Federal Grants To State And Local Governments: A Brief History

Federal Grants to State and Local Governments: A Brief HistoryFederal Grants to State and LocalGovernments: A Brief History

1785, enacted under the Articles of Confederation, required every new township1

1st Cong., 2nd sess., pp. 1039-1040, 1735-1738. Votes on the issue of assumption of debtsstnd

1910, as quoted in ibid., p. 64.

1986), p. 19.

1966 the Partnership for Public Health.

96 Stat. 1103.

89-90.

Delays In Payments For Existing Grant Awards

Though there are variations across states and federal grant programs, the longer the federal government is shut down, generally the greater the impact on federal grant program payments. OMB guidance indicates that grant management activities at the federal agency level for those agencies experiencing a lapse in appropriations would not continue during a shutdown, except in very limited circumstances. These activities include payment processing, routine oversight, inspection, accounting, administration, and other grant management activities.

Assistance For State Local And Tribal Governments

The COVID-19 public health crisis and resulting economic crisis have put state, local, and Tribal governments under unprecedented strain. The Treasury Department is providing needed relief to state, local, and Tribal governments to enable them to continue to support the public health response and lay the foundation for a strong and equitable economic recovery.

Also Check: Government Contracts For Box Trucks

Fiscal Federalism And Fiscal Institutions

What types of federal grants are made to state and local governments and how do they work?

The federal government distributes grants to states and localities for many purposes, but the bulk are dedicated to health care. Some grants are restricted to a narrow purpose but block grants give recipients more latitude in meeting program objectives.

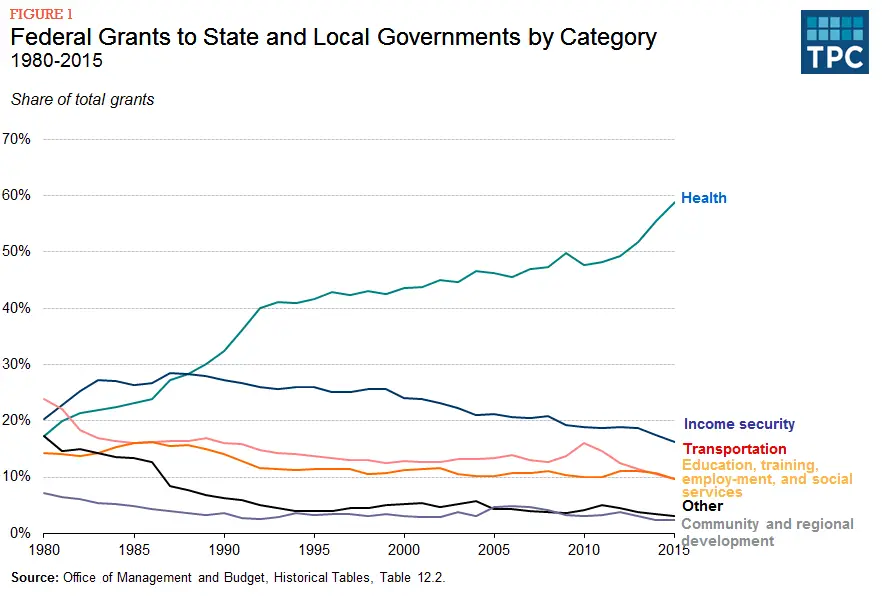

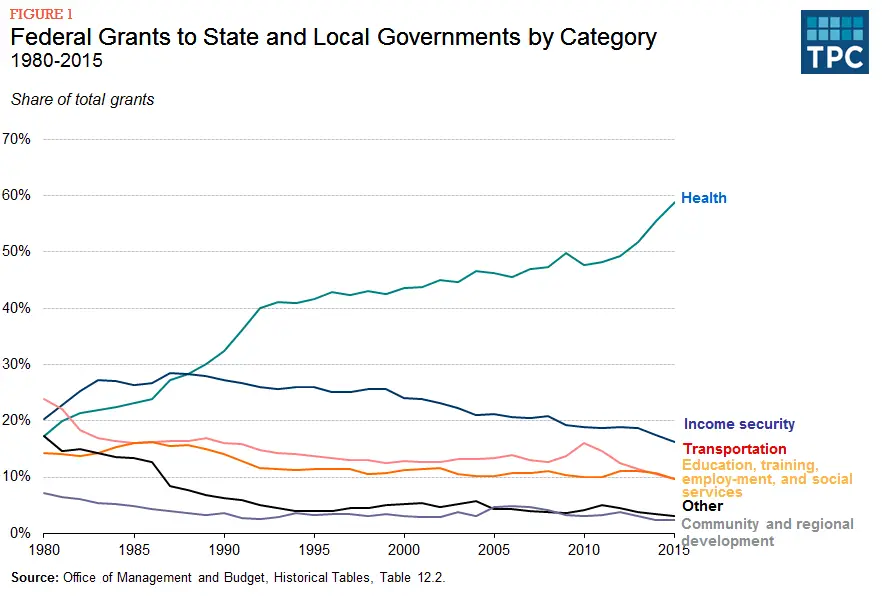

The federal government distributed about $721 billion to states and localities in fiscal year 2019, providing about one-quarter of these governments total revenues. About 61 percent of those funds were dedicated to health care, 16 percent to income security programs, and 9 percent each to transportation and education, training, employment, and social services .

The federal government distributes grants to state and local governments for several reasons. In some cases, the federal government may devolve or share responsibility for a given service or function because state and local governments have better information about local preferences and costs. In others, the federal government may offer states and localities incentives to undertake additional spending benefiting neighboring jurisdictions or the country as a whole.

Over the past 50 years, the composition of federal grants has shifted dramatically. For example, federal grants for health care programs were less than 20 percent of the total until the 1980s.

Federal Grants Provide Large Share Of State And Local Revenue

Following federal budget convention, the funding for grants to state and local governments comes from two parts of the federal budget: mandatory and discretionary. Combined, these federal grants provide approximately 31 percent of state budgets. Considering state and local budgets together, federal funding provides 22 percent of spending.

Mandatory programs are set in ongoing federal law that remains in place until changed. Funding depends on formulas and eligibility requirements set in the law. Mandatory grants to state and local governments totaled $467 billion in federal fiscal year 2016. The vast majority $385 billion, or 82 percent was for Medicaid and CHIP. The remainder, $86 billion, funded a number of other programs important to families and children, some of which are described below.

Federal spending for discretionary programs is appropriated annually. Grants to state and local governments come from the category known as non-defense discretionary programs. Discretionary grants to state and local governments are estimated to have totaled $199 billion in federal fiscal year 2016. The largest discretionary grant areas are transportation, including grants for highways, airports, and mass transit education, including support to improve outcomes for low-income students and students with special needs and programs to subsidize housing for low-income families and seniors and foster community development.

Recommended Reading: Government Contracting Certificate Programs

Coronavirus Effects On State Tax Revenues

In response to the coronavirus pandemic, Congress debated whether to provide additional funding to states for declines in tax revenue related to COVID-19. Business closures and job losses reduced payments of income taxes and sales taxes, which accounted for 60 percent of the revenue collected by states, according to the Federal Reserve Bank of Cleveland.

Estimates of the revenue reductions vary. Below are loss projections for Fiscal Years 2020 and 2021 from three different outlets.

| States Estimated Revenue Shortfalls From COVID | |

|---|---|

| Center of Budget and Policy Priorities | $110 billion |

| $121 billion |

Sounds Good But Where Do We Begin

At GovGrantsHelp, weve developed an easy-to-follow process to get you up to speed on the basics of identifying, applying for, and securing local government grants.

This step-by-step guide will walk you through the sometimes tedious process of collecting the information critical to nearly all grant opportunities, regardless of their origin.

Following our step-by-step guide will put you on the right track to a successful local government grant application.

You May Like: Entry Level Government Jobs Las Vegas

Who Can Get A Grant

The federal government awards grants to organizations including:

-

State and local governments

-

Non-profit organizations

-

Businesses

The intent of most grants is to fund projects that will benefit specific parts of the population or the community as a whole. What you might see about grants online or in the media may not be true. The federal government does not offer grants or free money to individuals to start a business or cover personal expenses. For personal financial assistance, the government offers federal benefit programs. These programs help individuals and families become financially self-sufficient or lower their expenses.

State And Local Government Data Analysis Tools For Roadway Safety

The purpose of this NOFO is to advance the U.S. Department of Transportation?s safety strategic goal, which includes using a data-driven systemic safety approach, by providing funding to build the capacity of State, local, and Tribal governments to use tools and information for policy and decision-making to improve roadway safety. The NOFO is an important next step in the Safety Data Initiative , which focuses on leveraging data integration, data visualization, and the use of advanced analytics to better understand surface transportation safety risks. Participants will develop, refine, and deploy roadway safety tools that address specific safety problems, which are an identified area of need for State, local, and Tribal practitioners. This will accelerate the roadway safety community?s ability to gain new safety insights from data and apply information in a meaningful way that can lead to more precise, informed, effective, and/or efficient practices.

Don’t Miss: Polk Real Foreclosure

How Does State Spending Differ From Local Spending

States and local governments provide different mixes of services, which are reflected in their direct general expenditures.

Local governments directly spent far more on elementary and secondary education than states in 2018: 40 percent of direct local government spending went to K-12 education versus less than 1 percent of direct state spending. However, while local governments overwhelmingly spent these dollars, much of that money came from state and federal funds.7 In total, during the 2017-2018 school year, states provided 47 percent of overall K-12 education funding, local governments provided 45 percent, and the federal government provided 8 percent.8

Meanwhile, states spent a higher percentage of their direct expenditures on higher education than local governments in 2018.

Similarly, states also directly spent a far higher percentage of their budgets on public welfare expenditures than local governments. In 2018, 44 percent of states’ direct general expenditures went toward public welfare, the largest direct expenditure at the state level. Local governments spent only 4 percent on public welfare. Much of public welfare spending is Medicaid spending, which is jointly funded by states and the federal government but administered by state governments .

Local governments spent a larger share of their budgets on police than state governments , while spending on health and hospitals and highways and roads were roughly equal at the two levels of government.

States Cannot Absorb These Potential Federal Funding Cuts

State and local governments do not have the funds to replace the magnitude of funds that could be lost through cuts to mandatory and discretionary spending. Many states are experiencing revenue shortfalls this year, and struggle in most years to find adequate revenues to support services. In all likelihood, states and localities will be forced to scale back or eliminate services and programs for families, seniors, and people with disabilities, rather than raise their own funds to continue the programs at their current level.

Moreover, even if they did raise some taxes to continue fully funding some affected programs, low-income residents would bear the consequences. State and local tax systems are, on the whole, regressive . Shifting responsibilities for funding services from the federal government, which has a progressive tax system, to states and localities would increase the burden on many of the same low-income people who would be at risk of losing services.

Also Check: Dental Implant Grants For Low Income

How And Why Does Spending Differ Across States

State and local governments spent $9,801 per capita in 2018, but per capita direct spending varies widely across states.

Among the states, Alaska had the highest per capita state and local spending in 2018 at $19,699, followed by New York and Wyoming . As is typical, the District of Columbias per capita spending exceeded all states at $20,418.10 Arizona and Georgia had the lowest per capita spending in 2018.

Data:

Differences in spending arise from variations in geography, demographics, history, and other external factors. They can also arise from state policy choices, such as generosity of service levels, eligibility rules for social services, or tax policy. For example, New York has relatively high K12 education spending even though it has relatively few school-age children and a bigger share of kids in private school than most states.11 Instead, it has high K12 education spending because it has more teachers per student enrollment and higher teacher salaries than most states.12 In contrast, although Idaho has many school-age children to educate and a high rate of attendance in public schools, it has relatively low K-12 education spending because it employs fewer teachers per student and has lower payroll costs than most states.13

What Do State And Local Governments Spend Money On

State and local governments spend most of their resources on education, health, and social service programs. In 2018, about one-third of state and local spending went toward combined elementary and secondary education and higher education .3

Another 22 percent of expenditures went toward public welfare in 2018. Public welfare includes spending on means-tested programs, such as Medicaid, Temporary Assistance for Needy Families, and Supplemental Security Income.4 Spending on health and hospitals was another 9 percent of state and local direct expenditures.

Medicaid constitutes a large, and growing, portion of state spending. However, Census does not separate Medicaid spending into its own category. Instead, most Medicaid spending is accounted for under the public welfare category with some spending counted as hospital expenditures.5

The National Association of State Budget Officers estimates that in fiscal year 2020 Medicaid alone accounted for nearly 29 percent of total state spendingup from 20 percent in 2008. 6

Highway and road spending was 6 percent of state and local direct general expenditures in 2018. Looking at criminal justice expenditures individually, police spending was 4 percent of state and local direct general expenditures, corrections spending was 3 percent, and court spending was 2 percent. Housing and community development expenditures accounted for another 2 percent of state and local direct general expenditures.

Read Also: Congress Mortgage Stimulus Program For Middle Class 2021

Federal Grants To State And Local Governments: Issues Raised By The Partial Government Shutdown

At the end of the day on December 21, 2018, the continuing appropriations measure, Making Further Continuing Appropriations for Fiscal Year 2019 ” rel=”nofollow”> P.L. 115-298), which encompasses 7 of the 12 regular annual appropriations acts, expired. The resulting lapse in appropriations resulted in the partial shutdown of unfunded agencies beginning on December 22, 2018. Federal agencies that received their FY2019 appropriations under the Energy and Water, Legislative Branch, and Military Construction and Veterans Affairs Appropriations Act, 2019 ” rel=”nofollow”> P.L. 115-244), and the Department of Defense and Labor, Health and Human Services, and Education Appropriations Act, 2019 ” rel=”nofollow”> P.L. 115-245) are not directly affected by the shutdown.

During the lapse in appropriations, the Office of Management and Budget has directed federal agencies to implement contingency plans designed to guide operations during the partial government shutdown. Federal agency operations include administration of over 1,700 congressionally authorized federal grant programs, some of which are administered by agencies currently experiencing a lapse in appropriations.

- the timing and duration of the federal government shutdown and

- the choices made by federal, state, and local officials in anticipation of, or during, a shutdown regarding grant program administration.

State And Local Expenditures

State and Local Spending

State and local governments spent $3.2 trillion on direct general government expenditures in fiscal year 2018.1 States spent $1.5 trillion directly and local governmentscities, townships, counties, school districts, and special districtsspent $1.7 trillion directly.2

While state governments raised more revenues than local governments in 2018, local governments’ direct expenditures were larger than states’ because localities often administer programs with funds transferred from state governments. In 2018, states transferred over $543 billion to local governments. However, a portion of state funding comes indirectly from the federal government in the form of pass-through grants. For example, the federal government sends elementary and secondary education funds to state governments, and then state governments transfer the money to local governments.

Also Check: Car Repair Financial Help

At Risk: Federal Grants To State And Local Governments

Programs for Low- and Moderate-Income Families Could Bear the Brunt of Cuts

These programs are too important to be considered as available resources that can be cut. Federal funds that go to state and local governments as grants help finance critical programs and services on which residents of every state rely. These grants, and the programs they support, are at serious risk of being substantially diminished or eliminated, based on proposals from President Trump and congressional Republicans. These programs are too important, particularly to low- and moderate-income people, to be considered as available resources that can be cut either immediately or over time to reduce the overall budget, to pay for greater defense spending, or to finance other Administration priorities such as deep tax cuts for high-income people.

Grants matter to state and local budgets. Federal spending in the form of mandatory and discretionary grants accounts for a large share of state and local government revenues. Federal grants provide approximately 31 percent of state budgets. Considering state and local budgets together, federal funding provides 22 percent of spending. The grants support health care, public education, housing, community development, child care, job training, transportation, and clean water, among other programs.

Mandatory Grants To States And Localities Include Critical Low

Mandatory grants provide funding for programs of particular importance to low- and moderate-income households, including children, seniors, and people with disabilities. Also known as entitlement programs, their benefits or services are available to anyone who meets their strict eligibility criteria, and funding increases automatically and immediately to respond to increased need. These programs include:

Recommended Reading: Safelink Wireless Las Vegas

Free Grants And Grant Scams

If you receive information stating you qualify for a “free grant,” it’s probably a scam. Get information from the Federal Trade Commission so you can better recognize and avoid grant scams. If you have been a victim of a grant scam, you can file a complaint with the FTC.

Contact your state consumer protection office if you have purchased a book or paid a fee to get grant information and are not satisfied.

How Can I Get A Grant For My Department

In order to receive a grant, your department must submit an application or proposal. Its important to recognize that a considerable amount of research and planning is necessary in order to submit a strong application.

The application process can be challenging to navigate. Most grant programs are only open once a year, are designed to fund a specific focus area and each individual grant program has specific requirements for eligibility.

On top of that, getting grant funding can be very competitive. The number of requests for funding is always greater than the funds available. This means that sometimes even a strong application may not be approved for funding.But dont be discouraged. With a little good old fashioned effort, planning and persistence, you should be able to secure funding for your project.

Also Check: Possible Careers For History Majors

Mandatory Grants Outside Major Health Programs At Historically Low Levels

Some federal grants to state and local governments are in the mandatory part of the federal budget. Mandatory programs are set in ongoing federal law that remains in place until changed their funding depends on formulas and eligibility requirements set in the law. Mandatory grants to state and local governments totaled $474 billion in federal fiscal year 2017. The vast majority of this funding $391 billion, or 83 percent was for Medicaid and the Childrens Health Insurance Program . The rest, $83 billion, funded numerous other programs for families and children.

Mandatory grants support programs of particular importance to low- and moderate-income households, including children, seniors, and people with disabilities. Also known as entitlement programs, their benefits or services are available to anyone who meets their strict eligibility criteria, and funding increases automatically and immediately to respond to increased need. Federal Medicaid and CHIP spending as a percent of the economy has grown significantly over time, due largely to enrollment growth and the rise in per-person health care costs. But mandatory grants to state and local governments other than for Medicaid and CHIP are at a lower percentage of the economy than when President Reagan left office.