I’m New To Canada How Do I Apply For Coverage

If you are moving to or returning to Manitoba from outside of Canada, eligibility is based on proof of your legal status in Canada and your residence in Manitoba.

Who is eligible for Manitoba Health and Seniors Care coverage?

Returning Canadians You are eligible for coverage the day you arrive in Manitoba when proof of your Canadian citizenship, arrival date and residence status are provided.

Permanent Resident You are eligible for coverage on your date of arrival in Manitoba when proof of Permanent Resident Status is provided or on the date Permanent Resident Status is granted.

Work Permit If your Work Permit is valid for at least 12 months in Manitoba, you and any family members listed on the Work Permit are eligible for coverage as of the date it was issued. If your Work Permit is less than 12 months, you are not eligible until you receive an extension allowing you to stay in Manitoba for at least 12 months. You will then be covered as of the date of the extension.

Study Permit Effective September 1, 2018, individuals with a Study Permit from Immigration, Refugees and Citizenship Canada are no longer eligible for health insurance coverage through Manitoba Health and Seniors Care .

When you register, you will need to:

- Complete a Manitoba Health Registration Form

- Provide your previous province’s/territory’s health card number

- Provide valid proof of legal status in Canada

Provide proof of residence in Manitoba: 6 months in a calendar year.

Understanding The Aca’s Premium Tax Credit Health Insurance Subsidy

The Affordable Care Act includes government subsidies to help people pay their health insurance costs. One of these health insurance subsidies is the premium tax credit which helps pay your monthly health insurance premiums.

Despite significant debate in Congress over the last few years, premium subsidies continue to be available in the health insurance marketplace/exchange in every state. And the American Rescue Plan has made the subsidies larger and more widely available for 2021 and 2022.

The premium tax credit/subsidy is complicated. In order to get the financial aid and use it correctly, you have to understand how the health insurance subsidy works. Here’s what you need to know to get the help you qualify for and use that help wisely.

Health Coverage For People With Disabilities

If you have a disability, you have three options for health coverage through the government.

-

Medicaid provides free or low-cost medical benefits to people with disabilities. Learn about eligibility and how to apply.

-

Medicare provides medical health insurance to people under 65 with certain disabilities and any age with end-stage renal disease . Learn about eligibility, how to apply and coverage.

-

Affordable Care Act Marketplace offers options to people who have a disability, dont qualify for disability benefits, and need health coverage. Learn about the .

Also Check: Single Mom Money From Government

How Much Will Private Health Insurance Cost In Retirement

Many Canadian retirees wonder, Should I take health insurance? and How much does retiree health insurance cost? The answers often depend on the health care services you need to pay for and where you live in.

If insurance costs less than the money youd have to pay, then it could definitely be worth having private health insurance. So, before taking out any health insurance for retirees in Canada, its important to do the math.

Health care insurance for retirees can range from just over $100 to over $400 per month. The price varies depending on your age, province and the extent of the coverage you may need. For example, cheaper options have a limit for prescription and dental costs and you have to pay a deductible .

Medical insurance options for early retirees are probably more attractive, given that they usually dont qualify for any financial assistance before 65. Is it worth having private health insurance if youre under 65 and spending thousands on prescription drugs? Probably, but again, it is important to do the math before signing up for any plan.

State And Local Government

Focusing on the needs of your organization and your employees

At Cigna, we understand that better health, convenience and savings shouldn’t have to be a choice.

Through a deep understanding of benefits management in the public sector, we’re equipped to deliver an experience that’s tailored to your needs.

Together, we’ll look for opportunities to help improve the health of your employees and their families, create innovative programs for collaboration and engagement, and help you reduce your total health care costs.

Connect With Us

Also Check: City Of Albuquerque Government Jobs

Health Insurance For Resident Expatriates

The extent of coverage for employers and their dependents is determined by the employee’s salary, designation etc. The extent of coverage and type of policy/scheme would determine the cost of your medical services.

In the emirate of Abu Dhabi, employers and sponsors are responsible for the providing health insurance coverage for their employees and their families .

In the emirate of Dubai, employers are required to provide health insurance coverage for their employees. Sponsors are required to get insurance cover for their resident dependents.

There are several insurance companies in the UAE. Many also provide Islamic insurance . The website of Insurance Authority provides a list of registered insurance companies in the UAE.

Related links:

Am I Covered For Emergency Care Outside Of Canada

Doctor Bills Manitoba Health and Seniors Care will pay for emergency doctors services outside of Canada at a rate equal to what a Manitoba doctor would receive for a similar service.

Hospital Bills Emergency hospital care is paid on an average daily rate established by Manitoba Health and Seniors Care.

You may be charged more than the amount paid by Manitoba Health and Seniors Care for services provided outside Canada.

The difference above the covered amount may be substantial and is your responsibility.

Bring or mail your original bill to the Out-of-Province Claim Section at Manitoba Health and Seniors Care within 6 months of receiving care. If you have made payments on your bills, Manitoba Health and Seniors Care requires a receipt showing the amount paid. If you do not include your receipt, Manitoba Health and Seniors Care will pay the hospital or doctor directly.

For more information contact:

Manitoba Health and Seniors Care300 Carlton Street Business hours: Monday to Friday 8:30 to 16:30 For more information call: 204-786-7303Toll free: 1-800-392-1207 Ext. 7303TDD/TTY: 204-774-8618TDD/TTY Relay Service outside Winnipeg: 711 or 1-800-855-0511

NOTE: The in-person Registration and Client Services Office at 300 Carlton St., Winnipeg will be temporarily closed to the public to support social distancing efforts. Services will be available by telephone or email. .

Recommended Reading: How To Do Government Contracting

How Do I Apply For The Premium Tax Credit Health Insurance Subsidy

Apply for the premium tax credit through your states health insurance exchange. If you get your health insurance anywhere else, you cant get the premium tax credit.

If you’re uncomfortable applying on your own for health insurance through your state’s exchange, you can get help from a licensed health insurance broker who is certified by the exchange, or from an enrollment assister/navigator. These folks can help you enroll in a plan and complete the financial eligibility verification process to determine whether you’re eligible for a subsidy.

If you’re in a state that uses HealthCare.gov as its exchange , you can use this tool to find an exchange-certified broker who can help you pick a health plan. If you already know what plan you want and just need someone to help you with the enrollment process, there are also navigators and enrollment counselors who can assist you, and you can use the same tool to find them. If you’re in a state that runs its own exchange, the exchange website will have a tool that will help you find enrollment assisters in your area .

I Earn Just $22000 A Year How Can I Afford The Out

Image: fizkes / stock.adobe.com

- Health insurance & health reform authority

Q. Ill turn 26 soon, and will lose access to coverage under my parents health plan. I understand that I am expected to buy insurance, and that I will receive a tax credit from the government to help me cover premiums. But the cheapest Bronze plans all seem to come with deductibles in excess of $7,000, and out-of-pocket maximums that are well over $8,000. Where am I supposed to come up with that sort of money? I earn just $22,000 a year.

A. Its true that deductibles and out-of-pocket maximums on Bronze plans are quite high. In 2021, the maximum out-of-pocket allowed on any plan is $8,550 for a single person. And Bronze plans tend to have out-of-pocket limits at or nearly at this limit.

But theres another subsidy in addition to the premium tax credit subsidy that you should know about . Its called the cost-sharing subsidy, or cost-sharing reduction. As long as your income doesnt exceed 250% of the poverty level, youre eligible for cost-sharing subsidies. These subsidies are automatically included in your plan if your income makes you eligible, as long as you buy a Silver plan. Unlike premium subsidies cost-sharing subsidies are only available on Silver plans.

| For 2021 coverage, HHS capped maximum out-of-pocket on Silver plans as follows : | |

|---|---|

| If you earn | |

| $25,521 $31,900 | $6,800 |

Recommended Reading: How To Get Free Government Internet

Tip #: Learn What A Few Of Those Wonky Health Insurance Terms Mean

How much can you afford to pay for health insurance every month? In order to compare the true overall cost of health plans and figure out which one might work best within your budget, you need to get familiar with several important insurance terms words like premium, cost-sharing, deductible and copay.

Luckily, we made a handy health insurance glossary just for you.

Insurance companies use these different types of charges the premium vs. the deductible, for example sort of like dials to keep their own costs manageable. A basic plan they sell might dial down the monthly premium on a particular plan, so it looks inexpensive. But that same plan might have a high, “dialed up” deductible of, say, $6,000 meaning you’ll have to spend $6,000 out of your own pocket on health services each year before your insurance begins to pay its portion of the cost. If you picked that plan, you’d be betting you won’t have to use a lot of health services, and so would only have to worry about your hopefully affordable premiums, and the costs of a few appointments.

An Alternative Way To Pay For Health Care Costs

If youre struggling to pay for prescriptions, dental care, home care or any other medical expenses, and its not worth getting private health insurance , what options do you have?

For homeowners aged 55-plus, the CHIP Reverse Mortgage® from HomeEquity Bank could provide the money you need to pay all of your medical costs, without having any impact on your retirement income.

You can receive the money in a lump sum or in monthly payments, to coincide with your monthly health care costs. And, because you dont have to pay what you owe , until you decide to sell your home, it wont stretch your finances.

If health insurance for retirees in Canada is out of reach for you, but you have considerable health care expenses, call us now at 1-866-522-2447. Well work out how much cash you can access and help you start the process.

Also Check: Government Subsidized Housing For Elderly

Government Health Care Through The Us Military

For those individuals who serve in the U.S. military and their families, there are three primary programs where health care services can be received:

- Veterans Affairs Health Care VA Health Care offers comprehensive benefits to military members for inpatient hospital care as well as outpatient services based on their income, service connection and discharge.

- CHAMPVA CHAMPVA is a comprehensive health program that serves the spouses and children of veterans who are either wholly or permanently disabled due to their service and are not covered by TRICARE

- TRICARE TRICARE offers several plans with varying benefits to active and retired military service members, their families and survivors based on their service categories.

Social insurance programs are offered by the government to assist the unemployed, disabled and older adults. Two primary health care programs are provided in the U.S.:

- Medicaid is a government-funded health insurance program that provides comprehensive medical insurance for free or at a very subsidized cost to individuals who qualify.

- Medicare is a program that guarantees specific health benefits to a sector of the population. Its based on age, citizenship and Medicare employee contributions. This program provides comprehensive medical insurance for free or at a meager cost.

Holdout States Haven’t Expanded Medicaid Leaving 2 Million People In Limbo

Then there’s Medicaid, the health insurance program for people with low incomes, that covers around 80 million people nearly one in four Americans. It’s funded by both the federal and state governments, but run by each state, so whether you’re eligible depends on where you live.

For practically everyone else, the place to go is Healthcare.gov, where you can shop for insurance in the marketplaces created by the Affordable Care Act, also known as Obamacare.

This is where you look for health insurance if you don’t fit any of the categories we mentioned previously, Corlette says if, for example, “your employer doesn’t offer you any coverage you’re not eligible for Medicare because you’re not old enough and you’re not poor enough for Medicaid. You can go to the marketplaces, apply for financial help depending on your income, and choose a plan there.”

Don’t Miss: Government Assistance For Single Person

What Types Of Coverage Exist

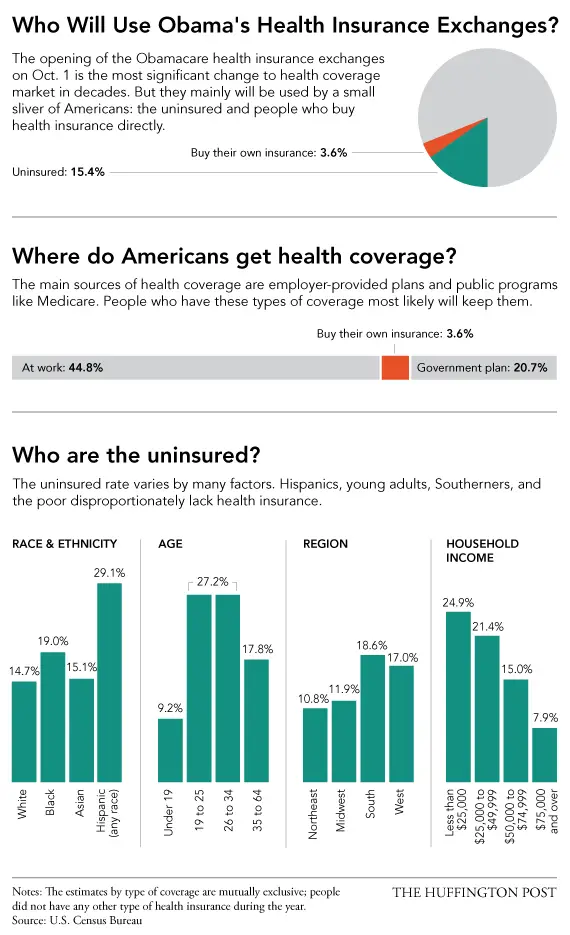

Health insurance coverage comes in three major types: employer-sponsored health insurance , individual or private plans and Medicare/Medicaid. In the last decade, the number of private employers offering employer-sponsored insurance decreased significantly, from 61.6% in 2008 to 47.3% in 2018, according to the Agency for Healthcare and Research Policy. In 2010, President Obama signed the Affordable Care Act into law, which made private health insurance significantly more accessible to uninsured Americans and expanded eligibility to Medicaid.

A Business Owner Who Has Employees

If you start a business and you have employees, you might be required to offer them health insurance. Even if it’s not required, you might decide to offer health insurance in order to be a competitive employer that can attract qualified job candidates. In this situation, you will be required to purchase a business health insurance plan, also known as a group plan.

Read Also: Federal Government Dental And Vision Insurance

How Do I Report Changes To My Registration Information

Please report changes such as a new address, birth, gender, adoption, death, marriage, divorce, or legal separation to the Insured Benefits Branch. Documentation is required for some changes.

Changing your sex designation on your health card

A Manitoba resident may request the change to their Manitoba health card. This can be done when a health card is issued at birth, or anytime thereafter by contacting Manitoba Health and Seniors Care, Registration and Client Services office.

In order to make the change to your Manitoba health card, please complete an eNotice of Change form and provide a photocopy of your Canadian Birth Certificate.

Dealing with Death

In the event of the death of a Manitoba resident, please report the death to Manitoba Health and Seniors Care. Next of kin of the deceased, an individual holding a power of attorney, or an executor or administrator of the deceaseds estate may inform Manitoba Health and Seniors Care of a death by providing a photocopy of the death certificate or a funeral directors certificate.

If a Manitoba resident dies in another Canadian province, Manitoba Health and Seniors Care will require the next of kin or one of the above mentioned legal representatives to provide the required documentation confirming death to Manitoba Health and Seniors Care, in order to ensure that the deceaseds information is changed in the Manitoba Health and Seniors Care registration database.

Please report changes to your registration information to:

Government Health Insurance Through The Marketplace

There are two types of marketplaces available where qualifying Americans can access government tax credits and affordable health care all in one place. The type you choose will depend on the state you come from. There is the federal health insurance exchange known as Healthcare.gov, and there are state-run marketplaces. California has its own state-run marketplace known as Covered California.

Individuals who qualify can purchase a private insurance plan or apply for a government subsidy to reduce their monthly insurance bill. To learn more about enrollment, subsidies and quotes, click Covered California.

Recommended Reading: What Is Fund Accounting In Government

Your Options If You’re Not Eligible Through Your Employer

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

If your employer doesn’t offer you health insurance as part of an employee benefits program, you may be looking at purchasing your own health insurance through a private health insurance company.

A premium is the amount of money an individual or business pays to an insurance company for coverage. Health insurance premiums are typically paid monthly. Employers who offer an employer-sponsored health insurance plan typically cover part of the insurance premiums. If you need to insure yourself, you’ll be paying the full cost of the premiums.

It is common to be concerned about how much it will cost to purchase health insurance for yourself. However, there are various options and prices available to you based on the level of coverage you need.

When purchasing your own insurance, the process is more complicated than simply selecting a company plan and having the premium payments come straight out of your paycheck every month. Here are some tips to help guide you through the process of purchasing your own health insurance.