Control And Ownership Structures

Control and ownership structure refers to the types and composition of shareholders in a corporation. In some countries such as most of Continental Europe, ownership is not necessarily equivalent to control due to the existence of e.g. dual-class shares, ownership pyramids, voting coalitions, proxy votes and clauses in the articles of association that confer additional voting rights to long-term shareholders. Ownership is typically defined as the ownership of cash flow rights whereas control refers to ownership of control or voting rights. Researchers often “measure” control and ownership structures by using some observable measures of control and ownership concentration or the extent of inside control and ownership. Some features or types of control and ownership structure involving corporate groups include pyramids, cross-shareholdings, rings, and webs. German “concerns” are legally recognized corporate groups with complex structures. Japanese keiretsu and South Korean chaebol are corporate groups which consist of complex interlocking business relationships and shareholdings. Cross-shareholding is an essential feature of keiretsu and chaebol groups. Corporate engagement with shareholders and other stakeholders can differ substantially across different control and ownership structures.

Family control

Diffuse shareholders

Positive Impacts Of Corporate Governance In Companies

A good corporate governance system:

- Ensures that the management of a company considers the best interests of everyone

- Helps companies deliver long-term corporate success and economic growth

- Maintains the confidence of investors and as consequence companies raise capital efficiently and effectively

- Has a positive impact on the price of shares as it improves the trust in the market

- Improves control over management and information systems

- Gives guidance to the owners and managers about what are the goals strategy of the company

- Minimizes wastages, corruption, risks, and mismanagement

- Most importantly it makes companies more resilient.

What Makes The Structure Of The Board Of Directors

Boards and directors are not all the same. In fact, they face different challenges and their structure is shaped by different factors. A KMPG report synthesized some of the variables that can affect the foundations of a board:

- The legal and regulatory obligations of the relevant geography which may range from a highly regulated environment that dictates board composition and responsibilities to no applicable laws at all, depending on the country in which the business is based.

- The companys ownership structure which may range from a business closely held by a few family members who see each other on a daily basis, to one with numerous, geographically dispersed distant family members, to the inclusion of other investors, either through private equity investment or publicly traded stock.

- The expectations and interests of key stakeholders including owners, other interested family members , customers, and insurers.

- The companys attributes size, resources, maturity, culture, and level of complexity.

In the end, companies with a good corporate governance system, together with an experienced board that has a growth-mindset and sustainability concerns, will be better positioned to prosper both in the short term and on the long run.

Also Check: How To Get Government Freight Contracts

The Cadbury Code Of Best Practice

Corporate governance became a high profile issue in December 1992, with the publication of the Cadbury Code of Best Practice and the Report of the Committeeon the Financial Aspects of Corporate Governance . This Committee, chaired by Sir Adrian Cadbury, had been formed in 1991 at a time of general concern over standards of financial reporting and accountability, particularly in the light of the BCCI and Maxwell cases, and when controversy was beginning to develop over levels of directors’ remuneration. The Committee’s report was based on the premise that company directors should have the freedom to develop their companies and drive them forward, but that they should do so within an effective framework of accountability. The Committee’s recommendations therefore focussed primarily on the structure of the board, its control and reporting functions and the role of the external auditors, and drew on principles that were already being widely followed. Although the recommendations were aimed mainly at listed companies, the Committee’s objective was to raise the overall standards of corporate governance and the general level of public confidence in financial reporting. All entities were therefore encouraged to follow the recommendations in the Cadbury Code of Best Practice.

J.R. Boatright, in, 2012

Governance And Corporate Transparency

In the business world, transparency is a measure of how well information about a company is communicated to its shareholders and creditors. In other words, it reflects how much information an organization shares with those outside the organization. The concept stands in opposition to opacity or opaqueness, which describes conditions where there is little or no clarity concerning what actions have been undertaken, how policies are created, what products are offered, etc.

Read Also: Do Illegal Immigrants Get Government Help

Definitions Of Corporate Governance

The concept of corporate governance is poorly defined because it covers various economics aspects. As a result of this different people have come up with different definitions on corporate governance. It is hard to point on any one definition as the ultimate definition on corporate governance. So the best way to define the concept is to provide a list of the definitions given by some noteworthy people.

Goals Of Corporate Governance

The phrase corporate governance came into prominent use in the 1980s, and is often used narrowly to refer to the mechanisms and rules that govern relationships among direct corporate participants in publicly-traded firms, especially shareholders, directors, managers, and sometimes employees. But, historically, questions about social control over corporate behavior have been quite important. Since the corporate form first emerged as the dominant way to organize big business enterprises in the second half of the nineteenth century, policy concerns about corporations have, at various times, focused on antitrust, consumer protection, pollution control, worker and/or investor protection, corporate involvement in the political process, and corporate contributions of resources to charitable causes.

Broadly speaking, there are two schools of thought about the appropriate goals of corporate governance institutions and arrangements. The shareholder primacy view, which has been dominant in the US and other English-speaking countries since the 1980s, has focused on the set of governance problems that arise in publicly-traded corporations in which equity shares are held and traded by numerous individuals who have little or no management connection to the firm. This problem has been referred to in the literature as the agency cost problem resulting from the separation of ownership from control .

Yong Tan, in, 2014

Also Check: Apply For Government Grants For Small Business

The Emperor Has No Clothes

Corporate Governance, is not or should not be about debate and discussion on executive compensation, shareholder protection, legislation and so on. In recent times, the issue has become not only a subject of fierce debate and public outcry, but also, as a result of this and arising legislation, a subject which wearies many company directors. Put in other words, therefore, the phrase coined above means that there is very little substance to modern corporate governance, in the view of the authors. What is behind all the fracas is to a great extent common sense, like many principles in business. Directors, for example, should naturally be responsible in their role as fiduciaries of other peoples money. This is rarely mentioned in the conventional, reporting-based definition of corporate governance.

To use another metaphor, there is so much smoke, that we have lost sight of the fire. This fire is the real message and definition of corporate governance, which is undoubtedly beneficial to all, that we should be good directors. The early Cadbury and Greenbury codes did not arise simply to produce legislation, but to encourage self-regulation, with the ultimate goal that in applying the recommendations, the company will become more efficient, gain shareholder value, and hopefully increase market value as a result.

This could be described as: looking at Management through Corporate Governance-tinted glasses

The 3 Pillars Of Sustainable Development

Good corporate governance is built on sustainability. Sustainability is built on three important pillars that companies must meet: economic development, social safety and environmental protection. It is defined as the ability to be competitive and profitable today, without costing future generations the ability to do the same. The key tenets are that sustainability is of great concern with todays investors who are looking for economic profit but who also wish to be socially responsible. Also know as a win-win for shareholders interests.

Also Check: Af Us Government Money Market A

Create Cloud Policy Statements

Cloud-based IT policies establish the requirements, standards, and goals that your IT staff and automated systems will need to support. Policy decisions are a primary factor in your cloud architecture design and how you will implement your policy adherence processes.

Individual cloud policy statements are guidelines for addressing specific risks identified during your risk assessment process. While these policies can be integrated into your wider corporate policy documentation, cloud policy statements discussed throughout the Cloud Adoption Framework guidance tends to be a more concise summary of the risks and plans to deal with them. Each definition should include these pieces of information:

- Business risk: A summary of the risk this policy will address.

- Policy statement: A concise explanation of the policy requirements and goals.

- Design or technical guidance: Actionable recommendations, specifications, or other guidance to support and enforce this policy that IT teams and developers can use when designing and building their cloud deployments.

If you need help starting to define your policies, consult the governance disciplines introduced in the governance section overview. The articles for these disciplines includes examples of common business risks encountered when moving to the cloud and sample policies used to remediate those risks. For example, see the Cost Management discipline’s sample policy definitions.

Stock Exchange Listing Standards

Companies listed on the New York Stock Exchange and other stock exchanges are required to meet certain governance standards. For example, the NYSE Listed Company Manual requires, among many other elements:

- Independent directors: “Listed companies must have a majority of independent directors … Effective boards of directors exercise independent judgment in carrying out their responsibilities. Requiring a majority of independent directors will increase the quality of board oversight and lessen the possibility of damaging conflicts of interest.” An independent director is not part of management and has no “material financial relationship” with the company.

- Board meetings that exclude management: “To empower non-management directors to serve as a more effective check on management, the non-management directors of each listed company must meet at regularly scheduled executive sessions without management.”

- Boards organize their members into committees with specific responsibilities per defined charters. “Listed companies must have a nominating/corporate governance committee composed entirely of independent directors.” This committee is responsible for nominating new members for the board of directors. Compensation and Audit Committees are also specified, with the latter subject to a variety of listing standards as well as outside regulations.

You May Like: Free Government Phones From Verizon

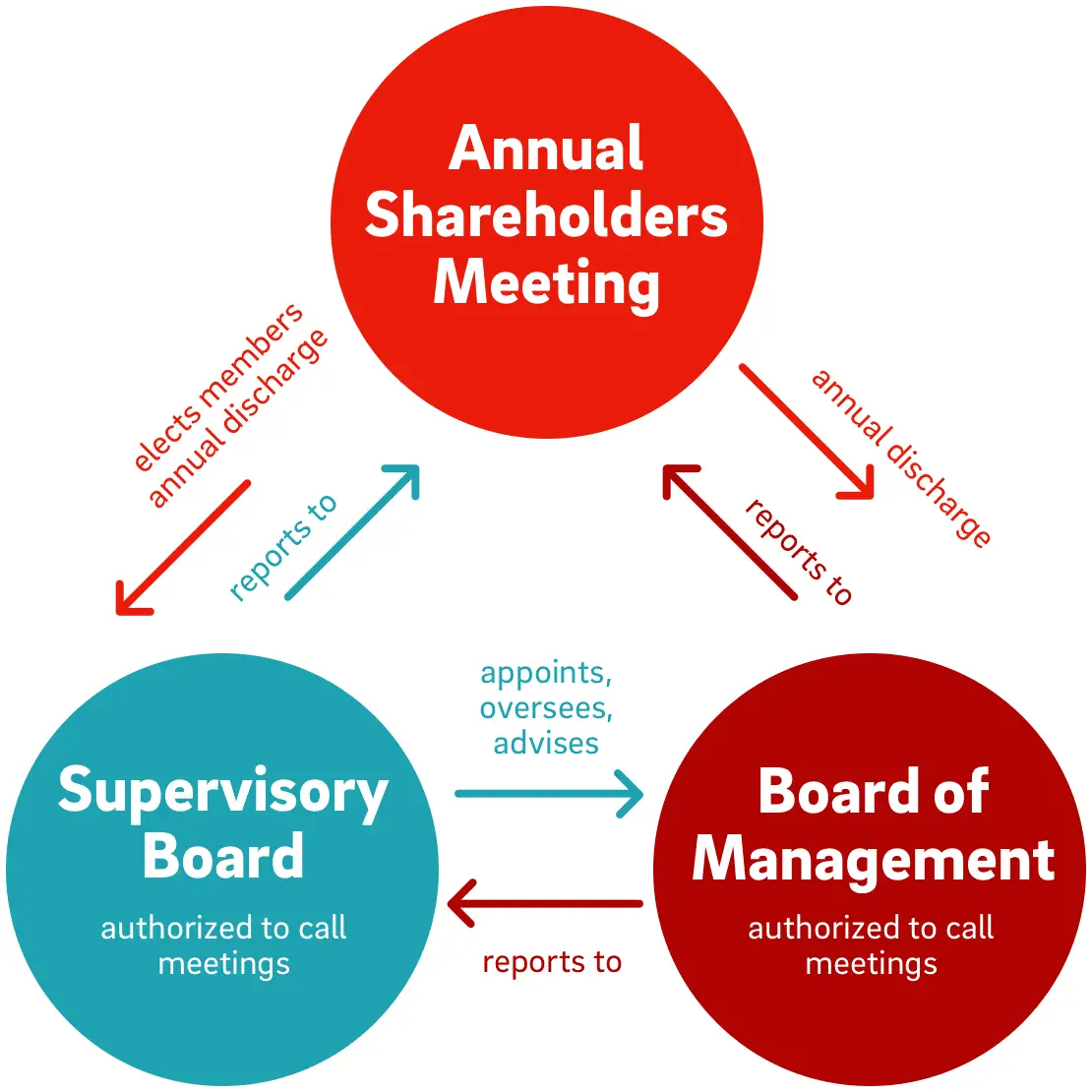

The Continental European Model Of Corporate Governance

In continental Europe, there is a different approach to corporate governance that advocates a multi-stakeholder approach. This has given rise to the stakeholder model which involves all those who have a stake in the company, thus placing emphasis on broader interests than just that of shareholders. The objective is to maximize not just shareholder value but also the interest of all other stakeholders such as workers, suppliers and even customers. Under this model, directors are seen as representatives with loyalty owed to all stakeholders rather than only to shareholders.

More Definitions Of Corporate Governance

Also Check: Government Help With Utility Bills

Current Trends & Corporate Governance Pressures

Beyond the expansion in scope from shareholder to stakeholder primacy, there are some interesting, current trends that are putting significant pressures on the corporate governance functions within organizations of all sizes.

Some examples are:

The Great Resignation

The so-called Great Resignation has created an environment where the very nature of work has changed. Firms must consider remote and hybrid working arrangements when planning to hire.

While this presents challenges, it has also opened the door to a much broader talent pool since companies are no longer required to hire people that live within commuting distance of the nearest office.

Climate change

Leadership at many organizations is realizing that climate change presents more than just environmental risks it can present existential risks to business operations .

With so many organizations making pledges to meet Net Zero or even carbon neutral emissions targets, having BOD representation with some ESG experience has become paramount in order to navigate the ESG disclosure landscape and to avoid the perception of greenwashing.

Geopolitical and Economic Uncertainty

Russias invasion of Ukraine in 2022, coupled with strained relations between two of the worlds economic superpowers , are a few of many factors that have converged to create chaos in supply chains, as well as subsequent economic uncertainty on a global scale.

Technology & Data

Corporate Governance: Commission Definitions

The system by which companies are directed and controlled.

Good corporate governance helps to build an environment of trust, transparency and accountability necessary for fostering long-term investment, financial stability and business integrity, thereby supporting stronger growth and more inclusive societies.

Corporate Governance is concerned with holding the balance between economic and social goals and between individual and communal goals. The corporate governance framework is there to encourage the efficient use of resources and equally to require accountability for the stewardship of those resources. The aim is to align as nearly as possible the interests of individuals, corporations and society

is the method by which a corporation is directed, administered or controlled. Corporate governance includes the laws and customs affecting that direction, as well as the goals for which the corporation is governed. The principal participants are the shareholders, management and the board of directors. Other participants include regulators, employees, suppliers, partners, customers, constituents and the general community. Wikipedia

Corporate governance is not an abstract goal, but exists to serve corporate purposes by providing a structure within which stockholders, directors and management can pursue most effectively the objectives of the corporation.US Business Round Table White Paper on Corporate Governance September 1997

Recommended Reading: What Do Government Contractors Do

Corporate Governance: Introduction Definition Features Importance Benefits And Other Details

ADVERTISEMENTS:

Corporate Governance: Practitioner Definitions

is gathering together a group of smart, accomplished people around a board table to make good decisions on behalf of the company and its stakeholders. As We Start Anew, Jim Kristie, editor and associate publisher of Directors & Boards.

is what you do with something after you acquire it. Its really that simple. Most mammals do it. Unless they own stock. it is almost comical to suggest that corporate governance is a new or complex or scary idea. When people own property they care for it: corporate governance simply means caring for property in the corporate setting. Sarah Teslik, former Executive Director of the Council of Institutional Investors

is the relationship among various participants in determining the direction and performance of corporations Monks and Minow, Corporate Governance, from 1995 version.

. is about how suppliers of capital get managers to return profits, make sure managers do not misuse the capital by investing in bad projects, and how shareholders and creditors monitor managers.American Management Association

. is the relationship between corporate managers, directors and the providers of equity, people and institutions who save and invest their capital to earn a return. It ensures that the board of directors is accountable for the pursuit of corporate objectives and that the corporation itself conforms to the law and regulations. International Chamber of Commerce

You May Like: Government Funded Health Insurance Programs

Corporate Governance And The Board Of Directors

The board of directors is the primary direct stakeholder influencing corporate governance. Directors are elected by shareholders or appointed by other board members. They represent shareholders of the company.

The board is tasked with making important decisions, such as corporate officer appointments, executive compensation, and dividend policy.

In some instances, board obligations stretch beyond financial optimization, as when shareholder resolutions call for certain social or environmental concerns to be prioritized.

Boards are often made up of insiders and independent members. Insiders are major shareholders, founders, and executives. Independent directors do not share the ties that insiders have. They are chosen for their experience managing or directing other large companies. Independents are considered helpful for governance because they dilute the concentration of power and help align shareholder interests with those of the insiders.

The board of directors must ensure that the company’s corporate governance policies incorporate corporate strategy, risk management, accountability, transparency, and ethical business practices.

A board of directors should consist of a diverse group of individuals, including those who have skills and knowledge of the business and those who can bring a fresh perspective from outside of the company and industry.

Members Of A Governance Team

The board of directors is the main influence here, composed of major shareholders, founders, and executives. However, it may include independent directors.

One of the main goals of corporate governance is ensuring that the leaders of a company are managing the organizations finances effectively and acting in the interest of all stakeholders. Most companies also need to comply with external laws and policies governing their particular industry.

The board and the management apparatus put in place below it are responsible for setting a goal or purpose to work towards, developing a consistent process to achieve it, organizing operations to support that process, evaluating performance outcomes, and using those outcomes to grow themselves and employees as individuals or teams.

Read Also: Government Assistance For Seniors Living At Home