Unable To Repay Student Loans

If you cant pay the full amount due on time or have to miss a student loan payment, your loan may be considered delinquent and you may be charged late fees. Contact your loan servicer immediately for help, and ask them about your options.

Find out about the new Student Debt Relief Plan and see if you qualify. The plan cancels federal student loan debts of up to $20,000 for Pell Grant recipients and up to $10,000 for other borrowers.

Learn about the COVID-19 emergency relief pause in federal student loan repayments that has been extended through December 31, 2022.

Consider Private Student Loans

Another option if you need to borrow more money than federal student loans can provide is to apply for a private loan from a bank, credit union, or other financial institution.

Private loans are available regardless of need, and you apply for them using the financial institution’s own forms rather than the FAFSA. To obtain a private loan, you will need to have a good credit rating or get someone who does have one, such as a parent or other relative, to cosign on the loan.

Having less-than-stellar credit can make it difficult to qualify for student loans. Private lenders will consider your income and credit history, and as a college student, you likely have poor credit or no credit at all. However, some lenders offer student loan options for borrowers with bad credit.

Generally, private loans carry higher interest rates than federal loans, and these rates are variable rather than fixed, which adds some uncertainty to the question of how much you’ll eventually owe. Private loans also lack the flexible repayment plans available with federal loans and are not eligible for loan consolidation under the Federal Direct Consolidation Loan program. However, you can refinance your private loans after you graduate, possibly at a lower interest rate.

Q Whats With All These Proposals To Forgive Student Debt

A. Some Democratic candidates are proposing to forgive all or some student debt. Sen. Elizabeth Warren, for instance, proposes to forgive up to $50,000 in loans for households with less than $100,000 in annual income. Borrowers with incomes between $100,000 and $250,000 would get less relief, and those with incomes above $250,000 would get none. She says this would wipe out student loan debt altogether for more than 75% of Americans with outstanding student loans. Former Vice President Joe Biden would enroll everyone in income-related payment plans . Those making $25,000 or less wouldnt make any payments and interest on their loans wouldnt accrue. Others would pay 5% of their discretionary income over $25,000 toward their loan. After 20 years, any unpaid balance would be forgiven. Pete Buttigieg favors expansion of some existing loan forgiveness programs, but not widespread debt cancellation.

Forgivingstudent loans would, obviously, be a boon to those who owe moneyand wouldcertainly give them money to spend on other things.

But whoseloans should be forgiven? What we have in place and we need to improve is asystem that says, If you cannot afford your loan payments, we will forgivethem, Sandra Baum, a student loan scholar at the Urban Institute, said at aforum at the Hutchins Center at Brookings in October 2019. Thequestion of whether we should also have a program that says, Lets alsoforgive the loan payments even if you can afford them is another question.

Don’t Miss: First Home Buyer Government Support

Loans And Grants For Full

When you apply for Nova Scotia Student Assistance for Full-Time Studies, you are applying for both Loans and Grants, from both the Government of Nova Scotia and the Government of Canada.

- Provincial and federal funding amounts are calculated using different income information, but have the same basic criteria.

- Some grants have additional criteria to help specific groups of students

- Grants do not need to be repaid.

- Loans must be repaid starting six months after you leave school.

- Nova Scotia Loans begin to accumulate interest six months after you leave school, unless you apply for and qualify for 0% interest.

- Canada Student Loans begin to accumulate interest six months after you leave school.

How Do I Apply For Student Loans

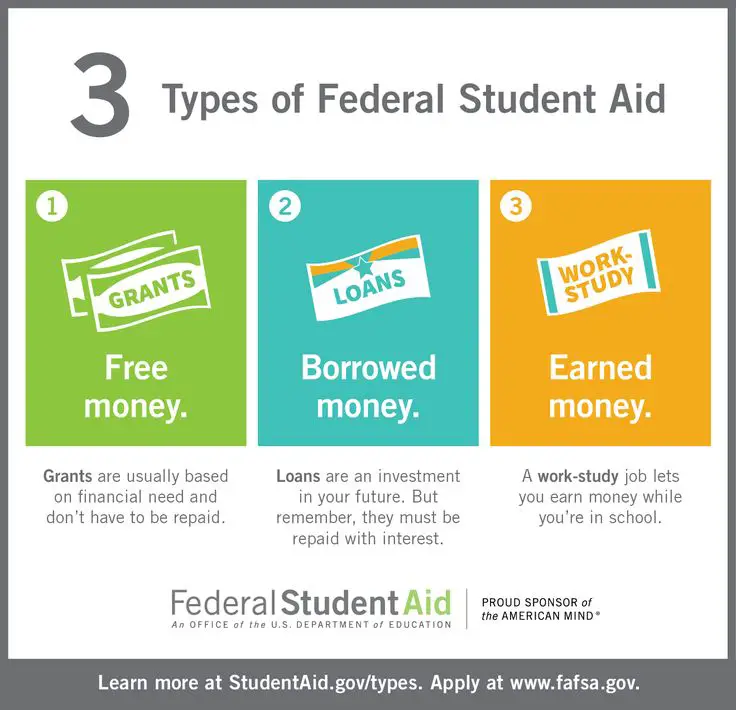

All federal loans made by the U.S. Department of Education require you to complete the Free Application for Federal Student Aid .

Schools that receive information from your FAFSA will be able to tell you if you qualify for federal student loans. Almost every American family qualifies for federal student loans.

For private student loans, you should shop around at different lenders, including banks, credit unions, or other student loan providers. A good practice is to get quotes from at least three different providers. You might first consult your local credit union or bank, if you or your family holds an account there. You should also consult your schools financial aid office to learn more about your payment options.

Recommended Reading: Government Free Mortgage Relief Program

Figure Out The Net Cost Of College

Start by calculating the cost of attendance at the school of your choice.

A good rule of thumb is to determine the net college cost and the amount of income and savings currently on hand, then subtract whats available from the net price.

For most students and parents, borrowing 125 percent of this difference is a good gauge of what is needed from student loans. Its easier to determine the net cost of college because all colleges and universities eligible to receive federal financial aid are required to provide an online calculator through their websites.

Part of the calculation also comes from figures in your federal student aid package. After the FAFSA is complete, a financial aid package is generated for each applicant.

Within that package, you are provided details regarding the type of aid offered, including all federal student loans you may be eligible for, federal work-study programs, supplemental educational opportunity grants, scholarships, and Pell Grants.

Based on the unmet need, you can determine what you may need to borrow to fund your education.

Alternatives To College Loans

Both federal and private student loans serve their purpose by helping millions of students achieve their educational goals. However, keeping an eye open for other options to help minimize your overall student loan debt is important.

Here are guides to some other ways to potentially lighten your financial burden:

Recommended Reading: Government Funding Programs For Real Estate Investors

When Will The Debt Forgiveness Application Be Available

In an , National Economic Council Deputy Director Bharat Ramamurti said that the application for student debt forgiveness will go live in early October. He also said that after borrowers complete their applications, “They can expect relief within four to six weeks.”

“Borrowers are advised to apply by roughly Nov. 15, in order to receive relief before the payment pause expires on Dec. 31,” Ramamurti said.

You can choose to be notified when the application becomes available by going to the Department of Education subscription page and signing up to receive “Federal Student Loan Borrower Updates,” the first checkbox in a long list of education topics.

We’ll update this story with more details when the application is available.

Free Money From The Government

The federal government does not offer grants or free money to individuals to start a business or cover personal expenses, contrary to what you might see online or in the media. Websites or other publications claiming to offer “free money from the government” are often scams. Report them to the Federal Trade Commission.

Recommended Reading: Local Government Federal Credit Union Routing Number

How To Apply For A Direct Loan

The Financial Aid Office will be accepting loan applications for the 2022/23 academic year from 3 May 2022. Please note that applications will be processed in strict order of receipt.

Notification of Student Loan Letters will be issued from July 2022 to eligible students who have submitted a complete application.

Public Service Loan Forgiveness

If you are employed by a government or not-for-profit organization, you may be able to receive loan forgiveness under the Public Service Loan Forgiveness Program.

The Public Service Loan Forgiveness Program forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

Note: Servicing for this program is managed by another federal student loan servicer. If you enroll in Public Service Loan Forgiveness, your eligible loans will be transferred from Great Lakes to that servicer. Also note, you may not receive a benefit for the same qualifying payments or period of service for Teacher Loan Forgiveness and Public Service Loan Forgiveness.

Also Check: Federal Government Jobs In Charlotte Nc

What Is A Grant From The Government

A grant is one of the ways the government funds ideas and projects to provide public services and stimulate the economy. Grants support critical recovery initiatives, innovative research, and many other programs. You can find a list of projects supported by grants in the Catalog of Federal Domestic Assistance . You can also learn about the federal grant process and search for government grants at Grants.gov.

What Is A Pell Grant

While researching the Biden administration’s student loan forgiveness plan, you’ll come across the term “Pell Grant” a lot. A Pell Grant is a form of financial aid you may be rewarded based on your financial needs, which are determined by the Department of Education during the Free Application for Federal Student Aid application process.

Your expected income, student status, school-related expenses and more are taken into account. Additionally, your school has to be enrolled in the program. Make sure to contact your school’s financial aid office if you’d like more details.

This type of financial aid, which doesn’t usually need to be paid back, is reserved for undergraduate students “who display exceptional financial need and have not earned a bachelor’s, graduate, or professional degree,” according to Federal Student Aid.

The maximum Pell Grant award for the 2022-23 school year was just under $7,000, Federal Student Aid states on its website.

Also Check: Government Jobs In Warner Robins Ga

How Does Student Loan Interest Work

Interest is a fee that the lender charges you to borrow money, usually expressed as a percentage of the amount you borrow. Student loans can have fixed interest rateswhich remain the same over the life of the loanor variable interest rates, which fluctuate over time based on certain economic conditions.

For most types of student loans, interest begins accruing as soon as you receive the money. That means the loan you took out freshman year will accrue interest during your time in schooland if you dont make payments until you graduate, your balance will be larger than what you originally borrowed. The exception to this rule is federal subsidized loans if you qualify for these, the government will pay the interest while youre in school or when your loans are deferred.

When you make a student loan payment, your money is first applied to any interest that has accrued since your last payment. Any remaining amount is then applied to your loans balance. When you first start repaying your loans, a large portion of your payments will be eaten up by interest charges. But as your loan slowly shrinks and your repayment progresses, more and more of your money will be applied directly to your loan balance.

Student Loan Forgiveness For Total And Permanent Disability

Overview: Get student loan forgiveness if you have a total and permanent disability. The Biden administration has cancelled $5.8 billion of student loans for student loan borrowers with a total and permanent disability. . You can provide information from the U.S. Social Security Administration, U.S. Department of Veterans Affairs or your physician.

Apply: Heres how to apply for a disability discharge.

Recommended Reading: Government Help With New Windows

Apply For Private Student Loans

After you learn how to get a federal student loan, private student loans are your next step. You can apply for private student loans and private parent loans through private lenders like banks, credit unions, or online lenders, which are outside of the government.

Its important to research your options to make sure youre getting the lowest interest rate. Youll also want to compare things like eligibility requirements, fees and other features.

Private lenders are looking for creditworthy borrowers. This means the lender will review your income, credit history, debt-to-income ratio, and length of employment. Most studentsincluding 90% of undergraduates and two-thirds of graduate studentswill need a cosigner to qualify. Also, you wont need the FAFSA to apply for private student loans.

But before applying for private student loans, you should consider the risks. These loans dont offer the same perks of protections as federal loans. The government wont pay for your interest while youre still in schoolunlike federal Direct Subsidized Loans. And once you graduate from school, you wont have access to federal income-driven repayment plans.

Once you find a cosigner, be sure to have their information handy when you complete your application.

Federal Student Loan Borrowing Limits

Each type of federal student loan has imposed limits based on the year of attendance, the status of the student , and other financial aid received for education. Heres a quick overview:

- First-Year Undergraduate Students Dependent students can borrow $5,500 with no more than $3,500 in subsidized loans independent students can borrow $9,500, with no more than $3,500 in subsidized loans.

- Second-Year Undergraduate Students Dependent students can borrow $6,500, with no more than $4,500 in subsidized loans independent students can borrow $10,500, with no more than $4,500 in subsidized loans.

- Third-Year and Beyond Undergraduate Students Dependent students can borrow $7,500, with no more than $5,500 in subsidized loans independent students can borrow $12,500, with no more than $5,500 in subsidized loans.

- Graduate and Professional Students $20,500 of unsubsidized only

The aggregate loan limit for dependent students is $31,000 with no more than $23,000 as subsidized. Independent undergraduate students can borrow $57,500, with no more than $23,000 in subsidized loans, while graduate and professional students can borrow $138,500, with no more than $65,500 in subsidized loans.

If you have met your federal student loan limit, private loans can fill the gap. Check out our guide to the best private student loans to get started.

Don’t Miss: Free Money Through Government Programs

Relatively Low Interest Rates

Additionally, federal student loans are low-interest student loans and often have lower rates than even the best private student loans, making the cost of borrowing for your education less expensive.

Federal student loan interest rates are set by Congress each year, but once you receive a loan, the interest rate does not change.

Some private student loan lenders offer variable interest rates that may seem lower initially, but as interest rates rise, so will your student loan interest rates.

Student Loan Forgiveness For Public Servants

Get student loan forgiveness if you work for a qualified government or non-profit employer. Youll need to meet certain requirements such as working full-time, making 120 monthly payments, and enrolling in an income-driven repayment plan. You can get total student loan forgiveness for all your federal student loans. . Biden announced major changes to student loan forgiveness, which helps more student loan borrowers get student loan forgiveness.

Apply:Heres how to apply for limited student loan forgiveness.

Also Check: How Ngo Get Fund From Government

Understand How Student Loans Work

Before you apply for a student loan, you should completely understand the requirements, how the student loan process works and what it really means to be in debt.

Most students borrow money for college from the government or from a private lender. In either case, the borrower typically has to sign some form of loan agreement that acknowledges the loan repayment terms.

With federal student loans, this agreement is called a Master Promissory Note. This confirms that you legally agree to pay back the loan, along with any interest and fees, no matter what.

Borrowers who dont repay their student loans may face harsh consequences, such as wage garnishment, suspension of professional licenses and a lower credit score. However, federal borrowers may be eligible for flexible payment plans or forbearance during times of unemployment.

Private student loans are a different story. If you cant make your private student loan payments, you may not have the option to postpone or lower payments through deferment or forbearance. You wont have the option for forgiveness, either. This includes Public Service Loan Forgiveness.

How Much Do Student Loans Cost

Congress sets federal student loan interest rates, which are different depending on the type of student loan you borrow. For instance, if you have a direct unsubsidized loan and a direct PLUS loan, youll pay different interest rates for both.

Here are the interest rates on loans for the 2022-2023 school year:

- 4.99% for direct subsidized and unsubsidized loans for undergraduates

- 6.54% for direct unsubsidized loans for graduate and professional students

- 7.54% for direct PLUS loans for graduate or professional students, and parents of dependent students

Your federal student loans consist of the principal, or the amount you borrowed, plus interest.

Once youve taken out your federal loan, the interest rate will not change. If you eventually combine your federal loans using a direct consolidation loan, the interest rate will be the average of your original loans rates rounded up. The only other time your interest rate changes is if you refinance your student loans.

Private student lenders determine your interest rate based on your creditworthiness, or that of your co-signer, if you have one. Some private student loans also charge fees, like origination or late fees. While federal student loans have fixed interest rates that dont change over the life of the loan, private student loans often let you choose between fixed or variable interest rates.

You May Like: Government Grants For Pilot Training