Disadvantages Of Medicare Advantage Plans

In general, Medicare Advantage Plans do not offer the same level of choice as a Medicare plus Medigap combination. Most plans require you to go to their network of doctors and health providers. Since Medicare Advantage Plans cant pick their customers , they discourage people who are sick by the way they structure their copays and deductibles.

Although Mom saw her MA premiums increase significantly over the years, she didnt have any real motivation to disenroll until after she broke her hip and required skilled care in a nursing facility. After a few days, the nursing home administrator told her that if she stayed there, she would have to pay for everything out of her own pocket. Why? Because a utilization review nurse at her MA plan, who had never seen or examined her, decided that the care she was receiving was no longer medically necessary.

Because there are no commonly used criteria as to what constitutes medical necessity, insurers have wide discretion in determining what they will pay for and when they will stop paying for services like skilled nursing care by decreeing it custodial.

Medicare Advantage Plans: The Cost Of Coverage

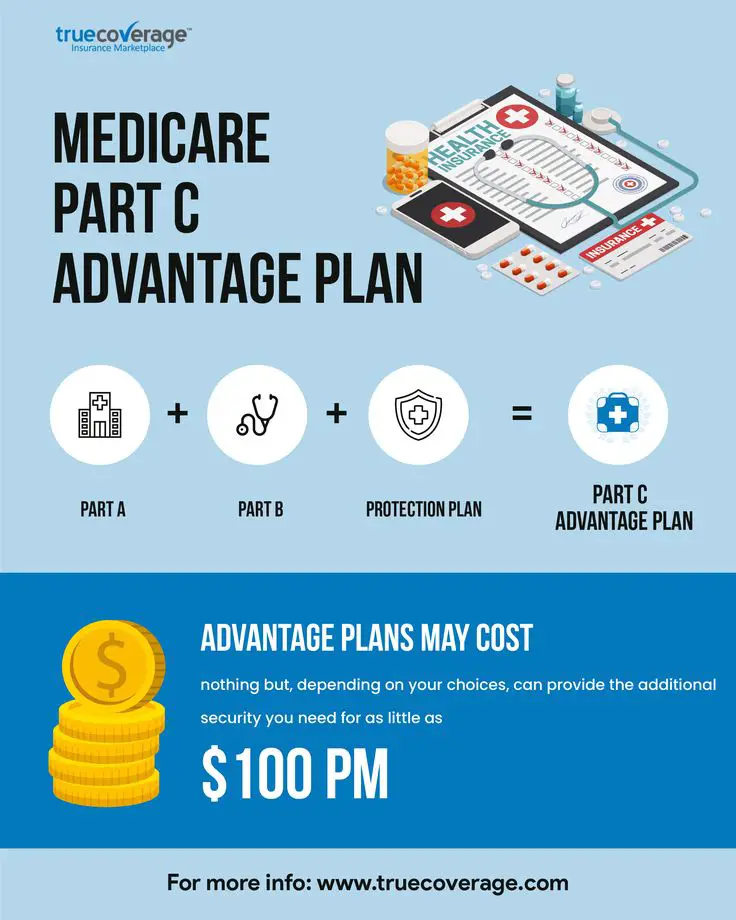

If you enroll in a Medicare Advantage plan, you will continue to pay your Medicare Part B premium each month. Some Medicare Advantage plans have a separate premium others do not.

Like Original Medicare, and most health insurance, Medicare Advantage plans generally require cost-sharing. This means you pay your portion for covered services and the plan pays the rest.

Some Medicare Advantage plans may have an annual deductible you must pay before the plan pays for covered services related to the benefit.

Many Medicare Advantage plans have copayments you pay for covered services. You may have to pay coinsurance amounts for certain services.

However, every Medicare Advantage plan has a maximum annual out-of-pocket limit for Part A and Part B medical services. This means that if your out-of-pocket medical expenses reach your plans limit, the plan will pay in full for all your covered services for the rest of the year. In 2020, this limit cannot be higher than $6,700. Many Medicare Advantage plans set lower limits.

Examples Of Our Projects:

Development of comprehensive Medicare Advantage strategies for Medicare Advantage, Special Needs and Dual Eligible plans, including:

- Feasibility assessments

- New CMS Medicare Advantage application development

- Medicare Stars improvement strategies

- Develop Special Needs Plan Model of Care

- Develop de novo Medicare Advantage applications

- Implementing critical operational functions and staffing models

Developing and Modeling Innovative Payment Models

- Evaluate new alternative payment models

- Develop novel payment concepts to propose to CMS and Medicare Advantage payers

- Model impacts of CMS payment changes

- Analyze and forecast size of the post-acute market change

- Identify new Medicare program reimbursement opportunities under value-based care

Don’t Miss: Free Grants For Dental Implants

Comparison With Private Insurance

Medicare differs from private insurance available to working Americans in that it is a social insurance program. Social insurance programs provide statutorily guaranteed benefits to the entire population . These benefits are financed in significant part through universal taxes. In effect, Medicare is a mechanism by which the state takes a portion of its citizens’ resources to provide health and financial security to its citizens in old age or in case of disability, helping them cope with the enormous, unpredictable cost of health care. In its universality, Medicare differs substantially from private insurers, which must decide whom to cover and what benefits to offer to manage their risk pools and ensure that their costs do not exceed premiums.

Medicare also has an important role in driving changes in the entire health care system. Because Medicare pays for a huge share of health care in every region of the country, it has a great deal of power to set delivery and payment policies. For example, Medicare promoted the adaptation of prospective payments based on DRG’s, which prevents unscrupulous providers from setting their own exorbitant prices. Meanwhile, the Patient Protection and Affordable Care Act has given Medicare the mandate to promote cost-containment throughout the health care system, for example, by promoting the creation of accountable care organizations or by replacing fee-for-service payments with bundled payments.

Where Does Federal Medicare Funding Come From

Funding for federal health insurance comes from two trust funds which are dedicated to Medicare use and held by the U.S. Treasury.

The Hospital Insurance Trust Fund is funded by federal payroll taxes and income taxes from Social Security benefits. Its used to pay for Medicare Part A expenses such as hospital, skilled nursing, hospice and home health care.

The Supplementary Medical Insurance Fund is composed of funds approved by Congress and Part B and Part D premiums paid by subscribers. Its used to pay for Medicare Part B expenses such as medically necessary and preventive services such as doctors visits and lab tests.Medicare cost $705.9 billion in 2017 and covered more than 58 million Americans.

You May Like: Rtc Jobs Las Vegas

Switching Back To Original Medicare

While you can save money with a Medicare Advantage Plan when you are healthy, if you get sick in the middle of the year, you are stuck with whatever costs you incur until you can switch plans during the next open season for Medicare. At that time, you can switch to an Original Medicare plan with Medigap. If you do, keep in mind that Medigap may charge you a higher rate than if you had enrolled when you first qualified for Medicare.

Most Medigap policies are issue-age rated policies or attained-age rated policies. This means that when you sign up later in life, you will pay more per month than if you had started with the Medigap policy at age 65. You may be able to find a policy that has no age rating, but those are rare.

D: Prescription Drug Plans

Medicare Part D went into effect on January 1, 2006. Anyone with Part A or B is eligible for Part D, which covers mostly self-administered drugs. It was made possible by the passage of the Medicare Modernization Act of 2003. To receive this benefit, a person with Medicare must enroll in a stand-alone Prescription Drug Plan or public Part C health plan with integrated prescription drug coverage . These plans are approved and regulated by the Medicare program, but are actually designed and administered by various sponsors including charities, integrated health delivery systems, unions and health insurance companies almost all these sponsors in turn use pharmacy benefit managers in the same way as they are used by sponsors of health insurance for those not on Medicare. Unlike Original Medicare , Part D coverage is not standardized . Plans choose which drugs they wish to cover . The plans can also specify with CMS approval at what level they wish to cover it, and are encouraged to use step therapy. Some drugs are excluded from coverage altogether and Part D plans that cover excluded drugs are not allowed to pass those costs on to Medicare, and plans are required to repay CMS if they are found to have billed Medicare in these cases.

Also Check: Goverment Jobs In Nevada

Do I Need To Enroll In A Qmb Program If I Have Medigap

Medigap coverage isnt necessary for anyone on the QMB program. This program helps you avoid the need for a Medigap plan by assisting in coverage for copays, premiums, and deductibles. Those that dont qualify for the QMB program may find that a Medigap plan helps make their health care costs much more predictable.

- Was this article helpful ?

Who Is Eligible For A Qualified Medicare Beneficiary Program In 2022

To be eligible for a QMB program, you must qualify for Part A. Your monthly income must be at or below $1,094 as an individual and $1,472 as a married couple. Your resources must not total more than $7,970 as an individual or $11,960 as a married couple.

Keep in mind that income and resource requirements for the QMB program are subject to increase each year. Thus, members must go through a redetermination to continue receiving benefits for the following year. This process includes providing your local Medicaid office with updated information about your monthly income and total resources.

If someone doesnt have Part A but is eligible, they can choose to sign up anytime throughout the year. Once theyve signed up for Part A, they can proceed to apply for the QMB program. If they need to pay a premium for Part A, the QMB program can cover it.

Don’t Miss: Government Grants For Homeschoolers

What Does Medicare Part B Cover

Medicare Part B generally covers costs for outpatient care such as doctor visits. Part B also covers preventive services, ambulance services, certain medical equipment, and mental health coverage. Some prescription drugs also qualify under this plan.

The standard monthly premium for Medicare Part B enrollees is $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

However, premiums are higher for any individual taxpayer whose modified adjusted gross income is more than $88,000, and more than $176,000 for married couples in 2021. Those thresholds rise to $91,000 and $182,000, respectively, in 2022.

Medicare Advantage Plans: Enrollment

You can enroll in a Medicare Advantage plan if you have Medicare Part A and Part B coverage and live in the Medicare Advantage plans service area. Usually you cant enroll in a Medicare Advantage plan if you have end-stage renal disease . You might be able to sign up for a special type of Medicare Advantage plan called a Special Needs Plan.

Here are the major Medicare Advantage enrollment periods:

- You can enroll in a Medicare Advantage plan when you become eligible for Medicare, during your Initial Enrollment Period.

- Each year during the Annual Election Period , you can enroll in or switch Medicare Advantage plans.

- If you are enrolled in a Medicare Advantage plan, you can change plans during the Medicare Advantage Open Enrollment Period .

- You may also be able to make changes to your Medicare Advantage plan under special circumstances, such as if you move.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

Don’t Miss: Los Lunas Government

Medicare Advantage And Medicaid

Some Medicare beneficiaries have the option to enroll in Medicare Advantage, which replaces their Part A and Part B benefits with a private insurance plan.

- Prescription drug coverage

- Vision coverage

- Wellness programs

Some people are dual eligible for Medicare Advantage and Medicaid. If youre enrolled in a Medicare Advantage plan that provides coverage for a treatment, service, or prescription drugs, your Medicare Advantage plan will cover it rather than Medicaid.

Medicaid may also cover your Medicare Advantage premium if you have one. The options for dual eligible individuals to receive their Medicare and Medicaid benefits vary by state.

Government Intervenes In False Claims Act Lawsuits Against Kaiser Permanente Affiliates For Submitting Inaccurate Diagnosis Codes To The Medicare Advantage Program

The United States has intervened in six complaints alleging that members of the Kaiser Permanente consortium violated the False Claims Act by submitting inaccurate diagnosis codes for its Medicare Advantage Plan enrollees in order to receive higher reimbursements.

The Kaiser Permanente consortium members are Kaiser Foundation Health Plan Inc., Kaiser Foundation Health Plan of Colorado, The Permanente Medical Group Inc., Southern California Permanente Medical Group Inc. and Colorado Permanente Medical Group P.C. Kaiser is headquartered in Oakland, California.

Medicares managed care program relies on the accuracy of information submitted by health care providers and plans to ensure that patients receive the appropriate level of care, and that plans receive the appropriate compensation, said Deputy Assistant Attorney General Sarah E. Harrington of the Justice Departments Civil Division. Todays action sends a clear message that we will hold health care providers and plans accountable if they seek to game the system by submitting false information.

The integrity of government health care programs must be protected, said Acting U.S. Attorney Stephanie Hinds for the Northern District of California. The Medicare Advantage Program maintains the health of millions, and wrongful acts that defraud the program cannot continue and will be pursued.

Read Also: Warner Robins Air Force Base Contractor Jobs

If Your Provider Charges You And Youre In The Qmb Program

Inform who is requesting payment that youre in the QMB program. If youve already paid, youre entitled to a refund.

To ensure this does not happen, show your QMB card or Medicare and Medicaid card to your providers each time you receive care. Your Medicare Summary Notice can also serve as proof that youre in the QMB program. You can access your MSN electronically through your MyMedicare.gov account.

If a provider continues to bill you, call Medicares toll-free number. They will confirm your QMB status and request cessation of billing and/or refunds from your provider. In the case that debt collectors wrongly pursue payment, you can submit a complaint to the Consumer Financial Protection Bureau online or via telephone.

Paved With Corporate Greed

The road to this point has been paved by multiple administrations from both parties. CMMI, the CMS innovation center that came up with direct contracting, was by the Affordable Care Act , the Obama administrations corporate-shaped, flagship health care reform effort. Originally meant to devise new health care payment models that would fix the spiraling costs and quality of care issues endemic to US health care, its mission was ripe for hijacking by the corporate interests that find a way to infiltrate every well-meaning government agency.

That moment came in 2018, when Trumps HHS secretary appointed health care executive Adam Boehler to head CMMI, where he soon set the plans for direct contracting into motion. According to the Intercept, Boehler designed direct contracting with specific companies in mind, including Oxeon, the venture capital firm that had backed a number of DCEs-to-be, including the very start-up Boehler had left to join CMMI and which he contracted with to staff the agency as it developed the initiative.

The goal is to privatize all of Medicare through this program.

One would have thought the Trump program would have been nixed by the Biden administration, particularly with talk of the new presidents Rooseveltian ambitions and a coming revival of activist government. Instead, the administration simply canceled one iteration of direct contracting, and went ahead with a different one in April 2021, with more set to roll out this year.

Don’t Miss: Where To Buy Gold Bars In Las Vegas

Coverage Choices For Medicare

If you’re older than 65 and not already getting benefits from Social Security, you have to sign up for Medicare Part A and Part B. It doesn’t happen automatically. However, if you already get Social Security benefits, you’ll get Medicare Part A and Part B automatically when you first become eligible .

There are two main ways to get Medicare coverage:

What Other Benefits Might Medicare Advantage Plans Offer

Probably the most notable benefit most Medicare Advantage plans offer is Medicare Part D prescription drug coverage. Often Medicare Advantage plans also provide coverage for routine vision, dental and hearing care. And recently many Medicare Advantage plans began offering new home-oriented, non-medical benefits. Some of these benefits may include telemedicine, transportation, and in-home safety assessments and/or personal aide services.

In a nutshell, its possible you could receive your medical, prescription drug, dental, vision and hearing coverage from a single Medicare Advantage plan insurer. You may even get some extra perks such as a discounted gym membership.

Don’t Miss: Congress Mortgage Stimulus Program Middle Class

What Does Medicare Pay For

As mentioned above, there are four different types of Medicare programs available to individuals. Basic Medicare coverage comes predominately via Parts A and B or through the Medicare Part C plan. Individuals may also opt to enroll in the Medicare Part D plan.

Medicare Parts A and B are colloquially known as Original Medicare, since they date from the beginning of the program back in 1965.

Qualified Medicare Beneficiary Programs And Medicare Advantage

If youre currently in the QMB program, you can enroll in a Medicare Advantage plan. There are unique plans for those with Medicare and Medicaid. A Medicare Advantage Special Needs Plan for dual-eligible individuals could be a fantastic option. Generally, there is a premium for the plan, but the Medicaid program will pay that premium.

Many people choose this extra coverage because it provides routine dental and vision care, and some come with a gym membership. While not every policy has these benefits, there may be one available in your area!

You May Like: Grants To Start A Trucking Company

Speak With A Licensed Insurance Agent

A licensed insurance agent can help you better understand your Medicare options and how they work with Medicaid. Speak with a licensed insurance agent now at 1-877-694-9278, TTY: 711.

*You must continue to pay your Medicare Part B premium. $0 premium plans may not be available in all areas.

Find a $0 premium Medicare Advantage plan today. 1

For California residents, CA-Do Not Sell My Personal Info, .

For a complete listing, please contact 1-800-MEDICARE , 24 hours a day, 7 days a week, or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

How Medicare Works

Medicare is a national healthcare program funded by the U.S. federal government. Congress created the program as part of the Social Security Act in 1965 to give coverage to people age 65 and older who didn’t have any health insurance.

The program is now administered by the Centers for Medicare and Medicaid Services and extends coverage to include people with certain disabilities and those who have end-stage renal disease and amyotrophic lateral sclerosis , or Lou Gehrig’s disease. There are four different parts to Medicare, all of which provide different types of services for the insured:

- Medicare Part A

- Medicare Part D

Also Check: Charitable Auto Resources Seattle