How Does Down Payment Assistance Vary By State

Federal programs are available to everyone who qualifies, so no matter where you live, you’re free to apply for down payment assistance. However, states vary – some offer many more programs than others do.To find out what government programs are available to you, check your state’s Department of Housing’s website. If you don’t find what you’re looking for there, find a number to call – usually, there’s a Contact Us page with important numbers. Let the person you speak with know that you’re a resident of the state and that you’re looking for down payment assistance programs that may be a good fit for your needs.Remember that down payment assistance is often available through county, city or township programs, as well as through private organizations and nonprofits. If your state doesn’t have specific programs that you qualify for, check for local programs instead.

Preserving Homeownership And Savings Education Strategies

The Preserving Homeownership and Savings Education Strategies grant is created by the Money Management International and Consumer Credit Counseling Services. This grant program helps the people or homeowners who missed their one or more mortgage payments. So that they can bring their mortgage up-to-date. One can get help from them if someone is qualified to get a grant. They have approximately $1 million available in their funds and they provide help from that fund to homeowners in the states.

Two Home Buyer Programs: Which Is Right For You

Your lender will also help you determine which TSAHC program you qualify for. Both programs offer the same down payment assistance options.

Homes for Texas Heroes ProgramIf youre in a hero profession, this is the home loan program for you. Hero professions include:

- Professional educators, which includes the following full-time positions in a public school district: school teachers, teacher aides, school librarians, school counselors, and school nurses

- Police officers and public security officers

- Firefighters and EMS personnel

- Correction officers and juvenile corrections officers

- Nursing faculty and allied health faculty

Home Sweet Texas Home Loan ProgramIf you dont qualify under one of the professions listed above, this is the best program for you.

Read Also: Government Mortgage Loans For Low Income

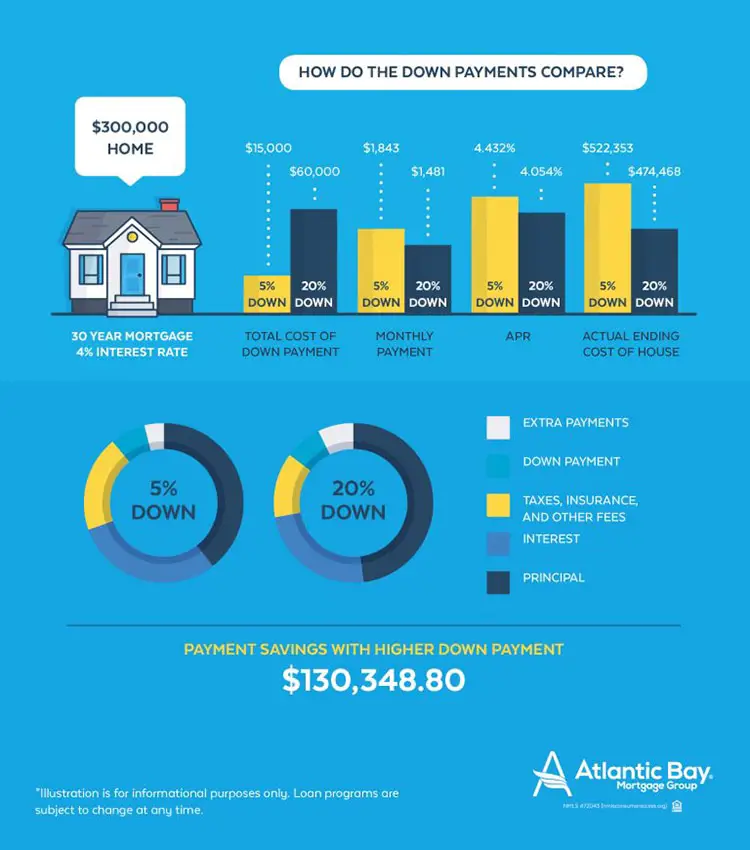

How Much Do You Have To Put Down On A House

The amount of your down payment depends on a few things, including your income, your loan type, the amount of TSAHC assistance that you choose, the cost of the home, and how much you want to borrow. The larger your down payment, the smaller your monthly mortgage payment will be. The smaller your down payment, the larger your monthly mortgage payment.

Your lender will help you figure out which TSAHC assistance option to choose and how much you need to put down on your house.

Does The Dpa Have To Be Paid Back

Short Answer: Yes, at least a portion, if not all, of the assistance has repayment requirements.

There are a variety of products within the GSFA Platinum Program. Each has different advantages and qualifying guidelines. For that reason, we encourage potential homebuyers to contact a GSFA Participating Lender to discuss your unique situation and needs. Our Lenders will provide you with complete program guidelines, interest rates, applicable APRs and discuss the down payment assistance options with you.

Certain restrictions apply on all programs. See a GSFA Platinum Participating Lender for complete program guidelines, current interest rates, loan applications, applicable fees and annual percentage rates

You May Like: Free Government Cell Phones For The Elderly

Florida Down Payment Assistance Programs

The Florida Housing Finance Corporation has four DPA programs:

- Florida Assist: Up to $10,000 toward down payment and closing costs. Takes the form of a deferred second mortgage thats repaid when you sell, transfer, or pay off the home, or refinance your mortgage

- Florida Homeownership Loan Program: Offers $10,000 as a repayable second mortgage that is paid off over 15 years at a 3% interest rate

- HFA Preferred and HFA Advantage PLUS Second Mortgage: Offers 3%, 4%, or 5% of the purchase price which is forgiven over 5 years. Only borrowers using a conventional mortgage are eligible

Discover more at the FHFCs website. And check HUDs list of alternative programs for Florida.

Kentucky Down Payment Assistance Programs

The Kentucky Housing Corporation offers two down payment assistance programs:

- Regular DPA: Borrow up to $7,500 repaid over 10 years with an interest rate of 3.75%

- Affordable DPA: Borrow up to $7,500. The loan is repayable over 10 years with interest of 1%. But you must be within certain income limits to qualify. Income limits vary by county and household size

For either program, your homes purchase price cant exceed $346,644. Check the KHCs website for more details, including income limits for the Affordable DPA program.

Meanwhile, consult HUDs list of alternative homeownership assistance programs in Kentucky.

Don’t Miss: Government Dental Assistance For Seniors

Hfa Advantage Mortgage Program

The New Jersey Housing and Mortgage Finance Agency’s HFA Advantage Mortgage Program provides a 30-year, fixed-rate conventional loan for eligible homebuyers purchasing a home in New Jersey. The HFA Advantage Mortgage Program offers affordable mortgage insurance and low down-payment and can be coupled with the NJHMFA Down Payment Assistance .

What Is A Down Payment On A House

When you buy a house, you usually have to also make a down payment. The down payment requirement is equal to a percentage of the cost of the property and can vary based on the type of loan you receive. For example, if a home costs $100,000 and a down payment of 5% is required, you must pay $5,000 at the time of purchase.

Read Also: Government Jobs For Young Adults

North Dakota Down Payment Assistance Programs

The North Dakota Housing Finance Agency has two programs, called Start and DCA, that are intended to help with upfront home buying closing costs. Both programs can offer up to 3% of the mortgage amount toward your down payment, closing costs, and/or prepaid items.

To qualify, youll have to have a household income below certain caps. And the value of the home youre buying may also be limited.

You can find details here. And take a look at HUDs list of other homeownership assistance programs in North Dakota.

Looking For More Homebuying Information

Take a moment to browse through our wealth ofhomebuying information. Youll find everything you need, from mortgage calculators, to home hunting worksheets.

- Homebuying Step by Step: Everything you need to buy a home in Canada.

- Condominium Buyerâs Guide: This Guide will give you the basic background information you need to figure out if condominium ownership is really for you.

- Financial Information and Calculators: Mortgage information, home buying calculators and government programs for buyers.

- Seniors Housing: Specific details on housing and financial information for people aged 55 and over.

- Newcomers: Everything newcomers to Canada need to know about homebuying.

- Mortgage Loan Insurance for Consumers: Details on costs, qualification requirements, product options, CMHC Green Home and more.

- Accessible and Adaptable Housing: Get more information about housing enabling people of all ages and abilities to stay in their community as long as possible.

CMHC providesmortgage loan insurance. This lets you buy a home with a minimum down payment starting at 5% with interest rates comparable to those with a 20% down payment. Ask your mortgage professional about CMHC.

You May Like: Georgia Free Government Cell Phones

Federal Housing Finance Agency Home Affordable Refinance Program

The HARP program helps the people who need to pay the last few installments of the payment. If any disabled homeowner is late or missed a few payments on their mortgage within the last year, then they can get help. From this program, the disabled borrowers will get a low cost and without an appraisal, a new mortgage with a lower interest rate. So that with this, they can pay their old mortgage payments and did not feel any stress or burden to pay the payments. For this, you can contact your local Bank, or with the lender to get guidance with HARP. You have to contact them before you reach out to FHFA. So, you have to try that you can contact the lender or your local bank as soon as possible, and get help to pay for the mortgage payments.

Bank Of Americas Community Homeownership Commitment

Good news for aspiring homeowners! Bank of Americas Community Homeownership Commitment® is bringing together products and resources that can help modest-income borrowers buy homes of their own. By combining down payment assistance and closing cost help with a low down payment mortgage, you may find that a new home is within reach.

You May Like: Us Cellular Government Employee Discount

Down Payment Assistance For First

When new buyers move into a neighborhood, the community benefits.

New homeowners make home improvements and raise local values, beautify lawns, increase curb appeal and, when homeowners spend money in local stores and businesses, they pay taxes that benefit the municipality.

Homeownership is the centerpiece of local U.S. economies, so area governments have incentives to make their streets attractive to incoming buyers.

Thats where down payment assistance comes in.

Down payment assistance programs make it possible for first-time home buyers to stop renting and start owning without saving for large, 20% down payments.

We cover everything you need to know about down payment assistance programs and how to find one today.

Pennsylvania Down Payment Assistance

Known as The Keystone State,Pennsylvania is home to 86 down payment homeownership programs and 46 agencies. The Keystone Advantage Assistance Loan Program is a second mortgage. It covers home purchase closing costs up to 4% of the final purchase price, or $6,000 whichever is less. Borrowers repay it monthly at 0% interest.

Don’t Miss: Government Policies For Senior Citizens

New Mexico Down Payment Assistance Programs

The New Mexico Mortgage Finance Authoritys FIRSTDown DPA program offers help with closing costs and down payments to first-time buyers. It provides up to $8,000 as a 30-year second mortgage at a relatively low interest rate.

- This program must be used in conjunction with New Mexicos FIRSTHome mortgage financing program

- There are caps on household incomes and home purchase prices. But those may be higher if youre buying in a target area

An alternative program, called HomeNow, also offers up to $8,000 in down payment assistance. The difference is that this loan can be forgiven after 10 years and is only available to borrowers with an income below 80% of the area median income .

You can find full details on the authoritys website. And read HUDs list of other homeowner assistance programs in New Mexico.

How To Apply For Mortgage Down Payment Assistance

Visit the website of the local government agency or organization administering the program to learn about down payment assistance requirements and to get a list of approved mortgage lenders.

Apply for a mortgage with a lender who is approved to work with the grant program. Local agencies may be able to recommend loan officers who have experience helping people apply for the grants they administer.

Read Also: What Is The Interest Rate On Government Student Loans

Connecticut Down Payment Assistance

Connecticut has 35 programs delivered by 19 agencies. The Connecticut Housing Finance Authority lets you borrow as a second mortgage up to 3.5% of the purchase price, with a minimum of $3,000. But you must put any savings you have above $10,000 into your down payment unless youre a qualified teacher or police officer.

Your local Department of Economic and Community Development office can steer you toward other programs, which may provide grants instead of loans.

Recommended Reading: Grb Platform

Njhmfa Down Payment Assistance Program

The NJHMFA state-wide Down Payment Assistance Program provides $10,000 for qualified first-time homebuyers to use as down payment and closing cost assistance when purchasing a home in New Jersey. The DPA is an interest-free, five-year forgivable second loan with no monthly payment

To participate in this program, theâ¯DPA must be paired with anâ¯NJHMFA first mortgage loan. The first mortgage loan is a competitive 30-year, fixed-rate government-insured loan , originated through an NJHMFA participating lender. Certain restrictions such as maximum household income and purchase price limits apply. For more information, contact an NJHMFA participating lenderâ¯below.

You May Like: Government Contract Jobs For Veterans

Njhmfa’s Down Payment Assistance Program

State-Wide Down Payment and Closing Cost Assistance for Homes Located in New Jersey

The NJHMFA Down Payment Assistance Program provides $10,000 for qualified first-time homebuyers to use as down payment and closing cost assistance when purchasing a home in New Jersey. The DPA is an interest-free, five-year forgivable second loan with no monthly payment.To participate in this program, the DPA must be paired with an NJHMFA first mortgage loan. The first mortgage loan is a competitive 30-year, fixed-rate government-insured loan , originated through an NJHMFA participating lender. Certain restrictions such as maximum household income and purchase price limits apply. View the income and purchase price limits here.NJHMFA’s participating lenders are the best representatives to help walk you through program qualification details including income and purchase price limits, and help you complete the application process. .

Tip To Get Mortgage Assistance From Charities

However, if you are disabled and worried about repaying the mortgage then you can take the mortgage insurance for repaying the mortgage. This insurance is very helpful for you if you are disabled or became disabled and not in the condition to pay more mortgage amount. The mortgage insurance pays all the loan amount that you did not do.

But getting mortgage insurance may be unwise if you buy it only for preventing one thing such as disability. That means you have to take the mortgage insurance when you see that it will give you more benefits.

Read Also: Apply For Government Grants For Nonprofit Organizations

If You Move Within 5 Years Youll Have To Pay Some Money Back

For many homeowners, real estate wealth is transformative and generational which is why the Downpayment Toward Equity Act encourages a long-term view on homeownership. According to the billâs draft version, buyers who change their residence or sell within five years of purchase are required to forfeit back a portion of their initial grant.

- Sell or move within Year 1: Repay 100% / $25,000

- Sell or move within Year 2: Repay 80% / $20,000

- Sell or move within Year 3: Repay 60% / $15,000

- Sell or move within Year 4: Repay 40% / $10,000

- Sell or move within Year 5: Repay 20% / $5,000

There are exceptions to the repayment rule, and no repayments are required for buyers who stay in their home at least five years.

Government Of Canada Homebuyer Incentives And Rebates

Purchasing a home can be both exciting and overwhelming. The Government of Canada offers a number of financial incentives to help you throughout the homebuying journey. Incentives for first-time buyers, tax credits, rebates and other programs are available. Find out which incentives might be right for you.

Also Check: Us Government Tax Exempt Form

Buy Your Home Without Making A Down Payment

There are ways to buy your home without paying a down payment if you havent been able to save enough money for the down payment or dont want to use other financial assets for the purpose. In this report, based on industry data, we describe what you need to know to take advantage of this innovative program, which allows you to enter the real estate market immediately and without paying any down payment. An expensive and important decision, buying a home can be stressful. Besides the price of the property, there are many costs that you need to consider, such as the initial payment, the interest rate that the bank will charge you for the mortgage, the closing costs, and the cost of private mortgage insurance . The good news is that there are ways to buy a house without a down payment.

No down payment offers you the chance to buy a house without paying a deposit. No deposit required! Thats right, without paying anything in advance! It is possible you own, or have owned, a home in the past and are now renting, or it might be your first time buying a house, and you hesitate because you cannot make a substantial down payment, or maybe you cannot spare any other financial assets for a house deposit. There is a no down payment program that can help you buy a home without having to make a down payment regardless of your current financial situation. It must. To qualify for the no down payment program, you must meet the following requirements.

Mississippi Down Payment Assistance Programs

The Mississippi Home Corporation offers two different mortgage programs that each come with their own brand of down payment assistance.

- Smart6: A 30-year fixed mortgage with a $6,000 down payment loan that carries 0% interest and comes due when you sell the home

- MRB7: A 30-year fixed-rate mortgage with $7,000 in down payment assistance that is forgiven after 10 years

MRB7 is for first-time home buyers only , while Smart6 can be used by first-time and repeat home buyers alike.

Find out more at the MHCs website. And consult HUDs list of other homeownership assistance programs operating in Mississippi.

Don’t Miss: Government Help For Senior Citizens

Do I Qualify For Down Payment Assistance

Every down payment assistance program has its own rules. Although many are designed for first-time buyers , there are several that people can use to make their second, third or subsequent home purchase.Some factors that affect down payment assistance include:

- Income – Many, but not all, down payment assistance programs, are income-based. In some places, you must make less than 80 percent of the area’s median income in others, you can make up to 140 percent of the area’s median income and still qualify. Check each program’s income requirements before you apply to save yourself time.

- Career Based – Some down payment assistance programs are limited to people in certain careers, or to people who have worked in certain careers, like VA loans, which are for military personnel and their immediate families, or the Teacher Next Door program, which is only available to teachers and school administrators.

- Home Location and Structure: Other programs depend on the home and a variety of other factors some are only available to people buying in certain areas or homes that need to be repaired or upgraded to be more energy efficient.

There’s no guarantee that you will qualify for down payment assistance the only way to find out is to examine each program’s guidelines and restrictions, and then apply.