Debt Relief Programs Cant Make Your Debt Disappear

Commercials full of lavish promises aside, debt relief programs cant just make your debt disappear. That said, in some circumstances, especially when you enlist the help of a good debt relief company, you may see a decrease in your overall balance, whether through a lowered interest rate or settlement resolution.

Read Also: Accurate Machine And Tool Los Lunas

Questions You Can Ask Your Issuer

While creditcard issuers are offering to help cardholders during this time, its not alwaysclear what they may be willing to offer people whove been affected by COVID-19.To help, weve put together a list of questions you can ask your issuer whenyou explore your options.

Itspossible that some of these questions may not be relevant to your situation andtheres no guarantee youll get what you want. But we hope theyll help youstart the conversation with your issuer.

Debtca Offers Options Empathy And Information

At Debt.ca, we understand what a mental and emotional burden it can be to face challenges with debt. Were here to provide a listening ear for the challenges youre facing, and to help you find practical solutions that will work. Were here to ensure youre informed of all your options, so you can choose the best option for you.

Debt.ca offers all the solutions you might need, all in one convenient place. Based on your situation, we connect you with the right qualified, accredited, and licensed service provider to assist you. Our debt relief network can connect you with lenders, credit counsellors, and Licensed Insolvency Trustees that have proven track records of helping people.

So, with Debt.ca, its not about driving you into the one solution we offer. Its about helping you find the solution that allows you to get debt-free as quickly as possible.

Recommended Reading: How To Take Out Government Student Loans

Check Your Credit Reports Regularly

You can typically check your credit reports for free, once a year. However, the three major credit reporting agencies Experian, TransUnion and Equifax are currently allowing consumers to check their reports weekly for free.

If you sign-up for a credit card relief package and are meeting the terms of that relief package, such as making a lower minimum payment, the company must report to the credit reporting agencies that you are current on the account. However, if you were already behind on your payments at the time you receive relief, the lender is not required to report that you are current.

And, if you find an error, you should work to dispute it, this is when it would be helpful to have a copy of the written agreement on hand.

Debt Relief: Understand Your Options And The Consequences

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

Find that youre just not making progress on your debt, no matter how hard you try? If thats the case, you might be facing overwhelming debt.

To break free of this financial burden, look into your debt relief options. These tools can change the terms or amount of your debt so you can get back on your feet more quickly.

But debt-relief programs are not the right solution for everyone, and its important to understand what the consequences might be.

Debt relief could involve wiping the debt out altogether in bankruptcy getting changes in your interest rate or payment schedule to lower your payments or persuading creditors to agree to accept less than the full amount owed.

You May Like: Government Construction Jobs For Bid

The Servicemembers Civil Relief Act

If youre active-duty military, you could qualify for some help through the Servicemembers Civil Relief Act . The SRCA offers some benefits and protections, such as reducing the interest rates on preexisting loans to 6% and limiting the collection activity agencies can do.

Taking advantage of the SCRA can reduce your interest rates when youre deployed, making the payments more manageable and preventing the balance from ballooning over time.

To find out whether you qualify for assistance through the SCRA, contact your local Armed Forces legal assistance office.

Monitor Your Credit For Free

Join the millions using CreditWise from Capital One.

- Even if theyâre nonprofit organizations, credit counselors may charge fees for their services.

- Be sure the credit counselor you choose is a reputable, accredited and certified one you can trust to manage payments on your behalf.

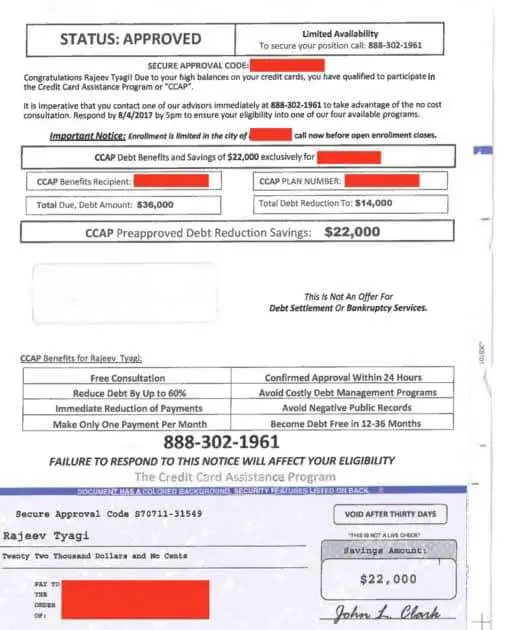

6. Debt Settlement

Debt settlement is when a lender waives a portion of your debt in exchange for you agreeing to pay back the remaining balance. According to the CFPB, debt settlement companies are âusually ⦠for-profit companies that charge a fee for their services.â Youâve probably seen them advertise their services on TV or online.

How it works: As the FTC describes it:

- Debt settlement companies offer to ânegotiate with your creditors to allow you to pay a âsettlementâ to resolve your debtâa lump sum that is less than the full amount that you owe.â

- Debt settlement programs typically ask you to âset aside a specific amount of money every month in savings ⦠and transfer this amount every month into an escrow-like account to accumulate enough savings to pay off any settlement.â

Keep in mind: The CFPB advises consumers to examine their agreement very carefully to understand and prepare for any eventuality. For example:

- âMost debt settlement companies will ask you to stop paying your debts in order to get creditors to negotiate ⦠a settlement.â

- In the meantime, late fees and interest can still accumulate and âcause your original debt to increase.â

7. Bankruptcy

You May Like: Government Help For Homeless Youth

It All Adds Up: Debt Consolidation Calculator

The proof is in the pudding. Seeing is believing. Less talk, more show. Whatever saying you prefer, we get ityou want to know exactly how much you could be saving and how fast you can be debt-free. Well, were here to help!

Just answer a couple of quick questions about your credit situation and our Debt Calculator will give you your results instantly.

Still wondering How can I consolidate my debt? Dont hesitate to call usits completely free and confidential.

Quick Links

How To Request Help From Your Credit Card Companies If Youve Been Impacted By The Coronavirus Pandemic

Missing a payment on your credit card or paying it late can result in fees or added interest, but it can also have a negative impact on your credit score. This is why its important to contact your credit card companies immediately if you know you cant pay your bill.

Here are important steps to requesting relief.

Also Check: Government Website To Check Credit Score For Free

Key Differences Between Consumer Proposals And Credit Counselling Plans

At first glance credit counselling and Consumer Proposals may sound much like the same consolidation solution but they have some distinct differences to be aware of:

- Consumer Proposals almost always come with a significant reduction in the total debt reductions of up to 70% or more are often possible. Interest is automatically frozen.

- Not all creditors will agree to work with a credit counsellor, so debts such as government debts would need to be paid separately in addition to your credit counselling payments.

- Only 50% of your creditors need to agree to your Consumer Proposal for it to be legally binding on all your creditors.

- Once filed, your Consumer Proposal will also protect you from collection action, creditor harassment and can even remove wage garnishments or other court actions.

Navigating Credit Card Debt During Covid

If the financial impact of the coronavirus pandemic has you looking for ways to consolidate your credit card debt, youre not alone. Many people may find themselves with more debt right now or may be facing debt issues theyve never encountered before.

If that describes your situation, you may have more than one option.

Weve compiled some resources to help you find relief measures announced by the government, credit card issuers and more. If you can take advantage of these relief measures, they may help ease some of your financial burden, making your debt more manageable. Check out our summaries of those resources below.

Read Also: Capability Statement Template For Government Contractors

Loans And Credit Card Relief For Covid

One thing isnt changing right away. Renters who can demonstrate theyve been economically hurt by coronavirus still cant be forced out of their homes.

Citing studies that indicate evictions lead to crowded living conditions, spreading COVID-19 and virus-linked deaths, the Centers for Disease Control extended its ban on evictions until October 3rd welcome relief to the eight million households the Census Bureau says are behind on their rent.

The COVID-19 pandemic has presented a historic threat to the nations public health, CDC Director Dr. Rochelle Walensky said. Keeping people in their homes and out of crowded or congregate settings like homeless shelters by preventing evictions is a key step in helping to stop the spread of COVID-19.

Theres welcome news for the 10 million-plus homeowners behind in their mortgage payments: Homeowners behind on their mortgage payments were granted relief through June 30 when the White House directed the Department of Housing and Urban Development, Department of Veterans Affairs, and Department of Agriculture to expand and extend forbearance and foreclosure relief programs for those with federally backed mortgages.

Additionally, Fannie Mae and Freddie Mac extended foreclosure moratoriums for an additional three months for borrowers approaching the end of their forbearance period.

An estimated 20% of homeowners missed at least one mortgage payment in 2020 and nearly half missed at least three payments since March 2020.

Qualifying For Debt Consolidation

A major challenge many people encounter when seeking consolidation is whether they actually qualify for the solution they are interested in.

- When it comes to bank-based consolidation, most lenders require you to have a fairly strong credit score and ideal debt-to-asset ratio to be eligible for borrowing.

- Lenders may alternatively ask you to have a co-signer to guarantee your loan, or for you to have an asset that they can hold security over .

- Conversely, with non-borrowing solutions like a Consumer Proposal, your credit score or account standings are not a factor in eligibility, nor are you required to pledge assets as collateral. A co-signer is never a requirement to file a Consumer Proposal.

Also Check: Government Listing Of Foreclosed Homes

Balance Transfer Credit Card

A balance transfer credit card is a credit card you can use to pay off other cards. Youre essentially moving your debt from one credit card to another. Why would you do that? Many balance transfer credit cards have a big benefit over traditional credit cards: They dont charge interest on debt you transfer from other cards for a set number of months. Depending on the card you choose, you could avoid credit card interest for a year or more.

You can transfer multiple credit card balances to a single balance transfer credit card. This is a good way to consolidate your credit card debt. Instead of having to juggle several credit card bills every month, youll have just one credit card to pay off.

There are two drawbacks of balance transfer credit cards:

- They typically charge a fee, known as a balance transfer fee. The fee amount depends on the card. Most charge 3% to 5% of the amount transferred. So if you transfer $100 in credit card debt to a balance transfer card, your new balance transfer card will probably charge you a $5 fee. If you transfer $1,000, youll likely pay up to $50 in fees.

- You need good credit to qualify for balance transfer cards with a 0% intro APR. If your isnt 670 or higher, its hard to get approved.

You May Like: City Jobs In Las Vegas

Stimulus Proposal: $10000 In Credit Card Interest Relief During Coronavirus Pandemic

Getty

The U.S. economy is continuing to roil from the coronavirus pandemic. While the official April unemployment rate of 14.7 percent marked the highest level since the Great Depression, it also understated the true economic devastation being inflicted across America. With Congress deadlocked on when to pass the next relief bill, let alone what provisions it should include, now is an opportune time to consider creative solutions to help Americans weather the extended Covid-19 crisis. One novel proposal by two law professors would provide government subsidies for consumer credit card interest payments.

The brainchild of Norman Silber, a senior research scholar at Yale Law School and professor at Hofstra Universitys Maurice A. Deane School of Law, and Jeff Sovern, professor at St. Johns University School of Law, the proposal would have the federal government subsidize interest payments on consumer credit card charges while also capping interest rates and allowing consumers to fully defer minimum payments. These steps would help stem the impending credit crunch that has already started to hit many Americans and maintain an accessible lending mechanism readily available to 75 percent of Americans.

In order to fully appreciate the potential impact of Silber and Soverns proposal, it is crucial to contextualize it in the missteps of the CARES Act and the early warning signs emerging of financial institutions scaling back available credit to consumers.

Recommended Reading: Best Government Jobs After Military

Debt Relief Options For Insolvency

Depending on your circumstances and the types of debts you have, you may need legal help to resolve your debt problems. Two options are available to all Canadians, a Consumer Proposal and Bankruptcy.

Consumer Proposal

Once it is agreed to, a consumer proposal is a legal agreement between you and your creditors to settle your debts. The process in Canada is governed by the Bankruptcy & Insolvency Act and allows you to repay a portion of your unsecured debts over a period of no more than 5 years.

A lot of debt relief companies and agencies have heavily advertised and over promoted the benefits of consumer proposals vs bankruptcy you can learn more about the differences between the two here.

Bankruptcy

Bankruptcy is a legal process that someone can enter into when they are not able to pay their debts, and they do not have any assets they can sell to pay their creditors. Someone in this position is said to be insolvent. The legal process for bankruptcy in Canada is governed by the Bankruptcy & Insolvency Act.

Declaring Bankruptcy or filing a Consumer Proposal does not always provide debt relief from all of your debts. Before you choose an extreme solution to deal with your debts, make sure that you have considered all of your options. Even if you think that you are completely insolvent, you should look at alternatives to bankruptcy first to make sure that you have considered all of your options. A certified credit counsellor can help you do this.

How Our Credit Card Relief Programs Work

During your first conversation with a certified credit counselor, well evaluate your financial situation and help you set a budget you can live with while you work on a . We may recommend that you enroll in one of our debt management programs, depending on the details of your situation. In our debt management plan, we consolidate all of your payments to creditors, enabling you to make just one payment each month to ACCC. We then take the responsibility for distributing funds to your creditors directly while working with them for a possible reduction in finance charges, interest rates, late fees, and over-limit charges. Our counselors also find out if credit card negotiation is possible. Creditors are usually more willing to reduce or forgive charges when they know youre actively working on reducing your debt through our relief programs.

Also Check: Government Small Business Start Up Loans

Best Interactive Program: Freedom Debt Relief

We chose Freedom Debt Relief due to the fact it offers an interactive client dashboard that lets clients track their progress.

-

Free consultation and no upfront fees

-

Client dashboard lets you track your progress

-

Less transparent results reporting

Freedom Debt Relief has been in business since 2002 and currently employs over 2,000 highly trained debt experts and professionals. It starts clients off by offering a free consultation with a certified debt consultant who can help them talk over their debts and what they hope to accomplish. From there, they craft a personalized debt settlement plan that asks you to save a specific amount in a separate account to use for debt settlement later on.

One feature that helps Freedom Debt Relief stand out is its interactive process. Once you sign up for a debt settlement program and begin making deposits, youll qualify for a client dashboard that you can use to stay up to date on your program. This dashboard lets you see how much you have saved, how much you owe, and any progress Freedom Debt Relief has made negotiating debts on your behalf.

Freedom Debt Relief says its clients dont pay any fees until work is done on their behalf. By the end of their debt settlement programs, customers pay a fee equal to a percentage of the amount of debt they enrolled in the program. While Freedom Debt Relief cannot guarantee it will settle your debts, it claims that many of its clients wind up paying significantly less than the amounts they once owed.