How To Trade Government Bond Futures

To speculate on interest rates, or to hedge against interest rate risk and inflation, you could consider trading the government bond futures market. With us, you can do this by taking a position using CFDs.

With CFDs, you would put down a small deposit to open a larger position, but your profits and losses will be calculated on the positions full size rather than your smaller margin amount.

Its important to note that leveraged financial products are complex and carry inherent risk. While leverage enables you to gain more profit for less capital if you predict the market movement correctly, you can also lose far more if the market moves against you. So, unlike owning bonds outright, your loss isnt limited to the bonds underlying value.

Government Bonds Trading Platform

CMC Marketâs online trading platform allows you to spread bet and trade CFDs across UK government bonds such as gilts. Additional to UK gilts, you can trade Euro bunds, Euro schatzs, Euro OATs and US treasury notes. Our online trading platformâ comes with an award-winning charting package* and can be adapted to your specific trading needs.

In A Normal Yield Curve Shorter Maturities = Lower Yields

This graph shows a sample “normal” yield curve. Bonds usually offer increasingly higher yields as their maturities get longer.

Bond duration, like maturity, is measured in years. It’s the outcome of a complex calculation that includes the bond’s present value, yield, coupon, and other features. It’s the best way to assess a bond’s sensitivity to interest rate changesbonds with longer durations are more sensitive.

BONDS AND INTEREST RATE CHANGES

In most cases, a bond’s coupon is set when it’s issued, and the rate won’t change. So how can volatility in the marketplace affect existing bonds?

Recommended Reading: Us Government Coins For Sale

Buying Vs Trading Bonds

If you buy government bonds and hold them until maturity, you will enjoy regular coupon payments and a return of your initial investment when they mature. During that time, however, the price of a government bond will fluctuate in the market. Bond prices have an inverse relationship with interest ratesâ âso when interest rates go up, government bond prices go down in the secondary market. Because of this, shorter-term investors who do not buy and hold bonds until maturity can experience gains or losses in the market. Bond traders can also look to profit from the relative differences in the yields of certain bonds, known as the spreadâ âfor instance, the spread between U.S. Treasuries and highly rated corporate bonds. Another bond trading strategy is to bet on changes in the spread between different maturities, known as the yield curve.

Government bonds can provide a combination of considerable safety and relatively high returns. However, investors need to be aware that governments sometimes lack the ability or willingness to pay back their debts.

Bonds Mobile Trading App

You can use also trade using our award-winning mobile trading applicationâ**, which can be used to spread bet and trade CFDs on bonds on the go. Available for most mobile devices and tablets, our mobile app has been purposely built to ensure a seamless trading experience. Read more about spread bettingâ and CFD tradingâ.

Recommended Reading: Property Tax Software For Government

How Much Do Bonds Cost

Bonds can vary in price depending on the type of bond youre buying. Ill be discussing the types in detail later, but heres a quick primer on cost:

- U.S. Treasury bonds start at $25.

- Municipal bonds typically start at and are sold in increments of $5,000.

- Corporate bonds typically start at $1,000.

Seek Professional Financial Advice

Its always best to speak to an independent financial adviser before investing in any kind of bonds. They will be able to go through the investment risks with you and advise which bonds match your long-term financial goals. Even though this investment option is considered lower-risk and relatively simple for new investors, it still makes sense to seek advice before placing your money in someone elses hands.

An IFA is also completely impartial, meaning they can help you assess whats right for you without any pressure to go ahead. As a result, they will guide you towards a bond option that genuinely fits your risk appetite and desired return, rather than pushing you towards something unsuitable because of commission or a vested interest.

You May Like: Government Approved Free Annual Credit Report

Are Bonds A Good Investment In 2022

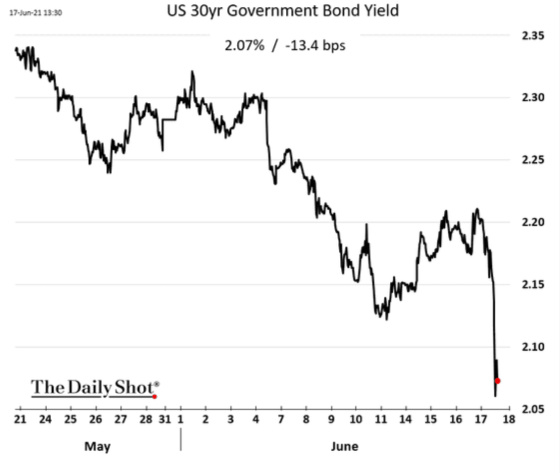

In 2022, the interest rates paid on bonds have been slowly rising because the Federal Reserve has begun raising the Federal reserve rate. If investors believe that interest rates are going to continue to rise in the next couple of years, they may opt to invest in bonds with short-term maturities if they are interested in higher yields. Alternatively, due to the inverse relationship between interest rates and bond prices, fixed security prices will continue to decline if the Federal Reserve continues to raise rates.

Bonds are often sought after as a hedge against market volatility and equity uncertainty. As public equity markets remain turbulent throughout 2022, those seeking to minimize losses may find shelter with fixed securities. During prior periods of recession, bonds have recorded losses, yet those losses have not been as large as equity or alternative investments.

There are several risk factors for investors to consider during 2022. As the Federal Reserve navigates scaling back monetary policy, equity markets are at higher risk for volatility. Alternatively, by not scaling back monetary policy fast enough, the Federal Reserve risks runaway or prolonged inflation. Both conditions have negative implications for bond markets in terms of pricing or future purchasing power.

How To Work Out The Value Of A Bond

Yield to maturity is a useful measure of the value of a bond. It is also a good way to compare what you’ll get by investing in different bonds.

YTM calculates the average annual return of a bond from when you buy it until maturity. It assumes that you reinvest coupon payments in the bond at the same interest rate the bond is earning.

Make sure you always balance the return against any risks before investing.

Also Check: Government Cleaning Jobs In Dc

Making Money From A Coupon

There are two ways that investors make money from bonds.

- The individual investor buys bonds directly, with the aim of holding them until they mature in order to profit from the interest they earn. They may also buy into a bond mutual fund or a bond exchange-traded fund .

- Professional bond traders dominate a secondary market for bonds, where existing issues are bought and sold at a discount to their face value. The amount of the discount depends partially on how many payments are still due before the bond reaches maturity. But its price also is a bet on the direction of interest rates. If a trader thinks interest rates on new bond issues will be lower, the existing bonds may be worth a little more.

In either case, the owner of the bond receives interest payments, known as the coupon, throughout the life of a bond, at the interest rate that was determined when it was issued.

Understanding The Factors That Move The Price Of Bonds

The price of bonds and the bond yield is affected by a number of factors. Supply and demand both impact the price of bonds, and the availability of government bonds is driven by the health of the global stock market. When stock markets are experiencing a period of rapid growth, many investors will move their funds into stocks to capitalise on the boom. As a result, demand for bonds goes down, as they do not offer the quick rewards that day trading can.

However, once the boom subsides, or if serious economic problems seem imminent, bonds become more appealing. Theyre considered a safe haven for investors cash, so will rise in price. However, as government spending increases to support increased numbers of unemployed people following a recession, for example it will need to issue more bonds to support itself. As a result, bond prices will come down again. Prices can therefore fluctuate like ocean waves the investor may sometimes have to think like a surfer, waiting to catch the right one.

Read Also: Georgia Free Government Cell Phones

How To Buy I Bonds

You can buy I bonds electronically online at the TreasuryDirect website. You can also purchase up to $5,000 per year of paper I bonds with the proceeds from your tax return. There is no secondary market for trading I bonds, meaning you cannot resell them you must cash them out directly with the U.S. government.

Do Bonds Increase In Value

Bonds can fluctuate in value, and in some cases, they can even go up and be sold for a profit on the secondary market.

Bonds tend to increase in value when:

Of course, your bond may fall in value, too. If you bought at a coupon rate of 4% and the new coupon rate is 6% nobody will want your bond for what you paid for it. Theyll just buy a new one.

Either way, your bonds value on the secondary market wont impact the amount the bond issuer pays you back on the maturity date. Thats fixed.

Recommended Reading: Government Loans For Working Parents

How To Buy Government Bonds

You are free to use this image on your website, templates, etc., Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:

The government auctions the bonds where financial institutions largely participate. Auctions are also open to the general public. The financial institutionsFinancial InstitutionsFinancial institutions refer to those organizations which provide business services and products related to financial or monetary transactions to their clients. Some of these are banks, NBFCs, investment companies, brokerage firms, insurance companies and trust corporations. read more then sell these bonds to banks, pension funds, and individuals. Individuals can acquire bonds from financial institutions with the help of brokers.

Investors can also buy them directly from the government. For example, using the TreasuryDirect account, individuals, trusts, corporations, estates, etc., can directly purchase Treasury securities from the US government. It is an account where one can purchase and hold the security. The picture above describes how an individual can acquire these bonds in the US.

Government bonds are valuable for the government, investors, and economy in the following ways.

For investors

For the Government:

For the Economy:

The Uses Of Government Bonds

Government bonds assist in funding deficits in the federal budget and are used to raise capital for various projects such as infrastructure spending. However, government bonds are also used by the Federal Reserve Bank to control the nation’s money supply.

When the Federal Reserve repurchases U.S. government bonds, the money supply increases throughout the economy as sellers receive funds to spend or invest in the market. Any funds deposited into banks are, in turn, used by those financial institutions to loan to companies and individuals, further boosting economic activity.

Also Check: Government Grants For Women Over 50

What Is A Treasury Bond

A Treasury bond, or “T-bond,” is debt issued by the U.S. government to raise money. When you buy a T-bond, you lend the federal government money, and it pays you a stated rate of interest until the loan comes due.

These types of securities are fully guaranteed by the U.S. government, so the probability that you won’t get your money back is extremely low.

A bond is simply a loan that you make to a particular entity — it could be a corporation, a municipality, or, in the case of T-bonds, the federal government. You make an initial loan amount — called the principal — and receive interest payments until the loan comes due in the future or at its time of maturity. At maturity, you should receive your entire principal back, plus the final payment of interest you’re owed.

Technically, all the securities discussed below are bonds, but the federal government uses the term “Treasury bonds” to refer specifically to its long-term basic security. Treasury bonds are issued in 30-year and 20-year terms and pay interest every six months. However, you don’t have to hold the bond for the full term. You can sell it anytime, but you must hold bonds purchased directly from the Treasury in your account for 45 days.

The related terms “note” and “bill” are reserved to describe shorter-term bonds. Treasury bills have maturity dates of four weeks to one year. Treasury note maturity dates range from two to 10 years.

Investors Prefer Bonds: How Sleepy Government Bonds Became The Hot Investment Of 2022

Move over, crypto. The hot investment of 2022 is way sleepier but a lot more stable. It’s U.S. government bonds.

A few weeks ago, so many people scrambled to get in on the asset that they crashed the Treasury’s website.

“It’s been a wild couple of months here,” said David Enna, founder of Tipswatch.com, a site that tracks government bonds. “This is stuff that never gets attention paid to it normally, but they’ve become very hot.”

You May Like: Government Grants For Minority Startup Businesses

How To Invest In Treasury Bonds

There are two common ways to buy individual Treasury securities: From TreasuryDirect, the official U.S. Department of the Treasury website for managing Treasury bonds, or from your online broker.

Many brokers allow you to buy and sell Treasury securities within your brokerage account. However, brokers often require a minimum purchase of $1,000 for Treasury securities. You can buy most securities in $100 increments on the TreasuryDirect website.

Note that the interest paid on Treasury securities is exempt from state and local taxes, but it is subject to federal income tax.

How I Bonds Fit Into A Low

I bonds are an excellent choice for conservative investors seeking a low-risk investment to protect their cash from inflation.

Although illiquid for one year, after that period you can cash them at any time. The three-month interest rate penalty for bonds cashed within the first five years is minimal in light of the fact that they preserve your initial purchase amount and you would find similar penalties for early withdrawals from other safe investments.

I bonds are appropriate for the cash and fixed portion of most investment portfolios. Today, the I bond returns handily beat those of certificates of deposit . Parents might also consider accumulating I bonds to assist with future college payments.

Looking For A Financial Advisor?

Get In Touch With A Pre-screened Financial Advisor In 3 Minutes

Also Check: Federal Government Contract Management Software

What Affects Government Bond Prices

The U.S. Treasury determines the initial price and interest rate yield on its marketable securities by holding regular auctions. Bidders are generally big traders known as primary dealers who then offer the bonds to investors on secondary, over-the-counter markets.

Auction bidders may choose to pay the bondâs par amount, or face value. However, if the bondâs yield is attractive compared to other investments, or thereâs more demand for it than supply, bidders may bid up the price and pay more than face value. Conversely, if there is abundant supply or better alternatives elsewhere, investors may seek to pay less than par.

When a new bond becomes widely available, several factors affect its price.

The 28 Cents That Could Break The Budget

Government bonds are loans you make to the government: You buy a bond for four weeks, six months, 10 years, etc., and at the end of that time, Uncle Sam pays you back with a little interest.

And when I say “little,” I really mean “little.” “People were making a couple of cents a year interest,” said Enna.

Fellow reporter Andrea Hsu and I decided to see what was going on for ourselves, so we went halfsies on a $100 government bond that matured after four weeks.

In return for lending the government $100 for four weeks, we earned 28 cents. This, admittedly, sounds puny, but it isn’t.

If we’d bought this same bond at the beginning of the year, we would have earned a small fraction of a penny. Now we’re getting more than 70 times that.

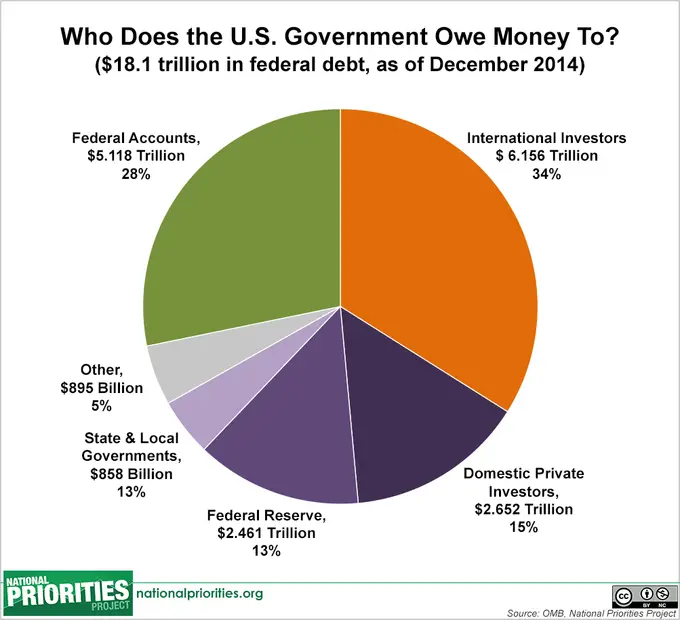

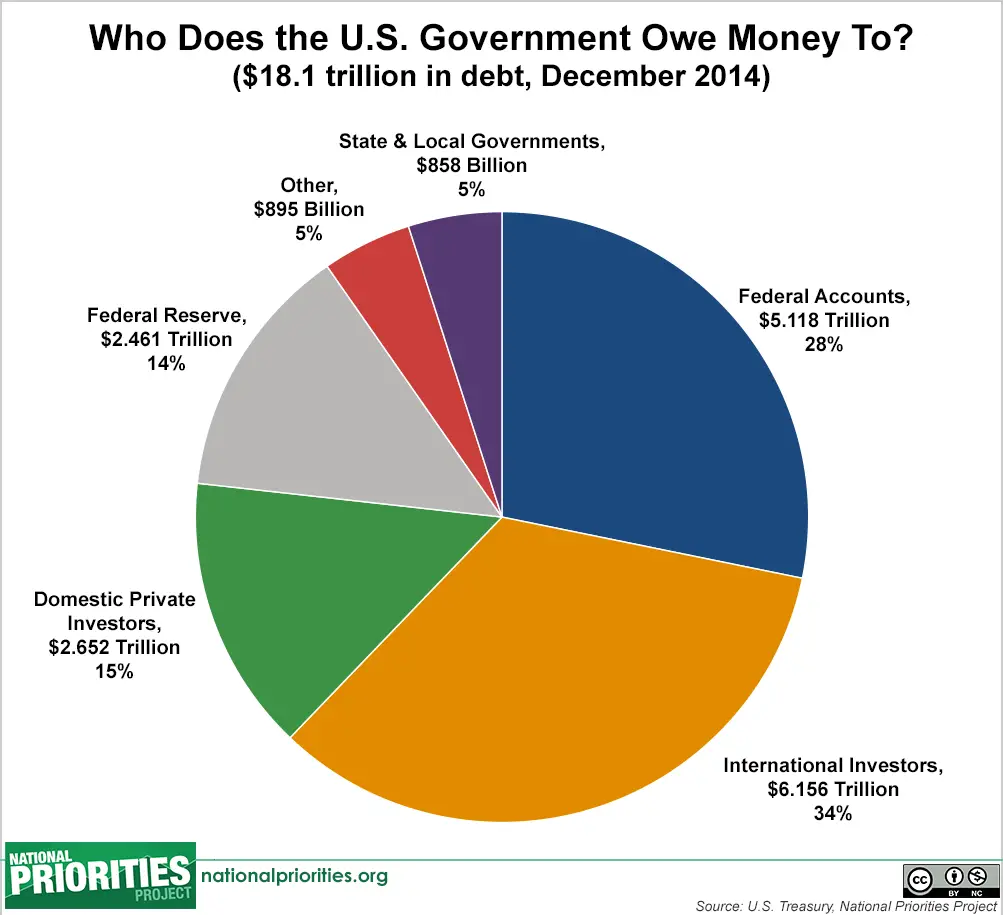

That’s great for us, but bad news for the U.S. government, which has $24 trillion worth of bonds it has to pay back, some of it at these higher interest rates.

In fact, these bond payments got so big in 2022, people are worried they could sink the U.S. into crippling debt or force drastic spending cuts.

And the money the U.S. gets from selling bonds is a crucial source of funding.

The U.S. needs the money from bonds to keep the lights on, and if it’s suddenly having to pay a ton of money to get that money, it is very bad news.

How did this happen?

You May Like: Government Surplus Aircraft For Sale

What Factors Influence The Price Of Gilts

Gilt prices in the UK fluctuate differently to stocks. The market sentiment of government bonds in the UK is largely affected by interest rates and economic policies, whereas a stockâs value is largely determined by a companyâs fundamental valuesâ. Government bonds are seen as a safe-haven asset, they act as a portfolio diversifier whilst sheltering against stocks volatility and paying a fixed rate coupon.

Maturing Cpb And Csb Series

The following CPBs and CSBs are maturing between November 1, 2021 and December 1, 2021:

| CPB | |

| Will be paid out at maturity | Redeem at maturity |

| N/A |

* The funds for the applicable matured series will automatically be paid out to the registered plan owner by cheque or direct deposit .

** All certificated CPBs and CSBs will stop earning interest by December 2021 and should be redeemed at your financial institution by presenting the certificates. If you cannot locate your certificates, follow the lost bond process.

Don’t Miss: Government Assisted Apartments For Seniors