Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Submit Your Request In Person:

Equifax has four office locations where you can request a free copy of your Equifax credit report in-person and receive a printed copy of your credit report after your identity is confirmed. Copies of the request form you will need to complete are available onsite.

You need to bring with you at least two forms of identification, including 1 photo identification and proof of current address. Also, you must provide the original copies of your chosen identification – photocopies and electronic versions are not accepted at the office. Examples of acceptable documentation include:

- Driver’s License

- Utility Bills

Acceptable Supporting IDs:

- Birth Certificate Issued in Canada

- T4 slip

- Citizenship and Immigration Canada Document IMM1000 or IMM1442

- Social Insurance Number Card issued by Canadian Government

- Certificate of Naturalization

Providing your Social Insurance Number is optional. If you provide your S.I.N., we will cross-reference it with our records to help ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

How To Order Your Free Annual Reports From Equifax Experian And Transunion

You can order your free annual credit reports through a toll-free phone number, online, or by mailing the Order Form at the end of this Information Sheet.

1-877-322-8228Annual Credit Report Request ServiceP. O. Box 105281Atlanta, GA 30348-5281

You have the option of requesting all three reports at once or staggering them. You could create a no-cost version of a credit-monitoring service. Just order a free report from one credit bureau, then four months later from another, and four months after that from the third bureau. That approach won’t give you a complete picture at any one time. Not all creditors provide information to all the bureaus. Monitoring services from the credit bureaus cost from about $40 to over $100 per year.

Don’t Miss: Good Jobs For History Majors

How To Get A Free Annual Credit Report From The Government

The Fair Credit Reporting Act entitles all Americans to a free credit report every 12 months. You can make this request via the official government-run website. The credit report contains information from the three major US credit reporting bureaus

This will take you to a page outlining the three-step process required to request your credit report.

This begins the three-step process.

Can You Get A Free Credit Report More Often Than Once A Year

There are certain circumstances where you can, by law, get a free credit report, even if you’ve already asked for one within the last 12 months.

If you receive a notice that you have been denied

- employment

AND you ask for the report within 60 days of receiving the notice.

The notice will give you the name, address and phone number of the company that did the credit report.

If you are unemployed and plan to look for a job within 60 days.

If you are on welfare.

If your report includes inaccuracies because of fraud or identity theft.

Read Also: City Of Las Vegas Government Jobs

Getting Free Credit Reports Under The Fcra

The three major credit bureaus have set up a central website and a mailing address where you can order your free annual report.

You may get your free reports at the same time or one at a time – the law allows you to order one free copy of your report from each of the credit bureaus every 12 months.

To get your free reports, visit AnnualCreditReport.com. You can also complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281.

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report, also known as your MIB consumer file, each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

You can request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Also Check: Government Jobs Las Vegas No Experience

How To Get Your Annual Credit Reports From The Major Credit Bureaus

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Federal law gives you free access to your credit reports from the three major credit bureaus: Equifax, Experian and TransUnion. Using the government-mandated AnnualCreditReport.com website is the quickest way to get them, but you can also request them by phone or mail. Until April 20, 2022, those reports which had been limited to once a year are available weekly to help consumers manage their finances.

Your credit reports are a detailed record of your past use of credit but they do not include your credit score. NerdWallet offers a free credit score and report, updated weekly using TransUnion data. Checking your score does not damage your credit.

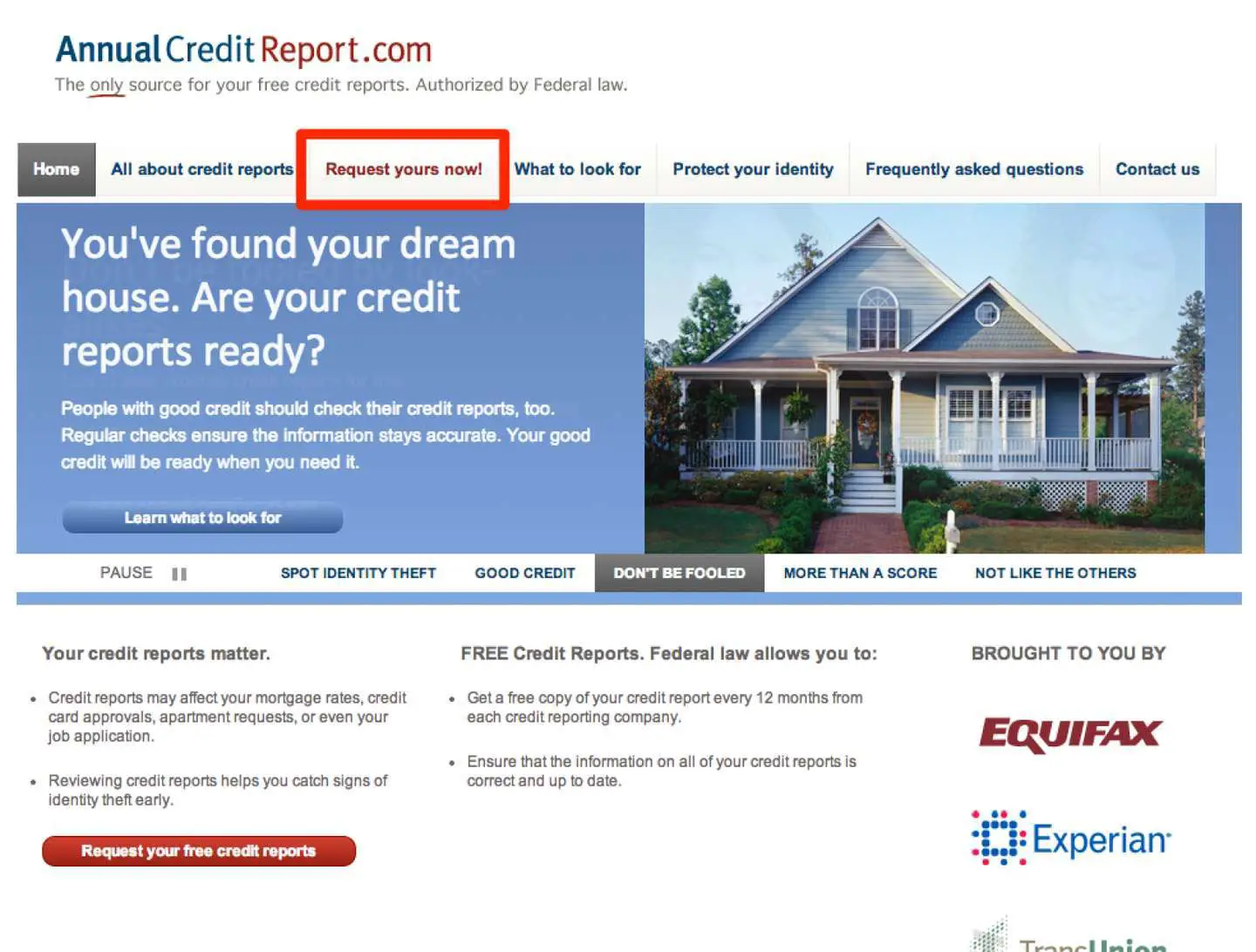

Heres how to use AnnualCreditReport.com.

Annualcreditreportcom For Free Credit Reports

AnnualCreditReport.com is the only authorized source for the free annual credit report that is yours by law. The FCRA guarantees access to your credit report for free from each of the three nationwide credit reporting agencies every 12 months.

This website is jointly operated by Experian, Equifax, and TransUnion and was created in order to comply with their obligations under the Fair and Accurate Credit Transactions Act to provide a method for American consumers to receive a free annual credit report. The goal was to allow consumers a way to ensure their credit information is correct and to guard against identity theft. The three major credit reporting agencies created the joint venture company, Central Source, LLC, to oversee their compliance with the FACTA. This service does not lower the consumers score nor does it count as a .

The FTC has received complaints from consumers who thought they were ordering their free report from other companies but were actually forced to pay fees or buy other services. While there are many companies out there with similar sounding names the site that provides this free government mandated credit report access is AnnualCreditReport.com. Consumers who want to take advantage of this free service should type the address carefully to avoid landing on a legitimate looking page run by a scam artist.

Also Check: Government Jobs Vegas

What About Free Credit Scores

There is no such thing as a free government credit score. Again, federal law currently provides free reportsbut not the scores that scoring models generated from the information in your reports. You won’t need to sign up for to access the scores either.

While going through the process of getting your free reports, you can buya credit score from each credit reporting agency if you want tothey will make it very easy to do so, and youll see several offers.

How To Correct Errors In Your Credit Report

If you see anything you believe is incorrect, contact the credit bureau immediately. You can call the telephone number on the report to speak with someone at the credit bureau. If you find evidence of identity theft, the next steps to take include contacting any creditors involved to close fraudulent accounts and filing a police report. See Identity Theft Victim Checklist, on our web page for more information on what to do.

Also Check: Possible Careers For History Majors

Why Don’t My Free Credit Reports Include Credit Scores

Your credit report and your credit score are not the same thing. Your credit report contains information that a credit reporting company has received about you. Your credit score is calculated by plugging the information in your credit report into a credit score formula. You may have multiple credit scores based upon who provided the score, and whether the company providing the score used their own scoring model or used a model available from a third party.

Federal law gives you the right to ask for a copy of your credit report from each nationwide credit reporting company every year for free. However, the law does not require the credit reporting companies to provide a free credit score.

Contacting The Credit Agencies Directly

If you prefer, you can call the major credit agencies directly and request a credit report at no charge. However, the FCRA-mandated Annual Free Credit Reports are only available through the website and phone number above. In other words, you might have to pay if you contact a directly.

The only way to get your annual free credit report is to use AnnualCreditReport.com or the phone number above. If you go any other route, you may have to pay or subscribe to a private service.

If you need additional credit reports , numerous companies try to sell subscription services or paid reports. That said, you might not need those services.

Contact the credit bureaus:

Read Also: City Of Las Vegas Government Jobs

Your Annual Credit Report Is Now Available Weekly And Its Still Free

The three national credit reporting agenciesTransUnion, Experian and Equifaxare required by federal law to provide you with a free annual credit report. In fact, AnnualCreditReport.com was created by the credit reporting agencies as a one-stop-shop to provide you with your annual credit reports.

In response to the COVID-19 health crisis, TransUnion is pleased to offer you one free weekly credit report online through April 20, 2022 at AnnualCreditReport.com. Reviewing your credit reports regularly helps you ensure the information reported is accurate. It also gives you an opportunity to monitor your account history to combat identity theft.

Nationwide Consumer Reporting Agencies

The three nationwide consumer credit reporting agencies, also called credit bureaus, are Equifax, Experian and TransUnion. They compile credit histories on consumers. Your credit history contains information from financial institutions, utilities, landlords, insurers, and others. The credit bureaus provide information on you to potential credit granters, insurers, landlords, and employers. You have the right to get a free copy of your credit history in several situations:

You also have the right to a free copy of your report from each of the credit bureaus every year.

Recommended Reading: Polk Real Foreclosure

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Consumer Protections On Credit Reports

The Fair Credit Reporting Act is a federal law that promotes the accuracy, fairness, and privacy of information maintained by credit bureaus. Consumer protections under the FCRA include:

- Anyone who uses a credit report or another type of consumer report to deny your application for credit, insurance, or employment â or to take another adverse action against you â must tell you, and must give you the name, address, and phone number of the agency that provided the information.

- You may request and obtain all the information about you maintained by a credit bureau. You are entitled to a free file disclosure:

- Once every 12 months

- If a person or business has taken adverse action against you because of information in your credit report

- If you are the victim of identity theft and place a fraud alert in your file

- If your file contains inaccurate information as a result of fraud

- If you are on public assistance or

- If you are unemployed but expect to apply for employment within 60 days.

Read Also: Grants For Trucking Companies

A Free Credit Report For Michigan Residents

DIFS recommends that consumers check their credit report at least once every 12 months at AnnualCreditReport.com. Monitoring and reviewing your credit report is an effective way to help fight identity theft. AnnualCreditReport.com serves as a central source for each of the three major credit reporting agencies. Consumers can request a report from each credit reporting agency within a one year period. Experts suggest that instead requesting reports from all three agencies at once, consumers request a single report every four months or so from a different agency. This strategy can help detect potential problems like identity theft sooner.

AnnualCreditReport.com is a free, no-obligation service established by federal law and provided by the major credit reporting services. You will not be required to purchase or subscribe to anything to view your credit report, though you can opt to pay a fee to learn your credit score number.

To get your report, you will have to provide certain information including your name, social security number and address. The online service has numerous features to protect the security of the information you send and receive.

Annual credit reports are also available by telephone.

Phone toll free: 877-322-8228

Review And Download Your Reports For Each Credit Bureau

The final two steps will be repeated for each credit bureau from which you’ve requested a credit report. At the end of each bureau’s steps, you will have the option to download a PDF of your credit report. I recommend either printing a hard copy or encrypting the downloaded file to prevent cyber-thieves from gaining access to this sensitive information.During the verification process, you will be asked questions about past loans, credit lines, etc. in order to verify your identity.

Recommended Reading: Entry Level Government Jobs Colorado

How To Spot Credit Report Scams

AnnualCreditReport.com is the only site sanctioned by the government, and there are a number of lookalike websites that the Federal Trade Commission calls imposters. Some include terms like free report in their names others purposely misspell AnnualCreditReport.com so the URL is nearly the same.

These sites may attempt to collect your personal information or direct you to other sites that want to sell you something. Or they may try to get you to sign up for a seemingly free credit report for which youll later be charged.

Use caution if youre asked to enter your credit card or bank account number, as this could be used to bill you at the end of a free trial. Also, check the sites security certificate, and be wary of sites with HTTP rather than HTTPS in the address. HTTP means the site is less secure.

Make sure to steer clear of sites that contain spelling or grammar errors, and be wary of phone calls or emails from senders claiming to represent AnnualCreditReport.com or one of the three major credit bureaus. The FTC says these companies wont contact you, so anyone claiming to be them is likely a scam.

Tips For A Positive Credit Report

- Pay your loans and other bills on time. Even if you fell into trouble in the past, you can rebuild your credit history by beginning to make payments as agreed. Paying your debts on time will have a positive effect on your credit score and can improve your access to credit.

- To help show that you have not borrowed too much, try to minimize how much you owe in relation to your credit limit. Don’t automatically close credit card accounts that have been paid in full and haven’t been used recently because that may lower your available credit. However, you may want to close a card with a zero balance if you pay a monthly fee for the card.

- If you believe you cannot repay your creditors, contact them immediately and explain your situation. Ask about renegotiating the terms of your loan, including the amount you repay. Reputable credit counseling organizations also can help you develop a personalized plan to solve your money problems, but less-reputable providers offer questionable or expensive services or make unsubstantiated claims.

Also Check: City Of Las Vegas Government Jobs