Affordable Care Act Reporting 1094/1095

For Employers:

For Developers and Transmitters:

If you file 250 or more Forms 1095-B or Forms 1095-C, you must electronically file them with the IRS. Electronically filing ACA information returns requires an application process separate from other electronic filing systems. Additional information about electronic filing of ACA Information Returns is on the Affordable Care Act Information Reporting Program page on IRS.gov and in Publications 5164 and 5165.

TOOLS

Through the Taxpayer Advocate Service , the IRS provides tools to be used by employers and individuals to assess penalties, determine measurement periods, assess potential small employer tax credits, assess premium tax credits and determine individual tax penalties.

Tax Exempt And Government Entities Division

Manual Transmittal

This transmits revised IRM 1.1.23, Organization and Staffing, Tax Exempt and Government Entities Division.

Background

This IRM contains the functional statements and responsibilities of the offices within Tax Exempt and Government Entities Division.

Material Changes

This revision includes the following changes:

IRM 1.1.23.1 – Added Internal Controls section in the IRM.

IRM 1.1.23.2 – Removed references to the Assistant Deputy Commissioner, due to organizational changes eliminated the position within TE/GE.

IRM 1.1.23.3 – Added TE/GE Equity, Diversity and Inclusion section.

IRM 1.1.23.4 and 1.1.23.6 – Documented the reorganization of Government Entities and Shared Services . Exempt Organizations and Government Entities are now under the same directorate. Shared Services is now its own function.

IRM 1.1.23.3 – Documented that Human Resources Customer Support, HR Resources Development Learning and Education, and Finance, now report to Human and Capital Resources which is under Shared Services.

IRM 1.1.23.4.3 – Documented the duties in greater detail of the EP Program Management Office.

IRM 1.1.23.5 – Moved Government Entities IRM content under the new EO/GE section.

IRM 1.1.23.5.4 – Documented the duties in greater detail of EO/GE Program Management Office.

IRM 1.1.23.6 – Documented the creation of Compliance Planning and Classification.

Editorial Changes were made throughout this IRM.

Effect on Other Documents

Audience

Effective Date

1.1.23.1

Memorandum Of Understandinginternal Revenue Service/department Of Labor Coordination Agreement

In order for the IRS and DOL to fulfill the mandates of the Employee Retirement Income Security Act of 1974 Sections 3003 and 3004 and in accordance with ERISA Section 506, the IRS and DOL have executed the Internal Revenue Service/Department of Labor Coordination Agreement .

The attached Agreement reflects changes resulting from the Modernization of the IRS, the change in name of the Department of Labor’s benefit plan regulatory agency from the Pension and Welfare Benefits Administration to the Employee Benefits Security Administration , and other revisions identified from the agencies’ experiences under the prior Agreements.

Although an essential component of the Agreement is timely coordination and emphasis on the need to eliminate duplicative investigative efforts, the agencies recognize there may be situations that require both agencies to become involved. The IRS and DOL agree to identify past situations where both agencies have had an examination/investigation on the same subject and to determine when it may be beneficial for the agencies and the public for examinations/investigations to be conducted jointly.

DOL will continue to refer Checksheet A to IRS to IRS for pension benefit plans in accordance with the requirements of Article II, D., of the Agreement. IRS will continue to make referrals to DOL on Checksheet B in accordance with the requirements of Article II, C. of the Agreement. Both forms have been revised. See Appendices B and C.

Tracking/Feedback

Recommended Reading: Governmentjobs.com Las Vegas

The Irs Tax Exempt & Government Entities Division Releases Its Fiscal Year 2019 Program Letter

On October 3, 2018, the Internal Revenue Service Tax Exempt and Government Entities Division released its Fiscal Year 2019 Program Letter. The Program Letter, which has previously been referred to as a Work Plan or Priority Letter, outlines the TE/GE FY18 activities and various projects and priorities for FY 19 with respect to tax-exempt organizations, employee plans, Indian tribal governments, and tax-exempt bonds.

Information Sessions On Irs Hiring

Did you know the IRS is hiring? Were hosting virtual information sessions where you can learn more about working for the IRS.

Hear from employees currently working in these positions and learn about the day-to-day work we do at the IRS. A representative from HR will also discuss the application process and some of the requirements for the positions.

Participate in the following IRS virtual information sessions for current and future announcements for Tax Law Specialist positions:

- Meeting ID: 161 480 2207

- Passcode: YmB9=pX#

- Meeting ID: 161 871 6566

- Exempt Organizations: Officers Treating EO as Schedule C Business

- Exempt Organizations: Form 990-N Filers/Gross Receipts Model

- Tax Exempt Bonds: Student Loan Bonds Market Segment

- Tax Exempt Bonds: Form 8038-G Yield Restriction

Read Also: Trucking Grants

Irs Virtual Nationwide Tax Forum

The 2021 Virtual Nationwide Tax Forum will consist of 30 live-streamed webinars between July 20 and August 19, 2021. Register by June 15 at 5 p.m. ET to get the $240 Early Bird rate before the price increases to $289.

Its a great way to earn up to 28 hours of CE credits while getting the latest information on tax law, cybersecurity and more. And you can visit the IRS booths in the Virtual Exhibit Hall, including the TE/GE booth, where you can find other information and chat with the IRS.

TE/GE is presenting two topics at this years virtual Tax Forum:

- Charities & Tax-Exempt Organizations Update: Learn about recent law and guidance changes and how those changes may affect your charity. Also, learn about the current electronic filing requirements for returns filed by charities and more.

- Retirement Plans – IRS Compliance Initiatives: Learn about the latest IRS compliance initiatives for retirement plans and what to do if your client receives a letter from the IRS about their plan. Use our audit experience to identify and avoid common mistakes in plans.

Office Of Professional Responsibility

OPR investigates suspected misconduct by attorneys, CPAs and enrolled agents involving practice before the IRS and has the power to impose various penalties. OPR can also take action against tax practitioners for conviction of a crime or failure to file their own tax returns. According to former OPR director Karen Hawkins, “The focus has been on roadkill the easy cases of tax practitioners who are non-filers.” The current acting director is Elizabeth Kastenberg.

Also Check: Congress Mortgage Stimulus Program For Middle Class 2021

Advisory Group To The Internal Revenue Service Tax Exempt And Government Entities Division Meeting

A Notice by the Internal Revenue Service on

Document Details

Information about this document as published in the Federal Register.

- Printed version:

Document Details

Document Statistics

- Page views:

- as of 12/25/2021 at 6:15 pm EST

Document Statistics

This document has been published in the Federal Register. Use the PDF linked in the document sidebar for the official electronic format.

-

Enhanced Content – Table of Contents

This table of contents is a navigational tool, processed from the headings within the legal text of Federal Register documents. This repetition of headings to form internal navigation links has no substantive legal effect.

Enhanced Content – Table of Contents

Enhanced Content – Submit Public Comment

Enhanced Content – Submit Public Comment

Enhanced Content – Read Public Comments

Enhanced Content – Read Public Comments

Enhanced Content – Sharing

Enhanced Content – Document Print View

Enhanced Content – Document Tools

These tools are designed to help you understand the official document better and aid in comparing the online edition to the print edition.

These markup elements allow the user to see how the document follows the Document Drafting Handbook that agencies use to create their documents. These can be useful for better understanding how a document is structured butare not part of the published document itself.

Enhanced Content – Developer Tools

Federal Income And Payroll Tax

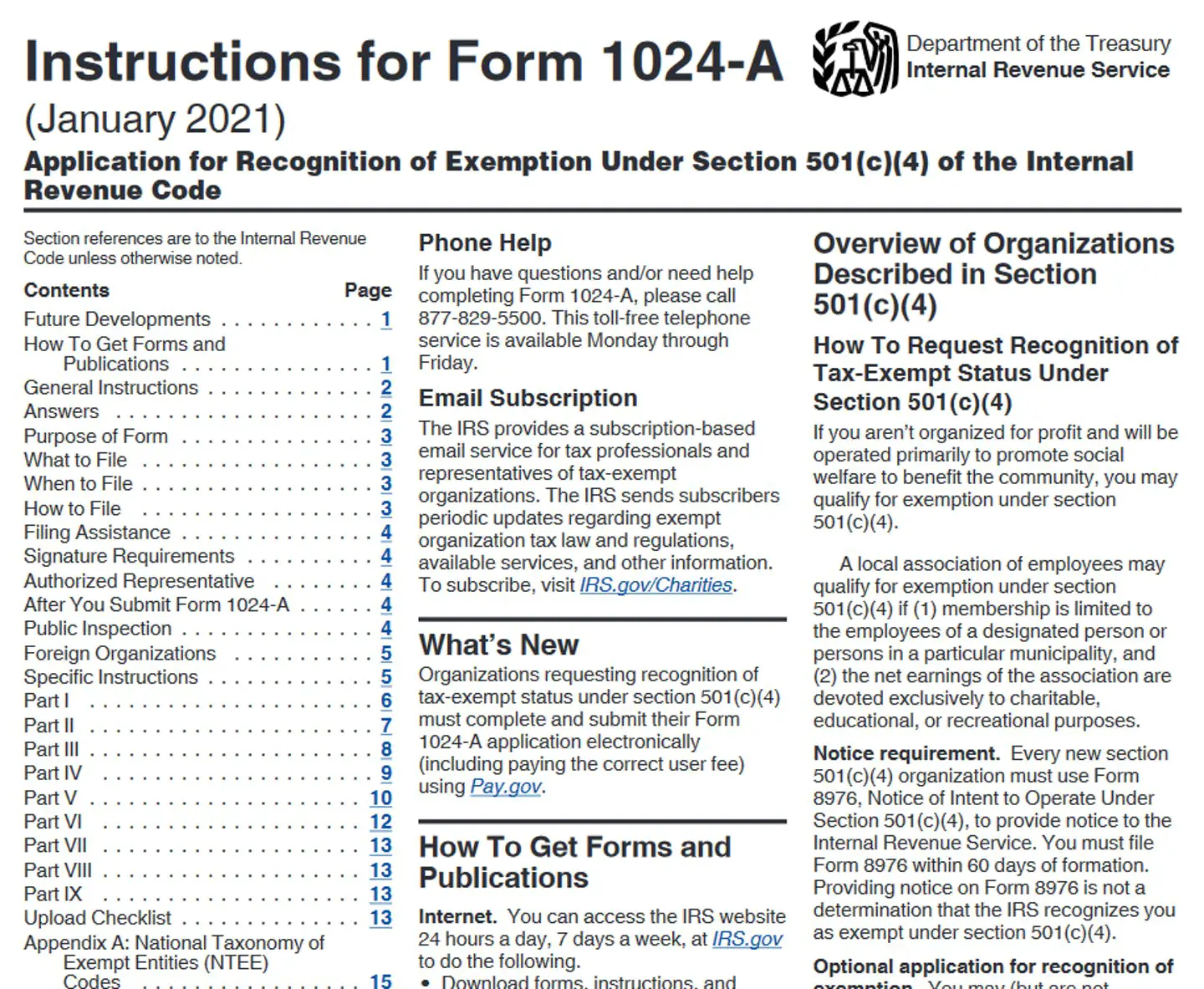

Refer to Tax-Exempt Status for Your Organization to review the rules and procedures for organizations that seek to obtain recognition of exemption from federal income tax under section 501 of the IRC. It explains the procedures you must follow to obtain an appropriate ruling or determination letter recognizing your organization’s exemption, as well as certain other information that applies generally to all exempt organizations. To qualify for exemption under the IRC, your organization must be organized for one or more of the purposes designated in the IRC. Organizations that are exempt under section 501 of the IRC include those organizations described in section 501. Section 501 organizations are covered in Tax-Exempt Status for Your Organization .

Also Check: Sacramento Federal Jobs

Outsourcing Collection And Tax

In September 2006, the IRS started to outsource the collection of taxpayers debts to private debt collection agencies. Opponents to this change note that the IRS will be handing over personal information to these debt collection agencies, who are being paid between 29% and 39% of the amount collected. Opponents are also worried about the agencies’ being paid on percent collected, because it will encourage the collectors to use pressure tactics to collect the maximum amount. IRS spokesman Terry Lemons responds to these critics saying the new system “is a sound, balanced program that respects taxpayers’ rights and taxpayer privacy”. Other state and local agencies also use private collection agencies.

In March 2009, the IRS announced that it would no longer outsource the collection of taxpayers debts to private debt collection agencies. The IRS decided not to renew contracts to private debt collection agencies, and began a hiring program at its call sites and processing centers across the country to bring on more personnel to process collections internally from taxpayers. As of October 2009, the IRS has ceased using private debt collection agencies.

In September 2009, after undercover exposé videos of questionable activities by staff of one of the IRS’s volunteer tax-assistance organizations were made public, the IRS removed ACORN from its volunteer tax-assistance program.

- NTEU, or

How To Contact Us

For answers to questions about charities and other non-profit organizations, call IRS Tax Exempt and Government Entities Customer Account Services at 829-5500 . If you prefer to write, use the address below.

For answers to employment tax questions, call the Business and Specialty Tax Line at 829-4933 .

To obtain a determination letter applying to a specific set of facts, or to send copies of amended documents write or fax to:

Internal Revenue Service

Read Also: Government Jobs Vegas

Commissioner Tax Exempt And Government Entities

The Commissioner, TE/GE, is the highest ranking executive in the Division and reports to the Deputy Commissioner, Services and Enforcement.

The Commissioner, TE/GE, together with the Deputy Commissioner, TE/GE is responsible for leading the development and execution of the Division’s long-term strategy consistent with the mission of the TE/GE Division and the Internal Revenue Service . This responsibility involves planning, managing, directing and executing nationwide activities for Employee Plans , Exempt Organizations , and Government Entities .

The Office of the Commissioner, TE/GE consists of the Commissioner, Deputy Commissioner, the Senior Technical Advisor and their immediate staff.

The Commissioner directly supervises the:

Deputy Commissioner, TE/GE

The Deputy Commissioner directly supervises the:

Director, Employee Plans

Director, Exempt Organizations and Government Entities

Director, Equity, Diversity and Inclusion

Director, Shared Services

Director, Compliance Planning & Classification

For additional information on the TE/GE Commissioner and Deputy Commissioner, go to: https://portal.ds.irsnet.gov/sites/TEGE/Pages/Home.aspx.

See the TE/GE organization chart:https://portal.ds.irsnet.gov/sites/TEGE/pages/lib/gen/org-chart.pdf.

1.1.23.3

Post Civil War Reconstruction And Popular Tax Reform

After the Civil War, Reconstruction, railroads, and transforming the North and South war machines towards peacetime required public funding. However, in 1872, seven years after the war, lawmakers allowed the temporary Civil War income tax to expire.

Income taxes evolved, but in 1894 the Supreme Court declared the Income Tax of 1894 unconstitutional in Pollock v. Farmers’ Loan & Trust Co., a decision that contradicted Hylton v. United States. The federal government scrambled to raise money.

In 1906, with the election of President Theodore Roosevelt, and later his successor William Howard Taft, the United States saw a populist movement for tax reform. This movement culminated during then-candidate Woodrow Wilson‘s election of 1912 and in February 1913, the ratification of the Sixteenth Amendment to the United States Constitution:

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

This granted Congress the specific power to impose an income tax without regard to apportionment among the states by population. By February 1913, 36 states had ratified the change to the Constitution. It was further ratified by six more states by March. Of the 48 states at the time, 42 ratified it. Connecticut, Rhode Island, and Utah rejected the amendment Pennsylvania, Virginia, and Florida did not take up the issue.

Also Check: Government Jobs In Sacramento

Irs Names Unit Heads For Taxexempt And Government Entities Division

WASHINGTONEvelyn Petschek, Commissioner of the Internal RevenueServices new Tax Exempt and Government Entities Division, todayannounced the directors for the divisions Employee Plans, Exempt Organizationsand Government Entities functions.

Carol Gold will be director of the new Employee Plans function. Gold hasheld a variety of positions within the current Employee Plans and ExemptOrganizations organization during her 23-year career with the IRS. She currentlyserves as director of the Employee Plans Division.

Steve Miller will head the new Exempt Organizations function. Currently theActing Assistant Commissioner for Employee Plans and Exempt Organizations,Miller spent several years in the Chief Counsels Office of Employee Benefits andExempt Organizations before joining the EP/EO organization in 1993. Miller alsohas experience as a staffer on the Joint Committee on Taxation and in privatepractice.

Ed Weiler will be director of the new Government Entities function. Weiler isa graduate of the 1987 Executive Development Program and has held a number ofpositions within the IRS including Deputy Assistant Commissioner EP/EO. Hecurrently serves as director of the Upstate New York IRS District.

The selection of these three very talented executives marks an importantmilestone in the modernization effort, Petschek said. With a solid managementteam in place, the Tax Exempt and Government Entities Division is well positionedto begin operations later this year.

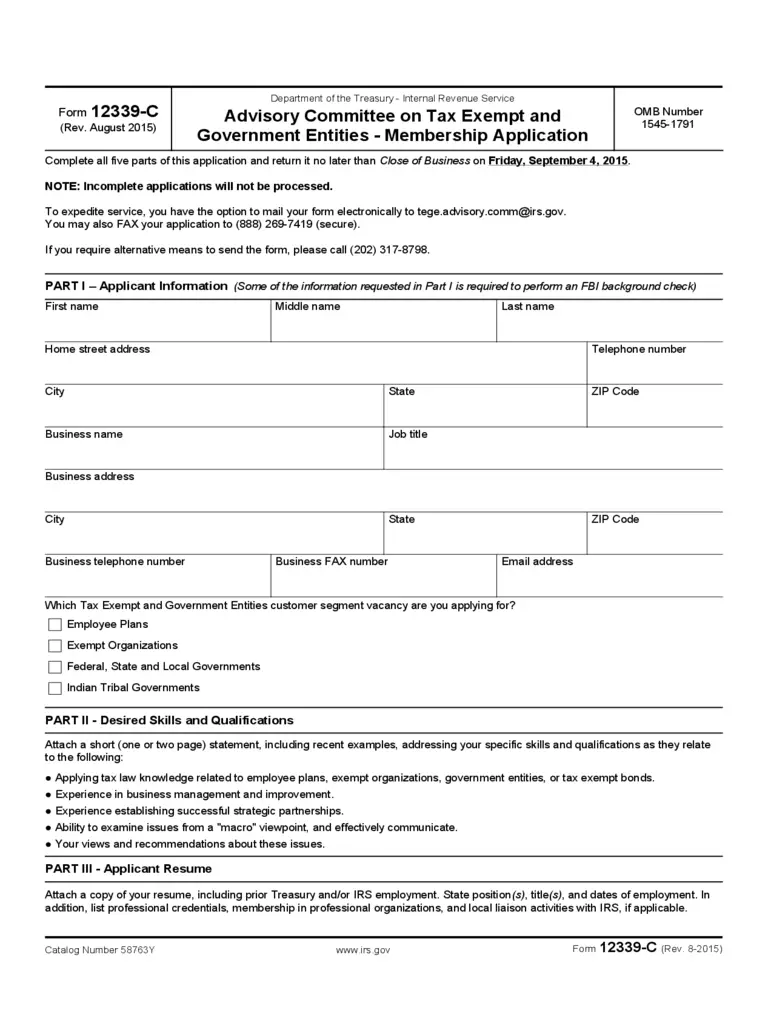

Advisory Committee On Tax Exempt And Government Entities Vacancies

Having trouble viewing this email? View it as a Web page.

| Tax Exempt Government Entities |

|

The IRS is seeking applicants for vacancies on the Advisory Committee on Tax Exempt and Government Entities . The committee provides advice and public input on the various areas of tax administration served by the Tax Exempt and Government Entities Division . Applications will be accepted through Sept. 26. This message was distributed automatically from the mailing list Tax Exempt & Government Entities Updates. Please Do Not Reply To This Message. |

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your . You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact .

This service is provided to you at no charge by the Internal Revenue Service .

Also Check: Government Contracts For Box Trucks

Compliance Planning And Classification

The mission of Compliance Planning and Classification is to develop and deliver the TE/GE Work Plan and associated case work to TE/GE.

The Compliance Work Plan includes the appropriate balance of exams and compliance checks selected using various methodologies, such as, Compliance Strategies, data- driven selections, referrals and claims. CP& C recommends Compliance Strategies and other case selection criteria to the TE/GE Compliance Governance Board and delivers this work to the relevant areas of TE/GE. CP& C also provides updates and feedback on results from the compliance actions taken by the functional areas to the Governance Board.

The Rulings and Agreements workplan consists of Determination work for Employee Plans Rulings and Agreements and Exempt Organizations Rulings and Agreements. These workstreams are driven by customers seeking rulings on the qualified status of retirement plans, organizations seeking tax exemption, and retirement plans that seek rulings or to correct operational and form defects with their plans.

The Director, CP& C, reports to the Deputy Commissioner, TE/GE, and is responsible for the classification and case assignment, issue identification and special review, and compliance planning and monitoring programs.

CP& C responsibilities include:

The Director, CP& C directly supervises and is responsible for the activities of:

Manager, Issue Identification and Special Review

Manager, Planning and Monitoring

Manager, Classification and Case Assignment

Office Of The Taxpayer Advocate

The Office of the Taxpayer Advocate, also called the Taxpayer Advocate Service, is an independent office within the IRS responsible for assisting taxpayers in resolving their problems with the IRS and identifying systemic problems that exist within the IRS. The current head of the organization, known as the United States Taxpayer Advocate, is Erin M. Collins.

You May Like: Jobs For History Lovers

Independent Office Of Appeals

The Independent Office of Appeals is an independent organization within the IRS that helps taxpayers resolve their tax disputes through an informal, administrative process. Its mission is to resolve tax controversies fairly and impartially, without litigation. Resolution of a case in Appeals “could take anywhere from 90 days to a year”. The current chief is Donna C. Hansberry.

Irsac Expands To Cover More Areas Of The Irs Irpac And Act To Join Centralized Advisory Committee In 2019

The IRS announced that the Internal Revenue Service Advisory Committees role will expand in 2019 to have a wider portfolio and will incorporate the Information Reporting Program Advisory Committee and the Advisory Committee on Tax Exempt and Government Entities . Although ACT will no longer exist, the IRS emphasizes that TE/GE issues will remain a priority area in the expanded IRSAC.

The Internal Revenue Service announced cost of living adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2019.

You May Like: Grants For Owner Operators