The Basics Of Employee Benefits For Government Contractors

March 4, 2021 by Brandon Downs

In 2020, the United States government spent approximately $1.1 trillion on contractual services and supplies, according to the Bureau of the Fiscal Service. Being a government contractor offers a range of benefits, such as good income, flexible work, timely payments and stable employment. However, companies that do business with the federal government must comply with specific labor laws and regulations. It is important to thoroughly review and understand these laws prior to accepting a government contract.

Contents

What Are Top 10 Highest Paying Cities For Federal Contractor Jobs

Weve identified 10 cities where the typical salary for a Federal Contractor job is above the national average. Topping the list is San Mateo, CA, with Berkeley, CA and Daly City, CA close behind in the second and third positions. Daly City, CA beats the national average by $16,673 , and San Mateo, CA furthers that trend with another $21,189 above the $98,706 average.

Significantly, San Mateo, CA has a very active Federal Contractor job market as there are several companies currently hiring for this type of role.

With these 10 cities having average salaries higher than the national average, the opportunities for economic advancement by changing locations as a Federal Contractor appears to be exceedingly fruitful.

Finally, another factor to consider is the average salary for these top ten cities varies very little at 9% between San Mateo, CA and San Francisco, CA, reinforcing the limited potential for much wage advancement. The possibility of a lower cost of living may be the best factor to use when considering location and salary for a Federal Contractor role.

| City |

|---|

The Pros And Cons Of Contracting With The Government

The United States government spent $835 billion in contractual services in 2018, making it the world’s largest employer for contract work. If you or your business can meet the government’s requirements, you could end up with a healthy revenue stream. But every job has its pros and cons, and government contracting is no different.

Whether you choose to become a government contractor could involve a mixture of circumstance and personal preference. There are some who swear by this type of work and others who wouldn’t touch a government job if offered one. Still, others have more government work than they can handle and long for something else.

While government contracting can be an excellent way to start or sustain a business, it’s not without its downsides. As with any risk, you must evaluate all factors to determine if the reward is worth the effort. Here are some of the pros and cons of contracting with the government.

Read Also: Quickbooks Government Approved Accounting System

Before You Hire Your First Independent Contractor

Before you begin paying an independent contractor, you will need several documents:

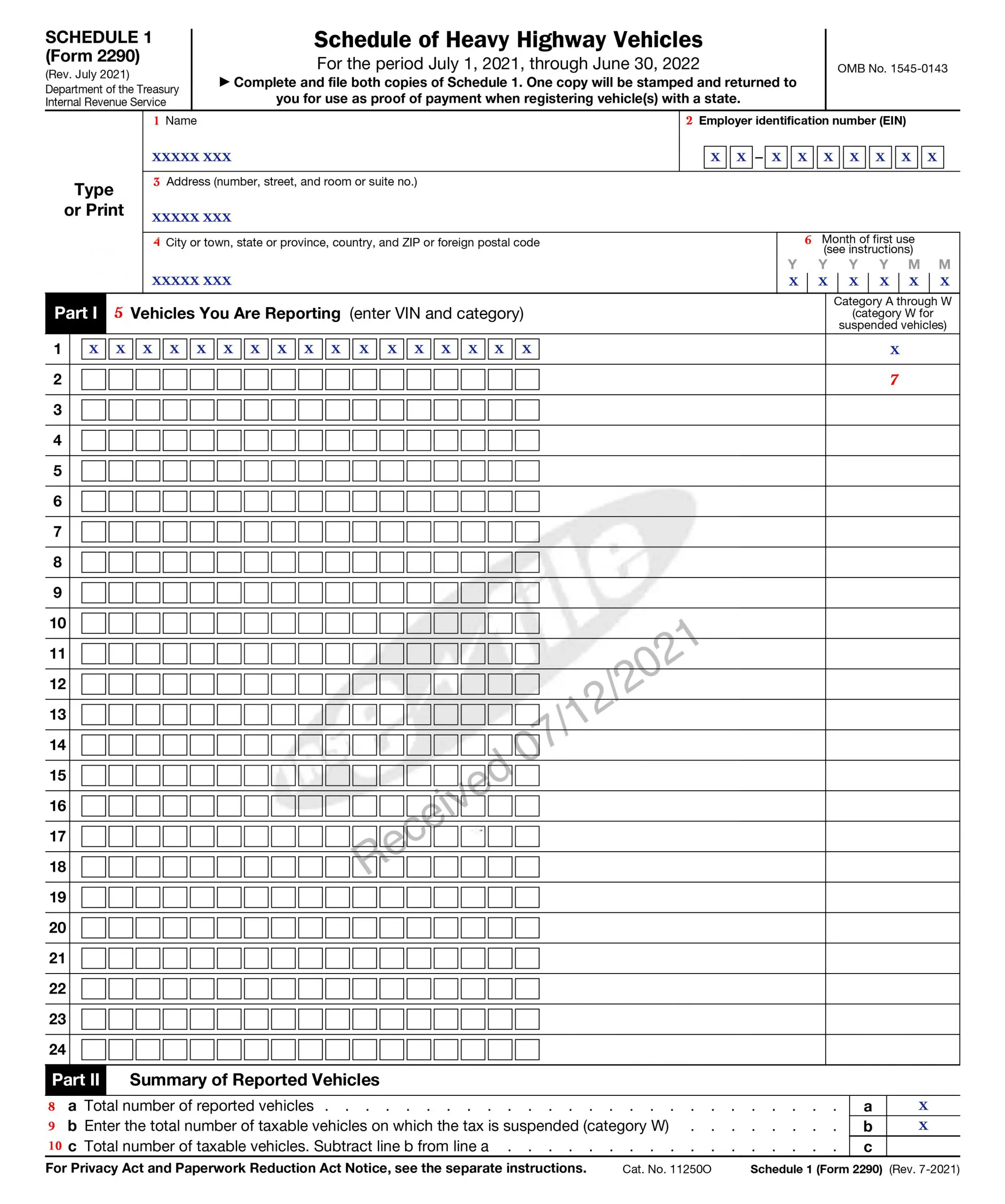

An Employer ID Number , which is similar to a Social Security Number for a business, is required for most businesses even if you have no employees. You can apply for and get an EIN number online through the IRS.

AW-9 Form signed by the worker. This form identifies the contractor and provides other information necessary for completing the payments and submitting them to the IRS.

An application or resume/CV from the prospective contractor and

A that includes terms of payment.

For projects, you might want a outlining the work to be done.

Employee Or Independent Contractor Factsheet

The Employment Standards Act applies to employees, regardless of whether they are employed on a part-time, full-time, temporary or permanent basis. The Act does not apply to independent contractors. A person who is an independent contractor is considered to be self-employed that is, in business for him or herself.

In order to determine whether a worker is an employee or an independent contractor under the Act, it is important to consider the definitions of employee, employer and work. The Act defines these terms very broadly. They read in part as follows:

“employee” includes:

a person, including a deceased person, receiving or entitled to wages for work performed for another, a person an employer allows, directly or indirectly, to perform work normally performed by an employee…

“employer” includes:

a person who has or had control or direction of an employee, or a person who is or was responsible, directly or indirectly, for the employment of an employee…

work means the labour or services an employee performs for an employer whether in the employees residence or elsewhere.

The Act is intended to protect as many workers as possible. When deciding if a worker is an employee or an independent contractor, one of the main questions to ask is whose business is it?

The courts have developed some common law tests that may be useful, but they must be considered in a manner consistent with the definitions and purposes of the Act.

Read Also: Single Mom Money From Government

Government Contracting: The Pros And Cons

The United States spent over 171 billion dollars on contractual services in 2018. If your company wants to access some of that money by becoming a government contractor, you should first be aware of and understand the potential advantages and disadvantages that come with the job. Here are three of the pros and cons of being a government contractor.

Who Qualifies For Per Diem

To qualify for full per diem, the contractor must maintain two residences during the contract assignment. In addition to their primary residence, the contractor must have a qualifying secondary residence.

Staying with a friend or family member does not qualify as a secondary residence.

Meals and Incidental Expenses only

In some situations, the contractor only receives per diem for M& IE. Generally speaking, a contractor will be entitled to M& IE when their work duties require them to be outside of the general area of their home longer than an ordinary workday.

For example, the M& IE portion only would be paid if:

- The client provides the lodging or reimburses the contractor directly for lodging

- The contractor does not expect lodging expenses to be incurred but will be away from their tax home longer than a standard workday

- If the standard workday is consistently exceeded and it would be unreasonable to have the contractor return to their tax home

Read Also: Verizon Wireless Government Phone Number

Reporting Payments To Independent Contractors

Each year you must report payments to any contract worker if you paid that person $600 or more during the year. Beginning in 2020, you must use a 1099-NEC form for this report. It’s due at the end of January of the year after the tax year. A10099-NEC for 2020 is due January 31, 2021.

If you are confused about reporting payments for independent contractors, see this article about Who Must Receive a 1099-NEC.

How Much Should Contractors Charge For Their Services

Each independent contractor may come up with an amount that will pay for all of his or her expenses. The figure must also compensate the contractor for his or her time and expertise and should provide some profit.

However, it is very important that the contractor not charge more than the market rate for any particular job.

Read Also: How To Sign Up For A Free Government Phone

Taking Advantage Of The Downtime

As the shutdown continues many contractors could be faced with an unpaid extended holiday. But some companies are making good use of the downtime.

We take this as an opportunity to execute a training plan, and keep the employees up to speed, said Wilkinson. Then the employees are ready to return to regular work when the shutdown ends.

Not all contractors are so fortunate as to keep busy during a shutdown, however, and unlike federal employees contractors can feel the pinch in other ways.

There is tremendous uncertainty of how long this shutdown will last, said Colturi. Unlike federal workers, some contractor staff likely will have no opportunity to receive back pay. In addition, there are constant questions about processing contract invoices, timely payments, new procurement delays, and general management and technical issues.

Related News

How To Determine The Correct Job Status

An independent contractor may:

- Make and keep his or her own schedule.

- Create a certain method to finish assignments.

- Take work as needed or on a case-by-case basis. The contractor may turn down offers if he or she so pleases.

- Will supply his or her own equipment and tools.

- Will have more than one client at a time.

- Can be let go at any time and may choose not to come to work.

- May determine if the work is permanent or temporary.

- Earn a profit or incur a loss from a given task.

- Be paid on a per-job basis.

- Need to invest in all equipment.

- Have to pay for business and traveling expenses as needed.

- Hire and pay assistants.

- Have a set schedule of assigned hours.

- Receive training from the company.

- Be provided with all the tools needed to finish work.

- Be required to complete all work assigned by the employer.

- Have only one employer.

The following questions will determine the type work relationship:

Read Also: Supply Chain Management In Government

Requirements For Federal Contractors

Q: What contracts are covered by the Executive Order?

A: The Executive Order applies to contracts or contract-like instruments entered into, extended, renewed, or option exercised after . The order applies to new contracts and contract-like instruments, new solicitation for contracts or contract-like instruments, extensions or renewals of contracts or contract-like instruments, and the exercise of an option on an existing contract or contract-like instrument, if:

-

it is a procurement contract or contract-like instrument for services, construction, or a leasehold interest in real property

-

it is a contract or contract-like instrument for services covered by the Service Contract Act

-

it is a contract or contract-like instrument for concessions, including any concessions contract excluded by Department of Labor regulations at 29 C.F.R. 4.133 or

-

it is a contract or contract-like instrument entered into with the Federal Government in connection with Federal property or lands and related to offering services for Federal employees, their departments, or the general public.

Executive Order On Increasing The Minimum Wage For Federal Contractors

By the authority vested in me as President by the Constitution and the laws of the United States of America, including the Federal Property and Administrative Services Act, 40 U.S.C. 101 et seq., and in order to promote economy and efficiency in procurement by contracting with sources that adequately compensate their workers, it is hereby ordered as follows:

Section 1. Policy. This order promotes economy and efficiency in Federal procurement by increasing the hourly minimum wage paid by the parties that contract with the Federal Government to $15.00 for those workers working on or in connection with a Federal Government contract as described in section 8 of this order. Raising the minimum wage enhances worker productivity and generates higher-quality work by boosting workers health, morale, and effort reducing absenteeism and turnover and lowering supervisory and training costs. Accordingly, ensuring that Federal contractors pay their workers an hourly wage of at least $15.00 will bolster economy and efficiency in Federal procurement.

THE WHITE HOUSE, April 27, 2021.

Recommended Reading: Practice Test For Government Jobs

Determining Whether The Individuals Providing Services Are Employees Or Independent Contractors

Before you can determine how to treat payments you make for services, you must first know the business relationship that exists between you and the person performing the services. The person performing the services may be:

In determining whether the person providing service is an employee or an independent contractor, all information that provides evidence of the degree of control and independence must be considered.

How Much Does A Federal Contractor Make

As of Oct 28, 2021, the average annual pay for a Federal Contractor in the United States is $98,706 a year.

Just in case you need a simple salary calculator, that works out to be approximately $47.45 an hour. This is the equivalent of $1,898/week or $8,226/month.

While ZipRecruiter is seeing annual salaries as high as $149,500 and as low as $23,000, the majority of Federal Contractor salaries currently range between $66,500 to $139,500 with top earners making $147,000 annually across the United States. The average pay range for a Federal Contractor varies greatly , which suggests there may be many opportunities for advancement and increased pay based on skill level, location and years of experience.

Based on recent job postings on ZipRecruiter, the Federal Contractor job market in both Chicago, IL and the surrounding area is very active. A Federal Contractor in your area makes on average $101,044 per year, or $2,338 more than the national average annual salary of $98,706. ranks number 1 out of 50 states nationwide for Federal Contractor salaries.

To estimate the most accurate annual salary range for Federal Contractor jobs, ZipRecruiter continuously scans its database of millions of active jobs published locally throughout America.

Find your next high paying job as a on ZipRecruiter today.

Read Also: Suing The Federal Government For Constitutional Violations

Cons Of Being A Government Contractor

Strict regulations

The federal government has a ton of rules and regulations. Every federal contractor is required to follow the Code of Federal Regulations and a variety of other labor standards. There are also limits to what you can subcontract.

Just the process of bidding on a government contract requires that you register with the System for Award Management and the SBA. Plus, you’ll need to have a NAICS code and a DUNS code. After jumping through these hoops, you’re going to have to write up an RFQ and an RFP, and potentially several of these depending on how many different contracts you want to bid on.

Steep competition

Assuming you go through the motions of applying for a government contract, it would be a mistake to believe that you’re the only person willing to do this work. It’s no secret that the government has deep pockets, so the competition is stiff for many contracts.

If you are a small business, you might find yourself competing with major companies and losing the work due to lack of experience or resources. Finding a niche in this type of work can help you land more contracts related to your specialty.

No benefits

While your salary might be a bit higher than a government employee, you won’t get any benefits such as health insurance, paid time off, and retirement packages. This is a significant downside to doing contract work, but it’s also the price of self-employment. If you’ve already decided to self-fund these items, you understand the tradeoff.

How Much Do Contractors Charge For Estimate

Contractors will either offer a free estimate or charge $50 to $1,000, depending on the project. For example, if you need an inspection or design consultation service, expect to pay for those. If you pay for your estimate, many general contractors will put that fee toward your project if you hire them.

Get Estimates From Local Contracting Pros

Recommended Reading: What Is Government Mortgage Relief Program

Government Contractors Paid Via Eft

It is now government policy to pay all contractors by EFT, electronicfunds transfer, whenever feasible. In making EFT payments, thegovernment uses the information contained in the Central ContractorRegistration database. To be paid, you must be in CCR.

This policy underscores the need to get your company registered in the CCR database,and to make sure that the information that you have entered is correctand current. If the EFT information in the CCR database is incorrect,then the government may suspend payment until correct information isentered. Remember that if your EFT information changes, you areresponsible for seeing that the information in the CCR database isupdated.

If you have more than one remittance address and/or EFT informationset in the CCR database, you must remember to notify the government ofthe payment receiving point applicable to the contract you are workingon. Otherwise, the government will automatically make payment to thefirst address.

If an incomplete or erroneous transfer occurs because the governmentused a contractor’s EFT information incorrectly, the government isresponsible for making a correct payment, paying any prompt paymentpenalty and recovering any erroneously directed funds.

The EFT information that the contractor must provide to the designated office includes:

Warning

Note that the government is required to protect against improper disclosure of all contractors’ EFT information.

How To Get Government Contracts As A Consultant: 3 Steps

By MBO Partners | June 30, 2021

- 0X

Have you ever wondered how to work with the government as an independent contractor? The federal government engages more contractors than any other organization in the world, which presents many opportunities for independents. Each year, billions of dollars in contracts are set aside for small businesses, women, minorities, and veterans.

Many independent consultants look to government contracting as another option for growing their business. Follow these three steps to understand the processes, requirements, and resources needed to get government contracts as a consultant.

You May Like: What Are Some Government Jobs

The Labor Department Is Seeking Comments By August 23

The Labor Department announced on Wednesday its seeking public comment on a proposed rule directing federal contractors to pay a $15 minimum wage for their workers starting next year.

The rule works to implement President Bidens executive order from April, which builds on one from President Obama in February 2014 that required federal contractors to pay their workers $10.10 per hour. Currently, the minimum wage for workers on federal contracts is $10.95 per hour and the tipped minimum wage is $7.65 per hour.

Bidens executive order says that starting on January 30, 2022, agencies have to incorporate the new minimum wage into their contract solicitations. By March 30, 2022, they have to implement the $15 minimum wage into new contracts. Agencies must also implement the higher wage into existing contracts when the parties exercise their option to extend such contracts, which often occurs annually, said a fact sheet from the White House. Every year after 2022, agencies must index the minimum wage to adjust for inflation.

Other provisions of the executive order include: eliminating the tipped minimum wage for contractors by 2024, ensuring that federal contract workers with disabilities receive the $15 minimum wage, and restoring the minimum wage protections for outfitters and guides on federal lands by revoking a May 2018 executive order from President Trump.

Manage Consent Preferences

Strictly Necessary Cookies – Always Active