Cost And Price Analysis For Government Contracts

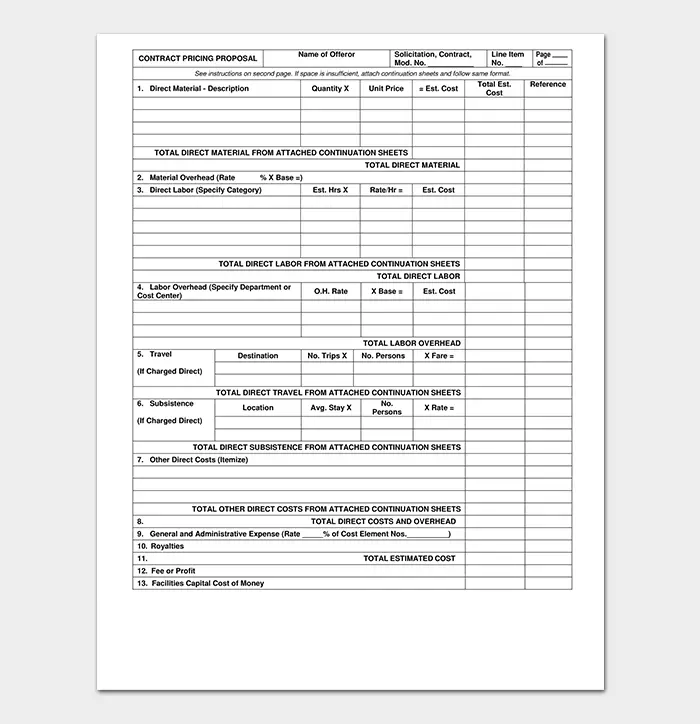

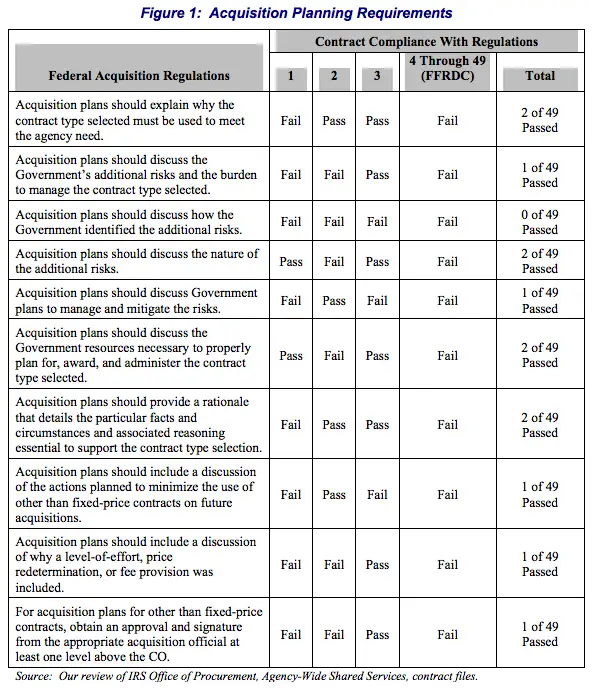

Federal Acquisition Regulation 15.402 requires government contracting officers to purchase supplies and services from responsible sources at fair and reasonable prices.

Contracting officers use cost and/or price analysis to determine that prices are fair and reasonable. The method and extent of the analysis depends on several factors, including the dollar value and urgency of the contract.

For many contracts, price analysis will establish that prices are fair and reasonable. Informal price analysis must be performed on all procurements over $3,000. Contracts over $30,000 require formal, written price analysis.

If price analysis and negotiation fail to achieve fair and reasonable prices, cost analysis with documentation of expenses may be required. Contracts over $700,000 also trigger cost analysis requirements of The Truthful Cost or Pricing Data Act .

Scoring Government Contracts Takes An Increasing Amount Of Time And Money

Uncle Sam is spending less, and that means that businesses are having to fight harder to win business contracts with the U.S. government.

In 2012, small-business contractors spent $128,628 on average to secure a federal government contract, according to an annual survey of government contractors released today by American Express. That is a 49 percent increase over the $86,124 active small-business contractors spent in 2009 and a 24 percent increase over the $103,827 spent in 2010. The survey is part of its Government Contracts Program, which helps train and educate small-business owners on how to win government contracts.

Part of that is because “spending” has become a dirty word in Washington, D.C., as the White House faces budget woes. The U.S. government spent $517 billion in its 2012 fiscal year, which ends in September, on contracts. That’s down 6 percent, or $35 billion, from what it spent in 2009.

Related: U.S. Federal Spending at Small Businesses Misses Mark. Again.

Of the money spent on government contracts, 23 percent is supposed to go to small businesses. The U.S. government has repeatedly missed that goal. The amount of work for Uncle Sam available to business is slipping, and the small-businesses fighting for remaining contracts are having to invest more time and money to win them.

And this survey, which was taken in February and March, was before sequestration hit, further tightening Uncle Sam’s belt.

Jd Edwards Enterpriseone Project And Government Contract Accounting Overview

This implementation guide describes how to use the programs and features within the JD Edwards EnterpriseOne Project and GovernmentContract Accounting system to set up and manage contracts that you enter into with the U.S. federal government as wellas complex commercial contracts. To use most of these programs and features, you must select the Project and Gov Contract Accounting Used check box in the Billing Constants program .

Managing contracts involves billing and recognizing revenue for transactions from multiple JD Edwards EnterpriseOne systems.For example, you bill for the time that your employees work and for the materials used for the contract. Therefore, many JDEdwards EnterpriseOne systems include programs or features to support PGCA. This implementation guide also includes chaptersthat describe how the following JD Edwards EnterpriseOne systems support PGCA:

-

Contract and Service Billing

-

Payroll and Time and Labor

-

General Accounting

-

Expense Management

Note. The chapters for these JD Edwards EnterpriseOne systems are overviews and do not provide details about base functionality.The details for these systems are included in their respective implementation guides. You should be familiar with the basefunctionality of these systems before using this implementation guide.

PGCA for Commercial Contracts

PGCA for U.S. Federal Government Contracts

Recommended Reading: Types Of Government Mortgage Loans

Time And Materials Risk

For Time and Materials contract, they are always level of effort contracts, because thats what a Time and Materials contract buys: hours. The contractors performance risk is very low, because the only obligation is to furnish the hours. The cost risk is also moderately low because remember part of Time and Materials is Cost Reimbursable so there youre going to get back whatever you spend. Its only the labor that has any risk at all, and thats only the pricing of the labor and the indirect costs. If your pricing model is good, then the cost risk is going to be low on the labor portion of a Time and Materials contract. The governments risk is just like a fixed price level of effort its going to be high because theres no assurance theyre going to get what they want. The only assurance they have is that theyre going to get the hours they ordered. Now the cost risk is relatively low because they know exactly what every hour is going to cost upfront. What they dont know is whether theyre going to get what they wanted out of those hours or not, and thats why the performance risk is high.

Jd Edwards Enterpriseone Project And Government Contract Accounting Implementation

This section provides an overview of the steps that are required to implement JD Edwards EnterpriseOne Project and GovernmentContract Accounting.

In the planning phase of your implementation, take advantage of all JD Edwards EnterpriseOne sources of information, includingthe installation guides and troubleshooting information. A complete list of these resources appears in the preface in About This Documentation, with information about where to find the most current version of each.

When determining which electronic software updates to install for JD Edwards EnterpriseOne Project and Government ContractAccounting, use the EnterpriseOne and World Change Assistant. EnterpriseOne and World Change Assistant, a Sun Microsystems,Inc Java-based tool, reduces the time required to search and download ESUs by 75 percent or more and enables you to installmultiple ESUs at one time.

See JD Edwards EnterpriseOne Tools 8.98: Software Update Guide.

Global Implementation Steps for JD Edwards EnterpriseOne Project and Government Contract Accounting

This table lists the suggested implementation steps for JD Edward EnterpriseOne Project and Government Contract Accounting.

|

Step |

Don’t Miss: How To Rent Your Home To The Government

Facilities Capital Cost Of Money

Facilities capital cost of money is an imputed cost related to the cost of contractor capital committed to facilities. CAS 414, Cost of Money as an Element of the Cost of Facilities Capital, provides detailed guidance on calculating the amount of facilities capital cost of money due under a specific contract. Under CAS 414, a business units facilities capital cost of money is calculated by multiplying the net book value of the business-units facilities investment by a cost of money rate based on the interest rates specified semi-annually by the Secretary of the Treasury under Public Law 92-41. The business-units facilities capital cost of money is then broken down by overhead pool and allocated to specific contracts using the same allocation base used to allocate the indirect costs in the overhead pool.

Facilities capital cost of money is determined without regard to whether the source is owners equity or borrowed capital. It is not a form of interest on borrowing by the firm. COM is an allowable cost element for related party rent transactions in accordance with FAR 31.205-36.

Brief History Of Government Contracts:

Contract types have been around since the very first financial transactions. In the beginning, all contracts were Fixed Price. When World War I came around, the concept of tear down and repair contract types were introduced. There was a Fixed Price order to tear down a piece of equipment that had failed. However, the problem was identified, and a proposal was prepared to repair it.

Next, a Time and Materials order was issued to make the repair. This type of contract is still very common today, even at your local auto repair shop. A major difference is that the auto repair shop usually does the diagnosis part at no charge. They look at it and tell you whats wrong with it and do the proposal on speculation.

When World War II rolled around, the concept of Cost Reimbursable contracts was born because there simply wasnt time for definitive specifications. The contractors found themselves developing things while the specifications were being written. Its just not possible to provide a fixed price for an effort like that you dont know where youre going, much less where you are.

The three basic contract types are fixed price, also called Firm Fixed Price and abbreviated FFP. If you are looking in the dictionary of acronyms, you will find FFP under contract types, Time and Materials, or labor hour T& M contracts, and Cost Reimbursement or Cost-Plus type contracts.

So how much money does the government spends on these contracts, and how much is allocated to each type?

You May Like: List Of Government Programs For Minorities

Determine Your True Costs To Best Price Out A Project

Why do small businesses tend to get their cost information wrong? Simply because many, if not most, small businesses don’t really know what their overhead costs are.

Often, when pricing out a project, businesses will simply take their prime costs and mark that figure up by some arbitrary percentage that they believe is sufficient to cover all indirect costs and give them some profit. Or they will use a single, company-wide rate applied on only one type of base, such as direct labor hours or engineering hours, for assigning indirect costs to the product or service provided. In either case, if this estimated percentage is higher than what their overhead really is, it affects their ability to be competitive. If their estimate is lower than what their costs really are, it affects their ability to be profitable.

If your business falls into one of these categories, we strongly recommend that, before you bid on a contract , you take the time and the steps necessary to determine your actual costs.

You might consider using some form of activity-based costing to accomplish this. ABC, in its simplest terms, is a cost management method that allows a business to determine the actual cost associated with each product and service. With this method, you look at every item and activity in your business associated with putting out your product or service and then attach a cost to it. In other words, you break your costs down to their least common denominator so you know what they really are.

Getting Started With Jd Edwards Enterpriseone Project And Government Contract Accounting

This chapter provides an overview of JD Edwards EnterpriseOne Project and Government Contract Accounting and discusses:

-

JD Edwards EnterpriseOne Project and Government Contract Accounting business process.

-

JD Edwards EnterpriseOne Project and Government Contract Accounting integration.

-

JD Edwards EnterpriseOne Project and Government Contract Accounting implementation.

Don’t Miss: Government Jobs For History Majors

How We Can Help

Contractors are required to support the cost and/or price analysis of the government. While the government may ask you to provide any data theyd like, you are only required to submit data permissible per FAR 15.403. Many small contractors divulge more information than they should, which can lead to a drawn out award process and the blurring of contract operational activities such as reporting requirements.

As experienced government contract professionals we will guide you through what you must do, what you may want to consider, and what you do not want to do during this process.

Jd Edwards Enterpriseone Project And Government Contract Accounting Integration

The JD Edwards EnterpriseOne Project and Government Contract Accounting system integrates with these JD Edwards EnterpriseOnesystems from Oracle:

JD Edwards EnterpriseOne Address Book

The JD Edwards EnterpriseOne Address Book system enables you to set up customer master records for the government entitiesand other customers with which you enter into contracts. You also set up supplier master records for the suppliers and subcontractorsthat will provide materials and perform work for contracts and employee records for internal employees.

JD Edwards EnterpriseOne Contract and Service Billing

To process billing and recognize revenue for PGCA contracts, you use many of the existing programs within the JD Edwards EnterpriseOneContract and Service Billing system, for example, the Journal Generation , Workfile Generation , Invoice Generation, and Contract Billing Line Details programs.

JD Edwards EnterpriseOne Procurement

You use the JD Edwards EnterpriseOne Procurement system to enter purchase orders for materials for contracts. The purchaseorders are then matched to vouchers, which you post to the general ledger. When you run the Workfile Generation program ,the system creates records in the Billing Detail Workfile table for the purchase order transactions so that you canbill for the cost of the materials.

JD Edwards EnterpriseOne Subcontract Management

JD Edwards EnterpriseOne General Accounting

JD Edwards EnterpriseOne Accounts Payable

JD Edwards EnterpriseOne Job Cost

Also Check: Louisiana Government Grants For Small Business

Dcaa Audit With Hybrid Contracts

Sometimes these hybrid contracts will contain the allowable cost and payment clause. If they do, that triggers the requirement for an Incurred Cost Submission. DCAA considers the Fixed Price hybrids, if they have cost type features, to be cost type contracts. They look for them in the Incurred Cost Submission schedules, and they will reject the submission when they find a hybrid contract that has been improperly classified.

These things are difficult to detect and theyre often missed, especially on a cursory review, and DCAA will sometimes miss them until its time to audit the incurred cost submission, three, four, or five years after the costs were booked. They then find that the contract was misclassified, reject the submission, and it must be done all over again.

The Incurred Cost Submission is used to establish a firms indirect rates for each year. Your fringe rates, your overhead rates, your General and Administrative or G& A rate, your Subcontract and Material Handling or SCMH rate, this is required if you have any contracts with the Allowable Cost and Payments clause in them. It is not determined by contract type. Contract type should be determined whether the clause is there or not, but if the clause is there, then the incurred cost submission is required, so its worth looking in your contracts and contracts groups to determine whether the clause is there or not, and not look at what the contract type says it is.

Cost Of Money Law And Legal Definition

Cost of money refers to the interest that could be earned if the amount invested in a business or security was invested in a government bond or time deposit. In other words the amount of interest that would be earned if the dollar value of inventory were invested at the State’s current investments earning rate. It also refers to the imputed cost determined by applying a cost-of-money rate to facilities capital employed in contract performance, or to an investment in tangible and intangible assets while they are being constructed, fabricated or developed for the contractor’s own use. Although technically not a recovery of interest, cost of money is intended to compensate a contractor for the capital cost of employing certain facilities in the performance of contracts, and therefore has many of the characteristics of a reimbursement for interest. However a cost of money provision is allowable only if the contractor’s capital investment is accounted for in accordance with the relevant Cost Accounting Standards and is specifically identified or proposed in the contractor’s cost proposal for a given contract.

You May Like: Environmental Social And Governance Investing

A Snapshot Of Government

In fiscal year 2020, the federal government spent more than $665 billion on contracts, an increase of over $70 billion from fiscal year 2019. Half of this increase, or $35 billion, is attributed to spending on medical supplies and pharmaceuticals to treat COVID-19 patients, among other things related to COVID-19.

Our infographic shows more details on how federal contracting dollars are spent across the federal governmentincluding which agencies obligated the most funds on contracts, what they bought, and whether the contracts were competed. In this years infographic, we also included information on federal spending under a special authority known as other transaction agreements . OTAs are exempt from the Federal Acquisition Regulation and as a result, agencies can customize them to help meet mission needs quickly and attract non-traditional government contractors. OTA usage has grown significantly over the past 5 years, with obligations increasing from $1.7 billion in 2016 to $16.5 billion in fiscal year 2020.

Overhead Vs G& a Costs

It can be difficult to differentiate overhead and G& A cost items, especially in small businesses where owners and employees wear many different hats.

Overhead costs are often referred to as contract support. They support a specific operation or function of the company and are usually related to a group of projects . A good rule of thumb is to say that an overhead cost exists because your company has billable work if you had no billable work, you would have no overhead costs. Examples include the cost of obtaining security clearance for employees and a proportionate share of facilities costs, such as rent and office supplies.

G& A costs are those that are necessary to the overall operation of the business. They are necessary to run a business, whether you have billable work or not, and typically include executive costs, legal and accounting fees, IT services, and a proportionate share of facilities costs.

Generally, if an employee usually charges his or her time to direct labor, then the indirect expense would be allocated to overhead. If an individual charges time to G& A, then his or her indirect expenses would be allocated to G& A.

Also Check: How To Become An Agent For The Government

Direct Vs Indirect Costs

In government contracting, a direct cost is any that is specifically identified with a particular final cost objective . To determine this, ask if the cost would be incurred even if the specific contact did not exist. If the answer is no, then it is generally a direct cost. These typically include costs related to labor, subcontractor expenses, materials, and travel.

Indirect costs, on the other hand, are not directly identified with a single final cost objective, but rather with two or more final cost objectives or with at least one intermediate cost objective, such as utilities, rent, insurance, and depreciation.

Indirect costs are accounted for in various pools. The totals of those cost pools are then allocated to each contract. In most cases, your company will create cost pools for fringe benefits, overhead, and G& A. Overhead cost pools will sometimes be spilt out further to allocate home office and field employees. Other common cost pools include material handling and subcontractor handling pools.

It is important to note that the number and composition of cost pools are determined by the contractor, not through government regulations. This is up to you, so know that fewer pools can make it easier to monitor rates and keep administrative costs down, but more cost pools can lend you a higher degree of financial accuracy and transparency.