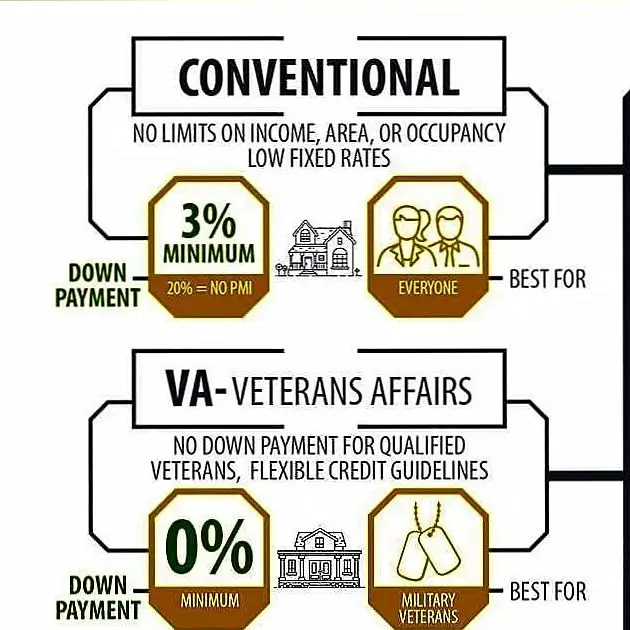

Department Of Veterans Affairs Loans

If youre active duty or a veteran of the U.S. Armed Forces, or a family member of one, you might qualify for a mortgage backed by the Department of Veterans Affairs. Theres no limit on how much you can borrow, but there are limits to how much of the loan the VA will guaranteeand that determines whether youll have to make a down payment.

VA loans have no down payment requirement as long as you dont buy a home more expensive than the VA home loan limit and arent subject to PMI, which is unlike other mortgage types. Homes purchased using VA loans must be a primary residence for the service member or spouse. Active-duty personnel can use a VA loan to buy a home for a dependent.

To get a VA loan, qualified applicants can visit a wide variety of local or online lenders. Anyone applying for a VA loan will have to present a Certificate of Eligibility, or COE. Buyers who qualify should sit down with a mortgage officer at an institution that offers VA-backed loans.

There, you can explore the procedures, how much you can borrow and a unique detail called entitlementshow much of the loan the Department of Veterans Affairs will guarantee.

How To Qualify For A First

Most first-time buyers choose to finance their homes with conventional loans. However, there are government-backed alternatives, including FHA, VA and USDA loans, that could be better for new buyers. FHA loans make up about 23% of loans taken out by first-time buyers VA loans account for 6%.

All these mortgage options have varying credit score, down payment and debt-to-income ratio requirements. Consider the following to find the right loan for you.

Other Government Resources For First

First-time home buyers often find it helpful to take a homebuyer education course before buying. And, if you use a government-run mortgage or down payment assistance program, homebuyer education is often required.

Many courses can be found online or through government housing agencies like Freddie Mac and Fannie Mae. Some are free, while others are available for a fee that typically ranges from $75 to $100, Gravelle says.

Even if you are not required to take this class, its worth your time and expense.

Homeownership is an important responsibility, and having a better understanding will ensure greater success, Anderson says.

You may even qualify for counseling through HUD for free.

There are HUD-approved housing counseling agencies in every state that can help borrowers navigate the process for no charge, adds Anderson.

Read Also: Government Health Insurance Exchange Subsidy Program

Construction And Rehab Loans

If youre building a home, a construction loan lets you finance the cost of the lot, materials, labor, and permits. One option is a construction-only loan which only covers the building process. Youll then refinance into a permanent mortgage upon completion of the home.

Another option is a construction-to-permanent loan. This covers the construction cost and the completed home. Conventional, FHA, VA, USDA, and jumbo programs have construction loan options.

If youre buying and renovating an existing fixer-upper home, you can also finance the purchase price and eligible renovations into a single rehab loan.

Rehabilitation loan options include:

Association Of Community Organizations For Reform Now

Since its inception in 1970, ACORN has grown to become the largest community organization of low- and moderate-income families in the nation. With over 350, 000 members and chapters across the U.S. as well as cities in Argentina, Peru, Mexico, the Dominican Republic and Canada, ACORN has helped develop communities through campaigning and fundraising for better housing, schools, neighborhood safety, health care and job conditions, to name a few.

Don’t Miss: Best Western Hotel Government Camp Oregon

Quotes From Other Lenders Involved In The Scheme

Susan Allen, CEO Retail and Business Banking at Santander said:

We know that raising a large deposit can often be challenging for potential home buyers, so were pleased to be part of the governments Mortgage Guarantee Scheme offering a range of 95% mortgages to help both first-time buyers and home movers.

As one of the UKs largest mortgage lenders we see how important homeownership is to our customers and we use our wide experience and expertise to support them throughout the home buying process.

Michelle Andrews, HSBC UKs Head of Buying A Home said:

We have supported home buyers and the wider housing market throughout the pandemic and are excited to support the Mortgage Guarantee Scheme.

After such a turbulent year it is great that this scheme will make a real difference in enabling first time buyers who didnt think they would have a chance of getting a mortgage and home movers to get the keys to their new home.

What Is The First Step In Getting Approved For A Home Loan

The first thing you will want to do is apply for a mortgage pre-approval. To apply, talk to your lender, and they will assess how much they will lend you based on your income, credit score, and assets. During pre-approval for a first-time home buyer loan, your lender can also lock in an interest rate.

Don’t Miss: Why Data Governance Is Needed

New 95% Mortgage Scheme Launches

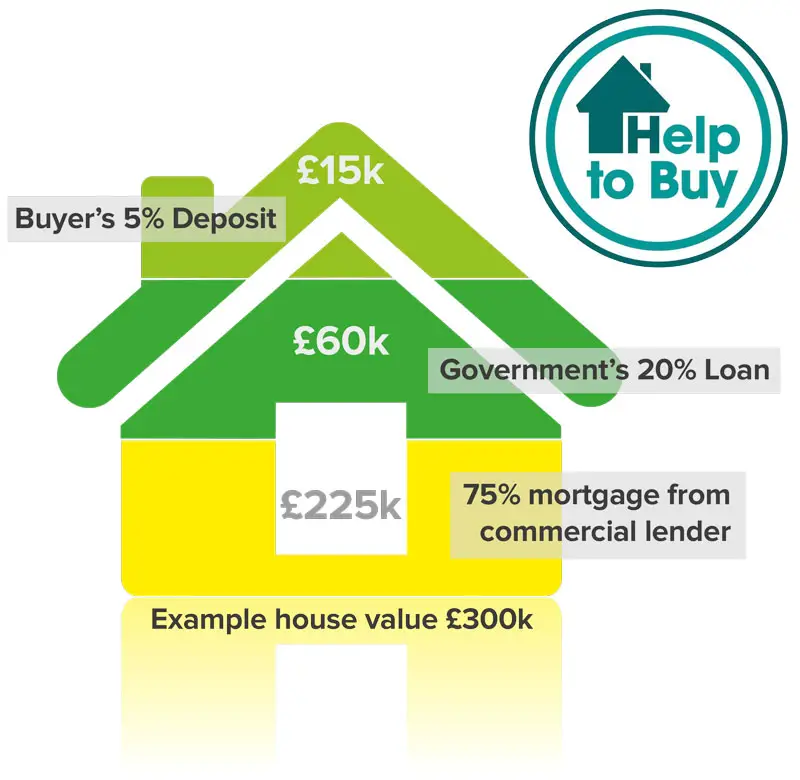

A new government-backed mortgage scheme will help first time buyers or current homeowners secure a mortgage with just a 5% deposit.

- From:

- 95% mortgage guarantee launches today, available on high streets across the country

- Scheme part of a range of ownership options to help make home ownership a reality

- New figures show demand for home ownership has soared during lockdown, with nearly 80% of private renters now saving for a deposit

- Todays launch further strengthens government commitment to supporting the housing sector

A new government-backed mortgage scheme to help people with 5% deposits get on to the housing ladder is available to lenders from today .

First announced at the Budget, the scheme will help first time buyers or current homeowners secure a mortgage with just a 5% deposit to buy a house of up to £600,000 providing an affordable route to home ownership for aspiring home-owners.

The government will offer lenders the guarantee they need to provide mortgages that cover the other 95%, subject to the usual affordability checks.

The scheme is now available from lenders on high streets across the country, with Lloyds, Santander, Barclays, HSBC and NatWest launching mortgages under the scheme today and Virgin Money following next month.

The government has made clear its commitment to tackling inequality in the housing market and levelling up the country. Official statistics show more homes were delivered in 2020 than in any year since 1987.

How Long Does It Take To Get Down Payment Assistance

How long it takes depends on the program and the type of assistance. Each state offers its own programs, as do different cities and organizations. These programs move at different speeds depending on the demand and size of the program.

Its important to know that, if you apply for down payment assistance, it may take longer to close on your home. The assistance program must work with your lender to secure the loan and the down payment funds. This can add time onto the closing process, depending on how quickly the down payment assistance program acts.

Recommended Reading: Best Careers For History Majors

You May Like: No Experience Government Jobs In Dc

National Homebuyers Fund Down Payment Assistance

Some first-time home buyer programs provide grants, rather than assistance securing a mortgage. The National Homebuyers Fund Down Payment Assistance is one example. The NHF is a nonprofit public benefit corporation that provides grants to qualified borrowers for closing and/or down payment costs, including first-time home buyers and repeat buyers, says Bitton.

The assistance is up to five percent of the mortgage loan amount, and it can be used for down payment or closing costs. The program isnt one-size-fits-all, so the assistance could be forgiven or there could be repayment options, depending on the buyers situation.

Get Your Credit Mortgage

Regardless of which type of mortgage loan you end up getting, it’s crucial to learn if you need to make some improvements at least three to six months before you apply. Check your to get an idea of where you stand and also view areas you may need to address.

Also, consider using Experian Boost®ø to potentially help increase your credit score. The program connects to your bank account and gives you credit for your on-time utility, phone and certain video streaming payments.

Improving your credit for a mortgage can take some time, but the sooner you begin the process, the easier it will be to stop potentially damaging activities and make the changes you need to qualify for a mortgage loan.

Also Check: List Of Government Grants For Individuals In Usa

Access The Special Housing Adaptation Grant

The main difference between the SHA grant and the SAH grant is the amount of funding available. Which one you qualify for may depend on the severity of your injuries and the number of grants available. The maximum funding under this grant is $20,387 for 2022. The funds can also be used up to six times.

S To Buying Your Home

Once youve found the house you want to buy:

Work with your agent to put together and sign a purchase agreement

Be sure the sales contract includes the VA escape clause or VA option clause. This provides an option to void the contract if the property doesnt appraise for the contract price.Ask your real estate agent for advice on other options for voiding the contract you may want to include, such as if the property fails a home inspection. These options are called contingencies.To learn more, watch this helpful video:Using your VA home loan benefit: working with a Realtor and lender

Have the house inspected and appraised

We strongly recommend that you get an inspection to check for any major defects before you purchase your home. A VA-approved appraiser will also appraise the house to make sure it meets basic property condition requirements , and will provide an opinion of value on the house. Please note that an appraisal isnt the same as an inspection.If the property doesnt appraise at a value thats high enough to get the loan, you have a few options. You can:

Also Check: Government Programs For Solar Power

% Loan To Equity Value

You dont need any equity to refinance your VA loan into a lower rate or take cash out in most cases. In fact, with a VA Streamline loan, you can refinance up to 120% of your homes value for changing your term or lowering your rate. This means you can refinance even if you owe more on your home than its worth.

Can The Government Help Me Buy A House

For many first-time home buyers, there are some real hurdles along the way. Whether its saving for a down payment and closing costs, qualifying for a mortgage loan, or simply navigating the home buying process.

Luckily, there are government programs both at the federal and state level that can help.

For many, the biggest hurdle when trying to purchase their first home is coming up with the upfront costs of a down payment. While the amount needed to put down varies depending on the type of loan, it can still be a roadblock on the journey to homeownership, says Mandie Anderson, branch manager with South Carolina-based Silverton Mortgage.

Government-backed loans are a great option for anyone who can afford a monthly payment, but wants to put less money down or has a lower credit score.

The good news is that there are numerous government loan programs and down payment assistance options designed especially for those who need a little extra help with financing. These programs can be a solution in particular for those who can afford a monthly mortgage payment but may not have a large sum of money on hand for the down payment, Anderson explains.

Government-backed loans are a great option for anyone who wants to put less money down or has a lower credit score, explains Jeff Gravelle, chief production officer at Newrez, a national mortgage lending and servicing organization.

Recommended Reading: What Is A Government Program

Who Is Considered A First

Anyone buying their very first home is automatically a first-time buyer.

But repeat buyers can sometimes qualify as first-time home buyers, too, giving them access to special loan programs and financial assistance.

Under most programs, a first-time home buyer is a person who has not had any ownership in the past three years, says Ryan Leahy, Sales Manager at Mortgage Network, Inc.

If you havent owned a home in the past 3 years, youre considered a first-time home buyer.

Nonprofits and local governments, which offer the majority of first-time home buyer grants, use this three-year rule to define first-time homeownership.

Thats especially good news for boomerang buyers who owned a home in the past but went through a short sale, foreclosure, or bankruptcy.

Under the three-year rule, these people have an easier road back to homeownership through first-time home buyer grants and loans.

Usda Loan: Perfect For Homes Located Outside Of Cities

The U.S. Department of Agriculture offers guaranteed and direct loans for homes in designated rural areas, which encompass approximately 97 percent of land in the United States.

The two main types of USDA loans are USDA guaranteed loans, which are issued by private lenders but backed by the USDA and USDA direct loans, which are issued directly by the USDA, with payment assistance provided in the form of a subsidy.

- Income limit: There are income limits for USDA direct loans that depend on your location and the number of people who will live in the home. The USDA Rural Development table lists the limits in every county in the country.

- Benefits: Option of zero down payment lenient credit requirements competitive interest rates 100 percent financing low monthly mortgage insurance premiums.

If youre interested in applying for a USDA direct loan, you should contact your states USDA office. For USDA guaranteed loans, you should reach out to a participating lender like radius financial group.

Don’t Miss: Government Employees Life Insurance Company Washington Dc

New Jersey Housing And Mortgage Finance Agency

- Translate

The State of NJ site may contain optional links, information, services and/or content from other websites operated by third parties that are provided as a convenience, such as Google⢠Translate. Google⢠Translate is an online service for which the user pays nothing to obtain a purported language translation. The user is on notice that neither the State of NJ site nor its operators review any of the services, information and/or content from anything that may be linked to the State of NJ site for any reason. –Read Full Disclaimer

close

New Jersey Housing and Mortgage Finance Agency

How Much Credit Do You Need To Buy A House For The First Time

For most first-time home buyer loans, youll need a . But you need to know that the better your score, the more flexible the requirements will be. And a high credit score will help you qualify for a better interest rate.

So it is imperative to monitor and manage your credit score. Pay bills on time and be responsible with your credit. When you have a high credit score, the mortgage lenders will be more accommodating, and youll qualify easier.

Also Check: At& t Government Internet Program

Get Your Finances In Order

It takes money to own a home. The upfront fees and down payment are one thing, but once youve moved in, youre also responsible for maintenance and repairs, property taxes, homeowners insurance, and other house-related costs. Saving up as much money as possible beforehand will help you be prepared for all of the expenses associated with buying and owning a home.

Create a budget to help prioritize setting money aside for closing costs, the down payment, and an emergency fund. Getting your finances in order by paying down debt will boost your credit score, which will improve your chances of getting approved for a mortgage and help you secure a better interest rate.

Financing Your Home Purchase

Finding the right lender or even the right loan isnt as straightforward as it may seem.

The Right Mortgage

There are conventional mortgages versus government-backed loans offered through the Federal Housing Administration , the Veterans Administration and U.S. Department of Agriculture . Youll need to weigh conforming versus non-conforming loans, and fixed-rate loans versus adjustable-rate mortgages. Theres so much to learn, and how you choose can cost or save you thousands of dollars.

Rocket Mortgage® isnt offering USDA loans at this time.

The Right Lender

A home buyers course will walk you through the process of comparing lenders, gathering your documentation and closing on your house. How important is it to shop around? Research done by Freddie Mac indicates that borrowers could save $1,500 on average over the life of the loan by getting one additional quote and about $3,000 on average for if they get five quotes.

With so many choices, its no surprise that many borrowers become overwhelmed. A home buyers course will walk you through the process of getting the mortgage you need to purchase your first home.

Recommended Reading: Get A Free Government Cell Phone