Student Loan Default: What It Is And How To Recover

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Student loan default can feel overwhelming. But if youve defaulted, youre not alone: Within three years of entering repayment, 9.7% of student loan borrowers default, according to the Education Department.

» MORE:

As part of the first coronavirus relief bill, the government stopped federal student loans from entering default and paused collection activities on those that already had. These protections are in place through Jan. 31, 2022.

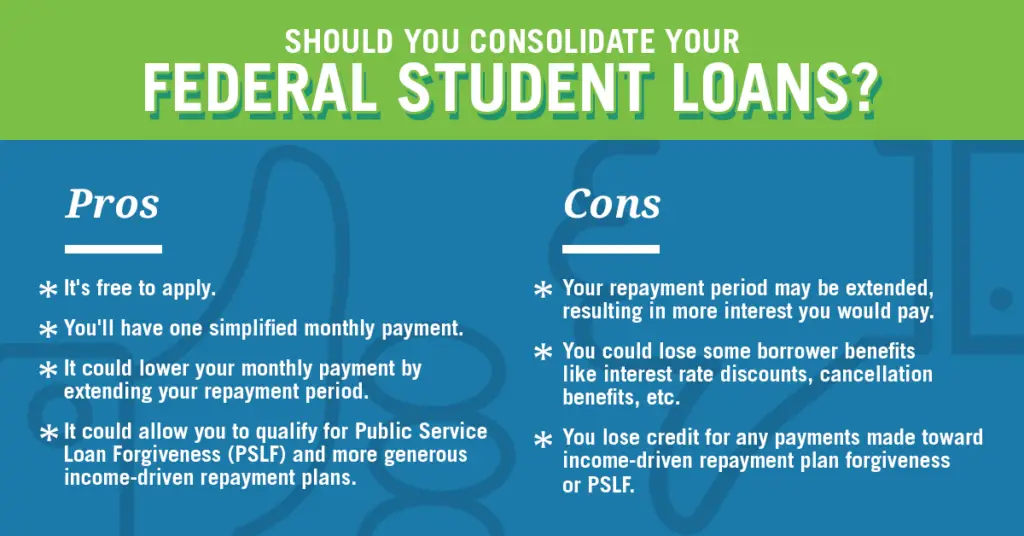

During this break, you can get loans back in good standing with options like loan rehabilitation and consolidation. Take action as soon as possible to avoid penalties like and when collection activities resume.

Student loan default means you did not make payments as outlined in your loans contract, also known as its promissory note. Default timelines vary for different types of student loans.

Before federal student loans default, they enter a status known as delinquency. Loans are considered delinquent as soon as you , although your servicer wont report these late payments to credit bureaus until 90 days have passed.

» MORE:

» MORE:

Repayment

Rehabilitation

Consolidation

» MORE:

What Does Student Loan Permanently Assigned To Government Mean

Stanley tate

The process of fixing your credit can be daunting. Credit reports contain a lot of information and use different codes to tell a story about your financial responsibility. In regularly reviewing your report, you may encounter an entry that says, âcollection account student loan permanently assigned to government.â

This status indicates that youâve defaulted on a federal student loan, and it was paid through insurance and closed. But it doesnât mean you no longer owe the debt. Hereâs what you need to know when your credit report shows âstudent loan permanently assigned to government.â

The Span Of Time Manage Defaulted Student Education Loans Stay On Credit File

Usually, bad foods should stay on your report for seven age from your go steady your halted making their monthly installments.

Student credit and damaging mark happen to be a bit of different: the effort body modifications dependent type of finance.

For individual lending, the timeline is 7 a long time because of your final payment.

For national personal loans, committed body is actually either:

You May Like: City Of Las Vegas Government Jobs

Why Navient Quit Your Student Loans

Navient, which services $300 billion of student loans for 12 million student loan borrowers, announced last week that Navient will exit federal student loan servicing with the U.S. Department of Education. . The surprising move, which came days before a major government shutdown was averted, could leave nearly six million student loan borrowers with a new student loan servicer. Navient signed a definitive agreement to transfer its federal student loan servicing for U.S. Department of Education-owned student loan accounts to Maximus, another student loan servicer. Navient and Maximus have submitted a preliminary request for review to Federal Student Aid , but the U.S. Department of Education must approve the transfer from Navient to Maximus. Why did Navient exit student loan servicing for federal student loans? . Navient was likely to face increase regulatory oversight from the U.S. Department of Education, Congress, state attorneys general and the Consumer Financial Protection Bureau .

Federal Student Aid Ombudsman Office

If you’ve tried all of these places and are still in need of help, consider contacting the Federal Student Aid Ombudsman office. The Department of Education’s student loan ombudsman helps borrowers with student loan problems. The ombudsman is a last resource usually, it will help you only after you’ve tried to resolve your issue yourself. You can contact the student loan ombudsman office at 877-557-2575.

Recommended Reading: City Of Las Vegas Government Jobs

If You Want To Fix Your Credit: Loan Rehabilitation

Student loan rehabilitation is often the best option to fix your credit because itâs the only one that removes the default from your credit report. However, the late payments will remain for 7 years.

You can rehabilitate your loans by contacting the collection agency assigned your debt and asking to enter the program. Under the loan rehabilitation program terms, you must make nine monthly loan payments within 10 consecutive months. Your monthly payments will be 15% of your discretionary income. If you canât afford that amount, you can request something more affordable.

You can only rehabilitate a student loan once. If you choose this option, make sure your contact information is up to date and that you can afford your payments once you complete the process. Ask the new loan servicer about enrolling in an income-driven repayment plan.

For Those Who Desire To Improve Their Credit Rating: Loan Rehabilitation

Because student loan rehabilitation eliminates the default from your credit report, it is frequently the best choice to repair your credit. However, the outstanding debts will stay in place for seven years.

Rehabilitating your loans is possible by calling the collecting agency assigned to your debt and asking to join the program, which is free of charge. Nine monthly loan payments must be made over ten consecutive months as part of the debt rehabilitation program.

Youll pay 15% of your discretionary money each month. If you are unable to afford that sum, you may request an alternative amount.

Student debt may only be rehabilitated once. Consider your financial situation before deciding on this choice, and make sure your contact information is up to date. Inquire with your new lender about the possibility of switching to a payment schedule based on your income instead of your principal and interest.

Also Check: City Of Las Vegas Government Jobs

What Does Student Loan Permanently Assign To Government Mean

Having a government claim/insurance claim status on a student loan indicates three things:

- A guaranty agency owns a federal student loan that you failed to pay back.

- The government-insured the loan.

- Your debt was reimbursed in full by insurance, and the government is now collecting on it.

Most likely, the Department of Educations Default Resolution Group has been assigned to the loan. Its possible that the DRG has kept your loan or transferred it to one of the governments private debt collectors.

How And Why Loans Are Transferred

The federal government only recently allowed loans through the William D. Ford Federal Direct Student Loan program and the Federal Family Education Loan program to be transferred to alternative loan servicers. According to Jill Rooney, Ph.D., the U.S. Department of Education announced in September, 2009 that it had expanded its federal loan servicer team to provide additional servicing capacity for Title IV loans owned by the Department of Education.

In English, that means that the USDOE was going to allow not-for-profit loan servicers to start taking over administration of federal loans. The reason behind this is to uphold a recent law that cuts out all banks and private lenders from the federal student loan industry. This law is part of a reform that is attempting to keep private business out of student loans, and thereby reduce costs, errors, and instances of fraud.

Recommended Reading: Government Grants To Start Trucking Business

What To Do If You’re At Risk Of Defaulting On Your Loans

Act fast by talking to your loan servicer immediately about how you can get back on track.

For federal student loan borrowers, your options may include switching to an income-drivenrepayment plan so you have a more affordable monthly payment, changing your monthly payment due date, streamlining repayment through a Direct Consolidation Loan or opting in for deferment or forbearance.

Federal loans offer all sorts of protections to help make your monthly payments more manageable, so we don’t recommend federal loan borrowers pursue refinancing to avoid defaulting. Through refinancing with a private lender, you lose all your federal loan protections.

Private student loan borrowers, on the other hand, may want to consider refinancing since private loans don’t come with the same protections and benefits.

Refinancing your private student loan can allow you to streamline multiple payments into one monthly bill. You might also be able to get a lower interest rate if you qualify, which can make your monthly payments more affordable.

Private student loan borrowers should consider SoFi Student Loan Refinancing, which Select ranked as the best overall student loan refinance lender for its low interest rates and borrower payment protections. SoFi also stands out for having its own Career Advisory Group to help members look for new employment, and it offers access to live customer support 7 days a week. Plus, SoFi members get free career coaching and financial advice from planners.

How Does It Affect Me

- The consequences of the government taking up student debt include:

- Salary garnishment for students school loans

- Taxes and Social Security benefits are canceled out

- Cannot get a Federal Housing Administration loan

- Excluded from government financial aid programs such as Title IV

- Losing ones license to practice

- Inability to qualify for debt forgiveness or repayment choices based on ones salary

Recommended Reading: City Of Las Vegas Government Jobs

Many Ways To Pay For College

Student loans arent the only way to pay for college. There are a variety of resources available to help you get the money you need. Opt for the items at the top of this list first, and work your way down to put your child in the best financial situation possible upon graduation.

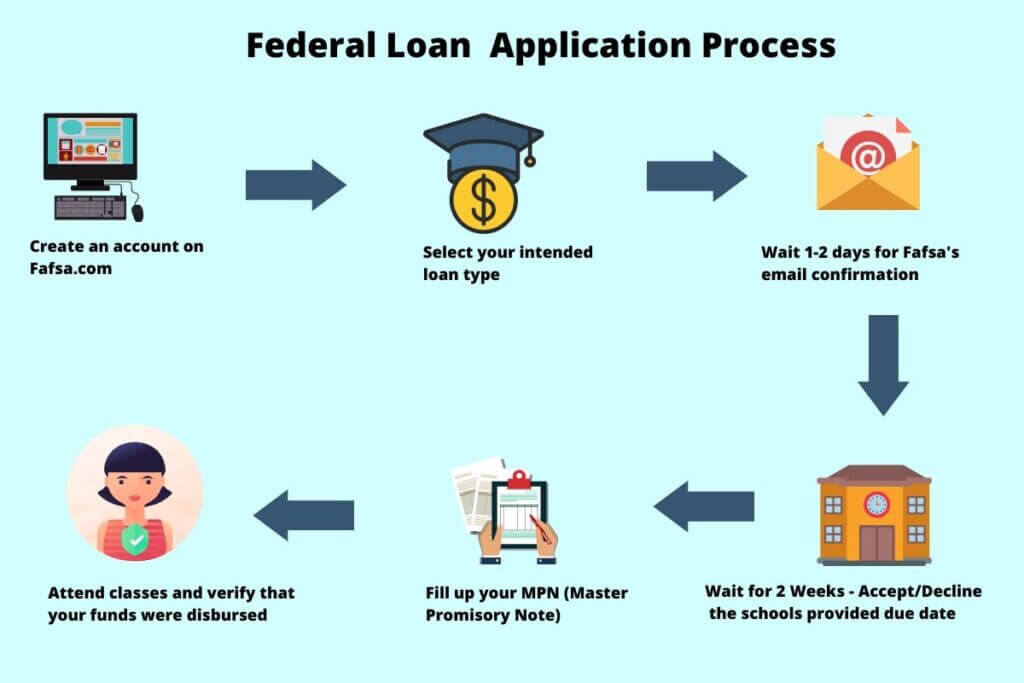

To apply for a federal student loan, your child must complete the Free Application for Federal Student Aid , and do so as soon as possible before each year that they will need federal student aid. Note that there are federal and state FAFSA deadlines, and colleges sometimes have individual deadlines. The FAFSA is the main determining factor the government uses to decide how much money borrowers qualify for, and the first students who apply are the first students who will receive a response.

You’ve Got Options If You Were Denied Pslf

If your application for Public Service Loan Forgiveness was denied, you may be able to receive loan forgiveness under the Temporary Expanded Public Service Loan Forgiveness opportunity.

As part of this opportunity, the Department of Education reconsiders your eligibility using an expanded list of qualifying repayment plans.

This TEPSLF opportunity is temporary, has limited funding, and will be provided on a first come, first served basis. Once all of the funds are used, the TEPSLF opportunity will end.

Visit StudentAid.gov for detailed information on how to be reconsidered for loan forgiveness.

Don’t Miss: Entry Level Government Jobs Colorado

What Goes On When Your Student Education Loans Aren On Your Credit File

Even though major credit reporting agencies like Experian stop showing the figuratively speaking, doesnt mean you no longer are obligated to repay on their behalf.

You however pay your education loans until:

Clearly, whenever it a federal education loan, there isnt any law of constraints. So you owe your own federal student education loans until you get rid of them a good way and/or different.

And furthermore, as theres certainly no law of rules, Really dont tending if you should work with a credit repair agency pro and so they have your student education loans taken away from your credit history and also your consumer credit score goes up by 300 areas.

Your very own federal financial products would stay to you forever.

Exactly What Is The Procedure For Taking Out Education Loans From Credit Profile

Eliminating student education loans from your own credit file is rather easy .

You ask a student loan provider to take out the belated repayment background from your own state.

Nevertheless they may not be able to make this happen unless you decide together with them.

And settlements just take income.

If you wear have got dollars for money and now you nonetheless need the education loans shed your credit score, where do you turn?

In that case, forward a disagreement letter towards credit rating organisation outlining the inaccurate negative know-how.

Ultimately, dispatch the document by qualified email, return receipt wanted.

Read Also: Grants For Homeschooling Parents

You Can Apply For A Direct Consolidation Loan By One Of The Following Methods:

You must make three complete, on-time, consecutive monthly payments to get the loan back on track.

- Accept the terms of a repayment plan based on your income.

If you have loans with a collection agency, you may begin the consolidation process by contacting them, or you can go to studentaid.gov to get started.

- You will still have a default line on your credit report if you consolidate your debts.

You may be able to consolidate again if you have already done so. FFEL Consolidation Loan holders are permitted to reduce again. The Direct Loan Program will be used to disburse the new loan.

I Have Collection/charge Off On My Credit Report And The Remark Is Student Loans Assigned To Government Collection Account Their Closed Also With What Does This Mean

If you consolidated your delinquent student loans and are now paying on them, you can call the Treasury Offset Program Call Center at 1-800-304-3107 at any point to see if you’re still subject to any offset.

If you owe certaindeliquent debts, such as student loan debt, that were submitted for offset,your refund can be used to pay off these debts.

The IRS or the Department of Treasury’sFinancial Management Service , which issues IRS tax refunds, can offset orreduce your federal tax refund or withhold the entire amount to satisfy thedebt. Any portion of your refund remaining after an offset will be refunded toyou.

Recommended Reading: Government Jobs Las Vegas

When Do Student Loan Payments Restart

Despite these major student loan servicers ending their federal contracts, your student loan payments will restart beginning February 1, 2022. The Biden administration has said that this current student loan relief is the final extension, so dont expect continued student loan relief beyond that date. This also implies that the Education Department will assign you a new student loan servicer instead of extending temporary student loan forbearance.

Getting a new student loan servicer may be a source of frustration or it could be a reason to celebrate. Its also a good time to review all your options for your student loans. Here are some popular ways to save money with your student loans:

Not Eligible For Total And Permanent Disability

If you believe you qualify for one of the programs other than the Total and Permanent Disability Discharge, complete and submit a loan forgiveness, cancellation, or discharge application form.

All forms are in Portable Document Format . In order to view PDF files, you must first download the free Acrobat Reader software. Detailed instructions for downloading and installing the Acrobat Reader are located on the Adobe website.

You May Like: City Of Las Vegas Government Jobs

Is Student Loan Debt Sold To Investors

The United States alone has approximately $1.73 trillion in outstanding student loan debt, from 45 million borrowers. These loans are packaged into securities that investors can buy, which deliver scheduled coupon payments much like an ordinary bond.

The Loan Servicercustomer Service For Your Childs Student Loans

Nelnet is a federal student loan servicer working on behalf of the U.S. Department of Education, the government agency that lends you or your child student loans.

A loan servicer acts as the customer service provider for the loans that the Department of Education lends to borrowers. While the Department of Education originates and funds federal loans, student loan servicers like Nelnet help parents and students navigate the student borrowing process for the lifetime of the loan. After your childs six-month grace period ends, they will make payments to their servicer.

| NelnetHere to Help |

|---|

|

Nelnet is a loan servicer that provides innovative products and services throughout the educational life cycle to help students and families reach their goals. Nelnet provides customer service on your or your childs federal student loans, so we answer questions, offer solutions if you’re having trouble paying, and process payments. |

Also Check: Possible Careers For History Majors

Amount And Duration Of Forgiveness

-

18 For the purposes of section 11.1 of the Act, the Minister may, for a year, forgive the lesser of

-

the outstanding principal of the borrowerâs guaranteed student loan, and

-

$8,000, in the case of a family physician or $4,000, in the case of a nurse or nurse practitioner, minus any amount that was forgiven for that year under section 9.2 of the Canada Student Financial Assistance Act.

The maximum number of years in respect of which an amount may be forgiven is five minus the number of years in respect of which the amount referred to in paragraph 28 of the

Student Loan Forgiveness And Discharge Options

In some cases, federal student loans can be forgiven in full or in part. Conditions for loan forgiveness include:

- Becoming a teacher or other public service professional under specific guidelines.

- Service in the U.S. Armed Forces.

- Closure of a college before completion of studies.

- Fraud or malfeasance on the part of an educational institution.

- False certification as a result of crime or identity theft.

- Total and permanent disability.

Though it is extremely rare, another way in which a student loan can be completely discharged is through a declaration of bankruptcy, although a borrower must be able to prove undue financial hardship in a bankruptcy court.

Courts use different tests and may consider some or all of the following criteria:

- You cannot maintain, based on current income and expenses, a minimal standard of living, if forced to repay the student loans.

- Additional circumstances exist indicating that this state of affairs is likely to persist for a significant portion of the repayment period of the loan.

- You have made good-faith efforts to repay your loans.

7 Minute Read

Don’t Miss: Trucking Grants