What Is Contract Financing

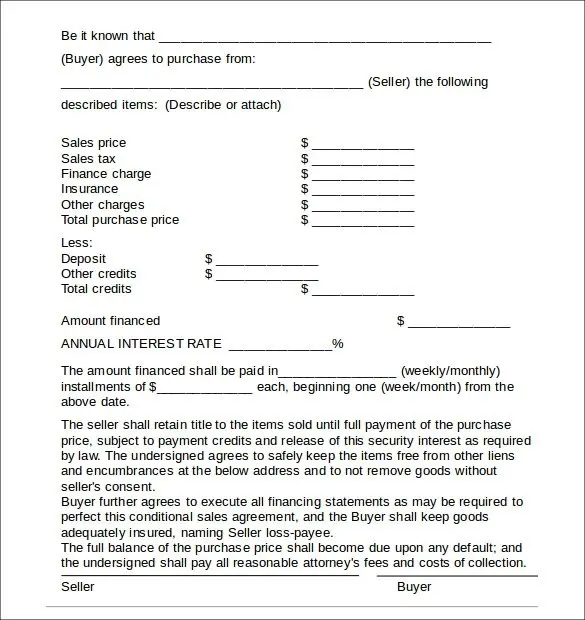

Contract financing is a payment solution where the contractor sells an invoice to a contract financing company to receive an advance up to 90% of the invoice amount before the project begins. This provides the company cash flow which can help finance project-related costs, such as inventory and equipment. When the contract is paid by the customer, the contract financing company will send the contractor the remaining amount, less a fee.

Purchase Order Funding For Government Contractors

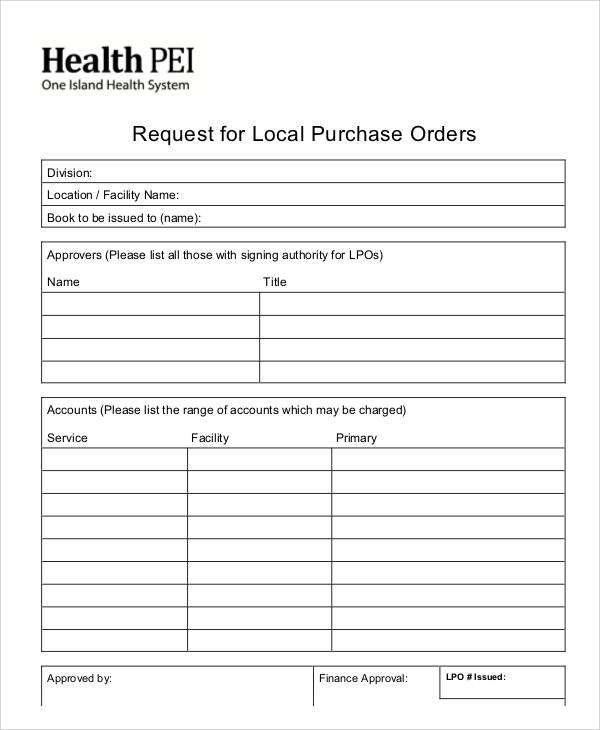

Purchase order funding is a form of short-term cash advance for companies who work on various projects for the federal government. Often, companies that are small or relatively new are not able to raise the funds needed to bid on a government contract, since they may not qualify for a bank loan or may not have the funds on hand. Purchase order funding for government contracts gives these companies a chance to win projects with their own funds.

Contract Performance In Foreign Countries

The enforceability of contract provisions for security of Government financing in a foreign jurisdiction is dependent upon local law and procedure. Prior to providing contract financing where foreign jurisdictions may become involved, the contracting officershall ensure the Governments security is enforceable. This may require the provision of additional or different security than that normally provided for in the standard contract clauses.

Recommended Reading: Loudoun Government Jobs

Unenforceability Of Unauthorized Obligations

Many supplies or services are acquired subject to supplier license agreements. These are particularly common in information technology acquisitions, but they may apply to any supply or service. For example, computer software and services delivered through the internet are often subject to license agreements, referred to as End User License Agreements , Terms of Service , or other similar legal instruments or agreements. Many of these agreements contain indemnification clauses that are inconsistent with Federal law and unenforceable, but which could create a violation of the Anti-Deficiency Act if agreed to by the Government.

Solicitation Provisions And Contract Clauses

The contractshall contain the paragraph entitled “Payment” of the clause at 52.212-4, Contract Terms and Conditions-Commercial Products and Commercial Services. If the contract will provide for contract financing, the contracting officershall construct a solicitation provision and contract clause. This solicitation provision shall be constructed in accordance with 32.204 or 32.205. If the procedure at 32.205 is used, the solicitation provision at 52.232-31, invitation to Propose Financing Terms, shall be included. The contract clauseshall be constructed in accordance with the requirements of this subpart and any agency regulations.

Each contract financing clause shall include:

A description of the-

Computation of the financing payment amounts of this section)

Specific conditions of contractor entitlement to those financing payments of this section)

Liquidation of those financing payments by delivery payments of this section)

Security the contractor will provide for financing payments and any terms or conditions specifically applicable thereto and

Frequency, form, and any additional content of the contractors request for financing payment (in addition to the requirements of the clause at 52.232-29, Terms for Financing of Purchases of Commercial Products and Commercial Services and

Unless agency regulations authorize alterations, the unaltered text of the clause at 52.232-29, Terms for Financing of Purchases of Commercial Products and Commercial Services.

Recommended Reading: Government Jobs For History Majors

Progress And Future Outlook

- A Tri-Party Agreement was negotiated between Capstone, the Client, and the Factor

- Capstone has received all funds on the financed POs on schedule

- The Client is projected to expand rapidly and utilize much more of the

- Purchase Order line on a going-forward basis once the new factoring relationship begins

Things You Need To Know About Government Purchase Order Funding

July 27, 2018 By Star Funding

Star Funding is one of the few lenders that offers purchase order financing for government contracts. Working with a federal or state government agency is a great way to grow your business. Whether you are searching for bid opportunities on FedBizOpps or filling local government purchase orders, winning a government contract can be very rewarding but at the same time it can stress out your cash flow.

When working with the government, purchase order financing can be your best option to fill the order. Many of our clients are selling to government agencies on a regular basis. You dont have to try and be like Jonah Hill in War Dogs, but a few nice winning bids can help you build a very profitable business.

Below are the top 8 questions a purchase order financing company will ask before financing your government purchase orders and contracts.

Don’t Miss: Government Jobs For History Majors

Q: What Ways Are Business Owners Able To Use Working Capital

The old saying goes: revenue is vanity, profit is sanity and cash flow is REALITY. Working capital is the lifeblood of a growing business. Having access to it means you can grow the business much faster. So even if you do have your own money to finance deals, you should still use other peoples money to bankroll your orders so that your own money can be used to grow the company.

A good example would be that if you have an order for R200,000 and it will cost R100,000 to execute on. If you have a R100,000, and used all of that to finance this one deal, you wont be able to take on anymore business until that deal pays out.

If you use The Peoples Fund, for example, we would provide the full capital, you can now use the R100,000 to either hire a short term sales team to win you more contracts, or pay for marketing to win more contracts. The Peoples Fund would at the end of the period R12,000 and you keep R88,000 profits without any of your own money being put down. The awesome thing is that the other orders you created with that same R100,000 can also be financed by The Peoples Fund.

We Help You Achieve More

Were on a mission to be Americas small business bank. Our deep knowledge and product expertise help us match you with the best solution to meet your unique needs. Were proud to invest in Americas business owners because your drive drives us.

Blackfish Federal Case Study

Learn how Blackfish overcame a common hurdle that many other small business government contractors face the lack of past performance.

Recommended Reading: Government Jobs For History Majors

Contractual Arrangements That Have Multiple Activities

Some relationships may involve other aspects beyond any procurement of goods, services or construction services. This might include personnel exchanges, research and development partnerships, sharing of data, or other technical information or various other types of collaboration. Arrangements to collaborate that have no procurement aspects in the short term may also lead to procurement relationships in the medium or long term.

A best practice in these instances is to look at how large a component the procurement aspect is as compared with the overall scope of activities. If procurement is a significant proportion of the related activity, or if it is risky or otherwise sensitive, departments should consider processing the arrangement through their usual procurement channels to ensure sufficient due diligence. These instances must be treated on a case-by-case basis. Early engagement with departments legal, procurement and financial expertise and with TBS can help determine the required course of action.

How Purchase Order Financing Works

The process of purchase order financing is simpler than it might sound. Before we jump into the steps of the process, letâs define a few terms:

- Borrower/seller: This is you, the person seeking advance funding or financing to fulfill a purchase order.

- Purchase order financing company/purchase order lender: This is the lender or the company thatâs providing the financing.

- Supplier: This is the company that manufactures or distributes the goods.

- Customer: This is your customer, the party thatâs trying to buy the goods and who has given you a written purchase order for the goods.

Recommended Reading: Goverment Jobs In Las Vegas

Financing For Government Contractors

The federal government awards about 23% of all government contract to small business owners. On an annual basis, the federal government commits approximately $500 billion in government contracts for research and development, as well as goods, and services. This means that around $115 billion of government contracts are awarded annually to small business owners.

SMB Compass can provide government contract financing for federal, state, and local government contracts. Our programs are also designed for both prime contractors and sub-contractors. Its also always best you work with a company that understands the federal assignment regarding the claims process!Government contracts come with a varying degree of capital needs. Small businesses incur both upfront and ongoing expenses that can be financed through government contract financing programs.

What this means is, a government contractor loan can be structured in many ways, but as always, the details are important, so be make sure they support all of your financing needs.

At SMB Compass we specialize in government contract financing and have the ability to provide support to different contract types. We also can provide mobilization funding, support letters to help strengthen bids for new contracts, and can provide government contract funding for earned but unbilled invoices.

- Increase the operating cash flow

- New contract bidding

Invoice Factoring

- Purchase inventory

- Hire new employees

Earned but Unbilled Factoring

- Payroll

Description Of Contract Financing Methods

Advance payments are advances of money by the Government to a prime contractor before, in anticipation of, and for the purpose of complete performance under one or more contracts. They are expected to be liquidated from payments due to the contractor incident to performance of the contracts. Since they are not measured by performance, they differ from partial, progress, or other payments based on the performance or partial performance of a contract. Advance payments may be made to prime contractors for the purpose of making advances to subcontractors.

Progress payments based on costs are made on the basis of costs incurred by the contractor as work progresses under the contract. This form of contract financing does not include-

Payments based on the percentage or stage of completion accomplished

Payments for partial deliveries accepted by the Government

Partial payments for a contract termination proposal or

Performance-based payments.

Loan guarantees are made by Federal Reserve banks, on behalf of designated guaranteeing agencies, to enable contractors to obtain financing from private sources under contracts for the acquisition of supplies or services for the national defense.

Progress payments based on a percentage or stage of completion are authorized by the statutes cited in 32.101.

Performance-based payments are contract financing payments made on the basis of-

Performance measured by objective, quantifiable methods

Accomplishment of defined events or

You May Like: Can I Get A Replacement Safelink Phone

When To Use Purchase Order Financing

Any business that needs to buy supplies to fill a customer order but canât afford those supplies might benefit from purchase order financing. Companies that use purchase order financing include:

- Startups

- Importers or exporters of finished goods

- Outsourced manufacturers

- Government contractors who are fulfilling government orders

One of the keys to knowing if your business qualifies for purchase order financing is whether you sell a completed product. If you sell services or materials, your business wonât qualify for purchase order financing.

Purchase order financing will help businesses who find themselves in these types of situations:

- Growing faster than cash is coming in

- Seasonal sales spikes

- Cyclical tight cash flow

If your business has experienced any of these cash flow problems, purchase order financing might be able to help smooth the flow of your business.

You Apply For Purchase Order Financing

When you confirm you canât afford to purchase the supplies necessary to fulfill your customerâs order, you can apply for purchase order financing. The lender will approve you for up to 100% of your supplier costs, depending on your qualification requirements, your customerâs creditworthiness, and your supplierâs reputation. Itâs more realistic to get approved for 80% or 90% financing.

You May Like: Highest Paying Jobs For History Majors

Contracting And Materiel Management

The following organizational roles act in response to policy and process requirements relating to the management of real property and materiel, investment planning, project management andprocurement across the government. These roles are not financial in nature, but are described in order to provide context and to link the financial processes.

Corporate Contracting and Materiel

Asset/Materiel Management Services

The Asset/materiel management services role provides contracting and materiel services for a department. The Government of Canadas definition of asset/materiel management services identifies three categories of services in departments and agencies. These services normally occur as a result of a financial transaction and may be directly associated with an employee or position. Administrative officers and staff provide the following:

Under the Manage Procure to Payment business process, asset/materiel management services is responsible for:

Responsibility Centre Manager Acquisitions

For the purpose of this guideline, a responsibility centre manager role can represent either an individual responsibility centre or a group of responsibility centres, as would be the case for senior managers.

The manager also has a financial management role, as described earlier in Financial Management. Due consideration should be given to adequate separation of duties between individualsin the Manage Procure to Payment process.

You Receive A Purchase Order

Your customer submits a purchase order to you that specifies the type and volume of goods theyâd like to purchase. Based on this information, you should be able to determine whether or not youll need to access financing to fulfill the order. If you do, this initiates the process of purchase order financing.

Don’t Miss: Free Touch Screen Government Phones Ohio

Payment Of Subcontractors Under Cost

If the contractor makes financing payments to a subcontractor under a cost-reimbursement prime contract, the contracting officershould accept the financing payments as reimbursable costs of the prime contract only under the following conditions:

The payments are made under the criteria in subpart 32.5 for customary progress payments based on costs, 32.202-1 for commercial product or commercial service purchase financing, or 32.1003 for performance-based payments, as applicable.

If customary progress payments are made, the payments do not exceed the progress payment rate in 32.501-1, unless unusual progress payments to the subcontractor have been approved in accordance with 32.501-2.

If customary progress payments are made, the subcontractor complies with the liquidation principles of 32.503-8, 32.503-9, and 32.503-10.

If performance-based payments are made, the subcontractor complies with the liquidation principles of 32.1004.

The subcontract contains financing payments terms as prescribed in this part.

Purchase Order Financing For Government Contracts

The money set aside for federal government contracts is set to grow even larger in the second half of 2021, and as business owners prepare to try and get their pieces of the pie, one of the financing vehicles that can help them is government purchase order financing.

What is Purchase Order Financing?

Purchase order financing, which is offered by both traditional and alternative lenders, is a form of short-term financing that will enable your suppliers to get paid for goods and services that you need to fulfill an order for a customer. For example, if you own a small car dealership and you get an order for 50 limousines from a customer and dont immediately have the cash to pay the manufacturer for those vehicles, you can use PO financing to purchase them.

The advantages of using this type of financing are endless. Through PO financing:

- The lender will take on invoice collection responsibility with your customer

- You can maintain your existing cash flow without having to take on new debt

- You can fulfill orders and cover supplier costs without impacting your ability to cover operation costs, and

- PO financing will allow you to grow your business by showing potential customers your ability to quickly supply goods and services.

Government Contracts Are a Gold Mine

PO Financing for Government Contracts

PO financing for government contracts allows your company to:

You May Like: What Is Congress Mortgage Stimulus Program For The Middle Class

Contract Clauses For Non

The contracting officershall insert the following clauses, appropriately modified with respect to payment due dates, in accordance with agency regulations-

The clause at 52.232-1, Payments, in solicitations and contracts when a fixed-price supply contract, a fixed-price service contract, or a contract for nonregulated communication services is contemplated

The clause at 52.232-2, Payment under Fixed-Price Research and Development Contracts, in solicitations and contracts when a fixed-price research and development contract is contemplated

The clause at 52.232-3, Payments under Personal Services Contracts, in solicitations and contracts for personal services

The clause at 52.232-4, Payments under Transportation Contracts and Transportation-Related Services Contracts, in solicitations and contracts for transportation or transportation-related services

The clause at 52.232-5, Payments under Fixed-Price Construction Contracts, in solicitations and contracts for construction when a fixed-price contract is contemplated

The clause at 52.232-6, Payments under Communication Service Contracts with Common Carriers, in solicitations and contracts for regulated communication services by common carriers and

The contracting officershall insert the following clauses, appropriately modified with respect to payment due dates in accordance with agency regulations:

Benefits Of Purchase Order Funding For Government Contractors

Producing goods and services under a government contract comes at a steep price. At Meridian PO Finance, we understand that if a private company is awarded a government contract, the last thing it should do is walk away due to capital restrictions, especially when you can get approved for small business financing.

Purchase order funding gives numerous private companies the resources they need in order to accept government contracts. Because working with the government offers private companies security and a steady flow of orders that pay exceptionally well, Meridian oftentimes is able to provide PO funding to government contractors. Understandably, government contracts possess a higher level of security than other industry contracts, making them a safer endeavor for purchase order finance companies like Meridian.

PO funding could be the missing piece between your company and a large government contract. With the right qualifications, private companies that receive PO funding from Meridian are able to successfully fill and deliver government orders quickly, pursue valuable government contracts, and avoid taking out costly loans due to credit restraints.

If it were not for government purchase order financing, countless of private companies would have to turn down valuable government contracts. Meridian PO Finance is here so that does not have to happen.

Don’t Miss: Sacramento Jobs Government