Mobile Check Deposit Pros

- Convenience. Depositing checks using your mobile device may be easier and less time-consuming than driving to a branch or ATM.

- Ease of use. Mobile check deposit apps offer a user-friendly experience, even for low-tech customers.

- Security. Depositing a paper check via mobile deposit can be as safe and secure as taking the money to a branch.

How Does Mobile Deposit Work

Its convenient and easy to use.

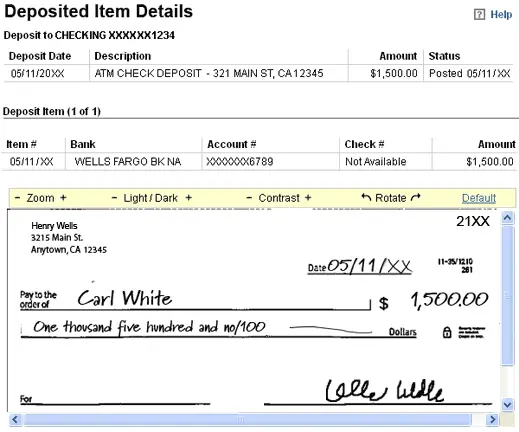

Sign on to the Wells Fargo Mobile® app, then follow these simple steps:

Youll receive a confirmation message on your mobile device for each successful deposit. Plus, well send a deposit confirmation to your primary email address and your Wells Fargo Online® Message Center secure mailbox.

Securely store your check for 5 days after your deposit, and then destroy it. This allows sufficient time in case the original check is required for any reason.

Brinks Money Prepaid Mobile App

How it works: The Brinks Money Prepaid Mobile App offers mobile check cashing to a prepaid Mastercard debit card with many of the same benefits as bank debit cards. You add funds by loading a check, scheduling direct deposits or transferring money from another Brinks card or a bank account. When you enroll in direct deposit, you can receive your paycheck up to two days faster.

Cost: The check-cashing fees are third-party fees that are subject to change. Expedited services range from 2% to 5% or a $5 flat fee.

What the app is best for: Transferring money to family and friends who use Netspend accounts

Where to download the app: or the App Store

Don’t Miss: City Of Warner Robins Ga Job Openings

Does Your Bank Offer Mobile Check Cashing

Straight out of the gate youâll first have to make sure that your banking institution offers mobile check-cashing and mobile check depositing to begin with.

Believe it or not, there are still a lot of banks that arenât all that interested in moving everything to the digital world as rapidly as some other institutions â though most all banks are implementing at least some sort of online and mobile banking services, recognizing that this is what customers are expecting as a bare minimum from banks today.

A simple phone call to your bank or a look on their website should clear this up for you pretty quickly. Bank employees will be able to let you know if mobile depositing checks or mobile check cashing is a possibility but they can also point you in the right direction to help you get the ball rolling, too.

Example: How Much It Costs To Cash A Government Of Canada Cheque At A Payday Loan Company

Suppose you have a Government of Canada cheque worth $1,000.

It would cost you about $33 to cash it if the payday loan company charges you:

- 2.99% of the value of the cheque, plus

- $2.99 for each item you cash

This means that after fees, you’d only get about $967 instead of the full $1,000.

Before using a payday loan company or other cheque-cashing service to cash your Government of Canada cheque, make sure you understand all of the fees that youll have to pay.

Also Check: Dental Grants For Individuals

Pros Of Using A Prepaid Card

i) No credit history required

Anybody interested in a prepaid card can since youre not borrowing money, the card provider doesnt check your credit score when issuing the card. This is suitable for people with poor credit scores including young adults who have not yet built up their credit history.

ii) No bank account required

Prepaid cards can stand as an alternative to a checking account. If you are unwilling to open a checking account, a prepaid card enables you to enjoy the privilege of paying using plastic money. However, prepaid cards are less costly than having a bank account and still gives you access to services such as check deposits, and online bill pay.

iii) Controls your budgeting

Since you are spending money that you dont have, credit cards can be too tempting. However, a prepaid card can enable you to avoid debt because you are only using what you have on the card. If the funds get depleted and are not loaded onto your card, you can no longer spend it.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Government Jobs For History Majors

How To Deposit A Paper Check On Cash App

If you have a paper or electronic check that you want to deposit on Cash App, then these steps will work for you.

Just keep in mind that once you enable Mobile Check deposit on Cash App, geolocation data and more personal information of your mobile phone will be shared with the platform.

Without further ado, follow these steps to deposit a check on Cash App.

- Step 1 – Verify your Cash App account: all your info must be up to date, including the deposit account and your contact information. Otherwise, you wont be able to deposit money on Cash App by any means

- Step 2 – Take a photo of your check: in order to successfully submit a Cash App mobile check, the check image must be as clear as possible

- Step 3 – Select the Add Money option: to start the electronic transfer, open the mobile app, tap on Add money, and then Bank Account. You have two options here – manually complete the data, or upload the check picture, which is faster

- Step 4 – Send the information to Cash App: double-check the mobile check capture process before submitting it. Remember that depositing checks incorrectly will cause the direct deposit to be rejected

- Step 5 – Wait for the hold period to finish: after you have successfully submitted the check deposit, Cash App receives the information of the mobile check capture and needs some time to process it.

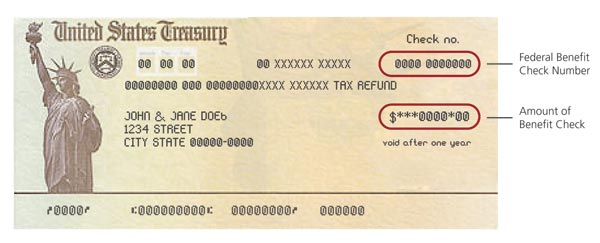

Note: Using Cash App to deposit a check is usually easy, but the process might be different with a Government or Treasury check.

Can I Actually Cash A Check Online

While cashing a check online is totally possible, it does differ slightly to when you cash a check in-person.

When you take a check into a physical location like a bank or check cashing store, you can get cash on the spot. So you literally cash the check.

Need Easy Extra $300+/Month for Free?InboxDollarsDaily Goodie BoxPanda ResearchKashKickSurvey JunkieSwagbucks

On the other hand, when you come to cash a check online youre not cashing it per se, youre depositing it into your bank account.

This means if youre looking for cash you can hold in your hand right now, then youll need to head into your bank or closest check cashing place.

However, if you are cool with having the funds deposited into your bank, then cash your check online instead.

Its so convenient. You dont have to head out anywhere. You can do it right from your computer or even your phone!

Amazing, right?

Don’t Miss: Congress Mortgage Stimulus Middle Class

Take Clear Pictures Of The Check With Your Mobile Device

Lay your check on a flat surface in a well-lit area. The mobile deposit feature in the banking app will ask to access your devices camera. After giving permission, position your phone or tablet above the check. There will be a rectangle on the screen guiding you to align the check. Make sure the entire check is in view. Steady your hands and keep the check in focus on the camera’s viewfinder. Then, tap the button on the screen to take the picture. You’ll need a snapshot of both the front and back of the check. All details, including account and routing numbers, should be clearly visible in the picture.

Some banks apps capture the image without prompting you, which can be helpful but also cause problems. If you have trouble with auto-capture, make sure your check and phone are set up correctly before opening the bank app.

If the check images arent coming out clearly, you can try a few things:

-

Place the camera a few inches farther above the check before taking the picture, leaving some space on all sides of the check within the camera viewfinder.

-

Clean your camera lens by wiping it with a soft cloth.

-

Make sure your app is updated.

-

Uninstall the app, restart your mobile device and then reinstall the app.

One Stop Shop Solution

The beauty of the check depositing service from a company like US Global Mail is how simple and straightforward it is to take advantage of.

For starters, customers that are already leveraging the mail forwarding or mail scanning service from this company are already going to have their checks handled by this organization â at least as far as scanning the original envelope and digitizing/recording that these checks were received is concerned.

The fact that this organization can then forward that check directly to your bank without you having to do absolutely anything is a huge advantage compared to many of the more cumbersome services out there that put a lot of hurdles in your way.

You May Like: Data Governance Implementation Plan

When Is My Money Available

If you deposit on a business day before 9 pm PT, your money will typically be available the next day. If you deposit after 9 pm PT or on a weekend or holiday, we’ll process the deposit on the next business day and your money will typically be available the day after that.

For example, a mobile deposit made:

Before 9 pm PT

- On Monday is typically available Tuesday

- On Friday is typically available Saturday

After 9 pm PT

- On Monday is typically available Wednesday

- On Friday is typically available Tuesday

Weekends

- On Saturday or Sunday is typically available Tuesday

Some checks can take longer to process, so we may need to hold some or all of the deposit for a little longer. Well let you know if we need to hold a deposit and include details about when to expect your money.

Status in Account Activity

You can view the status of your deposit in the Account Activity for the appropriate account.

You will know that your deposit amount is available when the amount appears in your available balance.

Hold notifications

When a hold is applied on any portion of your deposit, you will receive a notification that provides details on the amount held and when it will be available.

A deposit is held when funds are posted to your account but are not immediately available to cover debits or withdrawals. Common reasons include:

- Large deposit amount

| On the day after the deposit credit date |

Business days are Monday – Friday, except federal holidays.

Is The Check Any Good

Verify that checks are legitimate and make an effort to determine whether or not a check will bounce before you deposit it. If the person or company that wrote the check doesnt have enough money to cover the payment, your bank might charge you feeseven though it wasnt your fault.

If you continually deposit bad checks, your bank might even close your account. Whenever youre concerned about a check, contact the bank the check is written against to verify funds in the account and find out if the check will bounce.

You May Like: Full Time Jobs In Warner Robins Ga

Instant Online Check Cashing Options To Use

Millionaire Mob has been using a number of different online jobs without investment to increase our income. Oftentimes, that leads to opportunities where we need to find an instant online check cashing option.

Ive been a big fan of passive income, which leads to me cashing checks in various formats.

I like having cash value as fast as possible. In fact, I even had to cash a check instantly when I launched my book, Dividend Investing Your Way to Financial Freedom.

With my various income sources, cashing a check is a necessity. I need to be able to invest that as soon as possible to start making more money from it.

People think that checks are completely obsolete. When you have a number of different income sources or participate in manufactured spending, you end up having some checks laying around.

When you receive any payment by check, you can quickly get immediate access to your funds with instant online check cashing services.

It is the fastest and the most convenient way to get money into your hands without going to a bank or a check cashing store.

If you need to cash personal checks in-person, there are plenty of options to use.

I track all my flow of cash flows via Personal Capital. It helps me track my net worth and ensure my bank account balance reflects all of my various sources of income.

Use my link for Personal Capital and get a completely FREE consultation on your personal finance.

Remember: It Is You Who Runs The Risk

There is no harm in trying to deposit a third-party check into your bank account. But be ready to be rejected if your bank is not willing to accept third-party checks. It is not legally bound to accept this kind of check.

However, even if your bank accepts your friends check, in the ultimate scheme of things, it is really you who runs the risk because it is not your bank. A wise bank will not accept the check if you dont have enough money in your bank account to cover the amount indicated in the check.

The bank is only a repository for your money. It will not give out funds that you dont have. So, before they entertain the check, they will first check if you have enough money to cover the check should something go wrong. If they indiscriminately release money left and right, they will go bankrupt fast.

Recommended Reading: Free Grants For Dental Implants

What Types Of Checks Can I Deposit With Mobile Check Deposit

If you meet the requirements for mobile check deposit, here are some guidelines on what can and cant be deposited with Stash mobile check deposit:

What is accepted:

- Personal checks written to you

- Commercial pre-printed checks issued by a U.S. business to you such as:

- payroll checks

Note: Needs to be in USD

Whats not accepted:

- Checks:

- not payable to you

- payable to more than one person

- payable to Cash or Self

- payable in a foreign currency

- drawn on a bank outside the U.S.

- not dated, post-dated, or more than 90 days old

- irregular in any way

- previously cashed or deposited or returned unpaid for any reason

- suspected to be fraudulent, forged, altered or not properly authorized

- missing the persons signature who wrote you the check

- exceeding the deposit limits set for mobile deposits

Look For A Mail Forwarding/scanning Service That Also Offers Check Depositing

A mail forwarding and mail scanning service will be able to send your check to your door without any headache or hassle whatsoever, but some of them â top-tier organizations like US Global Mail, for example â also include check depositing services as part of your membership agreement.

This service is hugely advantageous for people that wouldnât have otherwise been able to cash physical checks while they are traveling overseas, a major problem for business owners and entrepreneurs that might have to spend extended amounts of time abroad but also need access to the money that they have coming in through the form of paper checks.

Check depositing services are available for all US Global Mail customers and are a safe and secure way to get the money you need deposited directly into your account with zero difficulty whatsoever.

Don’t Miss: What Is Of306

What Is Mobile Check Deposit

Mobile check deposit is a mobile banking tool that allows you to deposit checks to your bank account using your phone or mobile device. Instead of depositing checks at the ATM, your banks drive-through window or with a teller inside the lobby, you can add them to your account from wherever you happen to be, whether thats at home, work or on vacation.

The types of checks you may be able to add to your account using mobile check deposit include personal checks, business checks, cashiers checks and government-issued checks. This includes tax refunds and stimulus checks, such as those provided by the CARES Act. Your bank may or may not allow you to use mobile check deposits for foreign checks, third-party checks, money orders or travelers checks, so double-check their policies first.

Heres a simple guide to what mobile check deposit looks like in action:

- You download your banks mobile banking app, if you havent already, and create your unique login.

- You then log in to the app and find mobile check deposit in the menu.

- Next, sign the back of the check the way you would if you were depositing it at a branch .

- Choose the account you want to deposit the check to.

- Enter the check amount.

- Take a photo of the front and back of the check using your mobile devices camera.

- Review the deposit details, then hit submit, if theyre correct, to process your deposit.