Other Situations Where You Are Eligible For A Free Credit Report

If you are a victim of identity theft, you are entitled to place a fraud alert on your file and to receive copies of your credit report from each of the three credit reporting companies free of charge, regardless whether you have previously ordered your free annual reports.

For more information on ID theft, including advice for victims and tips on prevention, review the Attorney Generals Consumer Alerts: Identity Theft Prevention and Identity Theft Recovery.

If a company takes adverse action against you, such as denying an application for credit, insurance, or employment, you are entitled to a free credit report if you ask for it within 60 days of receiving notice of the adverse action. The notice will give you the name, address, and phone number of the credit reporting company to contact.

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Dun & Bradstreet Creditsignal

This credit report contains information about your accounts, the highest balance, and whether you have paid on time. You also get notifications of changes to your business Dun & Bradstreet credit scores , but not the actual scores.

Pros: Knowing whether your D& B scores change may be useful if youre applying for financing with a lender who looks at it.

Cons: Dun & Bradstreet may contact you to try to get you to purchase additional products to help build your business credit.

Sample showing change in credit scores:

Sample showing payment history:

Also Check: Getting Started With Data Governance

How Do I Improve My Credit

Look at your free credit report. The report will tell you how to improve your credit history. Only you can improve your credit. No one else can fix information in your credit report that is not good, but is correct.

It takes time to improve your credit history. Here are some ways to help rebuild your credit.

- Pay your bills by the date they are due. This is the most important thing you can do.

- Lower the amount you owe, especially on your credit cards. Owing a lot of money hurts your credit history.

- Do not get new credit cards if you do not need them. A lot of new credit hurts your credit history.

- Do not close older credit cards. Having credit for a longer time helps your rating.

After six to nine months of this, check your credit report again. You can use one of your free reports from Annual Credit Report.

How Does A Credit Scoring System Work

- Have you paid your bills on time? If your credit report shows that youve paid bills late, had an account put in collections, or declared bankruptcy, thats likely to affect your score negatively.

- Are you maxed out? Many scoring systems look at the amount of outstanding debt you have compared to your credit limits. If the amount you owe is close to your credit limit, its likely to hurt your score.

- How long have you had credit? Generally, scoring systems consider your credit track record. A short credit history may hurt your score, but paying bills on time and having low balances can offset that.

- Have you applied for new credit lately? Many scoring systems look at inquiries on your credit report to see whether youve applied for credit recently. If youve applied for too many new accounts recently, it could hurt your score. Not every inquiry is counted: for example, inquiries by creditors who are monitoring your account or making prescreened credit offers arent counted against you.

- How many credit accounts do you have, and what kinds of accounts are they? Although its generally considered a plus to have established credit accounts, too many credit card accounts may hurt your score. Also, many scoring systems consider the type of credit accounts you have. For example, under some scoring systems loans to consolidate your debt but not loans for buying a house or car may hurt your credit score.

You May Like: Government Grants To Pay Off Debt

How Do I Fix Inaccuracies On My Credit Report

If you see something on your report that you believe is inaccurate, it may be a good idea to contact the business that reported the account, as they are the ones who can provide you more details. Your other option is to start a dispute with the credit reporting agency that issued the credit report. To start a dispute with TransUnion, visit and well start an investigation.

What If Im Denied Credit Or Insurance Or Dont Get The Terms I Want

Under federal law, a creditors scoring system may not use certain characteristics for example, race, sex, marital status, national origin, or religion as factors when figuring out whether to give you credit. The law lets creditors use age, but any credit scoring system that includes age must give equal treatment to applicants who are older.

You have the right to:

Know whether your application was accepted or rejected within 30 days of filing a complete application.

Know why the creditor rejected your application. The creditor must

- tell you the specific reason for the rejection or

- that you are entitled to learn the reason if you ask within 60 days.

Learn the specific reason the lender offered you less favorable terms than you applied for, but only if you reject these terms. For example, if the lender offers you a smaller loan or a higher interest rate, and you dont accept the offer, you have the right to know why those terms were offered. Read to learn more.

If a business denies your application for credit or insurance because of information in your credit report, federal law says the business has to

- give you a notice that includes, among other things, the name, address, and phone number of the credit bureau that supplied the information.

- include your credit score in the notice if your credit score was a factor in the decision to deny you credit or to offer you terms less favorable than most other customers get.

If you get one of these notices:

Don’t Miss: Free Government Phones Milwaukee Wi

Where Do I Get My Free Credit Report

You can get your free credit report from Annual Credit Report. That is the only free place to get your report. You can get it online: AnnualCreditReport.com, or by phone: 1-877-322-8228.

You get one free report from each credit reporting company every year. That means you get three reports each year.

Downsides Of Late Payment

A late payment not only lowers your credit score, but also costs you in the form of late fees and higher interest rates. For instance, you could be charged a late fee even if you pay your credit card bill just one day late. Your lender will certainly raise your interest rate if you fall into the habit of regularly missing your credit card payments, which would mean you would have to pay more money to carry a balance.

Donât Miss: Dental Implant Grants

Recommended Reading: St Louis County Government Job Openings

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days

- online at AnnualCreditReport.com youll get access immediately

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request

It may take longer to get your report if the credit bureau needs more information to verify your identity.

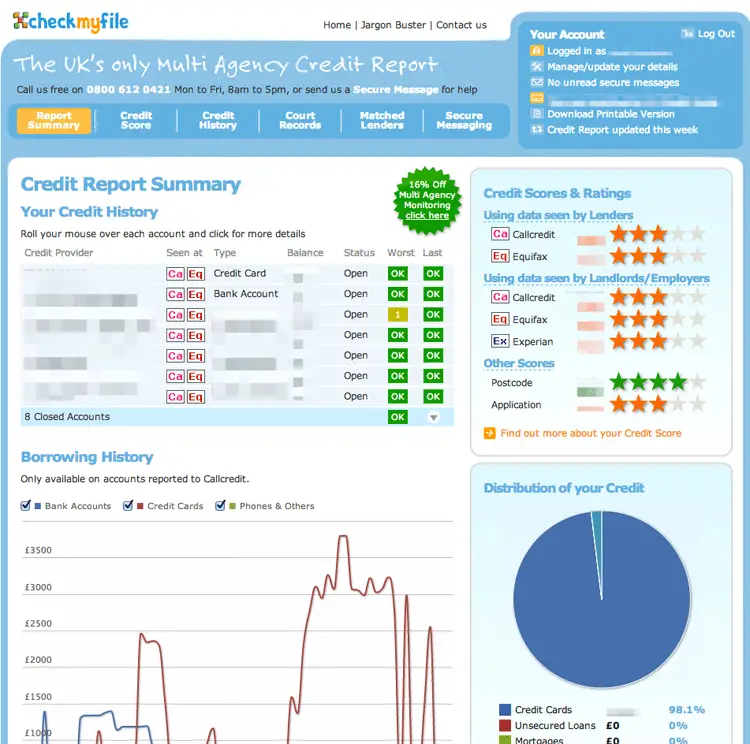

How To Get Your Experian Credit Score For Free

The largest credit reference agency offers new customers a free 30-day trial of its , which gives you access to your credit report, score, and email alerts about any changes on your file.

After the trial ends, it will cost you £14.99 a month.

You can access your Experian credit score through a free Experian account. This is designed to help people shop around to see how they can save money by comparing credit deals based on their financial profile.

Once youâve signed up, your score will remain free to access, but unlike the paid-for CreditExpert service, you wonât be able to see your credit report.

To be able to access both your Experian credit report and score for free, you can sign up to the Money Saving Expert Credit Club.

You can also see how likely you are to be accepted for the market-leading cards and loans and work out how much you can afford to borrow.

Unlike CreditExpert, you wonât receive alerts about any changes to your report.

Don’t Miss: How To Report Corruption In Local Government

How To Review Your Credit Reports

To check your reports for errors or possible signs of identity theft, look especially at three areas.

You can view sample credit reports, with the different sections explained, on the Web sites of the three credit bureaus: experian.com, transunion.com, equifax.com/home/en_us.

How To Order Your Free Credit Reports

One of the best ways to protect yourself from identity theft is to monitor your credit history. Now you can do that for free. Thanks to a new federal law, consumers can get one free credit report a year from each of the three national credit bureaus. Those bureaus are Equifax, Experian, and TransUnion.1 You can also get your reports for free from “specialty” credit bureaus. These companies prepare reports on your employment, insurance claims, rental and other histories.

Checking your credit reports at least once a year is a good way to discover identity theft. And the sooner identity theft is discovered, the easier it is to clear up. You can also identify errors in your credit reports that could be raising your cost of credit

Read Also: Governance Risk And Compliance Grc Software

File A Complaint About A Debt Collector

Report any problems you have with a debt collection company to your State Attorney General’s Office, the Federal Trade Commission , and the Consumer Financial Protection Bureau . Many states have their own debt collection laws that are different from the federal Fair Debt Collection Practices Act. Your state Attorney Generals office can help you find out your rights under your states law.

Get Your Credit Score And Report For Free

If you’ve ever applied for credit or a loan, there will be a credit report about you.

You have a right to get a copy of your credit report for free every 3 months. It’s worth getting a copy at least once a year.

Your credit report also includes a credit rating. This is the ‘band’ your credit score sits in .

Recommended Reading: Government Center Garage Monthly Parking

You Have More Than One Credit Report

When you order your free TransUnion credit report, youll also have the option to order your free Equifax and Experian credit reports. The information in these reports can differ, so its good practice to review all three. For example, some lenders choose to report account data to only one or two credit reporting agencies, not all three. Or, when you apply for a loan, a lender may only pull your credit report from one credit reporting agency, which would result in a hard inquiry on your credit report from that agency only.

You May Like: Government Jobs Vegas

Child Tax Credit Form For Taxes: Keep This Irs Letter To Make Sure You Get Your Money

The enhanced child tax credit isnât over yet. Learn what Letter 6419 is and why you need it.

The IRS started sending copies of Letter 6419 in December and will continue to mail them through January.

Tax season is now here, which means the rest of your child tax credit money will be on the way soon. Parents who didnât opt out of advance payments received half of their money in 2021. Those families and those who unenrolled from advance payments can expect to receive their remaining expanded child tax credit money with their refund after filing their 2021 taxes.

To ensure you get that money, youâll need to be on the lookout for a specific letter from the IRS with important information about your child tax credit. The IRS started mailing copies of Letter 6419 in late December and will continue to send more letters throughout January. The agency is urging you to hold on to the notice, as youâll need it when you file your 2021 taxes.

Weâll tell you what the letter contains and why you shouldnât throw it away. For more information, hereâs everything to know about the upcoming child tax credit payment. Also, hereâs what to do if youâre having issues with a missing payment.

Don’t Miss: What Is The Government Student Loan Forgiveness Program

What Do I Do With My Credit Report

Read it carefully. Make sure the information is correct:

- Personal information are the name and address correct?

- Accounts do you recognize them?

- Is the information correct?

The report will tell you how to improve your credit history. Only you can improve your credit history. It will take time. But if any of the information in your report is wrong, you can ask to have it fixed.

What Is A Credit Score

A credit score is a number. It is based on your credit history. But it does not come with your free credit report unless you pay for it.

A high credit score means you have good credit. A low credit score means you have bad credit. Different companies have different scores. Low scores are around 300. High scores are around 700-850.

Don’t Miss: I Want Free Money From The Government

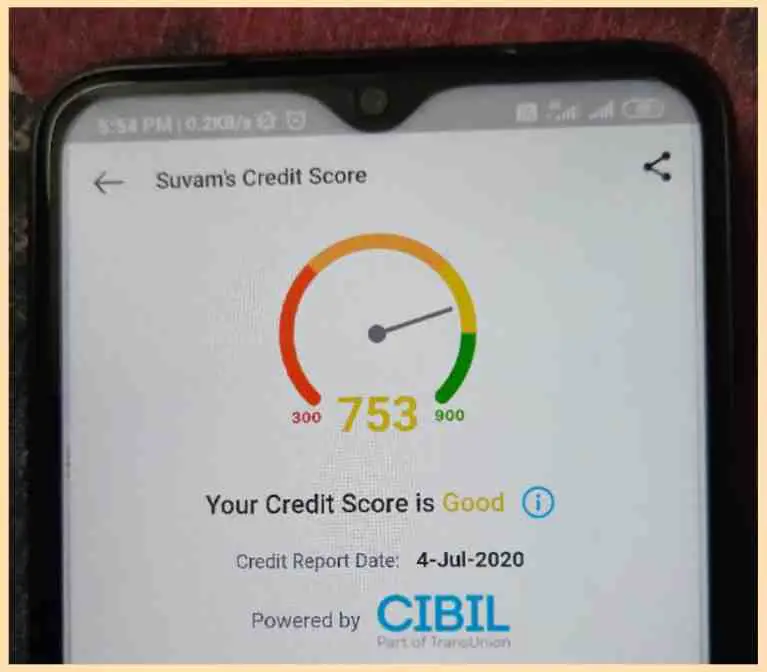

Check Your Free Cibil Score

Already registered? > > to get your updated credit score

What is CIBIL Score?

CIBIL score or credit score is like your financial report card. In other words, its simply the numerical representation of your repayment history.

Things you need to know about CIBIL score:

- The CIBIL score comes in the range of 300 to 900 in India â anything above 700 is considered good for the approval of loans or credit cards.

- A higher CIBIL score suggests good credit history and responsible repayment behaviour.

Why checking your latest CIBIL score is must?

This powerful number can help you with

- Higher chances of getting a loan or credit card approved

- Better offer on loan & credit card

- Taking charge of your finances

HDFC Bank is the official partner for CIBIL â Check Credit Score for Free

To get Free CIBIL score online within 2 minutes just provide some basic details:

Enter ID details

Successfully Answer Security Questions

For each report request, youll be asked a few questions about your finances that presumably only you can answer for instance, the approximate amount of your mortgage payment or who holds your auto loan and when you took it out.

Some consumers have reported difficulty using the site, particularly answering security questions about accounts that are several years old. If you cant recall those details, you can request your reports by mail or phone this process doesnt require security questions.

Recommended Reading: Aluguel De Carros Governador Valadares

Recommended Reading: Government Grants For Disabled People

What Should I Do When I Get My Credit Report

Your credit report has a lot of information. Check to see if the information is correct. Is it your name and address? Do you recognize the accounts listed?

If there is wrong information in your report, try to fix it. You can write to the credit reporting company. Ask them to change the information that is wrong. You might need to send proof that the information is wrong for example, a copy of a bill that shows the correct information. The credit reporting company must check it out and write back to you.

Check Your Reports Carefully For Errors

Look on your credit reports for any debts or credit cards you dont recognize. Also check for disputed items that still show up even though they were resolved in your favor. A late or missed payment isnt an error if it actually happened.

- Use our to review each report.

- If you find any errors on your reports, file a dispute to get them corrected as soon as possible. Learn how.

Also Check: Government Jobs In Davenport Fl