Key Drivers Of The Egrc Market

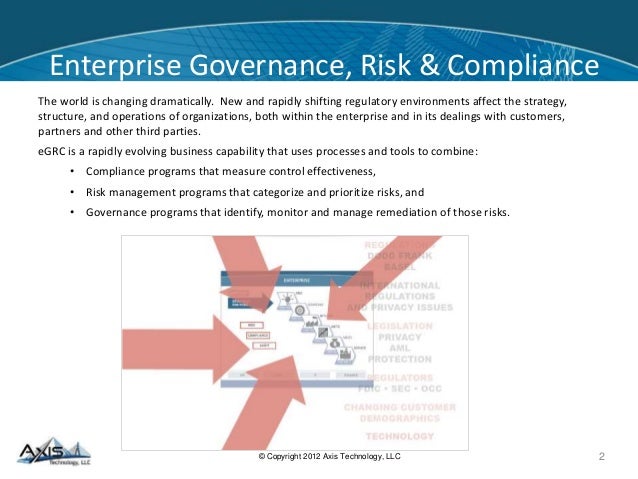

- Rising demand for eGRC solutions in BFSI sector: The BFSI sector faces growing pressure to enhance its operational performance and provide seamless experiences to clients. Therefore, the BFSI sector is focusing on a framework that can help organizations meet various compliance & regulatory related requirements. For instance, providers of banking services are majorly concerned about issues such as data security, consumer laws, business policy, and trade bills before deploying any cloud service.

- Cloud service providers set some standards for contract and policy agreements, along with solutions to solve issues related to data security and regulatory compliance management, etc. Therefore, issues such as data security, consumer laws, regulations, policies, and software licensing are significantly driving the eGRC market.

Enterprise Governance Risk And Compliance: How The Market Will Perform In Upcoming Years Based On Market Size Share Supply Volume And Major Regions

The exclusive research report onEnterprise Governance, Risk and Compliance Marketnow available with , offers a detailed analysis of the factors influencing the global business sphere. This report also provides precise information pertaining to market size, commercialization aspects and revenue estimation of this business. The report further elucidates the status of leading industry players thriving in the competitive spectrum of the Enterprise Governance, Risk and Compliance Market.

The adoption of compliance management software is increasing across organizations. The compliance management software is able to manage all tasks that are related to compliance such as documentation, planning, scheduling, reporting, mitigation and audit for the enterprise. This, in turn, eases the process of coordinating compliance-related activities, regulatory reporting, and controlling risks related to non-compliance.

Get Exclusive Sample PDF of Enterprise Governance, Risk and Compliance Market with Latest Research at:

Global Enterprise Governance, Risk and Compliance Market: Taxonomy

- On the basis of services, the Global Enterprise Governance, Risk and Compliance Market is segmented into:

- Integration Services

- Consulting Services

- Support Services

:

Managing Enterprise Governance Risk And Compliance

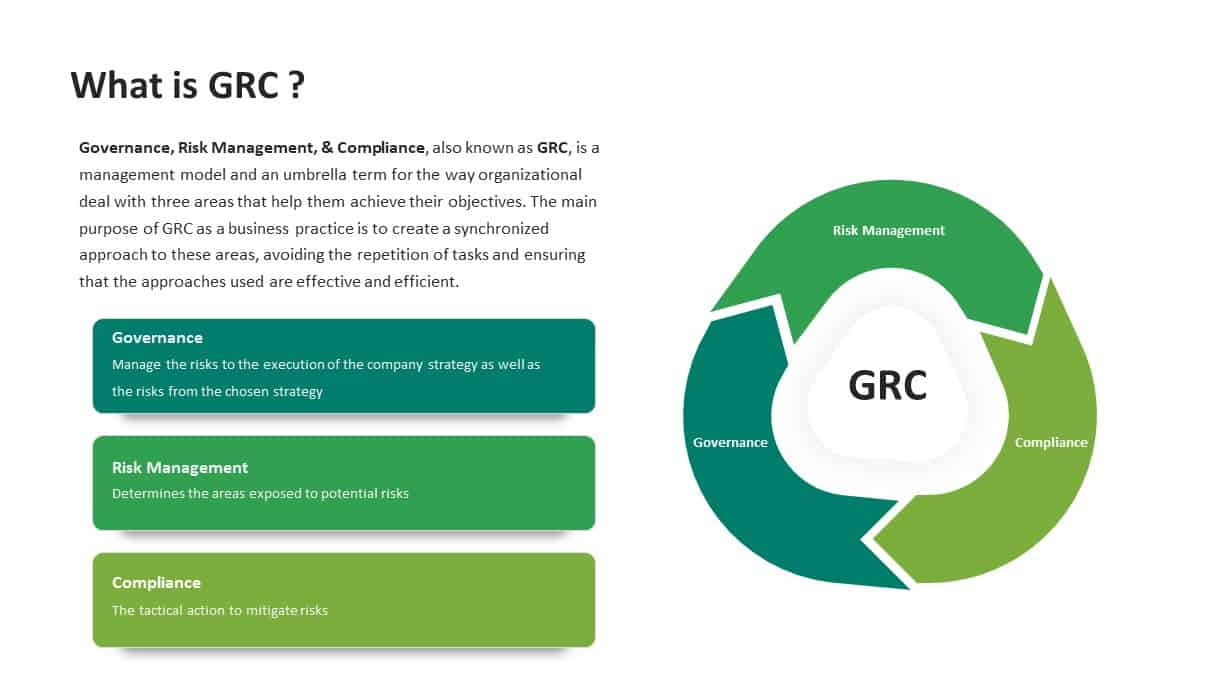

Simply defined, GRC is a coordinated and integrated strategy for corporate governance, enterprise-wide risk management, and compliance with regulatory and industry requirements. Organizations do this to improve quality processes, assess and manage risk and control activities, and comply with environmental, safety and other industry-specific regulations.

However, these efforts have often suffered from organizational silos, a focus on proximal needs, and a reliance on point solutions. Utilizing GRC as a strategy can enable businesses to make informed decisions that fundamentally change the way they manage risk and compliance.

Also Check: Government Dental Grants

Why Companies Large And Small Need Grc

- Stakeholders demand a high degree of transparency, accountability, and performance.

- Regulations are constantly changing in an unpredictable manner.

- Third party relationships and risks are growing exponentially, which is a challenge to management.

- The lack of risk identification has harsh impacts.

- Efficiency gains through GRC are necessary for business growth.

Growing It And Manufacturing Sector To Boost The Asia

Asia-Pacific is expected to register the fastest CAGR over the forecast period. Other important countries that are contributing to the growing adoption of the eGRC solution are Japan, South Korea, Taiwan, Vietnam, and Indonesia. Vietnam is catching up with 5G telecommunications services, as Viettel, Vietnamobile, MobiFone, Vietnam Posts, and the Telecommunications Group have worked together to launch the service by 2020. The fast development of IT infrastructure and the need to address cyber security risks are also driving the market.

Also Check: Loudoun County Public Schools Job Opportunities

Reducing Risks And Enabling The Business

More than ever, companies face the challenge of bringing their business processes in-line with existing and new legal requirements and industry regulations. It is critical not just to maintain compliance but truly manage risk to the enterprise. The merging of governance, risk management & compliance, also known as GRC, is an important step in accomplishing comprehensive security.

Benefits Of Partnering With An It Services Firm That Specializes In Grc

If you need outside help to implement or manage your GRC plans and processes, you should consider partnering with an IT firm with expertise in GRC.

Why?

Because IT is intimately involved in how you govern, how you manage risk, and how you comply with regulations.

When it comes to security and compliance, you cant afford to fail. This is why you should partner with an IT services firm that specializes in helping organizations like yours govern well, get secure, stay secure, and meet compliance standards.

The best IT services firms solve your complex IT challenges, help with strategic direction, proactively manage your IT infrastructure, and protect your people, platforms, networks, and data around the clock with advanced security solutions.

Don’t Miss: Government Grants For Home Repairs

Increasing Focus On Preventing Fraudulent Activities And Safeguarding Data To Augment Demand

The growing popularity and penetration of information technology over the span of the past three decades has directly or indirectly accelerated technological developments in various industrial domains. In the current scenario, organizations from various industrial sectors deploy different types of IT solutions in a range of applications. Moreover, the deployment of eGRC solutions has witnessed a noteworthy growth across a host of industrial sectors due to which, the eGRC market is anticipated to grow at a staggering pace during the forecast period.

A number of business entities are leaning toward eGRC solutions to improve risk management and prevent fraudulent activities to avoid monetary losses. Furthermore, the increasing focus on improving data protection infrastructure has prompted market players to develop advanced eGRC solutions to gain a competitive edge in the current market landscape. In several business organizations, innovations are primarily viewed as one of the most key capital ventures due to which, data protection has gained considerable spotlight. The advent of the IT has transformed the face of risk and data management and improves the decision-making process.

At the back of these factors, along with the increasing demand for eGRC solutions from the banking and finance sector, the global eGRC market is on the course to cross the value US$ 87.9 Bn by the end of 2030.

Request a sample to get extensive insights into the eGRC Market

Growing Technological Advancement To Drive North America Market

To understand geography trends > >

North America dominated the 2019 Global Enterprise governance, risk, and compliance market. North America is witnessing the adoption of high technology in almost every part of the business sector and is therefore considered to be the primary driver of enterprise implementation, governance, risk, and compliance growth in the North American market. Most suppliers in the region are engaged in the development of products and services for artificial intelligence , analytics, natural language processing , and machine learning and are therefore expected to drive regional market growth.

Recommended Reading: Government Suburban 2500 For Sale

What Is The Grc Capability Model

OCEG created an open-source GRC Capability Model that integrates risk, governance, audit, ethics/culture, IT, and compliance. Organizations can apply this holistic approach to different compliance subject areas and situations. Organizations can also use it with specific functional frameworks, including COSO, NIST, ISO, and ISACA.

Over 100 specialists guided the creation of the GRC Capability Model. It was based on a study of over 250 large organizations with documented best practices.

Here are the four components of the GRC Capability Model:

- Learn about organization culture and stakeholders to inform strategy and actionthis step involves learning about core influencing factors in the internal and external business environments to define purposeful objectives.

- Align actions with strategy and strategy with objectiveswork to ensure the decision-making process addresses opportunities, values, requirements, and threats.

- Performactions that encourage and reward desirable behaviorsdiscover events as soon as possible and dissuade and remediate undesirable behaviors.

- Evaluate strategy and actionson an ongoing basis, evaluate objectives and update them to improve organizational processes.

When talking about compliance efforts and risk management with board members, executives, and others, organizations can use the GRC Capability Model as a common language.

Keep Track Of Grc Progress

No GRC product or implementation roadmap is flawless, especially at the start. Organizations must continuously monitor the progress of their GRC implementation to evaluate performance based on metrics they specify. They should regularly assess risks, reevaluate existing controls, and update their policies to keep up with changing regulations and industry standards.

Related content: Read our guide to GRC audits

Read Also: City Of Warner Robins Ga Job Openings

Prepare Software For Integration

After choosing a GRC solution, the organization needs to integrate it with its current policies and processes. GRC software providers typically offer consultations and demos to test the product. An account manager can provide guidance in using the software and implementing it in the organization.

Next, management should assign internal roles and responsibilities for employees in the organization to implement GRC, defining the specific steps that each employee must take to implement and use the software.

How To Build A Business Case For Grc Software

Boards and the C-suite may recognize that GRC technology will provide better oversight and enhance risk and compliance overall but still be reluctant to allocate budget. The challenge is defining and measuring value cost, flexibility, efficiency, effectiveness in a way thats meaningful enough to sway those holding the purse strings.

Integrated GRC software standardizes processes, streamlines data collection, and enforces security. Automating routine tasks allows the risk and compliance team to shift from collecting data to higher-value work like investigating and remediating issues. Built-in analytics and centralized data provide fresh, data-driven insights, identify interdependencies that otherwise would have gone unnoticed, and give you an early look at risk indicators that can be used to drive strategic vision.

Add to that real-time reporting that extracts the story within your data for better, faster decisions. Dashboards also allow continuous monitoring of key indicators and metrics. In short, integrated GRC software gives you hard data on the current status of your risk and compliance program, where your weaknesses are, and what needs to be done. Right at your fingertips.

Dollars and SenseWhile its difficult to put an exact dollar figure on the ROI of integrated GRC software, there are ways to quantify the value.

Read Also: Replacement Government Phone

Governance Risk And Compliance

Your risk perspective and strategy can impact the balance between eluding failure and seizing competitive opportunities.

Todays rapidly changing business and regulatory environment requires thinking about risk in new ways. Taking an innovative approach to managing and enhancing your governance, risk and compliance activities can help you seize opportunities, stay a step ahead of uncertainty, and meet stakeholder expectations.

PwCs GRC team support many of the worlds leading organisations to capitalise on opportunities, navigate risks and deliver lasting change through the creation of a risk resilient business culture.

We can transform how you perceive – and capitalise on – risk.

Globalization and technology are todays core business drivers, with the potential to send unprecedented risks cascading across your enterprise or propel you toward unprecedented opportunity. By unlocking these risks you turn them into a catalyst for growth, stepping ahead of uncertainty.

The intensity of change in today´s business environment requires companies to manage and harness the power of proactive Enterprise Risk Management, combining innovative and proactive governance, risk and compliance activities into a comprehensive Enterprise Risk program that facilitates seizing competitive opportunities and meeting stakeholders expectations.

Enterprise Governance Risk And Compliance

Secondary Navigation

- Solutions

Finance Transformation Platform

Enable digital transformation and drive strategy with all your financial processes and data in a unified platform owned by Finance.

Industries

Every vertical market has its unique business needs, requiring software partners to develop specific capabilities and solutions for industry. Thats why CCH Tagetik offers industry-specific capabilities and packaged regulatory reporting within its financial performance platform.

Customers

At CCH Tagetik, we are continuously updating our performance management software with innovations based on input from our customers to improve the customer experience. We value customer relationships above all else. Thats why our customers rank us high in independent customer satisfaction surveys.

Events & News

Keep updated on the latest events and news about CCH Tagetik corporate performance management solutions and other Wolters Kluwer events. Participate in scheduled events and read our latest news!

About

We understand the complex challenges that the Office of the CFO faces and translate that knowledge into intuitive, enterprise-scale CCH Tagetik performance management software solutions.

Read Also: Los Lunas Government

Why Is Grc Important Today

As businesses grow increasingly complex, they need a way to effectively identify and manage key activities in the organization. Also needed is the ability to integrate traditional distinct management activities into a cohesive discipline that increases the effectiveness of people, business processes, technology, facilities and other important business elements.

GRC achieves this by breaking down the traditional barriers between business units and requiring them to work in a collaborative fashion to achieve the company’s strategic goals. GRC is one of the components of a well-managed organization in the 2020s.

Grc Products: Major Minor & Maintenance Ga And Premier Support Support End Date

- “Lifetime Support Policy: Oracle Applications”: See page 69, “Oracles Governance, Risk, and Compliance Releases”: Click on ‘Lifetime Support Policy: Oracle Applications ‘ under

- “Software Technical Support Policies”: See page 7, item 10: “Governance, Risk and Compliance Programs”:

For more information, please see FAQ: Support of On-Premises GRC Applications

You May Like: Government Fee For Trademark Registration

Egrc Market To Cross Valuation Of Us$ 879 Bn By 2030 Notes Tmr Study

– Need for banking fraud prevention reinforces advancements in data infrastructure in BFSI sector, spurring abundant opportunities in eGRC market

– AI-based eGRC solutions gain popularity expansion of digital business models in Asia Pacific to drive rapid uptake of solutions across industries

News provided by

What Does Grc Mean In Theory And In Practice

There are three main components of GRC:

- Governance Aligning processes and actions with the organizations business goals

- Risk Identifying and addressing all of the organizations risks

- Compliance Ensuring all activities meet legal and regulatory requirements

In the past, organizations often approached Governance, Risk, and Compliance as separate activities. Processes or systems frequently were created in response to a specific event e.g., new regulations, litigation, a data breach, or audit finding with little thought as to how that worked within the whole. The result was a tangle of inefficiencies, redundancies, and inaccuracies, including:

- Lack of visibility into the complete risk landscape

- Conflicting actions

- Unnecessary complexity

- Inability to assess the cascading effects of risk

The reality is that there is plenty of overlap between Governance, Risk, and Compliance. Each of the three disciplines creates information of value to the other two and all three impact the same technologies, people, processes, and information. An organization, for instance, might be subject to a new data-privacy regulation , while also holding itself to certain internal data-protection controls , both of which help mitigate cyber risk .

Learn more about Transforming Compliance from Check-the-Box to Champion.

Don’t Miss: Las Vegas Gov Jobs

Asconsit: We Provide Holistic Grc Solutions

GRC helps companies better prepare for business, technology, and regulatory changes and reduce risks while achieving business goals. Accurate definition and systematic analysis of possible impacts of risks on the performance of the company results in better business decisions. The integration of GRC and ICS enables better auditability and transparency for all business processes. In light of the dependencies and interactions of the three areas of governance, risk & compliance, it is clear that a holistic approach is needed to ensure a successful solution.

Rely on the holistic GRC solutions from ASCONSIT and the expertise of our consultants and engineers!

ASCONSIT GmbH

Automated And Optimized Integrated Governance Risk And Compliance

Companies invest heavily in cyber-threat detection and prevention technologies, but still manage regulatory and contractual compliance manually. Ivanti Neurons for GRC provides a simple way to unify your GRC management so all authority documents, citations, controls, and risks are tracked in a single system. It’s compliance, automated.

No-Code Platform

A platform that adapts to the way you do business. No need to hire certified, expensive specialists to administer or advance. Define your own unique governance activities to ensure you are meeting ever-evolving requirement changes.

Control Mapping

Ease the burden of complying with multiple regulations and standards with the ability to import any regulatory authority document into the system for easy mapping of citations to your security and compliance controls.

Adaptive Risk Assessment

Performing risk assessments doesn’t have to be manual or inconsistent. Receive automated guidance through the risk-assessment effort to ensure efficient and accurate results.

Automated Governance Activities

Replace repetitive and manual tasks with automated and organized governance activities. You and your team can focus on more strategic and pressing needs at hand and remove the potential for human error.

Read Also: Rtc Transit Jobs

Why Are Grc And Egrc Important

GRC and EGRC help organizations manage risk across an enterprise and prepare safeguards those against risks.By having the correct mechanisms in place to identify, manage, measure, and anticipate risks, executive management can prepare policies and institute procedures to minimize risks and their impacts.GRC and EGRC result in streamlined processes and standardized workflows.In the process of creating the policies and procedures to minimize risks, enterprises develop workflows. This way, when a company encounters the backlash of a risk, there is already a solution and course of action set out for employees to follow.GRC and EGRC buffers a company against regulatory scrutiny and errors.So that companies can comply with regulatory rules and reduce the risk of material errors, they are forced to institute the proper checks and balances around data. These prevent errors from making their way into regulatory reports, affecting decisions, and negatively impacting the organization.GRC and EGRC ensure that controls and systems are in place so data is consistent across the enterprise.GRC policies can take on different shapes. When it comes to the treatment of financial data in a complex enterprise setting, the necessary software must be put into place to prevent errors from making their way through the chain of data into reports.