt is eligible.

Erin Clark/The Boston Globe/Getty

In addition to the loan forgiveness, the president will also be extending the pandemic-era student loan pause on payments and interest through the end of the year.

Stefani Reynolds/AFP/Getty

When will forgiveness take effect?

The timing remains uncertain, but the Education Department has promised more details in the weeks ahead, at minimum before student loan payments resume in January 2023.

Read Also: How Much Does Government Disability Pay

Cares For Travel By Dti & Sb Corp

a. Best For: MSMEs in the tourism industry hit by the COVID-19 pandemic.

b. Overview: CARES for TRAVEL is part of the Bayanihan CARES program that is focused on the recovery of the tourism industry. SB Corp, in partnership with the DOT, will provide tourism MSMEs with zero interest, no collateral loans.

c. Loan Amount: PHP 10,000.00 to PHP 5 million depending on the asset size, annual sales of the business, as well as the submission of BIR-filed financial statements.

- Micro: Up to PHP 600,000

- Small: Up to PHP 3 million

- Medium: Up to PHP 5 million

d. Loan Term: 1 to 4 years depending on the loan amount.

e. Interest Rate: Zero interest rate, no collateral

f. Repayment Terms: A service fee of 4% to 8% depending on the loan term and amount borrowed

g. Application Process: Same application process as Bayanihan CARES 2.

h. Requirements: Same requirements as Bayanihan CARES 2

What Is A Grant From The Government

A grant is one of the ways the government funds ideas and projects to provide public services and stimulate the economy. Grants support critical recovery initiatives, innovative research, and many other programs. You can find a list of projects supported by grants in the Catalog of Federal Domestic Assistance . You can also learn about the federal grant process and search for government grants at Grants.gov.

You May Like: How To Win Government Bids

Why You May Not Want To File An Amended Tax Return

Here’s a potential workaround for borrowers in this example: The couple could file an amended tax return for 2020 or 2021. They would elect to file two tax returns as instead of a joint return. This way, the lower-earning spouse would qualify based on their income.

“Amending the return would get the forgiveness,” said LaBrecque, who is the head of planning strategy at Sequoia Financial Group.

However, borrowers shouldn’t necessarily scramble to file an amended return, he added.

For one, the government hasn’t yet offered key details about certain aspects of the forgiveness plan. For example, while some borrowers may get automatic relief, many others will have to apply and that application isn’t set to be released until early October.

It’s possible the government could issue rules that allow a lower-earning spouse in the above example to qualify for forgiveness based on their individual income instead of joint income. This would render an amended tax return unnecessary, if it occurs.

“I would say wait until we hear more, if you are in that position,” LaBrecque said. “If no guidance is issued, then amending will work.”

Here’s an illustration of potential federal tax consequences, provided by LaBrecque. The analysis assumes each spouse takes a standard deduction.

Resources For Borrowers Seeking Student Loan Forgiveness

- To learn more about the Biden administrations one-time debt cancellation initiative, visit the Education Departments dedicated website.

- To learn more about the Limited PSLF Waiver, visit the Education Departments dedicated website.

- To explore or complete Direct loan consolidation, go here.

- To start the process of completing PSLF Employment Certification forms, use the Education Departments PSLF Help Tool.

- To submit a PSLF reconsideration request, go here.

Don’t Miss: What Is Gsa Government Contracts

When Can I Apply

Next month. That’s nebulous but Secretary of Education Miguel Cardona tweeted out on September 5 that the application will open up in “early October.” In the meantime, you can sign up at the Federal Student Aid website to make sure all your information is up to date.

Just 3 steps and you can see student loan debt relief.

Secretary Miguel Cardona

People must apply before November 15 to be eligible for loan forgiveness before the December payment pause ends. The White House said that “the application will be available no later than when the pause on federal student loan repayments terminates at the end of the year.”

Where To Find Business Grants

Below is a list of some of the most robust resources for finding grants that can aid your business:

- SBA.gov is one of the top places to search for grants. The government site is filled with various grant and financing opportunities.

- Grants.gov is the ultimate database for federal grants. You can search for grants by funding type, eligibility, category and agency. Be forewarned: Sorting through the database will require some effort, but the potential payoff is that you may find a grant opportunity that is perfect for your company.

- The Economic Development Administration administers grants for economically depressed communities to stimulate new jobs and commercial growth.

- Similarly, Small Business Development Centers offer local resources that can help your business.

In the wake of the coronavirus, there are resources, including federal and private funding sources, that are helping businesses cope with the drastic economic contraction that is affecting the world.

- Economic Injury Disaster Loans are administered by the SBA and can provide businesses with working capital to pay employees, rent and other expenses.

- In addition to government loans, companies like Verizon have created funds that provide grants to small businesses.

Don’t Miss: Government Assistance Programs In Alabama

Do Your Research & Choose Which Government Loan Fits Your Need

Not all government loans are available for everyone. For example, the Bayanihan CARES 2 program prioritizes MSMEs hit by the pandemic, while the HEROES program is only available for OFWs. So, you should make sure to do your research and prepare accordingly.

When choosing a government loan, make sure that the loan amount, loan term, interest rate, and other pertinent details match your plan.

Other Types Of Help If Youre Homeless

Visit Benefits.gov to find out if youre eligible and how to apply for other types of help. This may include financial assistance, transportation, food, counseling, and more.

If you dont have medical insurance, you can use HRSA health centers. They give checkups, treatment when youre sick, pregnancy care, and immunizations for your children.

You May Like: Colt 45 Series 80 Government Model

Get Help With Utility Bills

Need help paying your heating or phone bill? These programs may be able to help:

-

The Low Income Home Energy Assistance Program helps low-income households cover heating and cooling costs. Grants are issued via states, which receive funding from the Department of Health and Human Services. Each state sets its own eligibility requirements, including income levels.

-

The Lifeline program offers discounted phone or internet service. You must meet certain eligibility requirements.

Search For Financial Assistance From The Government

Benefits.gov is a free website that can help you determine which types of government assistance you might qualify for. You can also find out how and where to apply.

- Using the Benefit Finder, answer questions about yourself and your needs. Afterwards, you can find out if youre eligible for programs to help you pay for:

- Utilities and other necessities

Check back with Benefits.gov in the future to see if youre eligible for additional benefits. You can report major life events or see if new benefit programs have become available.

Don’t Miss: Unclaimed Money From The Federal Government

Tata Capital’s Home Loan Offering Popular For Its Low Interest Rates And Simple Application Process Also Provides A Seamless Home Balance Transfer Process You Can Now Move Your Home Loans From Other Financial Institutes To Tata Capital Without Much Hassle If Your Existing Home Loan Carries A Higher Rate Of Interest Know That You Can Easily Switch Lenders By Opting For A Home Loan Balance Transfer A Balance Loan Transfer Lets You Transfer The Existing Loan From One Bank To Another To Avail Better Interest Rates And Loan Terms Not To Mention It Has Become A Convenient And Affordable Option Since Rbi Removed Foreclosure Penalties

Mumbai , September 20 : Tata Capital’s Home Loan offering, popular for its low interest rates and simple application process, also provides a seamless home balance transfer process. You can now move your home loans from other financial institutes to Tata Capital without much hassle. If your existing home loan carries a higher rate of interest, know that you can easily switch lenders by opting for a home loan balance transfer. A balance loan transfer lets you transfer the existing loan from one bank to another to avail better interest rates and loan terms. Not to mention, it has become a convenient and affordable option since RBI removed foreclosure penalties. According to RBI guidelines, lending institutions cannot levy a penalty on individuals for foreclosure or prepaying home loans at floating interest rates. Earlier, borrowers avoided prepaying a loan because of higher prepayment charges. But now, this guideline allows borrowers to avail lower interest rates offered by other lenders by opting for a home loan balance transfer. Hence, reducing your EMIs and making your home loan much more affordable. Should you go for a loan balance transfer? What are the factors to consider? Benefits Of Home Loan Balance Transfer

A few things you must consider before transferring your home loan to a new lender. 1. Credit Score

Claim Your Approved Loan & Plan For Repayment

Once your loan is approved, follow the guidelines from the government institution on how to get your funds. Each institution has different modes of fund release. For example, Land Bank releases the loan amount in lump sum or staggered release through the borrowers bank account.

Lastly, if you did Step 1 correctly, you should have a plan on how to pay the loan on time. Make sure to follow through on your repayment plan and have a backup plan as necessary.

Also Check: Where Do I Get A Government Phone

Application Process For $10000 Or $20000 In Student Loan Forgiveness Under Biden Initiative

Under Bidens one-time debt cancellation initiative, millions of borrowers with government-held federal student loans will be eligible for up to $20,000 in federal student loan forgiveness. Borrowers who received Pell Grants can get the maximum loan forgiveness amount, while borrowers who did not receive Pell Grants can still get up to $10,000 in debt cancellation. Eligibility is restricted to borrowers who earned less than $125,000 in either 2020 or 2021.

The Education Department will be releasing a student loan forgiveness application in just a few weeks, and it should be available on StudentAid.gov. Borrowers will have until December 31, 2023 to apply. The application is expected to be a simple attestation of income. While the administration says some student loan forgiveness will be provided to borrowers automatically if the Education Department already has a borrowers income data, all borrowers are encouraged to submit an application.

What Is A Government Loan

The U.S. government offers loan programs through different departments to support the needs of individuals, businesses, and communities. These loans provide capital for those who may not qualify for a loan from a private lender. Government loan programs can help:

- Improve the overall national economy and quality of life of its citizens

- Encourage innovation and entrepreneurship

- Improve the countrys human capital

- Reward veterans and their dependents for past contributions and help with present needs

Individuals and small businesses with little or no seed capital or collateral may find the terms for a private loan unaffordable. Low-cost government loans attempt to bridge this capital gap and enable long-term benefits for the recipients and the nation.

Also Check: How To Buy Government Property

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

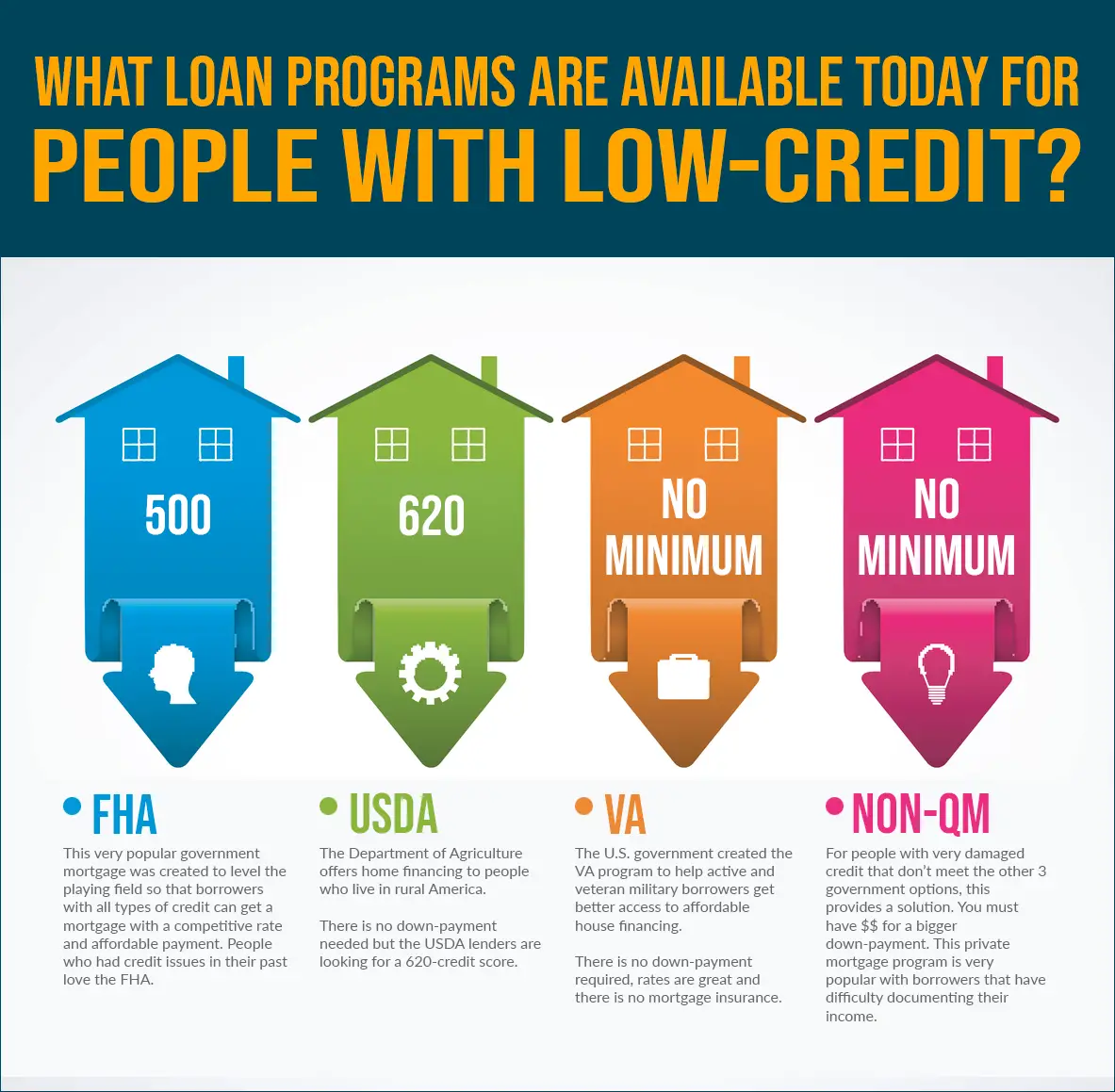

Private Vs Government Loans

Private loans, made by a private lender like a bank or credit union, are different than government loan programs. It may be more difficult for certain borrowers to qualify for loans through private lenders.

For example, a private mortgage lender may require good credit scores and a large down payment. But you might be able to qualify for an FHA mortgage with a lower down payment and flexible credit qualification.

Also Check: Personal Loans For Federal Government Employees

Fact Sheet: President Biden Announces Student Loan Relief For Borrowers Who Need It Most

A three-part plan delivers on President Bidens promise to cancel $10,000 of student debt for low- to middle-income borrowers

President Biden believes that a post-high school education should be a ticket to a middle-class life, but for too many, the cost of borrowing for college is a lifelong burden that deprives them of that opportunity. During the campaign, he promised to provide student debt relief. Today, the Biden Administration is following through on that promise and providing families breathing room as they prepare to start re-paying loans after the economic crisis brought on by the pandemic.Since 1980, the total cost of both four-year public and four-year private college has nearly tripled, even after accounting for inflation. Federal support has not kept up: Pell Grants once covered nearly 80 percent of the cost of a four-year public college degree for students from working families, but now only cover a third. That has left many students from low- and middle-income families with no choice but to borrow if they want to get a degree. According to a Department of Education analysis, the typical undergraduate student with loans now graduates with nearly $25,000 in debt.

- Provide relief to up to 43 million borrowers, including cancelling the full remaining balance for roughly 20 million borrowers.

These reforms would simplify loan repayment and deliver significant savings to low- and middle-income borrowers. For example: