What Are My Obligations With Respect To My Claim

While you are receiving benefits, you must be under the regular care of a licensed physician and following a course of treatment, which, in the opinion of the Insurer, is appropriate. You must also make every reasonable effort to comply with recommended treatment modalities which may facilitate your return to your employment during the first 24 months of disability or to obtain employment in a commensurate occupation at the end of the 24 months of disability.

Recommended Reading: Enhanced Relief Mortgage Program For The Middle Class

The Federal Employees Retirement System

Disability coverage for federal employees is part of the Federal Employees Retirement System . In fact, the coverage is referred to as âdisability retirement.â FERS is administrated by the U.S. Office of Personnel Management , which serves as the chief human resources agency and personnel policy manager for the federal government.

Congress created FERS in 1986, and it became effective on January 1, 1987. Federal civilian employees who have retirement coverage are covered by FERS. This includes having disability coverage.

Joyce: Its My Understanding That Federal Employees Dont Have Short

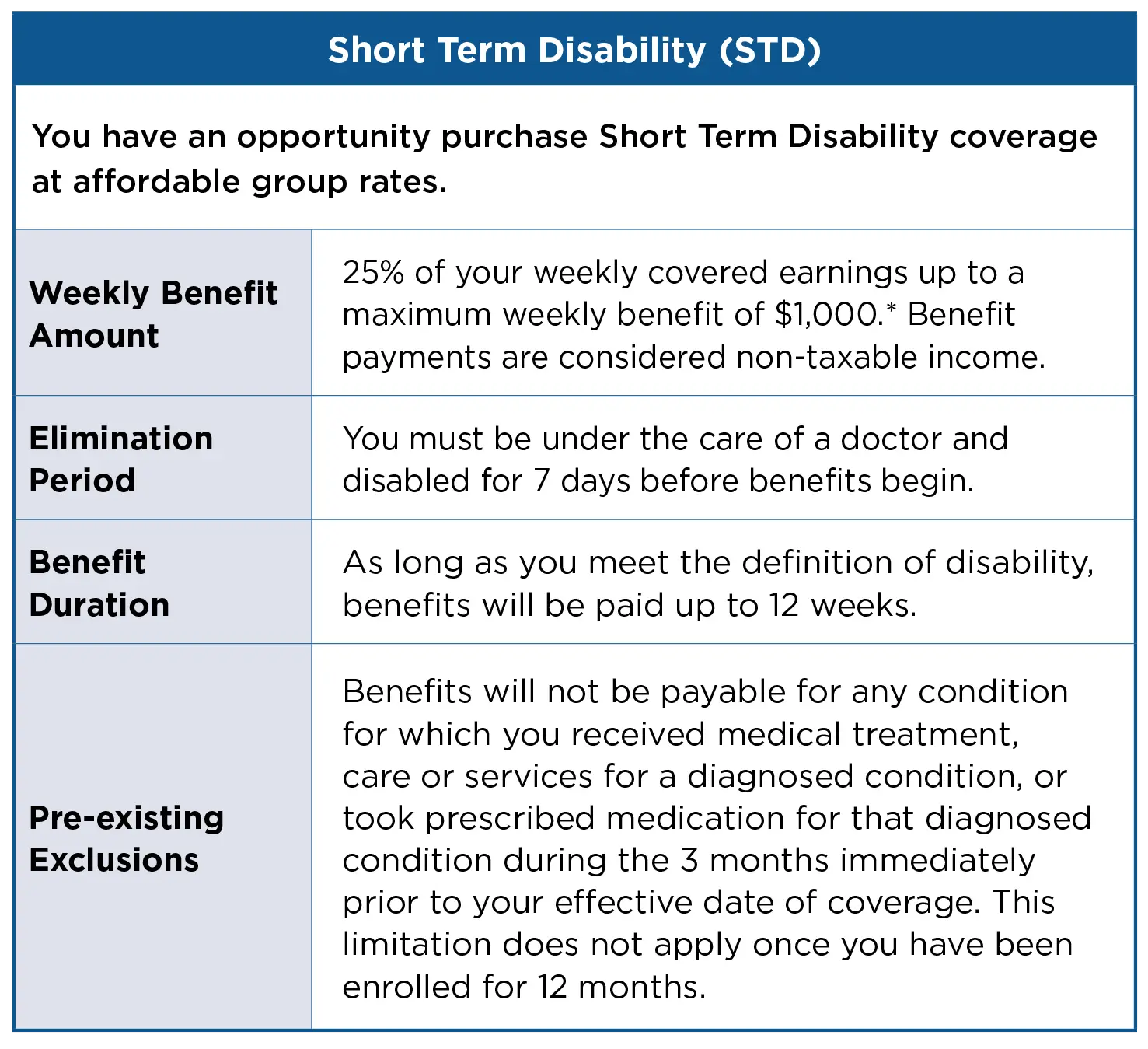

Greg: Correct. While the government will protect employees who have at least 18 months of employment from long-term disabling events through FERS Disability Retirement, there are no government-sponsored safeguards against short term disability, with the exception of sick leave, annual leave, and the leave bank.

Read Also: Mde How To Bomb The Us Government

Do I Need Disability Insurance

Would you be able to comfortably continue living as you do now if your paycheck vanished for weeks, months, or even years at a time?

Most Americans would collect serious debt during that time, perhaps too much to ever recover.

While most employers offer some sort of disability insurance, it may only cover you for a short period of time, or cover a small portion of your regular income.

We always advise to first learn about your current disability coverage, to make sure you feel comfortable with what it has to offer.

At Federal Employee Insurance Benefits, we focus entirely on providing coverage for federal employees.

We are familiar with federal occupations, and the benefits they may or may not include.

We are recommended by multiple unions, fighting for the rights and better futures of a combined total of more than 1,000,000 federal employees.

But Doesnt My Employer Offer This

Most employers offer some kind of disability insurance, but not all disability insurance is the same.

It may cover you for short-term sick leave, but leave you stranded if you become impaired for months, or even years.

It may cover you for longer, but only make up for a small portion of your regular income, forcing you to go back to work while you shouldnt or rely on your savings.

Also Check: Agenda Management Software For Government

Canada Pension Plan Disability Benefits

The Canada Pension Plan provides monthly payments to people who contribute to the plan during their working years.

You may be eligible for CPP disability benefits if:

- you contributed to the CPP for a certain number of years

- youre under 65 years old

- you have a severe and prolonged mental or physical disability

- your disability prevents you from working on a regular basis

The benefits include payments to children of a person with a disability.

Apply as early as possible if you think youre eligible for CPP disability benefits. Quebec residents may be eligible for a similar program called the Quebec Pension Plan . It may take several months to process your application.

If you applied for CPP or QPP disability benefits and were told that youre not eligible, you can ask to have your application reviewed or considered again.

Once you reach age 65, your CPP disability benefit will automatically change to regular CPP payments. Your regular CPP payments may be less than the CPP disability payments you got before.

If so, consider:

Heres What Gebas Comprehensive Disability Insurance Includes**:

Benefits are protected from inflation. Cost of Living Adjustments begins with your second year of collecting disability.Up to six annual adjustments will be made, with a maximum annual increase of 6%.

Partial Disability and Rehabilitation Benefits

Premiums will be waived after you begin receiving your benefit for a covered disability.

Coverage for a working spouse/domestic partner is also available

Exclusive member-only group rates with many convenient payment options

Survivor Income Benefits, when available, are paid to the insureds designated beneficiary

*Consult your tax advisor.

You May Like: How Much Does The Government Take Out Of Your Check

The Disability Application Process

Whether you apply online, by phone, or in person, the disability benefits application process follows these general steps:

- You gather the information and documents you need to apply. We recommend you print and review the . It will help you gather the information you need to complete the application.

- You complete and submit your application.

- We review your application to make sure you meet some for disability benefits.

- We check whether you worked enough years to qualify.

- We evaluate any current work activities.

- We process your application and forward your case to the Disability Determination Services office in your state.

- This State agency makes the disability determination decision.

To learn more about who decides if you are disabled, read our publication .

Once Youve Applied

Once we receive your application, well review it and contact you if we have questions. We might request additional documents from you before we can proceed

Look For Our Response

Youll receive a letter in the mail with our decision. If you included information about other family members when you applied, well let you know if they may be able to receive benefits on your record.

Check The Status

You can check the status of your application online using your personal mySocial Security account. If you are unable to check your status online, you can call us 1-800-772-1213 from 8:00 a.m. to 7:00 p.m., Monday through Friday.

Appeal A Decision

Also Check: Dell Government Employee Discount

How To Combine Private And Public Disability Insurance

Disability insurance companies dont want people to be overinsured. If you have coverage through your employer, the insurance company takes that into account when setting your coverage limits.

This can make getting private coverage more complicated for government employees. Federal employees are tricky because often they are unaware of the benefits theyll receive from public plans, says Jake Roszkowski, operations team lead at Policygenius. This is true for insurers, too.

With group coverage for private sector employees, an insurer simply subtracts the employer benefit from the maximum amount you can get under a supplemental policy. For federal employees, different insurance companies use different calculations to assume how much coverage youd get from FERS.

Common calculations include:

-

Assuming you already have coverage for 40% of your income

-

Assuming you already have coverage for 40% of your income, up to $10,000

-

Automatically assigning you 20% of your eligible benefit amount

If you dont know how much federal or private coverage youre eligible for, you can find yourself underinsured. Find out this amount by talking to a benefits administrator or insurance agent before purchasing a private supplemental disability policy.

You May Like: How To Get Government Money For Small Business

What Are My Responsibilities Related To The Rehabilitation Program

You are required to make every reasonable effort to facilitate recovery from your disability. This includes your full participation in an approved Rehabilitation Program and your acceptance of any reasonable offer of modified duties that your employer can put in place. You must also try to retrain for employment in a commensurate occupation where it is apparent that you will not be able to return to your regular occupation within the first 24 months that you receive disability benefits. The Insurer may withhold or discontinue your benefits if you do not comply with the above conditions.

How Do I Apply

Its easy. You can apply onlinein a few short minutes. In some cases, a medical exam and/or copies of medical records may be required. If so, the exam will be performed by a medical examiner appointed by our insurance underwriter, New York Life Insurance Company, at no charge to you. We also cover the cost of obtaining copies of your records. It may take up to eight weeks to complete the application process and receive your Certificate of Insurance.

You May Like: Government Dental Grants For Seniors

Enquiries About The Di Plan

Employees with questions about their coverage under the DI Plan should contact their compensation advisor.

Should you have any questions regarding this notice, please contact Treasury Board of Canada Secretariat, Pensions and Benefits Sector at .

Bayla Kolk Assistant Deputy Minister Pensions and Benefits Sector

Do Retroactive Salary Increases Affect The Calculation Of My Disability Insurance Benefit

In accordance with the Disability Insurance Contract, the retroactive salary increase provision applies only to claimants whose disability commenced on or after March 1, 1993.

Any retroactive salary increase approved after the commencement date of your Disability Insurance benefits will affect your insured salary and benefit level only when the effective date of the increase precedes the date your DI benefits began. Therefore, a retroactive salary increase approved in April, to take effect from February 10, would only be used to adjust benefits if your DI benefits commenced February 11 or later

Don’t Miss: How To Find Out If I Qualify For Government Assistance

Does Federal Employee Short Term Disability Insurance Cover Pre

Typically policies available to Federal Government Employees are guaranteed issue up to $2000 $3000 per month in benefits. Pre-existing conditions are typically not covered in the first 12 months of the policy. If you are looking for Short Term Disability Insurance to cover something you already know about and are going to be off of work in the first 12 months of coverage, you may be out of luck.

Employment Laws: Medical And Disability

When employees are injured or disabled or become ill on the job, they may be entitled to medical and/or disability-related leave under two federal laws: the Americans with Disabilities Act and the Family and Medical Leave Act . In addition, state workers’ Compensation laws have leave provisions that may apply. Depending on the situation, one or more of these laws can apply to the same employee. To help employers understand their responsibilities related to medical and disability-related leave, an overview of each is provided below, including information about where the laws intersect and overlap.

Workers’ Compensation laws apply to almost all employers. Workers’ compensation is a form of insurance that provides financial assistance, medical care and other benefits for employees who are injured or disabled on the job. Except for federal government employees and certain other groups of employees, workers’ Compensation laws are administered at the state level.

The Americans with Disabilities Act is a federal law that protects the rights of people with disabilities by eliminating barriers to their participation in many aspects of working and living in America. In particular, Title I of the ADA prohibits covered employers from discriminating against people with disabilities in the full range of employment-related activities, from recruitment to advancement to pay and benefits.

When Medical and Disability-Related Leave Laws Intersect

Also Check: Free Government Loans For Single Moms

Features Of Disability Income Programs :

- Benefits available on the 15th day. Covers both sickness and accidents. 1st day coverage if hospitalized for sickness.

- Benefits available from $600 to $3,000 per month.

- 24-hour coverage. Group rates. No medical exam needed to qualify.

- Pre-existing conditions covered after the first year.

- Pays 100% in addition to any other benefits or disability insurance you may have.

- Pays 50% in addition to workers compensation.

- Maternity covered the same as any other sickness.

- Many other outstanding benefits also available.

NO ELIGIBLE FEDERAL, POSTAL OR DC GOVERNMENT EMPLOYEE CAN BE TURNED DOWN.

You May Like: Free Phones For Disabled Persons

Joyce: It Seems Like Most Of The Feds We Speak With Are More Focused On Life Insurance Than On Disability Insurance Yet I Believe Its Much More Common For Someone To Become Disabled Than Pass Away Does That Match Your Experience

Greg: Joyce, this absolutely matches our experience. The idea of living with a disability is a scary thought, which causes many of our members to avoid the topic entirely. The fact remains though, that 12.6% of Americans live with some form of disability. A 2017 study by Group Market Share found that 1 in 4 Americans who are age 20 will suffer from a disabling event that is expected to last at least one year, before they reach their full social security retirement age. The fact that a 20 year old is more likely to become disabled than die begins to look more reasonable when we look at the reasons people become disabled Musculoskeletal disorders , Cancer , Mental Health . Despite all of this, many of our members continue to focus on their mortality and not their potential infirmity, which is why education about the risk of disability is so important.

Read Also: Government Grants For Sustainable Business

What Happens If A Federal Employee Becomes Disabled And Cant Work

by Joyce Warner

I recently sat down with Greg Klingler from the Government Employees Benefit Association and Cheri Cannon, from the law firm Tully Rinckey PLLC, to talk about the ins and outs of feds and disability insurance. This is a complicated topic and at FEEA we know many federal employees would like more information about it.

Does Short Term Disability Cover Maternity

Short Term Disability Insurance policies for Federal Employees typically will cover maternity or pregnancy, as long as you deliver after having the policy in place for 10 months. This means you can not be pregnant when you purchase a policy.

To find our more about Short Term Disability Insurance for Federal Employees, please .

Read Also: What Is The Government Mileage Reimbursement Rate

Leave Without Pay For Illness Or Injury

If you wish to request leave without pay for illness or injury, you must provide a medical certificate from your physician. With this certificate, and the indication of a likely return to work within a reasonable period of time, your manager will consider granting you leave without pay for illness or injury.

Once your leave without pay is approved, your manager will notify your departmental human resources. They will then notify the Pay Centre through a pay action request form. The Pay Centre will take the appropriate action to temporarily stop your salary.

Quick Tips About Federal Government Employee Short Term Disability

It is a permanent record that transfers with you to other Federal agencies or to the Federal Records Center when you leave Federal service. The participant will need to sign and return the form as soon as possible so there is no delay in processing the claims. We are not responsible for their content. Some congressional Democrats disagree.

Don’t Miss: Dell Federal Government Employee Discount Program

Benefits Of Private Disability Insurance For Federal Employees

Disability benefits through FERS are typically barebones and donât provide the tailored coverage that many people might need. A private disability insurance policy, on the other hand, can be customized with additional benefits such as:

-

Rehabilitation riders help pay for vocational training after a disability.

-

Partial or residual coverage gives partial benefits if your hours are cut back or you otherwise canât work to your full potential to receive the same income as you previously did.

-

Future purchase options allow you to increase your coverage in the future without going through the underwriting process again.

Even though federal employees are eligible for their own benefits and supplemental coverage might be less than you originally assumed, there are still benefits to getting a private policy that shouldnât be ignored.

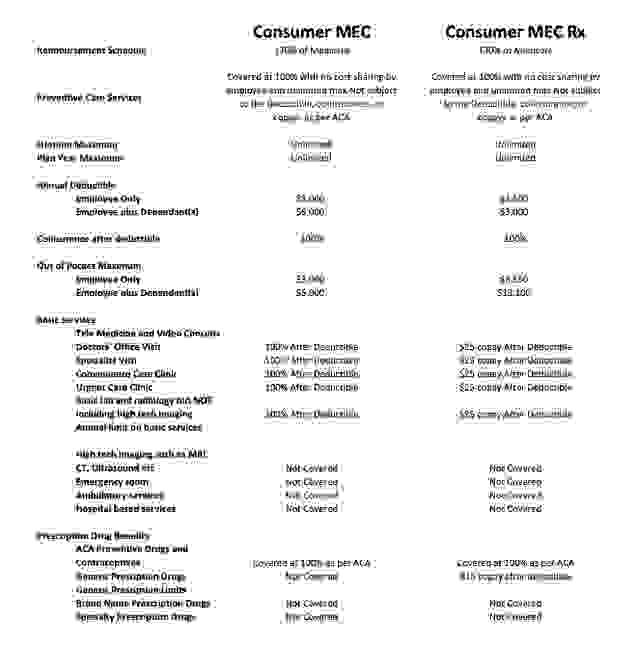

Health Coverage For People With Disabilities

If you have a disability, you have three options for health coverage through the government.

-

Medicaid provides free or low-cost medical benefits to people with disabilities. Learn about eligibility and how to apply.

-

Medicare provides medical health insurance to people under 65 with certain disabilities and any age with end-stage renal disease . Learn about eligibility, how to apply and coverage.

-

Affordable Care Act Marketplace offers options to people who have a disability, dont qualify for disability benefits, and need health coverage. Learn about the .

Don’t Miss: Us Federal Government System For Award Management

Frequently Asked Disability Insurance Questions

All active federal employees and federal contractors* working at least 20 hours per week are eligible, except for postal workers. Postal workers are eligible for Short Term Disability only.

*In order to be eligible for enrollment, federal contractors must receive compensation directly from their contracting agency.

Yes. After the chosen waiting period, benefits will be coordinated with leave and sick leave. Past that, benefits will be paid up to 6 weeks for a normal pregnancy and up to 8 weeks for a Cesarean Section pregnancy. Complications of pregnancy could continue benefits depending on the situation. You must have the coverage in-force BEFORE a pregnancy.

Our program is designed to fill in the gaps with your federal programs it does not replace any of your current benefits.

Short Term and Long Term Disability :

Bridges your income from the time that your leave stops or runs out until you are ready to return to work. All benefits coordinate with leave and sick leave to total no more than 60% of your gross income. This is usually pretty close to your take-home pay after taxes.

Supplements your income from disability retirement and increases your take home pay. In any case, you will not receive more than 60% of your gross income between Disability Retirement and policy benefits.

Please see the plans sample policy for more details.

Other Types Of Disability Insurance For Federal Employees

If youâre a federal employee, you can still buy your own individual disability insurance policy to supplement your federal benefits.

However, the private insurer will take in account the amount of your government disability benefits when determining how much coverage they will sell you. This is done to avoid a situation where you become overinsured and have an incentive to become disabled and miss work. Carriers also do this in cases where people are covered by a private group plan through their employers.

Because of how federal benefits are calculated, you will need to talk to the carrier or your agent to determine how the insurer is quantifying your existing government benefits. Insurance companies may calculate your existing coverage differently. Knowing a carrierâs calculation method before you buy can help you avoid having too little coverage from the private insurer.

Recommended Reading: How Much Can The Government Garnish Your Wages