How The Government Helps With Debt

The government doesnt sponsor debt relief programs like debt consolidation companies directly, but it does offer some forms of financial help.

- Regulation: The Federal Trade Commission has requirements for debt settlement companies and debt collection agencies. The Consumer Financial Protection Bureau accepts complaints against financial companies trying to treat customers unfairly.

- Military service member assistance: The Servicemembers Civil Relief Act lets veterans and active-duty military members qualify for lower interest rates on credit cards and mortgages, and offers other financial protections.

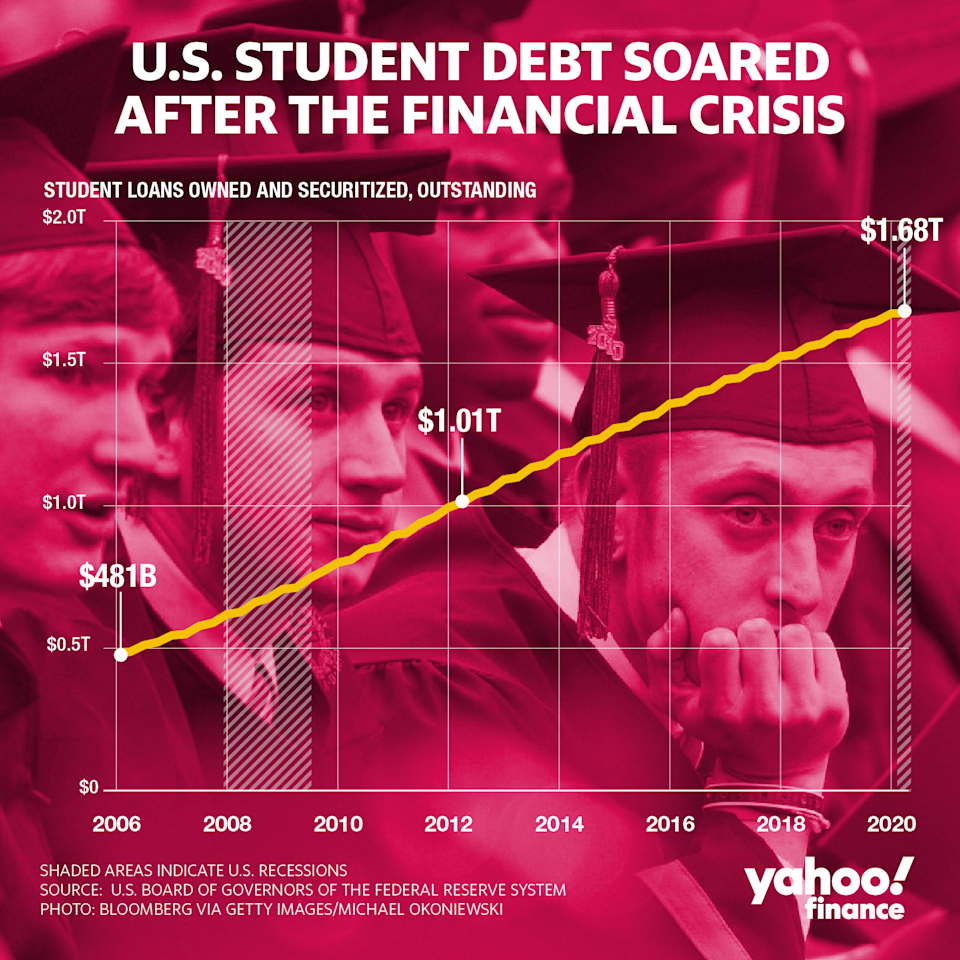

- Debt forgiveness: Government debt, as opposed to debt owed to a private company, can be forgiven. You may be able to settle your tax debt for less than you actually owe the IRS. You can also have student loan debt forgiven, canceled, or discharged, depending on your situation.

- Interest deductions: Certain types of interest are tax deductible, including interest on student loans, mortgages, and medical bills.

- Federal Housing Administration loans: Mortgages insured by the FHA have lower down payments than other loans. If you have this type of mortgage, you could also consider an FHA streamline refinance.

Tip No : Get A Good Feel From Your Initial Consultation

Most debt relief services offer free consultations. That way, they can evaluate your debt, credit, and finances to see if they can help you. But outside of finding out if youre eligible, use these consultations to get a read on companies you contact.

Make sure that you feel comfortable and confident after the consultation. If they leave you with more questions than answers, or you have a sinking feeling that something is wrong, dont move forward! Trust your gut and only work with someone that engenders trust.

And always keep in mind, that these consultations are free with no obligation. So, although the representative may push you to sign up immediately, theres no requirement to do so. You can thank them for their time, hang up and take time to consider what you want to do. You should never feel rushed or pressured into making a decision. Back to top

Does Debt Consolidation Help Your Credit Score

Successful use of debt consolidation will normally lead to a higher credit score for most borrowers. While applying for and initially obtaining a debt consolidation loan can result in a temporary decline in your credit, over the long term, your credit should improve. The debt consolidation loan will streamline your debt repayment, so youll be able to pay all your debts with a single payment. The same is true of a debt settlement program. You may initially face a decline in your credit score when you stop making your minimum payments, but by the time your program is over, your score should be as high if not higher than when you started. Additionally, as you steadily pay down your overall debt balance, your credit rating should improve as well.

Don’t Miss: Ocean City Md Government Jobs

Set Up Automatic Payments

Once you have your debt consolidation loan, see if your lender offers autopay. Many do, and some will even give you a discount for setting it up. Its a good way to potentially lower your interest payments if your poor credit resulted in a high rate. It will also help keep you on track especially important for your credit, since making timely payments on your loan is one of the best ways to raise your credit score.

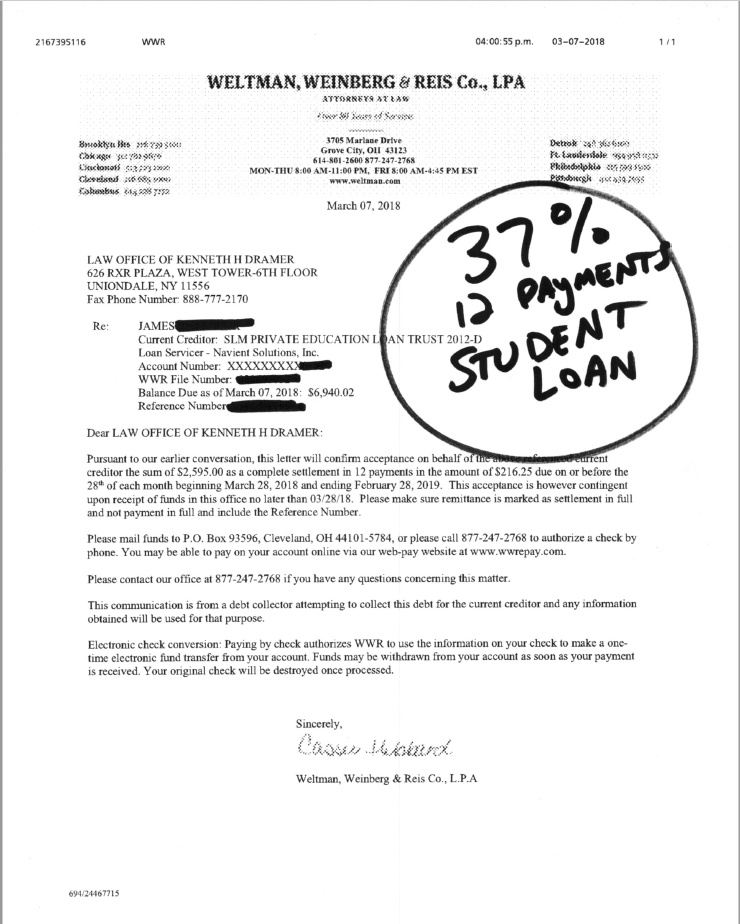

What If My Debt Has Already Gone To A Debt Collector

You may want to talk to the collector at least once, even if you dont think you owe the debt or cant repay it immediately. That way, you can find out more information about the debt and confirm whether its really yours. When talking with a debt collector, be careful about sharing your personal or financial information, especially if youre not already familiar with the collector. Not everyone who calls saying that you owe a debt is a real debt collector. Some are scammers who are just trying to take your money.

A collector has to give you validation information about the debt. They either have to do that during the collectors first phone call with you or in writing within five days after first contacting you.

The collector has to tell you

- how much money you owe

- the name of the creditor you owe it to

- how to get the name of the original creditor, and

- what to do if you dont think its your debt

You also can get a collector to stop contacting you, at any time, by sending a letter by mail asking for contact to stop.

Collectors cant harass you. For example, collectors

- cant threaten to hurt you

- may not use obscene or profane language

- cant repeatedly use the phone to annoy or harass you

Collectors cant lie. For example, collectors

- cannot tell you that you owe a different amount than what you actually owe

- may not pretend to be an attorney or from the government

- cant tell you that youll be arrested, or claim theyll take legal action against you if its not true

Also Check: Governance Of Portfolios Programs And Projects A Practice Guide

What Is A Debt Consolidation Loan

A Debt consolidation loan is simply a process by which you use one source of money to pay off the balance owed to multiple debtors. So, for example, you could have three credit cards with outstanding balances, a student loan, and a personal loan, all with balances that need to be partially paid out each month. A debt consolidation loan takes care of all of these debts and rolls them up into a single, more manageable monthly payment that is often lower than the previous payments you were making combined. When done right, debt consolidation loans can help clear up your debt and improve your credit over time.

Use Caution When Shopping For Debt Relief Services

Avoid any debt relief organization that:

- Charges any fees before it settles your debts or enters you into a debt management plan

- Pressures you to make “voluntary contributions,” which is really another name for fees

- Touts a “new government program” to bail out personal credit card debt

- Guarantees it can make your unsecured debt go away

- Tells you to stop communicating with your creditors, but doesn’t explain the serious consequences

- Tells you it can stop all debt collection calls and lawsuits

- Guarantees that your unsecured debts can be paid off for pennies on the dollar

- Won’t send you free information about the services it provides without requiring you to provide personal financial information, like your credit card account numbers, and balances

- Tries to enroll you in a debt relief program without reviewing your financial situation with you

- Offers to enroll you in a debt management plan without teaching you budgeting and money management skills

- Demands that you make payments into a debt management plan before your creditors have accepted you into the program

Don’t Miss: Government Early Childhood Education Programs

Native American Direct Loans

The VA also oversees the NADL program, which sponsors loans to help buy, build or improve homes on federal trust land. You could be eligible for this type of loan if youre a Native American veteran or a non-Native American veteran married to a Native American. Youll also need to provide a COE and meet other VA loan requirements.

Like with other VA mortgage programs, youll pay a one-time funding fee at closing. This is 1.25% for purchase loans and 0.5% for mortgage refinances.

Get Your Credit Mortgage

Regardless of which type of mortgage loan you end up getting, it’s crucial to learn if you need to make some improvements at least three to six months before you apply. Check your to get an idea of where you stand and also view areas you may need to address.

Also, consider using Experian Boost®ø to potentially help increase your credit score. The program connects to your bank account and gives you credit for your on-time utility, phone and certain video streaming payments.

Improving your credit for a mortgage can take some time, but the sooner you begin the process, the easier it will be to stop potentially damaging activities and make the changes you need to qualify for a mortgage loan.

Read Also: How Do I Upgrade My Government Phone

Do Debt Consolidation Loans Hurt Your Credit Score

Debt consolidation loans can put a temporary dent in your credit for several reasons. For one, in order to receive a debt consolidation loan from a reputable lender, youll need to submit to a hard credit inquiry, which can temporarily lower your credit score a bit. Some lenders may also view a debt consolidation loan on your credit profile in a negative light, seeing it as you struggling to manage your debts. However, debt consolidation loans can also help your credit score as they can help you pay off your debt faster and make payments more manageable.

Benefits Of A Debt Consolidation Loan

Someone might get a debt consolidation loan for one of several reasons. The biggest benefits of a debt consolidation loan include:

- Simplified finances: A debt consolidation loan rolls multiple monthly payments into one. Having only one lender and one monthly bill to worry about could help you pay off your debt more consistently and avoid missed payments, which lower your credit score.

- Lower interest rate: Its generally only wise to get a debt consolidation loan if you can get a better interest rate than what youre paying on your debt now. If youre paying an average of 16 percent to 20 percent on your credit cards and you can get a debt consolidation loan for 14 percent APR, youll save money overall.

- Fixed payment: Most debt consolidation loans have fixed interest rates and a set repayment term, so your monthly payment will be the same every month unlike monthly payments on credit cards.

Read Also: Government Grants For New Cars

Paying Off Your Debts

You can pay your debts in instalments by setting up:

- a Debt Management Plan which is an agreement with your creditors managed by a financial company

- an Administration Order when youve had a county court judgment or a High Court judgment against you for debts under £5,000

- an Individual Voluntary Arrangement which is managed by an insolvency practitioner

You can also get temporary protection from your creditors through the Breathing Space scheme, while still making repayments. Youll need to apply through a debt advisor.

In Scotland you can arrange a Debt Payment Programme from the Debt Arrangement Scheme.

You may also have the option of reaching an informal agreement with your creditors.

Enroll In A Flexible Spending Account

A Flexible Spending Account, is a program where government workers can allocate a small portion of their salary to be put into accounts that are dedicated for medical, dental, or dependent care.

For the most part, FSAs are use it or lose it, so try to pick the amount you intend to allocate after reviewing your health care needs or dependent care needs from the previous year. This is a fantastic way to save on out-of-pocket expenses and avoid debt.

Action item: If the option is available to you, enroll in an FSA as soon as you can.

Don’t Miss: How Do I Get A Government Business Loan

What Should Government Employees Do To Increase Their Chances Of Bargaining For The Best Interest Rate

They should do the following:

- Maintain a good credit score . They have higher chances of loan approval when the score is higher.

- The EMIS should be within 40 to 50% of the take-home pay. Otherwise, it will not be practical, and queries will arise as to whether or not one can repay the loan.

- Should avoid applying for multiple personal loans and make sure that they do not have a loan that they have not applied for just recently.

- Make sure that they do not have any credit card debts

- If they have a good record of handling loans and credit card debts, they will be eligible for pre-approved ICICI Bank Personal Loans.

Yes. Government employees can get personal loans from ICICI Bank.

Individuals can avail personal loans from ICICI Bank for various purposes, such as medical emergencies, marriage expenses, home renovation, purchasing gadgets, funding your vacation, online courses, and so on. Interest rates on personal loans offered by ICICI Bank range from 10.5% to 19% p.a. The bank charges you with a processing fee based on the loan amount. Foreclosure charges are 5% on outstanding principal plus GST for salaried customers. Foreclosure charges are not applicable if the loan is closed using ones own funds .

How Much Debt Is Ok For A Small Business To Have

While theres no specific amount as to how much debt you should or shouldnt have, its generally a good idea to keep your businesss debt-to-equity ratio in mind when calculating how much debt to take on. With consumer debt, this is known as debt-to-income ratio.

Your D/E ratio is measured by dividing your businesss debt by your shareholders equity. Your D/E ratio gives lenders insight as to whether you can afford more debt. As a result, you may want to keep that ratio low.

Read Also: Free Government Phones In My Area

Whats A Credit Counseling Agencies Do To Help

A reputable credit counseling organization can give you advice on managing your money and debts, help you develop a budget, offer you free educational materials and workshops, and help you make a plan to repay your debt. Its counselors are certified and trained in credit issues, money and debt management, and budgeting.

Good credit counselors spend time discussing your entire financial situation with you before coming up with a personalized plan to solve your money problems. Your first counseling session will typically last an hour, with an offer of follow-up sessions. Good counselors wont promise to fix all your problems or ask you to pay a lot of money before doing anything.

Dealing With Debt Collectors

The Fair Debt Collection Practices Act dictates how and when a debt collector may contact you:

- Debt collectors may call you between the hours of 8 a.m. and 9 p.m.

- They may not call you while you are at work

- They may not harass you, lie to you, or use unfair practices when they are trying to collect a debt from you

- They must honor a written request from you to stop further contact

If you want more information or have a consumer complaint, contact the Federal Trade Commission at 877-382-4357, the Consumer Financial Protection Bureau at 855-411-2372, or the Michigan Department of Licensing and Regulatory Affairs at 517-241-9288.

Follow us

Also Check: Government Statement Of Work Template

Can A Government Employee Get A Personal Loan From Icici Bank

Yes. Government employees can get personal loans from ICICI Bank.

Individuals can avail personal loans from ICICI Bank for various purposes, such as medical emergencies, marriage expenses, home renovation, purchasing gadgets, funding your vacation, online courses, and so on. Interest rates on personal loans offered by ICICI Bank range from 10.5% to 19% p.a. The bank charges you with a processing fee based on the loan amount. Foreclosure charges are 5% on outstanding principal plus GST for salaried customers. Foreclosure charges are not applicable if the loan is closed using ones own funds .

Also Check: Us Government Polygraph Training Program

How Long Does It Take To Get Approved For A Consolidation Loan

Approval turnaround times typically vary per institution. For example, some online lenders may approve your loan within a matter of minutes, while banks may take a few days or up to a week to process. Once your loan is approved, funding can arrive within 24 to 48 hours or up to one week, depending on your lender.

Also, keep in mind that once you are approved for a debt consolidation loan, it might take several weeks to pay off your existing debts, depending on the lender. They will likely still hold you responsible for any payment due dates within that waiting period.

Don’t Miss: Homeschool High School Government Curriculum

S To Getting A Debt Consolidation Loan For Bad Credit

If youre struggling to get out of debt and think a debt consolidation loan can help, youll likely have to have a credit score in the mid-600s, a history of on-time payments and sufficient income to qualify. However, every lender has its own requirements. Start with the following steps to help you find the right personal loans for debt consolidation and boost your chances of approval.

Rochester & Monroe County Employees Federal Credit Union

Routing Number: 222382234

We do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act.

Your savings federally insured to at least $250,000 and backed by the full faith and credit of the United States Government Agency

National Credit Union Administration, a U.S. Government Agency

Website designed by Mason Digital

Login to Your Account

Dont Miss: Data Domains In Data Governance

Also Check: Refinance Federal Student Loans Through Government

Government Debt Relief Programs

There are times that the federal government steps in to help consumers with a specific type of debt. These programs usually have a limited lifespan. Congress will set them up during a crisis and continue to renew them until consumers recover. Many of the programs you see outlined below started after the housing crisis of 2008 and the Great Recession of 2009.

Examples Of Bad Business Debt

Debt you cant afford: Debt becomes bad when youre unable to pay it off. The federal government even refers to it as worthless. Bad debt can be partially or fully deducted when filing your business income tax return. Other types of bad debts include:

Loans to employees, customers, suppliers or distributors

Sales that offer credit to customers

Read Also: Federal Grants To State And Local Governments