How Do I Apply For These First Home Buyer Government Grants/schemes

First off, you want to make sure that youre eligible for the government scheme/grant youre applying for. Each program has a slightly different eligibility requirement so you want to check off all the boxes prior to submitting your application.

Generally, you can apply for these government schemes and grants at the same time you apply for a home loan.

However, if youre planning on utilising any of the aforementioned grants or schemes, please have a discussion with your bank or mortgage broker prior to submitting your application.

Most lenders will apply for the grant on your behalf once a formal home loan approval is granted, and you have signed any relevant applications/declaration.

For the stamp duty waiver, your solicitor will handle the paperwork for you on settlement day.

There can be different eligibility requirements so its best to consult with your mortgage broker or directly with your lender up front.

Get Quotes From Three Lenders

Different offers are made by different lenders. It is important to compare different quotes and to analyze them thoroughly to determine which one suits you best. You can call. Call as many companies as possible if you have the time. It is important to get the best deal. Dont compare prices. APR You should also consider other factors such as flexibility, timeframe, and response times.

Energy Efficiency Alberta Home Improvement Rebate Program

When you perform renovations to your home that result in energy savings, such as by installing insulation, new windows, a tankless water heater, or a drain water heat recovery system, you may receive some of what you spent on the work in the form of a rebate.

Specific qualification information is available at the Energy Efficiency Alberta web site. Rebate amounts depend on the amount of energy savings you receive, but they can range from a couple hundred dollars to several thousand dollars for large renovation jobs.

Don’t Miss: Federal Government Jobs In Virginia

Homepath Ready Buyer Program

Fannie Mae offers first-time home buyers the chance to buy a foreclosed property for as little as 3% down with their HomePath® program. You can even apply for up to 3% of your closing costs back through the program as well. Fannie Mae homes sell in as-is condition, so you may have to repair a few things before your new place is live-in ready. However, closing cost assistance can help make it more possible to cover these expenses.

The HomePath® Ready Buyer program is only available to first-time buyers who want to live full-time in a house that theyre looking to purchase. You’ll need to take and pass Fannies Framework Homeownership course before you close.

State And Local First

- First-time buyer programs and grants, available through states or cities, for down payment or closing cost assistance

- Best for: First-time homebuyers who need closing cost or down payment assistance

Many municipalities offer first-time homebuyer grants and programs in an effort to attract new residents. The aid comes in the form of grants that dont have to be repaid or low-interest loans with deferred repayment. Some programs may have income limits.

Before buying a home, check your states housing authority website for more information, or contact a real estate agent or local HUD-approved housing counseling agency to learn more about first-time homebuyer loans in your area.

Read Also: Federal Government Jobs Fort Worth

West Virginia Down Payment Assistance Programs

The West Virginia Housing Development Fund offers help with down payments and closing costs.

The amount you can get ranges from up to $5,000 to up to $10,000, depending on the mortgage you choose and the size of the down payment youre going to make.

This assistance comes in the form of a 15-year second mortgage. At the time of writing, that loan has a very low interest rate of 2%.

Discover more on the development funds website. And read HUDs list of other homeownership assistance programs available in West Virginia.

Hire A Home Inspector

When you decide on a home you like and make an offer, its important to have the home thoroughly inspected before the deal can be finalized. You want to make sure there arent any unknown structural issues, or anything else that could affect the livability of your new place. Inspections usually take a few hours, and cost a few hundred to a few thousand dollars, depending on the size of the home.

You May Like: Government Grants For Wheelchair Vans

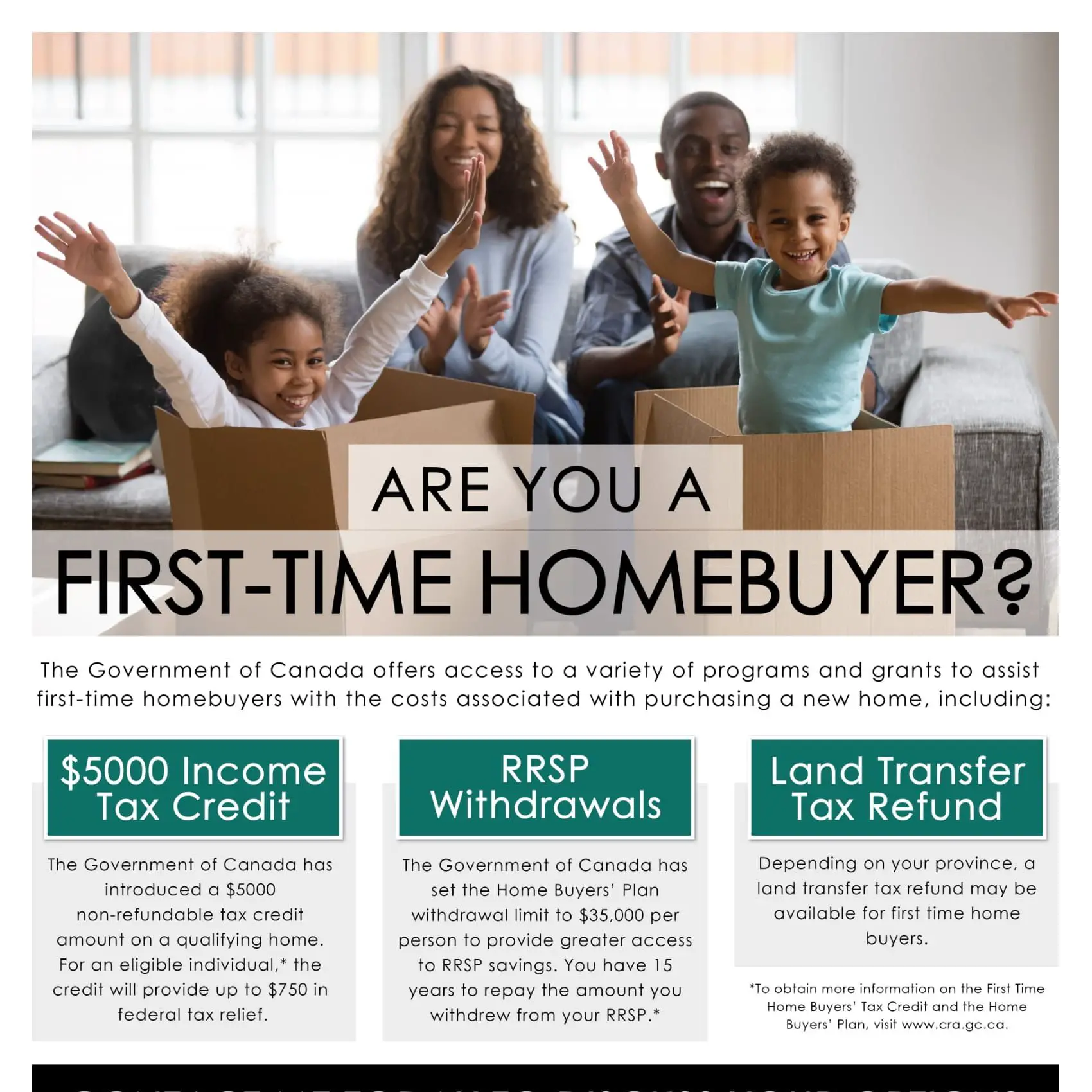

Land Transfer Tax Rebate

If you live in certain provinces or cities, youre eligible for a rebate on some of the land transfer tax you paid when purchasing your house. The amount of the rebate varies depending on where you live. Land transfer tax rebates are available in Ontario, British Columbia, and Prince Edward Island. The City of Toronto also offers a land transfer tax rebate to first-time buyers. You may receive this in addition to the rebate available to those in Ontario.

Maine Down Payment Assistance Programs

The Maine State Housing Authoritys First Home Loan Program is aimed at first-time buyers and those whove not owned a home within the last three years.

You get up to $3,500 toward your down payment and closing costs as a non-repayable grant. But that will be recouped by your lender through a slightly higher mortgage rate.

Eligibility criteria include an unspecified minimum credit score and caps on your household income and home purchase price. Youll also need to put 1% of your own cash toward your home purchase. .

Discover more at MSNAs website. And check HUDs list of other homeownership assistance programs in Maine.

Don’t Miss: How To Get Free Government Internet

Wyoming Down Payment Assistance Programs

The Wyoming Community Development Authority has two down payment assistance programs. Both provide a loan of up to $10,000.

Youll need a FICO score of 620 or better, and must contribute at least $1,500 toward your purchase, though that may be a gift.

The programs are:

- Home$tretch DPA 0% interest rate with no monthly payments, due only upon sale of the home, refinance or 30-year maturity

- Amortizing DPA Paid down in full with low monthly payments over 10 years

Both programs work only in conjunction with specific primary mortgage loans from the WCDA.

Find out more at WCDAs website. And check out HUDs list of other homeownership assistance programs in Wyoming.

Popular Articles

Are You A First

Unless you are a person with a disability or you are helping a related person with a disability buy or build a qualifying home, you have to be a first-time home buyer to withdraw funds from your RRSP to buy or build a qualifying home.

You are considered a first-time home buyer if, in the four-year period, you did not occupy a home that you or your current spouse or common-law partner owned.

You May Like: Working For A Government Contractor

Government Grants For Senior Citizens That Are First

The U.S. Department of Housing and Urban Development and other federal agencies provide home-ownership grants to income-qualified households. Seniors that are first-time home buyers, or who have not purchased a home within three years of applying for a grant are eligible for help. Grants are awarded to low-to-moderate income households. HUD has established the income limit levels for every county in the U.S. These income limit levels are based on the average household income for that county. Since some counties have higher average income levels than others, the low-income limit level will vary.

North Carolina Down Payment Assistance Programs

First-time and repeat homebuyers may be eligible for down payment loan of up to 5% of your mortgage balance with the NC Home Advantage Mortgage.

This assistance loan starts to be forgiven in year 11 of your mortgage, and will be fully forgiven by year 15. If you sell, transfer or refinance before year 11, youll have to pay back the whole amount.

The NC Home Advantage program has a similar program offering $8,000 in down payment assistance to veterans and first-time homebuyers.

Use the link above to get more information from the North Carolina Housing Finance Agencys website. And review HUDs list of other homeownership assistance programs in the state.

You May Like: Government Program For Buying House

Newly Built Home Exemption

Similar to B.C.s First Time Home Buyers Program, the Newly Built Home Exemption helps to lower or eliminate the property transfer tax youre required to pay on a new house. The difference is that this exemption applies to newly built homes, whether or not youre a first-time buyer.

Availability: British ColumbiaType: Property Transfer Tax ReliefValue: Up to $13,000 in tax exemptions.

Eligibility:

- Youre a Canadian citizen or permanent resident.

- The property is located in B.C. and is used as your principal residence.

- The property has a fair market value of $750,000 or less. If the value is between $750,000 and $800,000, you may be eligible for a partial exemption.

- The total property size is 1.24 acres or less. A partial exemption may apply if this size is exceeded or if the property has a second building.

- The property transfer was registered with the Land Title Office after February 16, 2016.

Things to note:

How to apply: You can apply for the Newly Built Home Exemption by entering exemption code 49 on your Property Transfer Tax Return.

Virginia Down Payment Assistance Programs

The Virginia Housing Development Authority has a program just for first-time buyers. It offers a grant of up to 2.5% of the homes purchase price.

To qualify, youll need a minimum credit score between 620 and 660, depending on the type of mortgage you choose. And your household income and the purchase price of your home must be below specified limits.

Find out more about these down payment assistance grants on theVHDA website. And read HUDs list of other homeownership assistance programs in the state.

Read Also: Rsa Identity Governance And Lifecycle

Idaho Down Payment Assistance Programs

The Idaho Housing and Finance Association runs two DPA programs:

- A Second Mortgage Loan With a credit score of at least 640 you could qualify for this 10-year loan, which must be repaid via monthly payments. You could borrow up to 3.5% of the homes purchase price

- A Forgivable Loan This loans balance slowly goes away over a seven-year period as long as you live in the home and dont refinance. This loan could equal as much as 3.5% of your homes price

Both these loans require borrowers to complete a homebuyer education course, and the borrower must always provide at least 0.5% of the home price in his or her own money. This means you couldnt use money from a gift or a separate DPA program.

Money from either loan could also be used to pay closing costs.

Visit the IHFA website for complete details which include income limits in some cases. And check HUDs list of alternative programs for Idaho.

Fannie Maes Homepath Ready Buyer Program

- A program that provides 3 percent in closing cost assistance to first-time buyers must complete an educational course and buy a foreclosed Fannie Mae property

- Best for: First-time homebuyers who need help for closing costs and are willing to buy a foreclosed home

Fannie Maes HomePath ReadyBuyer program is geared toward first-time buyers interested in foreclosed homes that are owned by Fannie Mae. After taking a required online homebuying education course, eligible borrowers can receive up to 3 percent in closing cost assistance toward the purchase of a HomePath property.

The trick is finding a HomePath property in your market, which might be a challenge since foreclosures typically account for only a small chunk of listings.

Read Also: Best Free Government Phone Ohio

How Do I Know If I Earn Too Much For The Downpayment Toward Equity Act Of 2021

First, type an address into this government lookup. If the 1-unit dwelling value is $548,250, to find the median income for your area, use this chart from the Bureau of Economic Analysis. When you find your median income, multiply it by 1.2 to find the maximum income allowed under the program. If the 1-unit dwelling value is above $548,250, multiply the median income by 1.8 to find the maximum allowed under the program.

Bank Of Americas Community Homeownership Commitment

Good news for aspiring homeowners! Bank of Americas Community Homeownership Commitment® is bringing together products and resources that can help modest-income borrowers buy homes of their own. By combining down payment assistance and closing cost help with a low down payment mortgage, you may find that a new home is within reach.

You May Like: Government Free Credit Score Yearly

Section 203 Of The Fha

If you dont want to spend a lot of money on your home renovations or improvements, you might look into section 203 FHA loans. This loan is guaranteed by the institution. After the improvements are made, the loan calculates your homes worth. They will then calculate the value of your home after all improvements have been made. They will lend you money to pay for renovations and let you pay them in small installments. You will be required to make a 3.5% deposit and upgrade must exceed $ 5,000 in order to apply. Make sure that your contractor knows the rules. 203 , Loan Its policies and its repayment times.

State And Local Programs For First Time Buyers

It is common for municipalities offer grants and programs to first-time homebuyers. It is your goal to attract new residents. This can be in the form either a grant or a loan that has low interest rates and flexibility. Be aware that not all programs are able to consider Limits on income Approve their beneficiaries. We recommend that your states website be consulted for further information. You should consult a professional real estate agent before you purchase your home. Agency HUD-approved Find out how to apply for a loan on your first home as a homeowner zone.

Read Also: Government Business Loans For Small Businesses

First Time Home Buyer Alberta: Grab These 15 Government Grants Rebates & Tax Credits Before Theyre Gone

If youre a first time home buyer in Alberta and are feeling an equal mixture of excitement, trepidation, and hyperventilation, those feelings are perfectly normal!When going through a transaction as large as a home purchase, those feelings actually are expected. Studying all of the different aspects of home buying can help you feel more confident as you go through the process for the first time, allowing you steer the extra energy from your excitement into a useful direction. And keeping a bit of skepticism close at hand while searching for the right home will help you avoid making mistakes based more on emotion than on the facts in front of you.Finally, if your trepidation relates to the financial burden of buying a home for the first time, the province of Alberta has quite a few programs and grants in place that can help alleviate this feeling. In the paragraphs that follow, weve put together a list of the programs and processes available to help first-time Alberta home purchasers meet the financial burden. As an added benefit, weve collected a series of tips that can help you figure out how to afford your first house purchase. To start, weve listed a series of federal government grants that Alberta residents can use to buy their first home then we follow up with provincial and municipal government grants that are only available to Alberta residents.

Downpayment Plus And Downpayment Plus Advantage

These are the programs that are administrated by the Federal Home Loan Bank of Chicago. The home buyers will get the help of $6,000 to pay for the down payment and closing costs. If you take the loan for five years then it will be forgiven. Buyers who want to have the benefit from this grant program have to contribute at least $1,000 to the home purchase value.

Along with this, the buyer has to complete the homebuyer education course as well as counseling. When the buyer wants to take help from this grant program to buy the home, then they have to include a lender who is a member of FHLB Chicago, or in the case of the Advantage program, or from a non-profit organization.

All these grant programs help first-time homebuyers to buy a home with the help of financial assistance. But the home buyers fulfill all the requirements and follow the rules.

Also Check: Government Grants To Start Trucking Business

Grants And Loans For First

Buying a home is a significant goal for many Ontarians but the path to homeownership presents many financial hurdles. Saving a sufficient down payment is tough enough on its own and when coupled with rising interest rates and tough qualification rules which includes a mortgage stress test affording a home becomes very difficult for some.

Luckily, there are plenty of grants available to help you out especially if youre a first-time homebuyer in Ontario.

There are three types of grants available to Ontarians: Those offered by the federal government, those offered by the provincial government, and those offered at the municipal level.

This is just a place to start a cheat sheet, if you will. Do yourself a favour and make a list of all the programs you may qualify for and do some further research it could save you thousands on your first home purchase.

So, without further ado, we present 20 grants for first-time buyers in Ontario.