How Much You Need To Repay

Verify your loan or line of credit contract to figure out the following:

- the total amount you owe

- the interest rate that will be applied to your debt

- how youll repay your debt

- how much youll pay

- how long it will take to pay back your debt

Contact the organization that provided your student loan or line of credit if you dont have the information listed above.

Unable To Repay Student Loans

If you cant pay the full amount due on time or have to miss a student loan payment, your loan may be considered delinquent and you may be charged late fees. Contact your loan servicer immediately for help, and ask them about your options.

Learn about COVID emergency relief for federal student loans that has been extended through January 31, 2022.

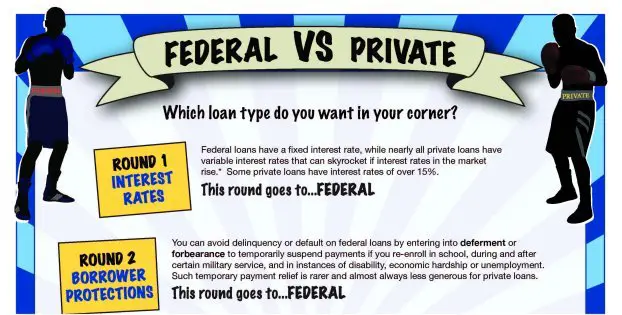

Taking Out Federal Student Loans Vs Taking Out Private Student Loans

There are two kinds of student loans you can get, federal and private. Federal loans are underwritten by the U.S. government and private loans are offered by private entities, such as a bank.

- To take out a federal student loan, you file the FAFSA, or the Free Application for Federal Student Aid.

- To take out a private student loan, you have to choose a lender and complete their application process.

Consider federal loan options in the students name first since they tend to have low fixed interest rates and special benefits only available on federal loans. Then use a private loan to help fill the gap.

Lets take a closer look at how the process works for each.

Read Also: Entry Level Government Jobs Sacramento

Federal And Private Student Loans

If you’re going to get one or more student loans, then you need to know what your options are. There are two basic categories of student loans: federal student loans and private student loans.

Federal student loans are issued by the U.S. Department of Education, and there are several loan options available. The Department of Education determines the types of loans you’re eligible for and the amount you can borrow based on information you enter during your Free Application for Federal Student Aid . Advantages of federal student loans include:

- They often have lower interest rates.

- Most won’t involve a credit check or require you to have a cosigner.

- There are income-based repayment plans available.

- They offer deferment and forbearance when borrowers can’t pay. With private loans, this may or may not be an option.

- You may qualify for loan forgiveness, which is when any remaining loan debt is forgiven after you’ve made a certain number of payments.

Private student loans are issued by private lenders, such as banks and credit unions. Although these loans lack many of the federal loan benefits listed above, they also have a few advantages of their own:

- Approval for private loans isn’t need-based like it is with federal loans, which could make it easier to borrow more.

- Amount limits are generally much higher with private lenders.

- Funding tends to happen more quickly with these types of loans.

How To Apply For Student Loans

The loan application process and timeline will vary depending on what type of loans you plan on taking out. I’ll talk generally about how to apply for both federal and private loans, although you should confirm the details with your lender, especially if you’re taking out private loans each lending institution will have its own protocols.

Read Also: Government Benefits For Legally Blind

Continuing Students Who Are From Or Normally Live In England

Youre a continuing student if you are:

- moving on to the next year of your course

- repeating a year of the same course or returning to a course after taking time out

- transferring onto a new course from your old course

If youre a continuing student whos from or normally lives in England, you should log in to your student finance account and apply online.

Claim Federal Student Loans

First, youll want to check your federal aid award package. After you filed a Free Application for Federal Student Aid , the Federal Student Aid Office evaluated your Expected Family Contribution and approved certain kinds and amounts of financial aid including student loans.

If you log into your student account with your college, you can navigate to your financial account section that outlines your aid award. You can see if there are any unused student loans or other aid you can claim. A financial aid administrator can also help you find out if you have unused federal aid.

In most cases, youll be able to borrow student loans up to the federal student loan limits or your cost of attendance , whichever is lower. Here are limits for common types of federal loans:

- Undergraduate Direct loan limits are as high as $7,500 a year for dependent students or $12,500 for independent students.

- Graduate Direct loan limits are $20,500 a year for independent students.

- PLUS loans are available to parents and graduate students to borrow up to the cost of attendance, after all other aid is applied.

Because youve already been approved for these student loans, you can quickly claim this unused aid and get funds disbursed to your student account. You can also talk to your parents about applying for a Parent PLUS loan to help cover costs.

Recommended Reading: City Of Las Vegas Government Jobs

Can You Get A Parent Plus Loan For Graduate School

Parent PLUS loans aren’t available for graduate school. Only parents of undergraduate students can get these loans. Graduate students can take out graduate PLUS loans. These are like parent PLUS loans but in the students name, not the parents.

Parents who want to help pay for advanced degrees can take out or co-sign private graduate school loans for their children. Private student loans have lower fees than PLUS loans and may come with lower interest rates, depending on your credit history.

But opting for a private loan means forgoing benefits like income-driven repayment and Public Service Loan Forgiveness. Before passing on PLUS loans, consider whether youll need those options based on your graduate degree and career path.

Student Lines Of Credit

If you have a student line of credit through your financial institution, you’ll have to pay the interest on the amount of money you borrow while youre still in school.

After you graduate, many financial institutions give you a 4 to 12-month grace period. During this time, you only have to pay the interest on your line of credit. After this period, youll pay back your debt through a repayment schedule agreed upon with your financial institution.

Contact your financial institution to get information about paying back your student line of credit.

Recommended Reading: County Jobs In Las Vegas

How To Borrow Without A Student Loan Cosigner

Before turning to private lending, prospective students should exhaust federal financial options. But sometimes they just dont provide enough money to complete your education. Private loans can help fill that gap. The Consumer Financial Protection Bureau reports that about 90% of new private loans require a cosigner, so this can be a much more difficult avenue to find financing. Be sure to find out right away if a cosigner is an eligibility requirement before investing too much time in a lender.

Interest rates and loan terms offered by private student loan lenders may not be as favorable as those offered by the government unless you have a good credit score and meet the lenders credit requirements. While the current interest rate for undergrads is 5.05% and 6.6% for graduate and professional degree-seeking students, private loan interest rates can range from 4 to 12%. It is always a good idea to search for reviews on any lender before making a decision.

The Application Process For A Federal Student Loan

You apply for a federal student loan by filling out and submitting the . You MUST submit the FAFSA to be eligible for a federal student loan.

Free money tip

Want to pay less for college? File the FAFSA® to see how much financial aid you can get. Sallie Mae and our partner Frank make applying easy with a faster, simplified process and step-by-step guidanceand it’s free.

To submit the FAFSA for federal student loans , there are a few things to keep in mind:

- Remember that theres no cost for submitting it.

- Complete the FAFSA every year you need money for college.

- Get it in as soon after October 1 as possible. The earlier, the better, since some grant money is awarded on a first-come, first-served basis.

Youll find out about how much youre eligible for in federal student loans when you receive your .

Read Also: Rtc Careers Las Vegas

Types Of Private Student Loans

When youve explored scholarships, grants, and federal loans, and still need money for college, you can consider a private student loan.

- Theyre issued by a bank or other financial institution.

- Private student loans are taken out by the student theyre often cosigned by a parent or another creditworthy individual.

- Parent loans are another way to get money for college. A parent or other creditworthy individual takes out the loan to help their student pay for college.

Madison is using 4 steps to ease the burden of college expenseshttps://play.vidyard.com/8KX2NTnzF7AiSB1BumQ77j?v=3.1.1& type=inline& referring_url=https%253A%252F%252Fwww.google.com%252F&

Taking Out Student Loans

College is a significant investment. Student loans can help you cover the cost so you can earn a degree and start your career, but they are paid back with interest so its important to only borrow what you need.

Before you take out a student loan, make sure to carefully review your repayment options and think ahead about how you will pay it back. Create a budget and stick to a plan so you can repay your student loans responsibly.

If you have additional questions about how to take out student loans, please visit our , or feel free to with any concerns.

Now that youve learned how to take out student loans, its time to learn .

You May Like: Governmentjobs.com Las Vegas

Who Can Get Federal Student Loans

Anyone attending a four-year college or university, community college, or career school can apply for federal student aid, including:

- Grants, which dont need to be paid back

- Work-study, which is part-time work that allows students to earn money while in school and

- Federal student loans

Most federal aid is decided based on financial need. Students must submit the FAFSA® and meet several other basic eligibility requirements to qualify.

Parents may also apply for federal student loans, called Federal PLUS Loans. These loans can also be applied toward the students educational costs.

| for Loans Disbursed Between July 1, 2021 and June 30, 2022 | |||

| Direct Loan for Dependent Undergraduates | Direct Loan for Independent Undergraduates | Direct Loan for Graduates | |

|---|---|---|---|

| No |

1Limit of combined subsidized and unsubsidized funds. back2Additional unsubsidized eligibility available for student whose parent is unable to obtain a PLUS loan. back

How To Take Out Private Student Loans Without A Cosigner

It is no secret that getting a college education in America can be a costly investment. Scholarships and grants are a great way to make a dent in your tuition, but they dont always cover all the expenses involved. Student loans are an option that many turn to as a way to invest in their future if they dont have enough cash on hand today.

Lenders will want some assurance that you will pay back your loan, and that is when a cosigner can come in handy. In 2015, more than 88% of all private loans had a cosigner, according to a report from MeasureOne. However, having a cosigner isnt always the best option for borrowers, or maybe it isnt an option at all. The cosigner, whether it is a parent, another family member or trusted friend, will also be on the hook for your loan and might not be able to take on that financial risk.

Fear not, there are other options for both graduate and undergrad students who do not have a cosigner when taking out student loans.

Read Also: Entry Level Government Jobs Las Vegas

How To Maintain Interest Free Status While You’re A Student

If you have taken out a government student loan in the past and do not have a current year’s loan, you are responsible for notifying the government of your full-time, in-school status. Otherwise, your loan may start accumulating interest.

You can request a confirmation of enrolment form from the Financial Aid and Awards, 422 University Centre . You must submit this form to the required government loan office within the current study period. Forms expire as of the last day of study for each term/school year and cannot be released after the study period has ended.

How Much Can You Borrow

Because you will have to pay back the money that you borrow with your student loans for college, only borrow what you really need. The amount that you can borrow depends on the type of loan. For federal loans, your college will determine the amount of money that you can borrow, but there are some limits:

- Undergraduate Federal Direct Stafford Loans: The borrowing limits are from $5,500 to $7,500 per year for dependent students and $9,500 to $12,500 per year for independent students, depending on your year in school.

- Graduate Federal Direct Stafford Loans: The borrowing limit is up to $20,500 per year for graduate and professional students and up to $40,500 per year for medical school students.

- Private loans: The maximum amount you can borrow from a private lender varies. Most lenders dont let you borrow more than your colleges cost of attendance minus other financial aid.

Direct loans are also subject toaggregate loan limits, meaning theres a maximum on the total amount that you can have in outstanding loans.

The borrowing limit for Federal Direct PLUS loans is generally the remainder of the cost of college not covered by Federal Direct Stafford loans and any other financial aid.

You May Like: Government Contracts For Dump Trucks

Consider Private Student Loans

Another option if you need to borrow more money than federal student loans can provide is to apply for a private loan from a bank, credit union, or other financial institution.

Private loans are available regardless of need, and you apply for them using the financial institution’s own forms rather than the FAFSA. To obtain a private loan, you will need to have a good credit rating or get someone who does have one, such as a parent or other relative, to cosign on the loan.

Having less-than-stellar credit can make it difficult to qualify for student loans. Private lenders will consider your income and credit history, and as a college student, you likely have poor credit or no credit at all. However, some lenders offer student loan options for borrowers with bad credit.

Generally, private loans carry higher interest rates than federal loans, and their rate is variable rather than fixed, which adds some uncertainty to the question of how much you’ll eventually owe. Private loans also lack the flexible repayment plans available with federal loans and are not eligible for loan consolidation under the Federal Direct Consolidation Loan program. However, you can refinance your private loans after you graduate, possibly at a lower interest rate.

Federal Direct Plus Loan

Grad PLUS and Parent PLUS loans are available to graduate students and parents of dependent undergraduate students. PLUS loans arent subsidized, so interest will start accruing as soon as the loan is fully disbursed. Repayment can be deferred while the student is enrolled in college and for six months after graduation.

You May Like: Government Jobs For History Majors

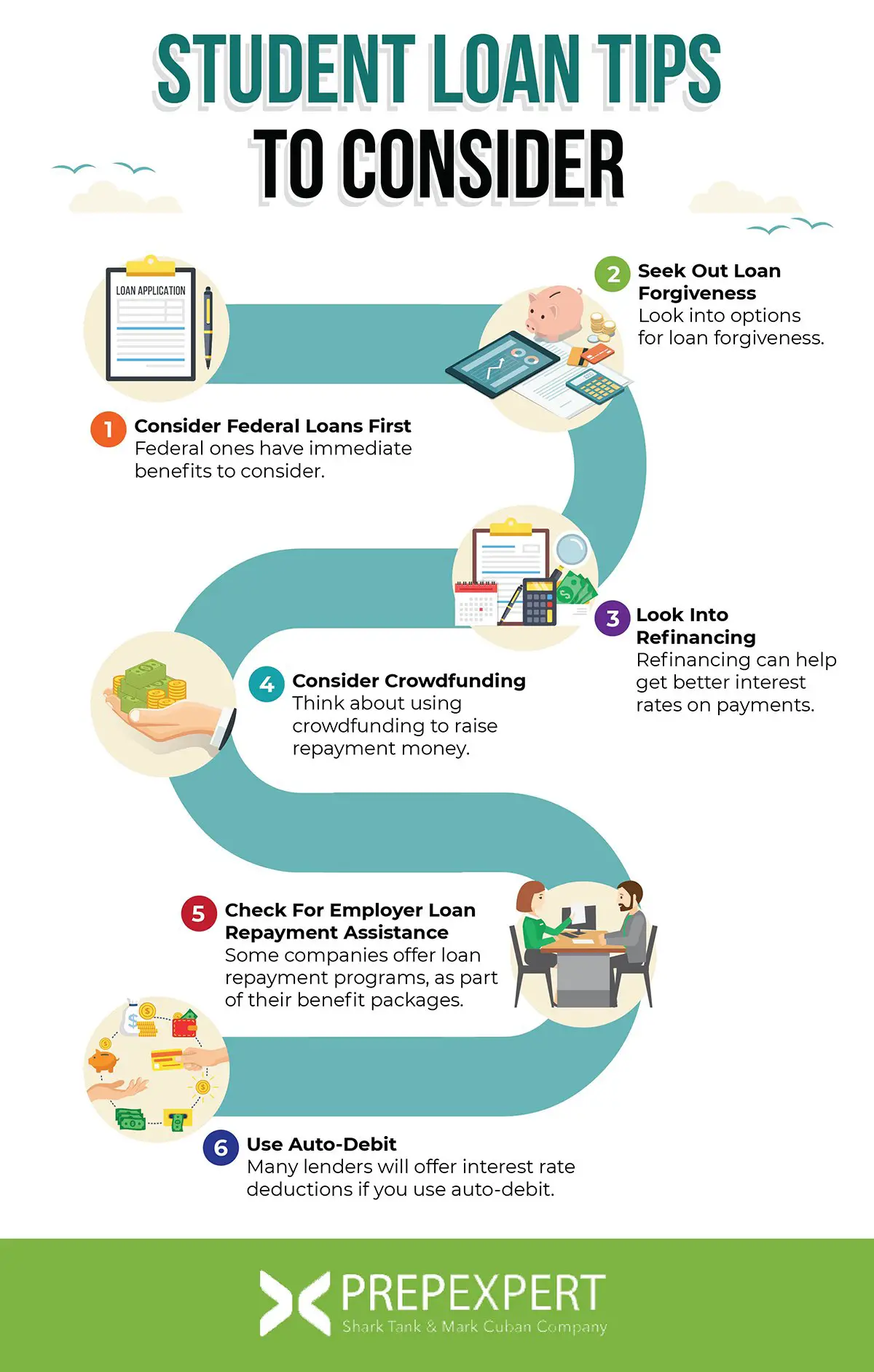

Take Advantage Of Interest Rate Discounts

An easy way to accelerate your student loan timeline is to utilize interest rate discounts that your loan servicer offers.

Federal loan servicers and some private lenders have automatic payment discounts, reducing your rate typically by around 0.25%. Some lenders offer additional loyalty discounts, further lowering your rate. These discounts help you save money and pay off your debt faster.

Student Loan Forgiveness Is Not The Same As Forbearance

Forgiveness eliminates your debt forbearance postpones your payments. If you’re having trouble making student loan payments, you can ask your lender for forbearance. Your lender may not give you a forbearance if you don’t meet eligibility requirements, such as being unemployed or having major medical expenses.

Interest on your loan will still accrue, and you can pay that interest during the forbearance period if you want. If you don’t pay it, the accrued interest will be added to your principal balance once your forbearance period is up. Your new monthly payment will be slightly higher as a result, and you’ll pay more interest in the long run.

The only relationship between forbearance and forgiveness is that when you’re in forbearance, since you’re not making payments, you’re not making progress toward the payment requirements of a forgiveness program you might be participating in.

Also Check: Government Dental Grants For Seniors

Alternative Ways To Afford Higher Education Without A Cosigned Loan

Student loans are not the only way to finance your education, just one piece of the puzzle. There are a number of different options students should consider to round out their financing.

Alternatives include:

- Contacting your school about work-study programs or grants

- Working full- or part-time and save up to take classes

- Taking general education courses at a community college

There are also options after graduation to help pay back federal loans. Work for a company that offers tuition reimbursement or utilizing government loan forgiveness programs are two popular options to get support with student debt after finishing school.