Student Loan Forgiveness Programs

1. Income-driven repayment forgiveness. The federal government offers four main income-driven repayment plans, which allow you to cap your loan payments at a percentage of your monthly income. When enrolled in one of these plans, your remaining loan balance will be eligible for forgiveness after 20 or 25 years, depending on the plan. These plans are most beneficial for those with large loan balances relative to their income. Only 32 borrowers have received loan forgiveness through income-driven repayment forgiveness, according to the National Consumer Law Center. This forgiveness was made tax free retroactive to Dec. 2020 through the end of 2025, as part of the March 2021 American Rescue Plan. However, most borrowers will not qualify for forgiveness through income-driven repayment until the early 2030s.

» MORE:Student loan payment plan promises forgiveness, but rarely delivers

2. Public Service Loan Forgiveness.Public Service Loan Forgiveness is available to government and qualifying nonprofit employees with federal student loans. Eligible borrowers can have their remaining loan balance forgiven tax-free after making 120 qualifying loan payments. Until Oct. 31, 2022, the Education Department has expanded which payments on federal student loans count toward PSLF through a limited waiver now, payments on FFEL and Perkins loans, late payments and payments made on any repayment plan will retroactively count as qualifying payments.

National Institute Of Mental Health

The National Institute of Mental Health Loan Repayment Program is aimed at health professionals who want to pursue research-based careers, like biomedical, behavioral, social, and clinical research projects.

This grant program will repay up to $50,000 of student loan debt per year in exchange for two years of qualified research funded by a U.S.-based nonprofit organization. It also reimburses federal and state taxes resulting from the repayment award.

Another bonus? These loan benefits are on top of the salary candidates receive for their research.

File A Consumer Proposal Or A Commercial Proposal

If you are self-employed and owe less than $250,000, you may qualify for a consumer proposal. Consumer proposals are legally binding debt settlement agreements that can help you come to an agreement with your creditors and pay only a fraction of what you owe. Consumer proposals can eliminate most kinds of debt, including credit card or tax debts.

Even though you could say that a consumer proposal is similar to setting your debts, the main difference is that filing a consumer proposal is a formal process thats legally binding. This means that both you and your creditors have to agree on certain terms and respect them.

Consumer proposals are debt-relief solutions that can be helpful for those who have debts that are significantly higher than what they can afford but want to avoid bankruptcy.

Don’t Miss: Government Giving Money To College Students

Armed Forces Loan Payment Programs

Many branches of the United State military offer loan payment programs that will pay off your student loans:

Each program is a little different, but will potentially pay off tens of thousands of dollars in student loans for you. As with other types of service-based loan repayment programs, these are specifically for federal student loans and not private loans.

How Do I Pay Off My Student Loan Debt Fast

Home \ Debt \ How Do I Pay Off My Student Loan Debt Fast?

Join millions of Canadians who have already trusted Loans Canada

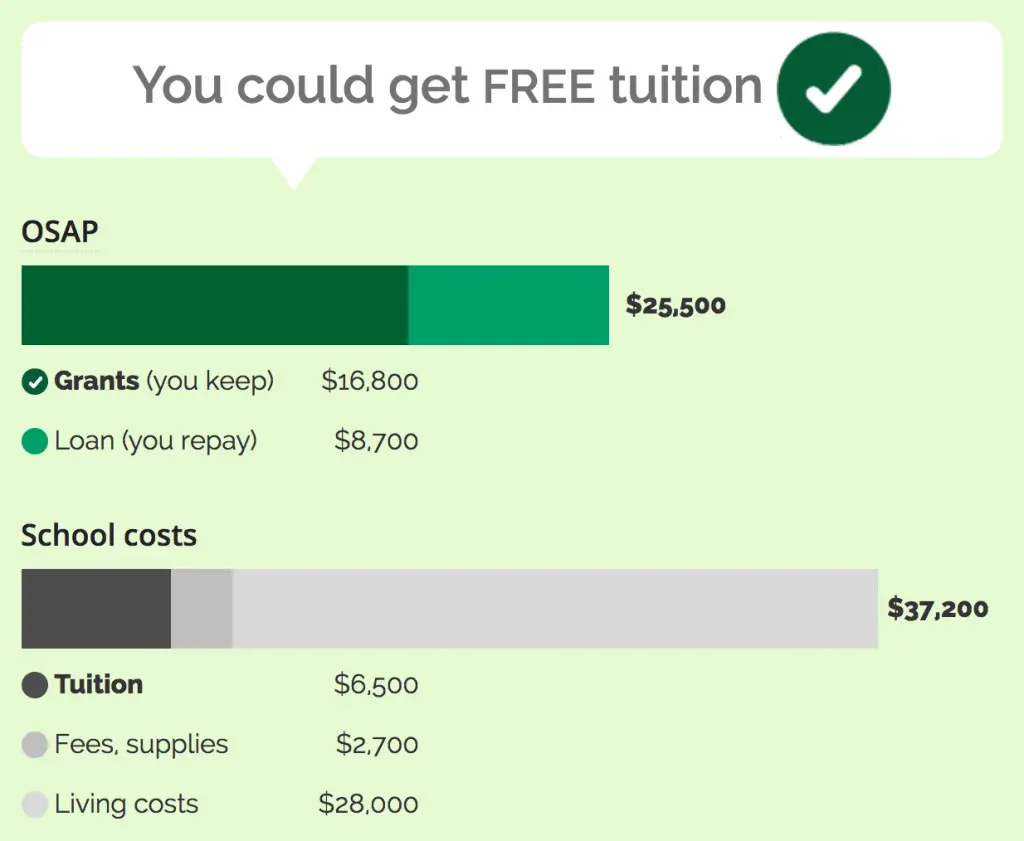

While there are many ways to get a well-paying job, the vast majority require some form of higher education and education costs money. The cost of living continues to rise, and many opt for post-secondary education to improve their chances of economic success. There are available measures to reduce your expenses, such as using savings and applying for scholarships and grants. However, many Canadians still require student loans to afford tuition. Student loans are accessible, and often the only way some individuals can access higher education.

Since the average individual with a degree makes roughly 1.7 times more than those without one, it truly is an investment in your future. Of course, that increased salary doesnt show up overnight. In the meantime, you must address your student loans, lest you damage your credit. The good news is that you can pay them down surprisingly quickly if you are diligent and savvy.

Recommended Reading: Las Vegas Government Jobs

Also Check: Federal Government Software Engineer Jobs

Student Loan Repayment Assistance For Teachers

If youre looking for student loan forgiveness for teachers, you have a couple of options, in addition to state programs.

- Teacher Loan Forgiveness: You could receive up to $17,500 toward student loan repayment when you teach certain subjects or in specific areas.

- Perkins Loan Cancellation for Teachers: For each year you teach in certain areas, you could have the ability to have a portion of your Perkins Loan canceled, up to 100%.

Cancelling A Student Loan

Sometimes plans change. You may be able to cancel student loans that you no longer need or want.

Private Loans: You can cancel a private student loan up until midnight on the third business days after you receive the final notice of acceptance. Your lender or school cannot disburse your loan funds until after this three-day cancellation period expires.

Federal Loans: You can cancel your federal loans if you inform your school that you no longer want the loans by the later of:

- The first day of the loan payment period .

- If you did give your school affirmative written confirmation of the types and amounts of federal student loans that you wanted for the loan year before your school credited your loan funds, then you can cancel within 14 days after your school notifies you that you have a right to cancel your loans.

- If you did not give your school affirmative written confirmation of the types and amounts of federal student loans that you wanted for the loan year before your school credited your loan funds, then you can cancel within 30 days after your school notifies you that you have a right to cancel your loans.

Tip: You might be able to cancel your federal loan after this time period, but that right is not guaranteed.

Read Also: How Long Does A Government Background Check Take

Student Loan Repayment Assistance Programs For Other Careers

Most state LRAPs award loan assistance to professionals in exchange for two years of service. The most common occupations are doctors, nurses, teachers and lawyers, but some other career paths qualify, too.

Several LRAPs for doctors, for instance, help out pharmacists and veterinarians. Other programs, like the Alfond Leaders Program in Maine, award people in STEM careers.

Even if youre not a doctor, nurse, teacher and lawyer, check your states offerings to find out if it has a loan repayment assistance program for you.

Federal Loan Payment Plans

You have the following general options once you default on your federal student loans:

- PAY IN FULL: If you can afford to repay your defaulted loan in full, you have the option of doing so. The loan debt will be fully wiped out, but your credit report will still reflect that you paid off a defaulted loan. Paying the loan in full will also restore your eligibility for federal aid.

- REHABILITATE: You can rehabilitate your loan by making a series of timely payments that you can afford. By doing so, your loan will be returned to its pre-default status. Loans rehabilitated after August 14, 2008 can be rehabilitated only once – if you default on a loan that you have already rehabilitated, you cannot rehabilitate that loan again. Some considerations when looking at rehabilitation are:

- Affordable Payments: There is no minimum payment required for rehabilitation. Payments are affordable and based on your total financial circumstances.

- Restored Loan Benefits: If you rehabilitate your loan, you can again become eligible for loan benefits that you had prior to default, including deferment, forbearance, loan forgiveness, and federal aid eligibility.

- Increased Cost: After you rehabilitate your loan, collection costs may be added to your loan and your monthly payment may increase.

- If you rehabilitate your loan, the default will be removed from your credit report, but late payments reported prior to your default might remain on your credit report.

Also Check: Us Government Cell Phone Program

Canadian Emergency Business Account Program

The Canadian Emergency Business Account is a $55 billion program that provides interest-free loans to small businesses and not-for-profits. CEBA provides loans of up to $60,000 to active businesses that are sole proprietorships, partnerships, or Canadian-controlled private corporations with active CRA business numbers that have an effective date of registration prior to March 1, 2020.

CEBA applications end March 31, 2021. You can apply for a CEBA business loan directly from your primary financial institution. There are more than 220 participating financial institutions across the country. Repaying the loan before December 31, 2022 results in loan forgiveness of 33 percent.

Your business may be eligible for the CEBA program if you paid $20,000 $1,500,000 in employment income in the 2019 calendar year or if you had $40,000 $1,500,000 eligible non-deferrable expenses such as rent, utilities, property taxes, and insurance and filed an income tax return with the CRA for 2019 or 2018.

The Canadian government will assess each application based on the information and supporting documentation submitted by your financial institution and will provide funding for your CEBA loan through the same institution.

Obtaining A Federal Direct Consolidation Loan

To obtain a federal direct consolidation loan, contact the US Department of Education.

If you have not yet consolidated, you can seek a federal direct consolidation loan in order to obtain an income contingent repayment plan. Federal direct consolidation loans are available if you havent been able to obtain a FFEL consolidation loan, income sensitive repayment terms acceptable to you or if you have defaulted on your FFEL loans.

You can request income-contingent repayment or income-based repayment. The consolidation loan application does not currently include a checkbox for requesting these repayment plans, so you must ask for it separately.

Also Check: Small Government Grants For Small Business

Cfpb College Cost Comparison Calculator

Once you have been accepted by colleges and receive financial aid offers, you can compare the cost of attending different schools with the financial aid and college cost comparison tool provided by the Consumer Financial Protection Bureau . The tool lets you compare the costs of different colleges, including the student loan debt that youll owe when you graduate, and estimates the percentage of your post-graduate monthly salary that will go toward paying off your loans.

Consolidating Loans After The Start Of An Lrp Award

If an applicant or awardee wishes to consolidate loans, the applicant/awardee should inform DLR as soon as possible by emailing . Only loans listed in the LRP portfolio may be included in the consolidation for the loan to remain eligible for loan repayment. This includes ensuring that a consolidation loan does not include loans that are ineligible for the LRP, such as:

- Non-educational loans

- Loans belonging to another individual and

- Loans disbursed after the start date of the first LRP award

DLR must be provided with the following:

You May Like: Credit Counseling Agencies Approved Government

How To Find Free Grants And Programs To Pay Off Student Loan Debt

Know where to look for free grants that can help you pay for your student loan debt. Here are some places that have loan repayment programs:

- Organizations that promote certain professions or skills

- State and federal governments

- Colleges and universities

- Employers

Check the eligibility requirements to know if you qualify in a loan repayment program. Prepare all the necessary documents and send your applications. Make sure that you understand all the terms and conditions. Some grants can become a loan if you dont meet service requirements, for example.

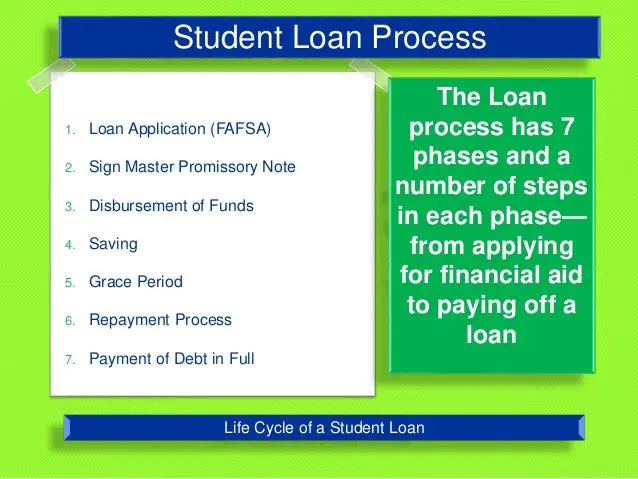

What Is A Loan

A loan is money that you borrow with the expectation that you will pay it back, within a deadline laid out by your lender.

Students can borrow money through , which are issued by the government, or private student loans, which are issued by non-government entitles like banks and credit unions. To qualify for a private student loan, youll need to demonstrate your ability to pay the loan back, usually with a .

Read Also: How Do Government Contractors Get Paid

Read Also: What Is The Government Grant For First Home Buyers

The Ultimate List Of Grants To Pay Off Student Loans

Dying for student loan debt relief? Sure, you can put those loans in deferment or forbearance, but both of those options have major drawbacks.

Its way better just to get your loan forgiven or have someone else pay it off for you. And if you’re interested in that , you’ve come to the right place. Get readythis is the largest guide to student loan debt relief we’ve ever assembled.

National Institute Of Health Loan Repayment Programs

The eight research programs within the NIHLP are divided between extramural research and intramural research. They are:

Eligibility

Also Check: Can The Government Take Your Inventions

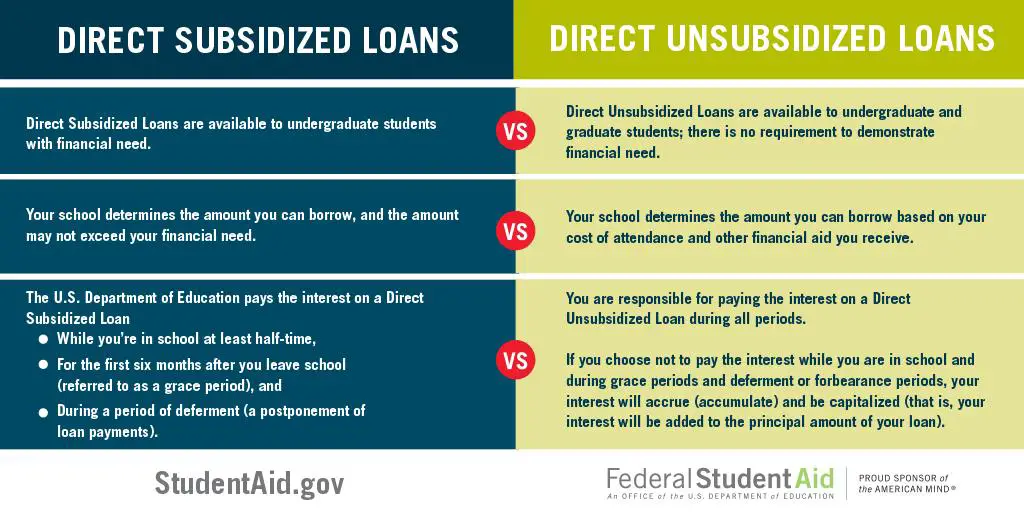

Teacher Loan Forgiveness Program

The Teacher Loan Forgiveness Program will pay up to $17,500 on subsidized and unsubsidized Direct Stafford Loans. In order to receive this loan benefit, teachers must be employed as full time, qualified teachers for five complete and consecutive academic years.

Additionally, this teaching must have be at an elementary school, secondary school, or educational service agency that serves low income students.

One of the downsides to TLFP is that private student loans and Direct PLUS loans are not eligible so the benefit only makes sense if you have Direct Stafford Loans.

If you are a teacher who is interested in learning more about the Teacher Loan Forgiveness Program check out the federal student aid webpage here.

Also see: Guide to student loan forgiveness programs

The Nd Career Builders Loan Repayment Program

If you reside in North Dakota and are employed in a high-need occupation, you can apply for the ND Career Builders loan repayment program. You will need to secure a commitment from a private-sector donor, who will be responsible for matching state dollars. The grant awards up to $5,667 per year for a maximum of three years. The award can go toward both federal and private student loans.

Read Also: Government Help With Car Insurance

Do A Search For A Grant That Fits Your Circumstances

As youve seen, before you can apply, you need to narrow down your search. Here are a few ideas:

- Do a search for grants available for people in your profession. These may involve working in a high-needs area.

- See if your current job qualifies for Public Service Loan Forgiveness.

- Search for grants available in your state, for people in your profession.

- Look into grants available for members of the military or nonprofits such as Teach for America or the Peace Corps, if youre willing to join up.

- See if your employer offers tuition assistance or student loan forgiveness.

- Find out if your college offers student loan forgiveness for people in your major.

Pay More Than The Minimum Amount

If you have the capacity, increasing the amount of your monthly payments will help you get out of debt faster. Whats more, the amount you pay above the minimum payment will go toward paying off the principal of the loan. Even better, this will help to reduce your balance and thus reduce the amount of interest you will have to pay.

Recommended Reading: T Mobile Discounts For Government Employees

Also Check: What Are Government Bonds Paying

Beware Of Student Loan Debt Relief Companies

Student loan debt relief companies charge fees for helping federal student loan borrowers enroll in income-driven repayment plans, consolidate loans, or get out of default. There is nothing these companies can do for you that you cant do on your own for free. You can review this U.S. Department of Education advisory on how to spot a student loan debt relief scam. If youve been deceived by a student loan debt relief company, please file a Student Loan Help Request.

How Can I Pay Off My Loans Fast

Many graduates want to pay off their student loans as fast as possible. Battist said she would like to have hers completely paid off within the next six years. “I would love to pay this off within the shortest time possible to minimize the interest rates,” she said.

If you want to be aggressive with paying off your loans, Williams suggests you try to refinance your loans and get a cheaper interest rate, if possible. “That way you save yourself some money on interest, and it can bring your monthly payment down as well.” Williams also suggests that any time you get extra money, put it toward a student loan payment. “If you get a bonus, a tax refund, or you get money from family, a friend or for a holiday, take all those extra dollars and throw them at the loan.”

Another option that Williams and Sun both suggest if you really want to pay off your loans in three to five years, is to pick up a side hustle. It can be driving an Uber or Lyft, doing freelance projects or really anything that can make you some extra cash alongside the money from your full-time job, that can go toward the loan payments.

“While three years sounds like a really long time, if you’re, let’s say, 21 graduating college and at 24 you’re student loan debt-free, from three years of sacrifice, you’ve got a whole life ahead of you,” Williams said.

Also Check: Agenda Management Software For Government