Dun & Bradstreet Creditsignal

This credit report contains information about your accounts, the highest balance, and whether you have paid on time. You also get notifications of changes to your business Dun & Bradstreet credit scores , but not the actual scores.

Pros: Knowing whether your D& B scores change may be useful if youre applying for financing with a lender who looks at it.

Cons: Dun & Bradstreet may contact you to try to get you to purchase additional products to help build your business credit.

Sample showing change in credit scores:

Sample showing payment history:

Brochures On Identity Theft

A brochure from the Federal Trade Commission entitled Stop Think and Click highlights seven practices for safe computing. The brochure also focuses on a web site called onguardonline.gov, which provides practical tips from the federal government and the technology industry to help you be on guard against internet fraud. Here are links to the top five web sites consumers can use to fight identity theft.

How To Get Free Credit Reports From Each Of The Three Credit Bureaus

The Fair Credit Reporting Act requires each of the three credit bureaus to provide consumers with one free credit report per year. Federal law also entitles consumers to receive free credit reports if any company has taken adverse action against them. This includes denial of credit, insurance or employment, as well as other reports from collection agencies or judgments. But consumers must request the report within 60 days from the date the adverse action occurred.

In addition, consumers who are on welfare, unemployed people who plan to look for a job within 60 days and victims of identity theft are also entitled to a free credit report from each of the credit bureaus.

You May Like: Government Help For Hearing Impaired

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

Also Check: Best Resume For Government Jobs

Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

Specialty Consumer Reporting Agencies

Specialty consumer reporting agencies prepare reports on consumers’ histories for specific purposes. The reports cover employment, insurance claims, residential rentals, check writing, and medical records. Think about ordering a specialty report if you are ready to buy homeowners or automobile insurance, open a checking account, apply for private health or life insurance, or rent a home or apartment.

Property Insurance Claim Reports: Insurance companies often check reports of this kind when you apply for homeowners or automobile insurance. One of these reports is the CLUE report .2 CLUE reports contain information on property loss claims against homeowner’s insurance and automobile insurance policies. A CLUE report contains personal information, such as your name, birth date, and Social Security number. It also contains a record of any auto or homeowner property loss claims you submitted to an insurance company. It includes the type of loss, date of the loss, and amount paid by the insurance company. It lists inquiries, or companies that have checked your claim history.

Another property loss report is called A-PLUS . The A-PLUS database is compiled by a smaller company and is less commonly used than the CLUE database. You may order a CLUE report and an A-PLUS for free once every 12 months.

Tenant History Reports: Landlords sometimes check your tenant history as well as your credit history. You may order a free copy of your tenant history report once every 12 months.

Don’t Miss: Free Solar Panels From The Us Government

Why You Should Care About Your Business Credit Score

So now you know why your business credit report is important, but what about your credit score? Well, that score will determine whether you qualify for any kind of small business financing, whether thats a business loan, line of credit, or business credit card. So keeping track of yours and making sure it continues to rise is key.

There are actually several different business credit score models:

- Dun & Bradstreet PAYDEX

- FICO® LiquidCredit® Small Business Scoring Service

- Equifax Business Delinquency Risk Score

Those are just a few of the commercial credit scores available. Different lenders use different scores, but not all are available to business owners.

You may assume you have a great score, but if youve made a few late payments to your credit cards, it could dip. Even if you pay your bill late only once, your score can be negatively impacted. If youre a victim of identity theft , your score could be affected. If you have tax liens, it influences your score. If you have several credit checks because youve been applying for loans all over townyep. You guessed it. Your credit score will be impacted.

The best way to ensure you have a good credit score is to stay on top of what it is. Once you sign up with one of the services well address in this article, check in on a regular basis and set up alerts to let you know if yours declines. Just keep in mind that dips are normal. If your scores change dramatically, though, you will want to dig deeper.

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Recommended Reading: How To Get A Job In Dc Government

How Do I Get My Free Credit Report

Reading time: 3 minutes

Highlights:

- You’re entitled to a free copy of your credit report every 12 months from the three nationwide credit bureaus by visiting annualcreditreport.com

- You can request these free annual credit reports online, by phone or by mail

- You can also create a myEquifax account and enroll in Equifax Core Credit for a free monthly Equifax credit report

If you want to check your credit reports from the three nationwide credit bureaus — Equifax, Experian and TransUnion — there are several ways. You may already know that you’re entitled to a free credit report from each of the three credit bureaus every 12 months.

In addition, you can sign up to receive additional free monthly credit reports from Equifax.

AnnualCreditReport.com

By law, you are allowed to get one free copy of your credit report every 12 months from each of the three nationwide credit bureaus by visiting www.annualcreditreport.com. These reports do not include .

You can also contact the annual credit report service:

If youre sending your request by mail, please be sure to include your name, Social Security number, current and previous addresses, date of birth, and telephone number. Or you can fill out the Annual Credit Report Request form on the Federal Trade Commissions website.

For your protection, you will also need to verify your identity with an acceptable form of identification. Find out more about acceptable forms of identification.

MyEquifax

Meeting certain requirements

How Do You Check Your Credit Report

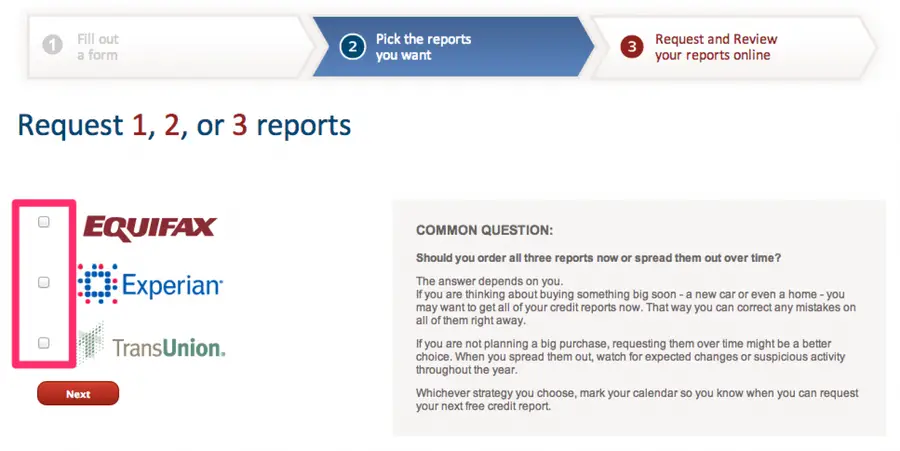

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Recommended Reading: Government Jobs In Los Lunas Nm

Fico Score Vs Annual Credit Report

Number of Reports

There are many companies that offer your credit score, but myFICO.com is the only company that provides the actual credit score that lenders see. myFICO.com provides scores from all three credit bureaus and the most commonly used 19 FICO scoring versions.

Annualcreditreport.com provides one copy of the your credit report from each of the three credit bureaus.

Frequency

A subscription to myFiCO.com provides credit reports and score updates every quarter.

The annual credit report provides a copy of your credit report once per year. There are exceptions where you can receive more than one copy of your credit report. For example, if you are denied a loan based on your credit score, you can receive a copy of your credit report.

Cost

A subscription to myFICO.com costs $29.95 per month. There are other companies that offer access to your credit scores for a lower monthly fee, but they do not provide all 19 versions of your score and may not be the true FICO score. offers a free credit score, but it is not the FICO score. So, pretty much if you want your FICO score, you will have to pay for it. Sometimes however if you are applying for a mortgage or car loan, the lender might choose to share the FICO score with you for free during the application processes.

The annual credit report is free.

Each Business Credit Bureau

If you prefer checking your credit on your own, all three of the business credit bureaus will give you a full copy of your credit report for a fee.

Also note that your business credit score will likely differ between bureaus. They all use different models to compute your credit score and may have different information on file. Capital One, for example, reports small business credit card activity to Dun & Bradstreet and Experian but not to Equifax .

Thats why its important that you track each score and get a credit report from each bureau.

You May Like: Government Grants To Help Fix Up Your Home

Your Childs Credit Report

Parents can place a Protected Consumer security freeze on their childs credit reports to help prevent identity theft. Check a childs credit report before they turn 16.

Youll need to provide the following:

- childs full name

- copy of social security card

- addresses for the past two years

- copy of the parents drivers license

- copy of proof of residence for the parent, such as a utility bill

- guardians should include guardianship papers

Send or submit the information to each of the three major credit reporting bureaus.

Successfully Answer Security Questions

For each report request, youll be asked a few questions about your finances that presumably only you can answer for instance, the approximate amount of your mortgage payment or who holds your auto loan and when you took it out.

Some consumers have reported difficulty using the site, particularly answering security questions about accounts that are several years old. If you cant recall those details, you can request your reports by mail or phone this process doesnt require security questions.

Recommended Reading: Aluguel De Carros Governador Valadares

Your Annual Credit Report Is Now Available Weekly And Its Still Free

The three national credit reporting agenciesTransUnion, Experian and Equifaxare required by federal law to provide you with a free annual credit report. In fact, AnnualCreditReport.com was created by the credit reporting agencies as a one-stop-shop to provide you with your annual credit reports.

In response to the COVID-19 health crisis, TransUnion is pleased to offer you one free weekly credit report online through April 20, 2022 at AnnualCreditReport.com. Reviewing your credit reports regularly helps you ensure the information reported is accurate. It also gives you an opportunity to monitor your account history to combat identity theft.

Are There Other Ways I Can Get A Free Report

Under federal law, youre entitled to a free report if a company denies your application for credit, insurance, or employment. Thats known as an adverse action. You must ask for your report within 60 days of getting notice of the action. The notice will give you the name, address, and phone number of the credit bureau, and you can request your free report from them.

- youre out of work and plan to look for a job within 60 days

- youre on public assistance, like welfare

- your report is inaccurate because of identity theft or another fraud

- you have a fraud alert in your credit file

Outside of these free reports, a credit bureau may charge you a reasonable amount for another copy of your report within a 12-month period.

Read Also: Types Of Government Mortgage Loans

Free Credit Score Information

Welcome to the Garrett Wilson Financial Center. Do you have financial problems and need money to start your own business? Do you need a loan to pay off your debts or pay off your bills or start a profitable business? Do you have a low credit rating and find it difficult to obtain capital / loans from domestic banks or other financial institutions payday loans lewisville tx? Do you need a loan or money for personal reasons? Garrett Wilson offers loans at a low interest rate of 2%. With no credit check, we offer personal loans, debt consolidation loans, venture capital, business loans, education loans, home loans, or loans for whatever reason you would need for your own reason. Contact us at:

I am Latrelle Black by name. I’m here to recommend Clark Morgan’s efforts. I needed a $ 60,000 consolidation loan. As soon as I got in touch with Clark Morgan Loan Firm on Wednesday of last week and Friday of last week, I would like to be notified by my bank that the fund has been transferred. I want everyone on this website to email Clark Morgan for a loan as I received my loan from them and I am very satisfied Contact them now Email: Thank you very much Thanks.

A credit score is based on a thorough analysis of ones credit files and an assessment of the data through numerical interpretation. A credit score reveals whether a person is creditworthy or not. The score is generally based on the information that is typically derived from the credit bureaus.

How To Order Your Free Annual Credit Reports

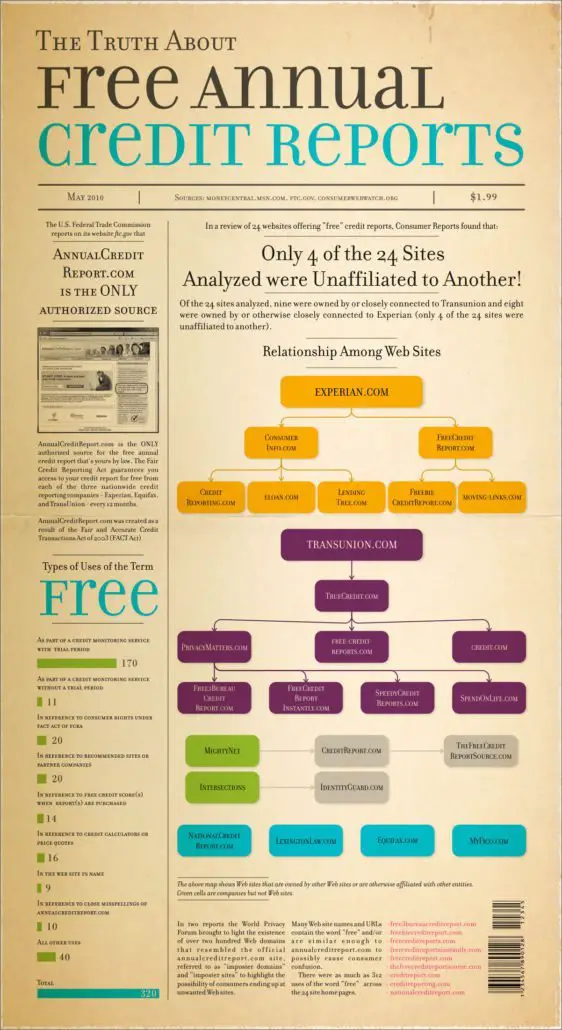

The three major credit reporting companies have set up a toll-free telephone number, a mailing address, and a central website to fill orders for the free annual credit report you are entitled to under law. These are the only ways to get free credit reports without any strings attached. If you order your report by phone or mail, it will be mailed to you within 15 days if you order it online, you should be able to access it immediately. It may take longer to receive your report if the credit reporting company needs more information to verify your identity.

Do not attempt to order free credit reports directly from the credit reporting agencies. Free credit reports advertised by other sources are not really free!

To order:

- – Call 877-322-8228 .

- – Complete the Annual Credit Report Request Form available online, the only truly free credit report website, and mail it to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.

- *Onlineat annualcreditreport.com.

Also Check: How To Do Government Contracting