Free Financial Assistance For Low Income Families From Government

Supplemental Security Income Program Adults with disabilities and older adults are eligible for Supplemental Security Income . SSI provides food, clothing, and shelter for the elderly, blind, and disabled. Approximately 8.4 million people receive $536 per month on average. Seventy-three percent of these are blind or disabled.

Good Neighbor Next Door

The Good Neighbor Next Door program offers unique benefits for nurses, first responders, and teachers. If youre eligible, you can buy HUD foreclosure homes at a 50% discount. Use an FHA mortgage, and you only need $100 for a down payment.

You can find the homes on the U.S. Department of Housing and Urban Development website, and you need a licensed real estate agent to put your offer in for you.

If your offer is accepted, and you qualify for financing, you get the home. The 50% discount makes homeownership a lot more affordable. The discount is actually a second mortgage. But it has no interest and requires no payments. Live in the home for three years, and the second mortgage is terminated.

How Long Does It Take To Get Down Payment Assistance

How long it takes depends on the program and the type of assistance. Each state offers its own programs, as do different cities and organizations. These programs move at different speeds depending on the demand and size of the program.

Its important to know that, if you apply for down payment assistance, it may take longer to close on your home. The assistance program must work with your lender to secure the loan and the down payment funds. This can add time to the closing process, depending on how quickly the down payment assistance program acts.

Read Also: Nc Local Government Credit Union

How Do I Get A First

Start by exploring the housing finance agency in your state. You’ll likely come across a number of programs designed especially for first-time buyers such as yourself. Many programs offer grants to help turn your homeownership dream into reality.

Be aware that not all first-time homebuyer grants are the same. Fund amounts depend on various factors, including location, credit score, income, and family size. An experienced lender can also point you in the right direction as far as grants are concerned.

Resources And Information On Home Buying For Low

Finding financing and assistance options that your family qualifies for is only half the battle. Buying a home is a multi-step process, and it can take several months to find the perfect home within your budget, secure financing, and navigate the closing process. The following resources and information will help you navigate the murky waters of purchasing a home with ease.

Don’t Miss: How To Measure Data Governance Success

The Affordable Connectivity Program Benefit Can Help Pay For At& t Internet Plans

The ACP is a federal government program that can help eligible customers pay for their home internet service. Through the ACP, eligible customers can reduce their AT& T Internet bill by up to $30 per month*, or up to $75 per month if they live on qualified Tribal Lands. *Terms, conditions & restrs apply.

Free Iphone Under Ebb Program Free Government Iphone

Government Programs for Low-Income Families To help low-income people and protect families from poverty, the federal government administers security programs, or welfare programs. Among the benefits offered through these welfare programs are subsidies under the Affordable Care Act. Check out these government programs for low-income families for more information on all the benefits available to them.

Read Also: How To Write A Statement Of Work Government

Ways To Get Free Government Iphone Through The Lifeline Program

If you are wondering how to apply for a free government iPhone from Lifeline, then the procedure is not that complex. We have listed some of the steps you need to follow to get a government iPhone from Lifeline.

- First of all you need to check the lifeline eligibility criteria using the National Verifier and then search for your provider.

- Every state has lifeline providers in various regions. You need to find such a provider who is providing iPhone models.

- Once you select your provider, you need to enquire on how to get a free government iPhone under this program.

Calhfa Home Buyer Requirements

Here is a list of home buyer eligibility requirements to help you understand whether or not you qualify for these loans.

- First-time home buyer: In most cases, to qualify for a loan you must be a first-time home buyer. If youve bought a home in the past, that does not necessarily mean you dont qualify. Youre considered a first-time home buyer if you havent owned a home in the three years prior to applying for a loan.

- You must have a minimum of 660 for a conventional low-income-rate loan, and a minimum credit score of 680 for a conventional standard-rate loan.

- Acceptable debt-to-income ratio: Your debt-to-income ratio, which compares the amount of money you owe to what you make, cannot exceed 45% for automated underwriting, or 43% for manual underwriting.

- Income cap: Your earnings cant exceed CalHFAs income limits, which are based on the specific area you are looking to buy in.

- Nationality: You must be a U.S. citizen, permanent resident, or qualified alien.

- Complete a home-buying course: You must complete a home-buying counseling course and present a certificate of completion. A course can be taken online, or in person through a HUD-approved housing counseling agency.

Note: Meeting these qualifications is no guarantee youll qualify for a loan, because each CalHFA-approved lender may have additional borrowing requirements.

Also Check: How To Start A Government Contracting Company

What Is A First

A first-time home buyer grant is a specific grant type designed to create new homeowners nationwide. Governments award grants on the local, state, and federal level and charitable and housing foundations nationwide.

Grants dont require repayment because the grant recipient performs a public good. For first-time home buyers, that public good is homeownership.

Homeownership is the keystone of the U.S. economy because homeowners:

- Stabilize neighborhoods of all shapes

- Increase prosperity within all communities

- Build generational wealth within families

According to government research, $10,000 grants to first-time home buyers can increase homeownership by 34 percent, so its no surprise that Congress recently introduced eight bills promoting grants and tax credits for first-time home buyers, including the LIFT Act.

When homeownership rates rise, its a greater economic good.

Cant Wait For Laws To Pass

You dont have to wait for Congress. You can purchase a home with little- or no-money down through local first-time home buyer programs and grants.

You can also apply for 97% and 100% mortgage loans and skip to the end by getting pre-approved.

Get pre-approved for a mortgage today.

Dan Green

Dan Green is a former mortgage loan officer and an industry expert. He’s appeared on NPR and CNBC, and in The Wall Street Journal, Bloomberg, and dozens of local newspapers. Dan has helped millions of first-time home buyers get educated on mortgages, real estate, and personal finance. Have mortgage questions? Ask Dan in the chat.

Recommended Reading: Michigan Schools And Government Credit Union Cd Rates

Can The Government Help Me Buy A House

For many first-time home buyers, there are some real hurdles along the way. Whether its saving for a down payment and closing costs, qualifying for a mortgage loan, or simply navigating the home buying process.

Luckily, there are government programs both at the federal and state level that can help.

For many, the biggest hurdle when trying to purchase their first home is coming up with the upfront costs of a down payment. While the amount needed to put down varies depending on the type of loan, it can still be a roadblock on the journey to homeownership, says Mandie Anderson, branch manager with South Carolina-based Silverton Mortgage.

Government-backed loans are a great option for anyone who can afford a monthly payment, but wants to put less money down or has a lower credit score.

The good news is that there are numerous government loan programs and down payment assistance options designed especially for those who need a little extra help with financing. These programs can be a solution in particular for those who can afford a monthly mortgage payment but may not have a large sum of money on hand for the down payment, Anderson explains.

Government-backed loans are a great option for anyone who wants to put less money down or has a lower credit score, explains Jeff Gravelle, chief production officer at Newrez, a national mortgage lending and servicing organization.

Where Can I Get A Free Iphone 12

You can simply visit the Verizon website and search for iPhone 12. You will find a link where you are able to choose the memory and color of the iPhone. Once you are done, you need to choose any unlimited plan and with the plan they will provide you a free iPhone 12. After that you need to enter your ZIP code and confirm your location.

Read Also: Petitions Uk Government And Parliament

Transforming Student Debt To Home Equity Act Of 2022

- Status: Introduced to the House

- Originally Introduced: April 1, 2022

- Latest Action Taken: April 1, 2022 Referred to the Committee on Financial Services

The Transforming Student Debt To Home Equity Act gives concessions to first-time buyers with monthly student loan payments to help them stop renting and start buying. The bill lowers mortgage rates for buyers, provides discounts on government-owned homes, and makes down payment assistance available.

The programs minimum eligibility standards are

- Must be a first-time home buyer

- Must be approved for a mortgage

- Must agree to own and live in the new home for 3 years

- Must have federal student loans not in default

- Must agree to take a homeownership class

Government Of Canada Programs To Support Homebuyers In 2022

In a high-interest market, prospective buyers can use all the help they can get. Luckily, the Government of Canada offers a number of assistance programs that can make the financial pain of that big purchase a little easier to handle.

This article has been updated from a previous version.

Its no secret that Canadas housing market is feeling the effects of high inflation and interest, rebounding from low borrowing rates during the COVID-19 pandemic.

According to the Canadian Real Estate Association, by September of this year, the average home price had fallen to $640,479, a 6.6% drop from the year prior. National home sales also fell 3.9% between August and September, as many Canadians are on the fence about purchasing a home only to face high and rising interest on their mortgage.

In a high interest rate environment, prospective buyers can use all the help they can get. Luckily, the Government of Canada offers a number of homebuyer assistance programs that can make the financial pain of that big purchase a little easier to handle. Find out if youre eligible for any of the following home ownership incentive programs in Canada.

Don’t Miss: Class Action Lawsuit Against Federal Government

Types Of Home Equity Loans

There are two types of home equity loans:

- Lump sum – This is a one-time, closed-end loan that usually has a fixed interest rate.

- Revolving line of credit – You can withdraw the funds at any time for more flexibility. These usually have adjustable interest rates.

For more information, refer to What You Should Know About Home Equity Lines of Credit, a guide by the Federal Reserve Board.

Who Is Eligible For Government Grants For Low Income Families

Every Grant and Program has some eligibility criteria that everyone has to pass, if you pass these criteria you can apply for any of the assistance given above.

Don’t Miss: Government Loans For Graduate School

Native American Direct Loan

Starting in 1992, the Native American Direct Loan program has made home loans available to Native American veterans who want to buy property on federal trust lands. The U.S. Department of Veterans Affairs serves as the lender, and borrowers enjoy not having to make a down payment or pay private mortgage insurance.

-

A Good Fit For: Eligible Native American veterans who would like to buy property on a federal trust land.

-

Whos Eligible: Native American Veterans and their spouses, as well as non-Native Veterans who are married to a Native non-Veteran. The tribal organization to which they belong must have signed a Memorandum of Understanding with the Secretary of Veterans Affairs. Applicants must also apply for a Certificate of Eligibility.

Good Neighbor Next Door Hud Loan

Public service workers who qualify for the Good Neighbor Next Door program have the opportunity to purchase homes at half the list price. The Department of Housing and Urban Development implemented this program to revitalize areas, make communities safer, and promote homeownership. Eligible properties are sold exclusively through the Good Neighbor Next Door sales program.

-

A Good Fit For: Public service workers who would benefit from receiving significant financial assistance when buying their first home.

-

Whos Eligible: Law enforcement officers, pre-kindergarten through 12th grade teachers, firefighters and emergency medical technicians . Homebuyers must commit to living in the property for at least 36 months as their sole residence.

Don’t Miss: How To Get Government Assistance For Food

What Financial Help Is Available For Home Repairs

Home improvement loan programs help with home repairs and modifications. They are the most common type of government financial assistance for home improvements. Some programs are available nationwide, while others are only available at the state or county level.

Find Loans and Other Incentives

- Learn about the HUD Title 1 Property Improvement Loan program. Loan amount and repayment terms are limited based on the type of property.

- Find out about the 203 Rehabilitation Mortgage Insurance Program. It lets homebuyers and homeowners borrow an extra $35,000 through their mortgage for home repairs and improvements.

- For programs in your community, contact:

Public Employee Homeownership Grant Program

- This program offers a grant of a secured loan to full or part-time employees of the Loudoun County Government, Courts and Constitutional Officers, and Loudoun County Public Schools.

- Loans are forgivable at 20% of the loan amount annually over a five-year period providing the employee does not leave employment, sell the home, or no longer occupies the residence.

- The grant amount is $10,000 for the purchase of a home located within Loudoun County.

- Funding is limited and available on a first-come, first-served basis. Gross annual household incomes must fall within 30% to 70% of the Area Median Income. The current eligible income range is $42,700 to $99,650 regardless of family size.

Don’t Miss: Parking Garages Near Government Center Boston

Closing Cost Assistance Programs For Home Buyers

Closing cost assistance programs are home buyer stimulus plans that pay up to 100% of a buyers purchase closing costs, including title expenses, transfer taxes, and mortgage fees.

Typically, home buyers apply for closing cost assistance through their local housing agency, separate from their lender. You can look up your states housing agency on the National Council of State Housing Agencies website. The buyer and the home must meet the agencys minimum quality standards.

Closing cost assistance programs target lower-income home buyers with average credit scores, at least.

The first step towards getting closing cost assistance is getting pre-approved.

Types Of Homeownership Programs

According to The Mortgage Reports, over 2,000 homeownership assistance programs are available nationwide. These programs can be categorized into a few different types of assistance for aspiring homeowners. It can be helpful to understand these distinctions so you know where to start your search for a loan. First, the most common type of assistance is grants for homeownership. These can come from various sources, but all act as gifts that are not repaid. Down payment grants are typically regulated on a local and state level.

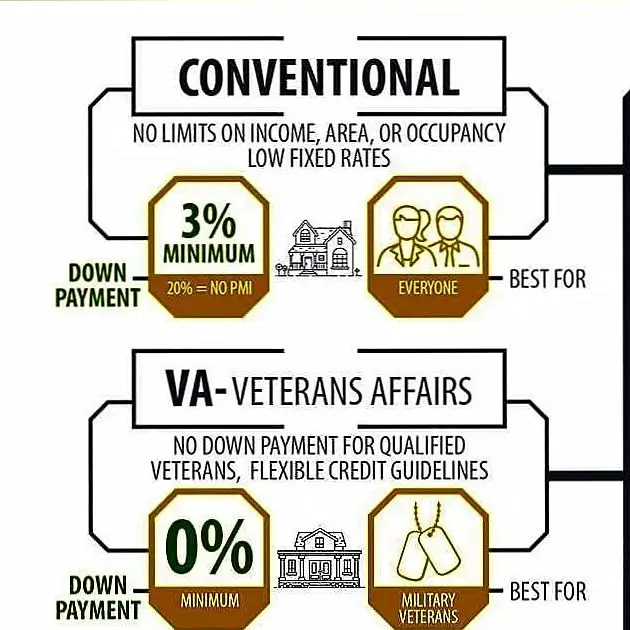

The other main type of homeownership help available to first-time buyers is loans but not those from traditional financial institutions. Numerous loan programs offer benefits such as varied approval requirements, deferred payments, or even loan forgiveness over time. Each of these loan types aims to make homeownership more attainable for a variety of Americans. One well-known example is the VA loan, which provides Veterans the opportunity to purchase a home without a down payment.

It should be said that the specific requirements associated with each program type will vary from loan to loan. Avoid ruling anything out until you are sure of the options available to you. Even if you do not meet the requirements of a grant in your area, for example, you may still be eligible for federal assistance when purchasing your first home.

Recommended Reading: Government Grant Programs For Individuals

Are Government Grants For Low Income Families Are Scam

Not All The Government Grants for low income families are scam, but yes there are various other organizations that are misusing government name for fraud and scams, these organization ask money and never help anyone, if you want to apply for any of the grants it is recommended to cross check government resources such as Grants.gov and https://benefits.org/ to find the right grant information.

Explore Your Home Buying Options

If youre getting serious about buying a home, its worth connecting with a mortgage lender. Your loan officer can help you explore your options, look into assistance programs, and gauge your eligibility.

Not only will this give you some direction, but getting pre-approved is also often required to make an offer on a home.

So, when youre ready, your first step should be to reach out and talk to a mortgage lender about your options.

You May Like: Work From Home Government Jobs