How Often Should You Check Your Free Credit Scores

Checking your free credit scores on Credit Karma isnt a one-time set-it-and-forget-it task. Your scores may be updated frequently as your changes, so checking them regularly can help you keep track of important changes in your credit profile.

Since you can check your free credit scores without hurting your credit, feel free to check as often as you like. If you see your credit scores steadily growing, it can help motivate you on your credit-building journey. And when youre ready to submit a credit application, getting a better idea of your overall credit health beforehand can give you a better sense of where you stand.

Psbs Are Offering Personal Loans At Attractive Rates Shows Cibil Data

The overall personal loan business dropped by 42.2% on a year-on-year basis in August 2020 due to economic disruptions caused by the Covid-19 pandemic.

However, the approach taken by public sector banks kept them in a good stead during the pandemic as their business grew by 66.5%, according to a data by credit bureau CIBIL data.

PSBs are offering personal loans to customers at attractive rates compared to their peers. This is attracting consumers to avail loans from PSBs despite facing financial hardship.

29 December 2020

General Consequences Of Skipping Monthly Payments

Whenever you miss a payment, you will be charged a late fee. Making continuously late payments, even if it is the day after the due date, could seriously damage your credit score. When your next bill is due, you will have to make two months of payments plus the late fee. Because of that, catching up can be difficult and it is more difficult the higher your monthly payments are. For that reason, mortgage and auto loan payments are often the most difficult to get caught up on. Try to avoid skipping payments altogether by planning ahead and living within your means.

Also, whenever you apply for a credit product, a creditor looks at your payment history first. So, making continuous partial or late payments could end up becoming costly to you. You will likely have your future loan applications rejected which again will lead to a downward spiral of your credit score. In the end, your credit health will be damaged.

The good news is, damaged credit health can be repaired. You can start by making your payments on time. Check your credit report to see that everything is reported correctly. If you find any error, correct it immediately.

Also Check: Www.qlinkwireless.com/register

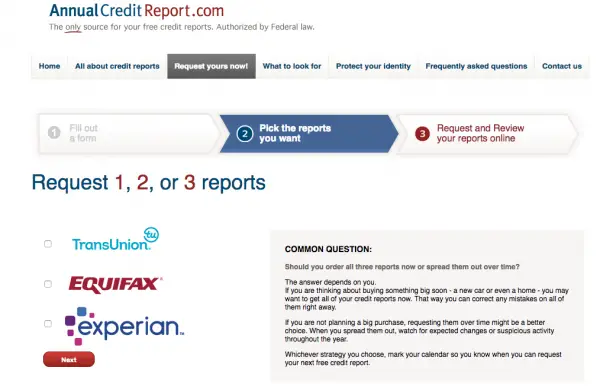

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days

- online at AnnualCreditReport.com youll get access immediately

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request

It may take longer to get your report if the credit bureau needs more information to verify your identity.

What Is Credit Score & Credit Report

The credit report is created using a borrowers credit history with detailed information of his/her prior borrowings and how loans/credit cards have been handled in the past. Apart from credit history, credit report also contains a list of banks/NBFCs that have made an enquiry for the consumers credit report.

The formula used for generating credit score is proprietary and it varies from one credit bureau to another, so the credit score of the same individual also varies from one CIC to another. Credit score is one of the key factors considered by lenders when approving a loan or credit card application. The closer an applicants score is to 900, greater are the chances of being approved for new credit cards and/or loans.

You May Like: Congress Mortgage Stimulus Program 2019

How To Get Your Experian Credit Score For Free

The largest credit reference agency offers new customers a free 30-day trial of its , which gives you access to your credit report, score, and email alerts about any changes on your file.

After the trial ends, it will cost you £14.99 a month.

You can access your Experian credit score through a free Experian account. This is designed to help people shop around to see how they can save money by comparing credit deals based on their financial profile.

Once you’ve signed up, your score will remain free to access, but unlike the paid-for CreditExpert service, you won’t be able to see your credit report.

To be able to access both your Experian credit report and score for free, you can sign up to the Money Saving Expert Credit Club.

You can also see how likely you are to be accepted for the market-leading cards and loans and work out how much you can afford to borrow.

Unlike CreditExpert, you won’t receive alerts about any changes to your report.

Can I See My Credit Report

You can get a free copy of your credit report every year. That means one copy from each of the three companies that writes your reports.

The law says you can get your free credit reports if you:

- go to AnnualCreditReport.com

Someone might say you can get a free report at another website. They probably are not telling the truth.

Don’t Miss: Safelink Free Replacement Phone

Vantagescore 30 Credit Score Factors

Different credit scores can have a lot in common under the hood, but each individual scoring modeluses its own combination of factors to determine your score.

Here are the major factors that determine your VantageScore 3.0 credit scores.

Payment history The biggest factor in your scores is your history of paying bills on time. Late or missed payments in your credit history could affect your scores significantly.

Age and type of credit A longer credit history, particularly with the same accounts, shows lenders that youve been able to stick with your accounts over time. Lenders may also consider it a plus if you have a mix of credit accounts with positive use.

Your measures the amount of credit you use relative to the amount available to you. Most experts recommend shooting for a rate below 30%, meaning you use less than 30% of your available credit.

Balances Similar to credit utilization, this factor takes into account your total balances across your accounts but in terms of the dollar amount and not the percentage. If you already owe a fair amount elsewhere, lenders may be less inclined to extend more credit to you.

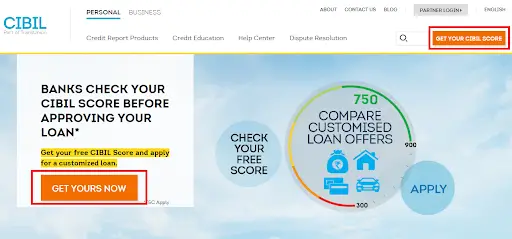

Why Do Banks Need To Check My Credit Score

Banks take a risk in lending to their customers. When a loan is lent, the lender wants to be sure that the amount is paid back with interest promptly. Therefore, lenders would like to ensure that they are lending only to the creditworthy or those who will pay back the amount responsibly. For banks or any other financial institutions, the only way to determine the creditworthiness of an individual is through his/her credit score.

Therefore any application for any form of credit is not approved without carrying out a credit check from the credit bureaus. Currently, banks have also started pricing the loans depending upon the credit scores.

Can Equifax delete or change my credit information on its own?

No, Equifax or any credit bureau cannot delete or change any information on its own.

The generation of the credit data is done at the lender’s end according to your credit actions. The same is reported to the credit bureau by the lenders. Your credit score is calculated based on the data shared by the lenders. So the credit bureaus have no role to play when it comes to data, it makes the calculations based on the information provided by the lenders.

In case of any errors in your credit information, you would need to raise a concern with the credit bureau who would then forward it to the lender for making necessarily corrections.Only when the corrected data is sent by the lender, will the Credit Bureau makes changes to your credit information.

Read Also: Charitable Auto Resources Seattle

Are There Any Chances Of Mistakes In Credit Report If Yes What Kind Of Mistakes Usually Happens

Errors are possible in a credit report. This may be due to oversight, where your name or PAN does not match correctly. Further, there can be errors where right credit accounts are not shown under your name or the amounts are not shown correctly. Some closed credit accounts might be erroneously shown as open.

Further, there can be grave errors like that of identity theft, where your PAN and details might have been used for obtaining credit cards or loans fraudulently.

So What Is A Credit Score

Your credit score is a number that banks and other financial institutions use to gauge your creditworthiness when making a lending decision. The higher the number, the lower the perceived risk. Generally, there is no minimum credit score required for a personal loanbut a healthy number is recommended if you want to get the best rates and avoid rejections. Having said that, if you are looking to apply for a personal loan, you will want a credit score of at least 750 or higher.

Your credit score is calculated taking several factors into account:

Recommended Reading: Jobs History Majors

Child Tax Credit Form For Taxes: Keep This Irs Letter To Make Sure You Get Your Money

The enhanced child tax credit isn’t over yet. Learn what Letter 6419 is and why you need it.

The IRS started sending copies of Letter 6419 in December and will continue to mail them through January.

Tax season is now here, which means the rest of your child tax credit money will be on the way soon. Parents who didn’t opt out of advance payments received half of their money in 2021. Those families and those who unenrolled from advance payments can expect to receive their remaining expanded child tax credit money with their refund after filing their 2021 taxes.

To ensure you get that money, you’ll need to be on the lookout for a specific letter from the IRS with important information about your child tax credit. The IRS started mailing copies of Letter 6419 in late December and will continue to send more letters throughout January. The agency is urging you to hold on to the notice, as you’ll need it when you file your 2021 taxes.

We’ll tell you what the letter contains and why you shouldn’t throw it away. For more information, here’s everything to know about the upcoming child tax credit payment. Also, here’s what to do if you’re having issues with a missing payment.

What Makes Up My Credit Score

Your credit score is broadly based on your past and current credit behavior. The factors that make up your credit score are

Repayment History : Prompt repayment on your past and existing credit products is the key to a good credit score.

Positive Credit Accounts : A credit score calculation takes into account your credit accounts and if they are positive or negative .

This ratio takes into account your spending on credit card to the overall credit limit on your credit card. A high ratio negatively affects your credit score.

There are two types of credit, secured and unsecured. A judicious mix of both is one of the factors beneficial for your credit account.

Hard Inquiries : These inquiries get created each time you apply for credit. Many hard inquiries over a short period of time is not good.

A long history of responsible behavior with credit is appreciated and contributes towards a good credit score.

Read Also: Middle Class Mortgage Stimulus Program

Check Your Free Cibil Score

Already registered? > > to get your updated credit score

What is CIBIL Score?

CIBIL score or credit score is like your financial report card. In other words, its simply the numerical representation of your repayment history.

Things you need to know about CIBIL score:

- The CIBIL score comes in the range of 300 to 900 in India – anything above 700 is considered good for the approval of loans or credit cards.

- A higher CIBIL score suggests good credit history and responsible repayment behaviour.

Why checking your latest CIBIL score is must?

This powerful number can help you with

- Higher chances of getting a loan or credit card approved

- Better offer on loan & credit card

- Taking charge of your finances

HDFC Bank is the official partner for CIBIL – Check Credit Score for Free

To get Free CIBIL score online within 2 minutes just provide some basic details:

Enter ID details

- PAN

What Details Would Be Mentioned In The Credit Report Of An Individual

A credit report is nothing but a reflection of the credit history of an individual. Therefore, a credit report contains details on all the aspects that affect a credit score.

A credit report would contain details of all your credit, present and past and their status. It also contains details of your repayment. Your detailed credit utilization report also makes a part of your credit report. The number of secured loans against unsecured loans can also be found in the report. The other details in the credit report would be the longest period for which you have held any credit account and the number of hard inquiries in the past 1 year against your PAN.

A credit report will also contain your basic information like name, PAN, address, phone number, etc.

Read Also: Scott Serota Salary

Importance Of Credit Score

A credit score is a number computed by an approved credit rating agency and it provides a hint of the creditworthiness of an individual. An individual’s credit score provides the lender with an idea of the “probability of default” of the individual, based on their . Your credit score tells a lender how likely you are to pay back a loan based on your past pattern of credit usage and loan repayment behavior.

Your credit score is important for reasons well beyond simply getting a loan. Qualifying for the dream house you want and even getting good insurance rates can depend on having good credit. It is therefore critical to know whether decisions like choosing to skip a loan payment will affect your credit score. Read on to know what goes into your credit score and how a delay in your loan payment can affect it.

Downsides Of Late Payment

A late payment not only lowers your credit score, but also costs you in the form of late fees and higher interest rates. For instance, you could be charged a late fee even if you pay your credit card bill just one day late. Your lender will certainly raise your interest rate if you fall into the habit of regularly missing your credit card payments, which would mean you would have to pay more money to carry a balance.

Don’t Miss: Dental Implant Grants

Rbi Rate Cut Followed By Increased Credit Growth By 100 Bps

The credit growth of all commercial banks had grown around 7% on 10 April to Rs.102.85 trillion. This was the data that had been gathered from the Reserve Bank of India . On 27 March, the RBI had reduced the repo rate by 75 bps for stimulating growth, after which the banks also lowered their deposit rates and lending rates.

This is an improvement from the 6% credit growth that had been seen in the previous fortnight ended 27 March. Credit growth has been reducing for the past few quarters and has been expected to reduce further because of the coronavirus that has disrupted all credit disbursals. The lenders from the public sector are now trying their best to push the covid-19 emergency credit lines to all their borrowers. It had been reported n 26 April that all branch-level officials in public sector banks are now having difficulty in managing the superiors expectations on higher credit growth. In a few cases, the branch officials have also learned that the demand for fresh credit has reduced drastically and this has brought almost all loan disbursals to a standstill.

28 April 2020

Clearscore* Free Access To Your Monthly Equifax Credit Report

What you get: Clearscore* provides free Equifax credit scores and reports, updated once a month, and also has an eligibility checker. Clearscore’s services are free for life.

Clearscore sometimes needs basic details about which bank you’re with in order for you to sign up. For instance, Clearscore might ask you to confirm the first two digits of your banking sort code and last six digits of your account number. These details are only used to match you to your credit report and are not saved.

You can also earn up to £6 for signing up if you’re new to Clearscore and sign up via this Topcashback* link.

How to cancel: Go to your ‘My Account’ page, and click on ‘Delete My Account’, you’ll be sent an email to confirm your cancellation request has been processed.

Or alternatively…

Also Check: Free Grants For Dental Implants

Do I Need To Get My Credit Score

It is very important to know what is in your credit report. But a credit score is a number that matches your credit history. If you know your history is good, your score will be good. You can get your credit report for free.

It costs money to find out your credit score. Sometimes a company might say the score is free. But if you look closely, you might find that you signed up for a service that checks your credit for you. Those services charge you every month.

Before you pay any money, ask yourself if you need to see your credit score. It might be interesting. But is it worth paying money for?

Is My Free Credit Score On Credit Karma Accurate

The free credit scores you see on Credit Karma come directly from Equifax or TransUnion. Its possible that more-recent activity will affect your credit scores, but theyre accurate in terms of the available data.

If you see errors on your credit reports that may be affecting your credit scores, you have options to dispute those errors.

Also Check: Qlink Wireless Upload Proof