Get Your Credit Score And Report For Free

If you’ve ever applied for credit or a loan, there will be a credit report about you.

You have a right to get a copy of your credit report for free every 3 months. It’s worth getting a copy at least once a year.

Your credit report also includes a credit rating. This is the ‘band’ your credit score sits in .

See Your Latest Credit Information

See the same type of information that lenders see when requesting your credit.

Your Credit Report captures financial information that lenders use to determine your creditworthiness. This includes the type of credit accounts, current balances, payment history, and any derogatory items you may have. You will also get a summary of your account totals, total debt, and personal information.

Will I Be Penalized For Shopping Around For The Best Interest Rate

A common misconception is that every inquiry decreases your credit score. This is not true. While an inquiry is recorded on your personal credit report every time you, one of your creditors or a potential creditor obtains your credit report, the presence of inquiries has only a small impact on your credit score. Many types of inquiries have absolutely no impact. Most scoring models take appropriate steps to avoid lowering your score because of multiple inquiries that might occur as you shop for the best car or home loan terms.

Read Also: What Is Nonprofit Board Governance

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Submit Your Request In Person:

Equifax has four office locations where you can request a free copy of your Equifax credit report in-person and receive a printed copy of your credit report after your identity is confirmed. Copies of the request form you will need to complete are available onsite.

You need to bring with you at least two forms of identification, including 1 photo identification and proof of current address. Also, you must provide the original copies of your chosen identification – photocopies and electronic versions are not accepted at the office. Examples of acceptable documentation include:

- Driver’s License

- Utility Bills

Acceptable Supporting IDs:

- Birth Certificate Issued in Canada

- T4 slip

- Citizenship and Immigration Canada Document IMM1000 or IMM1442

- Social Insurance Number Card issued by Canadian Government

- Certificate of Naturalization

Providing your Social Insurance Number is optional. If you provide your S.I.N., we will cross-reference it with our records to help ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

Read Also: Government Jobs Com Careers Cleveland

How Does A Credit Score Work

Your credit score is a number related to your credit history. If your credit score is high, your credit is good. If your credit score is low, your credit is bad.

There are different credit scores. Each credit reporting company creates a credit score. Other companies create scores, too. The range is different, but it usually goes from about 300 to 850 .

It costs money to look at your credit score. Sometimes a company might say the score is free. But usually there is a cost.

What To Look For When You Review Your Credit Report

Monitoring your credit report is even more important during uncertain economic times since fraudsters like to take advantage of these situations.

You should keep an eye out for common credit report errors and signs of fraud when checking your credit report, such as:

- New accounts that you didn’t open

- Identity errors

- Incorrect reporting of account status

- Data management errors

- Balance errors

If you notice any errors, dispute them as soon as possible. Check out our step-by-step guide on how to dispute a credit report error.

Learn more:

Read Also: What Is Government Community Cloud

Should I Order Reports From All Three Credit Bureaus At The Same Time

You can order free reports at the same time, or you can stagger your requests throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Because each credit bureau gets its information from different sources, the information in your report from one credit bureau may not reflect all, or the same, information in your reports from the other two credit bureaus.

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to file a dispute with Equifax Canada. You will need to complete the enclosed with your package. You can also review how to dispute information on your credit report for additional details on the Equifax dispute process.

Don’t Miss: How To Be A Government Contractor

How To Get A Free Annual Credit Report:

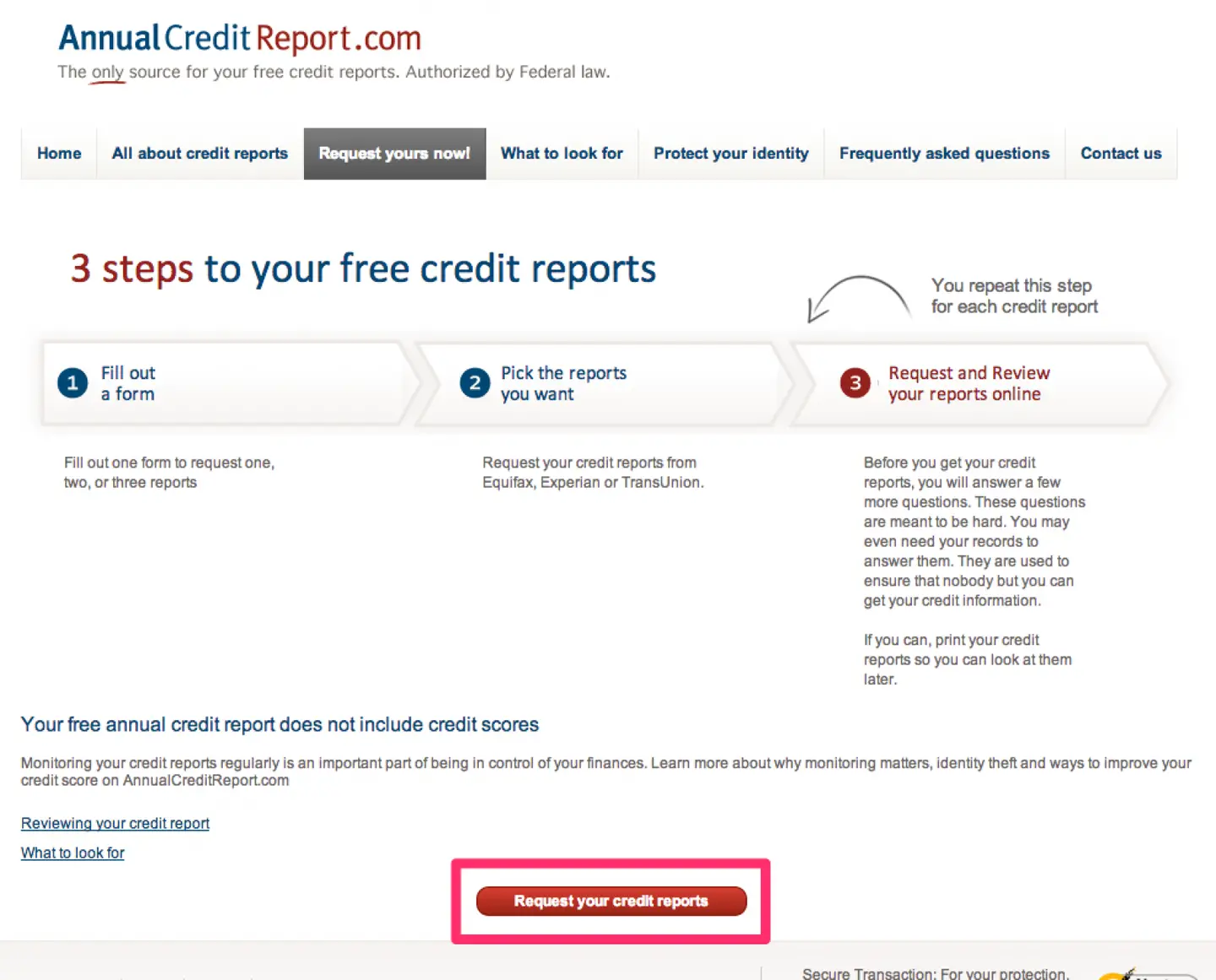

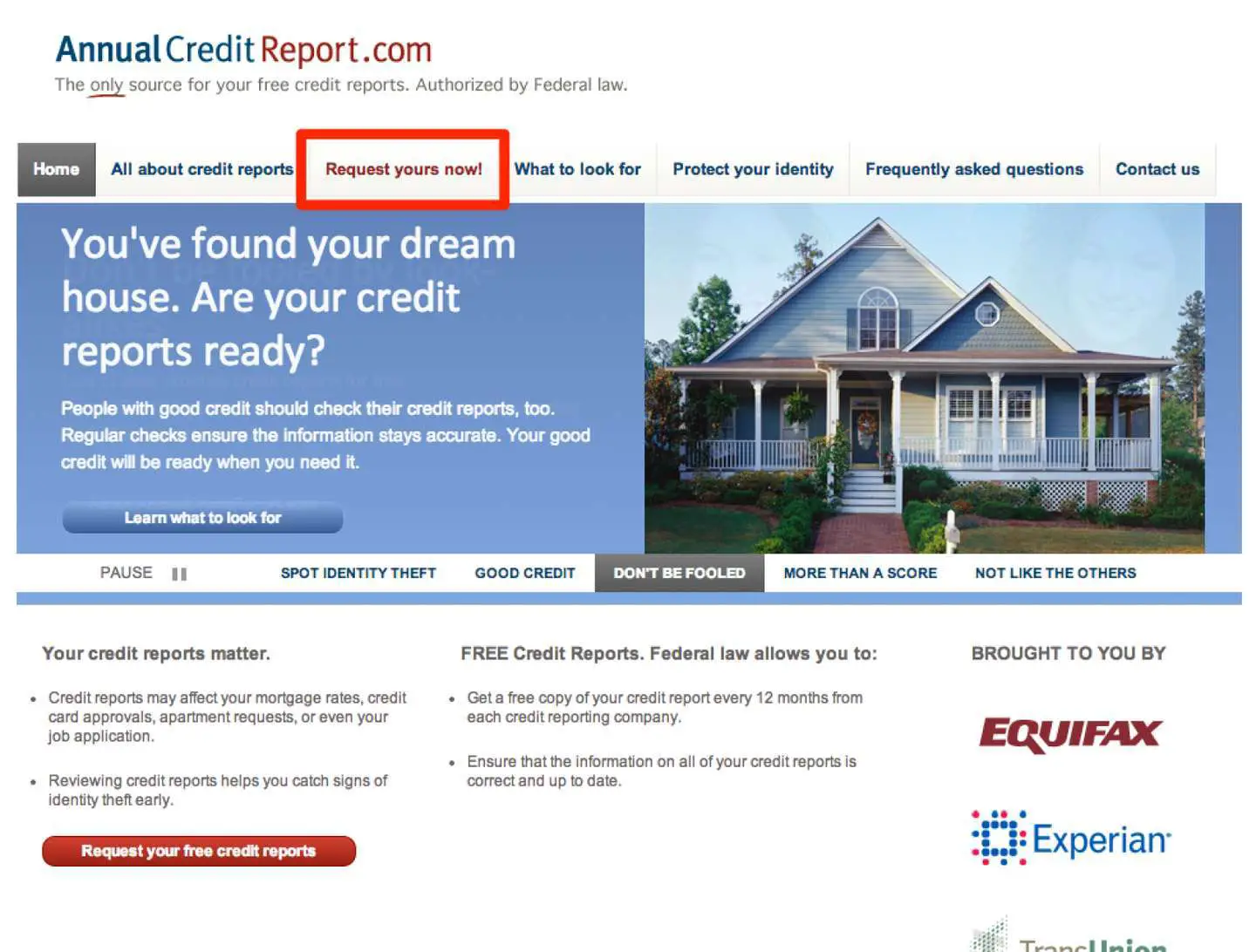

- Online: Visit AnnualCreditReport.com and click on Request Your Free Credit Reports, then fill out the request form, which will require your name, address, Social Security number, and date of birth. Then, choose which bureau you want a report from to view them online.

- : Call 1-877-322-8228 and press 1, then follow the prompts. You will need to provide the same information as the online method.

- : Print and fill out the Annual Credit Report Request Form. Then, mail it to Annual Credit Report Request Service / PO Box 105281 / Atlanta, GA 30348-5281.

If you get a report from AnnualCreditReport.com, its best not to check your Experian, Equifax and TransUnion reports all at the same time. Review one of them now, and save the others for later, spreading them out across the year. Pulling your reports in rotation will help you ensure that youre not missing anything for an extended period of time.

Just bear in mind that using only AnnualCreditReport.com would be a mistake, as it would normally blind you to credit-report changes for much of the year. Due to the COVID-19 pandemic, however, all three credit bureaus are offering free reports weekly on AnnualCreditReport.com through April 2021.

While WalletHub and AnnualCreditReport.com are the best options for getting a free credit report, there are plenty of other choices, too.

Checking Your Credit Report For Free

Private companies called “credit reporting agencies” collect information related to your access to and use of credit. They make that information available to others under certain circumstances in the form of a “credit report.” Lending institutions, employers, insurance agencies, and future creditors make decisions about you from the information in your credit report. Your credit report is an important document, and the law gives you certain protections against the reporting of incorrect information. Knowing your legal rights and remedies is a first step to resolving any problems related to your credit report.

Note: Your Credit Report is Free! Under state and federal law, you are entitled to one free copy of your credit report per calendar year from each of the three main credit reporting agencies noted above. Requesting a copy every year to ensure your report is without errors is worthwhile and recommended. If you ever apply for and are denied credit, you should immediately get a copy of your report to verify that all the information is correct. You have the right to know which credit reporting agency prepared the report that was used in the denial of your credit application. Under state law, you have the right to a free copy of your credit report within 60 days of being denied credit. Visit the annual credit report website or call 322-8228 to request your free annual credit report.

Don’t Miss: Government Loans For Multi Family Properties

Order Your Free Credit Report

Consumers can get free copies of their credit report each year. The Fair Credit Reporting Act requires each of the three nationwide consumer reporting agencies Equifax, Experian, and TransUnion to provide you with a free copy of your credit report, at your request, once every 12 months.

At least once a year, review each one of your three credit reports to:

- ensure that the information is accurate and up-to-date before you apply for a loan, lease a car, get a credit card, buy insurance, or apply for a job.

- help guard against identity theft. If identity thieves use your information to open new account in your name, those unpaid accounts get reported on your credit.

To order your FREE reports:

How Do I Check My Credit Report

This is easy to do by phone:

- Answer questions from a recorded system. You have to give your address, Social Security number, and birth date.

- Choose to only show the last four numbers of your Social Security number. It is safer than showing your full Social Security number on your report.

- Choose which credit reporting company you want a report from.

That company mails your report to you. It should arrive 2-3 weeks after you call.

Don’t Miss: Apply For Money From Government

*warnings When Ordering Online:

Misspelling the annualcreditreport.com site or using another site with similar words will take you to a site that will try to sell you something or collect your personal information. Even one mistyped letter could take you to a fraudulent website that looks and feels like a place to order credit reports but in fact has been set up by ID thieves to steal your information. Other sites with similar names exist and may try to sell you credit monitoring services.

Remember, only one website is authorized to fill orders for the free annual credit report you are entitled to under lawannualcreditreport.com. Other websites that claim to offer free credit report,, free credit scores, or free credit monitoring are not part of the legally mandated free annual credit report program.

Beware of emails, banner ads, pop-up ads, and telemarketing calls that promise to obtain your free annual credit report on your behalf. In particular, beware of email messages or internet ads claiming to be from annualcreditreport.com.

Also beware of any free offers for your credit score. One wrong click on an enticing ad for a free look at your credit score may have you signed up for costly or unnecessary credit monitoring or sharing your personal information with a thief.

Annualcreditreport.com will not send you an email asking for your personal information do not reply or click on any link in the message. Its likely a scam, leading to potential ID theft. Forward scam emails to the FTC .

Other Situations Where You Are Eligible For A Free Credit Report

If you are a victim of identity theft, you are entitled to place a fraud alert on your file and to receive copies of your credit report from each of the three credit reporting companies free of charge, regardless whether you have previously ordered your free annual reports.

For more information on ID theft, including advice for victims and tips on prevention, review the Attorney Generals Consumer Alerts: Identity Theft Prevention and Identity Theft Recovery.

If a company takes adverse action against you, such as denying an application for credit, insurance, or employment, you are entitled to a free credit report if you ask for it within 60 days of receiving notice of the adverse action. The notice will give you the name, address, and phone number of the credit reporting company to contact.

Recommended Reading: Us Government Patent Office Search

Ask About The Counsellor’s Qualifications

Ask about the counsellors qualifications, including:

- education

Common specialized training may include:

- Accredited Financial Counsellor Canada designation, offered by the Ontario Association of Credit Counselling Services

- Insolvency Counsellors Qualification Course, offered by the Canadian Association of Insolvency and Restructuring Professionals

The purpose of the training is to provide counsellors with the unique skills required to support consumers in the areas of personal finance, consumer credit, money management and counselling.

Submit Your Request By Mail:

First, you’ll need to download and complete the Canadian Credit Report Request Form.

Second, you must provide a photocopy of two pieces of valid, non-expired Canadian Government-issued identification. At least one of the two IDs must include your current home address. Examples of acceptable documentation include:

- Driver’s license

- Birth certificate

- Certificate of Indian Status

In order to protect your personal information, we will validate your identity before mailing your credit report to your confirmed home address. If your address is not up-to-date on either identification, you must also provide additional documentation that shows your current home address . Your copy should show the date of the document, the sender, your name, address and your account number.

- Documents must be less than 90 days old

- We recommend you blackout any transactional details.

- If you provide a credit card statement or copy of your credit card as proof, please ensure to blackout your CVV.

While providing your Social Insurance Number is optional, it helps us avoid delays and confusion in case another individual’s identifying information is similar to your own. If you provide your S.I.N., we will cross-reference it with our records to ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

As a last step, you will need to submit your completed form and proof of identity

Kindly allow 5 – 10 days for delivery.

Also Check: Texas Government Auctions Seized Property

What Happens After A Debt Collector Contacts You

Within five days after a debt collector first contacts you, the collector must send you a written notice that tells you the name of the creditor, how much you owe, and what action to take if you believe you do not owe the money. If you owe the money or part of it, contact the creditor to arrange for payment. If you believe you do not owe the money, contact the creditor in writing and send a copy to the collection agency informing them with a letter not to contact you.

How Do I Fix Mistakes In My Credit Report

- Write a letter. Tell the credit reporting company that you have questions about information in your report.

- Explain which information is wrong and why you think so.

- Say that you want the information corrected or removed from your report.

- Send a copy of your credit report with the wrong information circled.

- Send copies of other papers that help you explain your opinion.

- Send this information Certified Mail. Ask the post office for a return receipt. The receipt is proof that the credit reporting company got your letter.

The credit reporting company must look into your complaint and answer you in writing.

Read Also: What Is The Return On Government Bonds

Monitor Your Credit Regularly

Monitoring your scores and reports can tip you off to problems such as an overlooked payment or identity theft. It also lets you track progress on building your credit. NerdWallet offers both a free credit report summary and a free credit score, updated weekly.

Heres how the information youll get from AnnualCreditReport.com differs from what free personal finance sites may provide:

AnnualCreditReport.com provides:

-

Data from all three major credit bureaus

-

An extensive history of your credit use

Personal finance websites, including NerdWallet, provide:

-

Unlimited access

-

Data from one or two credit bureaus

-

A recent history of your credit use

-

Additional information about building and protecting your credit

AnnualCreditReport.com is authorized by federal law and safe to use as long as you ensure you’re on the correct site.

Double-check the URL when you type it, to be sure you have not made a typo. Some other sites have similar-sounding names, so check that the URL matches and the site looks as expected.

Be aware that your credit reports are free, but credit bureaus also use the AnnualCreditReport.com site to sell credit scores and promote paid services, such as . However, monitoring doesnt keep your identity from being stolen it just alerts you after the fact. For best protection, use a

Just get your free credit report. Dont get suckered by the upsell, says Ed Mierzwinski, consumer program director for the U.S. Public Interest Research Group.

AnnualCreditReport.com

Your Childs Credit Report

Parents can place a Protected Consumer security freeze on their childs credit reports to help prevent identity theft. Check a childs credit report before they turn 16.

Youll need to provide the following:

- childs full name

- copy of social security card

- addresses for the past two years

- copy of the parents drivers license

- copy of proof of residence for the parent, such as a utility bill

- guardians should include guardianship papers

Send or submit the information to each of the three major credit reporting bureaus.

Also Check: Government Employees Life Insurance Company Washington Dc

How To Order Your Free Annual Credit Reports

The three major credit reporting companies have set up a toll-free telephone number, a mailing address, and a central website to fill orders for the free annual credit report you are entitled to under law. These are the only ways to get free credit reports without any strings attached. If you order your report by phone or mail, it will be mailed to you within 15 days if you order it online, you should be able to access it immediately. It may take longer to receive your report if the credit reporting company needs more information to verify your identity.

Do not attempt to order free credit reports directly from the credit reporting agencies. Free credit reports advertised by other sources are not really free!

To order:

- – Call 877-322-8228 .

- – Complete the Annual Credit Report Request Form available online, the only truly free credit report website, and mail it to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.

- *Online – .